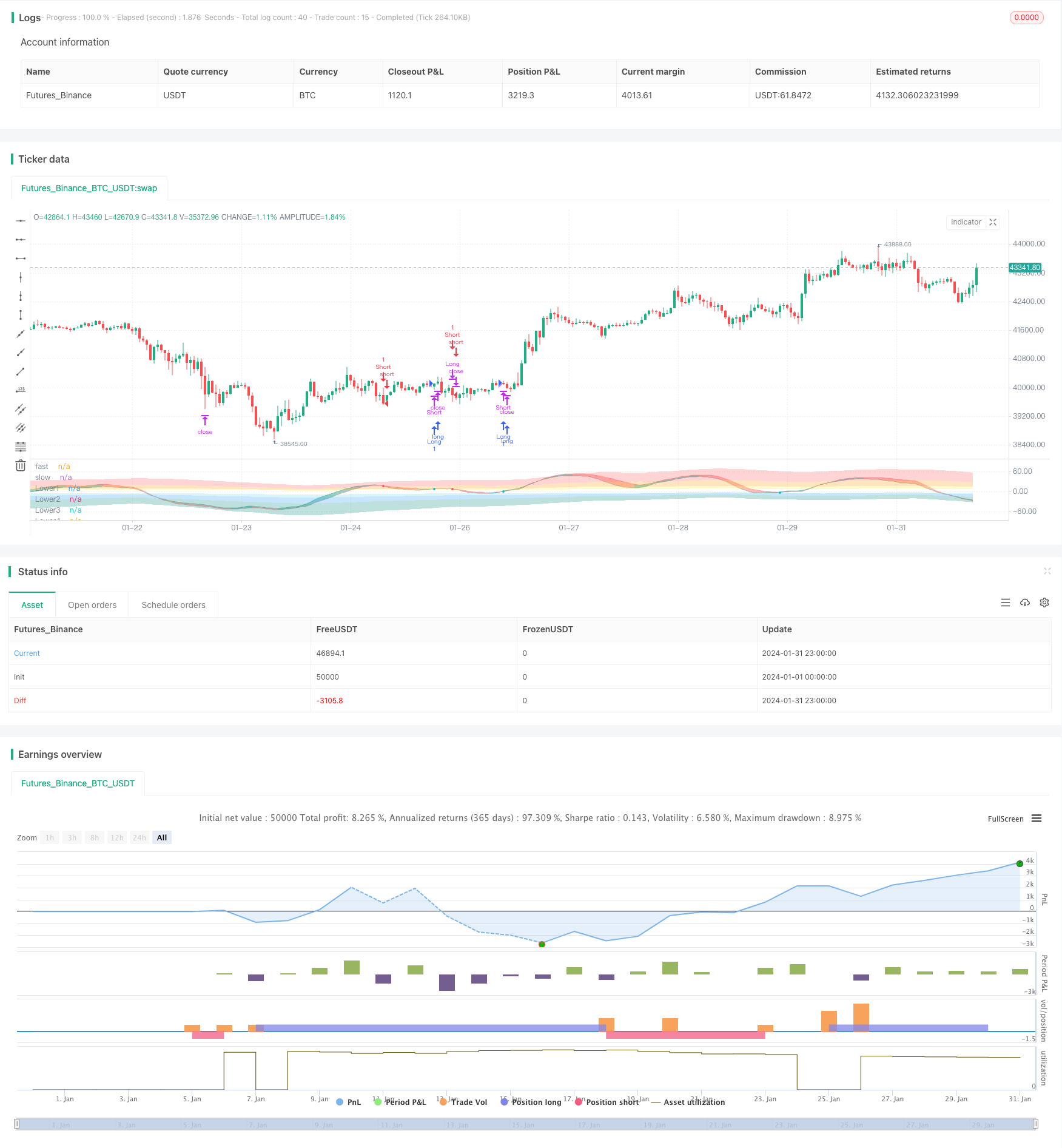

Estrategia de trading con oscilador arcoíris

Descripción general

La estrategia de comercio de los oscilantes del arco iris utiliza principalmente varios índices para suavizar los promedios móviles y los indicadores de oscilación para construir canales de oscilación múltiples, formando una señal de múltiples espacios clara en el nivel, pertenece a la estrategia de seguimiento de tendencias. La estrategia utiliza integralmente el RSI, CCI, Stochastic y MA para determinar el movimiento general del mercado y las zonas de sobreventa y sobreventa.

Principio de estrategia

- Calcula el promedio ponderado de los tres valores del RSI, CCI y Stochastic para construir el indicador de convulsiones integrado Magic;

- El indicador de Magic se suaviza con el índice varias veces, obteniendo dos curvas: sampleMagicFast y sampleMagicSlow;

- sampledMagicFast representa el promedio rápido, y sampledMagicSlow representa el promedio lento;

- Se produce una señal de compra cuando se usa el MagicSlow en el sampleMagicFast;

- Cuando se usa el sampleMagicSlow bajo el sampleMagicFast, se genera una señal de venta.

- Calcular la dirección de cambio de la última barra de sampledMagicFast con respecto a la barra anterior para determinar la tendencia actual;

- Los tiempos de entrada y salida se juzgan según la dirección de la tendencia y el cruce de sampledMagicFast y sampledMagicSlow.

Ventajas estratégicas

- La integración de varios indicadores para determinar la tendencia general del mercado y mejorar la precisión de las señales;

- Basado en el indicador de MA suavizado, que reduce el ruido de la señal de manera efectiva;

- La transmisión de señales de vibración es clara y fácil de manejar.

- Combinado con filtros de tendencia, puede configurarse para el seguimiento de la tendencia o la inversión de la misma.

- Se puede personalizar la intensidad de las zonas de sobreventa y sobrecompra, y es muy adaptable.

Riesgo estratégico

- Los parámetros mal configurados pueden hacer que la curva se suavice demasiado y se pierda el mejor momento de entrada.

- La configuración incorrecta de las zonas de sobreventa y sobrecompra puede causar un tiempo de vacío excesivo.

- El fallo de ciertos indicadores en la calificación multifactor puede debilitar la eficacia de la señal.

Resolución de las mismas:

- Optimización de los parámetros para una suavidad de curva moderada;

- Ajustar la intensidad de las zonas de sobrecompra y sobreventa para reducir la tasa de vacantes;

- Pruebe la capacidad de predicción de cada indicador, ajustado por peso.

Dirección de optimización de la estrategia

- Los parámetros del indicador se ajustan de forma dinámica en función de las características del mercado.

- La introducción de métodos de aprendizaje automático para optimizar la combinación de pesos de los indicadores;

- El aumento del volumen y la fluctuación filtrarán la señal de entrada.

Resumir

La estrategia de Rainbow Vibrator integra múltiples señales de indicadores para mejorar la estabilidad a través de un procesamiento suave del índice. La estrategia se puede configurar para adaptarse a la tendencia y al mercado de la oscilación, o solo para el movimiento de la oscilación de una variedad específica.

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © businessduck

//@version=5

strategy("Rainbow Oscillator [Strategy]", overlay=false, margin_long=100, margin_short=100, initial_capital = 2000)

bool trendFilter = input.bool(true, 'Use trend filter')

float w1 = input.float(0.33, 'RSI Weight', 0, 1, 0.01)

float w2 = input.float(0.33, 'CCI Weight', 0, 1, 0.01)

float w3 = input.float(0.33, 'Stoch Weight', 0, 1, 0.01)

int fastPeriod = input.int(16, 'Ocillograph Fast Period', 4, 60, 1)

int slowPeriod = input.int(22, 'Ocillograph Slow Period', 4, 60, 1)

int oscillographSamplePeriod = input.int(8, 'Oscillograph Samples Period', 1, 30, 1)

int oscillographSamplesCount = input.int(2, 'Oscillograph Samples Count', 0, 4, 1)

string oscillographMAType = input.string("RMA", "Oscillograph Samples Type", options = ["EMA", "SMA", "RMA", "WMA"])

int levelPeriod = input.int(26, 'Level Period', 2, 100)

int levelOffset = input.int(0, 'Level Offset', 0, 200, 10)

float redunant = input.float(0.5, 'Level Redunant', 0, 1, 0.01)

int levelSampleCount = input.int(2, 'Level Smooth Samples', 0, 4, 1)

string levelType = input.string("RMA", "Level MA type", options = ["EMA", "SMA", "RMA", "WMA"])

perc(current, prev) => ((current - prev) / prev) * 100

smooth(value, type, period) =>

float ma = switch type

"EMA" => ta.ema(value, period)

"SMA" => ta.sma(value, period)

"RMA" => ta.rma(value, period)

"WMA" => ta.wma(value, period)

=>

runtime.error("No matching MA type found.")

float(na)

getSample(value, samples, type, period) =>

float ma = switch samples

0 => value

1 => smooth(value, type, period)

2 => smooth(smooth(value, type, period), type, period)

3 => smooth(smooth(smooth(value, type, period), type, period), type, period)

4 => smooth(smooth(smooth(smooth(value, type, period), type, period), type, period), type, period)

float takeProfit = input.float(5, "% Take profit", 0.8, 100, step = 0.1) / 100

float stopLoss = input.float(2, "% Stop Loss", 0.8, 100, step = 0.1) / 100

float magicFast = w2 * ta.cci(close, fastPeriod) + w1 * (ta.rsi(close, fastPeriod) - 50) + w3 * (ta.stoch(close, high, low, fastPeriod) - 50)

float magicSlow = w2 * ta.cci(close, slowPeriod) + w1 * (ta.rsi(close, slowPeriod) - 50) + w3 * (ta.stoch(close, high, low, slowPeriod) - 50)

float sampledMagicFast = getSample(magicFast, oscillographSamplesCount, oscillographMAType, oscillographSamplePeriod)

float sampledMagicSlow = getSample(magicSlow, oscillographSamplesCount, oscillographMAType, oscillographSamplePeriod)

float lastUpperValue = 0

float lastLowerValue = 0

if (magicFast > 0)

lastUpperValue := math.max(magicFast, magicFast[1])

else

lastUpperValue := math.max(0, lastUpperValue[1]) * redunant

if (magicFast <= 0)

lastLowerValue := math.min(magicFast, magicFast[1])

else

lastLowerValue := math.min(0, lastLowerValue[1]) * redunant

float level1up = getSample( (magicFast >= 0 ? magicFast : lastUpperValue) / 4, levelSampleCount, levelType, levelPeriod) + levelOffset

float level2up = getSample( (magicFast >= 0 ? magicFast : lastUpperValue) / 2, levelSampleCount, levelType, levelPeriod) + levelOffset

float level3up = getSample( magicFast >= 0 ? magicFast : lastUpperValue, levelSampleCount, levelType, levelPeriod) + levelOffset

float level4up = getSample( (magicFast >= 0 ? magicFast : lastUpperValue) * 2, levelSampleCount, levelType, levelPeriod) + levelOffset

float level1low = getSample( (magicFast <= 0 ? magicFast : lastLowerValue) / 4, levelSampleCount, levelType, levelPeriod) - levelOffset

float level2low = getSample( (magicFast <= 0 ? magicFast : lastLowerValue) / 2, levelSampleCount, levelType, levelPeriod) - levelOffset

float level3low = getSample( magicFast <= 0 ? magicFast : lastLowerValue, levelSampleCount, levelType, levelPeriod) - levelOffset

float level4low = getSample( (magicFast <= 0 ? magicFast : lastLowerValue) * 2, levelSampleCount, levelType, levelPeriod) - levelOffset

var transparent = color.new(color.white, 100)

var overbough4Color = color.new(color.red, 75)

var overbough3Color = color.new(color.orange, 75)

var overbough2Color = color.new(color.yellow, 75)

var oversold4Color = color.new(color.teal, 75)

var oversold3Color = color.new(color.blue, 75)

var oversold2Color = color.new(color.aqua, 85)

upperPlotId1 = plot(level1up, 'Upper1', transparent)

upperPlotId2 = plot(level2up, 'Upper2', transparent)

upperPlotId3 = plot(level3up, 'Upper3', transparent)

upperPlotId4 = plot(level4up, 'Upper4', transparent)

fastColor = color.new(color.teal, 60)

slowColor = color.new(color.red, 60)

fastPlotId = plot(sampledMagicFast, 'fast', color = fastColor)

slowPlotId = plot(sampledMagicSlow, 'slow', color = slowColor)

lowerPlotId1 = plot(level1low, 'Lower1', transparent)

lowerPlotId2 = plot(level2low, 'Lower2', transparent)

lowerPlotId3 = plot(level3low, 'Lower3', transparent)

lowerPlotId4 = plot(level4low, 'Lower4', transparent)

fill(upperPlotId4, upperPlotId3, overbough4Color)

fill(upperPlotId3, upperPlotId2, overbough3Color)

fill(upperPlotId2, upperPlotId1, overbough2Color)

fill(lowerPlotId4, lowerPlotId3, oversold4Color)

fill(lowerPlotId3, lowerPlotId2, oversold3Color)

fill(lowerPlotId2, lowerPlotId1, oversold2Color)

upTrend = sampledMagicFast > sampledMagicFast[1]

buySignal = ((upTrend or not trendFilter) and ta.crossunder(sampledMagicSlow, sampledMagicFast)) ? sampledMagicSlow : na

sellSignal = ((not upTrend or not trendFilter) and ta.crossover(sampledMagicSlow, sampledMagicFast)) ? sampledMagicSlow : na

diff = sampledMagicSlow - sampledMagicFast

fill(fastPlotId, slowPlotId, upTrend ? fastColor : slowColor)

plot(buySignal, color = color.aqua, style = plot.style_circles, linewidth = 4)

plot(sellSignal, color = color.red, style = plot.style_circles, linewidth = 4)

// longCondition = upTrend != upTrend[1] and upTrend

long_take_level = strategy.position_avg_price * (1 + takeProfit)

long_stop_level = strategy.position_avg_price * (1 - stopLoss)

short_take_level = strategy.position_avg_price * (1 - takeProfit)

short_stop_level = strategy.position_avg_price * (1 + stopLoss)

strategy.close(id="Long", when=sellSignal, comment = "Exit")

strategy.close(id="Short", when=buySignal, comment = "Exit")

strategy.entry("Long", strategy.long, when=buySignal)

strategy.entry("Short", strategy.short, when=sellSignal)

strategy.exit("Take Profit/ Stop Loss","Long", stop=long_stop_level, limit=long_take_level)

strategy.exit("Take Profit/ Stop Loss","Short", stop=short_stop_level, limit=short_take_level)

// plot(long_stop_level, color=color.red, overlay=true)

// plot(long_take_level, color=color.green)