Stratégie de suivi de la tendance double et forte

Auteur:ChaoZhang est là., Date: 2023-11-16 15h50 et 54 minLes étiquettes:

Résumé

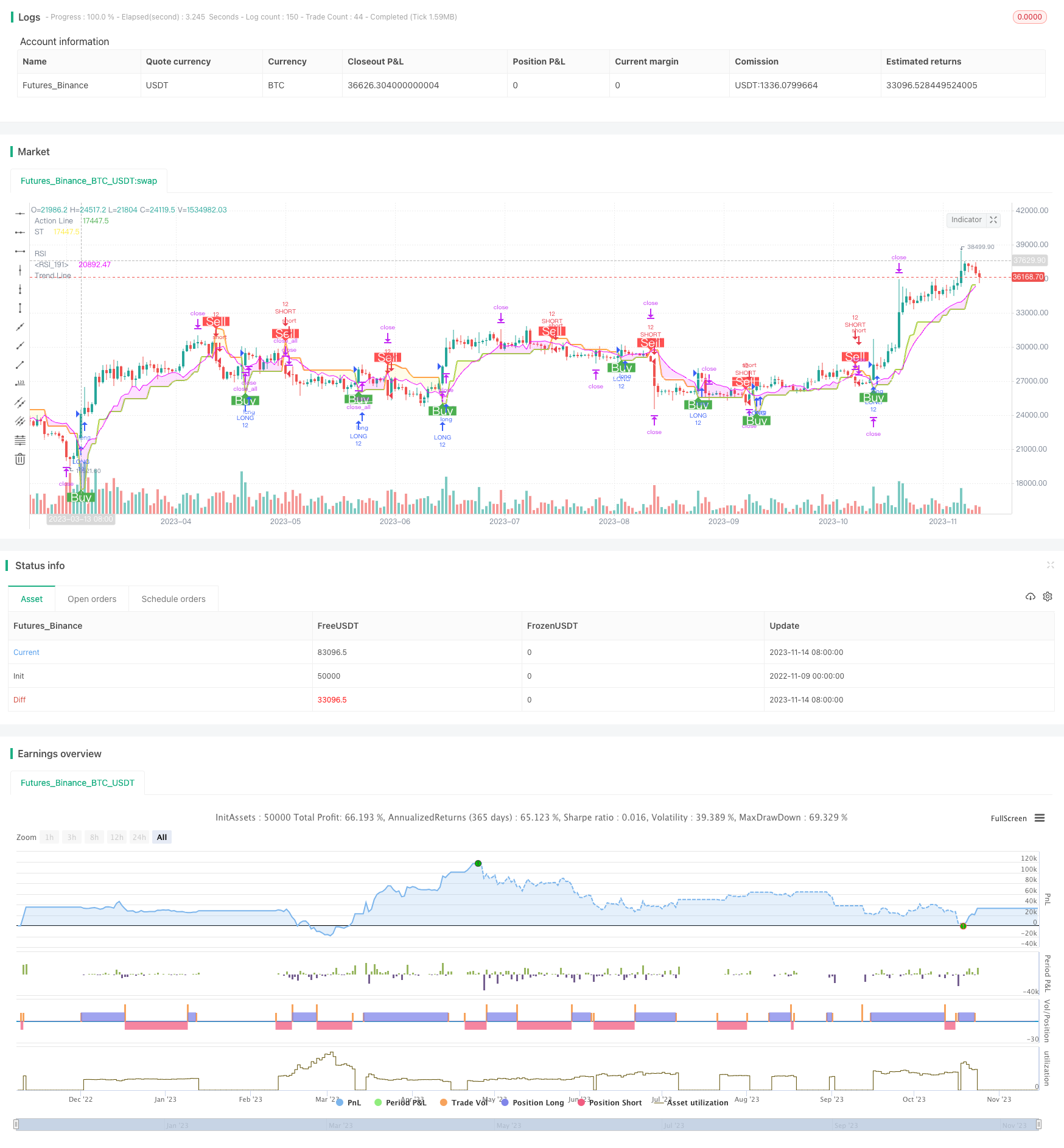

Cette stratégie est conçue avec des mécanismes de suivi de tendance doubles basés sur Supertrend et Relative Strength Index pour déterminer avec précision la tendance du marché et définir des points de stop loss et de profit raisonnables.

La logique de la stratégie

-

Calculer la Supertrend pour déterminer la direction principale de la tendance. Supertrend peut juger avec précision la direction de la tendance et donner des points d'entrée idéaux.

-

Calculer l'indice de force relative (RSI) comme indicateur auxiliaire pour le jugement de la tendance.

-

Allez long lorsque le prix de clôture dépasse la ligne de Supertrend, et allez court lorsque le prix de clôture dépasse la ligne de Supertrend.

-

Réglez raisonnablement les points de stop loss et de profit. Lorsque vous allez long, définissez la ligne de Supertrend comme le stop loss, et la ligne de Supertrend plus le profit raisonnable comme le profit de prise. Lorsque vous allez court, définissez la ligne de Supertrend comme le stop loss, et la ligne de Supertrend moins le profit raisonnable comme le profit de prise.

-

Les points de stop loss flotteront en fonction de la fluctuation du marché.

-

Évitez d'entrer lorsque le RSI diverge du Supertrend, ce qui indique un potentiel renversement de tendance.

Analyse des avantages

-

Le mécanisme de jugement de la double tendance peut réduire les faux signaux et renforcer la stabilité de la stratégie.

-

Les points de stop loss se déplacent avec la tendance pour maximiser le verrouillage des bénéfices et éviter un stop loss prématuré.

-

L'application du RSI filtre certains signaux commerciaux faibles.

-

Un positionnement de profit raisonnable maximise les bénéfices.

-

Les paramètres de stratégie réglables peuvent être optimisés pour différents produits et conditions de marché.

-

Les prélèvements contrôlables confèrent à la stratégie de fortes capacités de gestion des risques.

Analyse des risques

-

Dans le cas d'événements de cygne noir tels que des nouvelles politiques importantes, d'énormes fluctuations du marché peuvent arrêter les positions et causer des pertes importantes.

-

Des paramètres incorrects peuvent entraîner un stop-loss déraisonnable et des points de profit, augmentant les pertes ou réduisant les bénéfices.

-

La divergence entre le RSI et la Supertrend peut générer de faux signaux sur les marchés à fourchette.

Directions d'optimisation

-

Optimiser le paramètre de la période ATR pour différents produits.

-

Optimiser les paramètres de l'indicateur RSI pour trouver des conditions de tendance auxiliaires plus stables.

-

Incorporer d'autres indicateurs tels que les bandes de Bollinger et le KDJ pour définir des règles d'entrée et de sortie plus précises.

-

Testez différentes stratégies de prise de profit telles que le trailing stop, la prise de profit échelonnée, le wick stop, etc. pour améliorer la rentabilité.

-

Ajuster la taille des positions en fonction des résultats des tests antérieurs afin de réduire les risques liés aux transactions individuelles.

Conclusion

La stratégie démontre une solide stabilité et une rentabilité globales. Le jugement de la double tendance filtre efficacement le bruit et la stratégie de prise de stop loss / profit bloque les bénéfices et contrôle les risques. L'optimisation continue des paramètres et des conditions d'entrée / sortie permettra d'obtenir de bonnes performances dans différents environnements de marché.

/*backtest

start: 2022-11-09 00:00:00

end: 2023-11-15 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

//

// ▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒

// -----------------------------------------------------------------------------

// Copyright 2019 Mauricio Pimenta | exit490

// SuperTrend with Trailing Stop Loss script may be freely distributed under the MIT license.

//

// Permission is hereby granted, free of charge,

// to any person obtaining a copy of this software and associated documentation files (the "Software"),

// to deal in the Software without restriction, including without limitation the rights to use, copy, modify, merge,

// publish, distribute, sublicense, and/or sell copies of the Software, and to permit persons to whom the Software is furnished to do so,

// subject to the following conditions:

//

// The above copyright notice and this permission notice shall be included in all copies or substantial portions of the Software.

//

// THE SOFTWARE IS PROVIDED "AS IS", WITHOUT WARRANTY OF ANY KIND,

// EXPRESS OR IMPLIED, INCLUDING BUT NOT LIMITED TO THE WARRANTIES OF MERCHANTABILITY,

// FITNESS FOR A PARTICULAR PURPOSE AND NONINFRINGEMENT. IN NO EVENT SHALL THE AUTHORS OR COPYRIGHT HOLDERS BE LIABLE FOR ANY CLAIM,

// DAMAGES OR OTHER LIABILITY, WHETHER IN AN ACTION OF CONTRACT, TORT OR OTHERWISE, ARISING FROM,

// OUT OF OR IN CONNECTION WITH THE SOFTWARE OR THE USE OR OTHER DEALINGS IN THE SOFTWARE.

//

// -----------------------------------------------------------------------------

//

// Authors: @exit490

// Revision: v1.0.0

// Date: 5-Aug-2019

//

// Description

// ===========

// SuperTrend is a moving stop and reversal line based on the volatility (ATR).

// The strategy will ride up your stop loss when price moviment 1%.

// The strategy will close your operation when the market price crossed the stop loss.

// The strategy will close operation when the line based on the volatility will crossed

//

// The strategy has the following parameters:

//

// INITIAL STOP LOSS - Where can isert the value to first stop.

// POSITION TYPE - Where can to select trade position.

// ATR PERIOD - To select number of bars back to execute calculation

// ATR MULTPLIER - To add a multplier factor on volatility

// BACKTEST PERIOD - To select range.

//

// -----------------------------------------------------------------------------

// Disclaimer:

// 1. I am not licensed financial advisors or broker dealers. I do not tell you

// when or what to buy or sell. I developed this software which enables you

// execute manual or automated trades multplierFactoriplierFactoriple trades using TradingView. The

// software allows you to set the criteria you want for entering and exiting

// trades.

// 2. Do not trade with money you cannot afford to lose.

// 3. I do not guarantee consistent profits or that anyone can make money with no

// effort. And I am not selling the holy grail.

// 4. Every system can have winning and losing streaks.

// 5. Money management plays a large role in the results of your trading. For

// example: lot size, account size, broker leverage, and broker margin call

// rules all have an effect on results. Also, your Take Profit and Stop Loss

// settings for individual pair trades and for overall account equity have a

// major impact on results. If you are new to trading and do not understand

// these items, then I recommend you seek education materials to further your

// knowledge.

//

// YOU NEED TO FIND AND USE THE TRADING SYSTEM THAT WORKS BEST FOR YOU AND YOUR

// TRADING TOLERANCE.

//

// I HAVE PROVIDED NOTHING MORE THAN A TOOL WITH OPTIONS FOR YOU TO TRADE WITH THIS PROGRAM ON TRADINGVIEW.

//

// I accept suggestions to improve the script.

// If you encounter any problems I will be happy to share with me.

// -----------------------------------------------------------------------------

//

// ▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒ //

strategy(title='DEO SESSSION', shorttitle='DEO S', overlay=true, precision=8, calc_on_order_fills=true, calc_on_every_tick=true, backtest_fill_limits_assumption=0, default_qty_type=strategy.percent_of_equity, default_qty_value=100, initial_capital=1000, currency=currency.USD, linktoseries=true)

//

// ▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒ //

// === BACKTEST RANGE ===

backTestSectionFrom = input(title='════════════ FROM ════════════', defval=true)

// selected dates

i_startTime = input(title="START FILTER", defval=timestamp("02 Jan 2023 00:00 +0000"), group="RISK MANAGEMENT", tooltip="Start date & time to begin searching for setups")

i_endTime = input(title="END FILTER", defval=timestamp("12 Dec 2100 00:00 +0000"), group="RISK MANAGEMENT", tooltip="End date & time to stop searching for setups")

afterStartDate = true

//

// ▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒ //

parameterSection = input(title='══════════ STRATEGY ══════════', defval=true)

// === INPUT TO SELECT POSITION ===

positionType = input.string(defval='LONG', title='Position Type', options=['LONG', 'SHORT'])

// === INPUT TO SELECT INITIAL STOP LOSS

initialStopLossPercent = input.float(defval=3.0, minval=0.0, title='Initial Stop Loss')

// === INPUT TO SELECT BARS BACK

barsBack = input(title='ATR Period', defval=1)

// === INPUT TO SELECT MULTPLIER FACTOR

multplierFactor = input.float(title='ATR multplierFactoriplier', step=0.1, defval=3.0)

RSI = input.int(title='RSI', defval=7, minval=1, maxval=100)

calcSection = input(title='══════════ LOT CALC ══════════', defval=true)

accountBalance = input.float(title="ACCOUNT BALANCE", defval=250000, minval=1, group="INPUTS")

entryPrice = input.float(title="ENTRY PRICE", defval=100, minval=1, group="INPUTS")

slPrice = input.float(title="STOP LOSS PRICE", defval=100, minval=1, group="INPUTS")

riskPer = input.float(title="RISK USD", defval=1, minval=0.1, group="INPUTS")

lotSize = input.float(title="LOT SIZE", defval=10, minval=0.1, group="INPUTS")

RiskSize = riskPer

qtyLongTargetPrice = math.abs((RiskSize / ((entryPrice - slPrice) * syminfo.pointvalue)) / lotSize)

trendcSection = input(title='══════════ TREND LINE ══════════', defval=true)

// ema trend

tLen = input.int(200, minval=1, title="Trend Line")

tSrc = input(close, title="Source")

thisEma = ta.ema(tSrc, tLen)

plot(thisEma, title = "Trend Line",color=#ffffff)

MTSection = input(title='══════════ MT LOGIN ══════════', defval=true)

exchange = input.string(defval='MT5', title='EXCHANGE', options=['MT4', 'MT5'])

mtLogin= input.string(defval="", title='MT LOGIN', group = "mt")

mtPassword =input.string(defval='', title='MT PASSWORD', group = "mt")

mtServer =input.string(defval='', title='MT SERVER', group = "mt")

mtIsOn = input.string(defval='ON', title='STRATEGY ON', options=['ON', 'OFF'])

mtEntryMode = input.string(defval='CLOSE OPEN', title='ENTRY MODE', options=['CLOSE OPEN', 'OPEN'])

displaySection = input(title='══════════ DISPLAY LOGIN ══════════', defval=true)

displayTable = input(title="DISPLAY TABLE", defval=false, group = 'PRODUCTION', tooltip = "MAKES YOUR STRATEGY TRIGGER SLOWER")

//

// ▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒ //

// LOGIC TO FIND DIRECTION WHEN THERE IS TREND CHANGE ACCORDING VOLATILITY

atr = multplierFactor * ta.atr(barsBack)

longStop = hl2 - atr

longStopPrev = nz(longStop[1], longStop)

longStop := close[1] > longStopPrev ? math.max(longStop, longStopPrev) : longStop

shortStop = hl2 + atr

shortStopPrev = nz(shortStop[1], shortStop)

shortStop := close[1] < shortStopPrev ? math.min(shortStop, shortStopPrev) : shortStop

direction = 1

direction := nz(direction[1], direction)

direction := direction == -1 and close > shortStopPrev ? 1 : direction == 1 and close < longStopPrev ? -1 : direction

longColor = color.blue

shortColor = color.blue

var valueToPlot = 0.0

var colorToPlot = color.white

if direction == 1

valueToPlot := longStop

colorToPlot := color.green

colorToPlot

else

valueToPlot := shortStop

colorToPlot := color.red

colorToPlot

//RSI

src = close

ep = 2 * RSI - 1

auc = ta.ema(math.max(src - src[1], 0), ep)

adc = ta.ema(math.max(src[1] - src, 0), ep)

x1 = (RSI - 1) * (adc * 70 / (100 - 70) - auc)

ub = x1 >= 0 ? src + x1 : src + x1 * (100 - 70) / 70

x2 = (RSI - 1) * (adc * 30 / (100 - 30) - auc)

lb = x2 >= 0 ? src + x2 : src + x2 * (100 - 30) / 30

//Affichage

plot(math.avg(ub, lb), color=color.white ,linewidth=1, title='RSI')

plot(valueToPlot == 0.0 ? na : valueToPlot, title='Action Line', linewidth=2, color=color.new(colorToPlot, 0))

plotshape(direction == 1 and direction[1] == -1 ? longStop : na, title='Buy', style=shape.labelup, location=location.absolute, size=size.normal, text='Buy', textcolor=color.new(color.white, 0), color=color.new(color.green, 0))

plotshape(direction == -1 and direction[1] == 1 ? shortStop : na, title='Sell', style=shape.labeldown, location=location.absolute, size=size.normal, text='Sell', textcolor=color.new(color.white, 0), color=color.new(color.red, 0))

p_ma1 = plot(valueToPlot, title = "ST", color = color.rgb(255, 236, 66))

p_ma2 = plot(math.avg(ub, lb), title = "RSI", color = color.rgb(234, 0, 255))

// Definitions: Trends

TrendUp1() =>

valueToPlot > math.avg(ub, lb)

TrendDown1() =>

valueToPlot < math.avg(ub, lb)

trendColor1 = TrendUp1() ? color.rgb(255, 236, 66, 85): TrendDown1() ? color.rgb(234, 0, 255, 85) : color.rgb(255, 255, 255, 85)

fill(p_ma1, p_ma2, color=trendColor1)

longCondition () =>

ta.crossover(close, valueToPlot)

shortCondition () =>

ta.crossunder(close, valueToPlot)

IsLongShort() =>

strategy.position_size != 0

getNewLotSize() =>

math.abs(riskPer / (close - valueToPlot))

// plot(getNewLotSize(), "new lot size")

newLotS = getNewLotSize()

alertManagement = str.tostring(exchange) + "," + str.tostring(mtLogin) + "," +str.tostring(mtPassword) + ","

alertManagement += str.tostring(mtServer) + "," + str.tostring(newLotS)

// alertManagement += str.tostring(stopLoss) + "," + str.tostring(applyingSL) + "," + str.tostring(applyTrailingStop) + ","

// alertManagement += str.tostring(exchange) + "," + str.tostring(exchangeAccount) + "," + str.tostring(slAmount) + "," + str.tostring(closeTpAmount) + ","

// alertManagement += str.tostring(exchangeLeverage) + "," + str.tostring(exchangeLeverageType) + ","

// alertManagement += str.tostring(mtLogin) + "," + str.tostring(mtPassword) + "," + str.tostring(mtServer) + "," + str.tostring(mtLot) + ","

// alertManagement += str.tostring(mtTp) + "," + str.tostring(mtTs) + "," + str.tostring(orderStrategy)

// alertManagement = "alertManagement"

myStop = 0.0

myTarget = 0.0

if (longCondition())

qtyLongTargetPrice := math.abs((RiskSize / ((close - valueToPlot) * syminfo.pointvalue)) / lotSize)

if IsLongShort()

strategy.close_all(comment = "close all entries")

strategy.entry("LONG", strategy.long, qty=12, comment="LONG", alert_message=alertManagement)

strategy.exit("TPL", "LONG", stop=valueToPlot, limit= close + (close - valueToPlot), comment="Target", alert_message=alertManagement)

if (shortCondition())

qtyLongTargetPrice := math.abs((RiskSize / ((close - valueToPlot) * syminfo.pointvalue)) / lotSize)

if IsLongShort()

strategy.close_all(comment = "close all entries")

strategy.entry("SHORT", strategy.short, qty=12, comment="SHORT", alert_message=alertManagement)

strategy.exit("TPS", "SHORT", stop=valueToPlot, limit= close + (close - valueToPlot), comment="Target", alert_message=alertManagement)

// Calculate the average profit per open trade

// avgProfit = profitSum / strategy.opentrades

getTotalProfit()=>

// Sum the profit of all open trades

profitSum = 0.0

for tradeNumber = 0 to strategy.closedtrades - 1

if strategy.closedtrades.profit(tradeNumber) > 0

profitSum += strategy.closedtrades.profit(tradeNumber)

result = profitSum

getTotalLoss()=>

// Sum the profit of all open trades

lossSum = 0.0

for tradeNumber = 0 to strategy.closedtrades - 1

if strategy.closedtrades.profit(tradeNumber) < 0

lossSum += strategy.closedtrades.profit(tradeNumber)

result = lossSum

maxLossRun()=>

lossRun = 0.0

currentMaxLoss = 0.0

for tradeNo = 0 to strategy.closedtrades - 1

if strategy.closedtrades.profit(tradeNo) < 0.0

lossRun += strategy.closedtrades.profit(tradeNo)

else

currentMaxLoss := math.min(currentMaxLoss, lossRun)

lossRun := 0.0

result = currentMaxLoss

TotalTrades() =>

strategy.closedtrades + strategy.opentrades

maxDrawDown() =>

maxDrawdown = 0.0

for tradeNo = 0 to strategy.closedtrades - 1

maxDrawdown := math.max(maxDrawdown, strategy.closedtrades.max_drawdown(tradeNo))

result = maxDrawdown

maxRunUp() =>

maxRunup = 0.0

for tradeNo = 0 to strategy.closedtrades - 1

maxRunup := math.max(maxRunup, strategy.closedtrades.max_runup(tradeNo))

result = maxRunup

tradeMaxLossReached() =>

maxLoss = 0.0

for tradeNo = 0 to strategy.closedtrades - 1

maxLoss := math.min(maxLoss, strategy.closedtrades.profit(tradeNo))

result = maxLoss

tradingStartTime() =>

strategy.closedtrades.entry_time(0)

daysBetween(t1, t2) => (t1 - t2) / 86400000

// Table

var InfoPanel = table.new(position = position.bottom_right, columns = 2, rows = 40, border_width = 1)

ftable(_table_id, _column, _row, _text, _bgcolor) =>

table.cell(_table_id, _column, _row, _text, 0, 0, color.black, text.align_right, text.align_center, size.small, _bgcolor)

tfString(int timeInMs) =>

// @function Produces a string corresponding to the input time in days, hours, and minutes.

// @param (series int) A time value in milliseconds to be converted to a string variable.

// @returns (string) A string variable reflecting the amount of time from the input time.

float s = timeInMs / 100000

float m = s / 60

float h = m / 60

float d = h / 24

float mo = d / 30.416

int tm = math.floor(m % 60)

int tr = math.floor(h % 24)

int td = math.floor(d % 30.416)

int tmo = math.floor(mo % 12)

int ys = math.floor(d / 365)

string result =

switch

d == 30 and tr == 10 and tm == 30 => "1M"

d == 7 and tr == 0 and tm == 0 => "1W"

=>

string yStr = ys ? str.tostring(ys) + "Y " : ""

string moStr = tmo ? str.tostring(tmo) + "M " : ""

string dStr = td ? str.tostring(td) + "D " : ""

string hStr = tr ? str.tostring(tr) + "H " : ""

string mStr = tm ? str.tostring(tm) + "min" : ""

yStr + moStr + dStr + hStr + mStr

if displayTable

maxLossRunInMarket= maxLossRun()

maxLossReached = tradeMaxLossReached()

tradeMaxLossReached = tradeMaxLossReached()

tradingInDays=daysBetween(time, tradingStartTime())

totalTrades=TotalTrades()

- Stratégie de négociation de réseau fixe

- Indice de force relative Stratégie longue/courte

- Stratégie de rupture à double dynamique

- Stratégie de négociation de réversion moyenne basée sur les bandes de Bollinger et le ratio d'or

- Tendance de l'élan suivant la stratégie d'oscillation

- Suivre la stratégie basée sur la tendance de la vague et la tendance de la CMF

- Stratégie de suivi de tendance adaptative de Bollinger

- La stratégie de croisement des moyennes mobiles RSI sur plusieurs périodes

- Stratégie de rupture de tendance basée sur des bandes de Bollinger

- Stratégie d'arbitrage de moyenne mobile régularisée adaptative

- Stratégie d'indicateur de dynamique

- Stratégie inverse de Heikin-Ashi

- Stratégie de rupture de l'oscillation dynamique

- Tendance à la suite de la stratégie de convergence de l' EMA à 5 minutes

- Tendance de l'indice de risque suivant la stratégie

- Stratégie de divergence des IRS

- Stratégie de négociation DCA pondérée graduellement quantifiée

- Déviation de la moyenne mobile double combinée à la tendance de l'indicateur ATR

- Stratégie multi-tendance

- Stratégie de rentabilisation