Stratégie de rupture adaptative PMax basée sur les indicateurs RSI et T3

Aperçu

Cette stratégie est une stratégie de trading quantitative qui utilise les indicateurs RSI et T3 pour juger de la tendance et, en combinaison avec les indicateurs ATR, définir une ligne de stop-loss, pour réaliser un PMax adapté à la rupture. Son idée principale est d’optimiser le jugement de la tendance et les paramètres de stop-loss pour contrôler le risque tout en augmentant la rentabilité.

Principe de stratégie

Calculer le RSI et le T3 pour déterminer la tendance

- L’indicateur RSI est utilisé pour déterminer si une action est sur-achetée ou sur-vendue.

- Calculer les indices T3 en fonction de l’indicateur RSI pour déterminer la tendance

PMax est réglé en fonction de l’indicateur ATR

- Calculer l’indicateur ATR comme représentant de la volatilité

- Une ligne de stop-loss est définie au-dessus et en dessous de l’indicateur T3 et la largeur de la ligne est un certain nombre de fois l’indicateur ATR.

- Adaptation à la ligne de stop-loss

Achat et sortie à perte

- Le prix est considéré comme un signal d’achat lorsqu’il dépasse l’indicateur T3

- Retrait de la position actuelle lorsque le prix franchit la ligne de stop-loss

Avantages stratégiques

Les principaux avantages de cette stratégie sont les suivants:

- Les indices RSI et T3 combinés sont plus précis pour déterminer la tendance

- PMax s’adapte aux mécanismes de contrôle des pertes

- L’indicateur ATR sert de représentant de la volatilité pour définir la largeur de la ligne de rupture, en évitant d’être trop radical

- Le retrait et la rentabilité

Risque stratégique

La stratégie présente principalement les risques suivants:

- Le risque de revers

Lorsqu’une inversion de prix se produit dans un court laps de temps, cela peut entraîner une perte de stop-loss. La ligne de stop-loss peut être relâchée de manière appropriée pour réduire l’impact de la inversion.

- Le risque d’échec

Les indicateurs RSI et T3 ne sont pas fiables à 100% pour déterminer les tendances et peuvent entraîner des pertes en cas d’erreur de jugement. Les paramètres peuvent être ajustés de manière appropriée ou ajoutés à d’autres indicateurs pour optimiser.

Orientation de l’optimisation de la stratégie

Cette stratégie peut être optimisée dans les domaines suivants:

- Ajouter d’autres indicateurs comme les moyennes mobiles pour aider à juger la tendance

- Optimiser les paramètres de longueur des indices RSI et T3

- Tester différents ATR comme largeur de la ligne d’arrêt

- Amélioration de la marge de freinage en fonction des marchés

Résumer

Cette stratégie intègre les avantages de l’utilisation des trois indicateurs RSI, T3 et ATR, permettant une combinaison organique de jugement de tendance et de contrôle du risque. Par rapport à un seul indicateur, la combinaison présente des caractéristiques de haute précision de jugement et de contrôle du retrait, ce qui en fait une stratégie de suivi de tendance fiable. Il y a de la place pour l’optimisation des paramètres et du contrôle du risque, ce qui en fait une stratégie de trading quantitative recommandée dans l’ensemble.

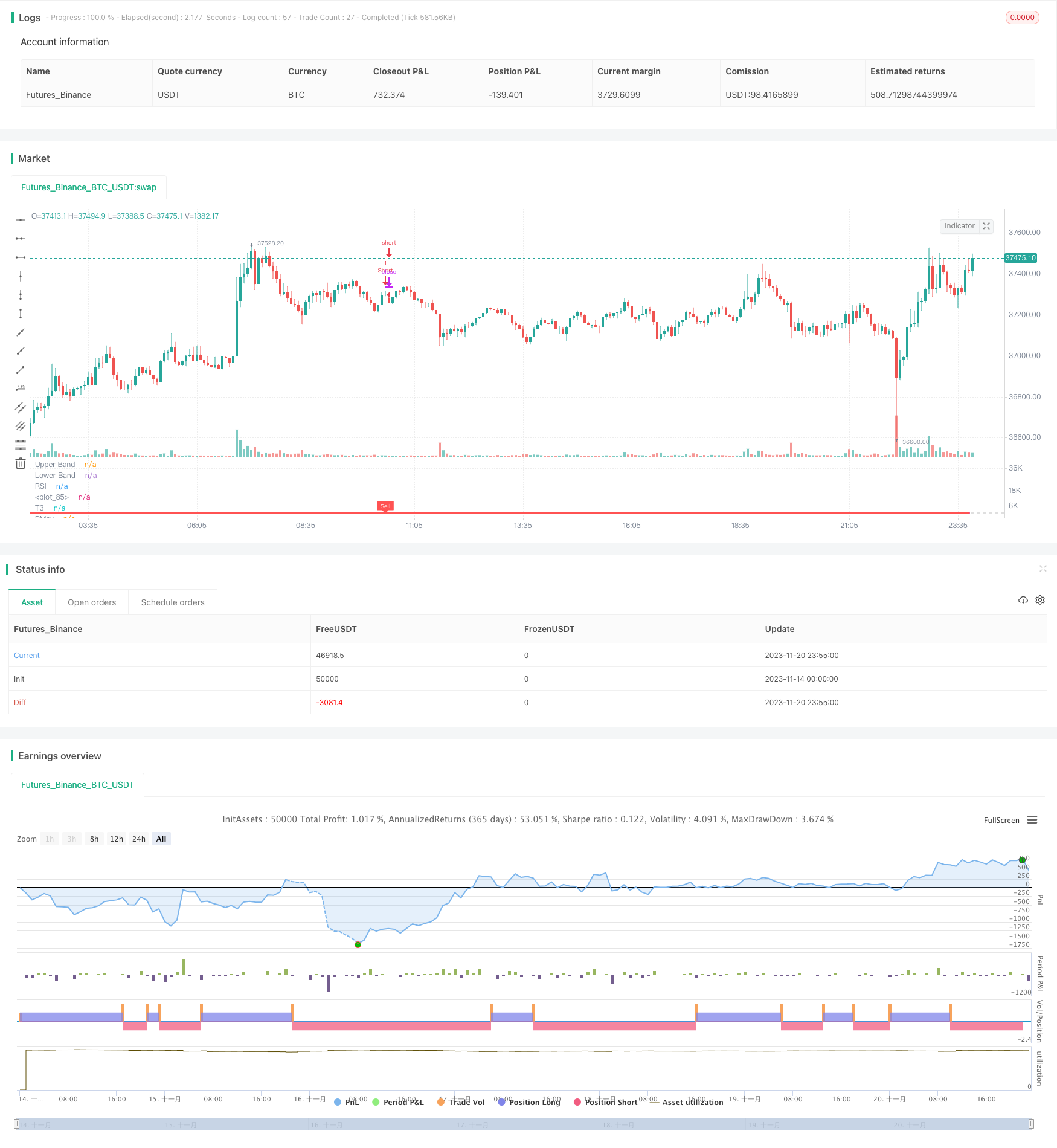

/*backtest

start: 2023-11-14 00:00:00

end: 2023-11-21 00:00:00

period: 5m

basePeriod: 1m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © KivancOzbilgic

//developer: @KivancOzbilgic

//author: @KivancOzbilgic

strategy("PMax on Rsi w T3 Strategy","PmR3St.", overlay=false, precision=2)

src = input(hl2, title="Source")

Multiplier = input(title="ATR Multiplier", type=input.float, step=0.1, defval=3)

length =input(8, "Tillson T3 Length", minval=1)

T3a1 = input(0.7, "TILLSON T3 Volume Factor", step=0.1)

Periods = input(10,title="ATR Length", type=input.integer)

rsilength = input(14, minval=1, title="RSI Length")

showrsi = input(title="Show RSI?", type=input.bool, defval=true)

showsupport = input(title="Show Moving Average?", type=input.bool, defval=true)

showsignalsk = input(title="Show Crossing Signals?", type=input.bool, defval=true)

highlighting = input(title="Highlighter On/Off ?", type=input.bool, defval=true)

i = close>=close[1] ? close-close[1] : 0

i2 = close<close[1] ? close[1]-close : 0

Wwma_Func(src,rsilength)=>

wwalpha = 1/ rsilength

WWMA = 0.0

WWMA := wwalpha*src + (1-wwalpha)*nz(WWMA[1])

WWMA=Wwma_Func(src,rsilength)

AvUp = Wwma_Func(i,rsilength)

AvDown = Wwma_Func(i2,rsilength)

AvgUp = sma(i,rsilength)

AvgDown =sma(i2,rsilength)

k1 = high>close[1] ? high-close[1] : 0

k2 = high<close[1] ? close[1]-high : 0

k3 = low>close[1] ? low-close[1] : 0

k4 = low<close[1] ? close[1]-low : 0

AvgUpH=(AvgUp*(rsilength-1)+ k1)/rsilength

AvgDownH=(AvgDown*(rsilength-1)+ k2)/rsilength

AvgUpL=(AvgUp*(rsilength-1)+ k3)/rsilength

AvgDownL=(AvgDown*(rsilength-1)+ k4)/rsilength

rs = AvUp/AvDown

rsi= rs==-1 ? 0 : (100-(100/(1+rs)))

rsh=AvgUpH/AvgDownH

rsih= rsh==-1 ? 0 : (100-(100/(1+rsh)))

rsl=AvgUpL/AvgDownL

rsil= rsl==-1 ? 0 : (100-(100/(1+rsl)))

TR=max(rsih-rsil,abs(rsih-rsi[1]),abs(rsil-rsi[1]))

atr=sma(TR,Periods)

plot(showrsi ? rsi : na, "RSI", color=#8E1599)

band1 = hline(70, "Upper Band", color=#C0C0C0)

band0 = hline(30, "Lower Band", color=#C0C0C0)

fill(band1, band0, color=#9915FF, transp=90, title="Background")

T3e1=ema(rsi, length)

T3e2=ema(T3e1,length)

T3e3=ema(T3e2,length)

T3e4=ema(T3e3,length)

T3e5=ema(T3e4,length)

T3e6=ema(T3e5,length)

T3c1=-T3a1*T3a1*T3a1

T3c2=3*T3a1*T3a1+3*T3a1*T3a1*T3a1

T3c3=-6*T3a1*T3a1-3*T3a1-3*T3a1*T3a1*T3a1

T3c4=1+3*T3a1+T3a1*T3a1*T3a1+3*T3a1*T3a1

T3=T3c1*T3e6+T3c2*T3e5+T3c3*T3e4+T3c4*T3e3

MAvg=T3

Pmax_Func(rsi,length)=>

longStop = MAvg - Multiplier*atr

longStopPrev = nz(longStop[1], longStop)

longStop := MAvg > longStopPrev ? max(longStop, longStopPrev) : longStop

shortStop = MAvg + Multiplier*atr

shortStopPrev = nz(shortStop[1], shortStop)

shortStop := MAvg < shortStopPrev ? min(shortStop, shortStopPrev) : shortStop

dir = 1

dir := nz(dir[1], dir)

dir := dir == -1 and MAvg > shortStopPrev ? 1 : dir == 1 and MAvg < longStopPrev ? -1 : dir

PMax = dir==1 ? longStop: shortStop

PMax=Pmax_Func(rsi,length)

plot(showsupport ? MAvg : na, color=color.black, linewidth=2, title="T3")

pALL=plot(PMax, color=color.red, linewidth=2, title="PMax", transp=0)

alertcondition(cross(MAvg, PMax), title="Cross Alert", message="PMax - Moving Avg Crossing!")

alertcondition(crossover(MAvg, PMax), title="Crossover Alarm", message="Moving Avg BUY SIGNAL!")

alertcondition(crossunder(MAvg, PMax), title="Crossunder Alarm", message="Moving Avg SELL SIGNAL!")

alertcondition(cross(src, PMax), title="Price Cross Alert", message="PMax - Price Crossing!")

alertcondition(crossover(src, PMax), title="Price Crossover Alarm", message="PRICE OVER PMax - BUY SIGNAL!")

alertcondition(crossunder(src, PMax), title="Price Crossunder Alarm", message="PRICE UNDER PMax - SELL SIGNAL!")

buySignalk = crossover(MAvg, PMax)

plotshape(buySignalk and showsignalsk ? PMax*0.995 : na, title="Buy", text="Buy", location=location.absolute, style=shape.labelup, size=size.tiny, color=color.green, textcolor=color.white, transp=0)

sellSignallk = crossunder(MAvg, PMax)

plotshape(sellSignallk and showsignalsk ? PMax*1.005 : na, title="Sell", text="Sell", location=location.absolute, style=shape.labeldown, size=size.tiny, color=color.red, textcolor=color.white, transp=0)

mPlot = plot(rsi, title="", style=plot.style_circles, linewidth=0,display=display.none)

longFillColor = highlighting ? (MAvg>PMax ? color.green : na) : na

shortFillColor = highlighting ? (MAvg<PMax ? color.red : na) : na

fill(mPlot, pALL, title="UpTrend Highligter", color=longFillColor)

fill(mPlot, pALL, title="DownTrend Highligter", color=shortFillColor)

dummy0 = input(true, title = "=Backtest Inputs=")

FromDay = input(defval = 1, title = "From Day", minval = 1, maxval = 31)

FromMonth = input(defval = 1, title = "From Month", minval = 1, maxval = 12)

FromYear = input(defval = 2005, title = "From Year", minval = 2005)

ToDay = input(defval = 1, title = "To Day", minval = 1, maxval = 31)

ToMonth = input(defval = 1, title = "To Month", minval = 1, maxval = 12)

ToYear = input(defval = 9999, title = "To Year", minval = 2006)

Start = timestamp(FromYear, FromMonth, FromDay, 00, 00)

Finish = timestamp(ToYear, ToMonth, ToDay, 23, 59)

Timerange() =>

time >= Start and time <= Finish ? true : false

if buySignalk

strategy.entry("Long", strategy.long,when=Timerange())

if sellSignallk

strategy.entry("Short", strategy.short,when=Timerange())