Stratégie de capture de l'inverse

Auteur:ChaoZhang est là., Date: 2023-11-24 16:43:25 Je vous en prie.Les étiquettes:

Résumé

La stratégie Reversal-Catcher est une stratégie de trading inverse qui utilise l'indicateur de volatilité Bollinger Bands et l'indicateur de dynamique RSI. Elle définit le canal Bollinger Bands et les lignes de surachat/survente RSI comme signaux pour trouver des opportunités d'inversion lorsque la direction de la tendance change.

La logique de la stratégie

La stratégie utilise les bandes de Bollinger comme indicateur technique principal, combiné avec le RSI et d'autres indicateurs de dynamique pour vérifier les signaux de trading.

- Utilisez l'EMA à 50 jours et l'EMA à 21 jours pour déterminer la tendance.

- Dans une tendance à la baisse, lorsque le prix dépasse la bande inférieure de Bollinger, et que l'indicateur RSI rebondit du territoire de survente, formant une croix dorée, il indique que la zone de survente a déjà atteint son fond, donnant un signal d'achat.

- Dans une tendance à la hausse, lorsque le prix dépasse la bande supérieure de Bollinger et que l'indice RSI retombe de la zone de surachat, formant une croix morte, il indique que la zone de surachat commence à se rétracter, donnant un signal de vente.

- Les signaux d'achat et de vente ci-dessus doivent être déclenchés ensemble pour éviter de faux signaux.

Analyse des avantages

Les avantages de cette stratégie sont les suivants:

- La combinaison des indicateurs de volatilité et de dynamique rend les signaux plus fiables.

- Le trading inverse présente un risque moindre et convient aux transactions à court terme.

- Les règles de trading sont programmables pour le trading automatisé.

- La combinaison avec le trading de tendance évite l'ouverture de désordres lors de la consolidation du marché.

Analyse des risques

Les risques de cette stratégie comprennent:

- Les bandes de Bollinger sont un risque de faux signaux, il faut un filtre RSI.

- Risque de renversement échoué, nécessite un stop-loss rapide.

- Risque d'inversion du moment, peut entrer trop tôt ou manquer le meilleur point d'entrée.

Pour contrôler les risques, nous pouvons définir un niveau de stop loss pour limiter l'exposition au risque, et optimiser des paramètres comme la période des bandes de Bollinger ou les chiffres du RSI pour améliorer les performances du système.

Directions d'optimisation

Les principaux axes d'optimisation sont les suivants:

- Optimiser les paramètres des bandes de Bollinger, ajuster la durée de la période et l'écart type pour trouver le réglage optimal.

- Optimiser la période des moyennes mobiles pour déterminer la meilleure période pour juger de la tendance.

- Ajustez les paramètres du RSI pour connaître la meilleure fourchette de surachat/survente.

- Ajoutez d'autres indicateurs comme KDJ, MACD pour diversifier les signaux d'entrée.

- Introduire des modèles d'apprentissage automatique pour trouver des paramètres optimisés.

Conclusion

La stratégie Reversal-Catcher est une stratégie de trading à court terme efficace dans l'ensemble. En combinant le filtrage des tendances et les signaux d'inversion, elle peut éviter de faux signaux lors de la consolidation du marché et éviter de lutter contre la tendance.

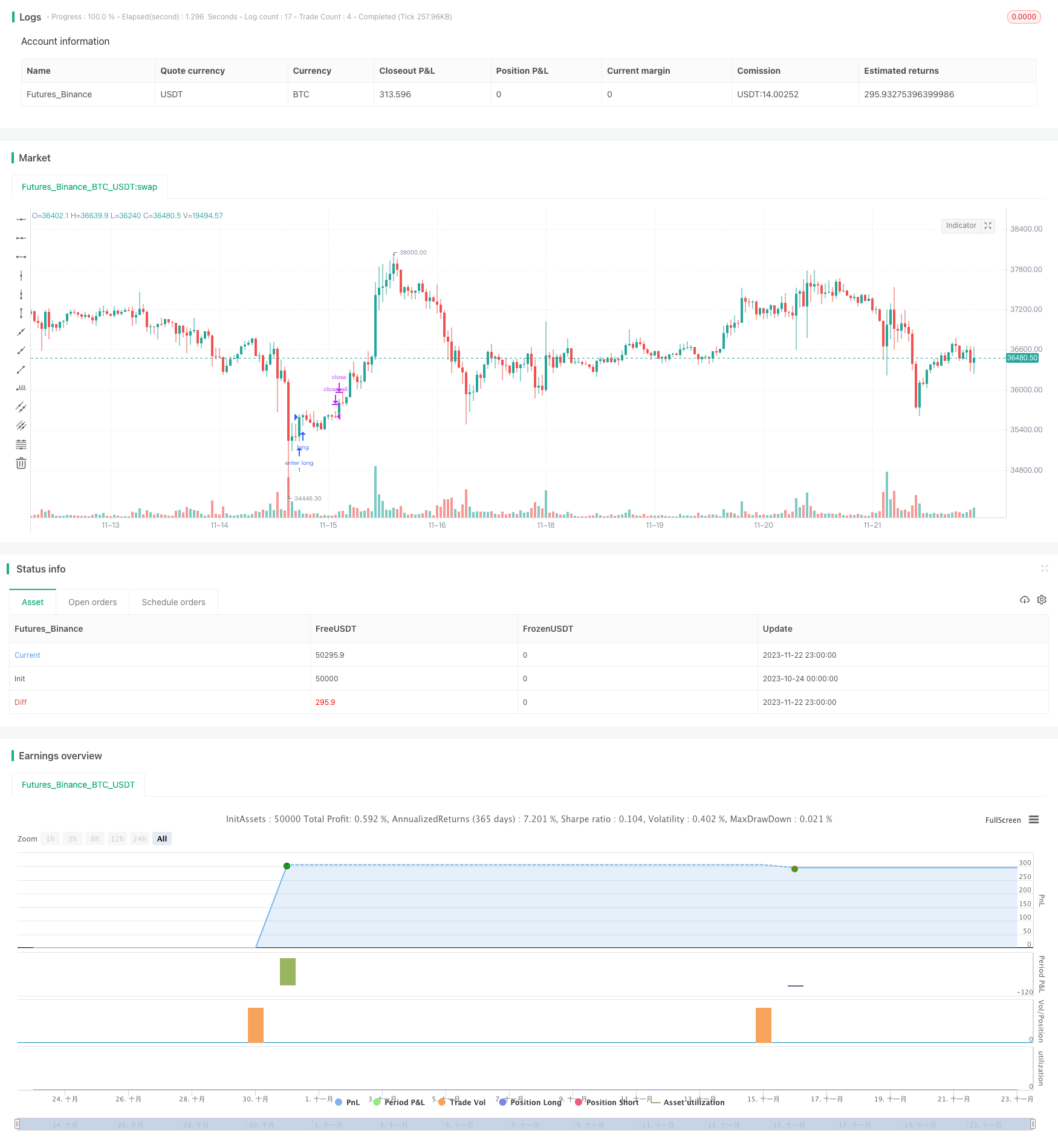

/*backtest

start: 2023-10-24 00:00:00

end: 2023-11-23 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This is an Open source work. Please do acknowledge in case you want to reuse whole or part of this code.

// Please see the documentation to know the details about this.

//@version=5

strategy('Strategy:Reversal-Catcher', shorttitle="Reversal-Catcher", overlay=true , currency=currency.NONE, initial_capital=100000)

// Inputs

src = input(close, title="Source (close, high, low, open etc.")

BBlength = input.int(defval=20, minval=1,title="Bollinger Period Length, default 20")

BBmult = input.float(defval=1.5, minval=1.0, maxval=4, step=0.1, title="Bollinger Bands Standard Deviation, default is 1.5")

fastMovingAvg = input.int(defval=21, minval=5,title="Fast Exponential Moving Average, default 21", group = "Trends")

slowMovingAvg = input.int(defval=50, minval=8,title="Slow Exponential Moving Average, default 50", group = "Trends")

rsiLenght = input.int(defval=14, title="RSI Lenght, default 14", group = "Momentum")

overbought = input.int(defval=70, title="Overbought limit (RSI), default 70", group = "Momentum")

oversold = input.int(defval=30, title="Oversold limit (RSI), default 30", group = "Momentum")

hide = input.bool(defval=true, title="Hide all plots and legends from the chart (default: true)")

// Trade related

tradeType = input.string(defval='Both', group="Trade settings", title="Trade Type", options=['Both', 'TrendFollowing', 'Reversal'], tooltip="Consider all types of trades? Or only Trend Following or only Reversal? (default: Both).")

endOfDay = input.int(defval=1500, title="Close all trades, default is 3:00 PM, 1500 hours (integer)", group="Trade settings")

mktAlwaysOn = input.bool(defval=false, title="Markets that never closed (Crypto, Forex, Commodity)", tooltip="Some markers never closes. For those cases, make this checked. (Default: off)", group="Trade settings")

// Utils

annotatePlots(txt, val, hide) =>

if (not hide)

var l1 = label.new(bar_index, val, txt, style=label.style_label_left, size = size.tiny, textcolor = color.white, tooltip = txt)

label.set_xy(l1, bar_index, val)

/////////////////////////////// Indicators /////////////////////

vwap = ta.vwap(src)

plot(hide ? na : vwap, color=color.purple, title="VWAP", style = plot.style_line)

annotatePlots('VWAP', vwap, hide)

// Bollinger Band of present time frame

[BBbasis, BBupper, BBlower] = ta.bb(src, BBlength, BBmult)

p1 = plot(hide ? na : BBupper, color=color.blue,title="Bollinger Bands Upper Line")

p2 = plot(hide ? na : BBlower, color=color.blue,title="Bollinger Bands Lower Line")

p3 = plot(hide ? na : BBbasis, color=color.maroon,title="Bollinger Bands Width", style=plot.style_circles, linewidth = 1)

annotatePlots('BB-Upper', BBupper, hide)

annotatePlots('BB-Lower', BBlower, hide)

annotatePlots('BB-Base(20-SMA)', BBbasis, hide)

// RSI

rsi = ta.rsi(src, rsiLenght)

// Trend following

ema50 = ta.ema(src, slowMovingAvg)

ema21 = ta.ema(src, fastMovingAvg)

annotatePlots('21-EMA', ema21, hide)

annotatePlots('50-EMA', ema50, hide)

// Trend conditions

upTrend = ema21 > ema50

downTrend = ema21 < ema50

// Condition to check Special Entry: HH_LL

// Long side:

hhLLong = barstate.isconfirmed and (low > low[1]) and (high > high[1]) and (close > high[1])

hhLLShort = barstate.isconfirmed and (low < low[1]) and (high < high[1]) and (close < low[1])

longCond = barstate.isconfirmed and (high[1] < BBlower[1]) and (close > BBlower) and (close < BBupper) and hhLLong and ta.crossover(rsi, oversold) and downTrend

shortCond = barstate.isconfirmed and (low[1] > BBupper[1]) and (close < BBupper) and (close > BBlower) and hhLLShort and ta.crossunder(rsi, overbought) and upTrend

// Trade execute

h = hour(time('1'), syminfo.timezone)

m = minute(time('1'), syminfo.timezone)

hourVal = h * 100 + m

totalTrades = strategy.opentrades + strategy.closedtrades

if (mktAlwaysOn or (hourVal < endOfDay))

// Entry

var float sl = na

var float target = na

if (longCond)

strategy.entry("enter long", strategy.long, 1, limit=na, stop=na, comment="Long[E]")

sl := low[1]

target := high >= BBbasis ? BBupper : BBbasis

alert('Buy:' + syminfo.ticker + ' ,SL:' + str.tostring(math.floor(sl)) + ', Target:' + str.tostring(target), alert.freq_once_per_bar)

if (shortCond)

strategy.entry("enter short", strategy.short, 1, limit=na, stop=na, comment="Short[E]")

sl := high[1]

target := low <= BBbasis ? BBlower : BBbasis

alert('Sell:' + syminfo.ticker + ' ,SL:' + str.tostring(math.floor(sl)) + ', Target:' + str.tostring(target), alert.freq_once_per_bar)

// Exit: target or SL

if ((close >= target) or (close <= sl))

strategy.close("enter long", comment=close < sl ? "Long[SL]" : "Long[T]")

if ((close <= target) or (close >= sl))

strategy.close("enter short", comment=close > sl ? "Short[SL]" : "Short[T]")

else if (not mktAlwaysOn)

// Close all open position at the end if Day

strategy.close_all(comment = "EoD[Exit]", alert_message = "EoD Exit", immediately = true)

- Stratégie d'inversion des prix guidée par le canal des prix

- Stratégie des bénéfices de l'indicateur KST

- Stratégie dynamique d'ajout de position bidirectionnelle

- Stratégie de renversement de l'indice de force relative

- Stratégie de trading rapide pour les crypto-monnaies

- L'indicateur RSI de KDJ est une stratégie de signaux croisés d'achat-vente.

- Ichimoku Backtester avec TP, SL et confirmation dans le cloud

- Stratégie des bandes gyroscopiques basée sur plusieurs délais et amplitude moyenne

- Stratégie d'inversion de la moyenne mobile croisée double

- Stratégie de suivi des moyennes mobiles dynamiques

- Stratégie d'inversion de l'écart RSI

- Stratégie de conseiller expert de 3 minutes

- Zone d'action ATR Stratégie de quantité en ordre inverse

- Tendance du MACD à la suite de la stratégie

- Analyse de l' élan Ichimoku Nuage de brouillard Foudre Stratégie de négociation

- Stratégie de négociation des feux de circulation basée sur l'EMA

- Stratégie de mise en correspondance de moyenne mobile double basée sur des bandes de Bollinger

- Stratégie de négociation algorithmique inversée à Las Vegas

- Stratégie du système des moyennes mobiles solides

- Stratégie avancée de suivi des tendances de la grille moyenne mobile à bande de Bollinger