Stratégie d'arrêt des pertes de traînée basée sur les écarts de prix

Auteur:ChaoZhang est là., Date: 2023-11-28 13:53:16 Je vous en prie.Les étiquettes:

Résumé

Cette stratégie adopte le principe de l'écart de prix pour aller long lorsque le prix dépasse les plus bas récents, avec des ordres de stop loss et de prise de profit pour suivre le prix le plus bas pour la prise de profit.

La logique de la stratégie

Il identifie les écarts lorsque le prix tombe en dessous du prix le plus bas au cours des N dernières heures, va long basé sur un pourcentage configuré, avec des ordres de stop loss et de take profit.

- Calculer le prix le plus bas en N heures récentes comme prix contraignant

- Passez long lorsque le prix en temps réel est inférieur au prix obligatoire * achetez en pourcentage

- Résultat de prise de participation basé sur le prix d'entrée * pourcentage de vente

- Le montant de l'obligation de mise en œuvre est calculé à partir du montant de l'obligation de mise en œuvre.

- Taille de la position en pourcentage du capital stratégique

- Ligne de perte avec le prix le plus bas

- Position fermée lorsque la prise de profit ou le stop loss est déclenché

Analyse des avantages

Les avantages de cette stratégie:

- Utiliser le concept d'écart de prix, améliorer le taux de réussite

- Stop-loss automatique pour bloquer la plupart des bénéfices

- Pourcentage de stop-loss et de prise de profit personnalisable pour les différents marchés

- Fonctionne bien pour les instruments avec des rebonds évidents

- Une logique simple et facile à mettre en œuvre

Analyse des risques

Il y a aussi des risques:

- La rupture des écarts peut échouer avec des bas plus bas

- Les paramètres de stop loss ou de prise de profit inappropriés peuvent entraîner une sortie prématurée

- Exiger un réglage périodique des paramètres pour les changements du marché

- Les instruments limités peuvent ne pas fonctionner pour certains pays.

- Une intervention manuelle est nécessaire de temps à autre

Directions d'optimisation

La stratégie peut être améliorée dans les domaines suivants:

- Ajouter des modèles d'apprentissage automatique pour le réglage automatique des paramètres

- Ajouter d'autres types d'ordres stop loss/take profit, par ex. stop loss de suivi, ordres entre parenthèses

- Optimiser la logique stop loss/take profit pour des sorties plus intelligentes

- Incorporer plus d'indicateurs pour filtrer les faux signaux

- Élargir à plus d'instruments pour améliorer l'universalité

Conclusion

En conclusion, il s'agit d'une stratégie de stop loss simple et efficace basée sur les écarts de prix. Elle réduit efficacement les fausses entrées et les verrouillages des bénéfices. Il reste encore beaucoup de place pour des améliorations dans le réglage des paramètres et le filtrage des signaux. Il vaut la peine de poursuivre la recherche et le raffinement.

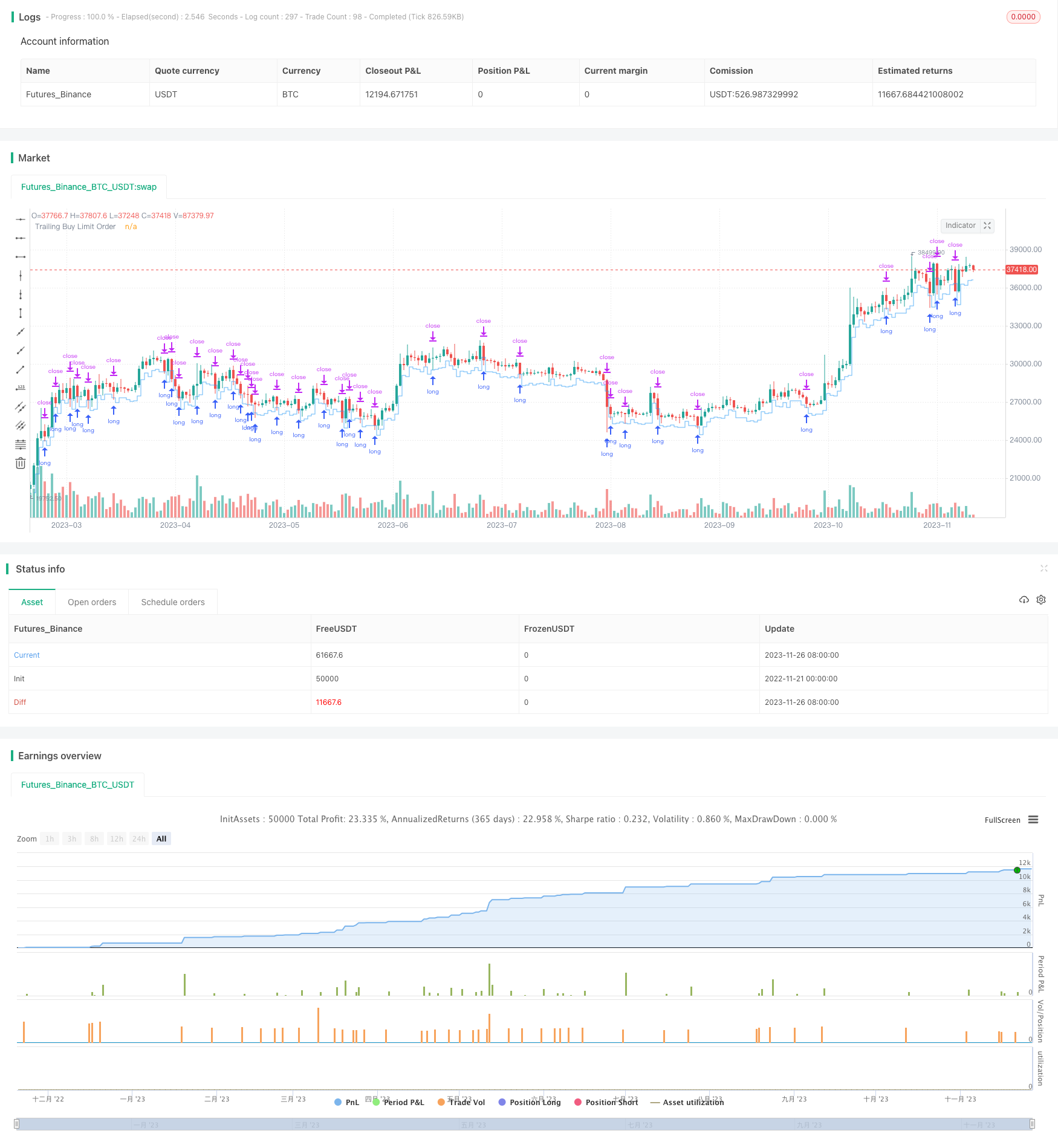

/*backtest

start: 2022-11-21 00:00:00

end: 2023-11-27 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

strategy(title="Squeeze Backtest by Shaqi v1.0", overlay=true, pyramiding=0, currency="USD", process_orders_on_close=true, commission_type=strategy.commission.percent, commission_value=0.075, default_qty_type=strategy.percent_of_equity, default_qty_value=100, initial_capital=100, backtest_fill_limits_assumption=0)

strategy.risk.allow_entry_in(strategy.direction.long)

R0 = "6 Hours"

R1 = "12 Hours"

R2 = "24 Hours"

R3 = "48 Hours"

R4 = "1 Week"

R5 = "2 Weeks"

R6 = "1 Month"

R7 = "Maximum"

buyPercent = input( title="Buy, %", type=input.float, defval=3, minval=0.01, step=0.01, inline="Percents", group="Squeeze Settings") * 0.01

sellPercent = input(title="Sell, %", type=input.float, defval=1, minval=0.01, step=0.01, inline="Percents", group="Squeeze Settings") * 0.01

stopPercent = input(title="Stop Loss, %", type=input.float, defval=1, minval=0.01, maxval=100, step=0.01, inline="Percents", group="Squeeze Settings") * 0.01

isMaxBars = input( title="Max Bars To Sell", type=input.bool, defval=true , inline="MaxBars", group="Squeeze Settings")

maxBars = input( title="", type=input.integer, defval=2, minval=0, maxval=1000, step=1, inline="MaxBars", group="Squeeze Settings")

bind = input( title="Bind", type=input.source, defval=close, group="Squeeze Settings")

isRange = input( title="Fixed Range", type=input.bool, defval=true, inline="Range", group="Backtesting Period")

rangeStart = input( title="", defval=R4, options=[R0, R1, R2, R3, R4, R5, R6, R7], inline="Range", group="Backtesting Period")

periodStart = input(title="Backtesting Start", type=input.time, defval=timestamp("01 Aug 2021 00:00 +0000"), group="Backtesting Period")

periodEnd = input( title="Backtesting End", type=input.time, defval=timestamp("01 Aug 2022 00:00 +0000"), group="Backtesting Period")

int startDate = na

int endDate = na

if isRange

if rangeStart == R0

startDate := timenow - 21600000

endDate := timenow

else if rangeStart == R1

startDate := timenow - 43200000

endDate := timenow

else if rangeStart == R2

startDate := timenow - 86400000

endDate := timenow

else if rangeStart == R3

startDate := timenow - 172800000

endDate := timenow

else if rangeStart == R4

startDate := timenow - 604800000

endDate := timenow

else if rangeStart == R5

startDate := timenow - 1209600000

endDate := timenow

else if rangeStart == R6

startDate := timenow - 2592000000

endDate := timenow

else if rangeStart == R7

startDate := time

endDate := timenow

else

startDate := periodStart

endDate := periodEnd

afterStartDate = (time >= startDate)

beforeEndDate = (time <= endDate)

notInTrade = strategy.position_size == 0

inTrade = strategy.position_size > 0

barsFromEntry = barssince(strategy.position_size[0] > strategy.position_size[1])

entry = strategy.position_size[0] > strategy.position_size[1]

entryBar = barsFromEntry == 0

notEntryBar = barsFromEntry != 0

buyLimitPrice = bind - bind * buyPercent

buyLimitFilled = low <= buyLimitPrice

sellLimitPriceEntry = buyLimitPrice * (1 + sellPercent)

sellLimitPrice = strategy.position_avg_price * (1 + sellPercent)

stopLimitPriceEntry = buyLimitPrice - buyLimitPrice * stopPercent

stopLimitPrice = strategy.position_avg_price - strategy.position_avg_price * stopPercent

if afterStartDate and beforeEndDate and notInTrade

strategy.entry("BUY", true, limit = buyLimitPrice)

strategy.exit("INSTANT", limit = sellLimitPriceEntry, stop = stopLimitPriceEntry)

strategy.cancel("INSTANT", when = inTrade)

if isMaxBars

strategy.close("BUY", when = barsFromEntry >= maxBars, comment = "Don't Sell")

strategy.exit("SELL", limit = sellLimitPrice, stop = stopLimitPrice)

showStop = stopPercent <= 0.03

plot(showStop ? stopLimitPrice : na, title="Stop Loss Limit Order", style=plot.style_linebr, color=color.red, linewidth=1)

plot(sellLimitPrice, title="Take Profit Limit Order", style=plot.style_linebr, color=color.purple, linewidth=1)

plot(strategy.position_avg_price, title="Buy Order Filled Price", style=plot.style_linebr, color=color.blue, linewidth=1)

plot(buyLimitPrice, title="Trailing Buy Limit Order", style=plot.style_stepline, color=color.new(color.blue, 30), offset=1)

- Stratégie MACD à plusieurs délais

- Stratégie de super-scalping basée sur les canaux RSI et ATR

- Stratégie de tendance de Donchian

- Stratégie de croisement des moyennes mobiles multi-SMA

- Stratégie de négociation des indicateurs RSI multiples

- Stratégie SuperTrend avec arrêt de perte de suivi

- Stratégie d'inversion de la moyenne mobile pondérée

- Stratégie de l'indice de force relative moyenne mobile

- Stratégie de suivi de tendance intelligente ADX

- Stratégie d'agrégation de l'impulsion RSI

- Stratégie de rupture de la moyenne mobile

- Stratégie de croisement de tendance combinée d'inversion de la moyenne mobile

- Stratégie de divergence des indicateurs de risque basée sur des axes pivots

- Ratio d'or stratégie de rupture longue

- Stratégie des bandes de Bollinger avec filtre RSI

- Une tendance à la suite d'une stratégie basée sur les canaux Keltner

- Stratégie de croisement des moyennes mobiles RSI

- stratégie de négociation de rupture d'élan

- L'indicateur RSI dynamique et la stratégie de négociation quantitative multifactorielle combinée de l'ICC

- Stratégie de tendance quantitative Super Z