Stratégie d'arrêt des pertes basée sur le suivi des tendances TFO et ATR

Auteur:ChaoZhang est là., Date: 2023-12-04 13:32:41 Je suis désoléLes étiquettes:

Résumé

Cette stratégie est conçue sur la base des indicateurs TFO (Trend Flex Oscillator) et ATR (Average True Range). Elle est adaptée aux marchés haussiers et ouvre des positions longues lorsque l'action des prix survendus semble inverser. Elle ferme généralement les positions en quelques jours, sauf si elle est prise dans un marché baissier, auquel cas elle se maintient.

La logique de la stratégie

Cette stratégie combine les indicateurs TFO et ATR pour déterminer les entrées et les sorties.

Conditions d'entrée: lorsque le TFO tombe en dessous d'un seuil (indiquant des niveaux de survente) et que le TFO a augmenté par rapport à la barre précédente (indiquant un renversement du TFO vers le haut) et que l'ATR est supérieur à un seuil de volatilité fixé (indiquant une volatilité croissante du marché), des positions longues sont ouvertes.

Conditions de sortie: lorsque le TFO dépasse un seuil (indiquant des niveaux de surachat) et que l'ATR dépasse un seuil défini, toutes les positions longues sont fermées.

La stratégie permet jusqu'à 15 positions longues simultanées, les paramètres pouvant être ajustés pour différents délais.

Les avantages

-

La combinaison de l'analyse des tendances et de la volatilité fournit des signaux stables.

-

Les paramètres d'entrée, de sortie et de stop loss réglables offrent une flexibilité.

-

Le stop loss intégré protège contre les mouvements extrêmes.

-

Le soutien à la pyramide et aux sorties partielles permet de compléter les bénéfices sur les marchés haussiers.

Les risques

-

Les marchés baissiers peuvent entraîner des pertes énormes.

-

Un mauvais réglage des paramètres peut entraîner une survente ou des entrées et sorties manquées.

-

Dans les mouvements extrêmes, le stop loss peut échouer et ne pas prévenir d'énormes pertes.

-

Le backtest ne reflète pas pleinement les performances en direct.

Des possibilités d'amélioration

-

Une ligne de stop-loss mobile peut être ajoutée pour des sorties en temps opportun et une meilleure protection à la baisse.

-

Un mécanisme de shorting peut être ajouté pour permettre des bénéfices lors de baisses du marché lorsque le TFO est inversé à la baisse et que l'ATR est suffisamment élevé.

-

Plus de filtres comme le changement de volume peuvent réduire les impacts des mouvements erratiques des prix.

-

Différents délais et paramètres peuvent être testés pour trouver la meilleure combinaison.

Conclusion

Cette stratégie combine les forces de l'analyse de tendance et de volatilité en utilisant TFO et ATR pour déterminer la direction du marché. Des mécanismes tels que la pyramide, la fermeture partielle et le stop loss permettent de compléter les bénéfices tout en contrôlant les risques pendant les marchés haussiers. Il y a place à des améliorations via plus de filtres d'indicateurs et d'optimisation des paramètres.

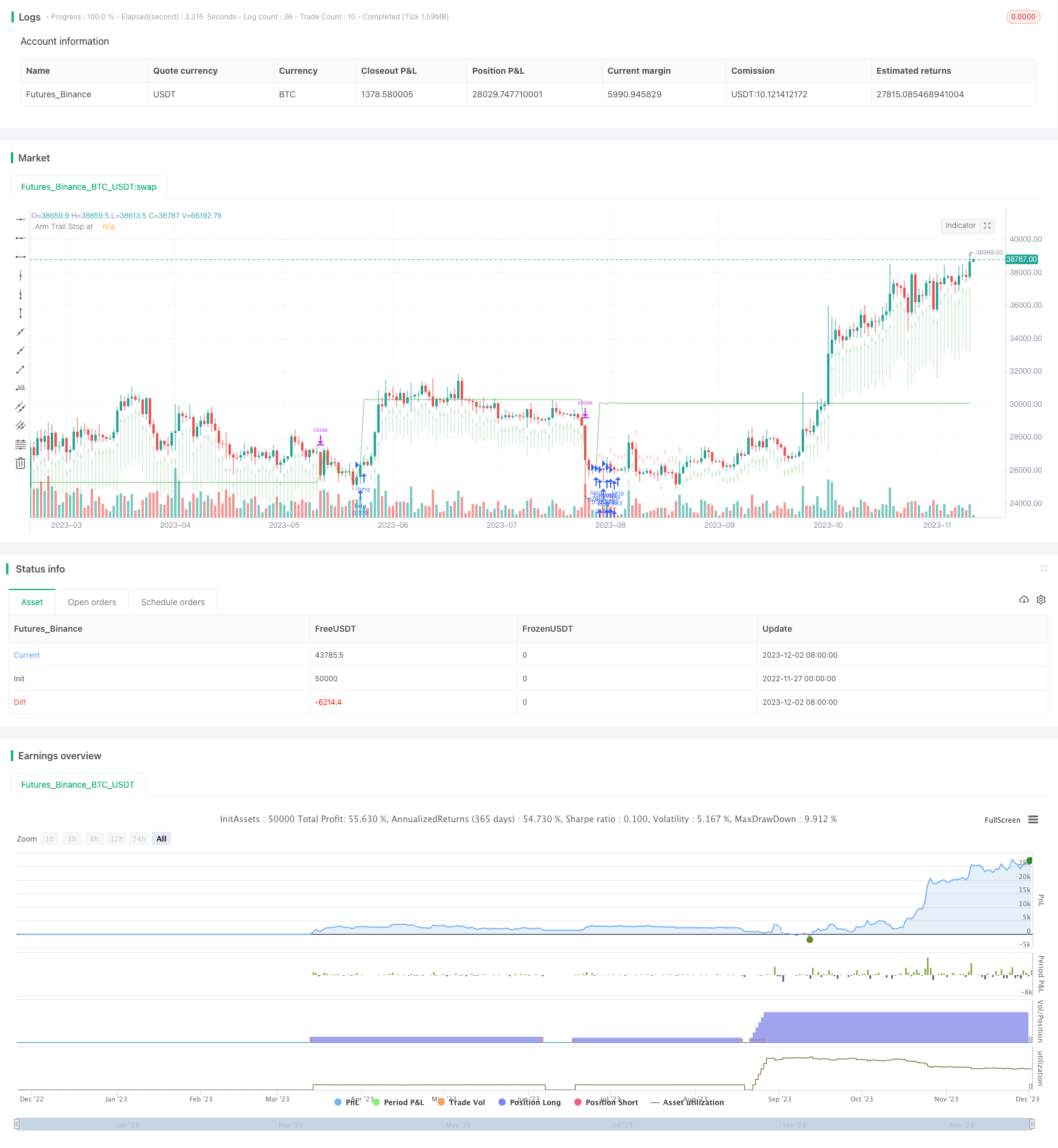

/*backtest

start: 2022-11-27 00:00:00

end: 2023-12-03 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © Chart0bserver

//

// Open Source attributions:

// portions © allanster (date window code)

// portions © Dr. John Ehlers (Trend Flex Oscillator)

//

// READ THIS CAREFULLY!!! ----------------//

// This code is provided for educational purposes only. The results of this strategy should not be considered investment advice.

// The user of this script acknolwedges that it can cause serious financial loss when used as a trading tool

// This strategy has a bias for HODL (Holds on to Losses) meaning that it provides NO STOP LOSS protection!

// Also note that the default behavior is designed for up to 15 open long orders, and executes one order to close them all at once.

// Opening a long position is predicated on The Trend Flex Oscillator (TFO) rising after being oversold, and ATR above a certain volatility threshold.

// Closing a long is handled either by TFO showing overbought while above a certain ATR level, or the Trailing Stop Loss. Pick one or both.

// If the strategy is allowed to sell before a Trailing Stop Loss is triggered, you can set a "must exceed %". Do not mistake this for a stop loss.

// Short positions are not supported in this version. Back-testing should NEVER be considered an accurate representation of actual trading results.

//@version=5

strategy('TFO + ATR Strategy with Trailing Stop Loss', 'TFO ATR Trailing Stop Loss', overlay=true, pyramiding=15, default_qty_type=strategy.cash, default_qty_value=10000, initial_capital=150000, currency='USD', commission_type=strategy.commission.percent, commission_value=0.5)

strategy.risk.allow_entry_in(strategy.direction.long) // There will be no short entries, only exits from long.

// -----------------------------------------------------------------------------------------------------------//

// Back-testing Date Range code ----------------------------------------------------------------------------//

// ---------------------------------------------------------------------------------------------------------//

fromMonth = input.int(defval=9, title='From Month', minval=1, maxval=12, group='Back-Testing Start Date')

fromDay = input.int(defval=1, title='From Day', minval=1, maxval=31, group='Back-Testing Start Date')

fromYear = input.int(defval=2021, title='From Year', minval=1970, group='Back-Testing Start Date')

thruMonth = 1 //input(defval = 1, title = "Thru Month", type = input.integer, minval = 1, maxval = 12, group="Back-Testing Date Range")

thruDay = 1 //input(defval = 1, title = "Thru Day", type = input.integer, minval = 1, maxval = 31, group="Back-Testing Date Range")

thruYear = 2112 //input(defval = 2112, title = "Thru Year", type = input.integer, minval = 1970, group="Back-Testing Date Range")

// === FUNCTION EXAMPLE ===

start = timestamp(fromYear, fromMonth, fromDay, 00, 00) // backtest start window

finish = timestamp(thruYear, thruMonth, thruDay, 23, 59) // backtest finish window

window() => // create function "within window of time

time >= start and time <= finish ? true : false

// Date range code -----//

// -----------------------------------------------------------------------------------------------------------//

// ATR Indicator Code --------------------------------------------------------------------------------------//

// ---------------------------------------------------------------------------------------------------------//

length = 18 //input(title="ATR Length", defval=18, minval=1)

Period = 18 //input(18,title="ATR EMA Period")

basicEMA = ta.ema(close, length)

ATR_Function = ta.ema(ta.tr(true), length)

EMA_ATR = ta.ema(ATR_Function, Period)

ATR = ta.ema(ta.tr(true), length)

ATR_diff = ATR - EMA_ATR

volatility = 100 * ATR_diff / EMA_ATR // measure of spread between ATR and EMA

volatilityAVG = math.round((volatility + volatility[1] + volatility[2]) / 3)

buyVolatility = input.int(3, 'Min Volatility for Buy', minval=-20, maxval=20, step=1, group='Average True Range')

sellVolatility = input.int(13, 'Min Volatility for Sell', minval=-10, maxval=20, step=1, group='Average True Range')

useAvgVolatility = input.bool(defval=false, title='Average the Volatility over 3 bars', group='Average True Range')

// End of ATR ------------/

// -----------------------------------------------------------------------------------------------------------//

// TFO Indicator code --------------------------------------------------------------------------------------//

// ---------------------------------------------------------------------------------------------------------//

trendflex(Series, PeriodSS, PeriodTrendFlex, PeriodEMA) =>

var SQRT2xPI = math.sqrt(8.0) * math.asin(1.0) // 4.44288293815 Constant

alpha = SQRT2xPI / PeriodSS

beta = math.exp(-alpha)

gamma = -beta * beta

delta = 2.0 * beta * math.cos(alpha)

float superSmooth = na

superSmooth := (1.0 - delta - gamma) * (Series + nz(Series[1])) * 0.5 + delta * nz(superSmooth[1]) + gamma * nz(superSmooth[2])

E = 0.0

for i = 1 to PeriodTrendFlex by 1

E += superSmooth - nz(superSmooth[i])

E

epsilon = E / PeriodTrendFlex

zeta = 2.0 / (PeriodEMA + 1.0)

float EMA = na

EMA := zeta * epsilon * epsilon + (1.0 - zeta) * nz(EMA[1])

return_1 = EMA == 0.0 ? 0.0 : epsilon / math.sqrt(EMA)

return_1

upperLevel = input.float(1.2, 'TFO Upper Level', minval=0.1, maxval=2.0, step=0.1, group='Trend Flex Ocillator')

lowerLevel = input.float(-0.9, 'TFO Lower Level', minval=-2.0, maxval=-0.1, step=0.1, group='Trend Flex Ocillator')

periodTrendFlex = input.int(14, 'TrendFlex Period', minval=2, group='Trend Flex Ocillator')

useSuperSmootherOveride = true //input( true, "Apply SuperSmoother Override Below*", input.bool, group="Trend Flex Ocillator")

periodSuperSmoother = 8.0 //input(8.0, "SuperSmoother Period*", input.float , minval=4.0, step=0.5, group="Trend Flex Ocillator")

postSmooth = 33 //input(33.0, "Post Smooth Period**", input.float , minval=1.0, step=0.5, group="Trend Flex Ocillator")

trendFlexOscillator = trendflex(close, periodSuperSmoother, periodTrendFlex, postSmooth)

// End of TFO -------------//

// -----------------------------------------------------------------------------------------------------------//

// HODL Don't sell if losing n% ---------------------------------------------------------------------------- //

// ---------------------------------------------------------------------------------------------------------//

sellOnStrategy = input.bool(defval=true, title='Allow Stategy to close positions', group='Selling Conditions')

doHoldLoss = true // input(defval = true, title = "Strategy can sell for a loss", type = input.bool, group="Selling Conditions")

holdLoss = input.int(defval=0, title='Value (%) must exceed ', minval=-25, maxval=10, step=1, group='Selling Conditions')

totalInvest = strategy.position_avg_price * strategy.position_size

openProfitPerc = strategy.openprofit / totalInvest

bool acceptableROI = openProfitPerc * 100 > holdLoss

// -----------------------//

// -----------------------------------------------------------------------------------------------------------//

// Buying and Selling conditions -------------------------------------------------------------------------- //

// ---------------------------------------------------------------------------------------------------------//

if useAvgVolatility

volatility := volatilityAVG

volatility

tfoBuy = trendFlexOscillator < lowerLevel and trendFlexOscillator[1] < trendFlexOscillator // Always make a purchase if TFO is in this lowest range

atrBuy = volatility > buyVolatility

tfoSell = ta.crossunder(trendFlexOscillator, upperLevel)

consensusBuy = tfoBuy and atrBuy

consensusSell = tfoSell and volatility > sellVolatility

if doHoldLoss

consensusSell := consensusSell and acceptableROI

consensusSell

// --------------------//

// -----------------------------------------------------------------------------------------------------------//

// Tracing & Debugging --------------------------------------------------------------------------------------//

// ---------------------------------------------------------------------------------------------------------//

plotchar(strategy.opentrades, 'Number of open trades', ' ', location.top)

plotarrow(100 * openProfitPerc, 'Profit on open longs', color.new(color.green, 75), color.new(color.red, 75))

// plotchar(strategy.position_size, "Shares on hand", " ", location.top)

// plotchar(totalInvest, "Total Invested", " ", location.top)

// plotarrow(strategy.openprofit, "Open profit dollar amount", color.new(color.green,100), color.new(color.red, 100))

// plotarrow(strategy.netprofit, "Net profit for session", color.new(color.green,100), color.new(color.red, 100))

// plotchar(acceptableROI, "Acceptable ROI", " ", location.top)

// plotarrow(volatility, "ATR volatility value", color.new(color.green,75), color.new(color.red, 75))

// plotchar(strategy.position_avg_price, "Avgerage price of holdings", " ", location.top)

// plotchar(volatilityAVG, "AVG volatility", " ", location.top)

// plotchar(fiveBarsVal, "change in 5bars", " ", location.top)

// plotchar(crossingUp, "crossingUp", "x", location.belowbar, textcolor=color.white)

// plotchar(crossingDown, "crossingDn", "x", location.abovebar, textcolor=color.white)

// plotchar(strategy.closedtrades, "closedtrades", " ", location.top)

// plotchar(strategy.wintrades, "wintrades", " ", location.top)

// plotchar(strategy.losstrades, "losstrades", " ", location.top)

// plotchar(close, "close", " ", location.top)

//--------------------//

// -----------------------------------------------------------------------------------------------------------//

// Trade Alert Execution ------------------------------------------------------------------------------------//

// ---------------------------------------------------------------------------------------------------------//

strategy.entry('long', strategy.long, when=window() and consensusBuy, comment='long')

if sellOnStrategy

strategy.close('long', when=window() and consensusSell, qty_percent=100, comment='Strat')

// -----------------------------------------------------------------------------------------------------------//

// Trailing Stop Loss logic -------------------------------------------------------------------------------- //

// ---------------------------------------------------------------------------------------------------------//

useTrailStop = input.bool(defval=true, title='Set Trailing Stop Loss on avg positon value', group='Selling Conditions')

arm = input.float(defval=15, title='Trailing Stop Arms At (%)', minval=1, maxval=30, step=1, group='Selling Conditions') * 0.01

trail = input.float(defval=2, title='Trailing Stop Loss (%)', minval=0.25, maxval=9, step=0.25, group='Selling Conditions') * 0.1

longStopPrice = 0.0

stopLossPrice = 0.0

if strategy.position_size > 0

longStopPrice := strategy.position_avg_price * (1 + arm)

stopLossPrice := strategy.position_avg_price * ((100 - math.abs(holdLoss)) / 100) // for use with 'stop' in strategy.exit

stopLossPrice

else

longStopPrice := close

longStopPrice

// If you want to hide the Trailing Stop Loss threshold (green line), comment this out

plot(longStopPrice, 'Arm Trail Stop at', color.new(color.green, 60), linewidth=2)

if strategy.position_size > 0 and useTrailStop

strategy.exit('exit', 'long', when=window(), qty_percent=100, trail_price=longStopPrice, trail_offset=trail * close / syminfo.mintick, comment='Trail')

//-----------------------------------------------------------------------------------------------------------//

- Stratégie de suivi des moyennes mobiles dynamiques

- Stratégie de négociation de l'oscillation à moyenne mobile double

- Les bandes EMA + Leledc + Bollinger suivent la tendance de la stratégie

- Analyse rapide de la stratégie RSI

- Stratégie de négociation de rupture de volatilité adaptative

- Stratégie des actions à moyenne mobile exponentielle élevée moins

- Stratégie de rupture du canal de Donchian

- Bitcoin - Stratégie de croisement MA

- Stratégie de test arrière de la transformation de Fisher

- 123 Stratégie combinée d'inversion et de bandes STARC

- La stratégie quantitative multifactorielle du grand plaisir

- Suivre la stratégie de ligne

- Stratégie de négociation de moyenne mobile quadruple exponentielle

- Stratégie de négociation croisée de la moyenne mobile exponentielle

- Stratégie de croisement à double moyenne mobile

- Stratégie de négociation de la moyenne mobile à double dynamique

- Variété de prise de bénéfices et arrêt de perte

- Stratégie de négociation bidirectionnelle basée sur le RSI et le STOCH RSI

- Stratégie de percée rapide et lente de l'EMA

- L'indicateur de risque et la combinaison de moyennes mobiles MT5 Stratégie de scalping Martingale