概述

快慢EMA黄金交叉突破策略是一种追踪市场趋势的简单有效策略。它利用不同周期的EMA均线进行交叉突破,产生买入和卖出信号。基本思路是:当短周期EMA上穿较长周期的EMA时,产生买入信号;当短周期EMA下穿较长周期EMA时,产生卖出信号。

策略原理

该策略主要依靠5周期、8周期和13周期的EMA均线比较,产生交易信号。包括:

- 计算5周期EMA、8周期EMA和13周期EMA。

- 当5周期EMA上穿8周期和13周期EMA时,产生买入信号。

- 当5周期EMA下穿8周期和13周期EMA时,产生卖出信号。

- 同时结合ADX指标判断趋势强度,只有在趋势足够强劲时才产生信号。

这样,就实现了追踪中长线趋势的效果。当短周期均线上穿长周期均线时,表示短期趋势转为多头,可以买入;当短周期均线下穿长周期均线时,表示短期趋势转为空头,应该卖出。

优势分析

该策略主要有以下优势:

- 操作简单,易于实现。

- 充分利用EMA均线的平滑作用,有效跟踪趋势。

- 多组EMA组合实施交叉,避免假信号。

- 结合ADX指标,使信号更加可靠。

- 回撤和最大跌幅都不高。

风险分析

该策略也存在一些风险:

- 趋势剧烈反转时,止损可能较大。可以适当放宽止损范围。

- 交易频率较高,容易增加交易费用。可以适当调整EMA参数,降低交易频率。

优化方向

该策略可以从以下几个方向进行优化:

- 优化EMA参数,找到最佳参数组合。

- 加入其他指标过滤,如KDJ、BOLL等,提高信号质量。

- 调整仓位管理,优化风险控制。

- 利用机器学习方法寻找更好的入场和出场规则。

总结

综上所述,快慢EMA黄金交叉突破策略整体运作顺畅,信号比较可靠,回撤不高,适合追踪中长线趋势。通过参数优化和规则完善,可以获得更好的策略效果。

策略源码

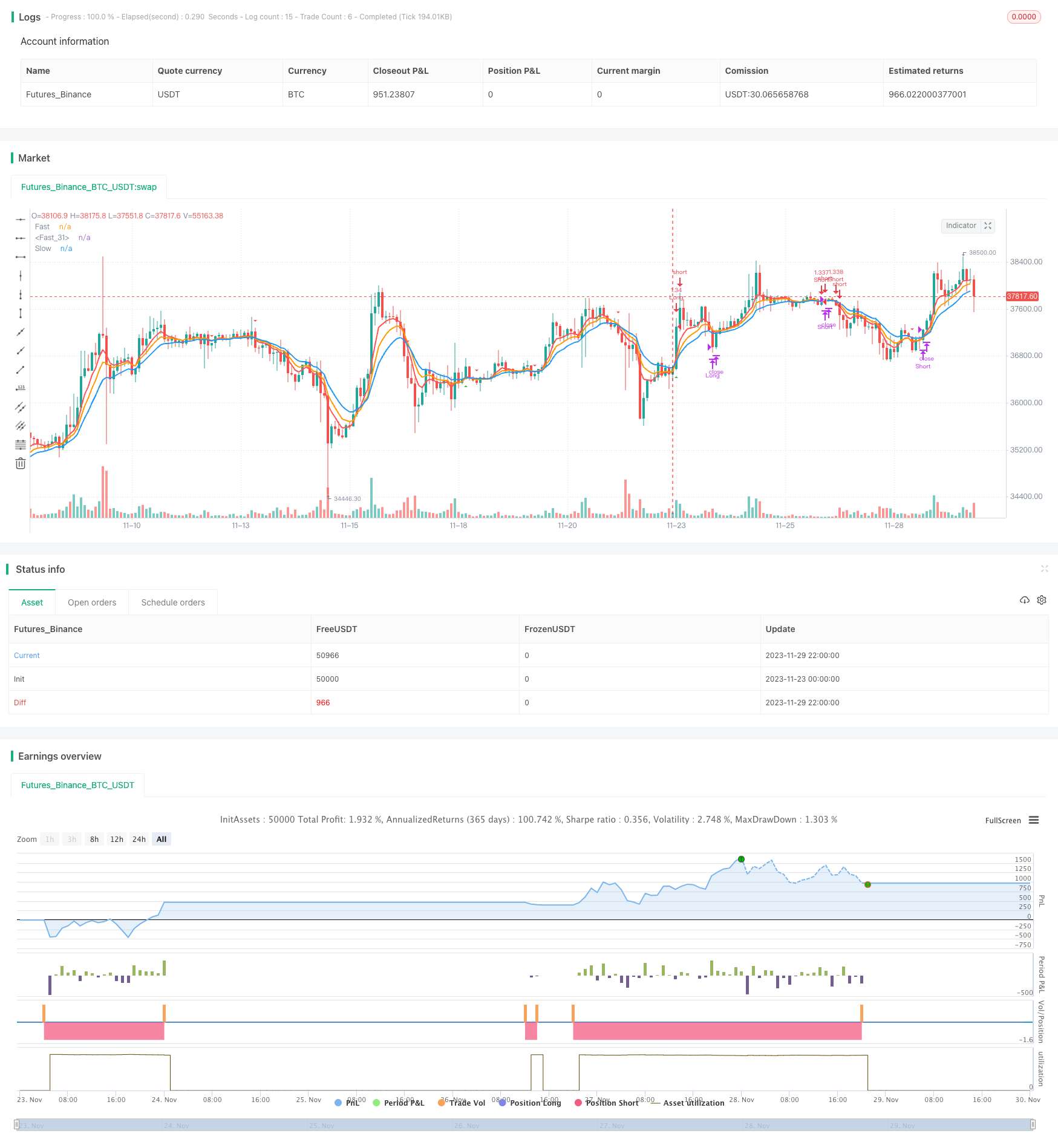

/*backtest

start: 2023-11-23 00:00:00

end: 2023-11-30 00:00:00

period: 2h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

//

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © gregoirejohnb

// @It is modified by ttsaadet.

// Moving average crossover systems measure drift in the market. They are great strategies for time-limited people.

// So, why don't more people use them?

//

//

strategy(title="EMA Crossover Strategy by TTS", shorttitle="EMA-5-8-13 COS by TTS", overlay=true, pyramiding=0, default_qty_type=strategy.percent_of_equity, default_qty_value=100, currency=currency.TRY,commission_type=strategy.commission.percent,commission_value=0.04, process_orders_on_close = true, initial_capital = 100000)

// === GENERAL INPUTS ===

//strategy start date

start_year = input(defval=2020, title="Backtest Start Year")

// === LOGIC ===

short_period = input(type=input.integer,defval=5,minval=1,title="Length")

mid_period = input(type=input.integer,defval=8,minval=1,title="Length")

long_period = input(type=input.integer,defval=13,minval=1,title="Length")

rsi_period = input(type=input.integer,defval=14,minval=1,title="Length")

longOnly = input(type=input.bool,defval=false,title="Long Only")

shortEma = ema(close,short_period)

midEma = ema(close,mid_period)

longEma = ema(close,long_period)

rsi = rsi(close, rsi_period)

[diplus, diminus, adx] = dmi(short_period, short_period)

plot(shortEma,linewidth=2,color=color.red,title="Fast")

plot(midEma,linewidth=2,color=color.orange,title="Fast")

plot(longEma,linewidth=2,color=color.blue,title="Slow")

longEntry = crossover(shortEma,midEma) and crossover(shortEma,longEma) //or ((shortEma > longEma) and crossover(shortEma,midEma)))and (adx > 25)

shortEntry =((shortEma < midEma) and crossunder(shortEma,longEma)) or ((shortEma < longEma) and crossunder(shortEma,midEma))

plotshape(longEntry ? close : na,style=shape.triangleup,color=color.green,location=location.belowbar,size=size.small,title="Long Triangle")

plotshape(shortEntry and not longOnly ? close : na,style=shape.triangledown,color=color.red,location=location.abovebar,size=size.small,title="Short Triangle")

plotshape(shortEntry and longOnly ? close : na,style=shape.xcross,color=color.black,location=location.abovebar,size=size.small,title="Exit Sign")

// === STRATEGY - LONG POSITION EXECUTION ===

enterLong() =>

longEntry and

time > timestamp(start_year, 1, 1, 01, 01)

exitLong() =>

crossunder(shortEma,longEma) or crossunder(close, longEma)

strategy.entry(id="Long", long=strategy.long, when=enterLong())

strategy.close(id="Long", when=exitLong())

// === STRATEGY - SHORT POSITION EXECUTION ===

enterShort() =>

not longOnly and shortEntry and

time > timestamp(start_year, 1, 1, 01, 01)

exitShort() =>

crossover(shortEma,longEma)

strategy.entry(id="Short", long=strategy.short, when=enterShort())

strategy.close(id="Short", when=exitShort())