Stratégie des moyennes mobiles stochastiques

Auteur:ChaoZhang est là., Date: 2023-12-19 11h41h40Les étiquettes:

Résumé

Cette stratégie combine la moyenne mobile exponentielle (EMA) avec l'oscillateur stochastique de manière à suivre la tendance et à continuer, ainsi que certaines fonctionnalités intéressantes.

La logique de la stratégie

La stratégie comporte 4 conditions obligatoires pour déverrouiller un signal de trading.

- L'EMA rapide doit être supérieure à l'EMA lente

- La ligne stochastique K% doit être dans le territoire de surachat

- La ligne stochastique K% doit traverser la ligne stochastique D%

- Prix de clôture entre EMA lente et EMA rapide Une fois que toutes les conditions sont exactes, une transaction commencera à l'ouverture de la prochaine bougie.

Analyse des avantages

La stratégie combine les avantages de l'EMA et du stochastique pour capturer efficacement le début et la poursuite des tendances, adaptées aux opérations à moyen et long terme.

Plus précisément, les avantages de cette stratégie sont les suivants:

- Les intersections de la MAE déterminent la direction de la tendance et améliorent la stabilité et la fiabilité du signal

- Les juges stochastiques ont suracheté et survendu des niveaux pour trouver des opportunités d'inversion

- Combinant deux indicateurs, il comporte à la fois un suivi de tendance et une inversion moyenne

- ATR calcule automatiquement la distance d'arrêt des pertes, en ajustant les arrêts en fonction de la volatilité du marché

- Taux de risque-récompense personnalisable pour répondre aux besoins des différents utilisateurs

- Fournit plusieurs paramètres personnalisables pour les utilisateurs à ajuster en fonction des marchés

Analyse des risques

Les principaux risques de cette stratégie proviennent de:

- Les passages à niveau EMA peuvent présenter de fausses ruptures, générant ainsi des signaux incorrects

- Stochastique lui-même a des propriétés de retard, peut manquer le meilleur moment pour les renversements de prix

- Une stratégie unique ne peut pas s'adapter pleinement à un environnement de marché en constante évolution

Pour atténuer les risques susmentionnés, nous pouvons prendre les mesures suivantes:

- Ajuster les paramètres de la période EMA pour éviter un trop grand nombre de faux signaux

- Incorporer plus d'indicateurs pour évaluer les tendances et les niveaux de soutien afin d'assurer des signaux fiables

- Définir des stratégies claires de gestion de l'argent pour contrôler l'exposition au risque par transaction

- Adopter des stratégies combinées afin que différentes stratégies puissent vérifier les signaux et améliorer la stabilité

Directions d'optimisation

La stratégie peut être encore optimisée dans les aspects suivants:

- Ajoutez un module d'ajustement de position basé sur la volatilité, réduisez la taille lorsque la volatilité augmente et augmentez lorsque la volatilité se calme.

- Ajouter le jugement des tendances sur des délais plus longs pour éviter les opérations contre tendance, par exemple la combinaison des tendances quotidiennes ou hebdomadaires.

- Ajouter des modèles d'apprentissage automatique pour aider à la génération de signaux.

- Optimiser les modules de gestion de l'argent pour rendre les arrêts et les tailles plus intelligents.

Conclusion

Cette stratégie intègre les avantages à la fois du suivi de la tendance et de la réversion moyenne, en tenant compte à la fois des environnements de marché à plus long terme et des comportements actuels des prix. C'est une stratégie efficace qui mérite d'être suivie et testée en temps réel.

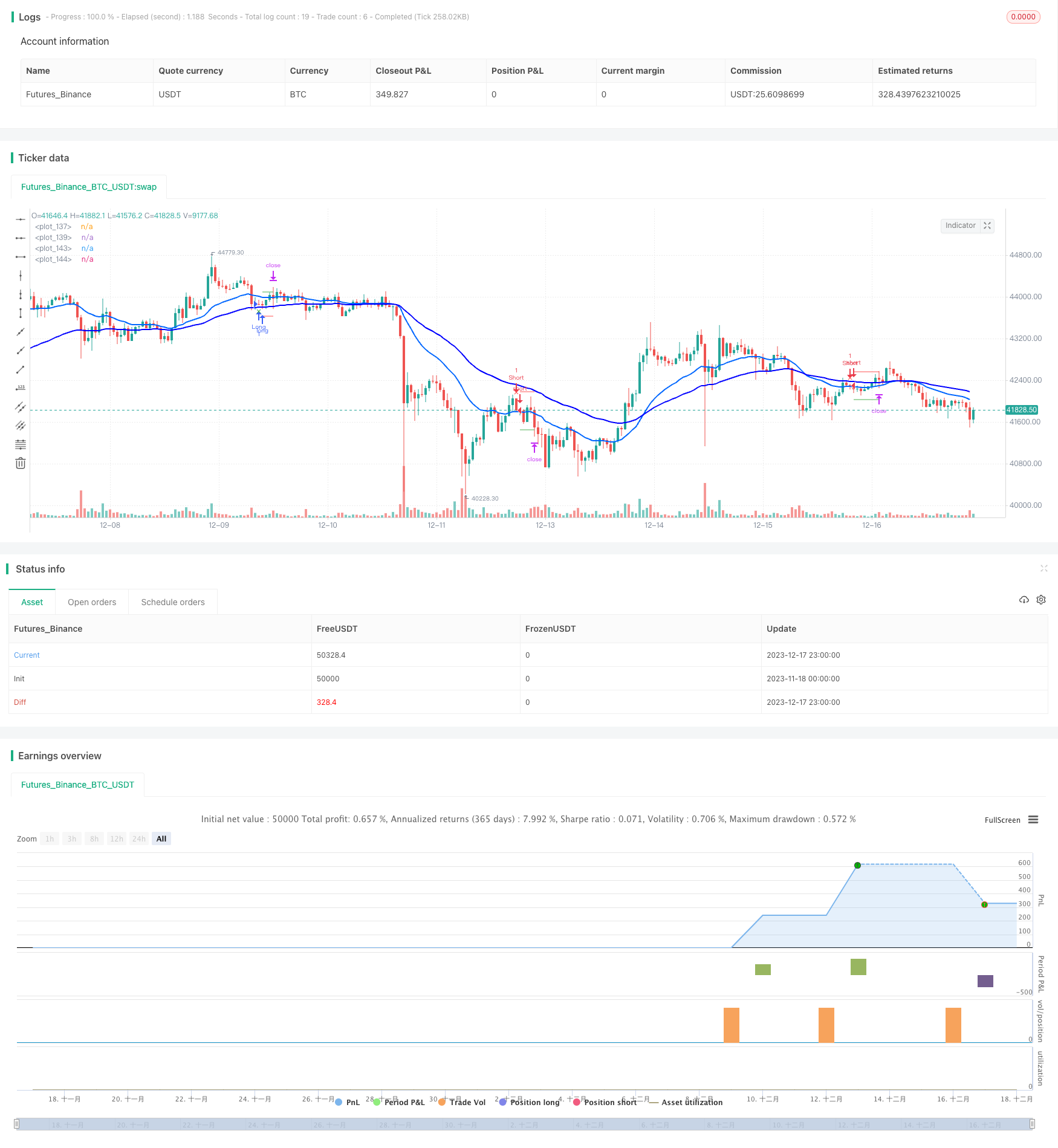

/*backtest

start: 2023-11-18 00:00:00

end: 2023-12-18 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © LucasVivien

// Since this Strategy may have its stop loss hit within the opening candle, consider turning on 'Recalculate : After Order is filled' in the strategy settings, in the "Properties" tabs

//@version=5

strategy("Stochastic Moving Average", shorttitle="Stoch. EMA", overlay=true, default_qty_type= strategy.cash, initial_capital=10000, default_qty_value=100)

//==============================================================================

//============================== USER INPUT ================================

//==============================================================================

var g_tradeSetup = " Trade Setup"

activateLongs = input.bool (title="Long Trades" , defval=true , inline="A1", group=g_tradeSetup, tooltip="")

activateShorts = input.bool (title="Short Trades" , defval=true , inline="A1", group=g_tradeSetup, tooltip="")

rr = input.float(title="Risk : Reward" , defval=1 , minval=0, maxval=100 , step=0.1, inline="" , group=g_tradeSetup, tooltip="")

RiskEquity = input.bool (title="Risk = % Equity ", defval=false , inline="A2", group=g_tradeSetup, tooltip="Set stop loss size as a percentage of 'Initial Capital' -> Strategy Parameter -> Properties tab (Low liquidity markets will affect will prevent to get an exact amount du to gaps)")

riskPrctEqui = input.float(title="" , defval=1 , minval=0, maxval=100 , step=0.1, inline="A2", group=g_tradeSetup, tooltip="")

RiskUSD = input.bool (title="Risk = $ Amount " , defval=false , inline="A3", group=g_tradeSetup, tooltip="Set stop loss size as a fixed Base currency amount (Low liquidity markets will affect will prevent to get an exact amount du to gaps)")

riskUSD = input.float(title="" , defval=1000, minval=0, maxval=1000000000, step=100, inline="A3", group=g_tradeSetup, tooltip="")

var g_stopLoss = " Stop Loss"

atrMult = input.float(title="ATR Multiplier", defval=1 , minval=0, maxval=100 , step=0.1, tooltip="", inline="", group=g_stopLoss)

atrLen = input.int (title="ATR Lookback" , defval=14, minval=0, maxval=1000, step=1 , tooltip="", inline="", group=g_stopLoss)

var g_stochastic = " Stochastic"

Klen = input.int (title="K%" , defval=14, minval=0, maxval=1000, step=1, inline="S2", group=g_stochastic, tooltip="")

Dlen = input.int (title=" D%" , defval=3 , minval=0, maxval=1000, step=1, inline="S2", group=g_stochastic, tooltip="")

OBstochLvl = input.int (title="OB" , defval=80, minval=0, maxval=100 , step=1, inline="S1", group=g_stochastic, tooltip="")

OSstochLvl = input.int (title=" OS" , defval=20, minval=0, maxval=100 , step=1, inline="S1", group=g_stochastic, tooltip="")

OBOSlookback = input.int (title="Stoch. OB/OS lookback", defval=0 , minval=0, maxval=100 , step=1, inline="" , group=g_stochastic, tooltip="This option allow to look 'x' bars back for a value of the Stochastic K line to be overbought or oversold when detecting an entry signal (if 0, looks only at current bar. if 1, looks at current and previous and so on)")

OBOSlookbackAll = input.bool (title="All must be OB/OS" , defval=false , inline="" , group=g_stochastic, tooltip="If turned on, all bars within the Stochastic K line lookback period must be overbought or oversold to return a true signal")

entryColor = input.color(title=" " , defval=#00ffff , inline="S3", group=g_stochastic, tooltip="")

baseColor = input.color(title=" " , defval=#333333 , inline="S3", group=g_stochastic, tooltip="Will trun to designated color when stochastic gets to opposite extrem zone of current trend / Number = transparency")

transp = input.int (title=" " , defval=50, minval=0, maxval=100, step=10, inline="S3", group=g_stochastic, tooltip="")

var g_ema = " Exp. Moving Average"

ema1len = input.int (title="Fast EMA ", defval=21, minval=0, maxval=1000, step=1, inline="E1", group=g_ema, tooltip="")

ema2len = input.int (title="Slow EMA ", defval=50, minval=0, maxval=1000, step=1, inline="E2", group=g_ema, tooltip="")

ema1col = input.color(title=" " , defval=#0066ff , inline="E1", group=g_ema, tooltip="")

ema2col = input.color(title=" " , defval=#0000ff , inline="E2", group=g_ema, tooltip="")

var g_referenceMarket =" Reference Market"

refMfilter = input.bool (title="Reference Market Filter", defval=false , inline="", group=g_referenceMarket)

market = input (title="Market" , defval="BTC_USDT:swap", inline="", group=g_referenceMarket)

res = input.timeframe(title="Timeframe" , defval="30" , inline="", group=g_referenceMarket)

len = input.int (title="EMA Length" , defval=50 , inline="", group=g_referenceMarket)

//==============================================================================

//========================== FILTERS & SIGNALS =============================

//==============================================================================

//------------------------------ Stochastic --------------------------------

K = ta.stoch(close, high, low, Klen)

D = ta.sma(K, Dlen)

stochBullCross = ta.crossover(K, D)

stochBearCross = ta.crossover(D, K)

OSstoch = false

OBstoch = false

for i = 0 to OBOSlookback

if K[i] < OSstochLvl

OSstoch := true

else

if OBOSlookbackAll

OSstoch := false

for i = 0 to OBOSlookback

if K[i] > OBstochLvl

OBstoch := true

else

if OBOSlookbackAll

OBstoch := false

//---------------------------- Moving Averages -----------------------------

ema1 = ta.ema(close, ema1len)

ema2 = ta.ema(close, ema2len)

emaBull = ema1 > ema2

emaBear = ema1 < ema2

//---------------------------- Price source --------------------------------

bullRetraceZone = (close < ema1 and close >= ema2)

bearRetraceZone = (close > ema1 and close <= ema2)

//--------------------------- Reference market -----------------------------

ema = ta.ema(close, len)

emaHTF = request.security(market, res, ema [barstate.isconfirmed ? 0 : 1])

closeHTF = request.security(market, res, close[barstate.isconfirmed ? 0 : 1])

bullRefMarket = (closeHTF > emaHTF or closeHTF[1] > emaHTF[1])

bearRefMarket = (closeHTF < emaHTF or closeHTF[1] < emaHTF[1])

//-------------------------- SIGNAL VALIDATION -----------------------------

validLong = stochBullCross and OSstoch and emaBull and bullRetraceZone

and activateLongs and (refMfilter ? bullRefMarket : true) and strategy.position_size == 0

validShort = stochBearCross and OBstoch and emaBear and bearRetraceZone

and activateShorts and (refMfilter ? bearRefMarket : true) and strategy.position_size == 0

//==============================================================================

//=========================== STOPS & TARGETS ==============================

//==============================================================================

SLdist = ta.atr(atrLen) * atrMult

longSL = close - SLdist

longSLDist = close - longSL

longTP = close + (longSLDist * rr)

shortSL = close + SLdist

shortSLDist = shortSL - close

shortTP = close - (shortSLDist * rr)

var SLsaved = 0.0

var TPsaved = 0.0

if validLong or validShort

SLsaved := validLong ? longSL : validShort ? shortSL : na

TPsaved := validLong ? longTP : validShort ? shortTP : na

//==============================================================================

//========================== STRATEGY COMMANDS =============================

//==============================================================================

if validLong

strategy.entry("Long", strategy.long,

qty = RiskEquity ? ((riskPrctEqui/100)*strategy.equity)/longSLDist : RiskUSD ? riskUSD/longSLDist : na)

if validShort

strategy.entry("Short", strategy.short,

qty = RiskEquity ? ((riskPrctEqui/100)*strategy.equity)/shortSLDist : RiskUSD ? riskUSD/shortSLDist : na)

strategy.exit(id="Long Exit" , from_entry="Long" , limit=TPsaved, stop=SLsaved, when=strategy.position_size > 0)

strategy.exit(id="Short Exit", from_entry="Short", limit=TPsaved, stop=SLsaved, when=strategy.position_size < 0)

//==============================================================================

//============================= CHART PLOTS ================================

//==============================================================================

//---------------------------- Stops & Targets -----------------------------

plot(strategy.position_size != 0 or (strategy.position_size[1] != 0 and strategy.position_size == 0) ? SLsaved : na,

color=color.red , style=plot.style_linebr)

plot(strategy.position_size != 0 or (strategy.position_size[1] != 0 and strategy.position_size == 0) ? TPsaved : na,

color=color.green, style=plot.style_linebr)

//--------------------------------- EMAs -----------------------------------

l1 = plot(ema1, color=#0066ff, linewidth=2)

l2 = plot(ema2, color=#0000ff, linewidth=2)

//-------------------------- Stochastic gradient ---------------------------

// fill(l1, l2, color.new(color.from_gradient(K, OSstochLvl, OBstochLvl,

// emaBull ? entryColor : emaBear ? baseColor : na,

// emaBull ? baseColor : emaBear ? entryColor : na), transp))

//---------------------------- Trading Signals -----------------------------

plotshape(validLong, color=color.green, location=location.belowbar, style=shape.xcross, size=size.small)

plotshape(validShort, color=color.red , location=location.abovebar, style=shape.xcross, size=size.small)

//---------------------------- Reference Market ----------------------------

bgcolor(bullRefMarket and refMfilter ? color.new(color.green,90) : na)

bgcolor(bearRefMarket and refMfilter ? color.new(color.red ,90) : na)

- Stratégie de négociation de rupture de la bande de Bollinger

- La stratégie de trading du RSI de Laguerre

- Stratégie de réintégration dynamique

- Le solide comme une pierre VIP Quant Strategy

- Stratégie de négociation croisée des moyennes mobiles optimisée par Golden Cross

- Stratégie de croisement de la moyenne mobile

- La stratégie de trading basée sur LazyBear

- Stratégie de course prolongée de huit jours

- Stratégie de recul des moyennes mobiles

- Dynamique MA tendance croisée suivant la stratégie

- Optimisation de l'économie de marché et de l'économie de marché

- RSI Bollinger Bands Stratégie de négociation à court terme

- Stratégie de suivi des super tendances

- Tendance du MACD à la suite de la stratégie intraday

- Stratégie de suivi de l'inversion moyenne en deux facteurs

- Stratégie de suivi des tendances basée sur un modèle à facteurs multiples avec arrêt de traînée adaptatif

- Stratégie de tendance adaptative combinée à plusieurs indicateurs

- Stratégie de négociation de modèles de bougies

- Stratégie de négociation des fluctuations de décaissement de SMA

- Stratégie basée sur le croisement EMA de 5 à 10 à 20 jours en utilisant la confirmation de la super-tendance