La stratégie de négociation à plusieurs périodes basée sur un indice de volatilité et un oscillateur stochastique

Auteur:ChaoZhang est là., Date: 2023-12-21 14h34 et 42 minLes étiquettes:

Résumé Cette stratégie combine l'indice de volatilité VIX et l'oscillateur stochastique RSI à travers une composition d'indicateurs sur différentes périodes de temps, afin d'obtenir des entrées de rupture efficaces et des sorties de surachat/survente.

Principaux

-

Calculer l'indice de volatilité VIX: prendre les prix les plus élevés et les plus bas au cours des 20 derniers jours pour calculer la volatilité.

-

Calculer l'oscillateur RSI: prendre les variations de prix au cours des 14 derniers jours.

-

Combinez les deux indicateurs, allez long quand VIX dépasse la bande supérieure ou le plus haut percentile, fermez longs quand le RSI dépasse 70.

Les avantages

- Il intègre plusieurs indicateurs pour une évaluation complète du calendrier du marché.

- Les indicateurs à travers les délais se vérifient mutuellement et améliorent la précision des décisions.

- Les paramètres personnalisables peuvent être optimisés pour différents instruments de négociation.

Les risques

- Un réglage incorrect des paramètres peut provoquer plusieurs faux signaux.

- Un seul indicateur de sortie peut manquer les renversements de prix.

Suggestions d'optimisation

- Incorporer plus d'indicateurs de confirmation tels que les moyennes mobiles et les bandes de Bollinger aux entrées de temps.

- Ajoutez plus d'indicateurs de sortie tels que les modèles de bougies inversées.

Résumé Cette stratégie utilise le VIX pour mesurer le timing du marché et les niveaux de risque, et filtre les transactions défavorables en utilisant les lectures de surachat / survente du RSI, afin d'entrer à des moments opportuns et de sortir en temps opportun avec des arrêts.

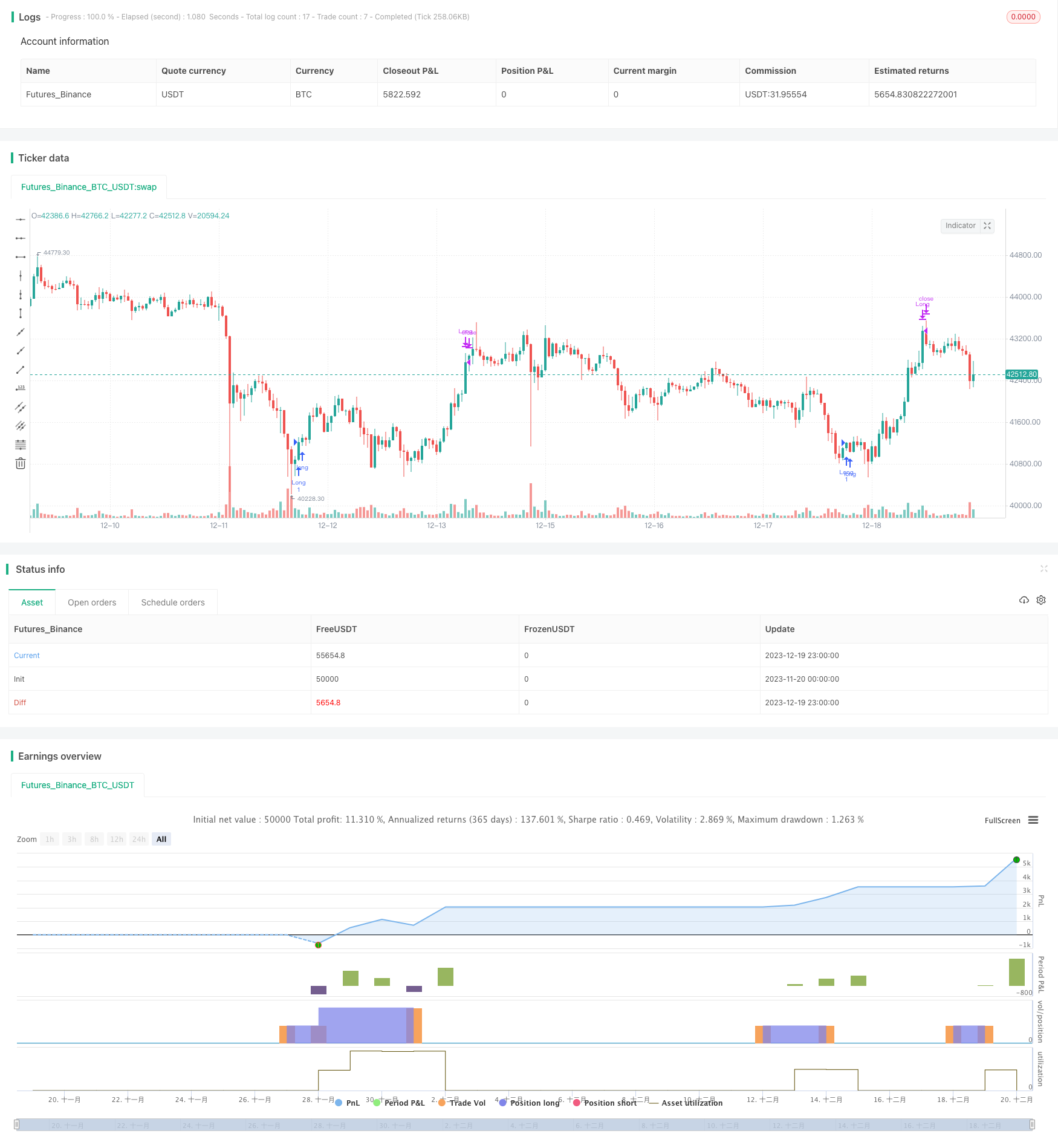

/*backtest

start: 2023-11-20 00:00:00

end: 2023-12-20 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © timj

strategy('Vix FIX / StochRSI Strategy', overlay=true, pyramiding=9, margin_long=100, margin_short=100)

Stochlength = input.int(14, minval=1, title="lookback length of Stochastic")

StochOverBought = input.int(80, title="Stochastic overbought condition")

StochOverSold = input.int(20, title="Stochastic oversold condition")

smoothK = input(3, title="smoothing of Stochastic %K ")

smoothD = input(3, title="moving average of Stochastic %K")

k = ta.sma(ta.stoch(close, high, low, Stochlength), smoothK)

d = ta.sma(k, smoothD)

///////////// RSI

RSIlength = input.int( 14, minval=1 , title="lookback length of RSI")

RSIOverBought = input.int( 70 , title="RSI overbought condition")

RSIOverSold = input.int( 30 , title="RSI oversold condition")

RSIprice = close

vrsi = ta.rsi(RSIprice, RSIlength)

///////////// Double strategy: RSI strategy + Stochastic strategy

pd = input(22, title="LookBack Period Standard Deviation High")

bbl = input(20, title="Bolinger Band Length")

mult = input.float(2.0 , minval=1, maxval=5, title="Bollinger Band Standard Devaition Up")

lb = input(50 , title="Look Back Period Percentile High")

ph = input(.85, title="Highest Percentile - 0.90=90%, 0.95=95%, 0.99=99%")

new = input(false, title="-------Text Plots Below Use Original Criteria-------" )

sbc = input(false, title="Show Text Plot if WVF WAS True and IS Now False")

sbcc = input(false, title="Show Text Plot if WVF IS True")

new2 = input(false, title="-------Text Plots Below Use FILTERED Criteria-------" )

sbcFilt = input(true, title="Show Text Plot For Filtered Entry")

sbcAggr = input(true, title="Show Text Plot For AGGRESSIVE Filtered Entry")

ltLB = input.float(40, minval=25, maxval=99, title="Long-Term Look Back Current Bar Has To Close Below This Value OR Medium Term--Default=40")

mtLB = input.float(14, minval=10, maxval=20, title="Medium-Term Look Back Current Bar Has To Close Below This Value OR Long Term--Default=14")

str = input.int(3, minval=1, maxval=9, title="Entry Price Action Strength--Close > X Bars Back---Default=3")

//Alerts Instructions and Options Below...Inputs Tab

new4 = input(false, title="-------------------------Turn On/Off ALERTS Below---------------------" )

new5 = input(false, title="----To Activate Alerts You HAVE To Check The Boxes Below For Any Alert Criteria You Want----")

sa1 = input(false, title="Show Alert WVF = True?")

sa2 = input(false, title="Show Alert WVF Was True Now False?")

sa3 = input(false, title="Show Alert WVF Filtered?")

sa4 = input(false, title="Show Alert WVF AGGRESSIVE Filter?")

//Williams Vix Fix Formula

wvf = ((ta.highest(close, pd)-low)/(ta.highest(close, pd)))*100

sDev = mult * ta.stdev(wvf, bbl)

midLine = ta.sma(wvf, bbl)

lowerBand = midLine - sDev

upperBand = midLine + sDev

rangeHigh = (ta.highest(wvf, lb)) * ph

//Filtered Bar Criteria

upRange = low > low[1] and close > high[1]

upRange_Aggr = close > close[1] and close > open[1]

//Filtered Criteria

filtered = ((wvf[1] >= upperBand[1] or wvf[1] >= rangeHigh[1]) and (wvf < upperBand and wvf < rangeHigh))

filtered_Aggr = (wvf[1] >= upperBand[1] or wvf[1] >= rangeHigh[1]) and not (wvf < upperBand and wvf < rangeHigh)

//Alerts Criteria

alert1 = wvf >= upperBand or wvf >= rangeHigh ? 1 : 0

alert2 = (wvf[1] >= upperBand[1] or wvf[1] >= rangeHigh[1]) and (wvf < upperBand and wvf < rangeHigh) ? 1 : 0

alert3 = upRange and close > close[str] and (close < close[ltLB] or close < close[mtLB]) and filtered ? 1 : 0

alert4 = upRange_Aggr and close > close[str] and (close < close[ltLB] or close < close[mtLB]) and filtered_Aggr ? 1 : 0

//Coloring Criteria of Williams Vix Fix

col = wvf >= upperBand or wvf >= rangeHigh ? color.lime : color.gray

isOverBought = (ta.crossover(k,d) and k > StochOverBought) ? 1 : 0

isOverBoughtv2 = k > StochOverBought ? 1 : 0

filteredAlert = alert3 ? 1 : 0

aggressiveAlert = alert4 ? 1 : 0

if (filteredAlert or aggressiveAlert)

strategy.entry("Long", strategy.long)

if (isOverBought)

strategy.close("Long")

- Stratégie de négociation à court terme basée sur l'indicateur de volatilité Chaikin

- Stratégie de suivi des tendances croisées à double MA

- Super tendance à la stratégie triple

- Stratégie dynamique d'arrêt des pertes

- Stratégie de croisement de moyenne mobile avec stop-loss et take-profit

- Stratégie inverse d'inversion moyenne basée sur la moyenne mobile

- Stratégie de négociation basée sur des bandes de Bollinger à haute fréquence

- Une stratégie quantitative de trading dans le nuage Ichimoku

- Stratégie de dynamique basée sur le modèle de rupture à double fond

- Stratégie de vortex stochastique

- Stratégie étendue adaptative de la CCI pour le commerce des produits de base dans le secteur de la pêche de fond

- Stratégie de dynamisme basée sur la pression de LazyBear

- Stratégie d'arrêt des bénéfices de la dent de scie à travers le plancher basée sur la moyenne mobile

- Stratégie de négociation dynamique de moyenne mobile pondérée

- La dernière stratégie de la bougie

- Stratégie quantitative d'inversion de l'indice de volume négatif

- Stratégie de rupture de la supertrend triple

- MACD de la stratégie de résistance relative

- Le système du Triple Dragon

- Opérations de haut niveau basées uniquement sur la stratégie hebdomadaire EMA8