Stratégie de swing trading adaptative multi-périodes Fibonacci

Aperçu

La stratégie de suivi de la tendance est une stratégie de suivi de la tendance qui combine la moyenne adaptative, l’indicateur stochastique RSI et la zone de rétraction de Fibonacci. La stratégie utilise plusieurs indicateurs pour analyser les tendances à différents niveaux et ajuster dynamiquement les positions.

Principe de stratégie

La stratégie de négociation des segments de Fibonacci adaptés à plusieurs périodes utilise les indicateurs techniques et les mécanismes suivants:

Ligne moyenne adaptative ((SMA et WMA): calculer la moyenne mobile adaptative des prix à différentes périodes (minutes, heures, journées, etc.). Déterminer la direction de la tendance en fonction de la marge de la moyenne.

Stochastic RSI: Calcule la valeur stochastique de l’indicateur RSI pour déterminer si le RSI est en sur-achat ou en sur-vente.

Zones de retrait de Fibonacci: cartographier les zones de retrait de Fibonacci en fonction des hauts et des bas les plus récents et définir des points d’achat et de vente optionnels. Ces zones sont caractérisées par un potentiel de renversement de tendance et d’ajustement.

Gestion des positions: Adaptez dynamiquement les positions en fonction des signaux faibles du RSI de Stoch et de la courbe d’équilibre adaptative.

La stratégie commence par déterminer la direction de la tendance, en établissant des points de vente et d’achat en option lorsque le prix de l’action entre dans la zone de rétraction de Fibonacci. Lorsqu’un signal d’entrée est émis par la moyenne automatique et le RSI de Stoch, l’ordre est exécuté à proximité du point de vente et d’achat en option. Le stop-loss est défini à l’extérieur de la zone de rétraction pour contrôler le risque.

Analyse des avantages

Les stratégies de négociation de segments de Fibonacci adaptés à des périodes multiples présentent les avantages suivants:

L’analyse de plusieurs périodes: évaluer simultanément plusieurs niveaux de périodes (minutes, heures, journées) et juger les tendances de manière plus globale.

Gestion dynamique des positions: modifier les positions en fonction de la situation, contrôler les risques.

Région de retournement de position: la zone de Fibonacci peut être utilisée pour capturer un revirement de tendance à court terme.

Arrêt strict: arrêt strict selon la zone de retrait, permettant d’éviter des pertes importantes.

Filtrage des signaux: les transactions sont effectuées uniquement à proximité des points d’achat et de vente sélectionnés, afin d’éviter les faux-brises.

Il y a beaucoup de place pour l’optimisation des paramètres: de nombreux paramètres d’entrée peuvent être ajustés en fonction du marché pour optimiser la performance de la stratégie.

Analyse des risques

La stratégie présente principalement les risques suivants:

Risque de défaillance de la zone de retrait: les prix ne peuvent pas toucher la zone de Fibonacci ou la zone de défaillance, il est impossible de construire un entrepôt. Il peut être atténué en élargissant la zone de couverture et en augmentant le nombre de zones.

Risque de suivi des pertes: les paramètres statiques d’arrêt des pertes peuvent être pré-touchés. Les pertes peuvent être optimisées par des moyens tels que l’arrêt dynamique et les zones de rupture de secours.

Risque de fausse rupture de signaux: La courbe de la moyenne adaptative, le Stoch RSI, provoque occasionnellement des fausses ruptures de signaux, ce qui entraîne des transactions inutiles. Les signaux peuvent être filtrés de manière appropriée pour réduire la probabilité de fausses ruptures.

Risque trop complexe: l’utilisation d’une combinaison de paramètres et d’indicateurs techniques augmente la complexité de la stratégie.

Direction d’optimisation

La stratégie de négociation des segments de Fibonacci adaptés à des cadres pluri-temporels peut également être optimisée dans les dimensions suivantes:

Tester plus de variétés d’actions et de devises pour évaluer la solidité de la stratégie. Adapter les paramètres en fonction des différents marchés.

Augmentation des mécanismes de filtrage du signal, réduction de la probabilité de faux signaux et amélioration du rapport sonore.

Tester et comparer l’efficacité des paramètres sur différents types de moyennes mobiles.

Essayez de remplacer les arrêts fixes par des arrêts de suivi ou des arrêts de secours pour voir l’efficacité de la stratégie.

Essayez des signaux de rupture ou des mécanismes de suivi des tendances, et concevez des stratégies de profit en ligne longue.

Résumer

La stratégie de négociation en bandes de Fibonacci, qui s’adapte à plusieurs périodes, utilise de multiples outils d’analyse pour identifier les tendances et déployer des positions précises pendant les périodes de rebond. Un mécanisme de contrôle strict des pertes et des risques aide à optimiser les bénéfices dans les grandes tendances.

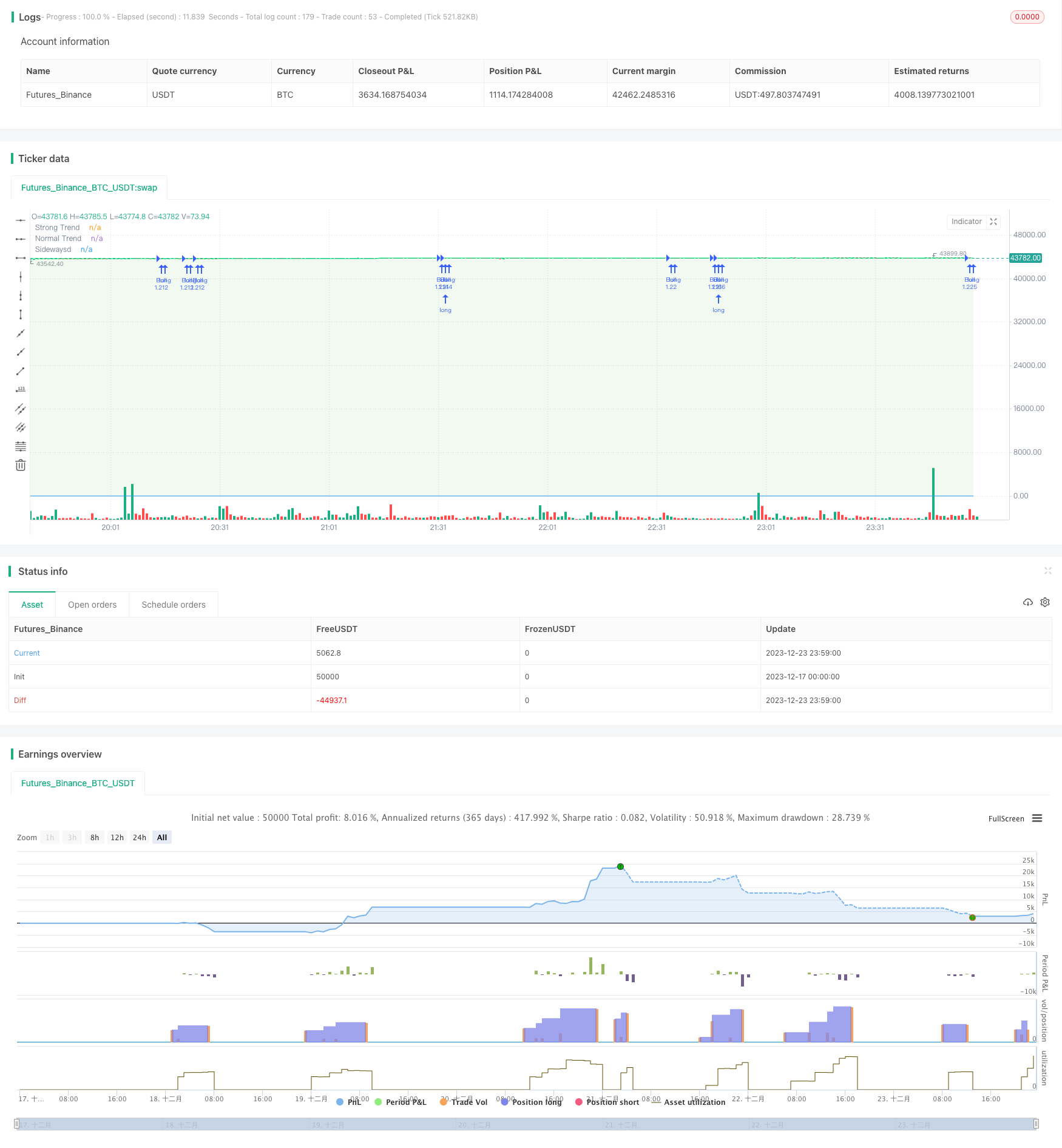

/*backtest

start: 2023-12-17 00:00:00

end: 2023-12-24 00:00:00

period: 1m

basePeriod: 1m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © imal_max

//@version=5

strategy(title="Auto Fib Golden Pocket Band - Autofib Moving Average", shorttitle="Auto Fib Golden Pocket Band", overlay=true, pyramiding=15, process_orders_on_close=true, calc_on_every_tick=true, initial_capital=10000, currency = currency.USD, default_qty_value=100, default_qty_type=strategy.percent_of_equity, commission_type=strategy.commission.percent, commission_value=0.05, slippage=2)

//indicator("Auto Fib Golden Pocket Band - Autofib Moving Average", overlay=true, shorttitle="Auto Fib Golden Pocket Band", timeframe""")

// Fibs

// auto fib ranges

// fib band Strong Trend

enable_StrongBand_Bull = input.bool(title='enable Upper Bullish Band . . . Fib Level', defval=true, group='══════ Strong Trend Levels ══════', inline="0")

select_StrongBand_Fib_Bull = input.float(0.236, title=" ", options=[-0.272, 0, 0.236, 0.382, 0.5, 0.618, 0.702, 0.71, 0.786, 0.83, 0.886, 1, 1.272], group='══════ Strong Trend Levels ══════', inline="0")

enable_StrongBand_Bear = input.bool(title='enable Lower Bearish Band . . . Fib Level', defval=false, group='══════ Strong Trend Levels ══════', inline="1")

select_StrongBand_Fib_Bear = input.float(0.382, '', options=[-0.272, 0, 0.236, 0.382, 0.5, 0.618, 0.702, 0.71, 0.786, 0.83, 0.886, 1, 1.272], group='══════ Strong Trend Levels ══════', inline="1")

StrongBand_Lookback = input.int(title='Pivot Look Back', minval=1, defval=400, group='══════ Strong Trend Levels ══════', inline="2")

StrongBand_EmaLen = input.int(title='Fib EMA Length', minval=1, defval=120, group='══════ Strong Trend Levels ══════', inline="2")

// fib middle Band regular Trend

enable_MiddleBand_Bull = input.bool(title='enable Middle Bullish Band . . . Fib Level', defval=true, group='══════ Regular Trend Levels ══════', inline="0")

select_MiddleBand_Fib_Bull = input.float(0.618, '', options=[-0.272, 0, 0.236, 0.382, 0.5, 0.6, 0.618, 0.702, 0.71, 0.786, 0.83, 0.886, 1, 1.272], group='══════ Regular Trend Levels ══════', inline="0")

enable_MiddleBand_Bear = input.bool(title='enable Middle Bearish Band . . . Fib Level', defval=true, group='══════ Regular Trend Levels ══════', inline="1")

select_MiddleBand_Fib_Bear = input.float(0.382, '', options=[-0.272, 0, 0.236, 0.382, 0.5, 0.618, 0.702, 0.71, 0.786, 0.83, 0.886, 1, 1.272], group='══════ Regular Trend Levels ══════', inline="1")

MiddleBand_Lookback = input.int(title='Pivot Look Back', minval=1, defval=900, group='══════ Regular Trend Levels ══════', inline="2")

MiddleBand_EmaLen = input.int(title='Fib EMA Length', minval=1, defval=400, group='══════ Regular Trend Levels ══════', inline="2")

// fib Sideways Band

enable_SidewaysBand_Bull = input.bool(title='enable Lower Bullish Band . . . Fib Level', defval=true, group='══════ Sideways Trend Levels ══════', inline="0")

select_SidewaysBand_Fib_Bull = input.float(0.6, '', options=[-0.272, 0, 0.236, 0.382, 0.5, 0.6, 0.618, 0.702, 0.71, 0.786, 0.83, 0.886, 1, 1.272], group='══════ Sideways Trend Levels ══════', inline="0")

enable_SidewaysBand_Bear = input.bool(title='enable Upper Bearish Band . . . Fib Level', defval=true, group='══════ Sideways Trend Levels ══════', inline="1")

select_SidewaysBand_Fib_Bear = input.float(0.5, '', options=[-0.272, 0, 0.236, 0.382, 0.5, 0.618, 0.702, 0.71, 0.786, 0.83, 0.886, 1, 1.272], group='══════ Sideways Trend Levels ══════', inline="1")

SidewaysBand_Lookback = input.int(title='Pivot Look Back', minval=1, defval=4000, group='══════ Sideways Trend Levels ══════', inline="2")

SidewaysBand_EmaLen = input.int(title='Fib EMA Length', minval=1, defval=150, group='══════ Sideways Trend Levels ══════', inline="2")

// Strong Band

isBelow_StrongBand_Bull = true

isBelow_StrongBand_Bear = true

StrongBand_Price_of_Low = float(na)

StrongBand_Price_of_High = float(na)

StrongBand_Bear_Fib_Price = float(na)

StrongBand_Bull_Fib_Price = float(na)

/// Middle Band

isBelow_MiddleBand_Bull = true

isBelow_MiddleBand_Bear = true

MiddleBand_Price_of_Low = float(na)

MiddleBand_Price_of_High = float(na)

MiddleBand_Bear_Fib_Price = float(na)

MiddleBand_Bull_Fib_Price = float(na)

// Sideways Band

isBelow_SidewaysBand_Bull = true

isBelow_SidewaysBand_Bear = true

SidewaysBand_Price_of_Low = float(na)

SidewaysBand_Price_of_High = float(na)

SidewaysBand_Bear_Fib_Price = float(na)

SidewaysBand_Bull_Fib_Price = float(na)

// get Fib Levels

if enable_StrongBand_Bull

StrongBand_Price_of_High := ta.highest(high, StrongBand_Lookback)

StrongBand_Price_of_Low := ta.lowest(low, StrongBand_Lookback)

StrongBand_Bull_Fib_Price := (StrongBand_Price_of_High - StrongBand_Price_of_Low) * (1 - select_StrongBand_Fib_Bull) + StrongBand_Price_of_Low //+ fibbullHighDivi

isBelow_StrongBand_Bull := StrongBand_Bull_Fib_Price > ta.lowest(low, 2) or not enable_StrongBand_Bull

if enable_StrongBand_Bear

StrongBand_Price_of_High := ta.highest(high, StrongBand_Lookback)

StrongBand_Price_of_Low := ta.lowest(low, StrongBand_Lookback)

StrongBand_Bear_Fib_Price := (StrongBand_Price_of_High - StrongBand_Price_of_Low) * (1 - select_StrongBand_Fib_Bear) + StrongBand_Price_of_Low// + fibbullLowhDivi

isBelow_StrongBand_Bear := StrongBand_Bear_Fib_Price < ta.highest(low, 2) or not enable_StrongBand_Bear

if enable_MiddleBand_Bull

MiddleBand_Price_of_High := ta.highest(high, MiddleBand_Lookback)

MiddleBand_Price_of_Low := ta.lowest(low, MiddleBand_Lookback)

MiddleBand_Bull_Fib_Price := (MiddleBand_Price_of_High - MiddleBand_Price_of_Low) * (1 - select_MiddleBand_Fib_Bull) + MiddleBand_Price_of_Low //+ fibbullHighDivi

isBelow_MiddleBand_Bull := MiddleBand_Bull_Fib_Price > ta.lowest(low, 2) or not enable_MiddleBand_Bull

if enable_MiddleBand_Bear

MiddleBand_Price_of_High := ta.highest(high, MiddleBand_Lookback)

MiddleBand_Price_of_Low := ta.lowest(low, MiddleBand_Lookback)

MiddleBand_Bear_Fib_Price := (MiddleBand_Price_of_High - MiddleBand_Price_of_Low) * (1 - select_MiddleBand_Fib_Bear) + MiddleBand_Price_of_Low// + fibbullLowhDivi

isBelow_MiddleBand_Bear := MiddleBand_Bear_Fib_Price < ta.highest(low, 2) or not enable_MiddleBand_Bear

if enable_SidewaysBand_Bull

SidewaysBand_Price_of_High := ta.highest(high, SidewaysBand_Lookback)

SidewaysBand_Price_of_Low := ta.lowest(low, SidewaysBand_Lookback)

SidewaysBand_Bull_Fib_Price := (SidewaysBand_Price_of_High - SidewaysBand_Price_of_Low) * (1 - select_SidewaysBand_Fib_Bull) + SidewaysBand_Price_of_Low //+ fibbullHighDivi

isBelow_SidewaysBand_Bull := SidewaysBand_Bull_Fib_Price > ta.lowest(low, 2) or not enable_SidewaysBand_Bull

if enable_SidewaysBand_Bear

SidewaysBand_Price_of_High := ta.highest(high, SidewaysBand_Lookback)

SidewaysBand_Price_of_Low := ta.lowest(low, SidewaysBand_Lookback)

SidewaysBand_Bear_Fib_Price := (SidewaysBand_Price_of_High - SidewaysBand_Price_of_Low) * (1 - select_SidewaysBand_Fib_Bear) + SidewaysBand_Price_of_Low// + fibbullLowhDivi

isBelow_SidewaysBand_Bear := SidewaysBand_Bear_Fib_Price < ta.highest(low, 2) or not enable_SidewaysBand_Bear

// Fib EMAs

// fib ema Strong Trend

StrongBand_current_Trend_EMA = float(na)

StrongBand_Bull_EMA = ta.ema(StrongBand_Bull_Fib_Price, StrongBand_EmaLen)

StrongBand_Bear_EMA = ta.ema(StrongBand_Bear_Fib_Price, StrongBand_EmaLen)

StrongBand_Ema_in_Uptrend = ta.change(StrongBand_Bull_EMA) > 0 or ta.change(StrongBand_Bear_EMA) > 0

StrongBand_Ema_Sideways = ta.change(StrongBand_Bull_EMA) == 0 or ta.change(StrongBand_Bear_EMA) == 0

StrongBand_Ema_in_Downtrend = ta.change(StrongBand_Bull_EMA) < 0 or ta.change(StrongBand_Bear_EMA) < 0

if StrongBand_Ema_in_Uptrend or StrongBand_Ema_Sideways

StrongBand_current_Trend_EMA := StrongBand_Bull_EMA

if StrongBand_Ema_in_Downtrend

StrongBand_current_Trend_EMA := StrongBand_Bear_EMA

// fib ema Normal Trend

MiddleBand_current_Trend_EMA = float(na)

MiddleBand_Bull_EMA = ta.ema(MiddleBand_Bull_Fib_Price, MiddleBand_EmaLen)

MiddleBand_Bear_EMA = ta.ema(MiddleBand_Bear_Fib_Price, MiddleBand_EmaLen)

MiddleBand_Ema_in_Uptrend = ta.change(MiddleBand_Bull_EMA) > 0 or ta.change(MiddleBand_Bear_EMA) > 0

MiddleBand_Ema_Sideways = ta.change(MiddleBand_Bull_EMA) == 0 or ta.change(MiddleBand_Bear_EMA) == 0

MiddleBand_Ema_in_Downtrend = ta.change(MiddleBand_Bull_EMA) < 0 or ta.change(MiddleBand_Bear_EMA) < 0

if MiddleBand_Ema_in_Uptrend or MiddleBand_Ema_Sideways

MiddleBand_current_Trend_EMA := MiddleBand_Bull_EMA

if MiddleBand_Ema_in_Downtrend

MiddleBand_current_Trend_EMA := MiddleBand_Bear_EMA

// fib ema Sideways Trend

SidewaysBand_current_Trend_EMA = float(na)

SidewaysBand_Bull_EMA = ta.ema(SidewaysBand_Bull_Fib_Price, SidewaysBand_EmaLen)

SidewaysBand_Bear_EMA = ta.ema(SidewaysBand_Bear_Fib_Price, SidewaysBand_EmaLen)

SidewaysBand_Ema_in_Uptrend = ta.change(SidewaysBand_Bull_EMA) > 0 or ta.change(SidewaysBand_Bear_EMA) > 0

SidewaysBand_Ema_Sideways = ta.change(SidewaysBand_Bull_EMA) == 0 or ta.change(SidewaysBand_Bear_EMA) == 0

SidewaysBand_Ema_in_Downtrend = ta.change(SidewaysBand_Bull_EMA) < 0 or ta.change(SidewaysBand_Bear_EMA) < 0

if SidewaysBand_Ema_in_Uptrend or SidewaysBand_Ema_Sideways

SidewaysBand_current_Trend_EMA := SidewaysBand_Bull_EMA

if SidewaysBand_Ema_in_Downtrend

SidewaysBand_current_Trend_EMA := SidewaysBand_Bear_EMA

// trend states and colors

all_Fib_Emas_Trending = StrongBand_Ema_in_Uptrend and MiddleBand_Ema_in_Uptrend and SidewaysBand_Ema_in_Uptrend

all_Fib_Emas_Downtrend = MiddleBand_Ema_in_Downtrend and StrongBand_Ema_in_Downtrend and SidewaysBand_Ema_in_Downtrend

all_Fib_Emas_Sideways = MiddleBand_Ema_Sideways and StrongBand_Ema_Sideways and SidewaysBand_Ema_Sideways

all_Fib_Emas_Trend_or_Sideways = (MiddleBand_Ema_Sideways or StrongBand_Ema_Sideways or SidewaysBand_Ema_Sideways) or (StrongBand_Ema_in_Uptrend or MiddleBand_Ema_in_Uptrend or SidewaysBand_Ema_in_Uptrend) and not (MiddleBand_Ema_in_Downtrend or StrongBand_Ema_in_Downtrend or SidewaysBand_Ema_in_Downtrend)

allFibsUpAndDownTrend = (MiddleBand_Ema_in_Downtrend or StrongBand_Ema_in_Downtrend or SidewaysBand_Ema_in_Downtrend) and (MiddleBand_Ema_Sideways or SidewaysBand_Ema_Sideways or StrongBand_Ema_Sideways or StrongBand_Ema_in_Uptrend or MiddleBand_Ema_in_Uptrend or SidewaysBand_Ema_in_Uptrend)

Middle_and_Sideways_Emas_Trending = MiddleBand_Ema_in_Uptrend and SidewaysBand_Ema_in_Uptrend

Middle_and_Sideways_Fib_Emas_Downtrend = MiddleBand_Ema_in_Downtrend and SidewaysBand_Ema_in_Downtrend

Middle_and_Sideways_Fib_Emas_Sideways = MiddleBand_Ema_Sideways and SidewaysBand_Ema_Sideways

Middle_and_Sideways_Fib_Emas_Trend_or_Sideways = (MiddleBand_Ema_Sideways or SidewaysBand_Ema_Sideways) or (MiddleBand_Ema_in_Uptrend or SidewaysBand_Ema_in_Uptrend) and not (MiddleBand_Ema_in_Downtrend or SidewaysBand_Ema_in_Downtrend)

Middle_and_Sideways_UpAndDownTrend = (MiddleBand_Ema_in_Downtrend or SidewaysBand_Ema_in_Downtrend) and (MiddleBand_Ema_Sideways or SidewaysBand_Ema_Sideways or MiddleBand_Ema_in_Uptrend or SidewaysBand_Ema_in_Uptrend)

UpperBand_Ema_Color = all_Fib_Emas_Trend_or_Sideways ? color.lime : all_Fib_Emas_Downtrend ? color.red : allFibsUpAndDownTrend ? color.white : na

MiddleBand_Ema_Color = Middle_and_Sideways_Fib_Emas_Trend_or_Sideways ? color.lime : Middle_and_Sideways_Fib_Emas_Downtrend ? color.red : Middle_and_Sideways_UpAndDownTrend ? color.white : na

SidewaysBand_Ema_Color = SidewaysBand_Ema_in_Uptrend ? color.lime : SidewaysBand_Ema_in_Downtrend ? color.red : (SidewaysBand_Ema_in_Downtrend and (SidewaysBand_Ema_Sideways or SidewaysBand_Ema_in_Uptrend)) ? color.white : na

plotStrong_Ema = plot(StrongBand_current_Trend_EMA, color=UpperBand_Ema_Color, title="Strong Trend")

plotMiddle_Ema = plot(MiddleBand_current_Trend_EMA, color=MiddleBand_Ema_Color, title="Normal Trend")

plotSideways_Ema = plot(SidewaysBand_current_Trend_EMA, color=SidewaysBand_Ema_Color, title="Sidewaysd")

Strong_Middle_fillcolor = color.new(color.green, 90)

if all_Fib_Emas_Trend_or_Sideways

Strong_Middle_fillcolor := color.new(color.green, 90)

if all_Fib_Emas_Downtrend

Strong_Middle_fillcolor := color.new(color.red, 90)

if allFibsUpAndDownTrend

Strong_Middle_fillcolor := color.new(color.white, 90)

Middle_Sideways_fillcolor = color.new(color.green, 90)

if Middle_and_Sideways_Fib_Emas_Trend_or_Sideways

Middle_Sideways_fillcolor := color.new(color.green, 90)

if Middle_and_Sideways_Fib_Emas_Downtrend

Middle_Sideways_fillcolor := color.new(color.red, 90)

if Middle_and_Sideways_UpAndDownTrend

Middle_Sideways_fillcolor := color.new(color.white, 90)

fill(plotStrong_Ema, plotMiddle_Ema, color=Strong_Middle_fillcolor, title="fib band background")

fill(plotMiddle_Ema, plotSideways_Ema, color=Middle_Sideways_fillcolor, title="fib band background")

// buy condition

StrongBand_Price_was_below_Bull_level = ta.lowest(low, 1) < StrongBand_current_Trend_EMA

StrongBand_Price_is_above_Bull_level = close > StrongBand_current_Trend_EMA

StronBand_Price_Average_above_Bull_Level = ta.ema(low, 10) > StrongBand_current_Trend_EMA

StrongBand_Low_isnt_toLow = (ta.lowest(StrongBand_current_Trend_EMA, 15) - ta.lowest(low, 15)) < close * 0.005

StronBand_Trend_isnt_fresh = ta.barssince(StrongBand_Ema_in_Downtrend) > 50 or na(ta.barssince(StrongBand_Ema_in_Downtrend))

MiddleBand_Price_was_below_Bull_level = ta.lowest(low, 1) < MiddleBand_current_Trend_EMA

MiddleBand_Price_is_above_Bull_level = close > MiddleBand_current_Trend_EMA

MiddleBand_Price_Average_above_Bull_Level = ta.ema(close, 20) > MiddleBand_current_Trend_EMA

MiddleBand_Low_isnt_toLow = (ta.lowest(MiddleBand_current_Trend_EMA, 10) - ta.lowest(low, 10)) < close * 0.0065

MiddleBand_Trend_isnt_fresh = ta.barssince(MiddleBand_Ema_in_Downtrend) > 50 or na(ta.barssince(MiddleBand_Ema_in_Downtrend))

SidewaysBand_Price_was_below_Bull_level = ta.lowest(low, 1) < SidewaysBand_current_Trend_EMA

SidewaysBand_Price_is_above_Bull_level = close > SidewaysBand_current_Trend_EMA

SidewaysBand_Price_Average_above_Bull_Level = ta.ema(low, 80) > SidewaysBand_current_Trend_EMA

SidewaysBand_Low_isnt_toLow = (ta.lowest(SidewaysBand_current_Trend_EMA, 150) - ta.lowest(low, 150)) < close * 0.0065

SidewaysBand_Trend_isnt_fresh = ta.barssince(SidewaysBand_Ema_in_Downtrend) > 50 or na(ta.barssince(SidewaysBand_Ema_in_Downtrend))

StrongBand_Buy_Alert = StronBand_Trend_isnt_fresh and StrongBand_Low_isnt_toLow and StronBand_Price_Average_above_Bull_Level and StrongBand_Price_was_below_Bull_level and StrongBand_Price_is_above_Bull_level and all_Fib_Emas_Trend_or_Sideways

MiddleBand_Buy_Alert = MiddleBand_Trend_isnt_fresh and MiddleBand_Low_isnt_toLow and MiddleBand_Price_Average_above_Bull_Level and MiddleBand_Price_was_below_Bull_level and MiddleBand_Price_is_above_Bull_level and Middle_and_Sideways_Fib_Emas_Trend_or_Sideways

SidewaysBand_Buy_Alert = SidewaysBand_Trend_isnt_fresh and SidewaysBand_Low_isnt_toLow and SidewaysBand_Price_Average_above_Bull_Level and SidewaysBand_Price_was_below_Bull_level and SidewaysBand_Price_is_above_Bull_level and (SidewaysBand_Ema_Sideways or SidewaysBand_Ema_in_Uptrend and ( not SidewaysBand_Ema_in_Downtrend))

// Sell condition

StrongBand_Price_was_above_Bear_level = ta.highest(high, 1) > StrongBand_current_Trend_EMA

StrongBand_Price_is_below_Bear_level = close < StrongBand_current_Trend_EMA

StronBand_Price_Average_below_Bear_Level = ta.sma(high, 10) < StrongBand_current_Trend_EMA

StrongBand_High_isnt_to_High = (ta.highest(high, 15) - ta.highest(StrongBand_current_Trend_EMA, 15)) < close * 0.005

StrongBand_Bear_Trend_isnt_fresh = ta.barssince(StrongBand_Ema_in_Uptrend) > 50

MiddleBand_Price_was_above_Bear_level = ta.highest(high, 1) > MiddleBand_current_Trend_EMA

MiddleBand_Price_is_below_Bear_level = close < MiddleBand_current_Trend_EMA

MiddleBand_Price_Average_below_Bear_Level = ta.sma(high, 9) < MiddleBand_current_Trend_EMA

MiddleBand_High_isnt_to_High = (ta.highest(high, 10) - ta.highest(MiddleBand_current_Trend_EMA, 10)) < close * 0.0065

MiddleBand_Bear_Trend_isnt_fresh = ta.barssince(MiddleBand_Ema_in_Uptrend) > 50

SidewaysBand_Price_was_above_Bear_level = ta.highest(high, 1) > SidewaysBand_current_Trend_EMA

SidewaysBand_Price_is_below_Bear_level = close < SidewaysBand_current_Trend_EMA

SidewaysBand_Price_Average_below_Bear_Level = ta.sma(high, 20) < SidewaysBand_current_Trend_EMA

SidewaysBand_High_isnt_to_High = (ta.highest(high, 20) - ta.highest(SidewaysBand_current_Trend_EMA, 15)) < close * 0.0065

SidewaysBand_Bear_Trend_isnt_fresh = ta.barssince(SidewaysBand_Ema_in_Uptrend) > 50

StrongBand_Sell_Alert = StronBand_Price_Average_below_Bear_Level and StrongBand_High_isnt_to_High and StrongBand_Bear_Trend_isnt_fresh and StrongBand_Price_was_above_Bear_level and StrongBand_Price_is_below_Bear_level and all_Fib_Emas_Downtrend and not all_Fib_Emas_Trend_or_Sideways

MiddleBand_Sell_Alert = MiddleBand_Price_Average_below_Bear_Level and MiddleBand_High_isnt_to_High and MiddleBand_Bear_Trend_isnt_fresh and MiddleBand_Price_was_above_Bear_level and MiddleBand_Price_is_below_Bear_level and Middle_and_Sideways_Fib_Emas_Downtrend and not Middle_and_Sideways_Fib_Emas_Trend_or_Sideways

SidewaysBand_Sell_Alert = SidewaysBand_Price_Average_below_Bear_Level and SidewaysBand_High_isnt_to_High and SidewaysBand_Bear_Trend_isnt_fresh and SidewaysBand_Price_was_above_Bear_level and SidewaysBand_Price_is_below_Bear_level and SidewaysBand_Ema_in_Downtrend and not (SidewaysBand_Ema_Sideways or SidewaysBand_Ema_in_Uptrend and ( not SidewaysBand_Ema_in_Downtrend))

// Backtester

////////////////// Stop Loss

// Stop loss

enableSL = input.bool(true, title='enable Stop Loss', group='══════════ Stop Loss Settings ══════════')

whichSL = input.string(defval='low/high as SL', title='SL based on static % or based on the low/high', options=['low/high as SL', 'static % as SL'], group='══════════ Stop Loss Settings ══════════')

whichOffset = input.string(defval='% as offset', title='choose offset from the low/high', options=['$ as offset', '% as offset'], group='Stop Loss at the low/high')

lowPBuffer = input.float(1.4, title='SL Offset from the Low/high in %', group='Stop Loss at the low/high') / 100

lowDBuffer = input.float(100, title='SL Offset from the Low/high in $', group='Stop Loss at the low/high')

SlLowLookback = input.int(title='SL lookback for Low/high', defval=5, minval=1, maxval=50, group='Stop Loss at the low/high')

longSlLow = float(na)

shortSlLow = float(na)

if whichOffset == "% as offset" and whichSL == "low/high as SL" and enableSL

longSlLow := ta.lowest(low, SlLowLookback) * (1 - lowPBuffer)

shortSlLow := ta.highest(high, SlLowLookback) * (1 + lowPBuffer)

if whichOffset == "$ as offset" and whichSL == "low/high as SL" and enableSL

longSlLow := ta.lowest(low, SlLowLookback) - lowDBuffer

shortSlLow := ta.highest(high, SlLowLookback) + lowDBuffer

//plot(shortSlLow, title="stoploss", color=color.new(#00bcd4, 0))

// long settings - 🔥 uncomment the 6 lines below to disable the alerts and enable the backtester

longStopLoss = input.float(0.5, title='Long Stop Loss in %', group='static % Stop Loss', inline='Input 1') / 100

// short settings - 🔥 uncomment the 6 lines below to disable the alerts and enable the backtester

shortStopLoss = input.float(0.5, title='Short Stop Loss in %', group='static % Stop Loss', inline='Input 1') / 100

/////// Take profit

longTakeProfit1 = input.float(4, title='Long Take Profit in %', group='Take Profit', inline='Input 1') / 100

/////// Take profit

shortTakeProfit1 = input.float(1.6, title='Short Take Profit in %', group='Take Profit', inline='Input 1') / 100

////////////////// SL TP END

/////////////////// alerts

selectalertFreq = input.string(defval='once per bar close', title='Alert Options', options=['once per bar', 'once per bar close', 'all'], group='═══════════ alert settings ═══════════')

BuyAlertMessage = input.string(defval="Bullish Divergence detected, put your SL @", title='Buy Alert Message', group='═══════════ alert settings ═══════════')

enableSlMessage = input.bool(true, title='enable Stop Loss Value at the end of "buy Alert message"', group='═══════════ alert settings ═══════════')

AfterSLMessage = input.string(defval="", title='Buy Alert message after SL Value', group='═══════════ alert settings ═══════════')

////////////////// Backtester

// 🔥 uncomment the all lines below for the backtester and revert for alerts

shortTrading = enable_MiddleBand_Bear or enable_StrongBand_Bear or enable_SidewaysBand_Bear

longTrading = enable_StrongBand_Bull or enable_MiddleBand_Bull or enable_SidewaysBand_Bull

longTP1 = strategy.position_size > 0 ? strategy.position_avg_price * (1 + longTakeProfit1) : strategy.position_size < 0 ? strategy.position_avg_price * (1 - longTakeProfit1) : na

longSL = strategy.position_size > 0 ? strategy.position_avg_price * (1 - longStopLoss) : strategy.position_size < 0 ? strategy.position_avg_price * (1 + longStopLoss) : na

shortTP = strategy.position_size > 0 ? strategy.position_avg_price * (1 + shortTakeProfit1) : strategy.position_size < 0 ? strategy.position_avg_price * (1 - shortTakeProfit1) : na

shortSL = strategy.position_size > 0 ? strategy.position_avg_price * (1 - shortStopLoss) : strategy.position_size < 0 ? strategy.position_avg_price * (1 + shortStopLoss) : na

strategy.risk.allow_entry_in(longTrading == true and shortTrading == true ? strategy.direction.all : longTrading == true ? strategy.direction.long : shortTrading == true ? strategy.direction.short : na)

strategy.entry('Bull', strategy.long, comment='Upper Band Long', when=StrongBand_Buy_Alert)

strategy.entry('Bull', strategy.long, comment='Lower Band Long', when=MiddleBand_Buy_Alert)

strategy.entry('Bull', strategy.long, comment='Lower Band Long', when=SidewaysBand_Buy_Alert)

strategy.entry('Bear', strategy.short, comment='Upper Band Short', when=StrongBand_Sell_Alert)

strategy.entry('Bear', strategy.short, comment='Lower Band Short', when=MiddleBand_Sell_Alert)

strategy.entry('Bear', strategy.short, comment='Lower Band Short', when=SidewaysBand_Sell_Alert)

// check which SL to use

if enableSL and whichSL == 'static % as SL'

strategy.exit(id='longTP-SL', from_entry='Bull', limit=longTP1, stop=longSL)

strategy.exit(id='shortTP-SL', from_entry='Bear', limit=shortTP, stop=shortSL)

// get bars since last entry for the SL at low to work

barsSinceLastEntry()=>

strategy.opentrades > 0 ? (bar_index - strategy.opentrades.entry_bar_index(strategy.opentrades-1)) : na

if enableSL and whichSL == 'low/high as SL' and ta.barssince(StrongBand_Buy_Alert or MiddleBand_Buy_Alert or SidewaysBand_Buy_Alert) < 2 and barsSinceLastEntry() < 2

strategy.exit(id='longTP-SL', from_entry='Bull', limit=longTP1, stop=longSlLow)

if enableSL and whichSL == 'low/high as SL' and ta.barssince(StrongBand_Sell_Alert or MiddleBand_Sell_Alert or SidewaysBand_Sell_Alert) < 2 and barsSinceLastEntry() < 2

strategy.exit(id='shortTP-SL', from_entry='Bear', limit=shortTP, stop=shortSlLow)

if not enableSL

strategy.exit(id='longTP-SL', from_entry='Bull', limit=longTP1)

strategy.exit(id='shortTP-SL', from_entry='Bear', limit=shortTP)