Stratégie d'arrêt-perte à double moyenne mobile

Auteur:ChaoZhang est là., Date: 2023-12-29 à 16h59Les étiquettes:

Résumé

Cette stratégie utilise des croisements de moyennes mobiles rapides et lents pour déterminer les positions longues et courtes. Elle devient longue lorsque le MA rapide traverse le MA lent et ferme la position lorsque le MA rapide traverse le MA lent. Pour poursuivre des bénéfices plus élevés, la stratégie adopte un mécanisme de stop loss.

Comment ça marche

La stratégie utilise des lignes de moyenne mobile simple (SMA) rapides et lentes pour déterminer les entrées et les sorties. Lorsque la SMA rapide traverse la SMA lente, elle signale une tendance haussière afin que la stratégie soit longue. Lorsque la SMA rapide traverse en dessous de la SMA lente, elle signale un renversement de tendance afin que la stratégie se prépare à fermer la position.

Pour maximiser les bénéfices, la stratégie introduit un mécanisme de stop-loss de trailing. Au lieu d'utiliser un prix de stop-loss fixe après l'ouverture de positions longues, elle fixe un prix de stop-loss de trailing qui monte à la suite de la hausse des prix. Chaque fois que le prix augmente d'un certain pourcentage, le prix de stop-loss de trailing s'ajuste d'un pourcentage prédéfini. Lorsque le prix se retire et atteint le prix de stop-loss de trailing, il déclenche l'ordre de stop-loss pour fermer la position.

En particulier, le prix du stop-loss est calculé comme suit:

Le montant de l'exposition au risque est calculé sur la base de l'exposition au risque.

Le pourcentage de suivi de stop loss est défini par le paramètre de stratégie

Lorsque le prix chute et atteint le prix de stop loss, il déclenche le signal de fermeture et la position sera fermée par un ordre de marché.

Les avantages

- Utiliser des moyennes mobiles doubles pour déterminer la direction de la tendance avec de bons résultats de backtest

- Adopter un stop-loss pour poursuivre des bénéfices plus élevés

- Pour les produits de base, la valeur de l'échange est calculée à partir de la valeur de l'échange.

- La ligne stop-loss continue de monter lorsque la tendance monte, ce qui garantit la plupart des profits

- Arrêt rapide des pertes lorsque la tendance s'inverse pour éviter de nouvelles pertes

Risques et solutions

- Le temps de croisement de la moyenne mobile peut provoquer de faux signaux. Testez différents paramètres pour trouver la combinaison optimale de MA

- Ajustez correctement le paramètre de pourcentage de retard de retard de perte

- Les écarts de prix peuvent directement pénétrer le prix de stop loss.

Directions d'optimisation

- Testez différents paramètres de la moyenne mobile pour trouver la combinaison optimale

- Testez différents paramètres de pourcentage de retard de stop loss pour trouver le niveau de stop loss optimal

- Ajouter d'autres indicateurs pour suspendre la négociation pendant les périodes d'intervalle afin d'éviter d'être affecté par des événements sporadiques

Conclusion

Cette stratégie combine des indicateurs de moyenne mobile pour juger de la direction de la tendance et un mécanisme de stop-loss pour verrouiller les profits, avec de bonnes performances sur les données de formation. En optimisant les paramètres et en contrôlant les risques, elle a le potentiel d'obtenir des profits stables. Cependant, aucune stratégie ne peut éviter complètement les pertes. Il est recommandé d'ajuster la taille des positions, de tester différents produits et de diversifier les risques.

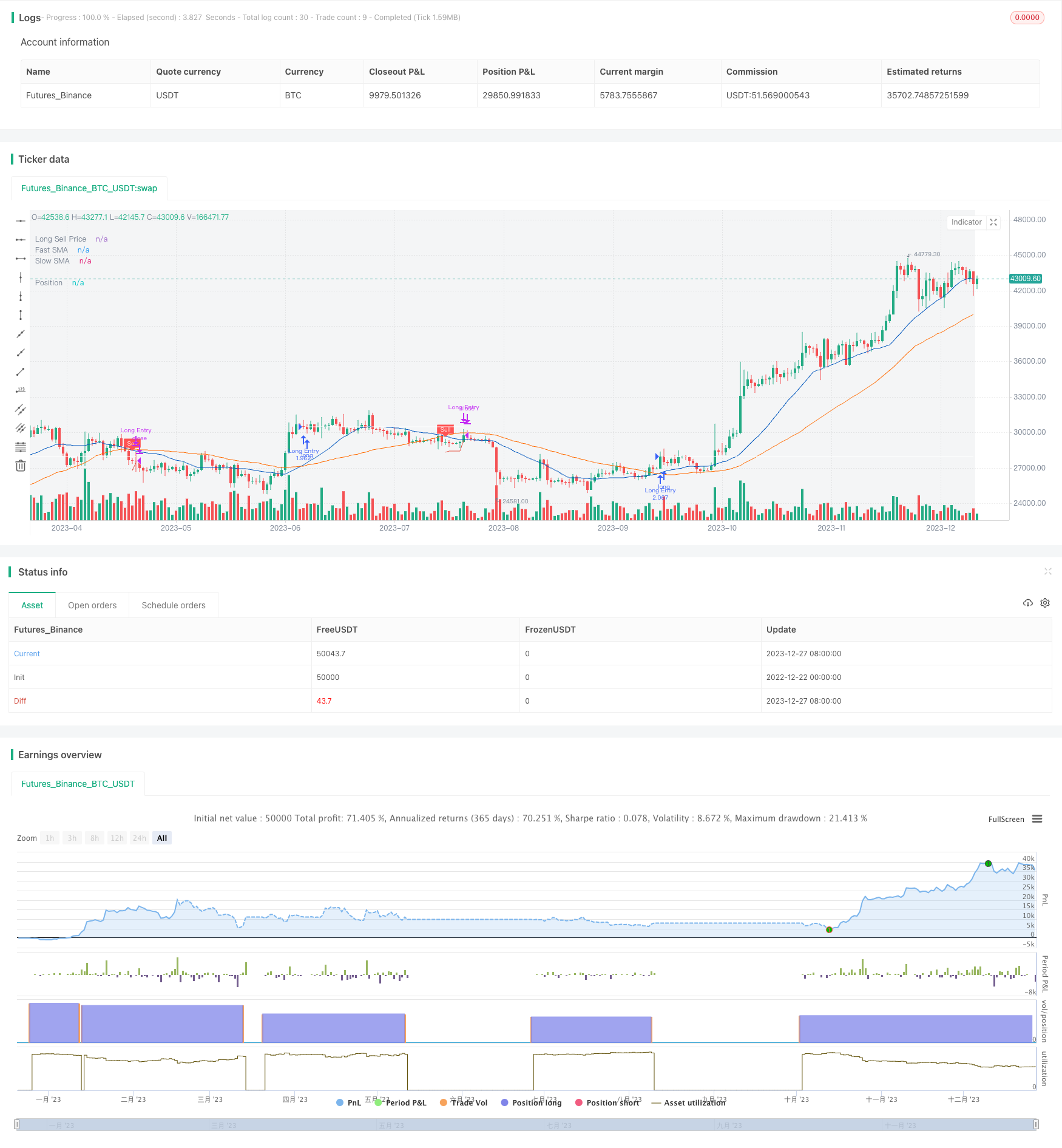

/*backtest

start: 2022-12-22 00:00:00

end: 2023-12-28 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

//

// ▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒

// -----------------------------------------------------------------------------

// Copyright 2022 Iason Nikolas | jason5480

// Trailing Buy script may be freely distributed under the MIT license.

//

// Permission is hereby granted, free of charge,

// to any person obtaining a copy of this software and associated documentation files (the "Software"),

// to deal in the Software without restriction, including without limitation the rights to use, copy, modify, merge,

// publish, distribute, sublicense, and/or sell copies of the Software, and to permit persons to whom the Software is furnished to do so,

// subject to the following conditions:

//

// The above copyright notice and this permission notice shall be included in all copies or substantial portions of the Software.

//

// THE SOFTWARE IS PROVIDED "AS IS", WITHOUT WARRANTY OF ANY KIND,

// EXPRESS OR IMPLIED, INCLUDING BUT NOT LIMITED TO THE WARRANTIES OF MERCHANTABILITY,

// FITNESS FOR A PARTICULAR PURPOSE AND NONINFRINGEMENT. IN NO EVENT SHALL THE AUTHORS OR COPYRIGHT HOLDERS BE LIABLE FOR ANY CLAIM,

// DAMAGES OR OTHER LIABILITY, WHETHER IN AN ACTION OF CONTRACT, TORT OR OTHERWISE, ARISING FROM,

// OUT OF OR IN CONNECTION WITH THE SOFTWARE OR THE USE OR OTHER DEALINGS IN THE SOFTWARE.

//

// -----------------------------------------------------------------------------

//

// Authors: @jason5480

// Revision: v1.0.1

// Date: 24-Feb-2022

//

// Description

// =============================================================================

// This strategy will go long if fast MA crosses over slow MA.

// If the 'Enable Trailing` is checked then the strategy instead of exiting from the position

// directly it will follow the price upwards (percentagewise) with small steps

// If the price drops by this percentage then the exit order will be executed

//

// The strategy has the following parameters:

//

// Fast SMA Length - How many candles back to calculte the fast SMA.

// Slow SMA Length - How many candles back to calculte the slow SMA.

// Enable Trailing - Enable or disable the trailing

// Deviation % - The step to follow the price when the open position condition is met.

// Source Exit Control - The source price to compare with the exit price to trigger the exit order when trailing.

//

// -----------------------------------------------------------------------------

// Disclaimer:

// 1. I am not licensed financial advisors or broker dealer. I do not tell you

// when or what to buy or sell. I developed this software which enables you

// execute manual or automated using TradingView. The

// software allows you to set the criteria you want for entering and exiting

// trades.

// 2. Do not trade with money you cannot afford to lose.

// 3. I do not guarantee consistent profits or that anyone can make money with no

// effort. And I am not selling the holy grail.

// 4. Every system can have winning and losing streaks.

// 5. Money management plays a large role in the results of your trading. For

// example: lot size, account size, broker leverage, and broker margin call

// rules all have an effect on results. Also, your Take Profit and Stop Loss

// settings for individual pair trades and for overall account equity have a

// major impact on results. If you are new to trading and do not understand

// these items, then I recommend you seek education materials to further your

// knowledge.

//

// YOU NEED TO FIND AND USE THE TRADING SYSTEM THAT WORKS BEST FOR YOU AND YOUR

// TRADING TOLERANCE.

//

// I HAVE PROVIDED NOTHING MORE THAN A TOOL WITH OPTIONS FOR YOU TO TRADE WITH THIS PROGRAM ON TRADINGVIEW.

//

// I accept suggestions to improve the script.

// If you encounter any problems I will be happy to share with me.

// -----------------------------------------------------------------------------

//

// ▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒

// SETUP ============================================================================================================

strategy(title = 'Trailing Sell',

shorttitle = 'TS',

overlay = true,

pyramiding = 0,

default_qty_type = strategy.percent_of_equity,

default_qty_value = 100,

initial_capital = 100000)

//

// ▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒

// FILTERS ==========================================================================================================

// INPUT ============================================================================================================

usefromDate = input.bool(defval = true, title = 'From', inline = "From Date", group = "Filters")

fromDate = input(defval = timestamp('01 Jan 2021 00:00 UTC'), title = '', inline = "From Date", group = 'Filters')

usetoDate = input.bool(defval = false, title = 'To ', inline = "To Date", group = "Filters")

toDate = input(defval = timestamp('31 Dec 2121 23:59 UTC'), title = '', inline = "To Date", group = 'Filters')

// LOGIC ============================================================================================================

isWithinPeriod() => true // create function "within window of time"

// PLOT =============================================================================================================

bgcolor(color = isWithinPeriod() ? color.new(color.gray, 90) : na, title = 'Period')

//

// ▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒

// STRATEGY =========================================================================================================

// INPUT ============================================================================================================

fastMALen = input.int(defval = 21, title = 'Fast/Slow SMA Length', inline = 'MA Length', group = 'Strategy')

slowMALen = input.int(defval = 49, title = '', tooltip = 'How many candles back to calculte the fast/slow SMA.', inline = 'MA Length', group = 'Strategy')

// LOGIC ============================================================================================================

fastMA = ta.sma(close, fastMALen)

slowMA = ta.sma(close, slowMALen)

bool openLongPosition = isWithinPeriod() and ta.crossover(fastMA, slowMA)

bool closeLongPosition = ta.crossunder(fastMA, slowMA)

// PLOT =============================================================================================================

var fastColor = color.new(#0056BD, 0)

plot(series = fastMA, title = 'Fast SMA', color = fastColor, linewidth = 1, style = plot.style_line)

var slowColor = color.new(#FF6A00, 0)

plot(series = slowMA, title = 'Slow SMA', color = slowColor, linewidth = 1, style = plot.style_line)

plotshape(series = closeLongPosition and strategy.position_size > 0 ? fastMA : na, title = 'Sell', text = 'Sell', style = shape.labeldown, location = location.absolute, color = color.new(color.red, 0), textcolor = color.new(color.white, 0), size = size.tiny)

//

// ▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒

// EXIT ============================================================================================================

// INPUT ============================================================================================================

enableTrailing = input.bool(defval = true, title = 'Enable Trailing', tooltip = 'Enable or disable the trailing for exit position.', group = 'Exit')

devExitPerc = input.float(defval = 3.0, title = 'Deviation %', minval = 0.01, maxval = 100, step = 0.05, tooltip = 'The step to follow the price when the open position condition is met.', group = 'Exit') / 100

ctrLongExitSrc = input.source(defval = low, title = 'Source Exit Control', tooltip = 'The source price to compare with the exit price to trigger the exit order when trailing.', group = 'Exit')

// LOGIC ============================================================================================================

var bool exitLongPosition = false

int barsSinceOpenLong = nz(ta.barssince(openLongPosition), 999999)

int barsSinceCloseLong = nz(ta.barssince(closeLongPosition), 999999)

int barsSinceExitLong = nz(ta.barssince(exitLongPosition), 999999)

bool closeLongIsActive = barsSinceOpenLong >= barsSinceCloseLong

bool exitLongIsPending = barsSinceExitLong >= barsSinceCloseLong

bool tryExitLongPosition = isWithinPeriod() and closeLongIsActive and exitLongIsPending

float longExitPrice = na

longExitPrice := if closeLongPosition and strategy.position_size > 0

close * (1 - devExitPerc)

else if tryExitLongPosition

math.max(high * (1 - devExitPerc), nz(longExitPrice[1], 999999))

else

na

exitLongPosition := enableTrailing ? isWithinPeriod() and ta.crossunder(closeLongPosition ? close : ctrLongExitSrc, longExitPrice) : closeLongPosition

// PLOT =============================================================================================================

var sellPriceColor = color.new(#e25141, 0)

plot(series = enableTrailing ? longExitPrice : na, title = 'Long Sell Price', color = sellPriceColor, linewidth = 1, style = plot.style_linebr)

//

// ▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒

// POSITION ORDERS ==================================================================================================

// LOGIC ============================================================================================================

// getting into LONG position

strategy.entry(id = 'Long Entry', direction = strategy.long, when = openLongPosition, alert_message = 'Long(' + syminfo.ticker + '): Started')

// submit close order on trend reversal

strategy.close(id = 'Long Entry', when = exitLongPosition, comment = 'Close Long', alert_message = 'Long(' + syminfo.ticker + '): Closed at market price')

// PLOT =============================================================================================================

var posColor = color.new(color.white, 0)

plot(series = strategy.position_avg_price, title = 'Position', color = posColor, linewidth = 1, style = plot.style_linebr)

// ==================================================================================================================

- Déplacer la stratégie de croisement de canaux à Vegas

- Tendance suivant une stratégie basée sur une moyenne mobile dynamique

- Stratégie de suivi des tendances combinées

- Neuf types de stratégie de croisement des moyennes mobiles

- La couverture automatique permanente de Binance OKX

- Tendance dynamique de rupture suivant la stratégie

- Stratégie de négociation des ratios transitifs basée sur le filtre Kalman et l'inversion moyenne

- Stratégie de régression linéaire inverse

- Stratégie de négociation de BankNifty Supertrend

- Stratégie des zones transitoires

- Stratégie de rupture de dynamique sur plusieurs délais

- Point pivot ratio d' or Acheter haut Vendre bas stratégie

- Stratégie de négociation de la tortue basée sur une moyenne mobile simple

- Stratégie de négociation MACD de la bande de Bollinger à moyenne mobile double

- Les bandes de Bollinger et la stratégie de croisement RSI

- Tendance à suivre une stratégie basée sur QQE et MA

- Stratégie de prix moyens pondérés par volume

- Stratégie quantitative à double indicateur

- Stratégie de suivi du moment

- Stratégie de négociation pour l'amélioration de l'indicateur RSI