Stratégie de trading à court terme basée sur le zigzag avec plusieurs modèles

Aperçu

La stratégie est basée sur l’indicateur ZigZag pour identifier les formes de ligne K et, en combinaison avec la ligne de rétractation de Fibonacci, définit la fenêtre d’entrée, le prix d’arrêt et le prix de perte, permettant la négociation de la ligne courte. La stratégie prend en charge plusieurs formes, y compris 13 formes de deux tendances plus ou moins longues, telles que Bat, Butterfly et Gartley.

Principe de stratégie

- Utilisation de l’indicateur ZigZag pour identifier les points d’inflexion potentiels

- Calculer les 4 derniers retournements pour voir s’ils correspondent à l’une des 13 formes prédéfinies

- L’entrée est donnée si la forme correspondante et le prix entrent dans la zone de retrait de Fibonacci de 0,382.

- Le stop est réglé sur la ligne de rétractation de 0,618. Le stop est réglé sur la ligne de rétractation de -0,618.

- Les formes efficaces comprennent les formes courantes Bat, Butterfly et Gartley, ainsi que certaines formes inverses comme Anti-Bat, Anti-Butterfly et ainsi de suite.

Analyse des avantages

- La stratégie utilise les avantages de l’indicateur ZigZag pour filtrer efficacement le bruit du marché et identifier plus clairement les virages de tendance

- Une combinaison de multiples formes pour augmenter les opportunités d’entrée tout en contrôlant les risques

- La rétrogradation de Fibonacci est utilisée pour définir des points de référence permettant de normaliser l’entrée et la fermeture des prises de profit.

Analyse des risques

- L’indicateur ZigZag est sensible aux paramètres et doit être réglé pour trouver la meilleure combinaison de paramètres

- Les homogénéisations massives augmentent le risque d’adaptation de la courbe, l’effet sur le disque peut être plus faible que la rétroanalyse

- Il n’est pas possible de détecter des formes plus complexes en ne considérant que les 4 derniers points de basculement.

- Le fait de ne pas prendre en compte les retests après la rupture de la ligne de retrait peut entraîner un arrêt prématuré des pertes

Direction d’optimisation

- Optimiser les paramètres ZigZag pour trouver la meilleure combinaison de paramètres

- Tests d’efficacité des formes d’augmentation, comme la prise en compte de la confirmation de la clôture des cours sur les points critiques

- Ajout de nouvelles formes de ligne K pour augmenter les opportunités d’Entry

- Augmentation des mécanismes de retrait et de retest pour réduire le risque de dommages

Résumer

La stratégie utilise l’indicateur ZigZag et la forme de la ligne K pour juger de la conversion de la tendance, la mise en place de la logique d’entrée et de sortie standardisée de la zone de retrait de Fibonacci, une stratégie de négociation en ligne courte potentielle. La clé est de trouver la meilleure combinaison de paramètres, tout en ajustant correctement le mécanisme de stop-loss, pour un meilleur effet en direct.

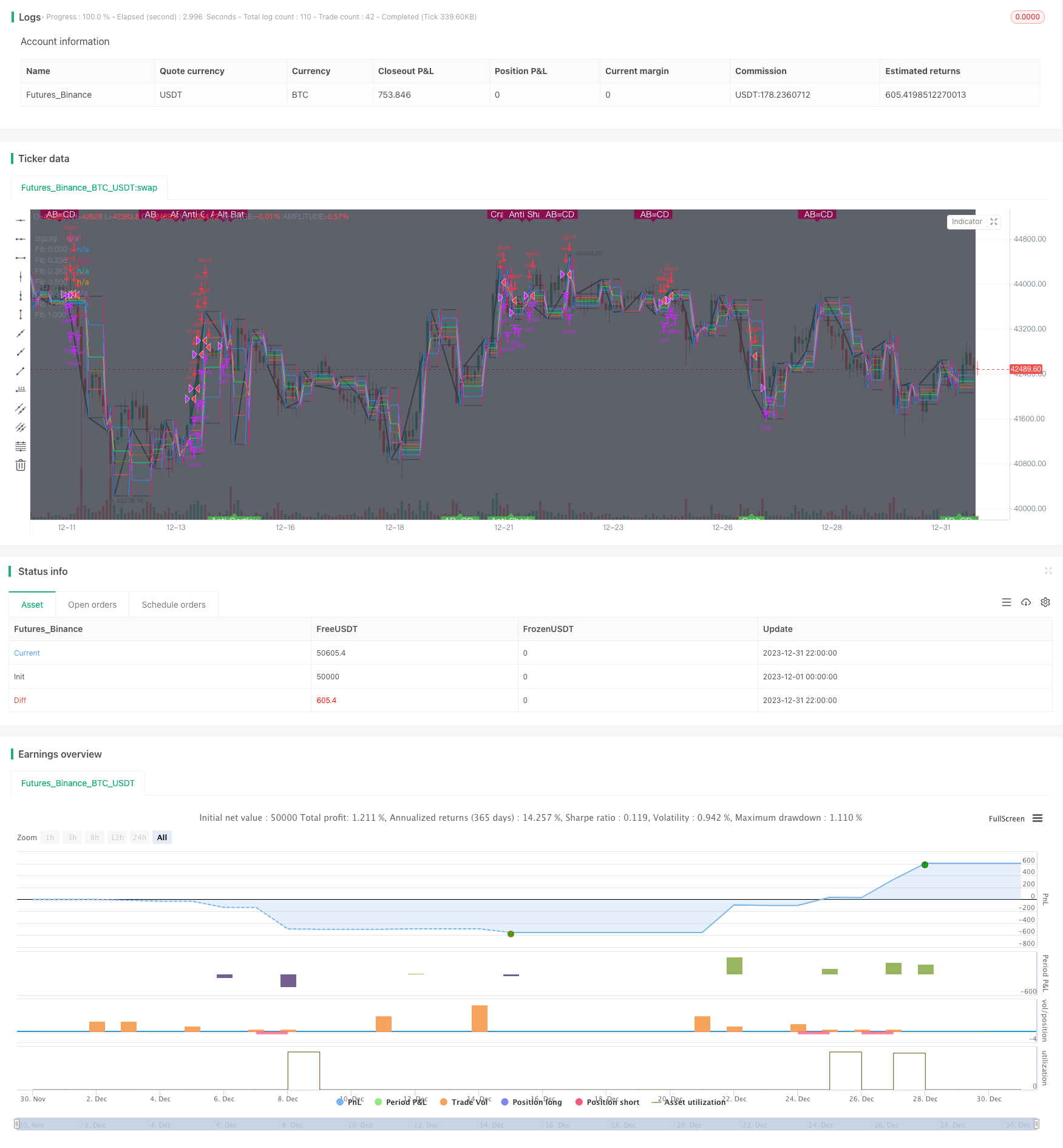

/*backtest

start: 2023-12-01 00:00:00

end: 2023-12-31 23:59:59

period: 2h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

strategy(title='[STRATEGY][RS]ZigZag PA Strategy V4', shorttitle='S', overlay=true)

useHA = input(false, title='Use Heikken Ashi Candles')

useAltTF = input(true, title='Use Alt Timeframe')

tf = input('60', title='Alt Timeframe')

showPatterns = input(true, title='Show Patterns')

showFib0000 = input(title='Display Fibonacci 0.000:', type=bool, defval=true)

showFib0236 = input(title='Display Fibonacci 0.236:', type=bool, defval=true)

showFib0382 = input(title='Display Fibonacci 0.382:', type=bool, defval=true)

showFib0500 = input(title='Display Fibonacci 0.500:', type=bool, defval=true)

showFib0618 = input(title='Display Fibonacci 0.618:', type=bool, defval=true)

showFib0764 = input(title='Display Fibonacci 0.764:', type=bool, defval=true)

showFib1000 = input(title='Display Fibonacci 1.000:', type=bool, defval=true)

zigzag() =>

_isUp = close >= open

_isDown = close <= open

_direction = _isUp[1] and _isDown ? -1 : _isDown[1] and _isUp ? 1 : nz(_direction[1])

_zigzag = _isUp[1] and _isDown and _direction[1] != -1 ? highest(2) : _isDown[1] and _isUp and _direction[1] != 1 ? lowest(2) : na

_ticker = useHA ? heikenashi(syminfo.tickerid) : syminfo.tickerid

sz = useAltTF ? (ta.change(time(tf)) != 0 ? request.security(_ticker, tf, zigzag()) : na) : zigzag()

plot(sz, title='zigzag', color=color.black, linewidth=2)

// ||--- Pattern Recognition:

x = ta.valuewhen(sz, sz, 4)

a = ta.valuewhen(sz, sz, 3)

b = ta.valuewhen(sz, sz, 2)

c = ta.valuewhen(sz, sz, 1)

d = ta.valuewhen(sz, sz, 0)

xab = (abs(b-a)/abs(x-a))

xad = (abs(a-d)/abs(x-a))

abc = (abs(b-c)/abs(a-b))

bcd = (abs(c-d)/abs(b-c))

// ||--> Functions:

isBat(_mode)=>

_xab = xab >= 0.382 and xab <= 0.5

_abc = abc >= 0.382 and abc <= 0.886

_bcd = bcd >= 1.618 and bcd <= 2.618

_xad = xad <= 0.618 and xad <= 1.000 // 0.886

_xab and _abc and _bcd and _xad and (_mode == 1 ? d < c : d > c)

isAntiBat(_mode)=>

_xab = xab >= 0.500 and xab <= 0.886 // 0.618

_abc = abc >= 1.000 and abc <= 2.618 // 1.13 --> 2.618

_bcd = bcd >= 1.618 and bcd <= 2.618 // 2.0 --> 2.618

_xad = xad >= 0.886 and xad <= 1.000 // 1.13

_xab and _abc and _bcd and _xad and (_mode == 1 ? d < c : d > c)

isAltBat(_mode)=>

_xab = xab <= 0.382

_abc = abc >= 0.382 and abc <= 0.886

_bcd = bcd >= 2.0 and bcd <= 3.618

_xad = xad <= 1.13

_xab and _abc and _bcd and _xad and (_mode == 1 ? d < c : d > c)

isButterfly(_mode)=>

_xab = xab <= 0.786

_abc = abc >= 0.382 and abc <= 0.886

_bcd = bcd >= 1.618 and bcd <= 2.618

_xad = xad >= 1.27 and xad <= 1.618

_xab and _abc and _bcd and _xad and (_mode == 1 ? d < c : d > c)

isAntiButterfly(_mode)=>

_xab = xab >= 0.236 and xab <= 0.886 // 0.382 - 0.618

_abc = abc >= 1.130 and abc <= 2.618 // 1.130 - 2.618

_bcd = bcd >= 1.000 and bcd <= 1.382 // 1.27

_xad = xad >= 0.500 and xad <= 0.886 // 0.618 - 0.786

_xab and _abc and _bcd and _xad and (_mode == 1 ? d < c : d > c)

isABCD(_mode)=>

_abc = abc >= 0.382 and abc <= 0.886

_bcd = bcd >= 1.13 and bcd <= 2.618

_abc and _bcd and (_mode == 1 ? d < c : d > c)

isGartley(_mode)=>

_xab = xab >= 0.5 and xab <= 0.618 // 0.618

_abc = abc >= 0.382 and abc <= 0.886

_bcd = bcd >= 1.13 and bcd <= 2.618

_xad = xad >= 0.75 and xad <= 0.875 // 0.786

_xab and _abc and _bcd and _xad and (_mode == 1 ? d < c : d > c)

isAntiGartley(_mode)=>

_xab = xab >= 0.500 and xab <= 0.886 // 0.618 -> 0.786

_abc = abc >= 1.000 and abc <= 2.618 // 1.130 -> 2.618

_bcd = bcd >= 1.500 and bcd <= 5.000 // 1.618

_xad = xad >= 1.000 and xad <= 5.000 // 1.272

_xab and _abc and _bcd and _xad and (_mode == 1 ? d < c : d > c)

isCrab(_mode)=>

_xab = xab >= 0.500 and xab <= 0.875 // 0.886

_abc = abc >= 0.382 and abc <= 0.886

_bcd = bcd >= 2.000 and bcd <= 5.000 // 3.618

_xad = xad >= 1.382 and xad <= 5.000 // 1.618

_xab and _abc and _bcd and _xad and (_mode == 1 ? d < c : d > c)

isAntiCrab(_mode)=>

_xab = xab >= 0.250 and xab <= 0.500 // 0.276 -> 0.446

_abc = abc >= 1.130 and abc <= 2.618 // 1.130 -> 2.618

_bcd = bcd >= 1.618 and bcd <= 2.618 // 1.618 -> 2.618

_xad = xad >= 0.500 and xad <= 0.750 // 0.618

_xab and _abc and _bcd and _xad and (_mode == 1 ? d < c : d > c)

isShark(_mode)=>

_xab = xab >= 0.500 and xab <= 0.875 // 0.5 --> 0.886

_abc = abc >= 1.130 and abc <= 1.618 //

_bcd = bcd >= 1.270 and bcd <= 2.240 //

_xad = xad >= 0.886 and xad <= 1.130 // 0.886 --> 1.13

_xab and _abc and _bcd and _xad and (_mode == 1 ? d < c : d > c)

isAntiShark(_mode)=>

_xab = xab >= 0.382 and xab <= 0.875 // 0.446 --> 0.618

_abc = abc >= 0.500 and abc <= 1.000 // 0.618 --> 0.886

_bcd = bcd >= 1.250 and bcd <= 2.618 // 1.618 --> 2.618

_xad = xad >= 0.500 and xad <= 1.250 // 1.130 --> 1.130

_xab and _abc and _bcd and _xad and (_mode == 1 ? d < c : d > c)

is5o(_mode)=>

_xab = xab >= 1.13 and xab <= 1.618

_abc = abc >= 1.618 and abc <= 2.24

_bcd = bcd >= 0.5 and bcd <= 0.625 // 0.5

_xad = xad >= 0.0 and xad <= 0.236 // negative?

_xab and _abc and _bcd and _xad and (_mode == 1 ? d < c : d > c)

isWolf(_mode)=>

_xab = xab >= 1.27 and xab <= 1.618

_abc = abc >= 0 and abc <= 5

_bcd = bcd >= 1.27 and bcd <= 1.618

_xad = xad >= 0.0 and xad <= 5

_xab and _abc and _bcd and _xad and (_mode == 1 ? d < c : d > c)

isHnS(_mode)=>

_xab = xab >= 2.0 and xab <= 10

_abc = abc >= 0.90 and abc <= 1.1

_bcd = bcd >= 0.236 and bcd <= 0.88

_xad = xad >= 0.90 and xad <= 1.1

_xab and _abc and _bcd and _xad and (_mode == 1 ? d < c : d > c)

isConTria(_mode)=>

_xab = xab >= 0.382 and xab <= 0.618

_abc = abc >= 0.382 and abc <= 0.618

_bcd = bcd >= 0.382 and bcd <= 0.618

_xad = xad >= 0.236 and xad <= 0.764

_xab and _abc and _bcd and _xad and (_mode == 1 ? d < c : d > c)

isExpTria(_mode)=>

_xab = xab >= 1.236 and xab <= 1.618

_abc = abc >= 1.000 and abc <= 1.618

_bcd = bcd >= 1.236 and bcd <= 2.000

_xad = xad >= 2.000 and xad <= 2.236

_xab and _abc and _bcd and _xad and (_mode == 1 ? d < c : d > c)

plotshape(not showPatterns ? na : isABCD(-1) and not isABCD(-1)[1], text="\nAB=CD", title='Bear ABCD', style=shape.labeldown, color=maroon, textcolor=white, location=location.top, transp=0, offset=-2)

plotshape(not showPatterns ? na : isBat(-1) and not isBat(-1)[1], text="Bat", title='Bear Bat', style=shape.labeldown, color=maroon, textcolor=white, location=location.top, transp=0, offset=-2)

plotshape(not showPatterns ? na : isAntiBat(-1) and not isAntiBat(-1)[1], text="Anti Bat", title='Bear Anti Bat', style=shape.labeldown, color=maroon, textcolor=white, location=location.top, transp=0, offset=-2)

plotshape(not showPatterns ? na : isAltBat(-1) and not isAltBat(-1)[1], text="Alt Bat", title='Bear Alt Bat', style=shape.labeldown, color=maroon, textcolor=white, location=location.top, transp=0)

plotshape(not showPatterns ? na : isButterfly(-1) and not isButterfly(-1)[1], text="Butterfly", title='Bear Butterfly', style=shape.labeldown, color=maroon, textcolor=white, location=location.top, transp=0)

plotshape(not showPatterns ? na : isAntiButterfly(-1) and not isAntiButterfly(-1)[1], text="Anti Butterfly", title='Bear Anti Butterfly', style=shape.labeldown, color=maroon, textcolor=white, location=location.top, transp=0)

plotshape(not showPatterns ? na : isGartley(-1) and not isGartley(-1)[1], text="Gartley", title='Bear Gartley', style=shape.labeldown, color=maroon, textcolor=white, location=location.top, transp=0)

plotshape(not showPatterns ? na : isAntiGartley(-1) and not isAntiGartley(-1)[1], text="Anti Gartley", title='Bear Anti Gartley', style=shape.labeldown, color=maroon, textcolor=white, location=location.top, transp=0)

plotshape(not showPatterns ? na : isCrab(-1) and not isCrab(-1)[1], text="Crab", title='Bear Crab', style=shape.labeldown, color=maroon, textcolor=white, location=location.top, transp=0)

plotshape(not showPatterns ? na : isAntiCrab(-1) and not isAntiCrab(-1)[1], text="Anti Crab", title='Bear Anti Crab', style=shape.labeldown, color=maroon, textcolor=white, location=location.top, transp=0)

plotshape(not showPatterns ? na : isShark(-1) and not isShark(-1)[1], text="Shark", title='Bear Shark', style=shape.labeldown, color=maroon, textcolor=white, location=location.top, transp=0)

plotshape(not showPatterns ? na : isAntiShark(-1) and not isAntiShark(-1)[1], text="Anti Shark", title='Bear Anti Shark', style=shape.labeldown, color=maroon, textcolor=white, location=location.top, transp=0)

plotshape(not showPatterns ? na : is5o(-1) and not is5o(-1)[1], text="5-O", title='Bear 5-O', style=shape.labeldown, color=maroon, textcolor=white, location=location.top, transp=0)

plotshape(not showPatterns ? na : isWolf(-1) and not isWolf(-1)[1], text="Wolf Wave", title='Bear Wolf Wave', style=shape.labeldown, color=maroon, textcolor=white, location=location.top, transp=0)

plotshape(not showPatterns ? na : isHnS(-1) and not isHnS(-1)[1], text="Head and Shoulders", title='Bear Head and Shoulders', style=shape.labeldown, color=maroon, textcolor=white, location=location.top, transp=0)

plotshape(not showPatterns ? na : isConTria(-1) and not isConTria(-1)[1], text="Contracting Triangle", title='Bear Contracting triangle', style=shape.labeldown, color=maroon, textcolor=white, location=location.top, transp=0)

plotshape(not showPatterns ? na : isExpTria(-1) and not isExpTria(-1)[1], text="Expanding Triangle", title='Bear Expanding Triangle', style=shape.labeldown, color=maroon, textcolor=white, location=location.top, transp=0)

plotshape(not showPatterns ? na : isABCD(1) and not isABCD(1)[1], text="AB=CD\n", title='Bull ABCD', style=shape.labelup, color=green, textcolor=white, location=location.bottom, transp=0)

plotshape(not showPatterns ? na : isBat(1) and not isBat(1)[1], text="Bat", title='Bull Bat', style=shape.labelup, color=green, textcolor=white, location=location.bottom, transp=0)

plotshape(not showPatterns ? na : isAntiBat(1) and not isAntiBat(1)[1], text="Anti Bat", title='Bull Anti Bat', style=shape.labelup, color=green, textcolor=white, location=location.bottom, transp=0)

plotshape(not showPatterns ? na : isAltBat(1) and not isAltBat(1)[1], text="Alt Bat", title='Bull Alt Bat', style=shape.labelup, color=green, textcolor=white, location=location.bottom, transp=0)

plotshape(not showPatterns ? na : isButterfly(1) and not isButterfly(1)[1], text="Butterfly", title='Bull Butterfly', style=shape.labelup, color=green, textcolor=white, location=location.bottom, transp=0)

plotshape(not showPatterns ? na : isAntiButterfly(1) and not isAntiButterfly(1)[1], text="Anti Butterfly", title='Bull Anti Butterfly', style=shape.labelup, color=green, textcolor=white, location=location.bottom, transp=0)

plotshape(not showPatterns ? na : isGartley(1) and not isGartley(1)[1], text="Gartley", title='Bull Gartley', style=shape.labelup, color=green, textcolor=white, location=location.bottom, transp=0)

plotshape(not showPatterns ? na : isAntiGartley(1) and not isAntiGartley(1)[1], text="Anti Gartley", title='Bull Anti Gartley', style=shape.labelup, color=green, textcolor=white, location=location.bottom, transp=0)

plotshape(not showPatterns ? na : isCrab(1) and not isCrab(1)[1], text="Crab", title='Bull Crab', style=shape.labelup, color=green, textcolor=white, location=location.bottom, transp=0)

plotshape(not showPatterns ? na : isAntiCrab(1) and not isAntiCrab(1)[1], text="Anti Crab", title='Bull Anti Crab', style=shape.labelup, color=green, textcolor=white, location=location.bottom, transp=0)

plotshape(not showPatterns ? na : isShark(1) and not isShark(1)[1], text="Shark", title='Bull Shark', style=shape.labelup, color=green, textcolor=white, location=location.bottom, transp=0)

plotshape(not showPatterns ? na : isAntiShark(1) and not isAntiShark(1)[1], text="Anti Shark", title='Bull Anti Shark', style=shape.labelup, color=green, textcolor=white, location=location.bottom, transp=0)

plotshape(not showPatterns ? na : is5o(1) and not is5o(1)[1], text="5-O", title='Bull 5-O', style=shape.labelup, color=green, textcolor=white, location=location.bottom, transp=0)

plotshape(not showPatterns ? na : isWolf(1) and not isWolf(1)[1], text="Wolf Wave", title='Bull Wolf Wave', style=shape.labelup, color=green, textcolor=white, location=location.bottom, transp=0)

plotshape(not showPatterns ? na : isHnS(1) and not isHnS(1)[1], text="Head and Shoulders", title='Bull Head and Shoulders', style=shape.labelup, color=green, textcolor=white, location=location.bottom, transp=0)

plotshape(not showPatterns ? na : isConTria(1) and not isConTria(1)[1], text="Contracting Triangle", title='Bull Contracting Triangle', style=shape.labelup, color=green, textcolor=white, location=location.bottom, transp=0)

plotshape(not showPatterns ? na : isExpTria(1) and not isExpTria(1)[1], text="Expanding Triangle", title='Bull Expanding Triangle', style=shape.labelup, color=green, textcolor=white, location=location.bottom, transp=0)

//-------------------------------------------------------------------------------------------------------------------------------------------------------------

fib_range = abs(d-c)

fib_0000 = not showFib0000 ? na : d > c ? d-(fib_range*0.000):d+(fib_range*0.000)

fib_0236 = not showFib0236 ? na : d > c ? d-(fib_range*0.236):d+(fib_range*0.236)

fib_0382 = not showFib0382 ? na : d > c ? d-(fib_range*0.382):d+(fib_range*0.382)

fib_0500 = not showFib0500 ? na : d > c ? d-(fib_range*0.500):d+(fib_range*0.500)

fib_0618 = not showFib0618 ? na : d > c ? d-(fib_range*0.618):d+(fib_range*0.618)

fib_0764 = not showFib0764 ? na : d > c ? d-(fib_range*0.764):d+(fib_range*0.764)

fib_1000 = not showFib1000 ? na : d > c ? d-(fib_range*1.000):d+(fib_range*1.000)

plot(title='Fib 0.000', series=fib_0000, color=fib_0000 != fib_0000[1] ? na : black)

plot(title='Fib 0.236', series=fib_0236, color=fib_0236 != fib_0236[1] ? na : red)

plot(title='Fib 0.382', series=fib_0382, color=fib_0382 != fib_0382[1] ? na : olive)

plot(title='Fib 0.500', series=fib_0500, color=fib_0500 != fib_0500[1] ? na : lime)

plot(title='Fib 0.618', series=fib_0618, color=fib_0618 != fib_0618[1] ? na : teal)

plot(title='Fib 0.764', series=fib_0764, color=fib_0764 != fib_0764[1] ? na : blue)

plot(title='Fib 1.000', series=fib_1000, color=fib_1000 != fib_1000[1] ? na : black)

bgcolor(not useAltTF ? na : change(time(tf))!=0?black:na)

f_last_fib(_rate)=>d > c ? d-(fib_range*_rate):d+(fib_range*_rate)

trade_size = input(title='Trade size:', type=float, defval=1.00)

ew_rate = input(title='Fib. Rate to use for Entry Window:', type=float, defval=0.382)

tp_rate = input(title='Fib. Rate to use for TP:', type=float, defval=0.618)

sl_rate = input(title='Fib. Rate to use for SL:', type=float, defval=-0.618)

buy_patterns_00 = isABCD(1) or isBat(1) or isAltBat(1) or isButterfly(1) or isGartley(1) or isCrab(1) or isShark(1) or is5o(1) or isWolf(1) or isHnS(1) or isConTria(1) or isExpTria(1)

buy_patterns_01 = isAntiBat(1) or isAntiButterfly(1) or isAntiGartley(1) or isAntiCrab(1) or isAntiShark(1)

sel_patterns_00 = isABCD(-1) or isBat(-1) or isAltBat(-1) or isButterfly(-1) or isGartley(-1) or isCrab(-1) or isShark(-1) or is5o(-1) or isWolf(-1) or isHnS(-1) or isConTria(-1) or isExpTria(-1)

sel_patterns_01 = isAntiBat(-1) or isAntiButterfly(-1) or isAntiGartley(-1) or isAntiCrab(-1) or isAntiShark(-1)

buy_entry = (buy_patterns_00 or buy_patterns_01) and close <= f_last_fib(ew_rate)

buy_close = high >= f_last_fib(tp_rate) or low <= f_last_fib(sl_rate)

sel_entry = (sel_patterns_00 or sel_patterns_01) and close >= f_last_fib(ew_rate)

sel_close = low <= f_last_fib(tp_rate) or high >= f_last_fib(sl_rate)

strategy.entry('buy', long=strategy.long, qty=trade_size, comment='buy', when=buy_entry)

strategy.close('buy', when=buy_close)

strategy.entry('sell', long=strategy.short, qty=trade_size, comment='sell', when=sel_entry)

strategy.close('sell', when=sel_close)