Aperçu

Cette stratégie est une stratégie de trading d’options de suivi de tendance basée sur une combinaison de plusieurs indicateurs techniques. Elle utilise principalement les croisements EMA comme signal central, en combinaison avec les signaux de confirmation de tendance SMA, VWAP, et filtre le signal en utilisant le MACD et le RSI comme indicateurs auxiliaires. La stratégie utilise la gestion du risque des points d’arrêt fixes pour améliorer la réussite des transactions grâce à des conditions d’entrée et à une gestion de position strictes.

Principe de stratégie

La stratégie utilise le croisement des EMA de 8 cycles et 21 cycles comme signal de négociation principal, et déclenche des signaux multiples lorsque le cours traverse les EMA de longues durées sur les EMA de courtes durées et que les conditions suivantes sont remplies: le cours est au-dessus des SMA de 100 et 200 cycles, la ligne MACD est au-dessus de la ligne de signal, et le RSI est supérieur à 50. Les conditions de déclenchement des signaux négatifs sont inverses. La stratégie introduit le VWAP comme référence de poids de prix pour aider à déterminer la position relative des prix actuels.

Avantages stratégiques

- Coopération multi-indicateurs pour améliorer la fiabilité du signal par la vérification croisée de différents cycles et types d’indicateurs

- Utiliser le suivi des tendances en combinaison avec les indicateurs de dynamique pour capturer les tendances tout en se concentrant sur la dynamique à court terme

- Les points de rupture fixes aident à protéger les bénéfices et à éviter les excès de cupidité

- Gestion rigoureuse des positions, afin d’éviter les ouvertures répétées et de réduire l’exposition au risque

- L’effet visuel est clair et comprend les mouvements EMA, SMA, VWAP et les marqueurs de signaux

Risque stratégique

- Des faux signaux peuvent fréquemment se produire sur des marchés volatils

- Les points de vente fixes peuvent entraîner la perte d’une plus grande opportunité de profit.

- Aucun paramètre de stop-loss, ce qui peut entraîner des pertes plus importantes dans des situations extrêmes

- L’utilisation de plusieurs indicateurs peut entraîner un retard de signal

- Le risque de glissement est possible dans les contrats d’options moins liquides

Orientation de l’optimisation de la stratégie

- Introduction d’un mécanisme de stop-loss adaptatif qui s’adapte à la dynamique de la volatilité du marché

- Ajout d’un module de gestion des volumes de transactions et ajustement dynamique des positions en fonction de la taille des comptes et des conditions du marché

- Ajout d’un filtre de volatilité du marché pour ajuster les paramètres de stratégie dans un environnement à forte volatilité

- Optimiser les paramètres de l’indicateur, en envisageant d’utiliser des cycles adaptatifs plutôt que des cycles fixes

- Ajout de filtres temporels pour éviter de négocier à des moments de forte volatilité tels que l’ouverture et la fermeture du marché

Résumer

Il s’agit d’une stratégie de trading d’options multi-indicateurs de suivi des tendances structurée et logiquement claire. La stratégie améliore la fiabilité des signaux de négociation en combinant de manière synchrone plusieurs indicateurs techniques et en utilisant des points d’arrêt fixes pour gérer les risques. Bien que la stratégie présente certains risques inhérents, la stabilité et la rentabilité de la stratégie peuvent être encore améliorées par les directions d’optimisation proposées. La conception visuelle de la stratégie aide également le trader à comprendre et à exécuter intuitivement les signaux de négociation.

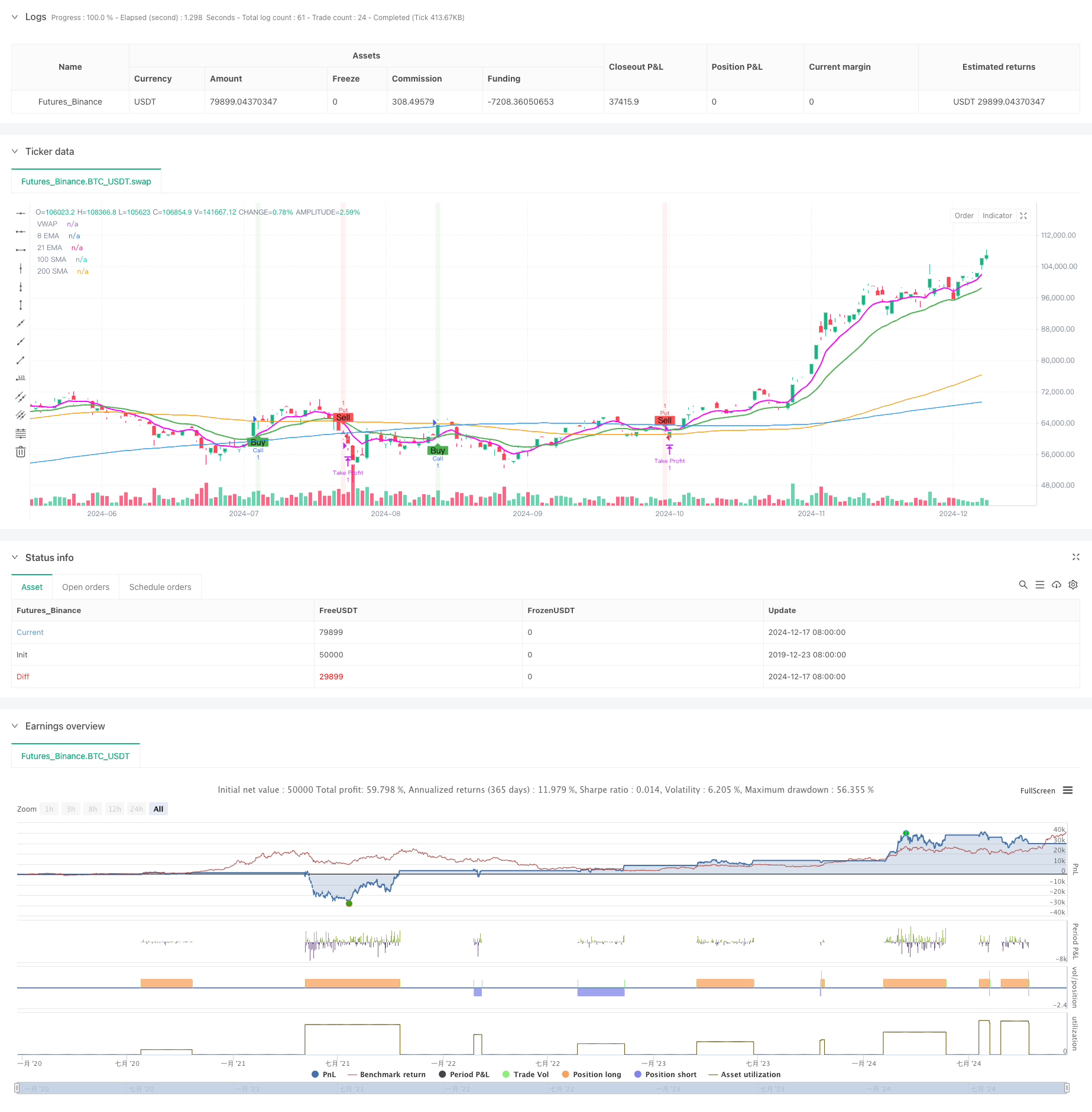

/*backtest

start: 2019-12-23 08:00:00

end: 2024-12-18 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("OptionsMillionaire Strategy with Take Profit Only", overlay=true, default_qty_type=strategy.fixed, default_qty_value=1)

// Define custom magenta color

magenta = color.rgb(255, 0, 255) // RGB for magenta

// Input settings for Moving Averages

ema8 = ta.ema(close, 8)

ema21 = ta.ema(close, 21)

sma100 = ta.sma(close, 100)

sma200 = ta.sma(close, 200)

vwap = ta.vwap(close) // Fixed VWAP calculation

// Input settings for MACD and RSI

[macdLine, signalLine, _] = ta.macd(close, 12, 26, 9)

rsi = ta.rsi(close, 14)

// Define trend direction

isBullish = ema8 > ema21 and close > sma100 and close > sma200

isBearish = ema8 < ema21 and close < sma100 and close < sma200

// Buy (Call) Signal

callSignal = ta.crossover(ema8, ema21) and isBullish and macdLine > signalLine and rsi > 50

// Sell (Put) Signal

putSignal = ta.crossunder(ema8, ema21) and isBearish and macdLine < signalLine and rsi < 50

// Define Position Size and Take-Profit Level

positionSize = 1 // Position size set to 1 (each trade will use one contract)

takeProfitPercent = 5 // Take profit is 5%

// Variables to track entry price and whether the position is opened

var float entryPrice = na // To store the entry price

var bool positionOpen = false // To check if a position is open

// Backtesting Execution

if callSignal and not positionOpen

// Enter long position (call)

strategy.entry("Call", strategy.long, qty=positionSize)

entryPrice := close // Store the entry price

positionOpen := true // Set position as opened

if putSignal and not positionOpen

// Enter short position (put)

strategy.entry("Put", strategy.short, qty=positionSize)

entryPrice := close // Store the entry price

positionOpen := true // Set position as opened

// Only check for take profit after position is open

if positionOpen

// Calculate take-profit level (5% above entry price for long, 5% below for short)

takeProfitLevel = entryPrice * (1 + takeProfitPercent / 100)

// Exit conditions (only take profit)

if strategy.position_size > 0

// Long position (call)

if close >= takeProfitLevel

strategy.exit("Take Profit", "Call", limit=takeProfitLevel)

if strategy.position_size < 0

// Short position (put)

if close <= takeProfitLevel

strategy.exit("Take Profit", "Put", limit=takeProfitLevel)

// Reset position when it is closed (this happens when an exit is triggered)

if strategy.position_size == 0

positionOpen := false // Reset positionOpen flag

// Plot EMAs

plot(ema8, color=magenta, linewidth=2, title="8 EMA")

plot(ema21, color=color.green, linewidth=2, title="21 EMA")

// Plot SMAs

plot(sma100, color=color.orange, linewidth=1, title="100 SMA")

plot(sma200, color=color.blue, linewidth=1, title="200 SMA")

// Plot VWAP

plot(vwap, color=color.white, style=plot.style_circles, title="VWAP")

// Highlight buy and sell zones

bgcolor(callSignal ? color.new(color.green, 90) : na, title="Call Signal Background")

bgcolor(putSignal ? color.new(color.red, 90) : na, title="Put Signal Background")

// Add buy and sell markers (buy below, sell above)

plotshape(series=callSignal, style=shape.labelup, location=location.belowbar, color=color.green, text="Buy", title="Call Signal Marker")

plotshape(series=putSignal, style=shape.labeldown, location=location.abovebar, color=color.red, text="Sell", title="Put Signal Marker")