बोलिंगर बैंड्स मानक विचलन ब्रेकआउट रणनीति

लेखक:चाओझांग, दिनांक: 2023-11-21 17:14:04टैगः

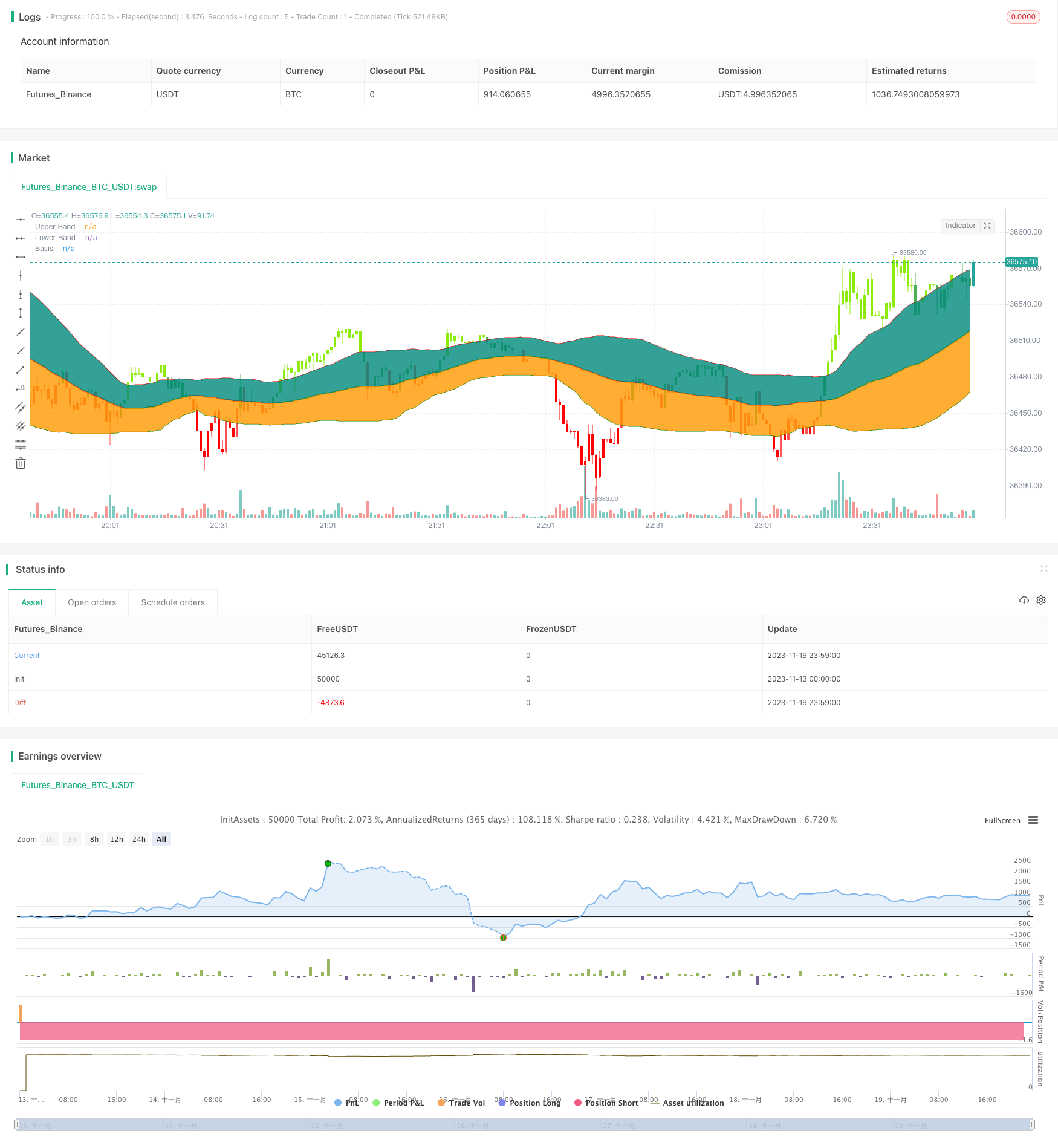

अवलोकन

यह रणनीति क्लासिक बोलिंगर बैंड्स संकेतक पर आधारित है। जब कीमत ऊपरी बैंड के ऊपर बंद होती है तो यह लंबी जाती है और जब कीमत निचले बैंड के नीचे बंद होती है तो यह छोटी हो जाती है। यह ब्रेकआउट रणनीति के बाद की प्रवृत्ति से संबंधित है।

रणनीति तर्क

- आधार रेखा 55-दिवसीय सरल चलती औसत है।

- ऊपरी और निचले बैंड क्रमशः आधार रेखा से एक मानक विचलन ऊपर और नीचे हैं।

- जब कीमत ऊपरी बैंड के ऊपर बंद हो जाती है तो एक लंबा संकेत उत्पन्न होता है।

- एक शॉर्ट सिग्नल तब उत्पन्न होता है जब कीमत निचले बैंड से नीचे बंद हो जाती है।

- क्लासिक दो मानक विचलन के स्थान पर एक मानक विचलन का उपयोग करने से जोखिम कम होता है।

लाभ विश्लेषण

- निश्चित मूल्य के स्थान पर मानक विचलन का प्रयोग जोखिम को कम करता है।

- 55-दिवसीय चलती औसत मध्यम अवधि के रुझान को बेहतर ढंग से प्रतिबिंबित कर सकती है।

- बंद पलायन झूठे पलायनों को फ़िल्टर करता है।

- बहु-समय-सीमा विश्लेषण के माध्यम से प्रवृत्ति की दिशा निर्धारित करना आसान है।

जोखिम विश्लेषण

- छोटी-छोटी कमाई करने के इच्छुक।

- लेन-देन शुल्क के प्रभाव पर विचार करने की आवश्यकता है।

- ब्रेकआउट सिग्नल झूठे ब्रेकआउट हो सकते हैं।

- फिसलने का नुकसान हो सकता है।

स्टॉप लॉस सेट करके, लेनदेन शुल्क पर विचार करके या सूचक फिल्टर जोड़कर जोखिम को कम किया जा सकता है।

अनुकूलन दिशाएँ

- सर्वोत्तम चलती औसत खोजने के लिए आधारभूत मापदंडों का अनुकूलन करें।

- इष्टतम मापदंडों को खोजने के लिए मानक विचलन आकार का अनुकूलन करें।

- आकलन के लिए सहायक आयतन संकेतक जोड़ें।

- स्टॉप लॉस तंत्र जोड़ें.

सारांश

इस रणनीति का समग्र तर्क स्पष्ट है। यह मानक विचलन बैंड चौड़ाई के माध्यम से जोखिम को समायोजित करता है और करीब ब्रेकआउट का उपयोग करके झूठे ब्रेकआउट से बचता है। लेकिन फिर भी स्टॉप लॉस का उपयोग करके, फिल्टर आदि जोड़कर अस्थिर नुकसान को रोकने के लिए आवश्यक है।

/*backtest

start: 2023-11-13 00:00:00

end: 2023-11-20 00:00:00

period: 1m

basePeriod: 1m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

//┌───── •••• ─────┐//

// TradeChartist //

//└───── •••• ─────┘//

//Bollinger Bands is a classic indicator that uses a simple moving average of 20 periods along with upper and lower bands that are 2 standard deviations away from the basis line.

//These bands help visualize price volatility and trend based on where the price is in relation to the bands.

//This Bollinger Bands filter plots a long signal when price closes above the upper band and plots a short signal when price closes below the lower band.

//It doesn't take into account any other parameters such as Volume/RSI/fundamentals etc, so user must use discretion based on confirmations from another indicator or based on fundamentals.

//This filter's default is 55 SMA and 1 standard deviation, but can be changed based on asset type

//It is definitely worth reading the 22 rules of Bollinger Bands written by John Bollinger.

strategy(shorttitle="BB Breakout Strategy", title="Bollinger Bands Filter", overlay=true,

pyramiding=1, currency=currency.NONE ,

initial_capital = 10000, default_qty_type = strategy.percent_of_equity,

default_qty_value=100, calc_on_every_tick= true, process_orders_on_close=false)

src = input(close, title = "Source")

length = input(55, minval=1, title = "SMA length")// 20 for classis Bollinger Bands SMA line (basis)

mult = input(1., minval=0.236, maxval=2, title="Standard Deviation")//2 for Classic Bollinger Bands //Maxval = 2 as higher the deviation, higher the risk

basis = sma(src, length)

dev = mult * stdev(src,length)

CC = input(true, "Color Bars")

upper = basis + dev

lower = basis - dev

//Conditions for Long and Short - Extra filter condition can be used such as RSI or CCI etc.

short = src<lower// and rsi(close,14)<40

long = src>upper// and rsi(close,14)>60

L1 = barssince(long)

S1 = barssince(short)

longSignal = L1<S1 and not (L1<S1)[1]

shortSignal = S1<L1 and not (S1<L1)[1]

//Plots and Fills

////Long/Short shapes with text

// plotshape(S1<L1 and not (S1<L1)[1]?close:na, text = "sᴇʟʟ", textcolor=#ff0100, color=#ff0100, style=shape.triangledown, size=size.small, location=location.abovebar, transp=0, title = "SELL", editable = true)

// plotshape(L1<S1 and not (L1<S1)[1]?close:na, text = "ʙᴜʏ", textcolor = #008000, color=#008000, style=shape.triangleup, size=size.small, location=location.belowbar, transp=0, title = "BUY", editable = true)

// plotshape(shortSignal?close:na, color=#ff0100, style=shape.triangledown, size=size.small, location=location.abovebar, transp=0, title = "Short Signal", editable = true)

// plotshape(longSignal?close:na, color=#008000, style=shape.triangleup, size=size.small, location=location.belowbar, transp=0, title = "Long Signal", editable = true)

p1 = plot(upper, color=#ff0000, display=display.all, transp=75, title = "Upper Band")

p2 = plot(lower, color=#008000, display=display.all, transp=75, title = "Lower Band")

p = plot(basis, color=L1<S1?#008000:S1<L1?#ff0000:na, linewidth=2, editable=false, title="Basis")

fill(p,p1, color=color.teal, transp=85, title = "Top Fill") //fill for basis-upper

fill(p,p2, color=color.orange, transp=85, title = "Bottom Fill")//fill for basis-lower

//Barcolor

bcol = src>upper?color.new(#8ceb07,0):

src<lower?color.new(#ff0000,0):

src>basis?color.green:

src<basis?color.red:na

barcolor(CC?bcol:na, editable=false, title = "Color Bars")

// //Alerts ---- // Use 'Once per bar close'

// alertcondition(condition=longSignal, title="Long - BB Filter", message='BB Filter Long @ {{close}}') // Use 'Once per bar close'

// alertcondition(condition=shortSignal, title="Short - BB Filter", message='BB Filter Short @ {{close}}') // Use 'Once per bar close'

Notestart1 = input(true, "╔═══ Time Range to BackTest ═══╗")

// === INPUT BACKTEST RANGE ===

FromMonth = input(defval=1, title="From Month", minval=1, maxval=12)

FromDay = input(defval=1, title="From Day", minval=1, maxval=31)

FromYear = input(defval=2018, title="From Year", minval=2015)

ToMonth = input(defval=1, title="To Month", minval=1, maxval=12)

ToDay = input(defval=1, title="To Day", minval=1, maxval=31)

ToYear = input(defval=9999, title="To Year", minval=2010)

// === FUNCTION EXAMPLE ===

start = timestamp(FromYear, FromMonth, FromDay, 00, 00) // backtest start window

finish = timestamp(ToYear, ToMonth, ToDay, 23, 59) // backtest finish window

window() => // create function "within window of time"

time >= start and time <= finish ? true : false

if(window())

strategy.entry("Long", long=true, when = longSignal)

// strategy.close("Long", when = (short and S3==0), comment = "Close Long")

if(window())

strategy.entry("Short", long=false, when = shortSignal)

// strategy.close("Short", when = (long and L3==0), comment = "Close Short")

अधिक

- 123 रिवर्स मूविंग एवरेज कन्वर्जेंस डिवर्जेंस संयोजन रणनीति

- हेकिन आशी हाईलो चैनल डायनेमिक मूविंग एवरेज ट्रेडिंग रणनीति

- मात्रात्मक स्वर्ण क्रॉस रणनीति

- इचिमोकू क्लाउड और एमएसीडी मोमेंटम राइडिंग रणनीति

- बहु चलती औसत ब्रेकआउट रणनीति

- स्टोकैस्टिक ओटीटी ट्रेडिंग रणनीति

- दोहरी मूविंग एवरेज रिवर्स रणनीति

- क्वांट ट्रेडिंग डबल क्लिक रिवर्स रणनीति

- फिबोनाची चैनल आधारित कैंडलस्टिक रिवर्सल ट्रेडिंग रणनीति

- गतिशील चलती औसत ट्रेंड क्रॉसओवर रणनीति

- VSTOCHASTIC RSI EMA CROSSOVER VMACD वेवफाइंडर रणनीति के साथ संयुक्त

- मल्टी टाइमफ्रेम डायनेमिक बैकटेस्टिंग रणनीति

- रिवर्सल लघु अवधि के ब्रेकआउट ट्रेडिंग रणनीति

- दोहरी चलती औसत क्रॉसओवर तीर रणनीति

- गति दोलन व्यापार रणनीति

- आरएसआई+सीसीआई+बोलिंगर बैंड डीसीए रणनीति

- फिबोनाची रिट्रेसमेंट मात्रात्मक व्यापार रणनीति

- दोहरे संकेतक दोलन की रणनीति

- दोहरी चलती औसत मूल्य सफलता रणनीति

- गतिशील स्टॉप लॉस ट्रेल रणनीति