एमएसीडी डबल मूविंग एवरेज ट्रैकिंग रणनीति

लेखक:चाओझांग, दिनांक: 2023-12-18 12:25:13टैगः

अवलोकन

इस रणनीति का नामएमएसीडी डबल मूविंग एवरेज ट्रैकिंग रणनीतियह व्यापार संकेतों के रूप में दोहरी चलती औसत के एमएसीडी सूचक के स्वर्ण क्रॉस और मृत्यु क्रॉस का उपयोग करता है, जो पिछले दिन की सबसे कम कीमत के साथ संयुक्त है।

रणनीति तर्क

- तेजी से ईएमए ((करीब,5), धीमी ईएमए ((करीब,8) और संकेत एसएमए ((एमएसीडी,3) की गणना करें

- लंबे संकेत को परिभाषित करें: जब तेज एमए धीमे एमए से ऊपर जाता है

- शॉर्ट सिग्नल को परिभाषित करें: जब तेज एमए धीमी एमए से नीचे जाता है या समापन मूल्य पिछले दिन की सबसे कम कीमत से कम होता है

- स्थिति का आकार प्रारंभिक पूंजी 2000 अमरीकी डालर से विभाजित है।

- स्टॉप लॉस के रूप में लंबी स्थिति को बंद करने के लिए लघु संकेत का उपयोग करें

लाभ विश्लेषण

- ओवरबॉट और ओवरसोल्ड जोन निर्धारित करने के लिए एमएसीडी संकेतक का उपयोग करें, दोहरे एमए के साथ ट्रेडिंग सिग्नल बनाने के लिए, झूठे ब्रेकआउट से बचें

- अल्पकालिक रुझानों को ट्रैक करें, समय पर स्टॉप लॉस करें

- स्थिति के आकार का गतिशील समायोजन अत्यधिक बड़े एकल नुकसान से बचाता है

जोखिम विश्लेषण

- एमएसीडी संकेतक में देरी का प्रभाव है, अल्पकालिक अवसरों को याद कर सकता है

- डबल एमए ट्रेडिंग सिग्नल से झूठे सिग्नल उत्पन्न हो सकते हैं

- स्टॉप हानि बिंदु बहुत आक्रामक है, उच्च आवृत्ति के साथ बाहर रोका जा रहा है

अनुकूलन दिशाएँ

- संकेतक संवेदनशीलता में सुधार के लिए एमएसीडी मापदंडों के संयोजन का अनुकूलन करें

- बाजार समेकन से झूठे संकेतों से बचने के लिए रुझान निर्णय जोड़ें

- बाजार की अस्थिरता का आकलन करने के लिए अस्थिरता सूचकांक के साथ संयोजन, स्टॉप लॉस बिंदु को समायोजित करें

सारांश

यह रणनीति क्लासिक एमएसीडी दोहरी चलती औसत संयोजन संकेतक का उपयोग ओवरबॉट और ओवरसोल्ड क्षेत्रों को निर्धारित करने के लिए करती है, जबकि गतिशील स्थिति आकार और पिछले दिन की सबसे कम कीमत को स्टॉप लॉस बिंदु डिजाइन के रूप में पेश करती है ताकि अल्पकालिक मूल्य उतार-चढ़ाव को पकड़ लिया जा सके। समग्र रणनीति तर्क स्पष्ट और समझने में आसान है, आगे परीक्षण और अनुकूलन के लायक है।

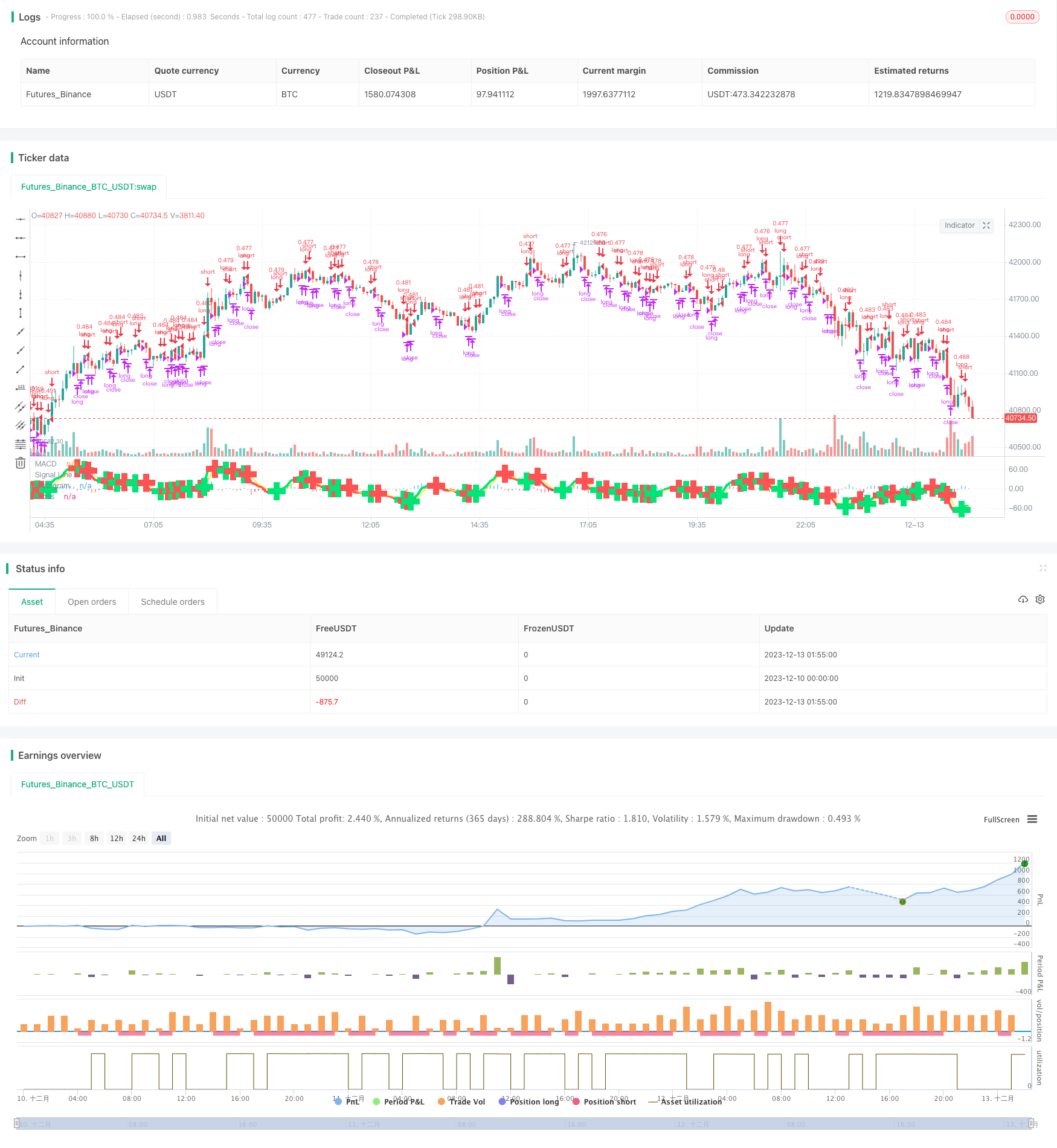

/*backtest

start: 2023-12-10 00:00:00

end: 2023-12-13 02:00:00

period: 5m

basePeriod: 1m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=2

// macd/cam v1 strategizing Chris Moody Macd indicator https://www.tradingview.com/script/OQx7vju0-MacD-Custom-Indicator-Multiple-Time-Frame-All-Available-Options/

// macd/cam v2 changing to macd 5,8,3

// macd/cam v2.1

// Sell when lower than previous day low.

// Initial capital of $2k. Buy/sell quantity of initial capital / close price

// Quitar short action

// Note: custom 1-week resolution seems to put AMD at 80% profitable

strategy(title="MACD/CAM 2.1", shorttitle="MACD/CAM 2.1") //

source = close

//get inputs from options

useCurrentRes = input(true, title="Use Current Chart Resolution?")

resCustom = input(title="Use Different Timeframe? Uncheck Box Above", defval="60")

smd = input(true, title="Show MacD & Signal Line? Also Turn Off Dots Below")

sd = input(true, title="Show Dots When MacD Crosses Signal Line?")

sh = input(true, title="Show Histogram?")

macd_colorChange = input(true,title="Change MacD Line Color-Signal Line Cross?")

hist_colorChange = input(true,title="MacD Histogram 4 Colors?")

venderLowerPrev = input(true,title="Vender cuando closing price < previous day low?")

res = useCurrentRes ? timeframe.period : resCustom

fastLength = input(5, minval=1), slowLength=input(8,minval=1)

signalLength=input(3,minval=1)

// find exponential moving average of price as x and fastLength var as y

fastMA = ema(source, fastLength)

slowMA = ema(source, slowLength)

macd = fastMA - slowMA

// simple moving average

signal = sma(macd, signalLength)

hist = macd - signal

outMacD = request.security(syminfo.tickerid, res, macd)

outSignal = request.security(syminfo.tickerid, res, signal)

outHist = request.security(syminfo.tickerid, res, hist)

histA_IsUp = outHist > outHist[1] and outHist > 0

histA_IsDown = outHist < outHist[1] and outHist > 0

histB_IsDown = outHist < outHist[1] and outHist <= 0

histB_IsUp = outHist > outHist[1] and outHist <= 0

//MacD Color Definitions

macd_IsAbove = outMacD >= outSignal

macd_IsBelow = outMacD < outSignal

plot_color = hist_colorChange ? histA_IsUp ? aqua : histA_IsDown ? blue : histB_IsDown ? red : histB_IsUp ? maroon :yellow :gray

macd_color = macd_colorChange ? macd_IsAbove ? lime : red : red

signal_color = macd_colorChange ? macd_IsAbove ? yellow : yellow : lime

circleYPosition = outSignal

plot(smd and outMacD ? outMacD : na, title="MACD", color=macd_color, linewidth=4)

plot(smd and outSignal ? outSignal : na, title="Signal Line", color=signal_color, style=line ,linewidth=2)

plot(sh and outHist ? outHist : na, title="Histogram", color=plot_color, style=histogram, linewidth=4)

circleCondition = sd and cross(outMacD, outSignal)

// Determine long and short conditions

longCondition = circleCondition and macd_color == lime

redCircle = circleCondition and macd_color == red

redCirclePrevLow = redCircle or low<low[1]

shortCondition = redCircle

if (venderLowerPrev)

shortCondition = redCirclePrevLow

strategy.initial_capital = 20000

// Set quantity to initial capital / closing price

cantidad = strategy.initial_capital/close

// Submit orders

strategy.entry(id="long", long=true, qty=cantidad, when=longCondition)

strategy.close(id="long", when=shortCondition)

plot(circleCondition ? circleYPosition : na, title="Cross", style=cross, linewidth=10, color=macd_color)

// hline(0, '0 Line', linestyle=solid, linewidth=2, color=white)

अधिक

- रैखिक प्रतिगमन और चलती औसत पर आधारित प्रतिगमन व्यापार रणनीति के बाद की प्रवृत्ति

- एमएसीडी रोबोट ट्रेडिंग रणनीति

- बोलिंगर बैंड्स दोहरी मानक विचलन व्यापार रणनीति

- एमएसीडी और आरएसआई क्रॉसओवर संकेतों पर आधारित ट्रेडिंग रणनीति

- बेजियन स्थिति आरएसआई ट्रेडिंग रणनीति

- पिवोट रिवर्स रणनीति

- एसटीआई सूचक और हॉल चलती औसत पर आधारित मात्रात्मक व्यापार रणनीति

- चैनल रुझान रणनीति

- सीसीआई केवल लंबी रणनीति

- चलती औसत रिबन रणनीति

- X48 - डेलाइट हंटर रणनीति अनुकूलन और अनुकूलन

- हेकिन-अशी - 0.5% परिवर्तन अल्पकालिक ट्रेडिंग रणनीति

- सकारात्मक चैनल ईएमए ट्रेलिंग स्टॉप रणनीति

- गैलीलियो गैलीली की चलती औसत क्रॉसओवर रणनीति

- विलियम्स संकेतक की एसी बैकटेस्ट रणनीति

- कम अस्थिरता वाले लाभ लेने और स्टॉप लॉस के साथ दिशागत खरीद

- चलती औसत के आधार पर निश्चित प्रतिशत स्टॉप लॉस और लाभ लेने की रणनीति

- डबल ईएमए और मूल्य अस्थिरता सूचकांक पर आधारित मात्रात्मक व्यापार रणनीति

- मोमेंटम ब्रेकआउट द्विदिशात्मक ट्रैकिंग रणनीति

- सुपर ट्रेंड एलएसएमए लंबी रणनीति