हाइकिन आशी के आधार पर सुपरट्रेंड ट्रेलिंग स्टॉप रणनीति

लेखक:चाओझांग, दिनांकः 2024-02-06 14:43:14टैगः

रणनीति का अवलोकन

यह रणनीति हेकिन आशि मोमबत्तियों और सुपरट्रेंड संकेतक को ट्रेंड फॉलो करने वाली रणनीति के साथ ट्रेलिंग स्टॉप लॉस में जोड़ती है। यह ट्रेंड को कुशलतापूर्वक ट्रैक करने और जोखिमों को नियंत्रित करने के लिए एक गतिशील स्टॉप लॉस लाइन के रूप में सुपरट्रेंड को लेते हुए, बाजार शोर और सुपरट्रेंड को ट्रेंड दिशा निर्धारित करने के लिए फिल्टर करने के लिए हेकिन आशि का उपयोग करता है।

रणनीति तर्क

- हेकिन आशि मोमबत्तियों की गणना करें: खुली, बंद, उच्च, कम कीमतें।

- सुपरट्रेंड संकेतक की गणना करेंः एटीआर और कीमत के आधार पर ऊपरी बैंड और निचला बैंड।

- हेकिन आशि बंद और सुपरट्रेंड बैंड को मिलाकर प्रवृत्ति दिशा निर्धारित करें।

- जब हेकिन आशि बंद सुपरट्रेंड के ऊपरी बैंड के करीब आता है, तो यह एक अपट्रेंड का संकेत देता है; जब हेकिन आशि बंद सुपरट्रेंड के निचले बैंड के करीब आता है, तो यह एक डाउनट्रेंड का संकेत देता है।

- अपट्रेंड्स में सुपरट्रेंड के ऊपरी बैंड को ट्रेलिंग स्टॉप लॉस के रूप में और डाउनट्रेंड्स में निचले बैंड का उपयोग करें।

लाभ

- हेकिन आशी झूठे पलायनों को फ़िल्टर करता है, जिससे अधिक विश्वसनीय संकेत मिलते हैं।

- सुपरट्रेंड के रूप में गतिशील स्टॉप लॉस प्रचुर ड्रॉडाउन से बचने के लिए प्रवृत्ति के साथ लाभ में लॉक करता है।

- समय-सीमाओं का संयोजन उच्च/निम्न को अधिक सटीक रूप से पुष्टि करता है।

- निर्धारित समय पर बाहर निकलने से कुछ समय पर तर्कहीन कदम उठाने से बचा जाता है।

जोखिम

- रुझान उलटने पर रुकने के लिए प्रवण है।

- सुपरट्रेंड पैरामीटर की अनुचित ट्यूनिंग से स्टॉप लॉस बहुत चौड़ा या बहुत संकीर्ण हो सकता है।

- स्थिति आकार की अनदेखी करता है. उचित शर्त आकार नियंत्रण सेट करना चाहिए.

- ट्रेडिंग लागतों की अनदेखी करता है। लागतों को ध्यान में रखना चाहिए।

बढ़ोतरी के अवसर

- सर्वश्रेष्ठ प्रदर्शन के लिए सुपरट्रेंड मापदंडों का अनुकूलन करें.

- स्थिति आकार नियंत्रण जोड़ें.

- कमीशन और फिसलन जैसी लागतों का लेखा-जोखा करें।

- रुझान की ताकत के आधार पर स्टॉप लॉस को लचीलापन से समायोजित करें।

- प्रवेश संकेतों के लिए अन्य संकेतकों के साथ फ़िल्टर जोड़ें।

निष्कर्ष

यह रणनीति हेकिन आशी और सुपरट्रेंड की ताकतों को जोड़ती है ताकि ट्रेंड दिशाओं की पहचान की जा सके और लाभ में लॉक करने के लिए गतिशील स्टॉप लॉस के साथ स्वचालित रूप से ट्रेंड को ट्रैक किया जा सके। मुख्य जोखिम ट्रेंड रिवर्स और पैरामीटर ट्यूनिंग से आते हैं। इन दोनों पहलुओं पर आगे के अनुकूलन से रणनीति प्रदर्शन में सुधार हो सकता है। कुल मिलाकर यह रणनीति दर्शाता है कि संकेतक एकीकरण कैसे व्यापार प्रणाली की स्थिरता और लाभप्रदता को बढ़ा सकता है।

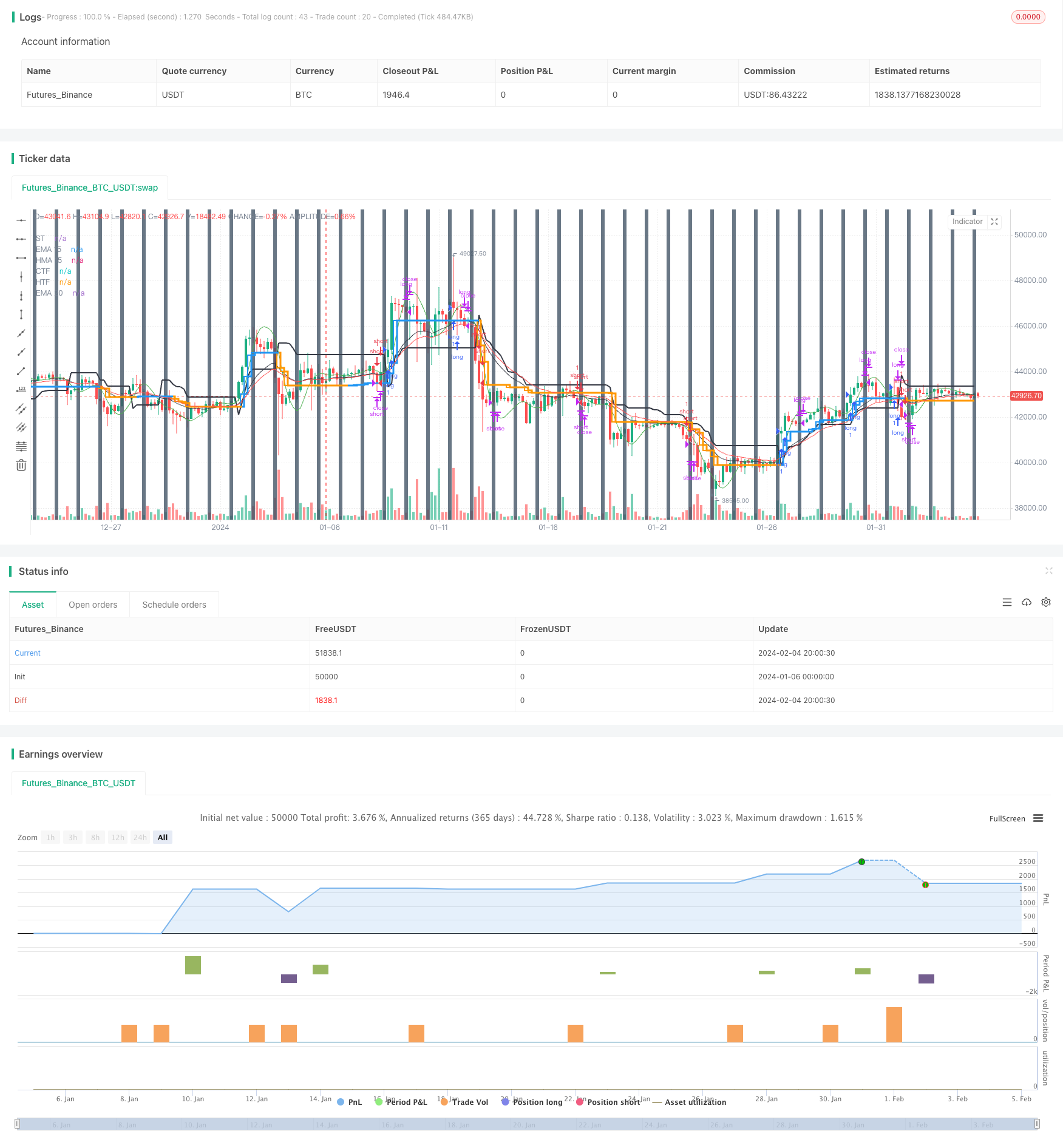

/*backtest

start: 2024-01-06 00:00:00

end: 2024-02-05 00:00:00

period: 4h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © ringashish

//@version=4

strategy("sa-strategy with HTF-TSL", overlay=true)

Pd = input(title="ATR Period", type=input.integer, defval=4)

Factor = input(title="ATR Multiplier", type=input.float, step=0.1, defval=2)

ST= supertrend(Factor, Pd)

heikinashi_close = security(heikinashi(syminfo.tickerid), timeframe.period, close)

heikinashi_low = security(heikinashi(syminfo.tickerid), timeframe.period, low)

heikinashi_open = security(heikinashi(syminfo.tickerid), timeframe.period, open)

heikinashi_high = security(heikinashi(syminfo.tickerid), timeframe.period, high)

heikinashi_close30 = security(heikinashi(syminfo.tickerid), "30", close)

//res1 = input("30", type=input.resolution, title="higher Timeframe")

//CCI TSL

res = input("240",type=input.resolution,title = "Higher Time Frame")

CCI = input(20)

ATR = input(5)

Multiplier=input(1,title='ATR Multiplier')

original=input(false,title='original coloring')

thisCCI = cci(close, CCI)

lastCCI = nz(thisCCI[1])

calcx()=>

bufferDn= high + Multiplier * sma(tr,ATR)

bufferUp= low - Multiplier * sma(tr,ATR)

if (thisCCI >= 0 and lastCCI < 0)

bufferUp := bufferDn[1]

if (thisCCI <= 0 and lastCCI > 0)

bufferDn := bufferUp[1]

if (thisCCI >= 0)

if (bufferUp < bufferUp[1])

bufferUp := bufferUp[1]

else

if (thisCCI <= 0)

if (bufferDn > bufferDn[1])

bufferDn := bufferDn[1]

x = 0.0

x := thisCCI >= 0 ?bufferUp:thisCCI <= 0 ?bufferDn:x[1]

x

tempx = calcx()

calcswap() =>

swap = 0.0

swap := tempx>tempx[1]?1:tempx<tempx[1]?-1:swap[1]

swap

tempswap = calcswap()

swap2=tempswap==1?color.blue:color.orange

swap3=thisCCI >=0 ?color.blue:color.orange

swap4=original?swap3:swap2

//display current timeframe's Trend

plot(tempx,"CTF",color=swap4,transp=0,linewidth=2, style = plot.style_stepline)

htfx = security(syminfo.tickerid,res,tempx[1],lookahead = barmerge.lookahead_on)

htfswap4 = security(syminfo.tickerid,res,swap4[1],lookahead = barmerge.lookahead_on)

plot(htfx,"HTF",color=htfswap4,transp=0,linewidth=3,style = plot.style_stepline)

//supertrend

Supertrend(Factor, Pd) =>

Up=hl2-(Factor*atr(Pd))

Dn=hl2+(Factor*atr(Pd))

TrendUp = 0.0

TrendUp := heikinashi_close[1]>TrendUp[1] ? max(Up,TrendUp[1]) : Up

TrendDown = 0.0

TrendDown := heikinashi_close[1]<TrendDown[1]? min(Dn,TrendDown[1]) : Dn

Trend = 0.0

Trend := heikinashi_close > TrendDown[1] ? 1: heikinashi_close< TrendUp[1]? -1: nz(Trend[1],1)

Tsl = Trend==1? TrendUp: TrendDown

S_Buy = Trend == 1 ? 1 : 0

S_Sell = Trend != 1 ? 1 : 0

[Trend, Tsl]

[Trend,Tsl] = Supertrend(Factor, Pd)

// Security

//ST1_Trend_MTF = security(syminfo.tickerid, res1, Tsl,barmerge.lookahead_on)

//plot(ST1_Trend_MTF, "higher ST")

crossdn = crossunder(heikinashi_close,Tsl) or crossunder(heikinashi_close[1],Tsl) or crossunder(heikinashi_close[2],Tsl) or heikinashi_close < Tsl

crossup = crossover(heikinashi_close,Tsl) or crossover(heikinashi_close[1],Tsl) or crossover(heikinashi_close[2],Tsl) or heikinashi_close > Tsl

plot(Tsl,"ST",color = color.black,linewidth =2)

plot(ema(heikinashi_close,20),"EMA 20",color=color.red)

plot(hma(heikinashi_close,15),"HMA 15",color=color.green)

plot(ema(heikinashi_close,15),"EMA 15",color=color.black)

closedown = (heikinashi_close < hma(heikinashi_close,15) and heikinashi_high > hma(heikinashi_close,15)) or(heikinashi_close < ema(heikinashi_close,20) and heikinashi_high > ema(heikinashi_close,20))

closeup = (heikinashi_close > hma(heikinashi_close,15) and heikinashi_low < hma(heikinashi_close,15)) or (heikinashi_close > ema(heikinashi_close,20) and heikinashi_low < ema(heikinashi_close,20))

buy = heikinashi_open == heikinashi_low and closeup and crossup and close > htfx

//buy = heikinashi_open == heikinashi_low and heikinashi_close > ema(close,20) and heikinashi_low < ema(close,20) and crossup

buyexit = cross(close,tempx) //heikinashi_open == heikinashi_high //and heikinashi_close < ema(close,15) and heikinashi_high > ema(close,15)

//if heikinashi_close30[1] < ST1_Trend_MTF

//sell = heikinashi_open == heikinashi_high and heikinashi_close < ema(close,20) and heikinashi_high > ema(close,20) and rsi(close,14)<60 and crossdn

sell = heikinashi_open == heikinashi_high and closedown and rsi(close,14)<55 and crossdn and close < htfx

sellexit = cross(close,tempx) //heikinashi_open == heikinashi_low //and heikinashi_close > ema(close,15) and heikinashi_low < ema(close,15)

rg = 0

rg := buy ? 1 : buyexit ? 2 : nz(rg[1])

longLogic = rg != rg[1] and rg == 1

longExit = rg != rg[1] and rg == 2

//plotshape(longExit,"exit buy",style = shape.arrowup,location = location.belowbar,color = color.red, text ="buy exit", textcolor = color.red)

//plotshape(longLogic,"BUY",style = shape.arrowup,location = location.belowbar,color = color.green, text ="buy", textcolor= color.green)

nm = 0

nm := sell ? 1 : sellexit ? 2 : nz(nm[1])

shortLogic = nm != nm[1] and nm == 1

shortExit = nm != nm[1] and nm == 2

//plotshape(shortExit,"exit sell",style = shape.arrowup,location = location.belowbar,color = color.red, text ="sell exit", textcolor = color.red)

//plotshape(shortLogic,"SELL",style = shape.arrowup,location = location.belowbar,color = color.green, text ="sell", textcolor= color.green)

//Exit at particular time

ExitHour = input(title="Exit Hour Of Day", type=input.integer, defval=15, step = 5, maxval = 24, minval = 0)

ExitMint = input(title="Exit Minute Of Day", type=input.integer, defval=15, step = 5, maxval = 24, minval = 0)

bgc = input(title="Highlight Background Color?", type=input.bool, defval=true)

mRound(num,rem) => (floor(num/rem)*rem)

exitTime = (hour(time) >= ExitHour and (minute == mRound(ExitMint, timeframe.multiplier))) ? 1 : 0

exitTime := exitTime == 0 ? (hour(time) >= ExitHour and (minute + timeframe.multiplier >= ExitMint)) ? 1 : 0 : exitTime

MarketClose = exitTime and not exitTime[1]

alertcondition(exitTime and not exitTime[1], title="Intraday Session Close Time", message="Close All Positions")

bgcolor(exitTime and not exitTime[1] and bgc ? #445566 : na, transp =40)

longCondition = longLogic

if (longCondition)

strategy.entry("long", strategy.long)

shortCondition = shortLogic

if (shortCondition)

strategy.entry("short", strategy.short)

strategy.close("short", when =cross(close,tempx) or MarketClose)

strategy.close( "long", when =cross(close,tempx) or MarketClose )

- दो-ड्राइवर क्वांटिज़ेड रिवर्स ट्रैकिंग रणनीति

- ओवरले ट्रेंड सिग्नल रणनीति

- स्विंग पॉइंट्स ब्रेकआउट दीर्घकालिक रणनीति

- गतिशील चलती औसत के आधार पर मात्रात्मक व्यापार रणनीति

- तीन मोमबत्तियों का रुझान उल्टा करने की रणनीति

- अनुकूलनशील दोहरी सफलता व्यापार रणनीति

- निचले स्तर पर उलटने के लिए मात्रात्मक व्यापार रणनीति

- गतिशीलता प्रवृत्ति अनुकूलन संयोजन रणनीति

- बहुआयामी चलती औसत बोलिंगर बैंड रणनीति

- क्रॉसिंग मूविंग एवरेज ब्रेकआउट रणनीति

- गति ब्रेकआउट रणनीति के साथ दोहरी चलती औसत

- वीडब्ल्यूएपी पर आधारित बोलिंगर बैंड ब्रेकआउट रणनीति

- फिबोनाची रिट्रेसमेंट डायनेमिक स्टॉप लॉस रणनीति

- गतिशील ईएमए और एमएसीडी क्रॉसओवर रणनीति

- दोहरे गति सूचकांक और रिवर्सल हाइब्रिड रणनीति

- टीडी अनुक्रमिक द्वि-दिशात्मक एस/आर ट्रेडिंग रणनीति

- बिटकॉइन के लिए सुपरट्रेंड मात्रात्मक ट्रेडिंग रणनीति

- एक अल्पकालिक रणनीति जो आरएसआई संकेतक और मूल्य सफलता को जोड़ती है

- रिचर्ड की कछुआ व्यापार रणनीति

- गतिशील ढलान प्रवृत्ति रेखा व्यापार रणनीति