Strategi lindung nilai futures dan spot cryptocurrency manual

Penulis:FMZ~Lydia, Dibuat: 2022-08-16 16:01:47, Diperbarui: 2023-09-19 21:39:31

Karena frekuensi hedging strategi hedging futures dan spot tidak tinggi, sebenarnya mungkin untuk beroperasi secara manual. Namun, jika Anda melakukannya secara manual, sangat tidak nyaman untuk beralih halaman berbagai bursa, mengamati harga, dan menghitung perbedaannya, dan kadang-kadang Anda mungkin ingin melihat lebih banyak varietas, dan tidak perlu menyiapkan beberapa monitor untuk menampilkan pasar. Apakah mungkin untuk mencapai tujuan operasi manual ini dengan strategi semi-otomatis? Lebih baik memiliki multi-spesies, oh! Ya, yang terbaik adalah membuka dan menutup posisi dengan satu klik. Oh! Ya, ada juga tampilan posisi...

Ketika ada kebutuhan, lakukan sekarang!

Merancang strategi lindung nilai futures dan spot cryptocurrency manual

Tulisan ini agak panjang, kurang dari 600 baris kode.

function createManager(fuEx, spEx, symbolPairs, cmdHedgeAmount, fuMarginLevel, fuMarginReservedRatio) {

var self = {}

self.fuEx = fuEx

self.spEx = spEx

self.symbolPairs = symbolPairs

self.pairs = []

self.fuExTickers = null

self.spExTickers = null

self.tickerUpdateTS = 0

self.fuMarginLevel = fuMarginLevel

self.fuMarginReservedRatio = fuMarginReservedRatio

self.cmdHedgeAmount = cmdHedgeAmount

self.preUpdateAccTS = 0

self.accAndPosUpdateCount = 0

self.profit = []

self.allPairs = []

self.PLUS = 0

self.MINUS = 1

self.COVER_PLUS = 2

self.COVER_MINUS = 3

self.arrTradeTypeDesc = ["positive arbitrage", "reverse arbitrage", "close positive arbitrage", "close reverse arbitrage"]

self.updateTickers = function() {

self.fuEx.goGetTickers()

self.spEx.goGetTickers()

var fuExTickers = self.fuEx.getTickers()

var spExTickers = self.spEx.getTickers()

if (!fuExTickers || !spExTickers) {

return null

}

self.fuExTickers = fuExTickers

self.spExTickers = spExTickers

self.tickerUpdateTS = new Date().getTime()

return true

}

self.hedge = function(index, fuSymbol, spSymbol, tradeType, amount) {

var fe = self.fuEx

var se = self.spEx

var pair = self.pairs[index]

var timeStamp = new Date().getTime()

var fuDirection = null

var spDirection = null

var fuPrice = null

var spPrice = null

if (tradeType == self.PLUS) {

fuDirection = fe.OPEN_SHORT

spDirection = se.OPEN_LONG

fuPrice = pair.fuTicker.bid1

spPrice = pair.spTicker.ask1

} else if (tradeType == self.MINUS) {

fuDirection = fe.OPEN_LONG

spDirection = se.OPEN_SHORT

fuPrice = pair.fuTicker.ask1

spPrice = pair.spTicker.bid1

} else if (tradeType == self.COVER_PLUS) {

fuDirection = fe.COVER_SHORT

spDirection = se.COVER_LONG

fuPrice = pair.fuTicker.ask1

spPrice = pair.spTicker.bid1

} else if (tradeType == self.COVER_MINUS) {

fuDirection = fe.COVER_LONG

spDirection = se.COVER_SHORT

fuPrice = pair.fuTicker.bid1

spPrice = pair.spTicker.ask1

} else {

throw "unknow tradeType!"

}

fe.goGetAcc(fuSymbol, timeStamp)

se.goGetAcc(spSymbol, timeStamp)

var nowFuAcc = fe.getAcc(fuSymbol, timeStamp)

var nowSpAcc = se.getAcc(spSymbol, timeStamp)

if (!nowFuAcc || !nowSpAcc) {

Log(fuSymbol, spSymbol, ", failed to get account data")

return

}

pair.nowFuAcc = nowFuAcc

pair.nowSpAcc = nowSpAcc

var nowFuPos = fe.getFuPos(fuSymbol, timeStamp)

var nowSpPos = se.getSpPos(spSymbol, spPrice, pair.initSpAcc, pair.nowSpAcc)

if (!nowFuPos || !nowSpPos) {

Log(fuSymbol, spSymbol, ", failed to get position data")

return

}

pair.nowFuPos = nowFuPos

pair.nowSpPos = nowSpPos

var fuAmount = amount

var spAmount = amount

if (tradeType == self.PLUS || tradeType == self.MINUS) {

if (nowFuAcc.Balance < (pair.initFuAcc.Balance + pair.initFuAcc.FrozenBalance) * self.fuMarginReservedRatio + (fuAmount * fuPrice / self.fuMarginLevel)) {

Log(pair.fuSymbol, "insufficient deposit!", "this plan uses", (fuAmount * fuPrice / self.fuMarginLevel), "currently available:", nowFuAcc.Balance,

"Plan to reserve:", (pair.initFuAcc.Balance + pair.initFuAcc.FrozenBalance) * self.fuMarginReservedRatio)

return

}

if ((tradeType == self.PLUS && nowSpAcc.Balance < spAmount * spPrice)) {

Log(pair.spSymbol, "insufficient funds!", "this purchase plans to use", spAmount * spPrice, "currently available:", nowSpAcc.Balance)

return

} else if (tradeType == self.MINUS && nowSpAcc.Stocks < spAmount) {

Log(pair.spSymbol, "insufficient funds!", "this selling plans to use", spAmount, "currently available:", nowSpAcc.Stocks)

return

}

} else {

var fuLongPos = self.getLongPos(nowFuPos)

var fuShortPos = self.getShortPos(nowFuPos)

var spLongPos = self.getLongPos(nowSpPos)

var spShortPos = self.getShortPos(nowSpPos)

if ((tradeType == self.COVER_PLUS && !fuShortPos) || (tradeType == self.COVER_MINUS && !fuLongPos)) {

Log(fuSymbol, spSymbol, ", there is no corresponding position in futures!")

return

} else if (tradeType == self.COVER_PLUS && Math.abs(fuShortPos.amount) < fuAmount) {

fuAmount = Math.abs(fuShortPos.amount)

} else if (tradeType == self.COVER_MINUS && Math.abs(fuLongPos.amount) < fuAmount) {

fuAmount = Math.abs(fuLongPos.amount)

}

if ((tradeType == self.COVER_PLUS && !spLongPos) || (tradeType == self.COVER_MINUS && !spShortPos)) {

Log(fuSymbol, spSymbol, ", there is no corresponding position in the spot!")

return

} else if (tradeType == self.COVER_PLUS && Math.min(Math.abs(spLongPos.amount), nowSpAcc.Stocks) < spAmount) {

spAmount = Math.min(Math.abs(spLongPos.amount), nowSpAcc.Stocks)

} else if (tradeType == self.COVER_MINUS && Math.min(Math.abs(spShortPos.amount), nowSpAcc.Balance / spPrice) < spAmount) {

spAmount = Math.min(Math.abs(spShortPos.amount), nowSpAcc.Balance / spPrice)

}

}

fuAmount = fe.calcAmount(fuSymbol, fuDirection, fuPrice, fuAmount)

spAmount = se.calcAmount(spSymbol, spDirection, spPrice, spAmount)

if (!fuAmount || !spAmount) {

Log(fuSymbol, spSymbol, "order quantity calculation error:", fuAmount, spAmount)

return

} else {

fuAmount = fe.calcAmount(fuSymbol, fuDirection, fuPrice, fuAmount[1])

spAmount = se.calcAmount(spSymbol, spDirection, spPrice, Math.min(fuAmount[1], spAmount[1]))

if (!fuAmount || !spAmount) {

Log(fuSymbol, spSymbol, "order quantity calculation error:", fuAmount, spAmount)

return

}

}

Log("contract code:", fuSymbol + "/" + spSymbol, "direction:", self.arrTradeTypeDesc[tradeType], "difference:", fuPrice - spPrice, "quantity of futures:", fuAmount, "quantity of spots:", spAmount, "@")

fe.goGetTrade(fuSymbol, fuDirection, fuPrice, fuAmount[0])

se.goGetTrade(spSymbol, spDirection, spPrice, spAmount[0])

var feIdMsg = fe.getTrade()

var seIdMsg = se.getTrade()

return [feIdMsg, seIdMsg]

}

self.process = function() {

var nowTS = new Date().getTime()

if(!self.updateTickers()) {

return

}

_.each(self.pairs, function(pair, index) {

var fuTicker = null

var spTicker = null

_.each(self.fuExTickers, function(ticker) {

if (ticker.originalSymbol == pair.fuSymbol) {

fuTicker = ticker

}

})

_.each(self.spExTickers, function(ticker) {

if (ticker.originalSymbol == pair.spSymbol) {

spTicker = ticker

}

})

if (fuTicker && spTicker) {

pair.canTrade = true

} else {

pair.canTrade = false

}

fuTicker = fuTicker ? fuTicker : {}

spTicker = spTicker ? spTicker : {}

pair.fuTicker = fuTicker

pair.spTicker = spTicker

pair.plusDiff = fuTicker.bid1 - spTicker.ask1

pair.minusDiff = fuTicker.ask1 - spTicker.bid1

if (pair.plusDiff && pair.minusDiff) {

pair.plusDiff = _N(pair.plusDiff, Math.max(self.fuEx.judgePrecision(fuTicker.bid1), self.spEx.judgePrecision(spTicker.ask1)))

pair.minusDiff = _N(pair.minusDiff, Math.max(self.fuEx.judgePrecision(fuTicker.ask1), self.spEx.judgePrecision(spTicker.bid1)))

}

if (nowTS - self.preUpdateAccTS > 1000 * 60 * 5) {

self.fuEx.goGetAcc(pair.fuSymbol, nowTS)

self.spEx.goGetAcc(pair.spSymbol, nowTS)

var fuAcc = self.fuEx.getAcc(pair.fuSymbol, nowTS)

var spAcc = self.spEx.getAcc(pair.spSymbol, nowTS)

if (fuAcc) {

pair.nowFuAcc = fuAcc

}

if (spAcc) {

pair.nowSpAcc = spAcc

}

var nowFuPos = self.fuEx.getFuPos(pair.fuSymbol, nowTS)

var nowSpPos = self.spEx.getSpPos(pair.spSymbol, (pair.spTicker.ask1 + pair.spTicker.bid1) / 2, pair.initSpAcc, pair.nowSpAcc)

if (nowFuPos && nowSpPos) {

pair.nowFuPos = nowFuPos

pair.nowSpPos = nowSpPos

self.keepBalance(pair)

} else {

Log(pair.fuSymbol, pair.spSymbol, "portfolio position update failed, nowFuPos:", nowFuPos, " nowSpPos:", nowSpPos)

}

self.accAndPosUpdateCount++

}

})

if (nowTS - self.preUpdateAccTS > 1000 * 60 * 5) {

self.preUpdateAccTS = nowTS

self.profit = self.calcProfit()

LogProfit(self.profit[0], "futures:", self.profit[1], "spots:", self.profit[2], "&") // Print the total profit curve, use the & character not to print the profit log

}

var cmd = GetCommand()

if(cmd) {

Log("interactive commands:", cmd)

var arr = cmd.split(":")

if(arr[0] == "plus") {

var pair = self.pairs[parseFloat(arr[1])]

self.hedge(parseFloat(arr[1]), pair.fuSymbol, pair.spSymbol, self.PLUS, self.cmdHedgeAmount)

} else if (arr[0] == "cover_plus") {

var pair = self.pairs[parseFloat(arr[1])]

self.hedge(parseFloat(arr[1]), pair.fuSymbol, pair.spSymbol, self.COVER_PLUS, self.cmdHedgeAmount)

}

}

LogStatus("current time:", _D(), "data update time:", _D(self.tickerUpdateTS), "position account update count:", self.accAndPosUpdateCount, "\n", "Profit and loss:", self.profit[0], "futures profit and loss:", self.profit[1],

"spot profit and loss:", self.profit[2], "\n`" + JSON.stringify(self.returnTbl()) + "`", "\n`" + JSON.stringify(self.returnPosTbl()) + "`")

}

self.keepBalance = function (pair) {

var nowFuPos = pair.nowFuPos

var nowSpPos = pair.nowSpPos

var fuLongPos = self.getLongPos(nowFuPos)

var fuShortPos = self.getShortPos(nowFuPos)

var spLongPos = self.getLongPos(nowSpPos)

var spShortPos = self.getShortPos(nowSpPos)

if (fuLongPos || spShortPos) {

Log("reverse arbitrage is not supported")

}

if (fuShortPos || spLongPos) {

var fuHoldAmount = fuShortPos ? fuShortPos.amount : 0

var spHoldAmount = spLongPos ? spLongPos.amount : 0

var sum = fuHoldAmount + spHoldAmount

if (sum > 0) {

var spAmount = self.spEx.calcAmount(pair.spSymbol, self.spEx.COVER_LONG, pair.spTicker.bid1, Math.abs(sum), true)

if (spAmount) {

Log(pair.fuSymbol, pair.spSymbol, "excess spot positions", Math.abs(sum), "fuShortPos:", fuShortPos, "spLongPos:", spLongPos)

self.spEx.goGetTrade(pair.spSymbol, self.spEx.COVER_LONG, pair.spTicker.bid1, spAmount[0])

var seIdMsg = self.spEx.getTrade()

}

} else if (sum < 0) {

var fuAmount = self.fuEx.calcAmount(pair.fuSymbol, self.fuEx.COVER_SHORT, pair.fuTicker.ask1, Math.abs(sum), true)

if (fuAmount) {

Log(pair.fuSymbol, pair.spSymbol, "long futures positions", Math.abs(sum), "fuShortPos:", fuShortPos, "spLongPos:", spLongPos)

self.fuEx.goGetTrade(pair.fuSymbol, self.fuEx.COVER_SHORT, pair.fuTicker.ask1, fuAmount[0])

var feIdMsg = self.fuEx.getTrade()

}

}

}

}

self.getLongPos = function (positions) {

return self.getPosByDirection(positions, PD_LONG)

}

self.getShortPos = function (positions) {

return self.getPosByDirection(positions, PD_SHORT)

}

self.getPosByDirection = function (positions, direction) {

var ret = null

if (positions.length > 2) {

Log("position error, three positions detected:", JSON.stringify(positions))

return ret

}

_.each(positions, function(pos) {

if ((direction == PD_LONG && pos.amount > 0) || (direction == PD_SHORT && pos.amount < 0)) {

ret = pos

}

})

return ret

}

self.calcProfit = function() {

var arrInitFuAcc = []

var arrNowFuAcc = []

_.each(self.pairs, function(pair) {

arrInitFuAcc.push(pair.initFuAcc)

arrNowFuAcc.push(pair.nowFuAcc)

})

var fuProfit = self.fuEx.calcProfit(arrInitFuAcc, arrNowFuAcc)

var spProfit = 0

var deltaBalance = 0

_.each(self.pairs, function(pair) {

var nowSpAcc = pair.nowSpAcc

var initSpAcc = pair.initSpAcc

var stocksDiff = nowSpAcc.Stocks + nowSpAcc.FrozenStocks - (initSpAcc.Stocks + initSpAcc.FrozenStocks)

var price = stocksDiff > 0 ? pair.spTicker.bid1 : pair.spTicker.ask1

spProfit += stocksDiff * price

deltaBalance = nowSpAcc.Balance + nowSpAcc.FrozenBalance - (initSpAcc.Balance + initSpAcc.FrozenBalance)

})

spProfit += deltaBalance

return [fuProfit + spProfit, fuProfit, spProfit]

}

self.returnPosTbl = function() {

var posTbl = {

type : "table",

title : "positions",

cols : ["index", "future", "future leverage", "qunatity", "spot", "qunatity"],

rows : []

}

_.each(self.pairs, function(pair, index) {

var nowFuPos = pair.nowFuPos

var nowSpPos = pair.nowSpPos

for (var i = 0 ; i < nowFuPos.length ; i++) {

if (nowSpPos.length > 0) {

posTbl.rows.push([index, nowFuPos[i].symbol, nowFuPos[i].marginLevel, nowFuPos[i].amount, nowSpPos[0].symbol, nowSpPos[0].amount])

} else {

posTbl.rows.push([index, nowFuPos[i].symbol, nowFuPos[i].marginLevel, nowFuPos[i].amount, "--", "--"])

}

}

})

return posTbl

}

self.returnTbl = function() {

var fuExName = "[" + self.fuEx.getExName() + "]"

var spExName = "[" + self.spEx.getExName() + "]"

var combiTickersTbl = {

type : "table",

title : "combiTickersTbl",

cols : ["future", "code" + fuExName, "entrusted selling", "entrusted purchase", "spot", "code" + spExName, "entrusted selling", "entrusted purchase", "positive hedging spreads", "reverse hedging spreads", "positive hedge", "positive hedge closeout"],

rows : []

}

_.each(self.pairs, function(pair, index) {

var spSymbolInfo = self.spEx.getSymbolInfo(pair.spTicker.originalSymbol)

combiTickersTbl.rows.push([

pair.fuTicker.symbol,

pair.fuTicker.originalSymbol,

pair.fuTicker.ask1,

pair.fuTicker.bid1,

pair.spTicker.symbol,

pair.spTicker.originalSymbol,

pair.spTicker.ask1,

pair.spTicker.bid1,

pair.plusDiff,

pair.minusDiff,

{'type':'button', 'cmd': 'plus:' + String(index), 'name': 'positive arbitrage'},

{'type':'button', 'cmd': 'cover_plus:' + String(index), 'name': 'close positive arbitrage'}

])

})

var accsTbl = {

type : "table",

title : "accs",

cols : ["code" + fuExName, "initial coin", "initial frozen coin", "initial money", "initial frozen money", "coin", "frozen coin", "money", "frozen money",

"code" + spExName, "initial coin", "initial frozen coin", "initial money", "initial frozen money", "coin", "frozen coin", "money", "frozen money"],

rows : []

}

_.each(self.pairs, function(pair) {

var arr = [pair.fuTicker.originalSymbol, pair.initFuAcc.Stocks, pair.initFuAcc.FrozenStocks, pair.initFuAcc.Balance, pair.initFuAcc.FrozenBalance, pair.nowFuAcc.Stocks, pair.nowFuAcc.FrozenStocks, pair.nowFuAcc.Balance, pair.nowFuAcc.FrozenBalance,

pair.spTicker.originalSymbol, pair.initSpAcc.Stocks, pair.initSpAcc.FrozenStocks, pair.initSpAcc.Balance, pair.initSpAcc.FrozenBalance, pair.nowSpAcc.Stocks, pair.nowSpAcc.FrozenStocks, pair.nowSpAcc.Balance, pair.nowSpAcc.FrozenBalance]

for (var i = 0 ; i < arr.length ; i++) {

if (typeof(arr[i]) == "number") {

arr[i] = _N(arr[i], 6)

}

}

accsTbl.rows.push(arr)

})

var symbolInfoTbl = {

type : "table",

title : "symbolInfos",

cols : ["contract code" + fuExName, "quantity accuracy", "price accuracy", "multiplier", "minimum order quantity", "spot code" + spExName, "quantity accuracy", "price accuracy", "multiplier", "minimum order quantity"],

rows : []

}

_.each(self.pairs, function(pair) {

var fuSymbolInfo = self.fuEx.getSymbolInfo(pair.fuTicker.originalSymbol)

var spSymbolInfo = self.spEx.getSymbolInfo(pair.spTicker.originalSymbol)

symbolInfoTbl.rows.push([fuSymbolInfo.symbol, fuSymbolInfo.amountPrecision, fuSymbolInfo.pricePrecision, fuSymbolInfo.multiplier, fuSymbolInfo.min,

spSymbolInfo.symbol, spSymbolInfo.amountPrecision, spSymbolInfo.pricePrecision, spSymbolInfo.multiplier, spSymbolInfo.min])

})

var allPairs = []

_.each(self.fuExTickers, function(fuTicker) {

_.each(self.spExTickers, function(spTicker) {

if (fuTicker.symbol == spTicker.symbol) {

allPairs.push({symbol: fuTicker.symbol, fuSymbol: fuTicker.originalSymbol, spSymbol: spTicker.originalSymbol, plus: fuTicker.bid1 - spTicker.ask1})

}

})

})

_.each(allPairs, function(pair) {

var findPair = null

_.each(self.allPairs, function(selfPair) {

if (pair.fuSymbol == selfPair.fuSymbol && pair.spSymbol == selfPair.spSymbol) {

findPair = selfPair

}

})

if (findPair) {

findPair.minPlus = pair.plus < findPair.minPlus ? pair.plus : findPair.minPlus

findPair.maxPlus = pair.plus > findPair.maxPlus ? pair.plus : findPair.maxPlus

pair.minPlus = findPair.minPlus

pair.maxPlus = findPair.maxPlus

} else {

self.allPairs.push({symbol: pair.symbol, fuSymbol: pair.fuSymbol, spSymbol: pair.spSymbol, plus: pair.plus, minPlus: pair.plus, maxPlus: pair.plus})

pair.minPlus = pair.plus

pair.maxPlus = pair.plus

}

})

return [combiTickersTbl, accsTbl, symbolInfoTbl]

}

self.onexit = function() {

_G("pairs", self.pairs)

_G("allPairs", self.allPairs)

Log("perform tailing processing and save data", "#FF0000")

}

self.init = function() {

var fuExName = self.fuEx.getExName()

var spExName = self.spEx.getExName()

var gFuExName = _G("fuExName")

var gSpExName = _G("spExName")

if ((gFuExName && gFuExName != fuExName) || (gSpExName && gSpExName != spExName)) {

throw "the exchange object has changed and the data needs to be reset"

}

if (!gFuExName) {

_G("fuExName", fuExName)

}

if (!gSpExName) {

_G("spExName", spExName)

}

self.allPairs = _G("allPairs")

if (!self.allPairs) {

self.allPairs = []

}

var arrPair = _G("pairs")

if (!arrPair) {

arrPair = []

}

var arrStrPair = self.symbolPairs.split(",")

var timeStamp = new Date().getTime()

_.each(arrStrPair, function(strPair) {

var arrSymbol = strPair.split("|")

var recoveryPair = null

_.each(arrPair, function(pair) {

if (pair.fuSymbol == arrSymbol[0] && pair.spSymbol == arrSymbol[1]) {

recoveryPair = pair

}

})

if (!recoveryPair) {

var pair = {

fuSymbol : arrSymbol[0],

spSymbol : arrSymbol[1],

fuTicker : {},

spTicker : {},

plusDiff : null,

minusDiff : null,

canTrade : false,

initFuAcc : null,

initSpAcc : null,

nowFuAcc : null,

nowSpAcc : null,

nowFuPos : null,

nowSpPos : null,

fuMarginLevel : null

}

self.pairs.push(pair)

Log("初始化:", pair)

} else {

self.pairs.push(recoveryPair)

Log("恢复:", recoveryPair)

}

self.fuEx.pushSubscribeSymbol(arrSymbol[0])

self.spEx.pushSubscribeSymbol(arrSymbol[1])

if (!self.pairs[self.pairs.length - 1].initFuAcc) {

self.fuEx.goGetAcc(arrSymbol[0], timeStamp)

var nowFuAcc = self.fuEx.getAcc(arrSymbol[0], timeStamp)

self.pairs[self.pairs.length - 1].initFuAcc = nowFuAcc

self.pairs[self.pairs.length - 1].nowFuAcc = nowFuAcc

}

if (!self.pairs[self.pairs.length - 1].initSpAcc) {

self.spEx.goGetAcc(arrSymbol[1], timeStamp)

var nowSpAcc = self.spEx.getAcc(arrSymbol[1], timeStamp)

self.pairs[self.pairs.length - 1].initSpAcc = nowSpAcc

self.pairs[self.pairs.length - 1].nowSpAcc = nowSpAcc

}

Sleep(300)

})

Log("self.pairs:", self.pairs)

_.each(self.pairs, function(pair) {

var fuSymbolInfo = self.fuEx.getSymbolInfo(pair.fuSymbol)

if (!fuSymbolInfo) {

throw pair.fuSymbol + ", species information acquisition failure!"

} else {

Log(pair.fuSymbol, fuSymbolInfo)

}

var spSymbolInfo = self.spEx.getSymbolInfo(pair.spSymbol)

if (!spSymbolInfo) {

throw pair.spSymbol + ", species information acquisition failure!"

} else {

Log(pair.spSymbol, spSymbolInfo)

}

})

_.each(self.pairs, function(pair) {

pair.fuMarginLevel = self.fuMarginLevel

var ret = self.fuEx.setMarginLevel(pair.fuSymbol, self.fuMarginLevel)

Log(pair.fuSymbol, "leverage settings:", ret)

if (!ret) {

throw "initial setting of leverage failed!"

}

})

}

self.init()

return self

}

var manager = null

function main() {

if(isReset) {

_G(null)

LogReset(1)

LogProfitReset()

LogVacuum()

Log("reset all data", "#FF0000")

}

if (isOKEX_V5_Simulate) {

for (var i = 0 ; i < exchanges.length ; i++) {

if (exchanges[i].GetName() == "Futures_OKCoin" || exchanges[i].GetName() == "OKEX") {

var ret = exchanges[i].IO("simulate", true)

Log(exchanges[i].GetName(), "switch analog disk")

}

}

}

var fuConfigureFunc = null

var spConfigureFunc = null

if (exchanges.length != 2) {

throw "two exchange objects need to be added!"

} else {

var fuName = exchanges[0].GetName()

if (fuName == "Futures_OKCoin" && isOkexV5) {

fuName += "_V5"

Log("Use OKEX V5 interface")

}

var spName = exchanges[1].GetName()

fuConfigureFunc = $.getConfigureFunc()[fuName]

spConfigureFunc = $.getConfigureFunc()[spName]

if (!fuConfigureFunc || !spConfigureFunc) {

throw (fuConfigureFunc ? "" : fuName) + " " + (spConfigureFunc ? "" : spName) + " not support!"

}

}

var fuEx = $.createBaseEx(exchanges[0], fuConfigureFunc)

var spEx = $.createBaseEx(exchanges[1], spConfigureFunc)

manager = createManager(fuEx, spEx, symbolPairs, cmdHedgeAmount, fuMarginLevel, fuMarginReservedRatio)

while(true) {

manager.process()

Sleep(interval)

}

}

function onerror() {

if (manager) {

manager.onexit()

}

}

function onexit() {

if (manager) {

manager.onexit()

}

}

Karena strategi multi-spesies lebih cocok untuk desain IO, perpustakaan kelas templat bernamaMultiSymbolCtrlLibStrategi ini tidak dapat diuji kembali, tetapi dapat diuji dengan bot simulasi (meskipun bot nyata telah dijalankan selama 2 bulan, tahap pengujian dan familiarization masih dijalankan dengan bot simulasi).

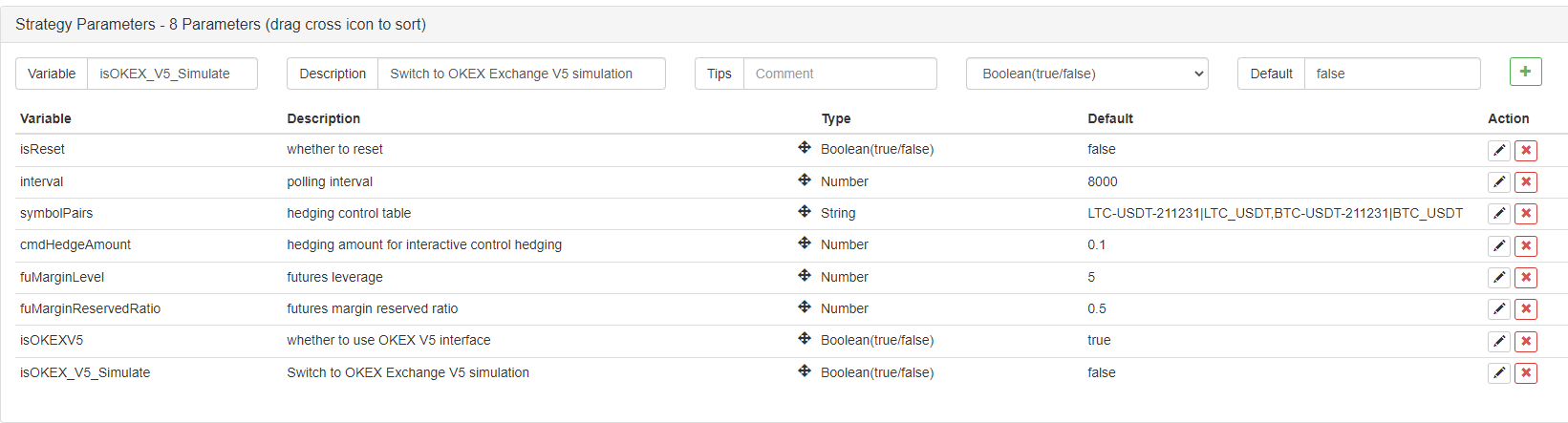

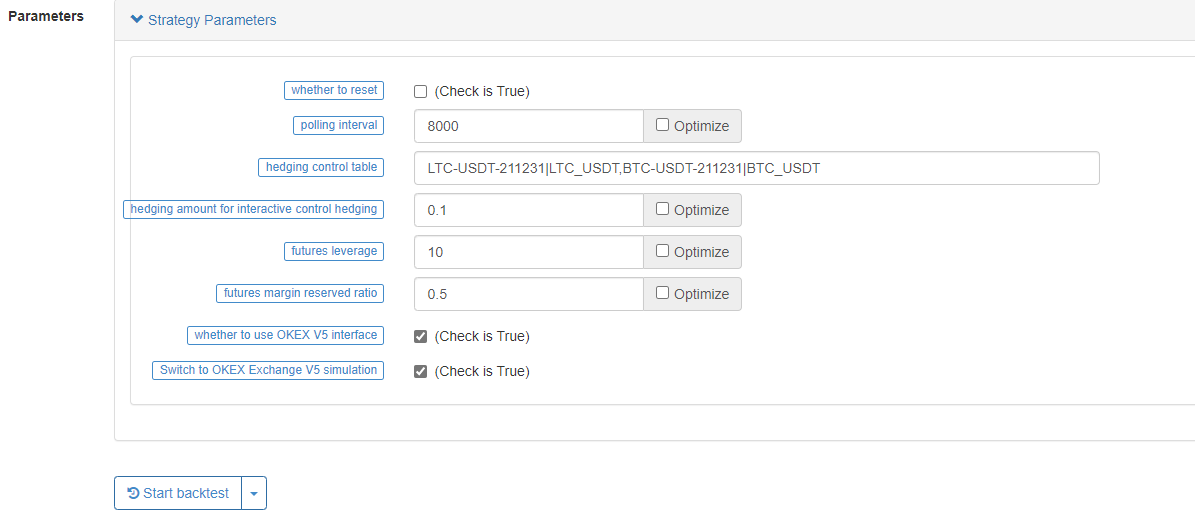

Parameter

Sebelum memulai tes, mari kita bicara tentang desain parameter pertama.

Tidak banyak parameter strategi, yang lebih penting adalah:

-

Tabel kontrol lindung nilai

LTC-USDT-211231|LTC_USDT,BTC-USDT-211231|BTC_USDTBerikut adalah strategi pengaturan untuk memantau kombinasi tersebut. Misalnya, pengaturan di atas adalah untuk memantau kontrak Litecoin (LTC-USDT-211231) dari bursa masa depan dan Litecoin (LTC_USDT) dari bursa spot. Kombinasi kontrak masa depan dan pasangan perdagangan spot dipisahkan oleh

|simbol untuk membentuk kombinasi. kombinasi yang berbeda dipisahkan oleh,Perhatikan bahwa simbol-simbol di sini semua dalam keadaan metode input bahasa Inggris! Kemudian Anda mungkin bertanya kepada saya bagaimana menemukan kode kontrak ini kode kontrak dan pasangan perdagangan spot semuanya didefinisikan oleh bursa, tidak didefinisikan oleh platform FMZ. Sebagai contoh,LTC-USDT-211231adalah kontrak kuartal kedua saat ini, disebutnext_quarterpada FMZ, dan sistem antarmuka OKEXdisebut LTC-USDT-211231. UntukLitecoin/USDTtrading pair, bot simulasi WexApp ditulis sebagaiLTC_USDTJadi bagaimana mengisi di sini tergantung pada nama yang didefinisikan dalam pertukaran. -

Nilai lindung nilai untuk lindung nilai kontrol interaktif Klik tombol kontrol bilah status untuk lindung nilai. Satuan adalah jumlah koin, dan strategi akan secara otomatis dikonversi menjadi jumlah kontrak untuk menempatkan pesanan.

Fungsi lain adalah mengatur disk analog, mengatur ulang data, menggunakan antarmuka OKEX V5 (karena juga kompatibel dengan V3) dan sebagainya, yang tidak terlalu penting.

Pengujian

Objek pertukaran pertama menambahkan pertukaran berjangka, dan yang kedua menambahkan objek pertukaran spot.

Bursa berjangka menggunakan robot simulasi antarmuka OKEX

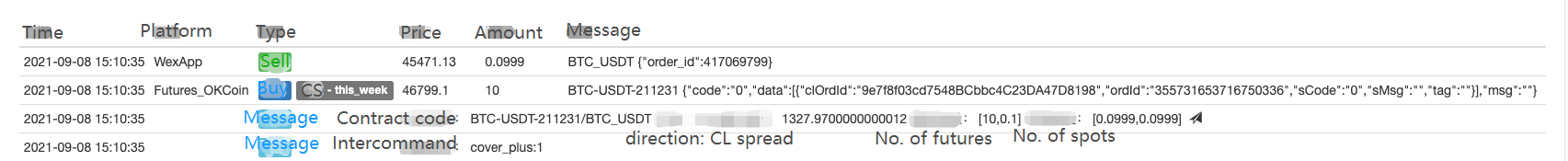

Klik tombol set positif dari kombinasi BTC dan buka posisi.

Klik untuk menutup arbitrage positif kemudian.

Kehilangan!!! Tampaknya penutupan posisi tidak dapat menutupi biaya penanganan ketika spread keuntungan kecil, perlu untuk menghitung biaya penanganan, pergeseran perkiraan, dan merencanakan spread secara wajar, dan kemudian menutup posisi.

Kode sumber strategi:https://www.fmz.com/strategy/314352

Mereka yang tertarik dapat menggunakannya dan memodifikasinya.

- Praktik Kuantitatif DEX Exchange ((1)-- dYdX v4 Panduan Penggunaan

- Penjelasan tentang suite Lead-Lag dalam mata uang digital (3)

- Pengantar ke Lead-Lag Arbitrage dalam Cryptocurrency (2)

- Penjelasan tentang suite Lead-Lag dalam mata uang digital (2)

- Pembahasan Penerimaan Sinyal Eksternal Platform FMZ: Solusi Lengkap untuk Penerimaan Sinyal dengan Layanan Http Terbina dalam Strategi

- FMZ platform eksplorasi penerimaan sinyal eksternal: strategi built-in https layanan solusi lengkap untuk penerimaan sinyal

- Pengantar ke Lead-Lag Arbitrage dalam Cryptocurrency (1)

- Penjelasan tentang suite Lead-Lag dalam mata uang digital (1)

- Diskusi tentang Penerimaan Sinyal Eksternal dari Platform FMZ: API Terluas VS Strategi Layanan HTTP Terintegrasi

- FMZ Platform Eksternal Signal Reception: Extension API vs Strategi Layanan HTTP Terbentuk

- Diskusi tentang Metode Pengujian Strategi Berdasarkan Generator Random Ticker

- Desain Sistem Manajemen Sinkronisasi Pesenan Berdasarkan FMZ Quant (1)

- Analisis Strategi LeeksReaper (1)

- Strategi Hedging Dinamis Opsi Deribit Delta

- Status terbaru dan operasi yang direkomendasikan dari strategi suku bunga pendanaan

- Tinjauan Pasar Mata Uang Digital di 2021 dan 10 Strategi Paling Sederhana yang Jatuh

- Model Faktor Mata Uang Digital

- Dari YouTube, "Magic Double EMA Equilibrium Strategy"

- Menulis alat perdagangan semi-otomatis menggunakan bahasa Pine

- Model faktor mata uang digital

- Jadilah penyelamatmu sendiri dalam transaksi

- Desain strategi lindung nilai spot cryptocurrency ((1)

- Strategi keseimbangan abadi yang cocok untuk pasar bear bottoming

- Cryptocurrency Quantitative Trading for Beginners - Membawa Anda Lebih Dekat dengan Cryptocurrency Quantitative (8)

- Cryptocurrency Quantitative Trading for Beginners - Membawa Anda Lebih Dekat dengan Cryptocurrency Quantitative (7)

- Cryptocurrency Quantitative Trading for Beginners - Membawa Anda Lebih Dekat dengan Cryptocurrency Quantitative (6)

- Gambaran umum dan arsitektur antarmuka utama Platform Perdagangan Kuantum FMZ

- Desain strategi Martingale untuk berjangka cryptocurrency

- Cryptocurrency Quantitative Trading for Beginners - Membawa Anda Lebih Dekat dengan Cryptocurrency Quantitative (5)

- Cryptocurrency Quantitative Trading for Beginners - Membawa Anda Lebih Dekat dengan Cryptocurrency Quantitative (4)

- Cryptocurrency Quantitative Trading for Beginners - Membawa Anda Lebih Dekat dengan Cryptocurrency Quantitative (3)