Strategi ATR multi-spesies berjangka mata uang digital (tutorial)

Penulis:FMZ~Lydia, Dibuat: 2022-11-08 10:34:22, Diperbarui: 2023-09-15 20:55:33

Baru-baru ini, beberapa pengguna platform kami berharap untuk mentransplantasikan strategi MyLanguage ke dalam strategi JavaScript, yang dapat secara fleksibel menambahkan banyak ide pengoptimalan. Bahkan memperluas strategi ke versi multi-spesies. Karena strategi MyLanguage biasanya merupakan strategi tren, dan banyak dari mereka dijalankan berdasarkan model harga penutupan. Antarmuka API dari pertukaran permintaan strategi tidak terlalu sering, yang cocok untuk mentransplantasikan ke versi strategi multi-spesies. Dalam artikel ini, kami akan mengambil strategi MyLanguage sederhana sebagai contoh untuk mentransplantasinya ke dalam versi bahasa JavaScript yang sederhana. Tujuan utamanya adalah mengajar dan mendukung penelitian. Jika Anda ingin membuat bot nyata, Anda mungkin perlu menambahkan beberapa detail (test harga pesanan, akurasi persentase kuantitas, kontrol kuantitas pesanan, tampilan informasi status pesanan berdasarkan aset, dll.), Dan juga perlu tes bot nyata.

Strategi MyLanguage yang Harus Dipindahkan

TR:=MAX(MAX((H-L),ABS(REF(C,1)-H)),ABS(REF(C,1)-L));

ATR:=EMA(TR,LENGTH2);

MIDLINE^^EMA((H + L + C)/3,LENGTH1);

UPBAND^^MIDLINE + N*ATR;

DOWNBAND^^MIDLINE - N*ATR;

BKVOL=0 AND C>=UPBAND AND REF(C,1)<REF(UPBAND,1),BPK;

SKVOL=0 AND C<=DOWNBAND AND REF(C,1)>REF(DOWNBAND,1),SPK;

BKVOL>0 AND C<=MIDLINE,SP(BKVOL);

SKVOL>0 AND C>=MIDLINE,BP(SKVOL);

// stop loss

// stop loss

C>=SKPRICE*(1+SLOSS*0.01),BP;

C<=BKPRICE*(1-SLOSS*0.01),SP;

AUTOFILTER;

Logika perdagangan strategi ini sederhana. Pertama, hitung ATR sesuai dengan parameter, kemudian hitung rata-rata harga tertinggi, terendah dan penutupan dari semua K-line BAR, dan kemudian hitung indikator EMA sesuai dengan data rata-rata. Akhirnya, gabungkan ATR dan koefisien N dalam parameter untuk menghitung upBand dan downBand.

Posisi pembukaan dan penjualan didasarkan pada harga penutupan. Buka posisi panjang ketika melampaui upBand dan jual posisi pembukaan (saat memegang posisi pendek). Buka posisi pendek ketika melampaui downBand dan jual posisi pembukaan. Ketika harga penutupan mencapai garis tengah, posisi akan ditutup, dan ketika harga penutupan mencapai harga stop loss, posisi juga akan ditutup (stop loss menurut SLOSS, SLOSS adalah 1, yaitu 0,01, yaitu 1%). Strategi ini dilaksanakan dalam model harga penutupan.

OK, jika kita memahami persyaratan strategis dan ide-ide dari MyLanguage, kita bisa mulai menanamkan mereka.

Prototipe Strategi Transplantasi dan Desain

Tidak banyak kode prototipe strategi, mulai dari 1 hingga 200 baris.

// parse params parameters, and parse strings as objects

var arrParam = JSON.parse(params)

// this function creates a chart configuration

function createChartConfig(symbol, atrPeriod, emaPeriod, index) { // symbol : trading pair, atrPeriod : ATR parameter period , emaPeriod : EMA parameter period, exchange object index corresponding to index

var chart = {

__isStock: true,

extension: {

layout: 'single',

height: 600,

},

title : { text : symbol},

xAxis: { type: 'datetime'},

series : [

{

type: 'candlestick', // K-line data series

name: symbol,

id: symbol + "-" + index,

data: []

}, {

type: 'line', // EMA

name: symbol + ',EMA:' + emaPeriod,

data: [],

}, {

type: 'line', // upBand

name: symbol + ',upBand' + atrPeriod,

data: []

}, {

type: 'line', // downBand

name: symbol + ',downBand' + atrPeriod,

data: []

}, {

type: 'flags',

onSeries: symbol + "-" + index,

data: [],

}

]

}

return chart

}

// main Logic

function process(e, kIndex, c) { // e is the exchange object, exchanges [0]..., kIndex is the K-line data series in the chart, and c is the chart object

// obtain K-line data

var r = e.GetRecords(e.param.period)

if (!r || r.length < e.param.atrPeriod + 2 || r.length < e.param.emaPeriod + 2) {

// if the K-line data length is insufficient, return

return

}

// calculate ATR indicators

var atr = TA.ATR(r, e.param.atrPeriod)

var arrAvgPrice = []

_.each(r, function(bar) {

arrAvgPrice.push((bar.High + bar.Low + bar.Close) / 3)

})

// calculate EMA indicators

var midLine = TA.EMA(arrAvgPrice, e.param.emaPeriod)

// calculate upBand and downBand

var upBand = []

var downBand = []

_.each(midLine, function(mid, index) {

if (index < e.param.emaPeriod - 1 || index < e.param.atrPeriod - 1) {

upBand.push(NaN)

downBand.push(NaN)

return

}

upBand.push(mid + e.param.trackRatio * atr[index])

downBand.push(mid - e.param.trackRatio * atr[index])

})

// draw the chart

for (var i = 0 ; i < r.length ; i++) {

if (r[i].Time == e.state.lastBarTime) {

// update

c.add(kIndex, [r[i].Time, r[i].Open, r[i].High, r[i].Low, r[i].Close], -1)

c.add(kIndex + 1, [r[i].Time, midLine[i]], -1)

c.add(kIndex + 2, [r[i].Time, upBand[i]], -1)

c.add(kIndex + 3, [r[i].Time, downBand[i]], -1)

} else if (r[i].Time > e.state.lastBarTime) {

// add

e.state.lastBarTime = r[i].Time

c.add(kIndex, [r[i].Time, r[i].Open, r[i].High, r[i].Low, r[i].Close])

c.add(kIndex + 1, [r[i].Time, midLine[i]])

c.add(kIndex + 2, [r[i].Time, upBand[i]])

c.add(kIndex + 3, [r[i].Time, downBand[i]])

}

}

// check the position

var pos = e.GetPosition()

if (!pos) {

return

}

var holdAmount = 0

var holdPrice = 0

if (pos.length > 1) {

throw "long and short positions are checked at the same time!"

} else if (pos.length != 0) {

holdAmount = pos[0].Type == PD_LONG ? pos[0].Amount : -pos[0].Amount

holdPrice = pos[0].Price

}

if (e.state.preBar == -1) {

e.state.preBar = r[r.length - 1].Time

}

// check the signal

if (e.state.preBar != r[r.length - 1].Time) { // closing price model

if (holdAmount <= 0 && r[r.length - 3].Close < upBand[upBand.length - 3] && r[r.length - 2].Close > upBand[upBand.length - 2]) { // the closing price cross over the upBand

if (holdAmount < 0) { // hold a short positions, close them

Log(e.GetCurrency(), "close short positions", "#FF0000")

$.CoverShort(e, e.param.symbol, Math.abs(holdAmount))

c.add(kIndex + 4, {x: r[r.length - 2].Time, color: 'red', shape: 'flag', title: 'close', text: "close short positions"})

}

// open long positions

Log(e.GetCurrency(), "open long positions", "#FF0000")

$.OpenLong(e, e.param.symbol, 10)

c.add(kIndex + 4, {x: r[r.length - 2].Time, color: 'red', shape: 'flag', title: 'long', text: "open long positions"})

} else if (holdAmount >= 0 && r[r.length - 3].Close > downBand[downBand.length - 3] && r[r.length - 2].Close < downBand[downBand.length - 2]) { // the closing price cross down the downBand

if (holdAmount > 0) { // hold long positions, close them

Log(e.GetCurrency(), "close long positions", "#FF0000")

$.CoverLong(e, e.param.symbol, Math.abs(holdAmount))

c.add(kIndex + 4, {x: r[r.length - 2].Time, color: 'green', shape: 'flag', title: 'close', text: "close long positions"})

}

// open short positions

Log(e.GetCurrency(), "open short positions", "#FF0000")

$.OpenShort(e, e.param.symbol, 10)

c.add(kIndex + 4, {x: r[r.length - 2].Time, color: 'green', shape: 'flag', title: 'short', text: "open short positions"})

} else {

// close positions

if (holdAmount > 0 && (r[r.length - 2].Close <= holdPrice * (1 - e.param.stopLoss) || r[r.length - 2].Close <= midLine[midLine.length - 2])) { // Hold a long position, the closing price is less than or equal to the midline, stop loss at the opening price

Log(e.GetCurrency(), "trigger midline or stop loss, close long positions", "#FF0000")

$.CoverLong(e, e.param.symbol, Math.abs(holdAmount))

c.add(kIndex + 4, {x: r[r.length - 2].Time, color: 'green', shape: 'flag', title: 'close', text: "close long positions"})

} else if (holdAmount < 0 && (r[r.length - 2].Close >= holdPrice * (1 + e.param.stopLoss) || r[r.length - 2].Close >= midLine[midLine.length - 2])) { // Hold a short position, the closing price is greater than or equal to the midline, stop loss at the opening price

Log(e.GetCurrency(), "trigger midline or stop loss, close short positions", "#FF0000")

$.CoverShort(e, e.param.symbol, Math.abs(holdAmount))

c.add(kIndex + 4, {x: r[r.length - 2].Time, color: 'red', shape: 'flag', title: 'close', text: "close short positions"})

}

}

e.state.preBar = r[r.length - 1].Time

}

}

function main() {

var arrChartConfig = []

if (arrParam.length != exchanges.length) {

throw "Parameters and exchange objects do not match!"

}

var arrState = _G("arrState")

_.each(exchanges, function(e, index) {

if (e.GetName() != "Futures_Binance") {

throw "The exchange is not supported!"

}

e.param = arrParam[index]

e.state = {lastBarTime: 0, symbol: e.param.symbol, currency: e.GetCurrency()}

if (arrState) {

if (arrState[index].symbol == e.param.symbol && arrState[index].currency == e.GetCurrency()) {

Log("restore:", e.state)

e.state = arrState[index]

} else {

throw "The restored data does not match the current settings!"

}

}

e.state.preBar = -1 // initial setting -1

e.SetContractType(e.param.symbol)

Log(e.GetName(), e.GetLabel(), "set contracts:", e.param.symbol)

arrChartConfig.push(createChartConfig(e.GetCurrency(), e.param.atrPeriod, e.param.emaPeriod, index))

})

var chart = Chart(arrChartConfig)

chart.reset()

while (true) {

_.each(exchanges, function(e, index) {

process(e, index + index * 4, chart)

Sleep(500)

})

}

}

function onexit() {

// record e.state

var arrState = []

_.each(exchanges, function(e) {

arrState.push(e.state)

})

Log("record:", arrState)

_G("arrState", arrState)

}

Parameter strategi:

var params = '[{

"symbol" : "swap", // contract code

"period" : 86400, // K-line period, 86,400 seconds is a day

"stopLoss" : 0.07, // stop loss factor, 0.07 or 7%

"atrPeriod" : 10, // ATR indicator parameters

"emaPeriod" : 10, // EMA indicator parameters

"trackRatio" : 1, // upBand and downBand coefficients

"openRatio" : 0.1 // The reserved opening percentage, which is not supported for now

}, {

"symbol" : "swap",

"period" : 86400,

"stopLoss" : 0.07,

"atrPeriod" : 10,

"emaPeriod" : 10,

"trackRatio" : 1,

"openRatio" : 0.1

}]'

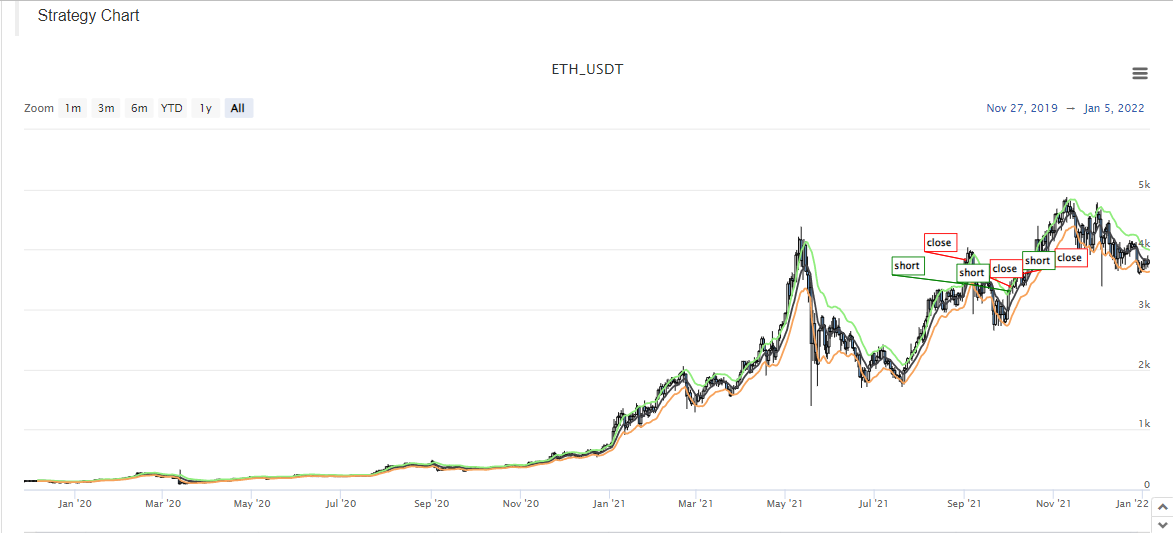

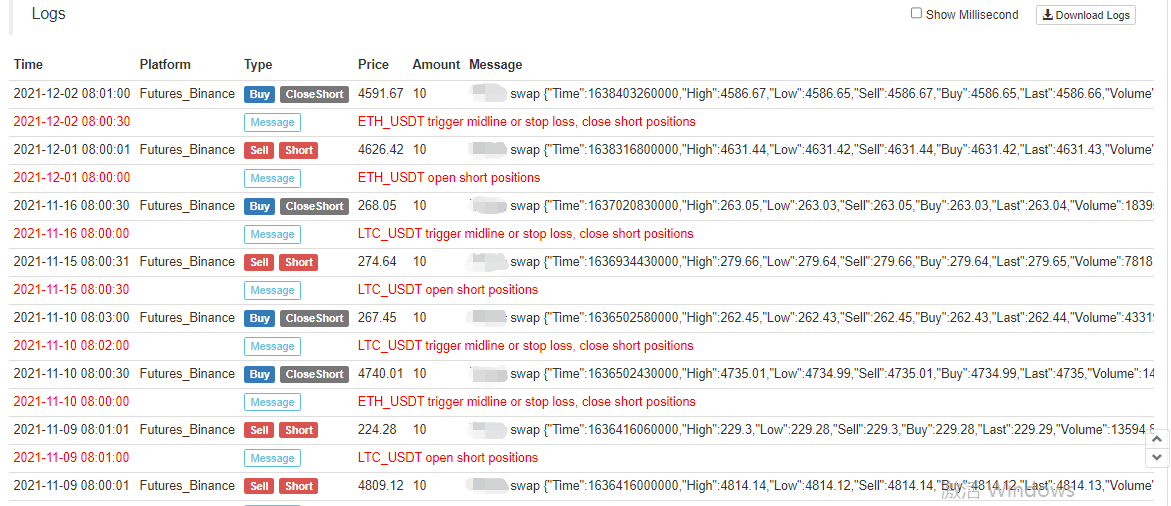

Screenshot dari backtest:

Kode sumber strategi:https://www.fmz.com/strategy/339344

Strategi hanya untuk backtesting dan belajar penelitian. Mohon modifikasi, optimalisasi, dan merujuk ke bot nyata sendiri.

- Pengantar ke Lead-Lag Arbitrage dalam Cryptocurrency (2)

- Penjelasan tentang suite Lead-Lag dalam mata uang digital (2)

- Pembahasan Penerimaan Sinyal Eksternal Platform FMZ: Solusi Lengkap untuk Penerimaan Sinyal dengan Layanan Http Terbina dalam Strategi

- FMZ platform eksplorasi penerimaan sinyal eksternal: strategi built-in https layanan solusi lengkap untuk penerimaan sinyal

- Pengantar ke Lead-Lag Arbitrage dalam Cryptocurrency (1)

- Penjelasan tentang suite Lead-Lag dalam mata uang digital (1)

- Diskusi tentang Penerimaan Sinyal Eksternal dari Platform FMZ: API Terluas VS Strategi Layanan HTTP Terintegrasi

- FMZ Platform Eksternal Signal Reception: Extension API vs Strategi Layanan HTTP Terbentuk

- Diskusi tentang Metode Pengujian Strategi Berdasarkan Generator Random Ticker

- Metode pengujian strategi berdasarkan generator pasar acak

- Fitur Baru FMZ Quant: Gunakan Fungsi _Serve untuk Membuat Layanan HTTP dengan Mudah

- Dapatkan 80 kali dalam 5 hari, kekuatan strategi frekuensi tinggi

- Penelitian dan Contoh pada Maker Spots dan Futures Hedging Strategy Design

- Membangun Basis Data Kuantitatif FMZ dengan SQLite

- Cara Menugaskan Data Versi Berbeda ke Strategi Sewa Melalui Metadata Kode Sewa Strategi

- Arbitrage Bunga Binance Perpetual Funding Rate (Pasar Bull Saat Ini Dianalisis 100%)

- Strategi Titik Peralihan Mata Uang Digital Futures Double-EMA (Tutorial)

- Mendaftar Strategi Saham Baru untuk Spot Mata Uang Digital (Tutorial)

- Menerapkan ide dengan 60 baris kode -- Strategi Penangkapan Ikan Bagian Bawah Kontrak

- Strategi EMA Ganda Multi-varietas Mata Uang Digital Spot (Tutorial)

- Desain Sistem Manajemen Sinkronisasi Pesenan Berdasarkan FMZ Quant (2)

- Menulis alat perdagangan semi-otomatis dengan menggunakan bahasa Pine

- Jelajahi Desain Strategi Frekuensi Tinggi dari Magic Change of LeeksReaper

- Analisis Strategi LeeksReaper (2)

- "Magic Double EMA Strategy" dari para Veteran YouTube

- Implementasi bahasa JavaScript dari indikator Fisher dan menggambar pada FMZ

- Contoh desain strategi dYdX

- Desain Sistem Manajemen Sinkronisasi Pesenan Berdasarkan FMZ Quant (1)

- Analisis Strategi LeeksReaper (1)

- Strategi Hedging Dinamis Opsi Deribit Delta

- Status terbaru dan operasi yang direkomendasikan dari strategi suku bunga pendanaan