Titik Pivot Supertrend

Penulis:ChaoZhang, Tanggal: 2022-05-17 15:45:37Tag:PivotATR

Halo semua,

Ada banyak jenis SuperTrend di sekitar. baru-baru ini saya berpikir tentang Supertrend berdasarkan Pivot Points kemudian saya menulis

Gagasan di balik skrip ini adalah menemukan titik pivot, menghitung rata-rata dari mereka dan seperti dalam supertrend menciptakan band yang lebih tinggi / lebih rendah oleh ATR. Seperti yang Anda lihat dalam algoritma skrip memberikan bobot ke titik pivot masa lalu, ini dilakukan untuk meluruskannya sedikit.

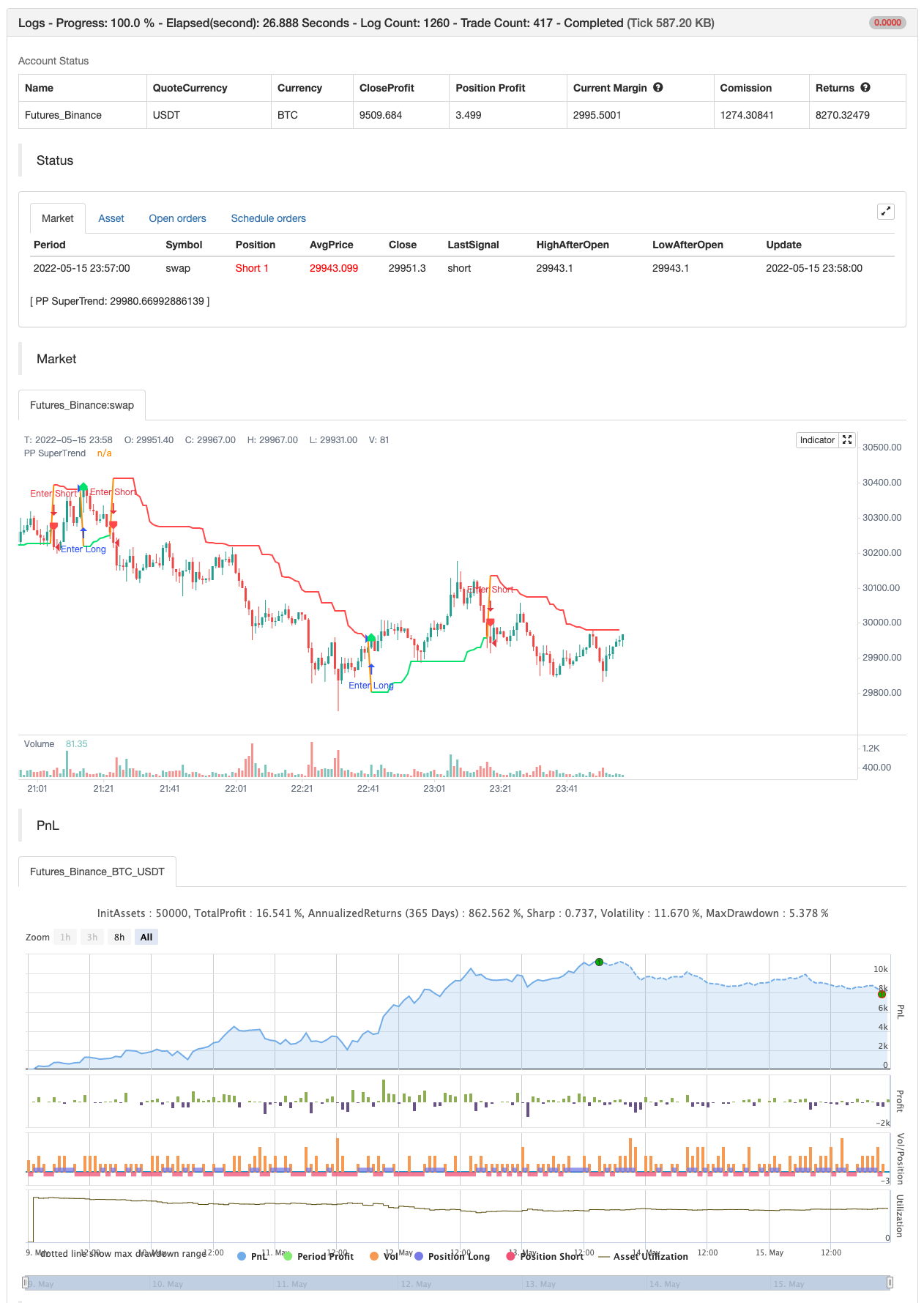

backtest

/*backtest

start: 2022-05-09 00:00:00

end: 2022-05-15 23:59:00

period: 1m

basePeriod: 1m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © LonesomeTheBlue

//@version=4

study("Pivot Point SuperTrend", overlay = true)

prd = input(defval = 3, title="Pivot Point Period", minval = 1, maxval = 50)

Factor=input(defval = 2, title = "ATR Factor", minval = 1, step = 0.1)

Pd=input(defval = 6, title = "ATR Period", minval=1)

showpivot = input(defval = false, title="Show Pivot Points")

showlabel = input(defval = true, title="Show Buy/Sell Labels")

showcl = input(defval = false, title="Show PP Center Line")

showsr = input(defval = false, title="Show Support/Resistance")

// get Pivot High/Low

float ph = pivothigh(prd, prd)

float pl = pivotlow(prd, prd)

// drawl Pivot Points if "showpivot" is enabled

plotshape(ph and showpivot, text="H", style=shape.labeldown, color=na, textcolor=color.red, location=location.abovebar, transp=0, offset = -prd)

plotshape(pl and showpivot, text="L", style=shape.labeldown, color=na, textcolor=color.lime, location=location.belowbar, transp=0, offset = -prd)

// calculate the Center line using pivot points

var float center = na

float lastpp = ph ? ph : pl ? pl : na

if lastpp

if na(center)

center := lastpp

else

//weighted calculation

center := (center * 2 + lastpp) / 3

// upper/lower bands calculation

Up = center - (Factor * atr(Pd))

Dn = center + (Factor * atr(Pd))

// get the trend

float TUp = na

float TDown = na

Trend = 0

TUp := close[1] > TUp[1] ? max(Up, TUp[1]) : Up

TDown := close[1] < TDown[1] ? min(Dn, TDown[1]) : Dn

Trend := close > TDown[1] ? 1: close < TUp[1]? -1: nz(Trend[1], 1)

Trailingsl = Trend == 1 ? TUp : TDown

// plot the trend

linecolor = Trend == 1 and nz(Trend[1]) == 1 ? color.lime : Trend == -1 and nz(Trend[1]) == -1 ? color.red : na

plot(Trailingsl, color = linecolor , linewidth = 2, title = "PP SuperTrend")

plot(showcl ? center : na, color = showcl ? center < hl2 ? color.blue : color.red : na)

// check and plot the signals

bsignal = Trend == 1 and Trend[1] == -1

ssignal = Trend == -1 and Trend[1] == 1

plotshape(bsignal and showlabel ? Trailingsl : na, title="Buy", text="Buy", location = location.absolute, style = shape.labelup, size = size.tiny, color = color.lime, textcolor = color.black, transp = 0)

plotshape(ssignal and showlabel ? Trailingsl : na, title="Sell", text="Sell", location = location.absolute, style = shape.labeldown, size = size.tiny, color = color.red, textcolor = color.white, transp = 0)

//get S/R levels using Pivot Points

float resistance = na

float support = na

support := pl ? pl : support[1]

resistance := ph ? ph : resistance[1]

// if enabled then show S/R levels

plot(showsr and support ? support : na, color = showsr and support ? color.lime : na, style = plot.style_circles, offset = -prd)

plot(showsr and resistance ? resistance : na, color = showsr and resistance ? color.red : na, style = plot.style_circles, offset = -prd)

// alerts

alertcondition(Trend == 1 and Trend[1] == -1, title='Buy Signal', message='Buy Signal')

alertcondition(Trend == -1 and Trend[1] == 1, title='Sell Signal', message='Sell Signal')

alertcondition(change(Trend), title='Trend Changed', message='Trend Changed')

if Trend == 1 and Trend[1] == -1

strategy.entry("Enter Long", strategy.long)

else if Trend == -1 and Trend[1] == 1

strategy.entry("Enter Short", strategy.short)

Artikel terkait

- Axis dukungan dan resistansi dinamis untuk menyesuaikan strategi perdagangan kuantitatif

- Villa Dinamic Pivot Supertrend Strategi

- Strategi perdagangan dalam kisaran fluktuasi berdasarkan indikator fluktuasi acak

- Strategi Pelacakan Tren Dinamis

- Strategi pengambilan dan manajemen posisi berdasarkan volatilitas

- SUPERTREND strategi stop loss multi-head trend tracker

- Progressi Fibonacci Dengan Jeda

- MillMachine

- Landelier Exit

- HalfTrend lebih kosong untuk melacak tren dan strategi pembelian stop loss

Informasi lebih lanjut

- Rasio energi arah berakselerasi volume RedK

- Donchian Breakout tidak ada cat ulang

- RedK Momentum Bars

- SuperJump Turn Back Bollinger Band

- Tren Fukuiz

- BOT Johny

- SSL hibrida

- Landelier Exit

- RISOTTO

- EMA Cloud Intraday Strategi

- Supertrend+4 bergerak

- ZigZag berdasarkan momentum

- VuManChu Cipher B + Divergences Strategi

- Konsep Dual SuperTrend

- Super Scalper

- Pengujian balik- Indikator

- Trendycious

- Pembunuh Sma BTC

- Cithakan Alerts ML

- Progressi Fibonacci Dengan Jeda