Strategi Stop Loss Dual Strong Trend Tracking

Penulis:ChaoZhang, Tanggal: 2023-11-16 15:50:54Tag:

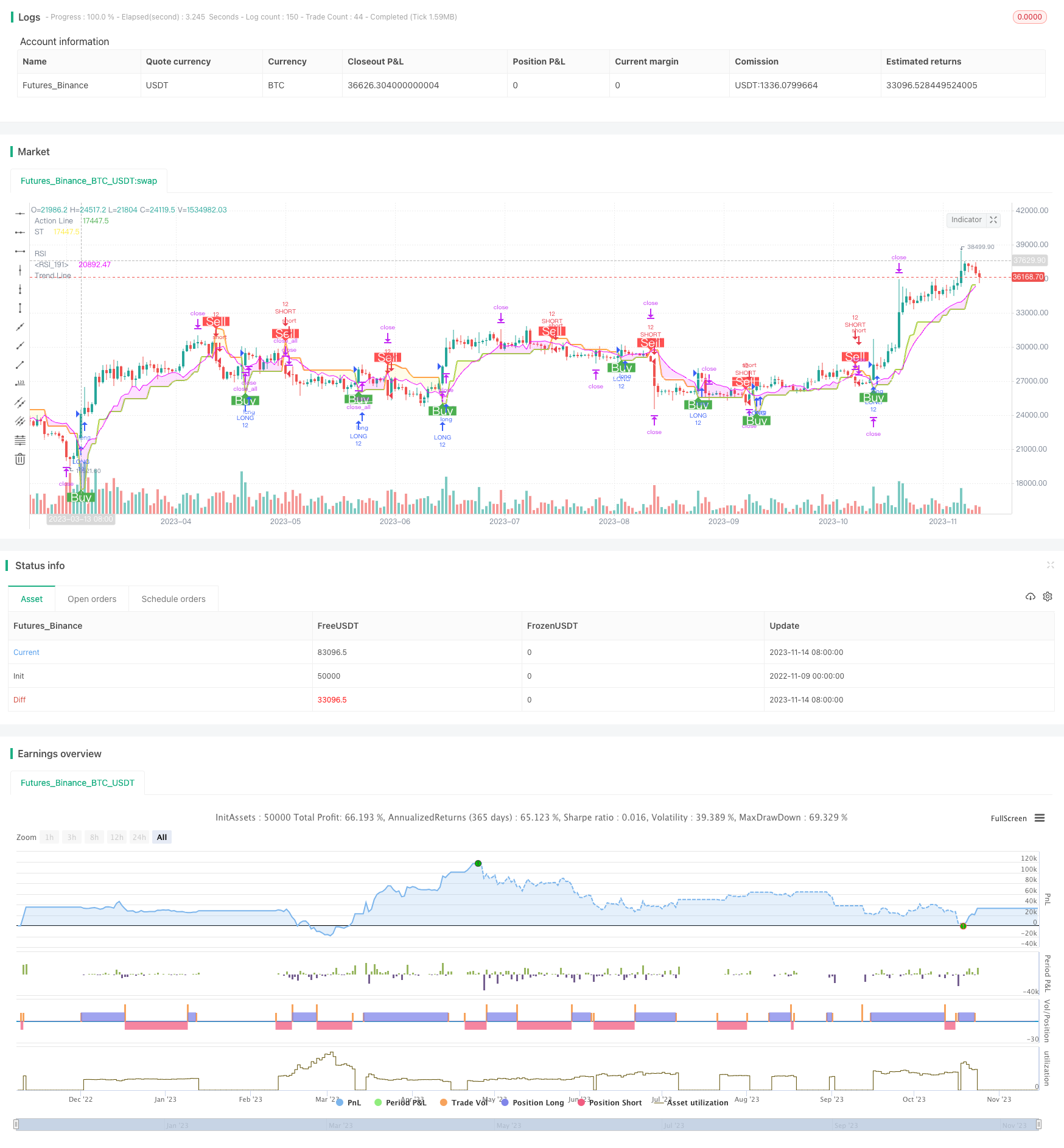

Gambaran umum

Strategi ini dirancang dengan mekanisme pelacakan tren ganda berdasarkan Supertrend dan Relative Strength Index untuk secara akurat menentukan tren pasar dan menetapkan titik stop loss dan take profit yang wajar. Strategi ini memiliki titik stop loss yang melacak pergerakan pasar, mengambil titik profit berdasarkan tren, dan penilaian tren ganda, yang dapat secara efektif mengendalikan risiko perdagangan individu dan mencapai pengembalian super kuat di pasar tren.

Logika Strategi

-

Menghitung Supertrend untuk menentukan arah tren utama. Supertrend dapat secara akurat menilai arah tren dan memberikan titik masuk yang ideal.

-

Menghitung Indeks Kekuatan Relatif (RSI) sebagai indikator tambahan untuk penilaian tren. RSI tinggi menunjukkan tren bullish di pasar bull. RSI rendah menunjukkan tren bearish di pasar bear.

-

Pergi panjang ketika harga penutupan melintasi di atas garis Supertrend, dan pergi pendek ketika harga penutupan melanggar di bawah garis Supertrend.

-

Setel stop loss dan take profit point secara wajar. Saat long, setel garis Supertrend sebagai stop loss, dan garis Supertrend ditambah profit wajar sebagai take profit. Saat short, setel garis Supertrend sebagai stop loss, dan garis Supertrend dikurangi profit wajar sebagai take profit.

-

Titik stop loss akan melayang sesuai dengan fluktuasi pasar. Saat pasar bergerak ke arah yang menguntungkan, garis stop loss akan bergerak ke arah yang menguntungkan untuk mengamankan keuntungan.

-

Hanya masukkan perdagangan ketika RSI sejajar dengan Supertrend, yang menunjukkan tren saat ini yang lebih kuat.

Analisis Keuntungan

-

Mekanisme penilaian tren ganda dapat mengurangi sinyal palsu dan meningkatkan stabilitas strategi.

-

Titik stop loss bergerak dengan tren untuk memaksimalkan profit locking dan menghindari stop loss prematur.

-

Aplikasi RSI menyaring beberapa sinyal perdagangan yang lemah.

-

Posisi keuntungan yang masuk akal memaksimalkan keuntungan.

-

Parameter strategi yang dapat disesuaikan dapat dioptimalkan untuk produk dan kondisi pasar yang berbeda.

-

Penarikan yang dapat dikontrol memberikan strategi kemampuan manajemen risiko yang kuat.

Analisis Risiko

-

Dalam kasus peristiwa angsa hitam seperti berita kebijakan penting, perubahan pasar yang besar dapat menghentikan posisi dan menyebabkan kerugian besar.

-

Pengaturan parameter yang tidak tepat dapat menyebabkan stop loss yang tidak wajar dan mengambil poin keuntungan, memperbesar kerugian atau mengecilkan keuntungan.

-

Perbedaan antara RSI dan Supertrend dapat menghasilkan sinyal palsu selama pasar yang terikat rentang. Hindari perdagangan dan tunggu tren yang jelas dalam kasus seperti itu.

Arahan Optimasi

-

Optimalkan parameter periode ATR untuk produk yang berbeda.

-

Mengoptimalkan pengaturan RSI untuk menemukan kondisi tren tambahan yang lebih stabil.

-

Menggabungkan indikator lain seperti Bollinger Bands dan KDJ untuk menetapkan aturan masuk dan keluar yang lebih tepat.

-

Uji strategi mengambil keuntungan yang berbeda seperti trailing stop, staggered profit taking, wick stop dll untuk meningkatkan profitabilitas.

-

Sesuaikan ukuran posisi berdasarkan hasil backtest untuk mengurangi risiko perdagangan tunggal.

Kesimpulan

Strategi ini menunjukkan stabilitas dan profitabilitas yang kuat secara keseluruhan. Penghakiman tren ganda menyaring kebisingan secara efektif dan strategi stop loss / profit taking mengunci keuntungan dan mengendalikan risiko. Optimalisasi terus-menerus parameter dan kondisi masuk / keluar akan memungkinkan kinerja yang baik di berbagai lingkungan pasar. Ini dapat berfungsi sebagai strategi templat yang sangat baik untuk perdagangan kuantitatif dan layak penelitian dan aplikasi yang mendalam.

/*backtest

start: 2022-11-09 00:00:00

end: 2023-11-15 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

//

// ▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒

// -----------------------------------------------------------------------------

// Copyright 2019 Mauricio Pimenta | exit490

// SuperTrend with Trailing Stop Loss script may be freely distributed under the MIT license.

//

// Permission is hereby granted, free of charge,

// to any person obtaining a copy of this software and associated documentation files (the "Software"),

// to deal in the Software without restriction, including without limitation the rights to use, copy, modify, merge,

// publish, distribute, sublicense, and/or sell copies of the Software, and to permit persons to whom the Software is furnished to do so,

// subject to the following conditions:

//

// The above copyright notice and this permission notice shall be included in all copies or substantial portions of the Software.

//

// THE SOFTWARE IS PROVIDED "AS IS", WITHOUT WARRANTY OF ANY KIND,

// EXPRESS OR IMPLIED, INCLUDING BUT NOT LIMITED TO THE WARRANTIES OF MERCHANTABILITY,

// FITNESS FOR A PARTICULAR PURPOSE AND NONINFRINGEMENT. IN NO EVENT SHALL THE AUTHORS OR COPYRIGHT HOLDERS BE LIABLE FOR ANY CLAIM,

// DAMAGES OR OTHER LIABILITY, WHETHER IN AN ACTION OF CONTRACT, TORT OR OTHERWISE, ARISING FROM,

// OUT OF OR IN CONNECTION WITH THE SOFTWARE OR THE USE OR OTHER DEALINGS IN THE SOFTWARE.

//

// -----------------------------------------------------------------------------

//

// Authors: @exit490

// Revision: v1.0.0

// Date: 5-Aug-2019

//

// Description

// ===========

// SuperTrend is a moving stop and reversal line based on the volatility (ATR).

// The strategy will ride up your stop loss when price moviment 1%.

// The strategy will close your operation when the market price crossed the stop loss.

// The strategy will close operation when the line based on the volatility will crossed

//

// The strategy has the following parameters:

//

// INITIAL STOP LOSS - Where can isert the value to first stop.

// POSITION TYPE - Where can to select trade position.

// ATR PERIOD - To select number of bars back to execute calculation

// ATR MULTPLIER - To add a multplier factor on volatility

// BACKTEST PERIOD - To select range.

//

// -----------------------------------------------------------------------------

// Disclaimer:

// 1. I am not licensed financial advisors or broker dealers. I do not tell you

// when or what to buy or sell. I developed this software which enables you

// execute manual or automated trades multplierFactoriplierFactoriple trades using TradingView. The

// software allows you to set the criteria you want for entering and exiting

// trades.

// 2. Do not trade with money you cannot afford to lose.

// 3. I do not guarantee consistent profits or that anyone can make money with no

// effort. And I am not selling the holy grail.

// 4. Every system can have winning and losing streaks.

// 5. Money management plays a large role in the results of your trading. For

// example: lot size, account size, broker leverage, and broker margin call

// rules all have an effect on results. Also, your Take Profit and Stop Loss

// settings for individual pair trades and for overall account equity have a

// major impact on results. If you are new to trading and do not understand

// these items, then I recommend you seek education materials to further your

// knowledge.

//

// YOU NEED TO FIND AND USE THE TRADING SYSTEM THAT WORKS BEST FOR YOU AND YOUR

// TRADING TOLERANCE.

//

// I HAVE PROVIDED NOTHING MORE THAN A TOOL WITH OPTIONS FOR YOU TO TRADE WITH THIS PROGRAM ON TRADINGVIEW.

//

// I accept suggestions to improve the script.

// If you encounter any problems I will be happy to share with me.

// -----------------------------------------------------------------------------

//

// ▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒ //

strategy(title='DEO SESSSION', shorttitle='DEO S', overlay=true, precision=8, calc_on_order_fills=true, calc_on_every_tick=true, backtest_fill_limits_assumption=0, default_qty_type=strategy.percent_of_equity, default_qty_value=100, initial_capital=1000, currency=currency.USD, linktoseries=true)

//

// ▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒ //

// === BACKTEST RANGE ===

backTestSectionFrom = input(title='════════════ FROM ════════════', defval=true)

// selected dates

i_startTime = input(title="START FILTER", defval=timestamp("02 Jan 2023 00:00 +0000"), group="RISK MANAGEMENT", tooltip="Start date & time to begin searching for setups")

i_endTime = input(title="END FILTER", defval=timestamp("12 Dec 2100 00:00 +0000"), group="RISK MANAGEMENT", tooltip="End date & time to stop searching for setups")

afterStartDate = true

//

// ▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒ //

parameterSection = input(title='══════════ STRATEGY ══════════', defval=true)

// === INPUT TO SELECT POSITION ===

positionType = input.string(defval='LONG', title='Position Type', options=['LONG', 'SHORT'])

// === INPUT TO SELECT INITIAL STOP LOSS

initialStopLossPercent = input.float(defval=3.0, minval=0.0, title='Initial Stop Loss')

// === INPUT TO SELECT BARS BACK

barsBack = input(title='ATR Period', defval=1)

// === INPUT TO SELECT MULTPLIER FACTOR

multplierFactor = input.float(title='ATR multplierFactoriplier', step=0.1, defval=3.0)

RSI = input.int(title='RSI', defval=7, minval=1, maxval=100)

calcSection = input(title='══════════ LOT CALC ══════════', defval=true)

accountBalance = input.float(title="ACCOUNT BALANCE", defval=250000, minval=1, group="INPUTS")

entryPrice = input.float(title="ENTRY PRICE", defval=100, minval=1, group="INPUTS")

slPrice = input.float(title="STOP LOSS PRICE", defval=100, minval=1, group="INPUTS")

riskPer = input.float(title="RISK USD", defval=1, minval=0.1, group="INPUTS")

lotSize = input.float(title="LOT SIZE", defval=10, minval=0.1, group="INPUTS")

RiskSize = riskPer

qtyLongTargetPrice = math.abs((RiskSize / ((entryPrice - slPrice) * syminfo.pointvalue)) / lotSize)

trendcSection = input(title='══════════ TREND LINE ══════════', defval=true)

// ema trend

tLen = input.int(200, minval=1, title="Trend Line")

tSrc = input(close, title="Source")

thisEma = ta.ema(tSrc, tLen)

plot(thisEma, title = "Trend Line",color=#ffffff)

MTSection = input(title='══════════ MT LOGIN ══════════', defval=true)

exchange = input.string(defval='MT5', title='EXCHANGE', options=['MT4', 'MT5'])

mtLogin= input.string(defval="", title='MT LOGIN', group = "mt")

mtPassword =input.string(defval='', title='MT PASSWORD', group = "mt")

mtServer =input.string(defval='', title='MT SERVER', group = "mt")

mtIsOn = input.string(defval='ON', title='STRATEGY ON', options=['ON', 'OFF'])

mtEntryMode = input.string(defval='CLOSE OPEN', title='ENTRY MODE', options=['CLOSE OPEN', 'OPEN'])

displaySection = input(title='══════════ DISPLAY LOGIN ══════════', defval=true)

displayTable = input(title="DISPLAY TABLE", defval=false, group = 'PRODUCTION', tooltip = "MAKES YOUR STRATEGY TRIGGER SLOWER")

//

// ▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒ //

// LOGIC TO FIND DIRECTION WHEN THERE IS TREND CHANGE ACCORDING VOLATILITY

atr = multplierFactor * ta.atr(barsBack)

longStop = hl2 - atr

longStopPrev = nz(longStop[1], longStop)

longStop := close[1] > longStopPrev ? math.max(longStop, longStopPrev) : longStop

shortStop = hl2 + atr

shortStopPrev = nz(shortStop[1], shortStop)

shortStop := close[1] < shortStopPrev ? math.min(shortStop, shortStopPrev) : shortStop

direction = 1

direction := nz(direction[1], direction)

direction := direction == -1 and close > shortStopPrev ? 1 : direction == 1 and close < longStopPrev ? -1 : direction

longColor = color.blue

shortColor = color.blue

var valueToPlot = 0.0

var colorToPlot = color.white

if direction == 1

valueToPlot := longStop

colorToPlot := color.green

colorToPlot

else

valueToPlot := shortStop

colorToPlot := color.red

colorToPlot

//RSI

src = close

ep = 2 * RSI - 1

auc = ta.ema(math.max(src - src[1], 0), ep)

adc = ta.ema(math.max(src[1] - src, 0), ep)

x1 = (RSI - 1) * (adc * 70 / (100 - 70) - auc)

ub = x1 >= 0 ? src + x1 : src + x1 * (100 - 70) / 70

x2 = (RSI - 1) * (adc * 30 / (100 - 30) - auc)

lb = x2 >= 0 ? src + x2 : src + x2 * (100 - 30) / 30

//Affichage

plot(math.avg(ub, lb), color=color.white ,linewidth=1, title='RSI')

plot(valueToPlot == 0.0 ? na : valueToPlot, title='Action Line', linewidth=2, color=color.new(colorToPlot, 0))

plotshape(direction == 1 and direction[1] == -1 ? longStop : na, title='Buy', style=shape.labelup, location=location.absolute, size=size.normal, text='Buy', textcolor=color.new(color.white, 0), color=color.new(color.green, 0))

plotshape(direction == -1 and direction[1] == 1 ? shortStop : na, title='Sell', style=shape.labeldown, location=location.absolute, size=size.normal, text='Sell', textcolor=color.new(color.white, 0), color=color.new(color.red, 0))

p_ma1 = plot(valueToPlot, title = "ST", color = color.rgb(255, 236, 66))

p_ma2 = plot(math.avg(ub, lb), title = "RSI", color = color.rgb(234, 0, 255))

// Definitions: Trends

TrendUp1() =>

valueToPlot > math.avg(ub, lb)

TrendDown1() =>

valueToPlot < math.avg(ub, lb)

trendColor1 = TrendUp1() ? color.rgb(255, 236, 66, 85): TrendDown1() ? color.rgb(234, 0, 255, 85) : color.rgb(255, 255, 255, 85)

fill(p_ma1, p_ma2, color=trendColor1)

longCondition () =>

ta.crossover(close, valueToPlot)

shortCondition () =>

ta.crossunder(close, valueToPlot)

IsLongShort() =>

strategy.position_size != 0

getNewLotSize() =>

math.abs(riskPer / (close - valueToPlot))

// plot(getNewLotSize(), "new lot size")

newLotS = getNewLotSize()

alertManagement = str.tostring(exchange) + "," + str.tostring(mtLogin) + "," +str.tostring(mtPassword) + ","

alertManagement += str.tostring(mtServer) + "," + str.tostring(newLotS)

// alertManagement += str.tostring(stopLoss) + "," + str.tostring(applyingSL) + "," + str.tostring(applyTrailingStop) + ","

// alertManagement += str.tostring(exchange) + "," + str.tostring(exchangeAccount) + "," + str.tostring(slAmount) + "," + str.tostring(closeTpAmount) + ","

// alertManagement += str.tostring(exchangeLeverage) + "," + str.tostring(exchangeLeverageType) + ","

// alertManagement += str.tostring(mtLogin) + "," + str.tostring(mtPassword) + "," + str.tostring(mtServer) + "," + str.tostring(mtLot) + ","

// alertManagement += str.tostring(mtTp) + "," + str.tostring(mtTs) + "," + str.tostring(orderStrategy)

// alertManagement = "alertManagement"

myStop = 0.0

myTarget = 0.0

if (longCondition())

qtyLongTargetPrice := math.abs((RiskSize / ((close - valueToPlot) * syminfo.pointvalue)) / lotSize)

if IsLongShort()

strategy.close_all(comment = "close all entries")

strategy.entry("LONG", strategy.long, qty=12, comment="LONG", alert_message=alertManagement)

strategy.exit("TPL", "LONG", stop=valueToPlot, limit= close + (close - valueToPlot), comment="Target", alert_message=alertManagement)

if (shortCondition())

qtyLongTargetPrice := math.abs((RiskSize / ((close - valueToPlot) * syminfo.pointvalue)) / lotSize)

if IsLongShort()

strategy.close_all(comment = "close all entries")

strategy.entry("SHORT", strategy.short, qty=12, comment="SHORT", alert_message=alertManagement)

strategy.exit("TPS", "SHORT", stop=valueToPlot, limit= close + (close - valueToPlot), comment="Target", alert_message=alertManagement)

// Calculate the average profit per open trade

// avgProfit = profitSum / strategy.opentrades

getTotalProfit()=>

// Sum the profit of all open trades

profitSum = 0.0

for tradeNumber = 0 to strategy.closedtrades - 1

if strategy.closedtrades.profit(tradeNumber) > 0

profitSum += strategy.closedtrades.profit(tradeNumber)

result = profitSum

getTotalLoss()=>

// Sum the profit of all open trades

lossSum = 0.0

for tradeNumber = 0 to strategy.closedtrades - 1

if strategy.closedtrades.profit(tradeNumber) < 0

lossSum += strategy.closedtrades.profit(tradeNumber)

result = lossSum

maxLossRun()=>

lossRun = 0.0

currentMaxLoss = 0.0

for tradeNo = 0 to strategy.closedtrades - 1

if strategy.closedtrades.profit(tradeNo) < 0.0

lossRun += strategy.closedtrades.profit(tradeNo)

else

currentMaxLoss := math.min(currentMaxLoss, lossRun)

lossRun := 0.0

result = currentMaxLoss

TotalTrades() =>

strategy.closedtrades + strategy.opentrades

maxDrawDown() =>

maxDrawdown = 0.0

for tradeNo = 0 to strategy.closedtrades - 1

maxDrawdown := math.max(maxDrawdown, strategy.closedtrades.max_drawdown(tradeNo))

result = maxDrawdown

maxRunUp() =>

maxRunup = 0.0

for tradeNo = 0 to strategy.closedtrades - 1

maxRunup := math.max(maxRunup, strategy.closedtrades.max_runup(tradeNo))

result = maxRunup

tradeMaxLossReached() =>

maxLoss = 0.0

for tradeNo = 0 to strategy.closedtrades - 1

maxLoss := math.min(maxLoss, strategy.closedtrades.profit(tradeNo))

result = maxLoss

tradingStartTime() =>

strategy.closedtrades.entry_time(0)

daysBetween(t1, t2) => (t1 - t2) / 86400000

// Table

var InfoPanel = table.new(position = position.bottom_right, columns = 2, rows = 40, border_width = 1)

ftable(_table_id, _column, _row, _text, _bgcolor) =>

table.cell(_table_id, _column, _row, _text, 0, 0, color.black, text.align_right, text.align_center, size.small, _bgcolor)

tfString(int timeInMs) =>

// @function Produces a string corresponding to the input time in days, hours, and minutes.

// @param (series int) A time value in milliseconds to be converted to a string variable.

// @returns (string) A string variable reflecting the amount of time from the input time.

float s = timeInMs / 100000

float m = s / 60

float h = m / 60

float d = h / 24

float mo = d / 30.416

int tm = math.floor(m % 60)

int tr = math.floor(h % 24)

int td = math.floor(d % 30.416)

int tmo = math.floor(mo % 12)

int ys = math.floor(d / 365)

string result =

switch

d == 30 and tr == 10 and tm == 30 => "1M"

d == 7 and tr == 0 and tm == 0 => "1W"

=>

string yStr = ys ? str.tostring(ys) + "Y " : ""

string moStr = tmo ? str.tostring(tmo) + "M " : ""

string dStr = td ? str.tostring(td) + "D " : ""

string hStr = tr ? str.tostring(tr) + "H " : ""

string mStr = tm ? str.tostring(tm) + "min" : ""

yStr + moStr + dStr + hStr + mStr

if displayTable

maxLossRunInMarket= maxLossRun()

maxLossReached = tradeMaxLossReached()

tradeMaxLossReached = tradeMaxLossReached()

tradingInDays=daysBetween(time, tradingStartTime())

totalTrades=TotalTrades()

- Strategi perdagangan jaringan tetap

- Indeks Kekuatan Relatif Strategi Long/Short

- Dual Momentum Breakout Strategi

- Strategi perdagangan reversi rata-rata berdasarkan Bollinger Bands dan Golden Ratio

- Tren momentum mengikuti strategi osilasi

- WaveTrend dan CMF Berbasis Tren Mengikuti Strategi

- Adaptive Bollinger Trend Tracking Strategy (Strategi Pelacakan Tren Bollinger yang Adaptif)

- Strategi Crossover Rata-rata Gerak RSI Multi-Timeframe

- Strategi Trend Breakout Berdasarkan Bollinger Bands

- Adaptive Regularized Moving Average Cross-Market Arbitrage Strategy (Strategi Arbitrage lintas pasar rata-rata bergerak adaptif)

- Strategi Indikator Momentum

- Strategi Kebalikan Heikin-Ashi

- Strategi Penembusan Osilasi Dinamis

- Tren Mengikuti Strategi Crossover EMA 5 Menit

- Trend RSI Mengikuti Strategi

- Strategi Divergensi RSI

- Strategi Perdagangan DCA Berimbang Secara bertahap yang Kuantit

- Penyimpangan rata-rata bergerak ganda dikombinasikan dengan tren indikator ATR Mengikuti strategi

- Strategi Multi Trend

- Strategi harga break-even