Strategi Indikator Teknis Bollinger Bands Berdasarkan Dekomposisi Deret Waktu dan Pembobotan Volume

Ringkasan

Strategi ini menggabungkan 4 indikator teknis, yaitu time series decomposition, volume order weighted average price, Brinband, dan delta (OBV-PVT) untuk menghasilkan penilaian multidimensi tentang tren harga, overbought dan oversold.

Prinsip Strategi

- Menggunakan pemisahan urutan waktu untuk menghilangkan kebisingan dan periodikitas dalam harga, dan mendapatkan penilaian tren yang lebih akurat;

- Berdasarkan garis tren ini, harga baru yang ditimbang dengan volume transaksi dihitung.

- Perhitungan harga penutupan dengan persentase lebar pita Brin BB% B untuk menilai overbought dan oversold;

- Perhitungan persentase lebar pita Brin dari delta varian OBV-PVT sebagai kriteria deviasi dari nilai kuantitatif;

- Sinyal perdagangan dihasilkan berdasarkan crossover multi-halus dari indikator harga-kuantitatif dan override-retraction dari indikator Bollinger Bands.

Analisis Keunggulan

- Strategi yang kuat, dengan berbagai penilaian harga, volume, dan karakteristik statistik;

- BB%B dan Delta ((OBV-PVT) digabungkan untuk lebih mengevaluasi overbought dan oversold dalam jangka pendek;

- Sinyal silang kuantitatif memfilter beberapa titik perdagangan yang berisik.

Analisis risiko

- Pengaturan parameter terlalu rumit dan tidak mudah disesuaikan;

- Gempa berkekuatan 7,2 SR yang melanda wilayah Indonesia pada tahun 2011 menyebabkan kerusakan yang sangat besar.

- Perbedaan harga tidak dapat sepenuhnya menyaring sinyal yang salah.

Strategi dapat dioptimalkan dengan mengadaptasi siklus rata-rata, amplitudo Brin dan rasio risiko-keuntungan, mengurangi frekuensi perdagangan dan meningkatkan rasio keuntungan per transaksi.

Meringkaskan

Strategi ini menggunakan berbagai alat analisis seperti penguraian urutan waktu, indikator Brin, indikator OBV, dan lain-lain. Dengan kombinasi organik dari hubungan kuantitatif, karakteristik statistik, dan penilaian tren, pengidentifikasian resonansi jangka pendek dapat secara efektif menangkap tren utama pasar. Namun, ada juga risiko tertentu yang perlu disesuaikan dengan parameter untuk mencapai kondisi optimal.

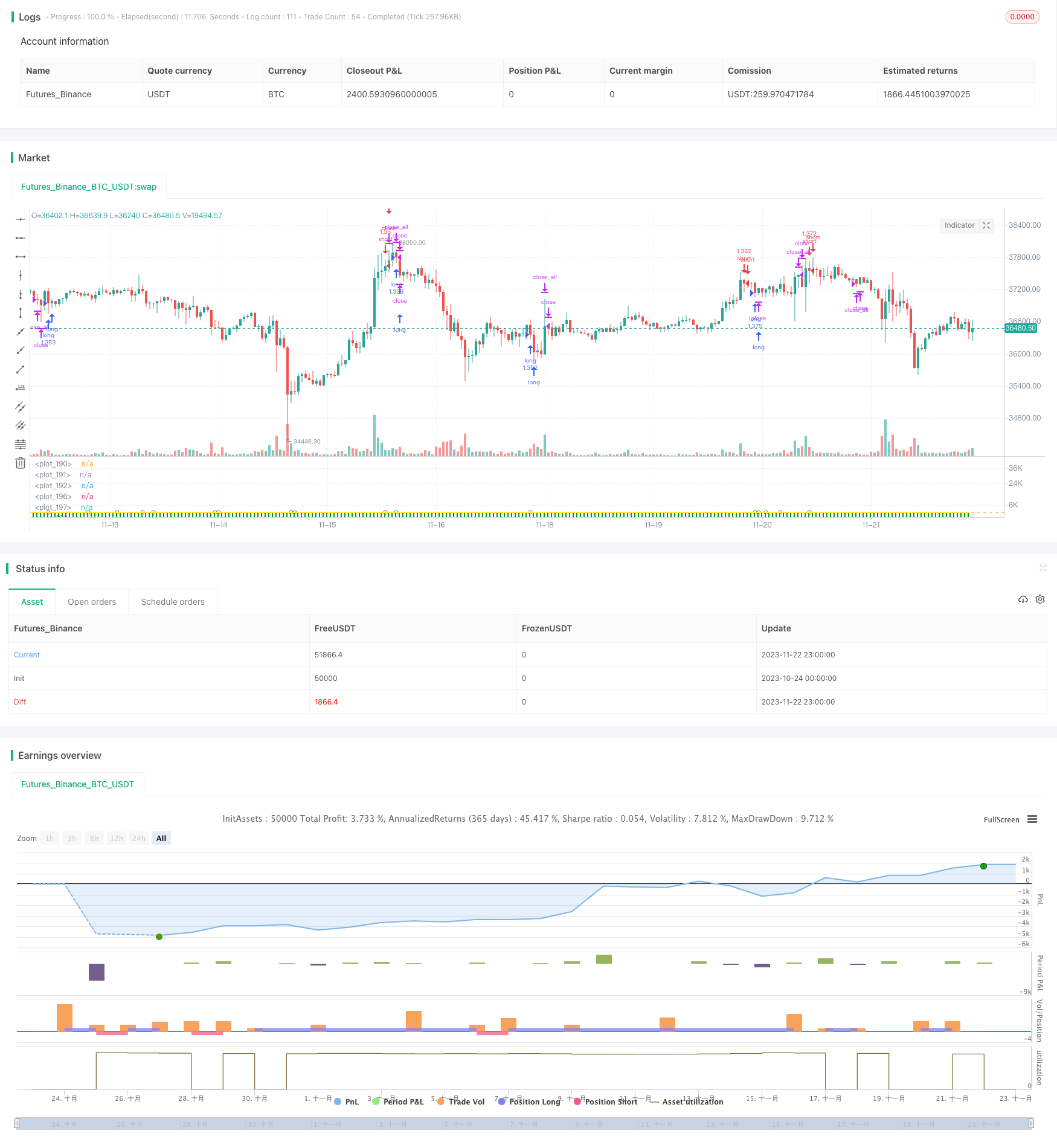

/*backtest

start: 2023-10-24 00:00:00

end: 2023-11-23 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

//// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © oakwhiz and tathal

//@version=4

strategy("BBPBΔ(OBV-PVT)BB", default_qty_type=strategy.percent_of_equity, default_qty_value=100)

startDate = input(title="Start Date", type=input.integer,

defval=1, minval=1, maxval=31)

startMonth = input(title="Start Month", type=input.integer,

defval=1, minval=1, maxval=12)

startYear = input(title="Start Year", type=input.integer,

defval=2010, minval=1800, maxval=2100)

endDate = input(title="End Date", type=input.integer,

defval=31, minval=1, maxval=31)

endMonth = input(title="End Month", type=input.integer,

defval=12, minval=1, maxval=12)

endYear = input(title="End Year", type=input.integer,

defval=2021, minval=1800, maxval=2100)

// Normalize Function

normalize(_src, _min, _max) =>

// Normalizes series with unknown min/max using historical min/max.

// _src : series to rescale.

// _min, _min: min/max values of rescaled series.

var _historicMin = 10e10

var _historicMax = -10e10

_historicMin := min(nz(_src, _historicMin), _historicMin)

_historicMax := max(nz(_src, _historicMax), _historicMax)

_min + (_max - _min) * (_src - _historicMin) / max(_historicMax - _historicMin, 10e-10)

// STEP 2:

// Look if the close time of the current bar

// falls inside the date range

inDateRange = true

// Stop loss & Take Profit Section

sl_inp = input(2.0, title='Stop Loss %')/100

tp_inp = input(4.0, title='Take Profit %')/100

stop_level = strategy.position_avg_price * (1 - sl_inp)

take_level = strategy.position_avg_price * (1 + tp_inp)

icreturn = false

innercandle = if (high < high[1]) and (low > low[1])

icreturn := true

src = close

float change_src = change(src)

float i_obv = cum(change_src > 0 ? volume : change_src < 0 ? -volume : 0*volume)

float i_pvt = pvt

float result = change(i_obv - i_pvt)

float nresult = ema(normalize(result, -1, 1), 20)

length = input(20, minval=1)

mult = input(2.0, minval=0.001, maxval=50, title="StdDev")

basis = ema(nresult, length)

dev = mult * stdev(nresult, length)

upper = basis + dev

lower = basis - dev

bbr = (nresult - lower)/(upper - lower)

////////////////INPUTS///////////////////

lambda = input(defval = 1000, type = input.float, title = "Smoothing Factor (Lambda)", minval = 1)

leng = input(defval = 100, type = input.integer, title = "Filter Length", minval = 1)

srcc = close

///////////Construct Arrays///////////////

a = array.new_float(leng, 0.0)

b = array.new_float(leng, 0.0)

c = array.new_float(leng, 0.0)

d = array.new_float(leng, 0.0)

e = array.new_float(leng, 0.0)

f = array.new_float(leng, 0.0)

/////////Initialize the Values///////////

//for more details visit:

// https://asmquantmacro.com/2015/06/25/hodrick-prescott-filter-in-excel/

ll1 = leng-1

ll2 = leng-2

for i = 0 to ll1

array.set(a,i, lambda*(-4))

array.set(b,i, src[i])

array.set(c,i, lambda*(-4))

array.set(d,i, lambda*6 + 1)

array.set(e,i, lambda)

array.set(f,i, lambda)

array.set(d, 0, lambda + 1.0)

array.set(d, ll1, lambda + 1.0)

array.set(d, 1, lambda * 5.0 + 1.0)

array.set(d, ll2, lambda * 5.0 + 1.0)

array.set(c, 0 , lambda * (-2.0))

array.set(c, ll2, lambda * (-2.0))

array.set(a, 0 , lambda * (-2.0))

array.set(a, ll2, lambda * (-2.0))

//////////////Solve the optimization issue/////////////////////

float r = array.get(a, 0)

float s = array.get(a, 1)

float t = array.get(e, 0)

float xmult = 0.0

for i = 1 to ll2

xmult := r / array.get(d, i-1)

array.set(d, i, array.get(d, i) - xmult * array.get(c, i-1))

array.set(c, i, array.get(c, i) - xmult * array.get(f, i-1))

array.set(b, i, array.get(b, i) - xmult * array.get(b, i-1))

xmult := t / array.get(d, i-1)

r := s - xmult*array.get(c, i-1)

array.set(d, i+1, array.get(d, i+1) - xmult * array.get(f, i-1))

array.set(b, i+1, array.get(b, i+1) - xmult * array.get(b, i-1))

s := array.get(a, i+1)

t := array.get(e, i)

xmult := r / array.get(d, ll2)

array.set(d, ll1, array.get(d, ll1) - xmult * array.get(c, ll2))

x = array.new_float(leng, 0)

array.set(x, ll1, (array.get(b, ll1) - xmult * array.get(b, ll2)) / array.get(d, ll1))

array.set(x, ll2, (array.get(b, ll2) - array.get(c, ll2) * array.get(x, ll1)) / array.get(d, ll2))

for j = 0 to leng-3

i = leng-3 - j

array.set(x, i, (array.get(b,i) - array.get(f,i)*array.get(x,i+2) - array.get(c,i)*array.get(x,i+1)) / array.get(d, i))

//////////////Construct the output///////////////////

o5 = array.get(x,0)

////////////////////Plottingd///////////////////////

TimeFrame = input('1', type=input.resolution)

start = security(syminfo.tickerid, TimeFrame, time)

//------------------------------------------------

newSession = iff(change(start), 1, 0)

//------------------------------------------------

vwapsum = 0.0

vwapsum := iff(newSession, o5*volume, vwapsum[1]+o5*volume)

volumesum = 0.0

volumesum := iff(newSession, volume, volumesum[1]+volume)

v2sum = 0.0

v2sum := iff(newSession, volume*o5*o5, v2sum[1]+volume*o5*o5)

myvwap = vwapsum/volumesum

dev2 = sqrt(max(v2sum/volumesum - myvwap*myvwap, 0))

Coloring=close>myvwap?color.green:color.red

av=myvwap

showBcol = input(false, type=input.bool, title="Show barcolors")

showPrevVWAP = input(false, type=input.bool, title="Show previous VWAP close")

prevwap = 0.0

prevwap := iff(newSession, myvwap[1], prevwap[1])

nprevwap= normalize(prevwap, 0, 1)

l1= input(20, minval=1)

src2 = close

mult1 = input(2.0, minval=0.001, maxval=50, title="StdDev")

basis1 = sma(src2, l1)

dev1 = mult1 * stdev(src2, l1)

upper1 = basis1 + dev1

lower1 = basis1 - dev1

bbr1 = (src - lower1)/(upper1 - lower1)

az = plot(bbr, "Δ(OBV-PVT)", color.rgb(0,153,0,0), style=plot.style_columns)

bz = plot(bbr1, "BB%B", color.rgb(0,125,125,50), style=plot.style_columns)

fill(az, bz, color=color.white)

deltabbr = bbr1 - bbr

oneline = hline(1)

twoline = hline(1.2)

zline = hline(0)

xx = input(.3)

yy = input(.7)

zz = input(-1)

xxx = hline(xx)

yyy = hline(yy)

zzz = hline(zz)

fill(oneline, twoline, color=color.red, title="Sell Zone")

fill(yyy, oneline, color=color.orange, title="Slightly Overbought")

fill(yyy, zline, color=color.white, title="DO NOTHING ZONE")

fill(zzz, zline, color=color.green, title="GO LONG ZONE")

l20 = crossover(deltabbr, 0)

l30 = crossunder(deltabbr, 0)

l40 = crossover(o5, 0)

l50 = crossunder(o5, 0)

z1 = bbr1 >= 1

z2 = bbr1 < 1 and bbr1 >= .7

z3 = bbr1 < .7 and bbr1 >= .3

z4 = bbr1 < .3 and bbr1 >= 0

z5 = bbr1 < 0

a1 = bbr >= 1

a2 = bbr < 1 and bbr >= .7

a4 = bbr < .3 and bbr >= 0

a5 = bbr < 0

b4 = deltabbr < .3 and deltabbr >= 0

b5 = deltabbr < 0

c4 = o5 < .3 and o5 >= 0

c5 = o5 < 0

b1 = deltabbr >= 1

b2 = deltabbr < 1 and o5 >= .7

c1 = o5 >= 1

c2 = o5 < 1 and o5 >= .7

///

n = input(16,"Period")

H = highest(hl2,n)

L = lowest(hl2,n)

hi = H[1]

lo = L[1]

up = high>hi

dn = low<lo

lowerbbh = lowest(10)[1]

bbh = (low == open ? open < lowerbbh ? open < close ? close > ((high[1] - low[1]) / 2) + low[1] :na : na : na)

plot(normalize(av,-1,1), linewidth=2, title="Trendline", color=color.yellow)

long5 = close < av and av[0] > av[1]

sell5 = close > av

cancel = false

if open >= high[1]

cancel = true

long = (long5 or z5 or a5) and (icreturn or bbh or up)

sell = ((z1 or a1) or (l40 and l20)) and (icreturn or dn) and (c1 or b1)

short = ((z1 or z2 or a1 or sell5) and (l40 or l20)) and icreturn

buy= (z5 or z4 or a5 or long5) and (icreturn or dn)

plotshape(long and not sell ? -0.5 : na, title="Long", location=location.absolute, style=shape.circle, size=size.tiny, color=color.green, transp=0)

plotshape(short and not sell? 1 : na, title="Short", location=location.absolute, style=shape.circle, size=size.tiny, color=color.red, transp=0)

if (inDateRange)

strategy.entry("long", true, when = long )

if (inDateRange) and (strategy.position_size > 0)

strategy.close_all(when = sell or cancel)

if (inDateRange)

strategy.entry("short", false, when = short )

if (inDateRange) and (strategy.position_size < 0)

strategy.close_all(when = buy)