Strategi perdagangan lampu lalu lintas berdasarkan EMA

Penulis:ChaoZhang, Tanggal: 2023-11-24 15:46:48Tag:

Gambaran umum

Strategi ini menggunakan 4 garis EMA dari periode yang berbeda untuk menghasilkan sinyal perdagangan berdasarkan urutan pengaturan mereka, mirip dengan lampu lalu lintas merah, kuning dan hijau.

Prinsip Strategi

-

Atur 3 garis EMA cepat (8 periode), menengah (14 periode) dan lambat (16 periode), ditambah 1 garis EMA jangka panjang (100 periode) sebagai filter.

-

Tentukan peluang panjang dan pendek berdasarkan urutan 3 garis EMA dan persilangan mereka dengan filter:

-

Ketika jalur cepat melintasi garis menengah atau jalur menengah melintasi garis lambat, itu ditentukan sebagai sinyal panjang.

-

Ketika garis menengah melintasi di bawah garis cepat, itu ditentukan sebagai sinyal dekat panjang.

-

Ketika jalur cepat melintasi di bawah jalur menengah atau jalur menengah melintasi di bawah jalur lambat, itu ditentukan sebagai sinyal pendek.

-

Ketika garis medium melintasi garis cepat, itu ditentukan sebagai sinyal dekat pendek.

- Menghakimi arah tren dan kekuatan melalui urutan dari 3 garis EMA, dikombinasikan dengan persilangan antara garis EMA dan filter untuk menentukan titik pembalikan, yang secara organik menggabungkan tren mengikuti dan pembalikan perdagangan.

Analisis Keuntungan

Strategi ini mengintegrasikan keuntungan dari kedua tren mengikuti dan pembalikan perdagangan, yang dapat memanfaatkan peluang pasar dengan baik.

- Menggunakan beberapa garis EMA membuat penilaian lebih kuat dan mengurangi sinyal palsu.

- Pengaturan yang fleksibel untuk kondisi panjang dan pendek menghindari kesempatan perdagangan yang hilang.

- Kombinasi garis EMA jangka panjang dan jangka pendek membuat penilaian yang komprehensif.

- Mengambil keuntungan yang dapat disesuaikan dan stop loss memungkinkan kontrol risiko yang lebih baik.

Melalui optimasi parameter, strategi ini dapat beradaptasi dengan lebih banyak produk dan telah menunjukkan profitabilitas dan stabilitas yang kuat dalam backtest.

Analisis Risiko

Risiko utama dari strategi ini terletak pada:

- Ketika urutan dari beberapa garis EMA menjadi berantakan, itu meningkatkan kesulitan dalam penilaian dan menyebabkan keraguan dalam perdagangan.

- Ini tidak dapat secara efektif menyaring sinyal palsu dari fluktuasi pasar yang tidak normal, yang dapat menyebabkan kerugian dalam volatilitas yang signifikan.

- Pengaturan parameter yang tidak tepat dapat mengakibatkan kriteria stop profit/loss yang terlalu santai atau terlalu ketat, yang menyebabkan hilangnya keuntungan atau kelebihan kerugian.

Disarankan untuk meningkatkan stabilitas strategi dan mengendalikan risiko dengan mengoptimalkan parameter, menetapkan tingkat stop loss, perdagangan dengan hati-hati dll.

Arahan Optimasi

Arah utama optimasi strategi ini:

- Sesuaikan parameter siklus garis EMA untuk menyesuaikan dengan lebih banyak produk.

- Tambahkan indikator lain seperti MACD, Bollinger Bands dll untuk meningkatkan keakuratan penilaian.

- Mengoptimalkan rasio profit taking/stop loss untuk mencapai keseimbangan terbaik antara risiko dan laba.

- Tambahkan mekanisme stop loss adaptif seperti ATR Stop Loss untuk lebih mengendalikan risiko penurunan.

Peningkatan konstan stabilitas dan profitabilitas strategi dapat dicapai dengan memperkenalkan penyesuaian parameter dan langkah-langkah pengendalian risiko dalam berbagai aspek.

Kesimpulan

Strategi Trading Traffic Light ini menggabungkan perdagangan trend dan reversal dengan menggunakan 4 set garis EMA untuk membentuk sinyal trading. Strategi ini telah menunjukkan profitabilitas yang kuat melalui optimasi parameter untuk beradaptasi dengan lebih banyak produk.

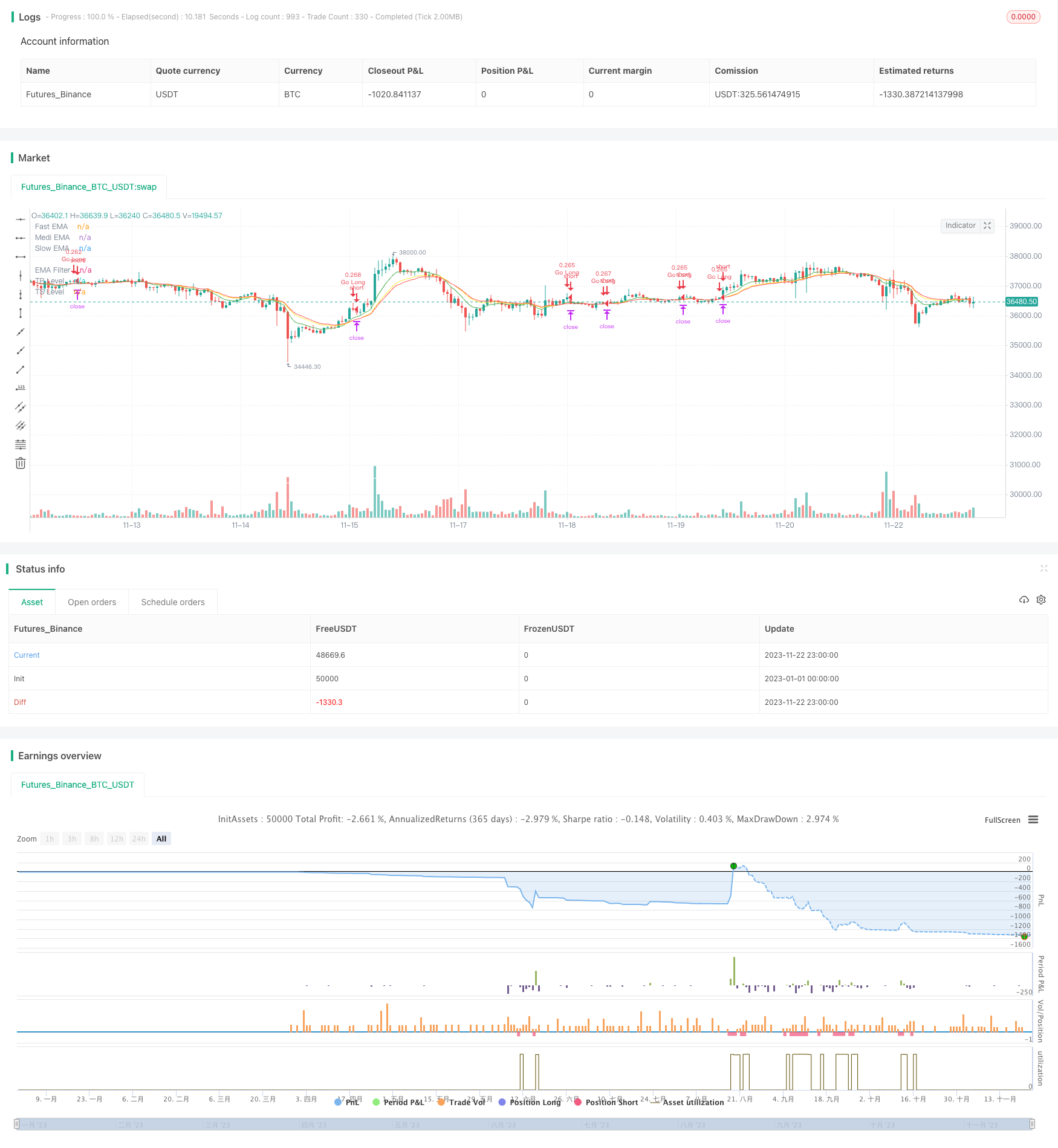

/*backtest

start: 2023-01-01 00:00:00

end: 2023-11-23 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © maxits

// 4HS Crypto Market Strategy

// This strategy uses 4 ema to get Long or Short Signals

// Length are: 8, 14, 16, 100

// We take long positions when the order of the emas is the following:

// green > yellow > red (As the color of Traffic Lights) and they are above white ema (Used as a filter for long positions)

// We take short positions when the order of the emas is the following:

// green < yellow < red (As the color of inverse Traffic Lights) and they are below white ema (Used as a filter for short positions)

//@version=4

strategy(title="Trafic Lights Strategy",

shorttitle="TLS",

overlay=true,

initial_capital=1000,

default_qty_value=20,

default_qty_type=strategy.percent_of_equity,

commission_value=0.1,

pyramiding=0

)

// User Inputs

// i_time = input(defval = timestamp("28 May 2017 13:30 +0000"), title = "Start Time", type = input.time) //Starting time for Backtesting

sep1 = input(title="============ System Conditions ============", type=input.bool, defval=false)

enable_Long = input(true, title="Enable Long Positions") // Enable long Positions

enable_Short = input(true, title="Enable Short Positions") // Enable short Positions

sep2 = input(title="============ Indicator Parameters ============", type=input.bool, defval=false)

f_length = input(title="Fast EMA Length", type=input.integer, defval=8, minval=1)

m_length = input(title="Medium EMA Length", type=input.integer, defval=14, minval=1)

s_length = input(title="Slow EMA Length", type=input.integer, defval=16, minval=1)

filter_L = input(title="EMA Filter", type=input.integer, defval=100, minval=1)

filterRes = input(title="Filter Resolution", type=input.resolution, defval="D") // ema Filter Time Frame

sep3 = input(title="============LONG Profit-Loss Parameters============", type=input.bool, defval=false)

e_Long_TP = input(true, title="Enable a Profit Level?")

e_Long_SL = input(false, title="Enable a S.Loss Level?")

e_Long_TS = input(true, title="Enable a Trailing Stop?")

long_TP_Input = input(40.0, title='Take Profit %', type=input.float, minval=0)/100

long_SL_Input = input(1.0, title='Stop Loss %', type=input.float, minval=0)/100

atrLongMultip = input(2.0, title='ATR Multiplier', type=input.float, minval=0.1) // Parameters to calculate Trailing Stop Loss

atrLongLength = input(14, title='ATR Length', type=input.integer, minval=1)

sep4 = input(title="============SHORT Profit-Loss Parameters============", type=input.bool, defval=false)

e_Short_TP = input(true, title="Enable a Profit Level?")

e_Short_SL = input(false, title="Enable a S.Loss Level?")

e_Short_TS = input(true, title="Enable a Trailing Stop?")

short_TP_Input = input(30.0, title='Take Profit %', type=input.float, minval=0)/100

short_SL_Input = input(1.0, title='Stop Loss %', type=input.float, minval=0)/100

atrShortMultip = input(2.0, title='ATR Multiplier', type=input.float, minval=0.1)

atrShortLength = input(14, title='ATR Length', type=input.integer, minval=1)

// Indicators

fema = ema(close, f_length)

mema = ema(close, m_length)

sema = ema(close, s_length)

filter = security(syminfo.tickerid, filterRes, ema(close, filter_L))

plot(fema, title="Fast EMA", color=color.new(color.green, 0))

plot(mema, title="Medi EMA", color=color.new(color.yellow, 0))

plot(sema, title="Slow EMA", color=color.new(color.red, 0))

plot(filter, title="EMA Filter", color=color.new(color.white, 0))

// Entry Conditions

longTrade = strategy.position_size > 0

shortTrade = strategy.position_size < 0

notInTrade = strategy.position_size == 0

inTrade = strategy.position_size != 0

priceEntry = strategy.position_avg_price

goLong = fema > mema and mema > sema and fema > filter and enable_Long and (crossover (fema, mema) or crossover (mema, sema) or crossover (sema, filter))

goShort = fema < mema and mema < sema and fema < filter and enable_Short and (crossunder (fema, mema) or crossunder (mema, sema) or crossunder (sema, filter))

close_L = crossunder(fema, mema)

close_S = crossover (fema, mema)

// Profit and Loss conditions

// Long

long_TP = priceEntry * (1 + long_TP_Input) // Long Position Take Profit Calculation

long_SL = priceEntry * (1 - long_SL_Input) // Long Position Stop Loss Calculation

atrLong = atr(atrLongLength) // Long Position ATR Calculation

long_TS = low - atrLong * atrLongMultip

long_T_stop = 0.0 // Code for calculating Long Positions Trailing Stop Loss/

long_T_stop := if (longTrade)

longStop = long_TS

max(long_T_stop[1], longStop)

else

0

//Short

short_TP = priceEntry * (1 - short_TP_Input) // Long Position Take Profit Calculation

short_SL = priceEntry * (1 + short_SL_Input) // Short Position Stop Loss Calculation

atrShort = atr(atrShortLength) // Short Position ATR Calculation

short_TS = high + atrShort * atrShortMultip

short_T_stop = 0.0 // Code for calculating Short Positions Trailing Stop Loss/

short_T_stop := if shortTrade

shortStop = short_TS

min(short_T_stop[1], shortStop)

else

9999999

// Strategy Long Entry

if goLong and notInTrade

strategy.entry("Go Long", long=strategy.long, comment="Go Long", alert_message="Open Long Position")

if longTrade and close_L

strategy.close("Go Long", when=close_L, comment="Close Long", alert_message="Close Long Position")

if e_Long_TP // Algorithm for Enabled Long Position Profit Loss Parameters

if (e_Long_TS and not e_Long_SL)

strategy.exit("Long TP & TS", "Go Long", limit = long_TP, stop = long_T_stop)

else

if (e_Long_SL and not e_Long_TS)

strategy.exit("Long TP & TS", "Go Long",limit = long_TP, stop = long_SL)

else

strategy.exit("Long TP & TS", "Go Long",limit = long_TP)

else

if not e_Long_TP

if (e_Long_TS and not e_Long_SL)

strategy.exit("Long TP & TS", "Go Long", stop = long_T_stop)

else

if (e_Long_SL and not e_Long_TS)

strategy.exit("Long TP & TS", "Go Long",stop = long_SL)

// Strategy Short Entry

if goShort and notInTrade

strategy.entry("Go Short", long=strategy.short, comment="Go Short", alert_message="Open Short Position")

if shortTrade and close_S

strategy.close("Go Short", comment="Close Short", alert_message="Close Short Position")

if e_Short_TP // Algorithm for Enabled Short Position Profit Loss Parameters

if (e_Short_TS and not e_Short_SL)

strategy.exit("Short TP & TS", "Go Short", limit = short_TP, stop = short_T_stop)

else

if (e_Short_SL and not e_Short_TS)

strategy.exit("Short TP & SL", "Go Short",limit = short_TP, stop = short_SL)

else

strategy.exit("Short TP & TS", "Go Short",limit = short_TP)

else

if not e_Short_TP

if (e_Short_TS and not e_Short_SL)

strategy.exit("Short TS", "Go Short", stop = short_T_stop)

else

if (e_Short_SL and not e_Short_TS)

strategy.exit("Short SL", "Go Short",stop = short_SL)

// Long Position Profit and Loss Plotting

plot(longTrade and e_Long_TP and long_TP ? long_TP : na, title="TP Level", color=color.green, style=plot.style_linebr, linewidth=2)

plot(longTrade and e_Long_SL and long_SL and not e_Long_TS ? long_SL : na, title="SL Level", color=color.red, style=plot.style_linebr, linewidth=2)

plot(longTrade and e_Long_TS and long_T_stop and not e_Long_SL ? long_T_stop : na, title="TS Level", color=color.red, style=plot.style_linebr, linewidth=2)

// Short Position Profit and Loss Plotting

plot(shortTrade and e_Short_TP and short_TP ? short_TP : na, title="TP Level", color=color.green, style=plot.style_linebr, linewidth=2)

plot(shortTrade and e_Short_SL and short_SL and not e_Short_TS ? short_SL : na, title="SL Level", color=color.red, style=plot.style_linebr, linewidth=2)

plot(shortTrade and e_Short_TS and short_T_stop and not e_Short_SL ? short_T_stop : na, title="TS Level", color=color.red, style=plot.style_linebr, linewidth=2)

- Ichimoku Backtester dengan TP, SL, dan Cloud Confirmation

- Strategi pita giroskopik berdasarkan beberapa kerangka waktu dan amplitudo rata-rata

- Strategi pembalikan crossover rata-rata bergerak ganda

- Strategi Pelacakan Rata-rata Bergerak Dinamis

- Strategi Pemangsa Pembalik

- RSI Gap Reversal Strategi

- Strategi Penasihat Ahli 3 Menit Singkat

- Zona Aksi ATR Reverse Order Quant Strategi

- Tren MACD Mengikuti Strategi

- Analisis Momentum Ichimoku Awan Kabut Petir Strategi Trading

- Strategi pencocokan rata-rata bergerak ganda berdasarkan Bollinger Bands

- Strategi Perdagangan Algoritma Las Vegas Terbalik

- Strategi Sistem Rata-rata Bergerak Padat

- Advanced Bollinger Band Moving Average Grid Trend Tracking Strategi

- Indikator Ichimoku Kinko Hyo Strategi Tren Balancing

- Indikator Harga Volume Strategi Perdagangan Seimbang

- Strategi SMA Adaptive Crossover Long Line yang diputar

- Strategi Arbitrage Rata-rata Bergerak Ganda

- Strategi investasi kuantitatif berdasarkan tanggal pembelian bulanan

- Strategi perdagangan deviasi standar tertimbang