Kombo Trend Reversal Moving Average Crossover Strategi

Penulis:ChaoZhang, Tanggal: 2023-11-28 13:47:05Tag:

Gambaran umum

Ini adalah strategi combo yang menggabungkan strategi pembalikan tren dan strategi crossover rata-rata bergerak untuk menghasilkan sinyal perdagangan yang lebih akurat.

Logika Strategi

Strategi ini terdiri dari dua bagian:

-

123 Strategi Reversal: Pergi panjang ketika harga tutup naik selama 2 hari berturut-turut dan stochastic lambat 9 hari berada di bawah 50; Pergi pendek ketika harga tutup turun selama 2 hari berturut-turut dan stochastic cepat 9 hari berada di atas 50.

-

Strategi Rata-rata Bill Williams: Hitung 13, 8 dan 5 hari rata-rata pergerakan harga median dan pergi panjang ketika MAs yang lebih cepat melintasi MAs yang lebih lambat; pergi pendek ketika MAs yang lebih cepat melintasi MAs yang lebih lambat.

Akhirnya, sinyal perdagangan yang sebenarnya hanya dihasilkan ketika kedua strategi setuju pada arah; jika tidak tidak ada perdagangan.

Analisis Keuntungan

Strategi combo menyaring kebisingan menggunakan validasi tren ganda, sehingga meningkatkan akurasi sinyal.

Analisis Risiko

Risiko adalah:

- Filter ganda mungkin kehilangan beberapa perdagangan yang baik

- Pengaturan MA yang salah dapat menilai tren secara salah

- Strategi pembalikan sendiri memiliki risiko kerugian

Risiko dapat dikurangi dengan mengoptimalkan parameter MA atau masuk/keluar logika.

Arahan Optimasi

Strategi dapat dioptimalkan dengan:

- Pengujian kombinasi MA yang berbeda untuk menemukan parameter optimal

- Menambahkan stop loss untuk membatasi kerugian

- Mengintegrasikan volume untuk mengidentifikasi kualitas sinyal

- Menggunakan pembelajaran mesin untuk mengoptimalkan otomatis

Kesimpulan

Strategi ini menggabungkan filter tren ganda dan MAs untuk secara efektif menyaring kebisingan dan meningkatkan akurasi keputusan.

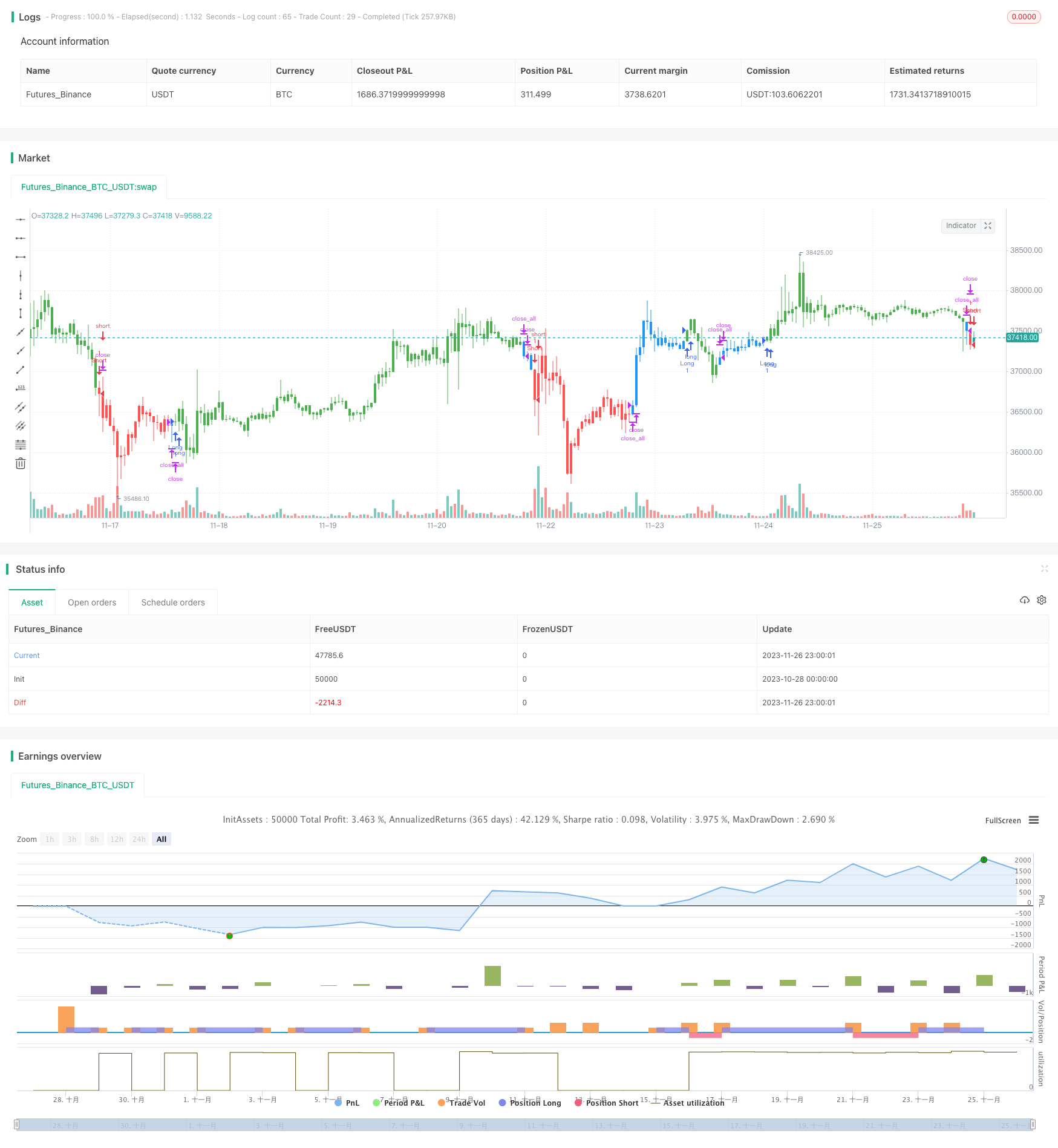

/*backtest

start: 2023-10-28 00:00:00

end: 2023-11-27 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=3

////////////////////////////////////////////////////////////

// Copyright by HPotter v1.0 18/06/2019

// This is combo strategies for get

// a cumulative signal. Result signal will return 1 if two strategies

// is long, -1 if all strategies is short and 0 if signals of strategies is not equal.

//

// First strategy

// This System was created from the Book "How I Tripled My Money In The

// Futures Market" by Ulf Jensen, Page 183. This is reverse type of strategies.

// The strategy buys at market, if close price is higher than the previous close

// during 2 days and the meaning of 9-days Stochastic Slow Oscillator is lower than 50.

// The strategy sells at market, if close price is lower than the previous close price

// during 2 days and the meaning of 9-days Stochastic Fast Oscillator is higher than 50.

//

// Second strategy

// This indicator calculates 3 Moving Averages for default values of

// 13, 8 and 5 days, with displacement 8, 5 and 3 days: Median Price (High+Low/2).

// The most popular method of interpreting a moving average is to compare

// the relationship between a moving average of the security's price with

// the security's price itself (or between several moving averages).

//

// WARNING:

// - For purpose educate only

// - This script to change bars colors.

////////////////////////////////////////////////////////////

Reversal123(Length, KSmoothing, DLength, Level) =>

vFast = sma(stoch(close, high, low, Length), KSmoothing)

vSlow = sma(vFast, DLength)

pos = 0.0

pos := iff(close[2] < close[1] and close > close[1] and vFast < vSlow and vFast > Level, 1,

iff(close[2] > close[1] and close < close[1] and vFast > vSlow and vFast < Level, -1, nz(pos[1], 0)))

pos

BillWilliamsAverages(LLength, MLength,SLength, LOffset,MOffset, SOffset ) =>

xLSma = sma(hl2, LLength)[LOffset]

xMSma = sma(hl2, MLength)[MOffset]

xSSma = sma(hl2, SLength)[SOffset]

pos = 0

pos := iff(close < xSSma and xSSma < xMSma and xMSma < xLSma, -1,

iff(close > xSSma and xSSma > xMSma and xMSma > xLSma, 1, nz(pos[1], 0)))

pos

strategy(title="Combo Backtest 123 Reversal & Bill Williams Averages. 3Lines", shorttitle="Combo", overlay = true)

Length = input(14, minval=1)

KSmoothing = input(1, minval=1)

DLength = input(3, minval=1)

Level = input(50, minval=1)

//-------------------------

LLength = input(13, minval=1)

MLength = input(8,minval=1)

SLength = input(5,minval=1)

LOffset = input(8,minval=1)

MOffset = input(5,minval=1)

SOffset = input(3,minval=1)

reverse = input(false, title="Trade reverse")

posReversal123 = Reversal123(Length, KSmoothing, DLength, Level)

posBillWilliamsAverages = BillWilliamsAverages(LLength, MLength,SLength, LOffset, MOffset, SOffset)

pos = iff(posReversal123 == 1 and posBillWilliamsAverages == 1 , 1,

iff(posReversal123 == -1 and posBillWilliamsAverages == -1, -1, 0))

possig = iff(reverse and pos == 1, -1,

iff(reverse and pos == -1, 1, pos))

if (possig == 1)

strategy.entry("Long", strategy.long)

if (possig == -1)

strategy.entry("Short", strategy.short)

if (possig == 0)

strategy.close_all()

barcolor(possig == -1 ? red: possig == 1 ? green : blue )

- Strategi Tren Donchian

- Strategi Crossover Rata-rata Gerak Multi-SMA

- Multi RSI Indikator Strategi Trading

- Strategi SuperTrend dengan Trailing Stop Loss

- Strategi pembalikan rata-rata bergerak tertimbang

- Strategi Indeks Kekuatan Relatif Moving Average

- Strategi Pelacakan Tren Cerdas ADX

- Strategi agregasi momentum RSI

- Strategi Stop Loss Terakhir Berdasarkan Kesenjangan Harga

- Strategi Breakout Rata-rata Bergerak

- Strategi Divergensi RSI berbasis pivot

- Rasio Emas Breakout Strategi Panjang

- Strategi Bollinger Bands dengan RSI Filter

- Tren Mengikuti Strategi Berdasarkan Saluran Keltner

- Strategi RSI Moving Average Crossover

- strategi perdagangan momentum breakout

- Strategi Perdagangan Kuantitatif Multi-Faktor RSI dan CCI yang Dinamis

- Strategi Tren Kuantitatif Super Z

- Strategi Pola Lilin

- CK Momentum Reversal Stop Loss Strategi