Strategi mengikuti tren berdasarkan kNN

Ringkasan

Strategi ini menggunakan k Near Neighborhood (kNN) algoritma pembelajaran mesin untuk memprediksi tren pasar, dan berdasarkan hasil prediksi menghasilkan sinyal posisi panjang dan posisi kosong. Strategi ini secara komprehensif mempertimbangkan beberapa faktor seperti data historis, indikator teknis, dan lain-lain.

Prinsip Strategi

Mengumpulkan data pelatihan: mengumpulkan urutan waktu seperti harga close out historis, volume transaksi, dan indikator teknis seperti RSI, CCI.

Pengolahan data: mengevaluasi nilai indikator dalam kisaran 0-100

Pelatihan model kNN: Masukkan dua karakteristik dari model kNN saat ini, hitung jarak Eropa antara vektor karakteristik ini dan vektor karakteristik sejarah, pilih jarak dari k sampel sejarah terdekat, dan statistikkan distribusi label k sampel ini:

Dapatkan prediksi: memprediksi tren pasar saat ini berdasarkan label dari k sampel terdekat. Jika prediksi adalah multipel, menghasilkan sinyal long position; Jika prediksi adalah kosong, menghasilkan sinyal kosong.

Perdagangan dengan filter seperti stop loss, kontrol posisi, dan moving average.

Keunggulan Strategis

Algoritma pembelajaran mesin digunakan untuk mengidentifikasi bentuk teknologi secara otomatis, tanpa intervensi manusia.

Fleksibilitas dalam memilih indikator teknis yang berbeda sebagai fitur model, dan strategi optimasi real-time.

Mengintegrasikan mekanisme pengendalian risiko yang ketat seperti penghentian kerugian, manajemen posisi.

Visualisasi menampilkan garis stop loss, jelas dan intuitif.

Risiko dan Solusi

Prediksi pembelajaran mesin dapat menimbulkan kesalahan. Model optimasi seperti nilai k, vektor karakteristik, dan rentang waktu sampel yang sesuai dapat dipilih.

Ada potensi risiko transaksi unilateral. Anda dapat menambahkan transaksi bilateral ke dalam kode untuk menghilangkan bug.

Parameter yang tidak tepat dapat menyebabkan perdagangan berlebihan. Harus disesuaikan dengan ukuran posisi, frekuensi perdagangan dan parameter lainnya.

Arah optimasi

Uji berbagai jenis indikator teknis sebagai karakteristik input kNN.

Cobalah metode pengukuran jarak lainnya, seperti jarak Manhattan.

Ukuran posisi disesuaikan dengan jarak sampel atau klasifikasi kualitas.

Tambahkan set latihan model, subdivisi set uji, dan optimasi scrolling.

Meringkaskan

Strategi ini menggunakan algoritma klasik kNN untuk memprediksi tren pasar dan melakukan perdagangan sesuai dengan sinyal yang diprediksi. Strategi ini memiliki parameter yang dapat disesuaikan, risiko yang dapat dikontrol, dan dapat memberikan solusi perdagangan otomatis yang efektif bagi pengguna. Pengguna dapat terus meningkatkan kinerja strategi dengan cara menyesuaikan portofolio indikator teknis, mengoptimalkan model overparameter, dll.

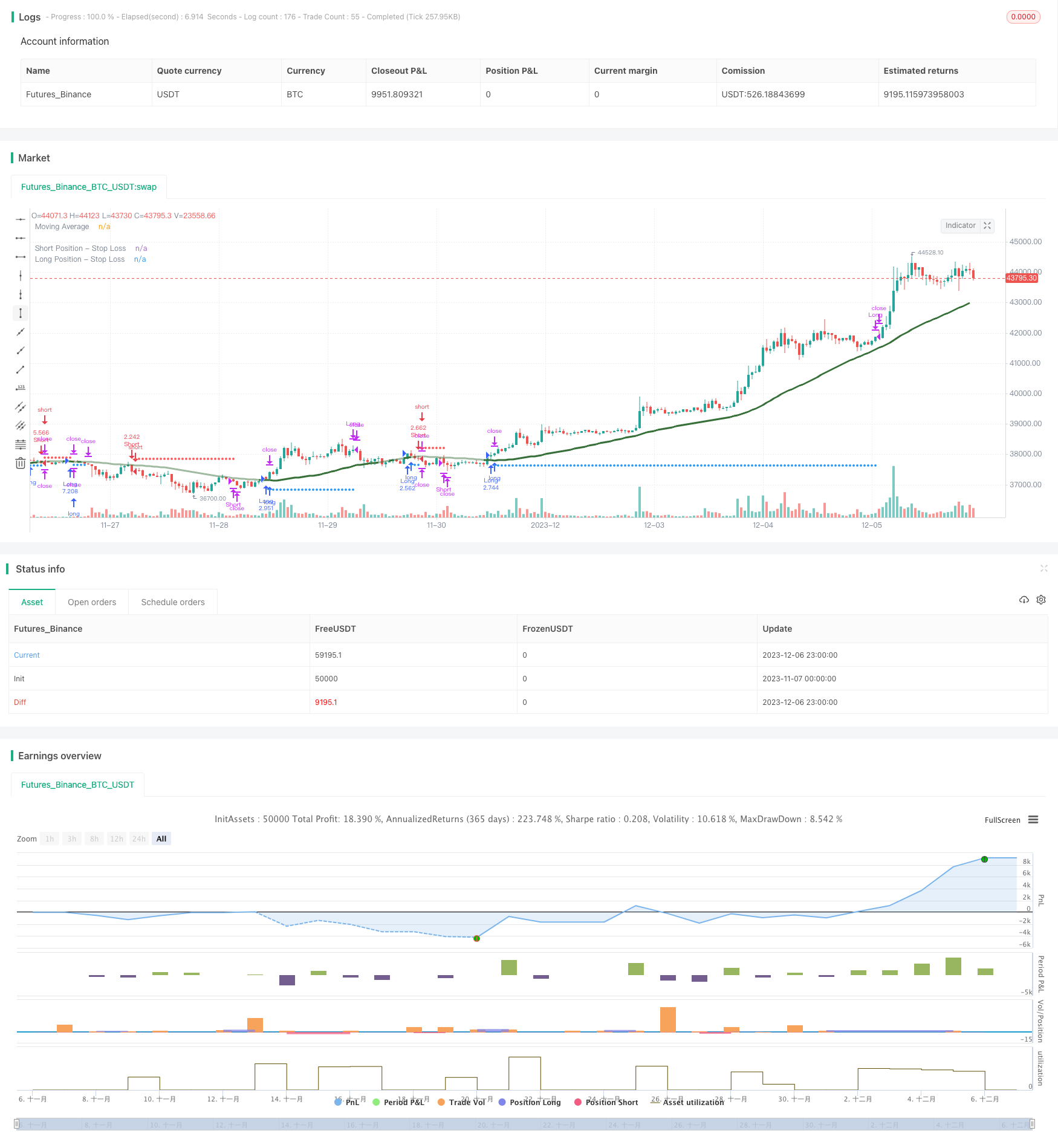

/*backtest

start: 2023-11-07 00:00:00

end: 2023-12-07 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © sosacur01

//@version=5

strategy(title=" kNN-based| Trend Following | Trend Following", overlay=true, pyramiding=1, commission_type=strategy.commission.percent, commission_value=0.2, initial_capital=10000)

//==========================================

// This script, based on Capissimo's original indicator code, transforms a kNN-based machine learning indicator into a TradingView strategy.

// It incorporates a backtest date range filter, on/off controls for long and short positions, a moving average filter, and dynamic risk management for adaptive position sizing.

// Credit to Capissimo for the foundational kNN algorithm.

//==========================================

//BACKTEST RANGE

useDateFilter = input.bool(true, title="Filter Date Range of Backtest",

group="Backtest Time Period")

backtestStartDate = input(timestamp("1 jan 2017"),

title="Start Date", group="Backtest Time Period",

tooltip="This start date is in the time zone of the exchange " +

"where the chart's instrument trades. It doesn't use the time " +

"zone of the chart or of your computer.")

backtestEndDate = input(timestamp("1 Jul 2100"),

title="End Date", group="Backtest Time Period",

tooltip="This end date is in the time zone of the exchange " +

"where the chart's instrument trades. It doesn't use the time " +

"zone of the chart or of your computer.")

inTradeWindow = true

if not inTradeWindow and inTradeWindow[1]

strategy.cancel_all()

strategy.close_all(comment="Date Range Exit")

//--------------------------------------

//LONG/SHORT POSITION ON/OFF INPUT

LongPositions = input.bool(title='On/Off Long Postion', defval=true, group="Long & Short Position")

ShortPositions = input.bool(title='On/Off Short Postion', defval=true, group="Long & Short Position")

//--------------------------------------

// kNN-based Strategy (FX and Crypto)

// Description:

// This strategy uses a classic machine learning algorithm - k Nearest Neighbours (kNN) -

// to let you find a prediction for the next (tomorrow's, next month's, etc.) market move.

// Being an unsupervised machine learning algorithm, kNN is one of the most simple learning algorithms.

// To do a prediction of the next market move, the kNN algorithm uses the historic data,

// collected in 3 arrays - feature1, feature2 and directions, - and finds the k-nearest

// neighbours of the current indicator(s) values.

// The two dimensional kNN algorithm just has a look on what has happened in the past when

// the two indicators had a similar level. It then looks at the k nearest neighbours,

// sees their state and thus classifies the current point.

// The kNN algorithm offers a framework to test all kinds of indicators easily to see if they

// have got any *predictive value*. One can easily add cog, wpr and others.

// Note: TradingViews's playback feature helps to see this strategy in action.

// Warning: Signals ARE repainting.

// Style tags: Trend Following, Trend Analysis

// Asset class: Equities, Futures, ETFs, Currencies and Commodities

// Dataset: FX Minutes/Hours+++/Days

//-- Preset Dates

int startdate = timestamp('01 Jan 2000 00:00:00 GMT+10')

int stopdate = timestamp('31 Dec 2025 23:45:00 GMT+10')

//-- Inputs

StartDate = input (startdate, 'Start Date', group="kNN-based Inputs")

StopDate = input (stopdate, 'Stop Date', group="kNN-based Inputs")

Indicator = input.string('RSI', 'Indicator', ['RSI','ROC','CCI','Volume','All'], group="kNN-based Inputs")

ShortWinow = input.int (8, 'Short Period [1..n]', 1, group="kNN-based Inputs")

LongWindow = input.int (29, 'Long Period [2..n]', 2, group="kNN-based Inputs")

BaseK = input.int (400, 'Base No. of Neighbours (K) [5..n]', 5, group="kNN-based Inputs")

Filter = input.bool (false, 'Volatility Filter', group="kNN-based Inputs")

Bars = input.int (300, 'Bar Threshold [2..5000]', 2, 5000, group="kNN-based Inputs")

//-- Constants

var int BUY = 1

var int SELL =-1

var int CLEAR = 0

var int k = math.floor(math.sqrt(BaseK)) // k Value for kNN algo

//-- Variable

// Training data, normalized to the range of [0,...,100]

var array<float> feature1 = array.new_float(0) // [0,...,100]

var array<float> feature2 = array.new_float(0) // ...

var array<int> directions = array.new_int(0) // [-1; +1]

// Result data

var array<int> predictions = array.new_int(0)

var float prediction = 0.0

var array<int> bars = array.new<int>(1, 0) // array used as a container for inter-bar variables

// Signals

var int signal = CLEAR

//-- Functions

minimax(float x, int p, float min, float max) =>

float hi = ta.highest(x, p), float lo = ta.lowest(x, p)

(max - min) * (x - lo)/(hi - lo) + min

cAqua(int g) => g>9?#0080FFff:g>8?#0080FFe5:g>7?#0080FFcc:g>6?#0080FFb2:g>5?#0080FF99:g>4?#0080FF7f:g>3?#0080FF66:g>2?#0080FF4c:g>1?#0080FF33:#00C0FF19

cPink(int g) => g>9?#FF0080ff:g>8?#FF0080e5:g>7?#FF0080cc:g>6?#FF0080b2:g>5?#FF008099:g>4?#FF00807f:g>3?#FF008066:g>2?#FF00804c:g>1?#FF008033:#FF008019

inside_window(float start, float stop) =>

time >= start and time <= stop ? true : false

//-- Logic

bool window = true

// 3 pairs of predictor indicators, long and short each

float rs = ta.rsi(close, LongWindow), float rf = ta.rsi(close, ShortWinow)

float cs = ta.cci(close, LongWindow), float cf = ta.cci(close, ShortWinow)

float os = ta.roc(close, LongWindow), float of = ta.roc(close, ShortWinow)

float vs = minimax(volume, LongWindow, 0, 99), float vf = minimax(volume, ShortWinow, 0, 99)

// TOADD or TOTRYOUT:

// ta.cmo(close, LongWindow), ta.cmo(close, ShortWinow)

// ta.mfi(close, LongWindow), ta.mfi(close, ShortWinow)

// ta.mom(close, LongWindow), ta.mom(close, ShortWinow)

float f1 = switch Indicator

'RSI' => rs

'CCI' => cs

'ROC' => os

'Volume' => vs

=> math.avg(rs, cs, os, vs)

float f2 = switch Indicator

'RSI' => rf

'CCI' => cf

'ROC' => of

'Volume' => vf

=> math.avg(rf, cf, of, vf)

// Classification data, what happens on the next bar

int class_label = int(math.sign(close[1] - close[0])) // eq. close[1]<close[0] ? SELL: close[1]>close[0] ? BUY : CLEAR

// Use particular training period

if window

// Store everything in arrays. Features represent a square 100 x 100 matrix,

// whose row-colum intersections represent class labels, showing historic directions

array.push(feature1, f1)

array.push(feature2, f2)

array.push(directions, class_label)

// Ucomment the followng statement (if barstate.islast) and tab everything below

// between BOBlock and EOBlock marks to see just the recent several signals gradually

// showing up, rather than all the preceding signals

//if barstate.islast

//==BOBlock

// Core logic of the algorithm

int size = array.size(directions)

float maxdist = -999.0

// Loop through the training arrays, getting distances and corresponding directions.

for i=0 to size-1

// Calculate the euclidean distance of current point to all historic points,

// here the metric used might as well be a manhattan distance or any other.

float d = math.sqrt(math.pow(f1 - array.get(feature1, i), 2) + math.pow(f2 - array.get(feature2, i), 2))

if d > maxdist

maxdist := d

if array.size(predictions) >= k

array.shift(predictions)

array.push(predictions, array.get(directions, i))

//==EOBlock

// Note: in this setup there's no need for distances array (i.e. array.push(distances, d)),

// but the drawback is that a sudden max value may shadow all the subsequent values.

// One of the ways to bypass this is to:

// 1) store d in distances array,

// 2) calculate newdirs = bubbleSort(distances, directions), and then

// 3) take a slice with array.slice(newdirs) from the end

// Get the overall prediction of k nearest neighbours

prediction := array.sum(predictions)

bool filter = Filter ? ta.atr(10) > ta.atr(40) : true // filter out by volatility or ex. ta.atr(1) > ta.atr(10)...

// Now that we got a prediction for the next market move, we need to make use of this prediction and

// trade it. The returns then will show if everything works as predicted.

// Over here is a simple long/short interpretation of the prediction,

// but of course one could also use the quality of the prediction (+5 or +1) in some sort of way,

// ex. for position sizing.

bool long = prediction > 0 and filter

bool short = prediction < 0 and filter

bool clear = not(long and short)

if array.get(bars, 0)==Bars // stop by trade duration

signal := CLEAR

array.set(bars, 0, 0)

else

array.set(bars, 0, array.get(bars, 0) + 1)

signal := long ? BUY : short ? SELL : clear ? CLEAR : nz(signal[1])

int changed = ta.change(signal)

bool startLongTrade = changed and signal==BUY

bool startShortTrade = changed and signal==SELL

// bool endLongTrade = changed and signal==SELL

// bool endShortTrade = changed and signal==BUY

bool clear_condition = changed and signal==CLEAR //or (changed and signal==SELL) or (changed and signal==BUY)

float maxpos = ta.highest(high, 10)

float minpos = ta.lowest (low, 10)

//----//MA INPUTS

MAFilter = input.bool(title='Use MA as Filter', defval=true, group = "MA Inputs")

averageType1 = input.string(defval="SMA", group="MA Inputs", title="MA Type", options=["SMA", "EMA", "WMA", "HMA", "RMA", "SWMA", "ALMA", "VWMA", "VWAP"])

averageLength1 = input.int(defval=40, title="MA Length", group="MA Inputs")

averageSource1 = input(close, title="MA Source", group="MA Inputs")

//MA TYPE

MovAvgType1(averageType1, averageSource1, averageLength1) =>

switch str.upper(averageType1)

"SMA" => ta.sma(averageSource1, averageLength1)

"EMA" => ta.ema(averageSource1, averageLength1)

"WMA" => ta.wma(averageSource1, averageLength1)

"HMA" => ta.hma(averageSource1, averageLength1)

"RMA" => ta.rma(averageSource1, averageLength1)

"SWMA" => ta.swma(averageSource1)

"ALMA" => ta.alma(averageSource1, averageLength1, 0.85, 6)

"VWMA" => ta.vwma(averageSource1, averageLength1)

"VWAP" => ta.vwap(averageSource1)

=> runtime.error("Moving average type '" + averageType1 +

"' not found!"), na

// MA COLOR VALUES

ma = MovAvgType1(averageType1, averageSource1, averageLength1)

ma_plot = close > ma ? color.rgb(54, 111, 56) : color.rgb(54, 111, 56, 52)

// MA BUY/SELL CONDITIONS

bullish_ma = MAFilter ? close > ma : inTradeWindow

bearish_ma = MAFilter ? close < ma : inTradeWindow

// MA ALTERNATING PLOT

plot(MAFilter ? ma : na, color=ma_plot, title="Moving Average", linewidth=3)

//--------------------------------------

//ENTRIES AND EXITS

long_entry = if inTradeWindow and startLongTrade and bullish_ma and LongPositions

true

long_exit = if inTradeWindow and startShortTrade

true

short_entry = if inTradeWindow and startShortTrade and bearish_ma and ShortPositions

true

short_exit = if inTradeWindow and startLongTrade

true

//--------------------------------------

//RISK MANAGEMENT - SL, MONEY AT RISK, POSITION SIZING

atrPeriod = input.int(7, "ATR Length", group="Risk Management Inputs")

sl_atr_multiplier = input.float(title="Long Position - Stop Loss - ATR Multiplier", defval=2, group="Risk Management Inputs", step=0.5)

sl_atr_multiplier_short = input.float(title="Short Position - Stop Loss - ATR Multiplier", defval=2, group="Risk Management Inputs", step=0.5)

i_pctStop = input.float(2, title="% of Equity at Risk", step=.5, group="Risk Management Inputs")/100

//ATR VALUE

_atr = ta.atr(atrPeriod)

//CALCULATE LAST ENTRY PRICE

lastEntryPrice = strategy.opentrades.entry_price(strategy.opentrades - 1)

//STOP LOSS - LONG POSITIONS

var float sl = na

//CALCULTE SL WITH ATR AT ENTRY PRICE - LONG POSITION

if (strategy.position_size[1] != strategy.position_size)

sl := lastEntryPrice - (_atr * sl_atr_multiplier)

//IN TRADE - LONG POSITIONS

inTrade = strategy.position_size > 0

//PLOT SL - LONG POSITIONS

plot(inTrade ? sl : na, color=color.blue, style=plot.style_circles, title="Long Position - Stop Loss")

//CALCULATE ORDER SIZE - LONG POSITIONS

positionSize = (strategy.equity * i_pctStop) / (_atr * sl_atr_multiplier)

//============================================================================================

//STOP LOSS - SHORT POSITIONS

var float sl_short = na

//CALCULTE SL WITH ATR AT ENTRY PRICE - SHORT POSITIONS

if (strategy.position_size[1] != strategy.position_size)

sl_short := lastEntryPrice + (_atr * sl_atr_multiplier_short)

//IN TRADE SHORT POSITIONS

inTrade_short = strategy.position_size < 0

//PLOT SL - SHORT POSITIONS

plot(inTrade_short ? sl_short : na, color=color.red, style=plot.style_circles, title="Short Position - Stop Loss")

//CALCULATE ORDER - SHORT POSITIONS

positionSize_short = (strategy.equity * i_pctStop) / (_atr * sl_atr_multiplier_short)

//===============================================

//LONG STRATEGY

strategy.entry("Long", strategy.long, comment="Long", when = long_entry and not short_entry, qty=positionSize)

if (strategy.position_size > 0)

strategy.close("Long", when = (long_exit), comment="Close Long")

strategy.exit("Long", stop = sl, comment="Exit Long")

//SHORT STRATEGY

strategy.entry("Short", strategy.short, comment="Short", when = short_entry and not long_entry, qty=positionSize_short)

if (strategy.position_size < 0)

strategy.close("Short", when = (short_exit), comment="Close Short")

strategy.exit("Short", stop = sl_short, comment="Exit Short")

//ONE DIRECTION TRADING COMMAND (BELLOW ONLY ACTIVATE TO CORRECT BUGS)

//strategy.risk.allow_entry_in(strategy.direction.long)