Strategi Scalping Saluran Volatilitas Noro

Ringkasan

Strategi scalping saluran harga Noro (Noro’s Price Channel Scalping Strategy) adalah strategi perdagangan scalping yang didasarkan pada saluran harga dan pita harga. Strategi ini menggunakan saluran harga dan fluktuasi harga untuk mengidentifikasi tren pasar dan melakukan penarikan ketika terjadi pergeseran arah tren.

Prinsip Strategi

Strategi ini pertama-tama menghitung saluran harga tertinggi ((lasthigh) dan saluran harga terendah ((lastlow)), kemudian menghitung garis tengah saluran harga ((center) ◄ lalu menghitung jarak harga dengan garis tengah ((dist) dan jarak rata-rata bergerak sederhana ((distsma) ◄ . Berdasarkan ini dapat dihitung pita harga 1 kali lipat dari garis tengah ((hd dan ld) dan 2 kali lipat dari garis tengah ((hd2 dan ld2).

Ketika harga melewati band yang 1 kali lebih besar dari garis tengah, maka dianggap sebagai bullish. Jika harga melewati band yang 1 kali lebih besar dari garis tengah, maka dianggap sebagai bearish. Strategi ini dilakukan dengan membuka posisi terbalik ketika muncul tanda-tanda kelelahan.

Keunggulan Strategis

- Menggunakan Saluran Harga untuk Memahami Trend Pasar dan Menghindari Kesalahan Perdagangan

- Mencari titik balik yang tepat berdasarkan pada fluktuasi harga untuk melihat apakah ada penurunan atau tidak

- Scalping adalah cara untuk mendapatkan keuntungan dengan cepat.

Risiko Strategis

- Jika harga berfluktuasi besar, saluran harga dan pita fluktuasi dapat gagal

- Perdagangan scalping membutuhkan frekuensi perdagangan yang lebih tinggi, mudah meningkatkan biaya perdagangan dan risiko slippage

- Strategi Stop Loss Perlu Diperhatikan Untuk Mengontrol Risiko Kerugian

Optimasi Strategi

- Optimalkan saluran harga dan parameter band volatilitas untuk lebih banyak situasi pasar

- Menentukan tren dan titik balik dalam kombinasi dengan indikator lainnya

- Meningkatkan strategi stop loss

- Mengingat biaya transaksi dan dampak slippage

Meringkaskan

Strategi scalping channel neurowave secara keseluruhan adalah strategi yang sangat cocok untuk perdagangan scalping. Ini menggunakan saluran harga dan band volatilitas untuk menilai tren pasar, dan membuka posisi terbalik ketika ada tanda-tanda puncak atau bawah. Strategi ini memiliki frekuensi perdagangan yang tinggi, keuntungan yang cepat, tetapi juga menghadapi risiko tertentu. Dengan pengoptimalan lebih lanjut, strategi ini dapat diterapkan di lebih banyak pasar yang berbeda.

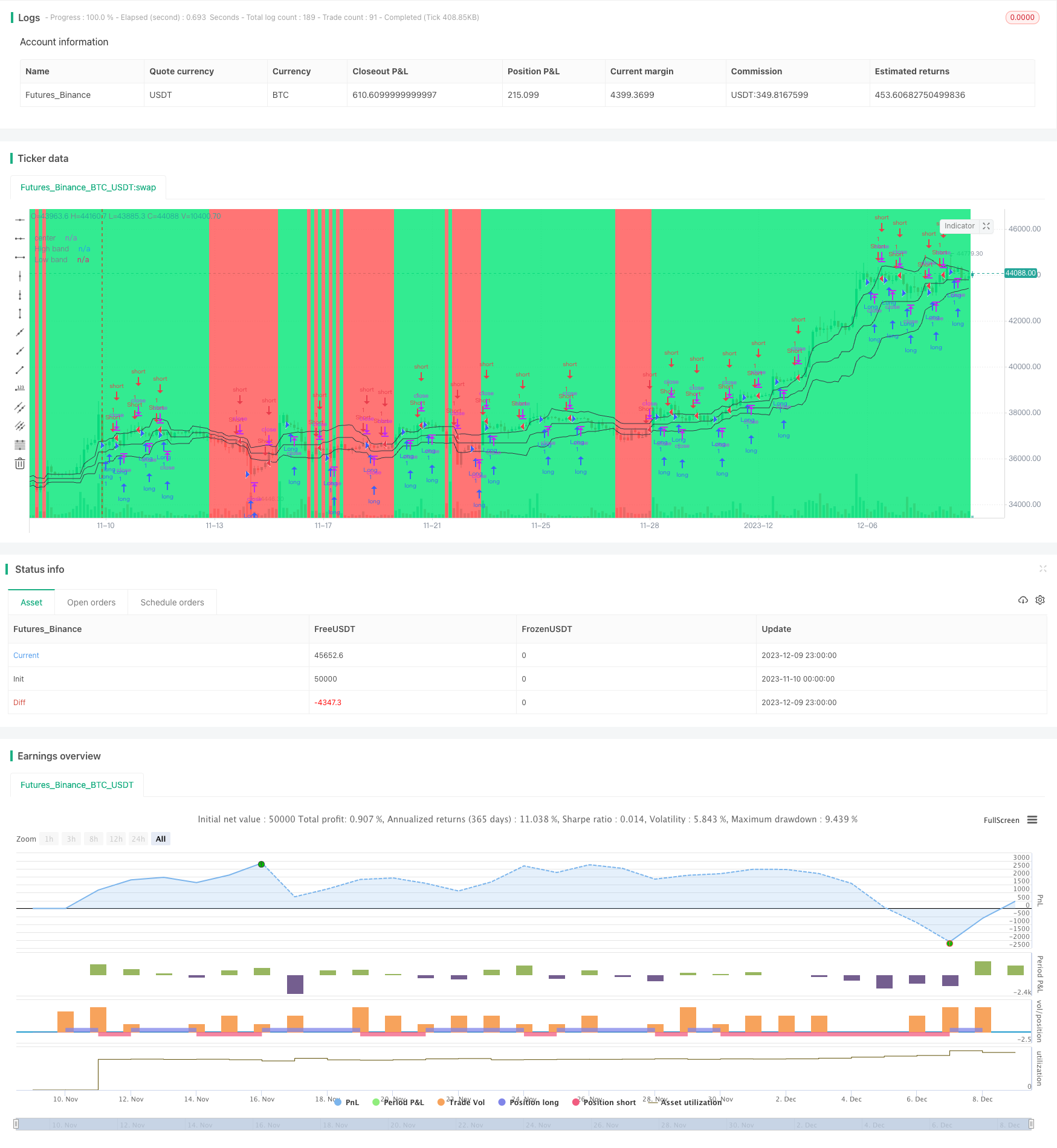

/*backtest

start: 2023-11-10 00:00:00

end: 2023-12-10 00:00:00

period: 3h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=2

strategy("Noro's Bands Scalper Strategy v1.0", shorttitle = "Scalper str 1.0", overlay=true, default_qty_type = strategy.percent_of_equity, default_qty_value=100.0, pyramiding=0)

//Settings

needlong = input(true, defval = true, title = "Long")

needshort = input(true, defval = true, title = "Short")

len = input(20, defval = 20, minval = 2, maxval = 200, title = "Period")

needbb = input(true, defval = true, title = "Show Bands")

needbg = input(true, defval = true, title = "Show Background")

src = close

//PriceChannel

lasthigh = highest(src, len)

lastlow = lowest(src, len)

center = (lasthigh + lastlow) / 2

//Distance

dist = abs(src - center)

distsma = sma(dist, len)

hd = center + distsma

ld = center - distsma

hd2 = center + distsma * 2

ld2 = center - distsma * 2

//Trend

trend = close < ld and high < hd ? -1 : close > hd and low > ld ? 1 : trend[1]

//Lines

colo = needbb == false ? na : black

plot(hd, color = colo, linewidth = 1, transp = 0, title = "High band")

plot(center, color = colo, linewidth = 1, transp = 0, title = "center")

plot(ld, color = colo, linewidth = 1, transp = 0, title = "Low band")

//Background

col = needbg == false ? na : trend == 1 ? lime : red

bgcolor(col, transp = 80)

//Signals

bar = close > open ? 1 : close < open ? -1 : 0

up7 = trend == 1 and bar == -1 and bar[1] == -1 ? 1 : 0

dn7 = trend == 1 and bar == 1 and bar[1] == 1 and close > strategy.position_avg_price ? 1 : 0

up8 = trend == -1 and bar == -1 and bar[1] == -1 and close < strategy.position_avg_price ? 1 : 0

dn8 = trend == -1 and bar == 1 and bar[1] == 1 ? 1 : 0

if up7 == 1 or up8 == 1

strategy.entry("Long", strategy.long, needlong == false ? 0 : trend == -1 ? 0 : na)

if dn7 == 1 or dn8 == 1

strategy.entry("Short", strategy.short, needshort == false ? 0 : trend == 1 ? 0 : na)