Strategi Pelacakan Rata-rata Bergerak Ganda MACD

Penulis:ChaoZhang, Tanggal: 2023-12-18 12:25:13Tag:

Gambaran umum

Strategi ini disebutStrategi Pelacakan Rata-rata Bergerak Ganda MACDIni menggunakan indikator MACD golden cross dan death cross dari moving average ganda sebagai sinyal perdagangan, dikombinasikan dengan harga terendah hari sebelumnya sebagai titik stop loss untuk melacak pergerakan harga jangka pendek.

Logika Strategi

- Menghitung EMA cepat ((dekat,5), EMA lambat ((dekat,8) dan sinyal SMA ((MACD,3)

- Mendefinisikan sinyal panjang: ketika MA cepat melintasi di atas MA lambat

- Mendefinisikan sinyal pendek: ketika MA cepat melintasi di bawah MA lambat atau harga penutupan lebih rendah dari harga terendah hari sebelumnya

- Ukuran posisi adalah modal awal 2000 USD dibagi dengan harga penutupan

- Gunakan sinyal pendek untuk menutup posisi panjang sebagai stop loss

Analisis Keuntungan

- Menggunakan indikator MACD untuk menentukan zona overbought dan oversold, dengan MAs ganda untuk membentuk sinyal perdagangan, menghindari pecah palsu

- Melacak tren jangka pendek, stop loss tepat waktu

- Penyesuaian dinamis ukuran posisi menghindari kerugian tunggal yang terlalu besar

Analisis Risiko

- Indikator MACD memiliki efek keterlambatan, mungkin kehilangan peluang jangka pendek

- Sinyal perdagangan MA ganda dapat menghasilkan sinyal palsu

- Stop loss point terlalu agresif, dengan frekuensi tinggi yang dihentikan

Arahan Optimasi

- Mengoptimalkan kombinasi parameter MACD untuk meningkatkan sensitivitas indikator

- Tambahkan penilaian tren untuk menghindari sinyal palsu dari konsolidasi pasar

- Menggabungkan dengan Volatility Index untuk menilai volatilitas pasar, menyesuaikan titik stop loss

Ringkasan

Strategi ini menggunakan indikator kombinasi rata-rata pergerakan ganda MACD klasik untuk menentukan zona overbought dan oversold, menghasilkan sinyal perdagangan, sambil memperkenalkan ukuran posisi dinamis dan harga terendah hari sebelumnya sebagai desain titik stop loss untuk menangkap fluktuasi harga jangka pendek.

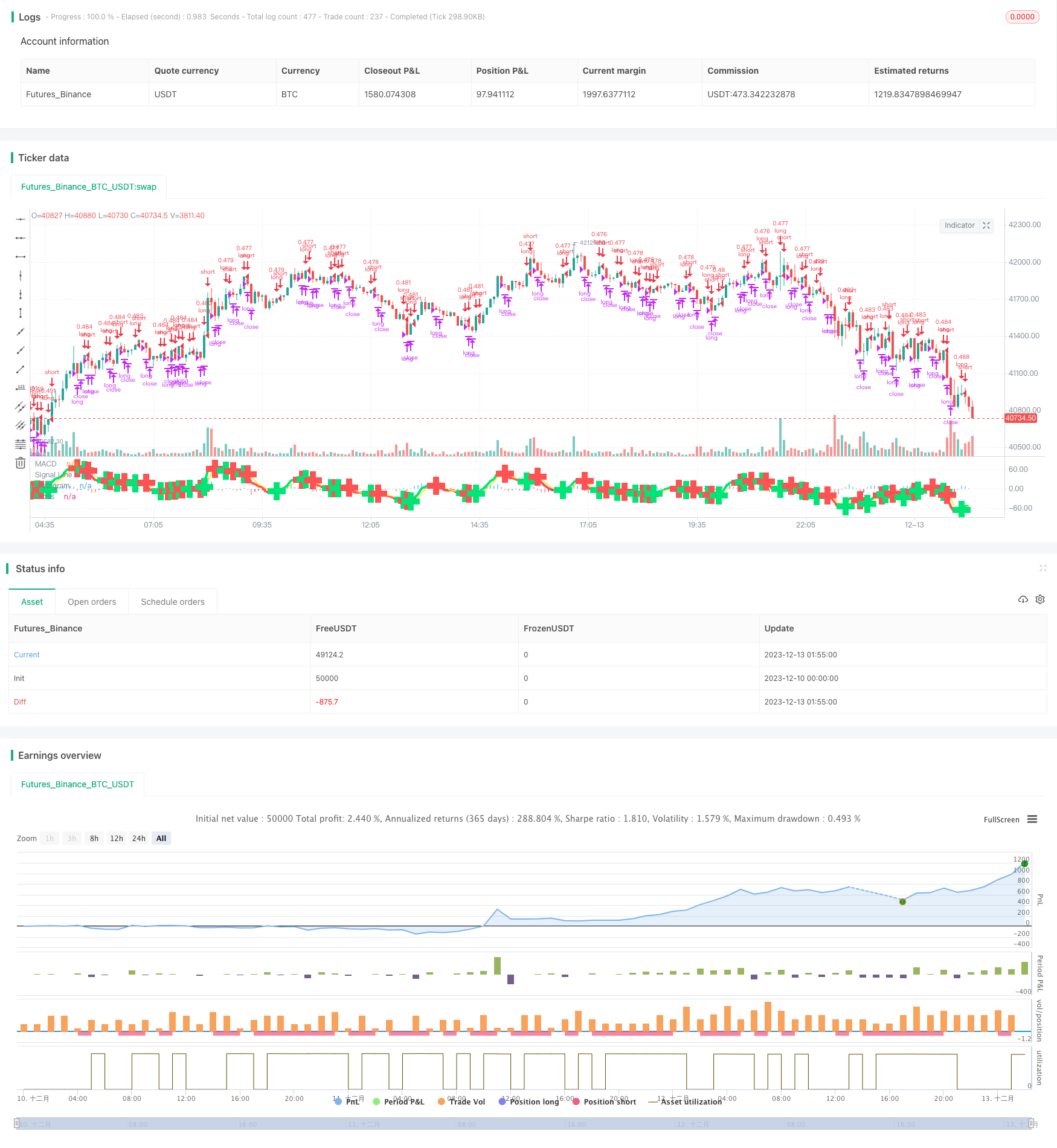

/*backtest

start: 2023-12-10 00:00:00

end: 2023-12-13 02:00:00

period: 5m

basePeriod: 1m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=2

// macd/cam v1 strategizing Chris Moody Macd indicator https://www.tradingview.com/script/OQx7vju0-MacD-Custom-Indicator-Multiple-Time-Frame-All-Available-Options/

// macd/cam v2 changing to macd 5,8,3

// macd/cam v2.1

// Sell when lower than previous day low.

// Initial capital of $2k. Buy/sell quantity of initial capital / close price

// Quitar short action

// Note: custom 1-week resolution seems to put AMD at 80% profitable

strategy(title="MACD/CAM 2.1", shorttitle="MACD/CAM 2.1") //

source = close

//get inputs from options

useCurrentRes = input(true, title="Use Current Chart Resolution?")

resCustom = input(title="Use Different Timeframe? Uncheck Box Above", defval="60")

smd = input(true, title="Show MacD & Signal Line? Also Turn Off Dots Below")

sd = input(true, title="Show Dots When MacD Crosses Signal Line?")

sh = input(true, title="Show Histogram?")

macd_colorChange = input(true,title="Change MacD Line Color-Signal Line Cross?")

hist_colorChange = input(true,title="MacD Histogram 4 Colors?")

venderLowerPrev = input(true,title="Vender cuando closing price < previous day low?")

res = useCurrentRes ? timeframe.period : resCustom

fastLength = input(5, minval=1), slowLength=input(8,minval=1)

signalLength=input(3,minval=1)

// find exponential moving average of price as x and fastLength var as y

fastMA = ema(source, fastLength)

slowMA = ema(source, slowLength)

macd = fastMA - slowMA

// simple moving average

signal = sma(macd, signalLength)

hist = macd - signal

outMacD = request.security(syminfo.tickerid, res, macd)

outSignal = request.security(syminfo.tickerid, res, signal)

outHist = request.security(syminfo.tickerid, res, hist)

histA_IsUp = outHist > outHist[1] and outHist > 0

histA_IsDown = outHist < outHist[1] and outHist > 0

histB_IsDown = outHist < outHist[1] and outHist <= 0

histB_IsUp = outHist > outHist[1] and outHist <= 0

//MacD Color Definitions

macd_IsAbove = outMacD >= outSignal

macd_IsBelow = outMacD < outSignal

plot_color = hist_colorChange ? histA_IsUp ? aqua : histA_IsDown ? blue : histB_IsDown ? red : histB_IsUp ? maroon :yellow :gray

macd_color = macd_colorChange ? macd_IsAbove ? lime : red : red

signal_color = macd_colorChange ? macd_IsAbove ? yellow : yellow : lime

circleYPosition = outSignal

plot(smd and outMacD ? outMacD : na, title="MACD", color=macd_color, linewidth=4)

plot(smd and outSignal ? outSignal : na, title="Signal Line", color=signal_color, style=line ,linewidth=2)

plot(sh and outHist ? outHist : na, title="Histogram", color=plot_color, style=histogram, linewidth=4)

circleCondition = sd and cross(outMacD, outSignal)

// Determine long and short conditions

longCondition = circleCondition and macd_color == lime

redCircle = circleCondition and macd_color == red

redCirclePrevLow = redCircle or low<low[1]

shortCondition = redCircle

if (venderLowerPrev)

shortCondition = redCirclePrevLow

strategy.initial_capital = 20000

// Set quantity to initial capital / closing price

cantidad = strategy.initial_capital/close

// Submit orders

strategy.entry(id="long", long=true, qty=cantidad, when=longCondition)

strategy.close(id="long", when=shortCondition)

plot(circleCondition ? circleYPosition : na, title="Cross", style=cross, linewidth=10, color=macd_color)

// hline(0, '0 Line', linestyle=solid, linewidth=2, color=white)

Lebih banyak

- Tren Mengikuti Strategi Perdagangan Regresi Berdasarkan Regresi Linear dan Moving Average

- Strategi Trading Robot MACD

- Bollinger Bands Dual Standard Deviation Strategi Perdagangan

- Strategi perdagangan berdasarkan sinyal crossover MACD dan RSI

- Strategi Perdagangan RSI Kondisi Bayesian

- Strategi Pivot Reversal

- Strategi perdagangan kuantitatif berdasarkan indikator TSI dan Hull Moving Average

- Strategi Tren Saluran

- Strategi CCI Lang Hanya

- Strategi Rata-rata Gerak Pita

- X48 - Optimasi dan Adaptasi Strategi DayLight Hunter

- Heikin-Ashi - 0.5% Perubahan Strategi Perdagangan Jangka Pendek

- Strategi Stop Trailing EMA Saluran Positif

- Strategi Crossover Rata-rata Gerak Galileo Galilei

- AC Backtest Strategi dari Williams Indikator

- Volatilitas rendah Pembelian arah dengan mengambil keuntungan dan stop loss

- Strategi Stop Loss dan Take Profit Persentase Tetap Berdasarkan Rata-rata Bergerak

- Strategi Perdagangan Kuantitatif Berdasarkan EMA Ganda dan Indeks Volatilitas Harga

- Momentum Breakout Strategi Pelacakan Bidirectional

- Super Trend LSMA Strategi Panjang