Strategi Perdagangan Grid Rata-rata Pergerakan Dinamis

Ringkasan

Strategi ini adalah strategi perdagangan grid dinamis yang menggunakan garis rata-rata yang bergerak. Ini akan memisahkan beberapa zona beli dan jual di bawah garis rata-rata sesuai dengan garis rata-rata dan amplitudo fluktuasi yang ditetapkan.

Prinsip Strategi

- Pengguna mengatur parameter Moving Average Line untuk menentukan sumbu tengah utama transaksi;

- Berdasarkan ATR dan parameter pengaturan, membedakan beberapa zona beli dan zona jual di bawah garis rata-rata;

- Ketika harga masuk ke zona beli yang berbeda, akan memicu sinyal melakukan lebih dari jumlah yang sesuai;

- Ketika harga kembali ke zona jual yang sesuai, maka akan terjadi pembiayaan berurutan.

- Ini adalah sistem perdagangan jaringan yang disesuaikan secara dinamis.

Keunggulan Strategis

- Menggunakan garis rata-rata untuk menentukan arah tren, menghindari posisi terbalik;

- Parameter ATR mempertimbangkan volatilitas pasar secara menyeluruh untuk membuat grid lebih dinamis;

- Untuk itu, perlu dilakukan langkah-langkah pencegahan dan pencegahan.

- Penghentian kerugian secara berurutan untuk menghindari kerugian yang terjatuh;

- Pengaturan parameter sederhana, mudah dioperasikan.

Risiko Strategis

- Terjadinya gempa besar dapat menyebabkan jaringan sering mengalami kerugian.

- Dalam tren yang kuat, titik-titik stop loss mungkin terlalu dekat, menyebabkan stop loss yang cepat setelah kenaikan;

- Pembangunan gudang ganda meningkatkan jumlah transaksi dan membebani biaya.

- Tidak berlaku untuk pasar bergejolak horizontal atau pasar tanpa tren yang jelas.

Risiko dapat dikurangi dengan melebarkan jarak grid yang tepat, mengoptimalkan parameter ATR, mengurangi jumlah posisi. Anda juga dapat mengatur kombinasi parameter perdagangan tren dan perdagangan goyangan sesuai dengan pasar yang berbeda.

Arah optimasi

- Indikator indeks riil dapat digunakan untuk menilai pergerakan saham besar, membedakan antara pasar terbuka;

- Varietas yang memiliki karakteristik tren dapat ditambahkan untuk penyaringan indikator kuantitatif untuk penggunaan strategis;

- Parameter ATR atau jarak grid dapat disesuaikan secara real-time berdasarkan fluktuasi;

- Anda dapat menambahkan strategi stop loss, mengikuti tren dan mendapatkan lebih banyak keuntungan.

Hal ini dapat dioptimalkan lebih lanjut, membuat strategi menjadi lebih dinamis dan bersifat lokal.

Meringkaskan

Strategi ini secara keseluruhan adalah strategi grid trend tracking yang lebih sederhana dan lebih matang. Ini menggunakan garis rata untuk menilai tren besar, kemudian membangun grid dinamis untuk melakukan perdagangan secara batch.

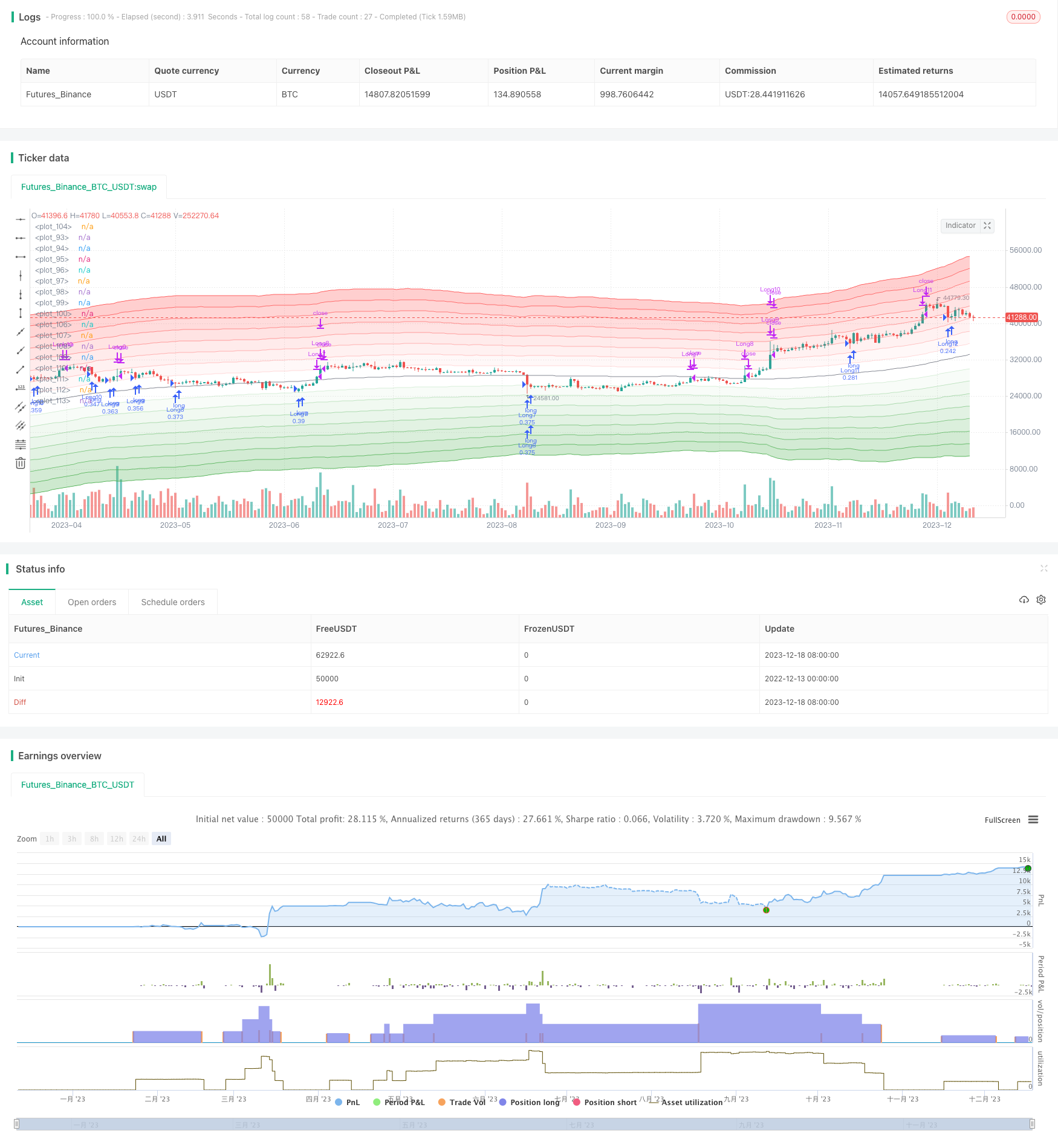

/*backtest

start: 2022-12-13 00:00:00

end: 2023-12-19 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © Seungdori_

//@version=5

strategy("Grid Strategy with MA", overlay=true, initial_capital = 100000, default_qty_type = strategy.cash, default_qty_value = 10000, pyramiding = 10, process_orders_on_close = true, commission_type = strategy.commission.percent, commission_value = 0.04)

//Inputs//

length = input.int(defval = 100, title = 'MA Length', group = 'MA')

MA_Type = input.string("SMA", title="MA Type", options=['EMA', 'HMA', 'LSMA', 'RMA', 'SMA', 'WMA'],group = 'MA')

logic = input.string(defval='ATR', title ='Grid Logic', options = ['ATR', 'Percent'])

band_mult = input.float(2.5, step = 0.1, title = 'Band Multiplier/Percent', group = 'Parameter')

atr_len = input.int(defval=100, title = 'ATR Length', group ='parameter')

//Var//

var int order_cond = 0

var bool order_1 = false

var bool order_2 = false

var bool order_3 = false

var bool order_4 = false

var bool order_5 = false

var bool order_6 = false

var bool order_7 = false

var bool order_8 = false

var bool order_9 = false

var bool order_10 = false

var bool order_11 = false

var bool order_12 = false

var bool order_13 = false

var bool order_14 = false

var bool order_15 = false

/////////////////////

//Region : Function//

/////////////////////

getMA(source ,ma_type, length) =>

maPrice = ta.ema(source, length)

ema = ta.ema(source, length)

sma = ta.sma(source, length)

if ma_type == 'SMA'

maPrice := ta.sma(source, length)

maPrice

if ma_type == 'HMA'

maPrice := ta.hma(source, length)

maPrice

if ma_type == 'WMA'

maPrice := ta.wma(source, length)

maPrice

if ma_type == "RMA"

maPrice := ta.rma(source, length)

if ma_type == "LSMA"

maPrice := ta.linreg(source, length, 0)

maPrice

main_plot = getMA(ohlc4, MA_Type, length)

atr = ta.atr(length)

premium_zone_1 = logic == 'ATR' ? ta.ema(main_plot + atr*(band_mult*1), 5) : ta.ema((main_plot*(1+band_mult*0.01*1)), 5)

premium_zone_2 = logic == 'ATR' ? ta.ema(main_plot + atr*(band_mult*2), 5) : ta.ema((main_plot*(1+band_mult*0.01*2)), 5)

premium_zone_3 = logic == 'ATR' ? ta.ema(main_plot + atr*(band_mult*3), 5) : ta.ema((main_plot*(1+band_mult*0.01*3)), 5)

premium_zone_4 = logic == 'ATR' ? ta.ema(main_plot + atr*(band_mult*4), 5) : ta.ema((main_plot*(1+band_mult*0.01*4)), 5)

premium_zone_5 = logic == 'ATR' ? ta.ema(main_plot + atr*(band_mult*5), 5) : ta.ema((main_plot*(1+band_mult*0.01*5)), 5)

premium_zone_6 = logic == 'ATR' ? ta.ema(main_plot + atr*(band_mult*6), 5) : ta.ema((main_plot*(1+band_mult*0.01*6)), 5)

premium_zone_7 = logic == 'ATR' ? ta.ema(main_plot + atr*(band_mult*7), 5) : ta.ema((main_plot*(1+band_mult*0.01*7)), 5)

premium_zone_8 = logic == 'ATR' ? ta.ema(main_plot + atr*(band_mult*8), 5) : ta.ema((main_plot*(1+band_mult*0.01*8)), 5)

//premium_zone_9 = ta.rma(main_plot + atr*(band_mult*9), 5)

//premium_zone_10 = ta.rma(main_plot + atr*(band_mult*10), 5)

discount_zone_1 = logic == 'ATR' ? ta.ema(main_plot - atr*(band_mult*1), 5) : ta.ema((main_plot*(1-band_mult*0.01*1)), 5)

discount_zone_2 = logic == 'ATR' ? ta.ema(main_plot - atr*(band_mult*2), 5) : ta.ema((main_plot*(1-band_mult*0.01*2)), 5)

discount_zone_3 = logic == 'ATR' ? ta.ema(main_plot - atr*(band_mult*3), 5) : ta.ema((main_plot*(1-band_mult*0.01*3)), 5)

discount_zone_4 = logic == 'ATR' ? ta.ema(main_plot - atr*(band_mult*4), 5) : ta.ema((main_plot*(1-band_mult*0.01*4)), 5)

discount_zone_5 = logic == 'ATR' ? ta.ema(main_plot - atr*(band_mult*5), 5) : ta.ema((main_plot*(1-band_mult*0.01*5)), 5)

discount_zone_6 = logic == 'ATR' ? ta.ema(main_plot - atr*(band_mult*6), 5) : ta.ema((main_plot*(1-band_mult*0.01*6)), 5)

discount_zone_7 = logic == 'ATR' ? ta.ema(main_plot - atr*(band_mult*7), 5) : ta.ema((main_plot*(1-band_mult*0.01*7)), 5)

discount_zone_8 = logic == 'ATR' ? ta.ema(main_plot - atr*(band_mult*8), 5) : ta.ema((main_plot*(1-band_mult*0.01*8)), 5)

//discount_zon_9 = ta.sma(main_plot - atr*(band_mult*9), 5)

//discount_zone_10 =ta.sma( main_plot - atr*(band_mult*10), 5)

//Region End//

////////////////////

// Region : Plots//

///////////////////

dis_low1 = plot(discount_zone_1, color=color.new(color.green, 80))

dis_low2 = plot(discount_zone_2, color=color.new(color.green, 70))

dis_low3 = plot(discount_zone_3, color=color.new(color.green, 60))

dis_low4 = plot(discount_zone_4, color=color.new(color.green, 50))

dis_low5 = plot(discount_zone_5, color=color.new(color.green, 40))

dis_low6 = plot(discount_zone_6, color=color.new(color.green, 30))

dis_low7 = plot(discount_zone_7, color=color.new(color.green, 20))

dis_low8 = plot(discount_zone_8, color=color.new(color.green, 10))

//dis_low9 = plot(discount_zone_9, color=color.new(color.green, 0))

//dis_low10 = plot(discount_zone_10, color=color.new(color.green, 0))

plot(main_plot, color =color.new(color.gray, 10))

pre_up1 = plot(premium_zone_1, color=color.new(color.red, 80))

pre_up2 = plot(premium_zone_2, color=color.new(color.red, 70))

pre_up3 = plot(premium_zone_3, color=color.new(color.red, 60))

pre_up4 = plot(premium_zone_4, color=color.new(color.red, 50))

pre_up5 = plot(premium_zone_5, color=color.new(color.red, 40))

pre_up6 = plot(premium_zone_6, color=color.new(color.red, 30))

pre_up7 = plot(premium_zone_7, color=color.new(color.red, 20))

pre_up8 = plot(premium_zone_8, color=color.new(color.red, 10))

//pre_up9 = plot(premium_zone_9, color=color.new(color.red, 0))

//pre_up10 = plot(premium_zone_10, color=color.new(color.red, 0))

fill(dis_low1, dis_low2, color=color.new(color.green, 95))

fill(dis_low2, dis_low3, color=color.new(color.green, 90))

fill(dis_low3, dis_low4, color=color.new(color.green, 85))

fill(dis_low4, dis_low5, color=color.new(color.green, 80))

fill(dis_low5, dis_low6, color=color.new(color.green, 75))

fill(dis_low6, dis_low7, color=color.new(color.green, 70))

fill(dis_low7, dis_low8, color=color.new(color.green, 65))

//fill(dis_low8, dis_low9, color=color.new(color.green, 60))

//fill(dis_low9, dis_low10, color=color.new(color.green, 55))

fill(pre_up1, pre_up2, color=color.new(color.red, 95))

fill(pre_up2, pre_up3, color=color.new(color.red, 90))

fill(pre_up3, pre_up4, color=color.new(color.red, 85))

fill(pre_up4, pre_up5, color=color.new(color.red, 80))

fill(pre_up5, pre_up6, color=color.new(color.red, 75))

fill(pre_up6, pre_up7, color=color.new(color.red, 70))

fill(pre_up7, pre_up8, color=color.new(color.red, 65))

//fill(pre_up8, pre_up9, color=color.new(color.red, 60))

//fill(pre_up9, pre_up10, color=color.new(color.red, 55))

//Region End//

///////////////////////

//Region : Strategies//

///////////////////////

//Longs//

longCondition1 = ta.crossunder(low, discount_zone_7)

longCondition2 = ta.crossunder(low, discount_zone_6)

longCondition3 = ta.crossunder(low, discount_zone_5)

longCondition4 = ta.crossunder(low, discount_zone_4)

longCondition5 = ta.crossunder(low, discount_zone_3)

longCondition6 = ta.crossunder(low, discount_zone_2)

longCondition7 = ta.crossunder(low, discount_zone_1)

longCondition8 = ta.crossunder(low, main_plot)

longCondition9 = ta.crossunder(low, premium_zone_1)

longCondition10 = ta.crossunder(low, premium_zone_2)

longCondition11 = ta.crossunder(low, premium_zone_3)

longCondition12 = ta.crossunder(low, premium_zone_4)

longCondition13 = ta.crossunder(low, premium_zone_5)

longCondition14 = ta.crossunder(low, premium_zone_6)

longCondition15 = ta.crossunder(low, premium_zone_7)

if (longCondition1) and order_1 == false

strategy.entry("Long1", strategy.long)

order_1 := true

if (longCondition2) and order_2 == false

strategy.entry("Long2", strategy.long)

order_2 := true

if (longCondition3) and order_3 == false

strategy.entry("Long3", strategy.long)

order_3 := true

if (longCondition4) and order_4 == false

strategy.entry("Long4", strategy.long)

order_4 := true

if (longCondition5) and order_5 == false

strategy.entry("Long5", strategy.long)

order_5 := true

if (longCondition6) and order_6 == false

strategy.entry("Long6", strategy.long)

order_6 := true

if (longCondition7) and order_7 == false

strategy.entry("Long7", strategy.long)

order_7 := true

if (longCondition8) and order_8 == false

strategy.entry("Long8", strategy.long)

order_8 := true

if (longCondition9) and order_9 == false

strategy.entry("Long9", strategy.long)

order_9 := true

if (longCondition10) and order_10 == false

strategy.entry("Long10", strategy.long)

order_10 := true

if (longCondition11) and order_11 == false

strategy.entry("Long11", strategy.long)

order_11 := true

if (longCondition12) and order_12 == false

strategy.entry("Long12", strategy.long)

order_12 := true

if (longCondition13) and order_13 == false

strategy.entry("Long13", strategy.long)

order_13 := true

if (longCondition14) and order_14 == false

strategy.entry("Long14", strategy.long)

order_14 := true

if (longCondition15) and order_15 == false

strategy.entry("Long14", strategy.long)

order_15 := true

//Close//

shortCondition1 = ta.crossover(high, discount_zone_6)

shortCondition2 = ta.crossover(high, discount_zone_5)

shortCondition3 = ta.crossover(high, discount_zone_4)

shortCondition4 = ta.crossover(high, discount_zone_3)

shortCondition5 = ta.crossover(high, discount_zone_2)

shortCondition6 = ta.crossover(high, discount_zone_1)

shortCondition7 = ta.crossover(high, main_plot)

shortCondition8 = ta.crossover(high, premium_zone_1)

shortCondition9 = ta.crossover(high, premium_zone_2)

shortCondition10 = ta.crossover(high, premium_zone_3)

shortCondition11 = ta.crossover(high, premium_zone_4)

shortCondition12 = ta.crossover(high, premium_zone_5)

shortCondition13 = ta.crossover(high, premium_zone_6)

shortCondition14 = ta.crossover(high, premium_zone_7)

shortCondition15 = ta.crossover(high, premium_zone_8)

if (shortCondition1) and order_1 == true

strategy.close("Long1")

order_1 := false

if (shortCondition2) and order_2 == true

strategy.close("Long2")

order_2 := false

if (shortCondition3) and order_3 == true

strategy.close("Long3")

order_3 := false

if (shortCondition4) and order_4 == true

strategy.close("Long4")

order_4 := false

if (shortCondition5) and order_5 == true

strategy.close("Long5")

order_5 := false

if (shortCondition6) and order_6 == true

strategy.close("Long6")

order_6 := false

if (shortCondition7) and order_7 == true

strategy.close("Long7")

order_7 := false

if (shortCondition8) and order_8 == true

strategy.close("Long8")

order_8 := false

if (shortCondition9) and order_9 == true

strategy.close("Long9")

order_9 := false

if (shortCondition10) and order_10 == true

strategy.close("Long10")

order_10 := false

if (shortCondition11) and order_11 == true

strategy.close("Long11")

order_11 := false

if (shortCondition12) and order_12 == true

strategy.close("Long12")

order_12 := false

if (shortCondition13) and order_13 == true

strategy.close("Long13")

order_13 := false

if (shortCondition14) and order_14 == true

strategy.close("Long14")

order_14 := false

if (shortCondition15) and order_15 == true

strategy.close("Long15")

order_15 := false