Strategi Momentum Berdasarkan Model Double Bottom Breakout

Penulis:ChaoZhang, Tanggal: 2023-12-21 15:16:24Tag:

Gambaran umum

Strategi ini didasarkan pada model double bottom menggunakan indikator teknis. Strategi ini mencari sinyal terobosan ketika pasar berada dalam keadaan oversold dan pola double bottom terbentuk di dekat area bawah. Strategi ini menggabungkan beberapa indikator untuk menilai keadaan overbought dan oversold pasar dan menghasilkan sinyal beli ketika bentuk double bottom. Strategi ini terutama cocok untuk perdagangan jangka menengah dan pendek.

Prinsip Strategi

Strategi ini terutama menilai apakah harga membentuk dasar ganda di sekitar tingkat dukungan utama dan apakah pasar berada dalam keadaan oversold.

-

Indikator RSI: Ketika indikator RSI menunjukkan pasar oversold, itu dianggap sinyal beli.

-

Indikator RVI: Ketika indikator RVI menunjukkan pasar oversold, itu dianggap sinyal beli.

-

Indikator MFI: Ketika indikator MFI menunjukkan pasar oversold, itu dianggap sinyal beli.

-

Indikator SAR: Ketika harga melanggar indikator SAR, itu dianggap sebagai sinyal beli.

-

Indikator SMA500: Ketika harga melanggar indikator SMA500, itu dianggap sebagai sinyal beli.

Strategi ini memperhitungkan penilaian dari beberapa indikator di atas dan menghasilkan sinyal beli ketika pola double bottom terbentuk di sekitar tingkat pendukung utama.

Keuntungan dari Strategi

Strategi ini memiliki keuntungan berikut:

-

Menggabungkan beberapa indikator untuk menilai status pasar membuat sinyal lebih dapat diandalkan.

-

Menghasilkan sinyal beli ketika bentuk double bottom memiliki probabilitas keuntungan yang relatif tinggi.

-

Menggunakan kombinasi indikator untuk menilai keadaan oversold dan overbought menghindari kehilangan peluang beli.

-

Mengintegrasikan model double bottom breakout dengan strategi indikator menggabungkan keuntungan dari perdagangan trend berikut dan rata-rata reversi.

-

Strategi ini memiliki ruang optimasi parameter yang besar dan parameter dapat disesuaikan untuk pasar yang berbeda.

Risiko dari Strategi

Strategi ini juga memiliki risiko berikut:

-

Risiko sinyal palsu dari indikator, yang mengakibatkan kerugian dari pembelian.

-

Stop loss dapat diatur untuk mengurangi kerugian per perdagangan.

-

Kesulitan pengoptimalan parameter berdimensi tinggi besar dan membutuhkan dukungan data historis yang besar. Algoritma bertahap dapat diadopsi untuk pengoptimalan bertahap.

-

Mengandalkan data historis untuk hasil pengujian, kinerja sebenarnya akan berbeda.

Arahan Optimasi

Arah optimasi utama untuk strategi ini meliputi:

-

Mengoptimalkan bobot indikator beli untuk menentukan kombinasi bobot optimal.

-

Mengoptimalkan parameter indikator untuk menentukan kombinasi parameter terbaik.

-

Menambahkan strategi stop loss untuk mengurangi kerugian per perdagangan.

-

Meningkatkan modul manajemen posisi untuk keuntungan yang lebih stabil.

-

Menggabungkan algoritma pembelajaran mesin untuk membangun mekanisme optimasi parameter adaptif.

Kesimpulan

Strategi ini mengintegrasikan model double bottom breakout dan penilaian indikator oversold, menghasilkan sinyal beli ketika double bottom terbentuk di sekitar level support utama.

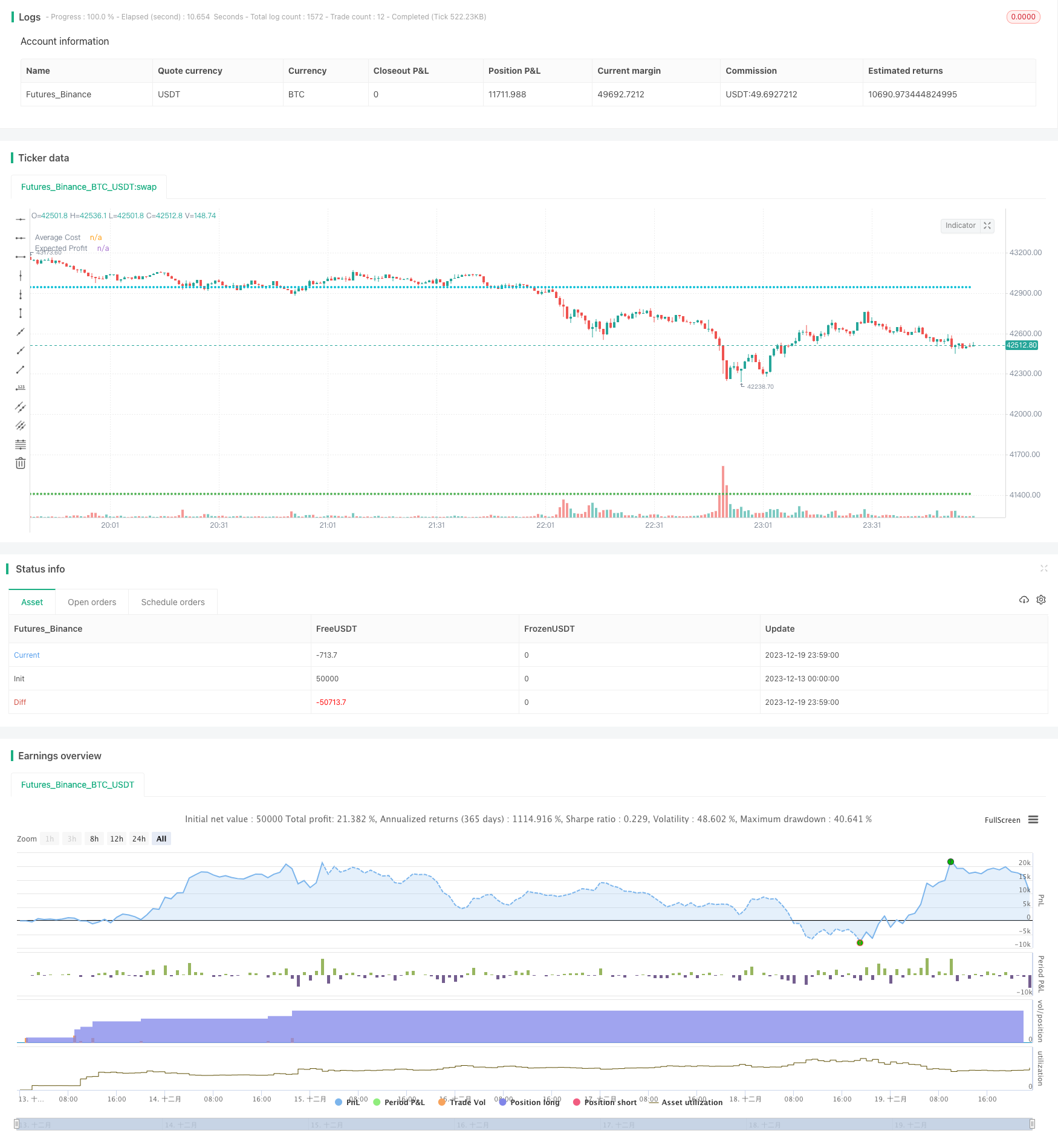

/*backtest

start: 2023-12-13 00:00:00

end: 2023-12-20 00:00:00

period: 1m

basePeriod: 1m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("UP & DOWN - BNB/USDT 15min", shorttitle="U&D - BNB 15min", overlay=true, calc_on_order_fills=true, calc_on_every_tick=true, initial_capital = 1000,pyramiding = 40,backtest_fill_limits_assumption = 1, process_orders_on_close=true, currency = currency.USD, default_qty_type = strategy.cash, default_qty_value = 25, commission_type = strategy.commission.percent, commission_value = 0.1)

// This startergy optimized to BNB 15 min standerd candlestic chart and buy & sell signals were based on technical analysis.

UP_DOWN = input.string( title='Trade in', options=['Only on Up Trends', 'Uptrend and down trend'], defval='Uptrend and down trend')

var profit_cal = input.float( defval = 3.7, title = "Expected profit %", minval = 0.2, step = 0.1)

//Backtest dates

fromMonth = input.int(defval = 10,title = "From Month", minval = 1, maxval = 12, group = 'Time Period Values')

fromDay = input.int(defval = 1, title = "From Day", minval = 1, maxval = 31, group = 'Time Period Values')

fromYear = input.int(defval = 2021, title = "From Year", minval = 1970, group = 'Time Period Values')

thruMonth = input.int(defval = 1, title = "Thru Month", minval = 1, maxval = 12, group = 'Time Period Values')

thruDay = input.int(defval = 1, title = "Thru Day", minval = 1, maxval = 31, group = 'Time Period Values')

thruYear = input.int(defval = 2112, title = "Thru Year", minval = 1970, group = 'Time Period Values')

//showDate = input(defval = true, title = "Show Date Range", group = 'Time Period Values')

start = timestamp(fromYear, fromMonth, fromDay, 00, 00) // backtest start window

finish = timestamp(thruYear, thruMonth, thruDay, 23, 59) // backtest finish window

window() => true

// inputs

//Inputs of SAR Indicator

sar1 = input.float(defval=0.0002, title='SAR value 1',step=0.0001, group = 'SAR Values')

sar2 = input.float(defval=0.0004, title='SAR value 2',step=0.0001, group = 'SAR Values')

sar3 = input.float(defval=0.1, title='SAR value 3',step=0.1, group = 'SAR Values')

src_close = input(close, "SAR Source - close", group = 'SAR Values')

src_open = input(open, "SAR Source - open", group = 'SAR Values')

bool sar_visible = input(false, "Show SAR",group = 'SAR Values' )

// Inputs of Super trend indicator

ST_T = input.int(defval=16, title = 'Supertrend - Trend', step =1, group = 'Super Trend')

ST_D = input.int(defval=7, title = 'Supertrend - Direction', step =1, group = 'Super Trend')

ST_SMA = input.int(defval=1, title = 'Supertrend - SMA', step = 1, group = 'Super Trend')

bool ST_visible = input(false, "Show Super Trend",group = 'Super Trend' )

//Inputs of SMA500 indicator

src_sma500 = input(high, 'SMA500 - Source', group = 'SMA500')

lb_sma500 = input.int(defval = 143, title = 'SMA500 - Look back period', step=10, group = 'SMA500')

bool sma500_visible = input(false, "Show SMA500",group = 'SMA500' )

// Calculations

// SMA500 Indicator

SMA500 = ta.sma(src_sma500,lb_sma500)

SMA700 = ta.sma(close,700)

SMA_Open = ta.sma(open,9)

//SMA9 Indicator

SMA9 = ta.sma((high+low)/2,5)

risingSMA9 = ta.rising(SMA9,1)

fallingSMA9 = ta.falling(SMA9,1)

color plotcolor1 = color.black

if risingSMA9

plotcolor1 := color.green

// SAR Indicator

sar = ta.sar(sar1, sar2, sar3)

sma2_close = ta.sma(src_close,1)

sma2_open = ta.sma(src_open,1)

//Supertrend

[supertrend, direction] = ta.supertrend(ST_T, ST_D)

up_trend = ta.sma(direction < 0 ? supertrend : na,ST_SMA)

down_trend = ta.sma(direction < 0? na : supertrend, ST_SMA)

// Color change

color plotcolor2 = color.green

if open>down_trend or close>down_trend

plotcolor2 := color.lime

if open<down_trend or close<down_trend

plotcolor2 := color.red

color plotcolor3 = color.green

if open>up_trend or close>up_trend

plotcolor3 := color.yellow

if open<up_trend or close<up_trend

plotcolor3 := color.red

color plotcolor4 = color.black

if (open>sar or close>sar)

plotcolor4 := color.white

if (open<sar or close<sar)

plotcolor4 := color.red

color plotcolor5 = color.black

if (open>SMA500 or close>SMA500)

plotcolor5 := color.green

if (open<SMA500 or close<SMA500)

plotcolor5 := color.red

color plotcolor6 = color.green

rising_taalma = ta.rising (ta.alma(open,10,.99,1),1)

falling_taalma = ta.falling (ta.alma(open,10,.99,1),1)

if rising_taalma

plotcolor6 := color.green

if falling_taalma

plotcolor6 := color.red

// buy and sell conditions for uptrend

longCondition1 = (open >= down_trend or high>= down_trend or ta.crossover(open,down_trend)or ta.crossover(high,down_trend))

longCondition2 = (open >= up_trend or high>= up_trend or ta.crossover(open,up_trend)or ta.crossover(high,up_trend))

longCondition3 = (open >= SMA500 or high>= SMA500 or ta.crossover(open,SMA500)or ta.crossover(high,SMA500))

longCondition4 = (open >= sar or high>= sar or ta.crossover(open,sar)or ta.crossover(high,sar))

longCondition5 = rising_taalma

shortCondition1 = (close < down_trend or low< down_trend or ta.crossunder(close,down_trend)or ta.crossunder(low,down_trend))

shortCondition2 = (close < up_trend or low< up_trend or ta.crossunder(close,up_trend)or ta.crossunder(low,up_trend))

shortCondition3 = (close < SMA500 or low< SMA500 or ta.crossunder(close,SMA500)or ta.crossunder(low,SMA500))

shortCondition4 = (close < sar or low< sar or ta.crossunder(close,sar)or ta.crossunder(low,sar))

shortCondition5 = falling_taalma

comp_buy1 = longCondition1 and longCondition2 and longCondition3 and longCondition4 and longCondition5

op_buy1 = shortCondition3 and longCondition1 and longCondition2 and longCondition4

op_buy2 = shortCondition1 and shortCondition2 and longCondition3 and longCondition4 and longCondition5

comp_sell1 = shortCondition1 and shortCondition2 and shortCondition3 and shortCondition4 and shortCondition5

op_sell1 = shortCondition3 and shortCondition4 and longCondition1 and longCondition2

op_sell2 = shortCondition4 and longCondition1 and longCondition2 and longCondition3

op_sell3 = longCondition2 and shortCondition1 and shortCondition4 and shortCondition3

op_sell4 = longCondition2 and shortCondition1 and shortCondition4

var b1 = 0

var b2 = 0

var b3 = 0

if comp_buy1 == true and comp_buy1[1] == false

b1 := 1

else

b1 := 0

if op_buy1 == true and op_buy1[1] == false

b2 := 1

else

b2 := 0

if op_buy2 == true and op_buy2[1] == false

b3 := 1

else

b3 := 0

// DCA method based on indicators

//RSI Indicator

len_rsi_10 = input.int(10, title="Length", group = "RSI Indicator - 10", minval=1, maxval = 10, step = 1)

src_rsi_10 = input(ohlc4, "Source", group = "RSI Indicator - 10")

up_rsi_10 = ta.rma(math.max(ta.change(src_rsi_10), 0), len_rsi_10)

down_rsi_10 = ta.rma(-math.min(ta.change(src_rsi_10), 0), len_rsi_10)

rsi_10 = down_rsi_10 == 0 ? 100 : up_rsi_10 == 0 ? 0 : 100 - (100 / (1 + up_rsi_10 / down_rsi_10))

var p_rsi = 0

if rsi_10>= 0 and rsi_10<10

p_rsi := 0

else if rsi_10>= 10 and rsi_10<20

p_rsi := 10

else if rsi_10>= 20 and rsi_10<30

p_rsi := 20

else if rsi_10>= 30 and rsi_10<40

p_rsi := 30

else if rsi_10>= 40 and rsi_10<50

p_rsi := 40

else if rsi_10>= 50 and rsi_10<60

p_rsi := 50

else if rsi_10>= 60 and rsi_10<70

p_rsi := 60

else if rsi_10>= 70 and rsi_10<80

p_rsi := 70

else if rsi_10>= 80 and rsi_10<90

p_rsi := 80

else if rsi_10>= 90 and rsi_10<100

p_rsi := 90

len_rsi_50 = input.int(50, title="Length", group = "RSI Indicator - 50", minval=11, maxval = 50, step = 1)

src_rsi_50 = input(high, "Source", group = "RSI Indicator - 50")

up_rsi_50 = ta.rma(math.max(ta.change(src_rsi_50), 0), len_rsi_50)

down_rsi_50 = ta.rma(-math.min(ta.change(src_rsi_50), 0), len_rsi_50)

rsi_50 = down_rsi_50 == 0 ? 100 : up_rsi_50 == 0 ? 0 : 100 - (100 / (1 + up_rsi_50 / down_rsi_50))

var p_rsi_50 = 0

if rsi_50>= 0 and rsi_50<10

p_rsi_50 := 0

else if rsi_50>= 10 and rsi_50<20

p_rsi_50 := 10

else if rsi_50>= 20 and rsi_50<30

p_rsi_50 := 20

else if rsi_50>= 30 and rsi_50<40

p_rsi_50 := 30

else if rsi_50>= 40 and rsi_50<50

p_rsi_50 := 40

else if rsi_50>= 50 and rsi_50<60

p_rsi_50 := 50

else if rsi_50>= 60 and rsi_50<70

p_rsi_50 := 60

else if rsi_50>= 70 and rsi_50<80

p_rsi_50 := 70

else if rsi_50>= 80 and rsi_50<90

p_rsi_50 := 80

else if rsi_50>= 90 and rsi_50<100

p_rsi_50 := 90

len_rsi_100 = input.int(100, title="Length", group = "RSI Indicator - 100", minval=51, maxval = 200, step = 10)

src_rsi_100 = input(ohlc4, "Source", group = "RSI Indicator - 100")

up_rsi_100 = ta.rma(math.max(ta.change(src_rsi_100), 0), len_rsi_100)

down_rsi_100 = ta.rma(-math.min(ta.change(src_rsi_100), 0), len_rsi_100)

rsi_100 = down_rsi_100 == 0 ? 100 : up_rsi_100 == 0 ? 0 : 100 - (100 / (1 + up_rsi_100 / down_rsi_100))

var p_rsi_100 = 0

if rsi_100>= 0 and rsi_100<10

p_rsi_100 := 0

else if rsi_100>= 10 and rsi_100<20

p_rsi_100 := 10

else if rsi_100>= 20 and rsi_100<30

p_rsi_100 := 20

else if rsi_100>= 30 and rsi_100<40

p_rsi_100 := 30

else if rsi_100>= 40 and rsi_100<50

p_rsi_100 := 40

else if rsi_100>= 50 and rsi_100<60

p_rsi_100 := 50

else if rsi_100>= 60 and rsi_100<70

p_rsi_100 := 60

else if rsi_100>= 70 and rsi_100<80

p_rsi_100 := 70

else if rsi_100>= 80 and rsi_100<90

p_rsi_100 := 80

else if rsi_100>= 90 and rsi_100<100

p_rsi_100 := 90

// Relative Volatility Indicator

length_rvi_10 = input.int(defval = 10, minval=1, maxval = 10, step = 1, title="Length - RVI", group = "RVI Indicator - 10")

len_rvi_10 = input.int(defval = 10, minval=1, maxval = 10, step = 1, title="Length - EMA", group = "RVI Indicator - 10")

src_rvi_10 = input(high, title = "Source", group = "RVI Indicator - 10")

stddev_rvi_10 = ta.stdev(src_rvi_10, length_rvi_10)

upper_rvi_10 = ta.ema(ta.change(src_rvi_10) <= 0 ? 0 : stddev_rvi_10, len_rvi_10)

lower_rvi_10 = ta.ema(ta.change(src_rvi_10) > 0 ? 0 : stddev_rvi_10, len_rvi_10)

rvi_10 = upper_rvi_10 / (upper_rvi_10 + lower_rvi_10) * 100

var p_rvi_10 = 0

if rvi_10 >= 0 and rvi_10 <10

p_rvi_10 := 0

else if rvi_10 >= 10 and rvi_10 <20

p_rvi_10 := 10

else if rvi_10 >= 20 and rvi_10 <30

p_rvi_10 := 20

else if rvi_10 >= 30 and rvi_10 <40

p_rvi_10 := 30

else if rvi_10 >= 40 and rvi_10 <50

p_rvi_10 := 40

else if rvi_10 >= 50 and rvi_10 <60

p_rvi_10 := 50

else if rvi_10 >= 60 and rvi_10 <70

p_rvi_10 := 60

else if rvi_10 >= 70 and rvi_10 <80

p_rvi_10 := 70

else if rvi_10 >= 80 and rvi_10 <90

p_rvi_10 := 80

else if rvi_10 >= 90 and rvi_10 <100

p_rvi_10 := 90

length_rvi_50 = input.int(defval = 50, minval=11, maxval = 50, step = 1, title="Length - RVI", group = "RVI Indicator - 50")

len_rvi_50 = input.int(defval = 50, minval=11, maxval = 50, step = 1, title="Length - EMA", group = "RVI Indicator - 50")

src_rvi_50 = input(close, title = "source", group = "RVI Indicator - 50")

stddev_rvi_50 = ta.stdev(src_rvi_50, length_rvi_50)

upper_rvi_50 = ta.ema(ta.change(src_rvi_50) <= 0 ? 0 : stddev_rvi_50, len_rvi_50)

lower_rvi_50 = ta.ema(ta.change(src_rvi_50) > 0 ? 0 : stddev_rvi_50, len_rvi_50)

rvi_50 = upper_rvi_50 / (upper_rvi_50 + lower_rvi_50) * 100

var p_rvi_50 = 0

if rvi_50 >= 0 and rvi_50 <10

p_rvi_50 := 0

else if rvi_50 >= 10 and rvi_50 <20

p_rvi_50 := 10

else if rvi_50 >= 20 and rvi_50 <30

p_rvi_50 := 20

else if rvi_50 >= 30 and rvi_50 <40

p_rvi_50 := 30

else if rvi_50 >= 40 and rvi_50 <50

p_rvi_50 := 40

else if rvi_50 >= 50 and rvi_50 <60

p_rvi_50 := 50

else if rvi_50 >= 60 and rvi_50 <70

p_rvi_50 := 60

else if rvi_50 >= 70 and rvi_50 <80

p_rvi_50 := 70

else if rvi_50 >= 80 and rvi_50 <90

p_rvi_50 := 80

else if rvi_50 >= 90 and rvi_50 <100

p_rvi_50 := 90

length_rvi_100 = input.int(defval = 100, minval=51, maxval = 200, step = 10, title="Length - RVI", group = "RVI Indicator - 100")

len_rvi_100 = input.int(defval = 100, minval=51, maxval = 200, step = 10, title="Length - EMA", group = "RVI Indicator - 100")

src_rvi_100 = input(close, title = "Source", group = "RVI Indicator - 100")

stddev_rvi_100 = ta.stdev(src_rvi_100, length_rvi_100)

upper_rvi_100 = ta.ema(ta.change(src_rvi_100) <= 0 ? 0 : stddev_rvi_100, len_rvi_100)

lower_rvi_100 = ta.ema(ta.change(src_rvi_100) > 0 ? 0 : stddev_rvi_100, len_rvi_100)

rvi_100 = upper_rvi_100 / (upper_rvi_100 + lower_rvi_100) * 100

var p_rvi_100 = 0

if rvi_100 >= 0 and rvi_100 <10

p_rvi_100 := 0

else if rvi_100 >= 10 and rvi_100 <20

p_rvi_100 := 10

else if rvi_100 >= 20 and rvi_100 <30

p_rvi_100 := 20

else if rvi_100 >= 30 and rvi_100 <40

p_rvi_100 := 30

else if rvi_100 >= 40 and rvi_100 <50

p_rvi_100 := 40

else if rvi_100 >= 50 and rvi_100 <60

p_rvi_100 := 50

else if rvi_100 >= 60 and rvi_100 <70

p_rvi_100 := 60

else if rvi_100 >= 70 and rvi_100 <80

p_rvi_100 := 70

else if rvi_100 >= 80 and rvi_100 <90

p_rvi_100 := 80

else if rvi_100 >= 90 and rvi_100 <100

p_rvi_100 := 90

// Money flow index

len_mfi_10 = input.int(defval = 10, minval=1, maxval = 10, step = 1, title="Length - MFI", group = "MFI Indicator - 10")

src_mfi_10 = input(high, title = "source", group = "MFI Indicator - 10")

mf_10 = ta.mfi(src_mfi_10, len_mfi_10)

var p_mfi_10 = 0

if mf_10>= 0 and mf_10<10

p_mfi_10 := 0

else if mf_10>= 10 and mf_10<20

p_mfi_10 := 10

else if mf_10>= 20 and mf_10<30

p_mfi_10 := 20

else if mf_10>= 30 and mf_10<40

p_mfi_10 := 30

else if mf_10>= 40 and mf_10<50

p_mfi_10 := 40

else if mf_10>= 50 and mf_10<60

p_mfi_10 := 50

else if mf_10>= 60 and mf_10<70

p_mfi_10 := 60

else if mf_10>= 70 and mf_10<80

p_mfi_10 := 70

else if mf_10>= 80 and mf_10<90

p_mfi_10 := 80

else if mf_10>= 90 and mf_10<100

p_mfi_10 := 90

len_mfi_50 = input.int(defval = 50, minval=11, maxval = 50, step = 1, title="Length - MFI", group = "MFI Indicator - 50")

src_mfi_50 = input(high, title = "source", group = "MFI Indicator - 50")

mf_50 = ta.mfi(src_mfi_50, len_mfi_50)

var p_mfi_50 = 0

if mf_50>= 0 and mf_50<10

p_mfi_50 := 0

else if mf_50>= 10 and mf_50<20

p_mfi_50 := 10

else if mf_50>= 20 and mf_50<30

p_mfi_50 := 20

else if mf_50>= 30 and mf_50<40

p_mfi_50 := 30

else if mf_50>= 40 and mf_50<50

p_mfi_50 := 40

else if mf_50>= 50 and mf_50<60

p_mfi_50 := 50

else if mf_50>= 60 and mf_50<70

p_mfi_50 := 60

else if mf_50>= 70 and mf_50<80

p_mfi_50 := 70

else if mf_50>= 80 and mf_50<90

p_mfi_50 := 80

else if mf_50>= 90 and mf_50<100

p_mfi_50 := 90

len_mfi_100 = input.int(defval = 100, minval=51, maxval = 200, step = 10, title="Length - MFI", group = "MFI Indicator - 100")

src_mfi_100 = input(high, title = "source", group = "MFI Indicator - 100")

mf_100 = ta.mfi(src_mfi_100, len_mfi_100)

var p_mfi_100 = 0

if mf_100>= 0 and mf_100<10

p_mfi_100 := 0

else if mf_100>= 10 and mf_100<20

p_mfi_100 := 10

else if mf_100>= 20 and mf_100<30

p_mfi_100 := 20

else if mf_100>= 30 and mf_100<40

p_mfi_100 := 30

else if mf_100>= 40 and mf_100<50

p_mfi_100 := 40

else if mf_100>= 50 and mf_100<60

p_mfi_100 := 50

else if mf_100>= 60 and mf_100<70

p_mfi_100 := 60

else if mf_100>= 70 and mf_100<80

p_mfi_100 := 70

else if mf_100>= 80 and mf_100<90

p_mfi_100 := 80

else if mf_100>= 90 and mf_100<100

p_mfi_100 := 90

//Balance of power indicator

bop = ((((close - open) / (high - low))*100)+50)

bop_sma_100 = ta.sma(bop,100)

// Buy and Sell lavels based on Indicators

l_val_rsi = input.int (defval = 40, title = "Lower value of RSI", maxval = 100, minval = 0, step = 10, group = 'Indicator Values')

l_val_rvi = input.int (defval = 40, title = "Lower value of RVI", maxval = 100, minval = 0, step = 10, group = 'Indicator Values')

l_val_mfi = input.int (defval = 40, title = "Lower value of MFI", maxval = 100, minval = 0, step = 10, group = 'Indicator Values')

//h_val_rsi = input.int (defval = 60, title = "Higher value of RSI", maxval = 100, minval = 0, step = 10, group = 'Indicator Values')

//h_val_rvi = input.int (defval = 50, title = "Higher value of RVI", maxval = 100, minval = 0, step = 10, group = 'Indicator Values')

//h_val_mfi = input.int (defval = 50, title = "Higher value of MFI", maxval = 100, minval = 0, step = 10, group = 'Indicator Values')

buy_rsi = p_rsi_100 <= l_val_rsi and p_rsi_50<p_rsi_100 and p_rsi<=p_rsi_50

buy_rvi = p_rvi_100 <= l_val_rvi and p_rvi_50<=p_rvi_100 and p_rvi_10<=p_rvi_50

buy_mfi = p_mfi_100 <= l_val_mfi and p_mfi_50<=p_mfi_100 and p_mfi_10<=p_mfi_50

buy_compound = buy_rsi and buy_rvi and buy_mfi ? 100 : 0

var float buy_compound_f = na

if (buy_compound[1] == 100 and buy_compound == 0) //and open > close

buy_compound_f := 1

else

buy_compound_f := na

ma_9 = ta.ema(close,2)

co_l1 = strategy.position_avg_price*0.95

co_l2 = strategy.position_avg_price*0.90

co_l3 = strategy.position_avg_price*0.85

co_l4 = strategy.position_avg_price*0.80

//Take profit in Market bottoms

profit_f = 1.0 + (profit_cal/100)

// Trading

var final_option = UP_DOWN == 'Uptrend and down trend' ? 1 : 2

if final_option == 1

if ((buy_compound_f ==1 or ta.crossover(ma_9, co_l1) or ta.crossover(ma_9, co_l2) or ta.crossover(ma_9, co_l3) or ta.crossover(ma_9, co_l4)) and window())

strategy.entry("long", strategy.long,comment = "BUY")

else if ( comp_sell1 and window()) and strategy.position_avg_price * profit_f < close

strategy.close("long", qty_percent = 100, comment = "SELL")

else if final_option == 2

if (b1 or b2 or b3) and window()

strategy.entry("long", strategy.long, comment = "BUY")

else if (comp_sell1 or op_sell1 or op_sell2 or op_sell3 or op_sell4 ) and window()

strategy.close("long", qty_percent = 100, comment = "SELL")

bool PM_visible = input(false, "Show Profit marjin and average price", group = 'Safty Margins')

bool SM_visible = input(false, "Show Safty Grids", group = 'Safty Margins' )

//Graphs

plot(PM_visible or final_option == 1 ? strategy.position_avg_price : na, color = color.green, title = "Average Cost", style = plot.style_circles)

plot(PM_visible or final_option == 1 ? strategy.position_avg_price* profit_f :na, color = color.aqua, title = "Expected Profit", style = plot.style_circles)

plot(SM_visible ? strategy.position_avg_price*0.95 : na, color = color.gray, title = "SAFTY MARGIN - 95%", linewidth = 1, style = plot.style_circles)

plot(SM_visible ? strategy.position_avg_price*0.90 : na, color = color.gray, title = "SAFTY MARGIN - 90%", linewidth = 1, style = plot.style_circles)

plot(SM_visible ? strategy.position_avg_price*0.85 : na, color = color.gray, title = "SAFTY MARGIN - 85%", linewidth = 1, style = plot.style_circles)

plot(SM_visible ? strategy.position_avg_price*0.80 : na, color = color.gray, title = "SAFTY MARGIN - 80%", linewidth = 1, style = plot.style_circles)

plot(ST_visible or final_option == 2 ? down_trend:na, "Down trend", color = plotcolor2, linewidth=2)

plot(ST_visible or final_option == 2 ? up_trend: na , "Up direction", color = plotcolor3, linewidth=2)

plot(sar_visible or final_option == 2 ? sar:na, title='SAR', color=plotcolor4, linewidth=2)

plot(sma500_visible or final_option == 2 ? SMA500:na,title='SMA500', color=plotcolor5, linewidth=3)

- Strategi Tren Saluran Donchian

- Strategi pembalikan momen berdasarkan model multi-faktor

- Strategi Trading Jangka Pendek Berdasarkan Indikator Volatilitas Chaikin

- Strategi Pelacakan Tren Crossover Dual MA

- Super Trend Triple Strategi

- Strategi Stop Loss yang Dinamis

- Strategi crossover rata-rata bergerak dengan stop-loss dan take-profit

- Strategi pembalikan rata-rata berdasarkan rata-rata bergerak

- Strategi perdagangan frekuensi tinggi berdasarkan Bollinger Bands

- Strategi Perdagangan Awan Ichimoku Kuantitatif

- Strategi Steroid Steroid

- Strategi perdagangan multi-periode berdasarkan indeks volatilitas dan osilator stokastik

- Strategi Perdagangan Perikanan Dasar CCI yang Diperluas

- Strategi Momentum Berdasarkan Squeeze LazyBear

- Strategi Stop Profit Sawtooth yang Terbatas Berdasarkan Moving Average

- Strategi perdagangan rata-rata bergerak tertimbang dinamis

- Strategi Lilin Terakhir

- Strategi kuantitatif pembalikan indeks volume negatif

- Triple Supertrend Breakout Strategi

- MACD dari Strategi Kekuatan Relatif