Trend Reversal Momentum Indicators Strategi Pelacakan Crossover

Penulis:ChaoZhang, Tanggal: 2023-12-29 16:21:12Tag:

Gambaran umum

Strategi ini menggabungkan MACD, RSI, ADX dan indikator teknis momentum lainnya untuk mengidentifikasi sinyal pembalikan harga dan mengadopsi strategi terbalik untuk masuk ketika tren yang kuat berbalik.

Prinsip Strategi

Strategi ini pertama-tama menggabungkan crossover rata-rata bergerak cepat dan lambat indikator MACD untuk menilai tren harga; kemudian menggunakan indikator RSI untuk menyaring breakout palsu dan memastikan bahwa sinyal perdagangan dihasilkan hanya setelah pembalikan harga yang sebenarnya terjadi; akhirnya menggunakan indikator ADX untuk memverifikasi kembali apakah harga telah memasuki keadaan tren.

Secara khusus, ketika garis cepat MACD melintasi di atas garis lambat, RSI lebih tinggi dari 50 dan naik, ADX lebih besar dari 20, itu adalah sinyal beli; ketika garis cepat MACD melintasi di bawah garis lambat, RSI lebih rendah dari 50 dan turun, ADX lebih besar dari 20, itu adalah sinyal jual.

Analisis Keuntungan

Keuntungan terbesar dari strategi ini adalah bahwa ia menggabungkan beberapa indikator untuk secara efektif menyaring whipsaws dan sinyal yang salah, benar-benar mengunci titik infleksi pembalikan tren, sehingga mendapatkan tingkat kemenangan yang lebih tinggi.

Analisis Risiko

Risiko terbesar dari strategi ini adalah penilaian yang salah tentang pembalikan tren, seperti harga membuat retracement yang mendalam yang menghasilkan penilaian yang salah.

Solusinya adalah untuk lebih mengoptimalkan parameter, menyesuaikan margin stop loss, atau menggabungkan lebih banyak indikator tambahan untuk penyaringan sinyal.

Arahan Optimasi

Strategi ini dapat dioptimalkan lebih lanjut dalam arah berikut:

-

Mengoptimalkan kombinasi parameter MACD dan RSI untuk meningkatkan keakuratan penilaian pembalikan harga;

-

Meningkatkan penyaringan indikator, seperti KD, BOLL dll, untuk membentuk efek indikator yang saling mencakup;

-

Mengatur margin stop loss secara dinamis sesuai dengan kondisi pasar yang berbeda;

-

Mengubah posisi mengambil keuntungan secara real time sesuai dengan tren aktual setelah pembalikan.

Ringkasan

Strategi ini menggabungkan beberapa indikator momentum untuk mengidentifikasi peluang pembalikan harga potensial. Melalui optimasi parameter, menggabungkan lebih banyak indikator tambahan, secara dinamis menyesuaikan strategi stop loss dan take profit, stabilitas dan keandalan strategi dapat ditingkatkan lebih lanjut untuk mengunci berbagai peluang perdagangan yang disediakan oleh pasar.

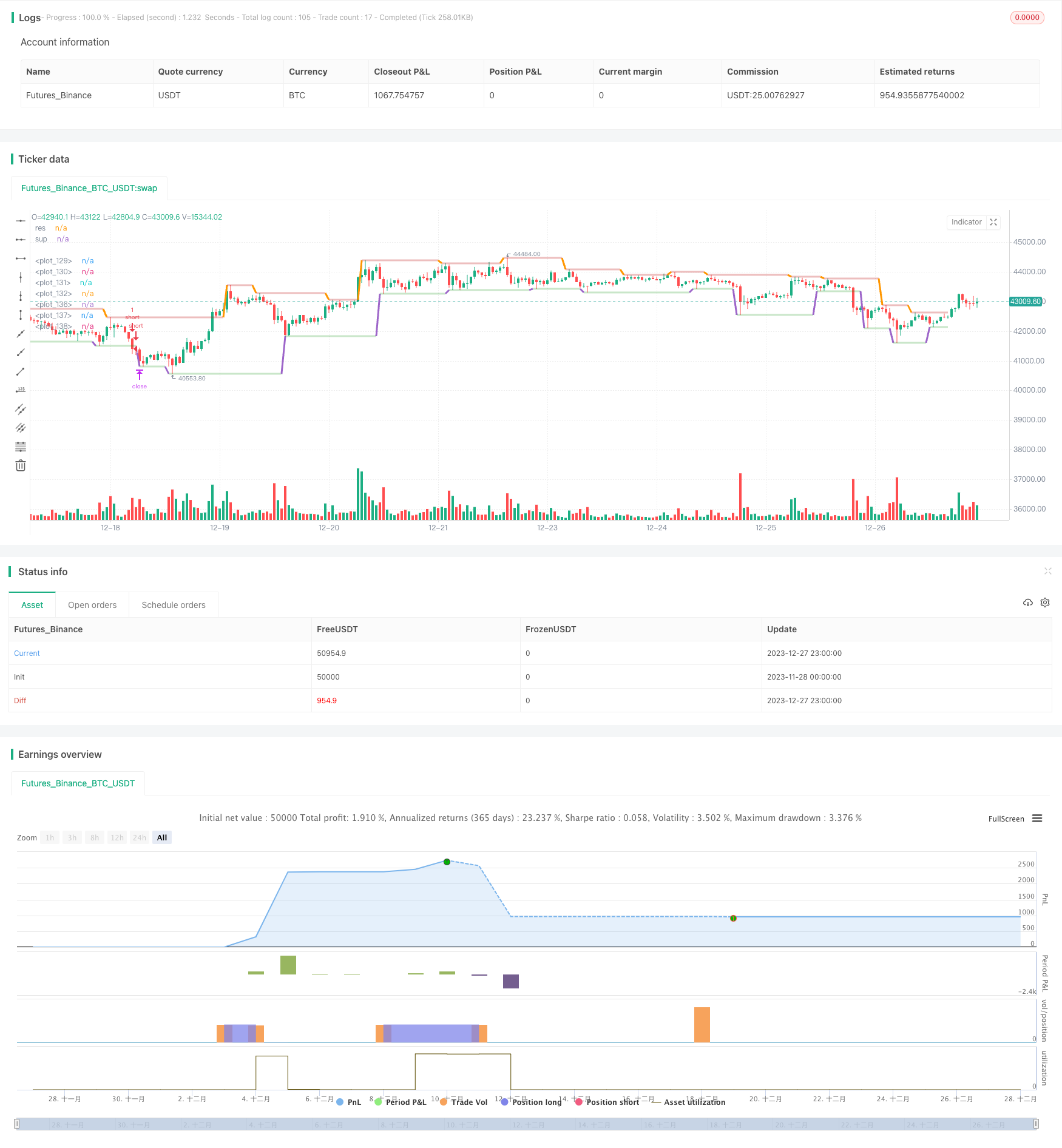

/*backtest

start: 2023-11-28 00:00:00

end: 2023-12-28 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © AHMEDABDELAZIZZIZO

//@version=5

strategy("Ta Strategy", overlay=true )

// inputs

inversestrategy = input.bool(false, title = "Inverse Strategy",tooltip = "This option makes you reverse the strategy so that long signals become where to short ")

direction = input.string(defval = "Both" , options = ["Both" , "Short" , "Long"] )

leftbars= input(6,title = " Left Bars" , group = "Support and resistance")

rightbars = input(6, title = " Right Bars", group = "Support and resistance")

macdfast = input(12, title = "MACD Fast", group = "MACD")

macdslow = input(26, title = "MACD Slow",group = "MACD")

macdsignal = input(7, "MACD Signal",group = "MACD")

sellqty = input(50, title = "QTY to sell at TP 1")

len = input(14, title="ADX Length" , group = "ADX")

// sup and res

res = fixnan(ta.pivothigh(high,leftbars,rightbars))

sup = fixnan(ta.pivotlow(low , leftbars,rightbars))

// macd

macd =ta.ema(close,macdfast) - ta.ema(close,macdslow)

signal=ta.ema(macd,macdsignal)

//adx

up = ta.change(high)

down = -ta.change(low)

plusDM = na(up) ? na : (up > down and up > 0 ? up : 0)

minusDM = na(down) ? na : (down > up and down > 0 ? down : 0)

truerange = ta.rma(ta.tr,len)

plusDI = 100 * ta.rma(plusDM, len) / truerange

minusDI = 100 * ta.rma(minusDM, len) / truerange

dx = 100 * ta.rma(math.abs(plusDI - minusDI) / (plusDI + minusDI), len)

adx = ta.sma(dx, len)

// start deal condition

longcondition = ta.crossover(macd,signal) and close > res and ta.rsi(close,14) > 50 and plusDI > minusDI and adx > 20

shortcondition = ta.crossunder(macd,signal) and close < sup and ta.rsi(close,14) < 50 and plusDI < minusDI and adx > 20

//tp

longtp1 = input.float(6, "Long TP 1", minval = 0.0, step = 0.25, group = "Exit LONG Orders") /100

longtp2 = input.float(12, "Long TP 2", minval = 0.0, step = 0.25, group = "Exit LONG Orders") /100

longsl1 = input.float(3.0, "Long SL", minval = 0.0, step = 0.25, group = "Exit LONG Orders") /100

longtakeprofit1 = (strategy.position_avg_price * (1 + longtp1))

longstoploss1 = (strategy.position_avg_price * (1 - longsl1))

longtakeprofit2 = (strategy.position_avg_price * (1 + longtp2))

//sl

shorttp1 = input.float(6.0, "Short TP 1 ", minval = 0.0, step = 0.25, group = "Exit SHORT Orders")/100

shorttp2 = input.float(12.0, "Short TP 2", minval = 0.0, step = 0.25, group = "Exit SHORT Orders")/100

shortsl1 = input.float(3.0, "Short SL", minval = 0.0, step = 0.25, group = "Exit SHORT Orders")/100

shorttakeprofit1 = (strategy.position_avg_price * (1- shorttp1))

shortstoploss1 = (strategy.position_avg_price * (1 + shortsl1))

shorttakeprofit2 = (strategy.position_avg_price * (1- shorttp2))

//placeorders

if inversestrategy == false

if direction == "Both"

if longcondition and strategy.opentrades == 0

strategy.entry("long" , strategy.long )

strategy.exit("exit long 1","long",qty_percent = sellqty ,limit = longtakeprofit1,stop = longstoploss1)

strategy.exit("exit long 2","long",qty_percent = 100 ,limit = longtakeprofit2,stop = longstoploss1)

if high >= longtakeprofit1

strategy.cancel("exit long 2")

strategy.exit("exit long 3","long",qty_percent = 100 ,limit = longtakeprofit2,stop = strategy.position_avg_price)

if shortcondition and strategy.opentrades == 0

strategy.entry("short",strategy.short)

strategy.exit("exit short 1","short",qty_percent = sellqty ,limit = shorttakeprofit1,stop = shortstoploss1)

strategy.exit("exit short 2","short",qty_percent = 100 ,limit = shorttakeprofit2,stop = shortstoploss1)

if low <= shorttakeprofit1

strategy.cancel("exit short 2")

strategy.exit("exit short 3","short",qty_percent = 100 ,limit = shorttakeprofit2,stop = strategy.position_avg_price)

else if direction == "Long"

if longcondition and strategy.opentrades == 0

strategy.entry("long" , strategy.long )

strategy.exit("exit long 1","long",qty_percent = sellqty ,limit = longtakeprofit1,stop = longstoploss1)

strategy.exit("exit long 2","long",qty_percent = 100 ,limit = longtakeprofit2,stop = longstoploss1)

if high >= longtakeprofit1

strategy.cancel("exit long 2")

strategy.exit("exit long 3","long",qty_percent = 100 ,limit = longtakeprofit2,stop = strategy.position_avg_price)

else if direction == "Short"

if shortcondition and strategy.opentrades == 0

strategy.entry("short",strategy.short)

strategy.exit("exit short 1","short",qty_percent = sellqty ,limit = shorttakeprofit1,stop = shortstoploss1)

strategy.exit("exit short 2","short",qty_percent = 100 ,limit = shorttakeprofit2,stop = shortstoploss1)

if low <= shorttakeprofit1

strategy.cancel("exit short 2")

strategy.exit("exit short 3","short",qty_percent = 100 ,limit = shorttakeprofit2,stop = strategy.position_avg_price)

else

if direction == "Both"

if shortcondition and strategy.opentrades == 0

strategy.entry("long" , strategy.long )

strategy.exit("exit long 1","long",qty_percent = sellqty ,limit = longtakeprofit1,stop = longstoploss1)

strategy.exit("exit long 2","long",qty_percent = 100 ,limit = longtakeprofit2,stop = longstoploss1)

if high >= longtakeprofit1

strategy.cancel("exit long 2")

strategy.exit("exit long 3","long",qty_percent = 100 ,limit = longtakeprofit2,stop = strategy.position_avg_price)

if longcondition and strategy.opentrades == 0

strategy.entry("short",strategy.short)

strategy.exit("exit short 1","short",qty_percent = sellqty ,limit = shorttakeprofit1,stop = shortstoploss1)

strategy.exit("exit short 2","short",qty_percent = 100 ,limit = shorttakeprofit2,stop = shortstoploss1)

if low <= shorttakeprofit1

strategy.cancel("exit short 2")

strategy.exit("exit short 3","short",qty_percent = 100 ,limit = shorttakeprofit2,stop = strategy.position_avg_price)

else if direction == "Long"

if shortcondition and strategy.opentrades == 0

strategy.entry("long" , strategy.long )

strategy.exit("exit long 1","long",qty_percent = sellqty ,limit = longtakeprofit1,stop = longstoploss1)

strategy.exit("exit long 2","long",qty_percent = 100 ,limit = longtakeprofit2,stop = longstoploss1)

if high >= longtakeprofit1

strategy.cancel("exit long 2")

strategy.exit("exit long 3","long",qty_percent = 100 ,limit = longtakeprofit2,stop = strategy.position_avg_price)

else if direction == "Short"

if longcondition and strategy.opentrades == 0

strategy.entry("short",strategy.short)

strategy.exit("exit short 1","short",qty_percent = sellqty ,limit = shorttakeprofit1,stop = shortstoploss1)

strategy.exit("exit short 2","short",qty_percent = 100 ,limit = shorttakeprofit2,stop = shortstoploss1)

if low <= shorttakeprofit1

strategy.cancel("exit short 2")

strategy.exit("exit short 3","short",qty_percent = 100 ,limit = shorttakeprofit2,stop = strategy.position_avg_price)

////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////

lsl1 = plot(strategy.position_size <= 0 ? na : longstoploss1, color=color.rgb(124, 11, 11), style=plot.style_linebr, linewidth=1)

ltp1 = plot(strategy.position_size <= 0 ? na : longtakeprofit1, color=color.rgb(15, 116, 18), style=plot.style_linebr, linewidth=1)

ltp2 = plot(strategy.position_size <= 0 ? na : longtakeprofit2, color=color.rgb(15, 116, 18), style=plot.style_linebr, linewidth=1)

avg = plot(strategy.position_avg_price, color=color.rgb(255, 153, 0, 47), style=plot.style_linebr, linewidth=1)

fill(ltp1,avg , color =strategy.position_size <= 0 ? na : color.rgb(82, 255, 97, 90))

fill(ltp2,ltp1 , color =strategy.position_size <= 0 ? na : color.rgb(82, 255, 97, 90))

///////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////

ssl1 = plot(strategy.position_size >= 0 ? na : shortstoploss1, color=color.red, style=plot.style_linebr, linewidth=1)

stp1 = plot(strategy.position_size >= 0 ? na : shorttakeprofit2, color=color.green, style=plot.style_linebr, linewidth=1)

stp2 = plot(strategy.position_size >= 0 ? na : shorttakeprofit1, color=color.green, style=plot.style_linebr, linewidth=1)

fill(stp1,avg , color =strategy.position_size >= 0 ? na : color.rgb(30, 92, 35, 90))

fill(stp2,stp1 , color =strategy.position_size >= 0 ? na : color.rgb(30, 92, 35, 90))

//////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////

resplot = plot(res, color=ta.change(res) ? na : #bf141446, linewidth=3, offset=-(rightbars+1), title="res")

supplot = plot(sup, color=ta.change(sup) ? na : #118f113a, linewidth=3, offset=-(rightbars+1), title="sup")

- Multi Timeframe Momentum Breakout Strategi

- Pivot Point Golden Ratio Beli Tinggi Jual Strategi Rendah

- Strategi Perdagangan Penyu Berdasarkan Rata-rata Bergerak Sederhana

- Strategi Perdagangan Bollinger Band MACD Rata-rata Bergerak Ganda

- Bollinger Bands dan RSI Crossover Strategy

- Tren Mengikuti Strategi Berdasarkan QQE dan MA

- Strategi Harga Rata-rata Tertimbang Volume

- Strategi Dual-Indikator Kuantitatif

- Strategi Pelacakan Momentum

- Strategi perdagangan untuk meningkatkan indikator RSI

- Strategi Penarikan Multi Timeframe

- Momentum dan Aliran Uang Strategy Cashing Crossroad

- Dinamis Mengambil Keuntungan Mengikuti Strategi Tren

- 10EMA Strategi Pelacakan Tren Ganda

- Strategi Pivot Point Backtest yang Dinamis

- Strategi Tren Crossover EMA Dual

- Strategi Sinyal CVDVWAP Bergelombang yang Tertanam

- RSI Fibonacci Retracement Strategi

- Bollinger Bands + RSI + Strategi Perdagangan Ganda EMA

- Strategi Optimasi Trailing Stop Dinamis Berdasarkan Awan Ichimoku