Tiga Indikator Sentimen Didorong Breakout Strategi

Penulis:ChaoZhang, Tanggal: 2024-01-17 17:53:55Tag:

Gambaran umum

Strategi ini menggabungkan indikator QQE Mod, indikator SSL Hybrid dan indikator Waddah Attar Explosion, membentuk sinyal perdagangan dan termasuk dalam strategi breakout sentimen yang didorong oleh beberapa indikator.

Logika Strategi

Logika inti dari strategi ini didasarkan pada keputusan perdagangan yang dibentuk oleh tiga indikator:

Indikator QQE Mod: Indikator ini meningkatkan indikator RSI untuk membuatnya lebih sensitif dalam menilai sentimen pasar.

Indikator hibrida SSL: Indikator ini secara komprehensif mempertimbangkan situasi terobosan dari beberapa rata-rata bergerak untuk menentukan tanda pasar.

Indikator Ledakan Waddah Attar: Indikator ini menilai kekuatan eksplosif harga dalam saluran. Strategi ini menggunakannya untuk menentukan apakah momentum selama breakout cukup.

Ketika indikator QQE mengeluarkan sinyal pembalikan bawah, indikator SSL menunjukkan saluran top breakout, dan indikator Waddah Attar menentukan momentum eksplosif, strategi ini menghasilkan keputusan beli.

Strategi ini juga menetapkan stop loss yang tepat dan mengambil keuntungan untuk mengunci keuntungan sejauh mungkin, yang merupakan strategi breakout yang didorong oleh sentimen berkualitas tinggi.

Analisis Keuntungan

Strategi ini memiliki keuntungan berikut:

- Mengintegrasikan beberapa indikator untuk menentukan sentimen pasar dan menghindari risiko pecah palsu

- Pertimbangkan secara komprehensif indikator pembalikan, indikator saluran dan indikator momentum untuk memastikan tingkat konfirmasi yang tinggi selama pecah

- Mengadopsi stop loss bergerak presisi tinggi untuk membatasi risiko dan mengunci keuntungan

- Parameter telah melalui banyak tes optimasi dengan stabilitas yang baik, cocok untuk jangka menengah dan panjang penyimpanan

- Parameter indikator dapat dikonfigurasi untuk menyesuaikan gaya strategi agar sesuai dengan kondisi pasar yang lebih luas

Analisis Risiko

Risiko utama dari strategi ini meliputi:

- Ini cenderung menghasilkan lebih banyak perdagangan kecil yang rugi selama penurunan yang berkelanjutan

- Hal ini bergantung pada sinyal indikator serentak beberapa yang mungkin gagal luar biasa di beberapa pasar

- Risiko over-optimasi ada untuk beberapa indikator seperti QQE, parameter harus ditetapkan dengan hati-hati

- Stop loss bergerak hampir tidak dapat memainkan peran normalnya dalam beberapa kondisi pasar yang tidak biasa

Untuk mengatasi risiko di atas, disarankan untuk menyesuaikan parameter indikator agar lebih stabil, dan dengan tepat memperpanjang periode kepemilikan untuk mendapatkan tingkat keuntungan yang lebih tinggi.

Arahan Optimasi

Strategi ini dapat dioptimalkan lebih lanjut dalam aspek berikut:

- Sesuaikan parameter indikator untuk membuatnya lebih stabil atau sensitif

- Tambahkan modul optimasi ukuran posisi berdasarkan volatilitas

- Tambahkan modul kontrol risiko pembelajaran mesin untuk mengevaluasi kondisi pasar secara dinamis

- Menggunakan model pembelajaran mendalam untuk memprediksi pola indikator dan meningkatkan akurasi keputusan

- Memperkenalkan analisis kerangka waktu silang untuk mengurangi kemungkinan terjadinya kebocoran palsu

Kesimpulan

Strategi ini mengintegrasikan keuntungan dari beberapa indikator sentimen utama untuk membangun strategi breakout yang didorong sentimen yang efisien. Ini berhasil menghindari risiko yang dibawa oleh banyak breakout berkualitas rendah, dan memiliki gagasan stop loss presisi tinggi untuk mengunci keuntungan. Ini adalah strategi breakout yang matang dan dapat diandalkan yang layak dipelajari dan dimanfaatkan. Dengan optimasi parameter berkelanjutan dan prediksi model, ini memiliki potensi untuk menghasilkan pengembalian yang berlebihan yang lebih konsisten.

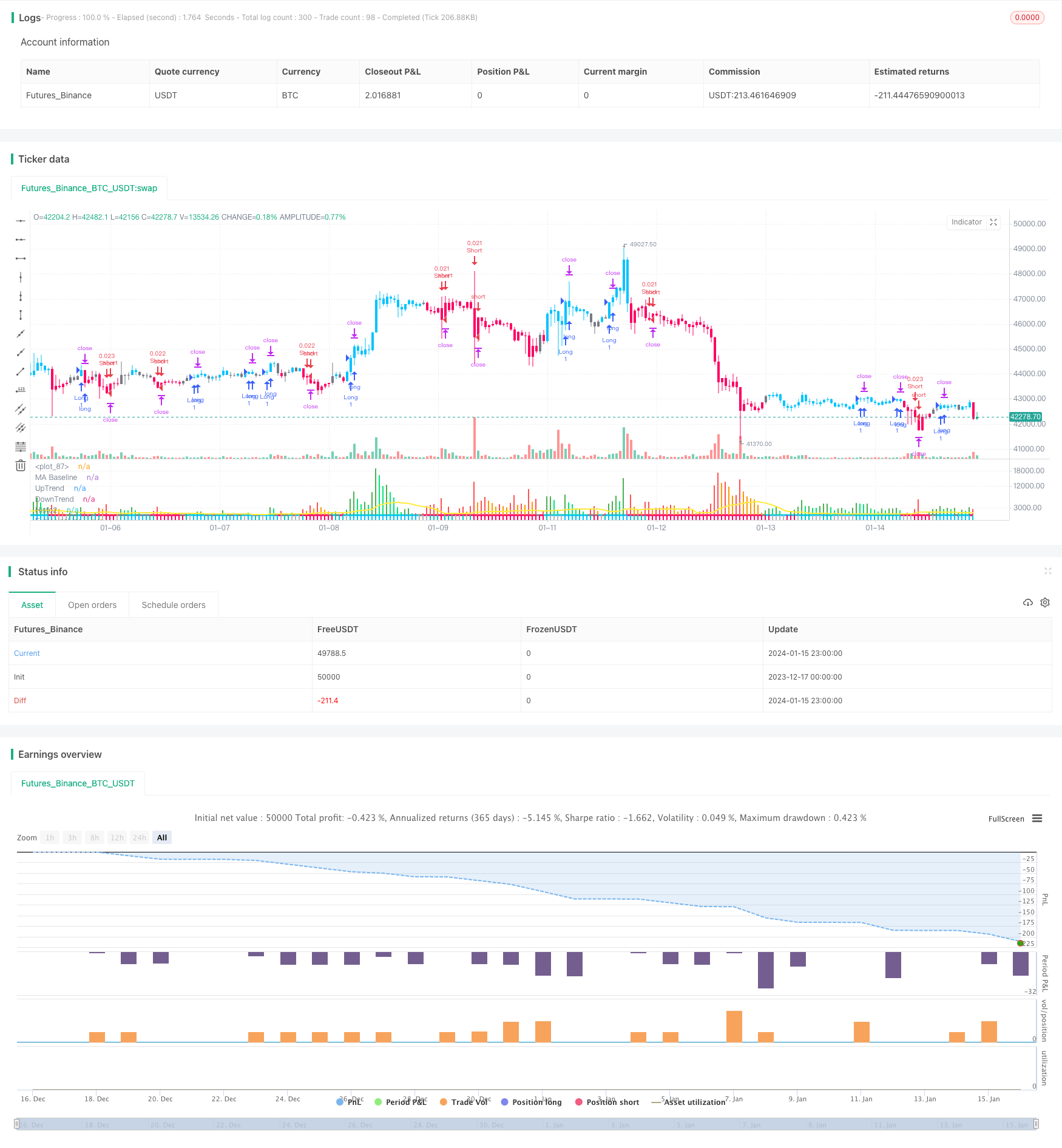

/*backtest

start: 2023-12-17 00:00:00

end: 2024-01-16 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// Strategy based on the 3 indicators:

// - QQE MOD

// - SSL Hybrid

// - Waddah Attar Explosion

//

// Strategy was designed for the purpose of back testing.

// See strategy documentation for info on trade entry logic.

//

// Credits:

// - QQE MOD: Mihkel00 (https://www.tradingview.com/u/Mihkel00/)

// - SSL Hybrid: Mihkel00 (https://www.tradingview.com/u/Mihkel00/)

// - Waddah Attar Explosion: shayankm (https://www.tradingview.com/u/shayankm/)

//@version=5

strategy("QQE MOD + SSL Hybrid + Waddah Attar Explosion", overlay=false)

// =============================================================================

// STRATEGY INPUT SETTINGS

// =============================================================================

// ---------------

// Risk Management

// ---------------

swingLength = input.int(10, "Swing High/Low Lookback Length", group='Strategy: Risk Management', tooltip='Stop Loss is calculated by the swing high or low over the previous X candles')

accountRiskPercent = input.float(2, "Account percent loss per trade", step=0.1, group='Strategy: Risk Management', tooltip='Each trade will risk X% of the account balance')

// ----------

// Date Range

// ----------

start_year = input.int(title='Start Date', defval=2022, minval=2010, maxval=3000, group='Strategy: Date Range', inline='1')

start_month = input.int(title='', defval=1, group='Strategy: Date Range', inline='1', options = [1, 2, 3, 4, 5, 6, 7, 8, 9, 10, 11, 12])

start_date = input.int(title='', defval=1, group='Strategy: Date Range', inline='1', options = [1, 2, 3, 4, 5, 6, 7, 8, 9, 10, 11, 12, 13, 14, 15, 16, 17, 18, 19, 20, 21, 22, 23, 24, 25, 26, 27, 28, 29, 30, 31])

end_year = input.int(title='End Date', defval=2023, minval=1800, maxval=3000, group='Strategy: Date Range', inline='2')

end_month = input.int(title='', defval=1, group='Strategy: Date Range', inline='2', options = [1, 2, 3, 4, 5, 6, 7, 8, 9, 10, 11, 12])

end_date = input.int(title='', defval=1, group='Strategy: Date Range', inline='2', options = [1, 2, 3, 4, 5, 6, 7, 8, 9, 10, 11, 12, 13, 14, 15, 16, 17, 18, 19, 20, 21, 22, 23, 24, 25, 26, 27, 28, 29, 30, 31])

in_date_range = true

// =============================================================================

// INDICATORS

// =============================================================================

// -------

// QQE MOD

// -------

RSI_Period = input.int(6, title='RSI Length', group='Indicators: QQE Mod Settings')

SF = input.int(6, title='RSI Smoothing', group='Indicators: QQE Mod Settings')

QQE = input.int(3, title='Fast QQE Factor', group='Indicators: QQE Mod Settings')

ThreshHold = input.int(3, title='Thresh-hold', group='Indicators: QQE Mod Settings')

qqeSrc = input(close, title='RSI Source', group='Indicators: QQE Mod Settings')

Wilders_Period = RSI_Period * 2 - 1

Rsi = ta.rsi(qqeSrc, RSI_Period)

RsiMa = ta.ema(Rsi, SF)

AtrRsi = math.abs(RsiMa[1] - RsiMa)

MaAtrRsi = ta.ema(AtrRsi, Wilders_Period)

dar = ta.ema(MaAtrRsi, Wilders_Period) * QQE

longband = 0.0

shortband = 0.0

trend = 0

DeltaFastAtrRsi = dar

RSIndex = RsiMa

newshortband = RSIndex + DeltaFastAtrRsi

newlongband = RSIndex - DeltaFastAtrRsi

longband := RSIndex[1] > longband[1] and RSIndex > longband[1] ? math.max(longband[1], newlongband) : newlongband

shortband := RSIndex[1] < shortband[1] and RSIndex < shortband[1] ? math.min(shortband[1], newshortband) : newshortband

cross_1 = ta.cross(longband[1], RSIndex)

trend := ta.cross(RSIndex, shortband[1]) ? 1 : cross_1 ? -1 : nz(trend[1], 1)

FastAtrRsiTL = trend == 1 ? longband : shortband

length = input.int(50, minval=1, title='Bollinger Length', group='Indicators: QQE Mod Settings')

qqeMult = input.float(0.35, minval=0.001, maxval=5, step=0.1, title='BB Multiplier', group='Indicators: QQE Mod Settings')

basis = ta.sma(FastAtrRsiTL - 50, length)

dev = qqeMult * ta.stdev(FastAtrRsiTL - 50, length)

upper = basis + dev

lower = basis - dev

//qqe_color_bar = RsiMa - 50 > upper ? #00c3ff : RsiMa - 50 < lower ? #ff0062 : color.gray

// Zero cross

QQEzlong = 0

QQEzlong := nz(QQEzlong[1])

QQEzshort = 0

QQEzshort := nz(QQEzshort[1])

QQEzlong := RSIndex >= 50 ? QQEzlong + 1 : 0

QQEzshort := RSIndex < 50 ? QQEzshort + 1 : 0

Zero = hline(0, color=color.white, linestyle=hline.style_dotted, linewidth=1, display=display.none)

RSI_Period2 = input.int(6, title='RSI Length', group='Indicators: QQE Mod Settings')

SF2 = input.int(5, title='RSI Smoothing', group='Indicators: QQE Mod Settings')

QQE2 = input.float(1.61, title='Fast QQE2 Factor', group='Indicators: QQE Mod Settings')

ThreshHold2 = input.int(3, title='Thresh-hold', group='Indicators: QQE Mod Settings')

src2 = input(close, title='RSI Source', group='Indicators: QQE Mod Settings')

Wilders_Period2 = RSI_Period2 * 2 - 1

Rsi2 = ta.rsi(src2, RSI_Period2)

RsiMa2 = ta.ema(Rsi2, SF2)

AtrRsi2 = math.abs(RsiMa2[1] - RsiMa2)

MaAtrRsi2 = ta.ema(AtrRsi2, Wilders_Period2)

dar2 = ta.ema(MaAtrRsi2, Wilders_Period2) * QQE2

longband2 = 0.0

shortband2 = 0.0

trend2 = 0

DeltaFastAtrRsi2 = dar2

RSIndex2 = RsiMa2

newshortband2 = RSIndex2 + DeltaFastAtrRsi2

newlongband2 = RSIndex2 - DeltaFastAtrRsi2

longband2 := RSIndex2[1] > longband2[1] and RSIndex2 > longband2[1] ? math.max(longband2[1], newlongband2) : newlongband2

shortband2 := RSIndex2[1] < shortband2[1] and RSIndex2 < shortband2[1] ? math.min(shortband2[1], newshortband2) : newshortband2

cross_2 = ta.cross(longband2[1], RSIndex2)

trend2 := ta.cross(RSIndex2, shortband2[1]) ? 1 : cross_2 ? -1 : nz(trend2[1], 1)

FastAtrRsi2TL = trend2 == 1 ? longband2 : shortband2

// Zero cross

QQE2zlong = 0

QQE2zlong := nz(QQE2zlong[1])

QQE2zshort = 0

QQE2zshort := nz(QQE2zshort[1])

QQE2zlong := RSIndex2 >= 50 ? QQE2zlong + 1 : 0

QQE2zshort := RSIndex2 < 50 ? QQE2zshort + 1 : 0

hcolor2 = RsiMa2 - 50 > ThreshHold2 ? color.silver : RsiMa2 - 50 < 0 - ThreshHold2 ? color.silver : na

plot(RsiMa2 - 50, color=hcolor2, title='Histo2', style=plot.style_columns, transp=50)

Greenbar1 = RsiMa2 - 50 > ThreshHold2

Greenbar2 = RsiMa - 50 > upper

Redbar1 = RsiMa2 - 50 < 0 - ThreshHold2

Redbar2 = RsiMa - 50 < lower

plot(Greenbar1 and Greenbar2 == 1 ? RsiMa2 - 50 : na, title='QQE Up', style=plot.style_columns, color=color.new(#00c3ff, 0))

plot(Redbar1 and Redbar2 == 1 ? RsiMa2 - 50 : na, title='QQE Down', style=plot.style_columns, color=color.new(#ff0062, 0))

// ----------

// SSL HYBRID

// ----------

show_Baseline = input(title='Show Baseline', defval=true)

show_SSL1 = input(title='Show SSL1', defval=false)

show_atr = input(title='Show ATR bands', defval=true)

//ATR

atrlen = input(14, 'ATR Period')

mult = input.float(1, 'ATR Multi', step=0.1)

smoothing = input.string(title='ATR Smoothing', defval='WMA', options=['RMA', 'SMA', 'EMA', 'WMA'])

ma_function(source, atrlen) =>

if smoothing == 'RMA'

ta.rma(source, atrlen)

else

if smoothing == 'SMA'

ta.sma(source, atrlen)

else

if smoothing == 'EMA'

ta.ema(source, atrlen)

else

ta.wma(source, atrlen)

atr_slen = ma_function(ta.tr(true), atrlen)

////ATR Up/Low Bands

upper_band = atr_slen * mult + close

lower_band = close - atr_slen * mult

////BASELINE / SSL1 / SSL2 / EXIT MOVING AVERAGE VALUES

maType = input.string(title='SSL1 / Baseline Type', defval='HMA', options=['SMA', 'EMA', 'DEMA', 'TEMA', 'LSMA', 'WMA', 'MF', 'VAMA', 'TMA', 'HMA', 'JMA', 'Kijun v2', 'EDSMA', 'McGinley'])

len = input(title='SSL1 / Baseline Length', defval=60)

SSL2Type = input.string(title='SSL2 / Continuation Type', defval='JMA', options=['SMA', 'EMA', 'DEMA', 'TEMA', 'WMA', 'MF', 'VAMA', 'TMA', 'HMA', 'JMA', 'McGinley'])

len2 = input(title='SSL 2 Length', defval=5)

SSL3Type = input.string(title='EXIT Type', defval='HMA', options=['DEMA', 'TEMA', 'LSMA', 'VAMA', 'TMA', 'HMA', 'JMA', 'Kijun v2', 'McGinley', 'MF'])

len3 = input(title='EXIT Length', defval=15)

src = input(title='Source', defval=close)

tema(src, len) =>

ema1 = ta.ema(src, len)

ema2 = ta.ema(ema1, len)

ema3 = ta.ema(ema2, len)

3 * ema1 - 3 * ema2 + ema3

kidiv = input.int(defval=1, maxval=4, title='Kijun MOD Divider')

jurik_phase = input(title='* Jurik (JMA) Only - Phase', defval=3)

jurik_power = input(title='* Jurik (JMA) Only - Power', defval=1)

volatility_lookback = input(10, title='* Volatility Adjusted (VAMA) Only - Volatility lookback length')

//MF

beta = input.float(0.8, minval=0, maxval=1, step=0.1, title='Modular Filter, General Filter Only - Beta')

feedback = input(false, title='Modular Filter Only - Feedback')

z = input.float(0.5, title='Modular Filter Only - Feedback Weighting', step=0.1, minval=0, maxval=1)

//EDSMA

ssfLength = input.int(title='EDSMA - Super Smoother Filter Length', minval=1, defval=20)

ssfPoles = input.int(title='EDSMA - Super Smoother Filter Poles', defval=2, options=[2, 3])

//EDSMA

get2PoleSSF(src, length) =>

PI = 2 * math.asin(1)

arg = math.sqrt(2) * PI / length

a1 = math.exp(-arg)

b1 = 2 * a1 * math.cos(arg)

c2 = b1

c3 = -math.pow(a1, 2)

c1 = 1 - c2 - c3

ssf = 0.0

ssf := c1 * src + c2 * nz(ssf[1]) + c3 * nz(ssf[2])

ssf

get3PoleSSF(src, length) =>

PI = 2 * math.asin(1)

arg = PI / length

a1 = math.exp(-arg)

b1 = 2 * a1 * math.cos(1.738 * arg)

c1 = math.pow(a1, 2)

coef2 = b1 + c1

coef3 = -(c1 + b1 * c1)

coef4 = math.pow(c1, 2)

coef1 = 1 - coef2 - coef3 - coef4

ssf = 0.0

ssf := coef1 * src + coef2 * nz(ssf[1]) + coef3 * nz(ssf[2]) + coef4 * nz(ssf[3])

ssf

ma(type, src, len) =>

float result = 0

if type == 'TMA'

result := ta.sma(ta.sma(src, math.ceil(len / 2)), math.floor(len / 2) + 1)

result

if type == 'MF'

ts = 0.

b = 0.

c = 0.

os = 0.

//----

alpha = 2 / (len + 1)

a = feedback ? z * src + (1 - z) * nz(ts[1], src) : src

//----

b := a > alpha * a + (1 - alpha) * nz(b[1], a) ? a : alpha * a + (1 - alpha) * nz(b[1], a)

c := a < alpha * a + (1 - alpha) * nz(c[1], a) ? a : alpha * a + (1 - alpha) * nz(c[1], a)

os := a == b ? 1 : a == c ? 0 : os[1]

//----

upper = beta * b + (1 - beta) * c

lower = beta * c + (1 - beta) * b

ts := os * upper + (1 - os) * lower

result := ts

result

if type == 'LSMA'

result := ta.linreg(src, len, 0)

result

if type == 'SMA' // Simple

result := ta.sma(src, len)

result

if type == 'EMA' // Exponential

result := ta.ema(src, len)

result

if type == 'DEMA' // Double Exponential

e = ta.ema(src, len)

result := 2 * e - ta.ema(e, len)

result

if type == 'TEMA' // Triple Exponential

e = ta.ema(src, len)

result := 3 * (e - ta.ema(e, len)) + ta.ema(ta.ema(e, len), len)

result

if type == 'WMA' // Weighted

result := ta.wma(src, len)

result

if type == 'VAMA' // Volatility Adjusted

/// Copyright © 2019 to present, Joris Duyck (JD)

mid = ta.ema(src, len)

dev = src - mid

vol_up = ta.highest(dev, volatility_lookback)

vol_down = ta.lowest(dev, volatility_lookback)

result := mid + math.avg(vol_up, vol_down)

result

if type == 'HMA' // Hull

result := ta.wma(2 * ta.wma(src, len / 2) - ta.wma(src, len), math.round(math.sqrt(len)))

result

if type == 'JMA' // Jurik

/// Copyright © 2018 Alex Orekhov (everget)

/// Copyright © 2017 Jurik Research and Consulting.

phaseRatio = jurik_phase < -100 ? 0.5 : jurik_phase > 100 ? 2.5 : jurik_phase / 100 + 1.5

beta = 0.45 * (len - 1) / (0.45 * (len - 1) + 2)

alpha = math.pow(beta, jurik_power)

jma = 0.0

e0 = 0.0

e0 := (1 - alpha) * src + alpha * nz(e0[1])

e1 = 0.0

e1 := (src - e0) * (1 - beta) + beta * nz(e1[1])

e2 = 0.0

e2 := (e0 + phaseRatio * e1 - nz(jma[1])) * math.pow(1 - alpha, 2) + math.pow(alpha, 2) * nz(e2[1])

jma := e2 + nz(jma[1])

result := jma

result

if type == 'Kijun v2'

kijun = math.avg(ta.lowest(len), ta.highest(len)) //, (open + close)/2)

conversionLine = math.avg(ta.lowest(len / kidiv), ta.highest(len / kidiv))

delta = (kijun + conversionLine) / 2

result := delta

result

if type == 'McGinley'

mg = 0.0

mg := na(mg[1]) ? ta.ema(src, len) : mg[1] + (src - mg[1]) / (len * math.pow(src / mg[1], 4))

result := mg

result

if type == 'EDSMA'

zeros = src - nz(src[2])

avgZeros = (zeros + zeros[1]) / 2

// Ehlers Super Smoother Filter

ssf = ssfPoles == 2 ? get2PoleSSF(avgZeros, ssfLength) : get3PoleSSF(avgZeros, ssfLength)

// Rescale filter in terms of Standard Deviations

stdev = ta.stdev(ssf, len)

scaledFilter = stdev != 0 ? ssf / stdev : 0

alpha = 5 * math.abs(scaledFilter) / len

edsma = 0.0

edsma := alpha * src + (1 - alpha) * nz(edsma[1])

result := edsma

result

result

///SSL 1 and SSL2

emaHigh = ma(maType, high, len)

emaLow = ma(maType, low, len)

maHigh = ma(SSL2Type, high, len2)

maLow = ma(SSL2Type, low, len2)

///EXIT

ExitHigh = ma(SSL3Type, high, len3)

ExitLow = ma(SSL3Type, low, len3)

///Keltner Baseline Channel

BBMC = ma(maType, close, len)

useTrueRange = input(true)

multy = input.float(0.2, step=0.05, title='Base Channel Multiplier')

Keltma = ma(maType, src, len)

range_1 = useTrueRange ? ta.tr : high - low

rangema = ta.ema(range_1, len)

upperk = Keltma + rangema * multy

lowerk = Keltma - rangema * multy

//Baseline Violation Candle

open_pos = open * 1

close_pos = close * 1

difference = math.abs(close_pos - open_pos)

atr_violation = difference > atr_slen

InRange = upper_band > BBMC and lower_band < BBMC

//SSL1 VALUES

Hlv = int(na)

Hlv := close > emaHigh ? 1 : close < emaLow ? -1 : Hlv[1]

sslDown = Hlv < 0 ? emaHigh : emaLow

//EXIT VALUES

Hlv3 = int(na)

Hlv3 := close > ExitHigh ? 1 : close < ExitLow ? -1 : Hlv3[1]

sslExit = Hlv3 < 0 ? ExitHigh : ExitLow

base_cross_Long = ta.crossover(close, sslExit)

base_cross_Short = ta.crossover(sslExit, close)

codiff = base_cross_Long ? 1 : base_cross_Short ? -1 : na

//COLORS

show_color_bar = input(title='Color Bars', defval=true)

color_bar = close > upperk ? #00c3ff : close < lowerk ? #ff0062 : color.gray

color_ssl1 = close > sslDown ? #00c3ff : close < sslDown ? #ff0062 : na

//PLOTS

plotarrow(codiff, colorup=color.new(#00c3ff, 20), colordown=color.new(#ff0062, 20), title='Exit Arrows', maxheight=20, offset=0, display=display.none)

p1 = plot(0, color=color_bar, linewidth=3, title='MA Baseline', transp=0)

barcolor(show_color_bar ? color_bar : na)

// ---------------------

// WADDAH ATTAR EXPLOSION

// ---------------------

sensitivity = input.int(180, title="Sensitivity", group='Indicators: Waddah Attar Explosion')

fastLength=input.int(20, title="FastEMA Length", group='Indicators: Waddah Attar Explosion')

slowLength=input.int(40, title="SlowEMA Length", group='Indicators: Waddah Attar Explosion')

channelLength=input.int(20, title="BB Channel Length", group='Indicators: Waddah Attar Explosion')

waeMult=input.float(2.0, title="BB Stdev Multiplier", group='Indicators: Waddah Attar Explosion')

calc_macd(source, fastLength, slowLength) =>

fastMA = ta.ema(source, fastLength)

slowMA = ta.ema(source, slowLength)

fastMA - slowMA

calc_BBUpper(source, length, mult) =>

basis = ta.sma(source, length)

dev = mult * ta.stdev(source, length)

basis + dev

calc_BBLower(source, length, mult) =>

basis = ta.sma(source, length)

dev = mult * ta.stdev(source, length)

basis - dev

t1 = (calc_macd(close, fastLength, slowLength) - calc_macd(close[1], fastLength, slowLength))*sensitivity

e1 = (calc_BBUpper(close, channelLength, waeMult) - calc_BBLower(close, channelLength, waeMult))

trendUp = (t1 >= 0) ? t1 : 0

trendDown = (t1 < 0) ? (-1*t1) : 0

plot(trendUp, style=plot.style_columns, linewidth=1, color=(trendUp<trendUp[1]) ? color.lime : color.green, transp=45, title="UpTrend", display=display.none)

plot(trendDown, style=plot.style_columns, linewidth=1, color=(trendDown<trendDown[1]) ? color.orange : color.red, transp=45, title="DownTrend", display=display.none)

plot(e1, style=plot.style_line, linewidth=2, color=color.yellow, title="ExplosionLine", display=display.none)

// =============================================================================

// STRATEGY LOGIC

// =============================================================================

// QQE Mod

qqeGreenBar = Greenbar1 and Greenbar2

qqeRedBar = Redbar1 and Redbar2

qqeBuy = qqeGreenBar and not qqeGreenBar[1]

qqeSell = qqeRedBar and not qqeRedBar[1]

// SSL Hybrid

sslBuy = close > upperk and close > BBMC

sslSell = close < lowerk and close < BBMC

// Waddah Attar Explosion

waeBuy = trendUp > 0 and trendUp > e1

waeSell = trendDown > 0 and trendDown > e1

inLong = strategy.position_size > 0

inShort = strategy.position_size < 0

longCondition = qqeBuy and sslBuy and waeBuy and in_date_range

shortCondition = qqeSell and sslSell and waeSell and in_date_range

swingLow = ta.lowest(source=low, length=swingLength)

swingHigh = ta.highest(source=high, length=swingLength)

longStopPercent = math.abs((1 - (swingLow / close)) * 100)

shortStopPercent = math.abs((1 - (swingHigh / close)) * 100)

// Position sizing (default risk 2% per trade)

riskAmt = strategy.equity * accountRiskPercent / 100

longQty = math.abs(riskAmt / longStopPercent * 100) / close

shortQty = math.abs(riskAmt / shortStopPercent * 100) / close

if (longCondition and not inShort and not inLong)

strategy.entry("Long", strategy.long, qty=longQty)

strategy.exit("Long SL/TP", from_entry="Long", stop=swingLow, alert_message='Long SL Hit')

buyLabel = label.new(x=bar_index, y=high[1], color=color.green, style=label.style_label_up)

label.set_y(id=buyLabel, y=0)

label.set_tooltip(id=buyLabel, tooltip="Risk Amt: " + str.tostring(riskAmt) + " Qty: " + str.tostring(longQty) + " Swing low: " + str.tostring(swingLow) + " Stop Percent: " + str.tostring(longStopPercent))

if (shortCondition and not inLong and not inShort)

strategy.entry("Short", strategy.short, qty=shortQty)

strategy.exit("Short SL/TP", from_entry="Short", stop=swingHigh, alert_message='Short SL Hit')

sellLabel = label.new(x=bar_index, y=high[1], color=color.red, style=label.style_label_up)

label.set_y(id=sellLabel, y=0)

label.set_tooltip(id=sellLabel, tooltip="Risk Amt: " + str.tostring(riskAmt) + " Qty: " + str.tostring(shortQty) + " Swing high: " + str.tostring(swingHigh) + " Stop Percent: " + str.tostring(shortStopPercent))

openTradesInProfit() =>

result = 0.

for i = 0 to strategy.opentrades-1

result += strategy.opentrades.profit(i)

result > 0

exitLong = inLong and base_cross_Short and openTradesInProfit()

strategy.close(id = "Long", when = exitLong, comment = "Closing Long", alert_message="Long TP Hit")

exitShort = inShort and base_cross_Long and openTradesInProfit()

strategy.close(id = "Short", when = exitShort, comment = "Closing Short", alert_message="Short TP Hit")

// =============================================================================

// DATA WINDOW PLOTTING

// =============================================================================

plotchar(0, "===========", "", location = location.top, color=#141823)

plotchar(0, "BUY SIGNALS:", "", location = location.top, color=#141823)

plotchar(0, "===========", "", location = location.top, color=#141823)

plotchar(qqeBuy, "QQE Mod: Buy Signal", "", location = location.top, color=qqeBuy ? color.green : color.orange)

plotchar(sslBuy, "SSL Hybrid: Buy Signal", "", location = location.top, color=sslBuy ? color.green : color.orange)

plotchar(waeBuy, "Waddah Attar Explosion: Buy Signal", "", location = location.top, color=waeBuy ? color.green : color.orange)

plotchar(inLong, "inLong", "", location = location.top, color=inLong ? color.green : color.orange)

plotchar(exitLong, "Exit Long", "", location = location.top, color=exitLong ? color.green : color.orange)

plotchar(0, "============", "", location = location.top, color=#141823)

plotchar(0, "SELL SIGNALS:", "", location = location.top, color=#141823)

plotchar(0, "============", "", location = location.top, color=#141823)

plotchar(qqeSell, "QQE Mod: Sell Signal", "", location = location.top, color=qqeSell ? color.red : color.orange)

plotchar(sslSell, "SSL Hybrid: Sell Signal", "", location = location.top, color=sslSell ? color.red : color.orange)

plotchar(waeSell, "Waddah Attar Explosion: Sell Signal", "", location = location.top, color=waeSell ? color.red : color.orange)

plotchar(inShort, "inShort", "", location = location.top, color=inShort ? color.red : color.orange)

plotchar(exitShort, "Exit Short", "", location = location.top, color=exitShort ? color.red : color.orange)

- Strategi Perdagangan Kuantitatif Berbasis Indikator SAR, Saham dan Sekuritas Parabolik

- EMA Trading Strategy untuk Emas yang Cepat Terobosan

- Dual-Faktor Momentum Pelacakan Reversal Strategi

- Strategi Perdagangan Pembalikan Momentum

- Bollinger Band dan RSI Bercampur dengan Strategi DCA

- Emma Pullback Pendek Strategi

- NoroBands Momentum Posisi Strategi

- Strategi Pelacakan Tren Pembalikan Konfirmasi Ganda

- Strategi perdagangan kuantitatif OBV yang didorong oleh indikator MACD

- Rata-rata Biaya Dolar Setelah Strategi Downtrend

- Strategi Pembalikan Tren Berdasarkan Rata-rata Bergerak, Pola Harga dan Volume

- Strategi Rata-rata Bergerak Ganda

- Momentum Moving Average Crossover Trading Strategi

- Strategi Golden Cross Dual Moving Average

- Momentum Wave Bollinger Bands Strategi Tren

- Strategi perdagangan dengan momentum terbalik

- Strategi Indikator Bandpass Mean PB

- RSI & Fibonacci 5 menit Strategi Perdagangan

- Triple Moving Average Dikombinasikan dengan Strategi Kuantitatif MACD

- Optimasi Momentum Breakout