Strategi mengikuti tren yang menggabungkan EMA ganda dan RSI

Ringkasan

Strategi ini mengidentifikasi tren harga dengan menggunakan kombinasi dua indikator EMA dan RSI, dan masuk tepat waktu saat berbalik arah tren. Secara khusus, strategi ini menggunakan EMA dengan periode yang lebih panjang untuk menentukan arah tren besar, sementara menggunakan indikator RSI untuk menentukan fenomena overbought dan oversold jangka pendek.

Prinsip Strategi

Menggunakan EMA 200 siklus untuk menentukan arah tren besar. Harga naik melalui garis EMA sebagai sinyal bullish, turun melalui garis EMA sebagai sinyal bearish.

Parameter indikator RSI diatur untuk 10 periode. Di mana RSI melewati 40 adalah sinyal oversell, dan melewati 60 adalah sinyal overbought.

Ketika tren besar adalah naik (biaya lebih tinggi dari garis EMA), jika terjadi sinyal oversold di bawah RSI yang menembus 40, masuk lebih banyak.

Ketika tren besar adalah turun (harga di bawah garis EMA), jika terjadi sinyal overbought 60 pada indikator RSI, melakukan shorting masuk.

Stop loss disetel 4 kali lipat dari ATR. Stop loss disetel 2 kali lipat dari stop loss, untuk mencapai rasio risiko-pengembalian 2: 1.

Analisis Keunggulan

Keuntungan terbesar dari strategi ini adalah kombinasi antara indikator tren dan reversal, yang memungkinkan untuk masuk ke dalam permainan tepat waktu ketika tren terjadi, sehingga dapat memperoleh kinerja yang lebih baik. Keuntungan spesifiknya adalah sebagai berikut:

Menggunakan sistem dual EMA untuk menentukan arah tren utama, dapat secara efektif melacak tren harga.

Indeks RSI dapat mengidentifikasi overbought dan oversold dalam jangka pendek, membantu menentukan kapan masuk ke pasar.

Stop loss diatur melalui indikator ATR, yang dapat menyesuaikan stop loss sesuai dengan volatilitas pasar, yang menguntungkan untuk pengendalian risiko.

Mengikuti prinsip perdagangan tren secara ketat dapat mengurangi perdagangan yang tidak perlu dan mengurangi risiko sistematis.

Analisis risiko

Strategi ini memiliki risiko utama sebagai berikut:

Dalam proses penurunan tren, sinyal perdagangan yang salah dapat dihasilkan. Pada saat ini, Anda perlu memeriksa waktu dan masuk dengan hati-hati.

Dalam situasi ekstrem, stop loss yang ditetapkan oleh ATR mungkin terlalu besar atau terlalu kecil dan perlu disesuaikan secara dinamis. Anda juga dapat mempertimbangkan untuk menggantikannya dengan metode stop loss lainnya.

Sinyal perdagangan mungkin menghasilkan frekuensi yang lebih tinggi, perlu diperhatikan apakah sesuai dengan preferensi frekuensi perdagangan Anda.

Perhatikan apakah parameter RSI disetel dengan benar, dan optimalkan parameter bila diperlukan.

Arah optimasi

Strategi ini dapat dioptimalkan dengan cara sebagai berikut:

Selain itu, ada juga indikator lain seperti MACD yang dapat diuji untuk membantu menentukan arah tren.

Anda dapat menguji indikator reversal lainnya, seperti KDJ, Bollinger Bands, dan lain-lain dalam kombinasi dengan RSI untuk mencari sinyal perdagangan yang lebih baik.

Algoritma pembelajaran mesin dapat diperkenalkan untuk mencapai stop loss dan stalling dinamis dengan menyesuaikan parameter secara adaptif.

Ini dapat dikombinasikan dengan faktor-faktor lain, seperti indikator emosi, aspek berita, dan lain-lain, untuk meningkatkan stabilitas keseluruhan sistem.

Meringkaskan

Secara keseluruhan, strategi ini adalah strategi garis pendek yang sangat khas yang menggabungkan pelacakan tren dan indikator pembalikan. Dengan menggunakan EMA ganda untuk menilai tren besar, sekaligus memanfaatkan fitur pembalikan indikator RSI untuk menangkap peluang pullback dalam tren. Secara prinsip, strategi ini menggabungkan keunggulan berbagai indikator bersama-sama, dan FORM memiliki efek komplementer yang bagus.

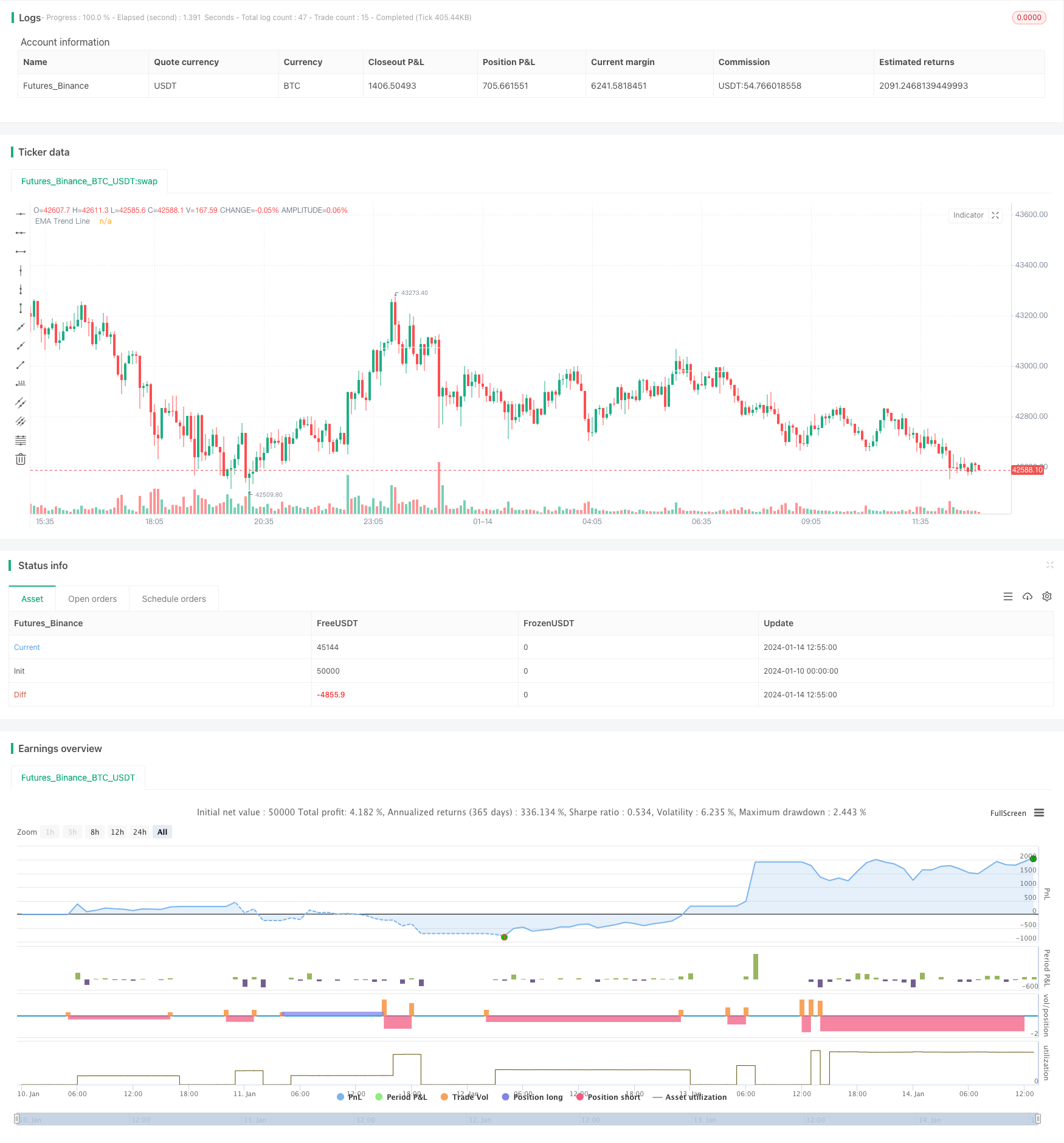

/*backtest

start: 2024-01-10 00:00:00

end: 2024-01-14 13:00:00

period: 5m

basePeriod: 1m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © kevinmck100

// @description

// This strategy is intended to be used as a base template for building new strategies.

//

// It incorporates the following features:

//

// - Risk management: Configurable X% loss per stop loss

// Configurable R:R ratio

//

// - Trade entry: Calculated position size based on risk tolerance

//

// - Trade exit: Stop Loss currently configurable ATR multiplier but can be replaced based on strategy

// Take Profit calculated from Stop Loss using R:R ratio

//

// - Backtesting: Configurable backtesting range by date

//

// - Trade drawings: TP/SL boxes drawn for all trades. Can be turned on and off

// Trade exit information labels. Can be turned on and off

// NOTE: Trade drawings will only be applicable when using overlay strategies

//

// - Debugging: Includes section with useful debugging techniques

//

// Strategy conditions:

//

// - Trade entry: LONG: C1: Price is above EMA line

// C2: RSI is crossing out of oversold area

// SHORT: C1: Price is below EMA line

// C2: RSI is crossing out of overbought area

//

// - Trade exit: Stop Loss: Stop Loss ATR multiplier is hit

// Take Profit: R:R multiplier * Stop Loss is hit

//

// The idea is to use RSI to catch pullbacks within the main trend. Note that

// this strategy is intended to be a simple base strategy for building upon.

// It was not designed to be traded in its current form.

//@version=5

INITIAL_CAPITAL = 1000

DEFAULT_COMMISSION = 0.02

MAX_DRAWINGS = 500

IS_OVERLAY = true

strategy("Risk Management Strategy Template", "Strategy Template", overlay = IS_OVERLAY, initial_capital = INITIAL_CAPITAL, currency = currency.NONE, max_labels_count = MAX_DRAWINGS, max_boxes_count = MAX_DRAWINGS, max_lines_count = MAX_DRAWINGS, default_qty_type = strategy.cash, commission_type = strategy.commission.percent, commission_value = DEFAULT_COMMISSION)

// =============================================================================

// INPUTS

// =============================================================================

// ------------------------ Replacable section - Start -------------------------

// ------------------

// Indicator Settings

// ------------------

emaLength = input.int (200, "EMA Length ", group = "Indicators: Settings", inline = "IS1", minval = 1, tooltip = "EMA line to identify trend direction. Above EMA trend line is bullish. Below EMA trend line is bearish")

rsiLength = input.int (10, "RSI Length ", group = "Indicators: Settings", inline = "IS2", minval = 1)

// ----------------------

// Trade Entry Conditions

// ----------------------

rsiOverbought = input.int (60, "RSI Overbought ", group = "Strategy: Conditions", inline = "SC1", minval = 50, maxval = 100, tooltip = "RSI overbought level used to identify pullbacks within the main trend. RSI crossing BELOW this level triggers a SHORT when in a DOWN trend")

rsiOversold = input.int (40, "RSI Oversold ", group = "Strategy: Conditions", inline = "SC2", minval = 0, maxval = 50, tooltip = "RSI overbought level used to identify pullbacks within the main trend. RSI crossing ABOVE this level triggers a LONG when in an UP trend")

// ---------------------

// Trade Exit Conditions

// ---------------------

atrLength = input.int (14, "Stop Loss ATR Length ", group = "Strategy: Exit Conditions", inline = "EC1", minval = 0, tooltip = "Length of ATR used to calculate Stop Loss.")

slAtrMultiplier = input.float(4, "Stop Loss ATR Multiplier ", group = "Strategy: Exit Conditions", inline = "EC2", minval = 0, step = 0.1, tooltip = "Size of StopLoss is determined by multiplication of ATR value. Take Profit is derived from this also by multiplying the StopLoss value by the Risk:Reward multiplier.")

// ------------------------- Replacable section - End --------------------------

// ---------------

// Risk Management

// ---------------

riskReward = input.float(2, "Risk : Reward 1 :", group = "Strategy: Risk Management", inline = "RM1", minval = 0, step = 0.1, tooltip = "Previous high or low (long/short dependant) is used to determine TP level. 'Risk : Reward' ratio is then used to calculate SL based of previous high/low level.\n\nIn short, the higher the R:R ratio, the smaller the SL since TP target is fixed by previous high/low price data.")

accountRiskPercent = input.float(1, "Portfolio Risk % ", group = "Strategy: Risk Management", inline = "RM1", minval = 0, step = 0.1, tooltip = "Percentage of portfolio you lose if trade hits SL.\n\nYou then stand to gain\n Portfolio Risk % * Risk : Reward\nif trade hits TP.")

// ----------

// Date Range

// ----------

startYear = input.int (2022, "Start Date ", group = 'Strategy: Date Range', inline = 'DR1', minval = 1900, maxval = 2100)

startMonth = input.int (1, "", group = 'Strategy: Date Range', inline = 'DR1', options = [1, 2, 3, 4, 5, 6, 7, 8, 9, 10, 11, 12])

startDate = input.int (1, "", group = 'Strategy: Date Range', inline = 'DR1', options = [1, 2, 3, 4, 5, 6, 7, 8, 9, 10, 11, 12, 13, 14, 15, 16, 17, 18, 19, 20, 21, 22, 23, 24, 25, 26, 27, 28, 29, 30, 31])

endYear = input.int (2100, "End Date ", group = 'Strategy: Date Range', inline = 'DR2', minval = 1900, maxval = 2100)

endMonth = input.int (1, "", group = 'Strategy: Date Range', inline = 'DR2', options = [1, 2, 3, 4, 5, 6, 7, 8, 9, 10, 11, 12])

endDate = input.int (1, "", group = 'Strategy: Date Range', inline = 'DR2', options = [1, 2, 3, 4, 5, 6, 7, 8, 9, 10, 11, 12, 13, 14, 15, 16, 17, 18, 19, 20, 21, 22, 23, 24, 25, 26, 27, 28, 29, 30, 31])

// ----------------

// Drawing Settings

// ----------------

showTpSlBoxes = input.bool(false, "Show TP / SL Boxes", group = "Strategy: Drawings", inline = "D1", tooltip = "Show or hide TP and SL position boxes.\n\nNote: TradingView limits the maximum number of boxes that can be displayed to 500 so they may not appear for all price data under test.")

showLabels = input.bool(false, "Show Trade Exit Labels", group = "Strategy: Drawings", inline = "D2", tooltip = "Useful labels to identify Profit/Loss and cumulative portfolio capital after each trade closes.\n\nAlso note that TradingView limits the max number of 'boxes' that can be displayed on a chart (max 500). This means when you lookback far enough on the chart you will not see the TP/SL boxes. However you can check this option to identify where trades exited.")

// =============================================================================

// INDICATORS

// =============================================================================

// ------------------------ Replacable section - Start -------------------------

// ---

// EMA

// ---

ema = ta.ema(close, emaLength)

plot(ema, "EMA Trend Line", color.white)

// ---

// RSI

// ---

rsi = ta.rsi(close, rsiLength)

// ------------------------- Replacable section - End --------------------------

// =============================================================================

// STRATEGY LOGIC

// =============================================================================

// ---------

// FUNCTIONS

// ---------

percentAsPoints(pcnt) =>

math.round(pcnt / 100 * close / syminfo.mintick)

calcStopLossPrice(pointsOffset, isLong) =>

priceOffset = pointsOffset * syminfo.mintick

if isLong

close - priceOffset

else

close + priceOffset

calcProfitTrgtPrice(pointsOffset, isLong) =>

calcStopLossPrice(-pointsOffset, isLong)

printLabel(barIndex, msg) => label.new(barIndex, close, msg)

printTpSlHitBox(left, right, slHit, tpHit, entryPrice, slPrice, tpPrice) =>

if showTpSlBoxes

box.new (left = left, top = entryPrice, right = right, bottom = slPrice, bgcolor = slHit ? color.new(color.red, 60) : color.new(color.gray, 90), border_width = 0)

box.new (left = left, top = entryPrice, right = right, bottom = tpPrice, bgcolor = tpHit ? color.new(color.green, 60) : color.new(color.gray, 90), border_width = 0)

line.new(x1 = left, y1 = entryPrice, x2 = right, y2 = entryPrice, color = color.new(color.yellow, 20))

line.new(x1 = left, y1 = slPrice, x2 = right, y2 = slPrice, color = color.new(color.red, 20))

line.new(x1 = left, y1 = tpPrice, x2 = right, y2 = tpPrice, color = color.new(color.green, 20))

printTpSlNotHitBox(left, right, entryPrice, slPrice, tpPrice) =>

if showTpSlBoxes

box.new (left = left, top = entryPrice, right = right, bottom = slPrice, bgcolor = color.new(color.gray, 90), border_width = 0)

box.new (left = left, top = entryPrice, right = right, bottom = tpPrice, bgcolor = color.new(color.gray, 90), border_width = 0)

line.new(x1 = left, y1 = entryPrice, x2 = right, y2 = entryPrice, color = color.new(color.yellow, 20))

line.new(x1 = left, y1 = slPrice, x2 = right, y2 = slPrice, color = color.new(color.red, 20))

line.new(x1 = left, y1 = tpPrice, x2 = right, y2 = tpPrice, color = color.new(color.green, 20))

printTradeExitLabel(x, y, posSize, entryPrice, pnl) =>

if showLabels

labelStr = "Position Size: " + str.tostring(math.abs(posSize), "#.##") + "\nPNL: " + str.tostring(pnl, "#.##") + "\nCapital: " + str.tostring(strategy.equity, "#.##") + "\nEntry Price: " + str.tostring(entryPrice, "#.##")

label.new(x = x, y = y, text = labelStr, color = pnl > 0 ? color.new(color.green, 60) : color.new(color.red, 60), textcolor = color.white, style = label.style_label_down)

// ----------

// CONDITIONS

// ----------

inDateRange = time >= timestamp(syminfo.timezone, startYear, startMonth, startDate, 0, 0) and time < timestamp(syminfo.timezone, endYear, endMonth, endDate, 0, 0)

// ------------------------ Replacable section - Start -------------------------

// Condition 1: Price above EMA indicates bullish trend, price below EMA indicates bearish trend

bullEma = close > ema

bearEma = close < ema

// Condition 2: RSI crossing back from overbought/oversold indicates pullback within trend

bullRsi = ta.crossover (rsi, rsiOversold)

bearRsi = ta.crossunder (rsi, rsiOverbought)

// Combine all entry conditions

goLong = inDateRange and bullEma and bullRsi

goShort = inDateRange and bearEma and bearRsi

// ------------------------- Replacable section - End --------------------------

// Trade entry and exit variables

var tradeEntryBar = bar_index

var profitPoints = 0.

var lossPoints = 0.

var slPrice = 0.

var tpPrice = 0.

var inLong = false

var inShort = false

// Entry decisions

openLong = (goLong and not inLong)

openShort = (goShort and not inShort)

flippingSides = (goLong and inShort) or (goShort and inLong)

enteringTrade = openLong or openShort

inTrade = inLong or inShort

// ------------------------ Replacable section - Start -------------------------

// Exit calculations

atr = ta.atr(atrLength)

slAmount = atr * slAtrMultiplier

slPercent = math.abs((1 - (close - slAmount) / close) * 100)

tpPercent = slPercent * riskReward

// ------------------------- Replacable section - End --------------------------

// Risk calculations

riskAmt = strategy.equity * accountRiskPercent / 100

entryQty = math.abs(riskAmt / slPercent * 100) / close

if openLong

if strategy.position_size < 0

printTpSlNotHitBox(tradeEntryBar + 1, bar_index + 1, strategy.position_avg_price, slPrice, tpPrice)

printTradeExitLabel(bar_index + 1, math.max(tpPrice, slPrice), strategy.position_size, strategy.position_avg_price, strategy.openprofit)

strategy.entry("Long", strategy.long, qty = entryQty, alert_message = "Long Entry")

enteringTrade := true

inLong := true

inShort := false

if openShort

if strategy.position_size > 0

printTpSlNotHitBox(tradeEntryBar + 1, bar_index + 1, strategy.position_avg_price, slPrice, tpPrice)

printTradeExitLabel(bar_index + 1, math.max(tpPrice, slPrice), strategy.position_size, strategy.position_avg_price, strategy.openprofit)

strategy.entry("Short", strategy.short, qty = entryQty, alert_message = "Short Entry")

enteringTrade := true

inShort := true

inLong := false

if enteringTrade

profitPoints := percentAsPoints(tpPercent)

lossPoints := percentAsPoints(slPercent)

slPrice := calcStopLossPrice(lossPoints, openLong)

tpPrice := calcProfitTrgtPrice(profitPoints, openLong)

tradeEntryBar := bar_index

strategy.exit("TP/SL", profit = profitPoints, loss = lossPoints, comment_profit = "TP Hit", comment_loss = "SL Hit", alert_profit = "TP Hit Alert", alert_loss = "SL Hit Alert")

// =============================================================================

// DRAWINGS

// =============================================================================

// -----------

// TP/SL Boxes

// -----------

slHit = (inShort and high >= slPrice) or (inLong and low <= slPrice)

tpHit = (inLong and high >= tpPrice) or (inShort and low <= tpPrice)

exitTriggered = slHit or tpHit

entryPrice = strategy.closedtrades.entry_price (strategy.closedtrades - 1)

pnl = strategy.closedtrades.profit (strategy.closedtrades - 1)

posSize = strategy.closedtrades.size (strategy.closedtrades - 1)

// Print boxes for trades closed at profit or loss

if (inTrade and exitTriggered)

inShort := false

inLong := false

printTpSlHitBox(tradeEntryBar + 1, bar_index, slHit, tpHit, entryPrice, slPrice, tpPrice)

printTradeExitLabel(bar_index, math.max(tpPrice, slPrice), posSize, entryPrice, pnl)

// Print TP/SL box for current open trade

if barstate.islastconfirmedhistory and strategy.position_size != 0

printTpSlNotHitBox(tradeEntryBar + 1, bar_index + 1, strategy.position_avg_price, slPrice, tpPrice)

// =============================================================================

// DEBUGGING

// =============================================================================

// Data window plots

plotchar(slPrice, "Stop Loss Price", "")

plotchar(tpPrice, "Take Profit Price", "")

// Label plots

plotDebugLabels = false

if plotDebugLabels

if bar_index == tradeEntryBar

printLabel(bar_index, "Position size: " + str.tostring(entryQty * close, "#.##"))