Rata-rata pergerakan superimposed zero lag dikombinasikan dengan strategi perdagangan keluar garis kantilever

Ringkasan

Gagasan utama dari strategi ini adalah untuk mencari waktu masuk dan keluar yang lebih tepat dengan menggabungkan arah arah tren dari nol lag di atas rata-rata bergerak (ZLSMA) dan keluar dari garis tegak (CE). ZLSMA adalah indikator tren yang dapat menentukan perubahan tren lebih awal.

Prinsip Strategi

Bagian ZLSMA:

- Garis LMA dengan panjang 130 periode dihitung secara terpisah menggunakan metode regresi linier.

- Kemudian letakkan dua garis LMA di atasnya untuk mendapatkan perbedaan yang diberikan pada eq.

- Akhirnya, perbedaan eq ditambahkan melalui garis LMA asli untuk membentuk rata-rata bergerak ZLSMA dengan overlap nol.

Bagian CE:

- Hitung indikator ATR dan kalikan dengan faktor ((default2) untuk menentukan jarak dinamis dari titik tertinggi atau titik terendah terdekat.

- Ketika harga penutupan melampaui garis stop loss atau garis stop loss headline yang paling dekat, aturlah garis stop loss tersebut sesuai.

- Berdasarkan perubahan posisi harga penutupan terhadap garis stop loss, lebih banyak arah melakukan shorting.

Waktu masuk:

- ZLSMA menilai arah tren, CE masuk saat sinyal.

Stop loss:

- Kabel panjang dilengkapi dengan stop loss dan stop stop.

- Garis pendek menggantikan stop loss tetap dengan output dinamis CE.

Analisis Keunggulan

- ZLSMA dapat mengidentifikasi tren lebih awal dan menghindari terobosan palsu.

- CE dapat menyesuaikan titik ekspor secara fleksibel sesuai dengan tingkat fluktuasi pasar.

- Rasio risiko-keuntungan dari strategi dapat disesuaikan.

- Lini panjang dan pendek menggunakan metode stop loss yang berbeda untuk mengendalikan risiko.

Analisis risiko

- Penetapan parameter yang tidak tepat dapat meningkatkan tingkat input atau memperluas jangkauan stop loss.

- Jika situasi berubah dengan cepat, masih ada risiko hambatan akan dilanggar.

Arah optimasi

- Optimasi parameter dapat diuji untuk berbagai pasar dan periode waktu.

- Parameter stop loss dapat dipertimbangkan untuk disesuaikan dengan fluktuasi atau siklus tertentu.

- Anda dapat mencoba kombinasi dengan indikator atau model lain untuk meningkatkan tingkat keuntungan.

Meringkaskan

Strategi ini terutama menggunakan nol lag overlay moving averages untuk menentukan arah tren, dikombinasikan dengan indikator pending line output untuk mencari waktu masuk dan keluar yang lebih tepat. Keuntungan dari strategi ini adalah bahwa rasio stop loss dapat disesuaikan, dan bahwa dinamika pending line output dapat disesuaikan untuk mengendalikan risiko sesuai dengan kondisi pasar. Langkah selanjutnya adalah mencoba optimasi parameter dan kombinasi strategi untuk meningkatkan stabilitas dan profitabilitas lebih lanjut.

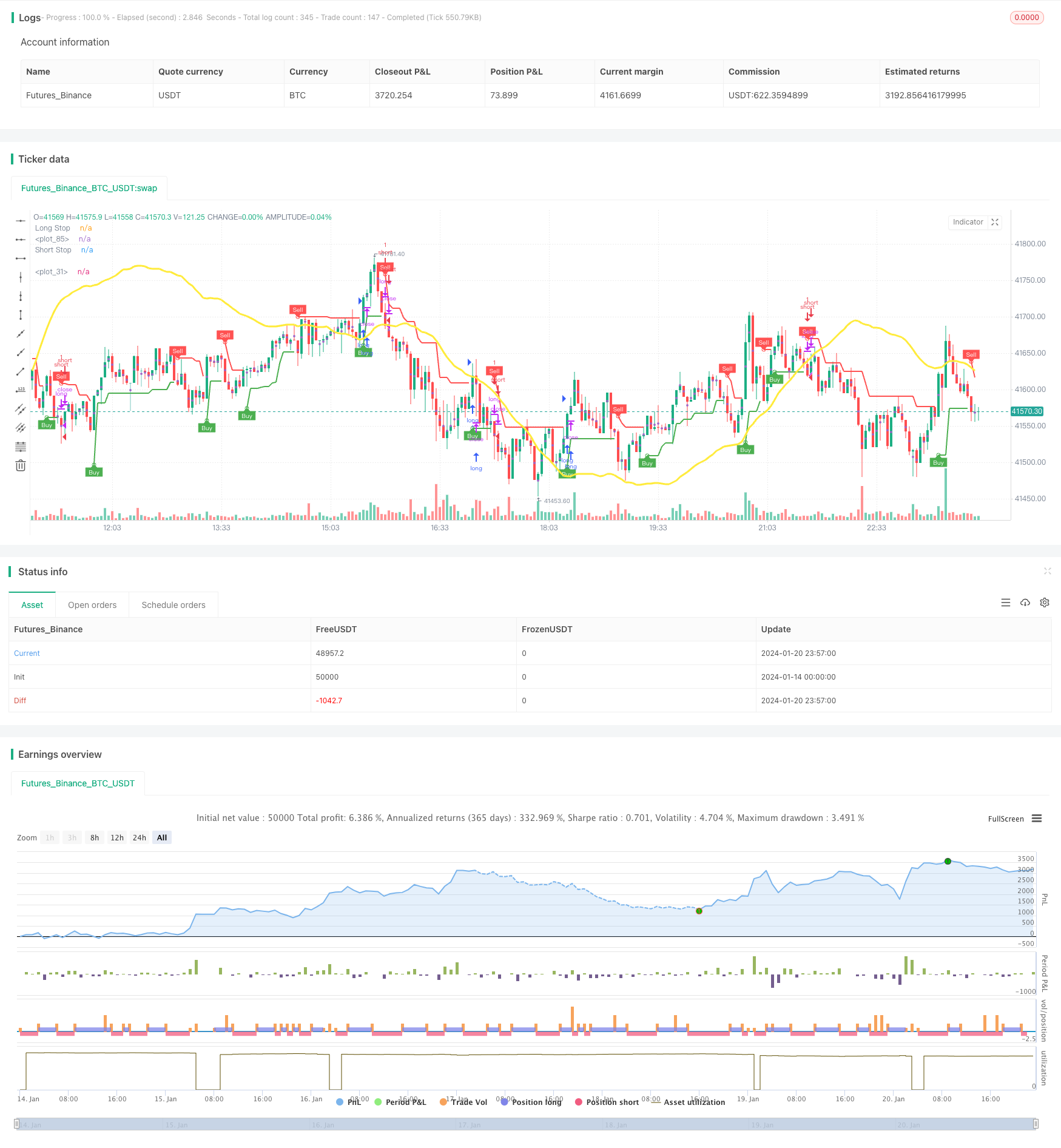

/*backtest

start: 2024-01-14 00:00:00

end: 2024-01-21 00:00:00

period: 3m

basePeriod: 1m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © GGkurg

//@version=5

strategy(title = "ZLSMA + Chandelier Exit", shorttitle="ZLSMA + CE", overlay=true)

var GRP1 = "take profit / stop loss"

TP = input(title='long TP%', defval=2.0, inline = "1", group = GRP1)

SL = input(title='long SL%', defval=2.0, inline = "1", group = GRP1)

TP2 = input(title='short TP', defval=2.0, inline = "2", group = GRP1)

SL2 = input(title='short SL', defval=2.0, inline = "2", group = GRP1)

//-------------------------------------------------calculations

takeProfitPrice = strategy.position_avg_price * (1+(TP/100))

stopLossPrice = strategy.position_avg_price * (1-(SL/100))

takeProfitPrice2 = strategy.position_avg_price * (1-(TP2/100))

stopLossPrice2 = strategy.position_avg_price * (1+(SL2/100))

//---------------------------------------ZLSMA - Zero Lag LSMA

var GRP2 = "ZLSMA settings"

length1 = input(title='Length', defval=130, inline = "1", group = GRP2)

offset1 = input(title='Offset', defval=0, inline = "2", group = GRP2)

src = input(close, title='Source', inline = "3", group = GRP2)

lsma = ta.linreg(src, length1, offset1)

lsma2 = ta.linreg(lsma, length1, offset1)

eq = lsma - lsma2

zlsma = lsma + eq

plot(zlsma, color=color.new(color.yellow, 0), linewidth=3)

//---------------------------------------ZLSMA conditisions

//---------long

longc1 = close > zlsma

longclose1 = close < zlsma

//---------short

shortc1 = close < zlsma

shortclose1 = close > zlsma

//---------------------------------------Chandelier Exit

var string calcGroup = 'Chandelier exit settings'

length = input.int(title='ATR Period', defval=1, group=calcGroup)

mult = input.float(title='ATR Multiplier', step=0.1, defval=2.0, group=calcGroup)

useClose = input.bool(title='Use Close Price for Extremums', defval=true, group=calcGroup)

var string visualGroup = 'Visuals'

showLabels = input.bool(title='Show Buy/Sell Labels', defval=true, group=visualGroup)

highlightState = input.bool(title='Highlight State', defval=true, group=visualGroup)

var string alertGroup = 'Alerts'

awaitBarConfirmation = input.bool(title="Await Bar Confirmation", defval=true, group=alertGroup)

atr = mult * ta.atr(length)

longStop = (useClose ? ta.highest(close, length) : ta.highest(length)) - atr

longStopPrev = nz(longStop[1], longStop)

longStop := close[1] > longStopPrev ? math.max(longStop, longStopPrev) : longStop

shortStop = (useClose ? ta.lowest(close, length) : ta.lowest(length)) + atr

shortStopPrev = nz(shortStop[1], shortStop)

shortStop := close[1] < shortStopPrev ? math.min(shortStop, shortStopPrev) : shortStop

var int dir = 1

dir := close > shortStopPrev ? 1 : close < longStopPrev ? -1 : dir

var color longColor = color.green

var color shortColor = color.red

var color longFillColor = color.new(color.green, 90)

var color shortFillColor = color.new(color.red, 90)

var color textColor = color.new(color.white, 0)

longStopPlot = plot(dir == 1 ? longStop : na, title='Long Stop', style=plot.style_linebr, linewidth=2, color=color.new(longColor, 0))

buySignal = dir == 1 and dir[1] == -1

plotshape(buySignal ? longStop : na, title='Long Stop Start', location=location.absolute, style=shape.circle, size=size.tiny, color=color.new(longColor, 0))

plotshape(buySignal and showLabels ? longStop : na, title='Buy Label', text='Buy', location=location.absolute, style=shape.labelup, size=size.tiny, color=color.new(longColor, 0), textcolor=textColor)

shortStopPlot = plot(dir == 1 ? na : shortStop, title='Short Stop', style=plot.style_linebr, linewidth=2, color=color.new(shortColor, 0))

sellSignal = dir == -1 and dir[1] == 1

plotshape(sellSignal ? shortStop : na, title='Short Stop Start', location=location.absolute, style=shape.circle, size=size.tiny, color=color.new(shortColor, 0))

plotshape(sellSignal and showLabels ? shortStop : na, title='Sell Label', text='Sell', location=location.absolute, style=shape.labeldown, size=size.tiny, color=color.new(shortColor, 0), textcolor=textColor)

midPricePlot = plot(ohlc4, title='', style=plot.style_circles, linewidth=0, display=display.none, editable=false)

longStateFillColor = highlightState ? dir == 1 ? longFillColor : na : na

shortStateFillColor = highlightState ? dir == -1 ? shortFillColor : na : na

fill(midPricePlot, longStopPlot, title='Long State Filling', color=longStateFillColor)

fill(midPricePlot, shortStopPlot, title='Short State Filling', color=shortStateFillColor)

await = awaitBarConfirmation ? barstate.isconfirmed : true

alertcondition(dir != dir[1] and await, title='Alert: CE Direction Change', message='Chandelier Exit has changed direction!')

alertcondition(buySignal and await, title='Alert: CE Buy', message='Chandelier Exit Buy!')

alertcondition(sellSignal and await, title='Alert: CE Sell', message='Chandelier Exit Sell!')

//---------------------------------------Chandelier Exit conditisions

//---------long

longc2 = buySignal

longclose2 = sellSignal

//---------short

shortc2 = sellSignal

shortclose2 = buySignal

//---------------------------------------Long entry and exit

if longc1 and longc2

strategy.entry("long", strategy.long)

if strategy.position_avg_price > 0

strategy.exit("close long", "long", limit = takeProfitPrice, stop = stopLossPrice, alert_message = "close all orders")

if longclose1 and longclose2 and strategy.opentrades == 1

strategy.close("long","ema long cross", alert_message = "close all orders")

//---------------------------------------Short entry and exit

if shortc1 and shortc2

strategy.entry("short", strategy.short)

if strategy.position_avg_price > 0

strategy.exit("close short", "short", limit = takeProfitPrice2, stop = stopLossPrice2, alert_message = "close all orders")

if shortclose1 and shortclose2 and strategy.opentrades == 1

strategy.close("close short","short", alert_message = "close all orders")