Strategi perdagangan terobosan dua arah berdasarkan K-line

Ringkasan

Ini adalah strategi perdagangan dua arah berdasarkan garis K. Ini akan menghasilkan sinyal perdagangan ketika harga penutupan garis K saat ini memiliki dua garis K teratas dan terendah yang telah terobosan.

Prinsip Strategi

Logika dasar dari strategi ini adalah:

Definisi sinyal banteng:

bull = close > open and close > math.max(close[2], open[2]) and low[1] < low[2] and high[1] < high[2]。 Artinya, harga penutupan garis K saat ini lebih besar dari harga bukaan, dan lebih besar dari harga tertinggi dari dua garis K sebelumnya, sementara harga terendah dari garis K saat ini lebih rendah dari harga terendah dari garis K sebelumnya。Definisi sinyal beruang:

bear = close < open and close < math.min(close[2], open[2]) and low[1] > low[2] and high[1] > high[2]。 Artinya, harga penutupan garis K saat ini lebih kecil dari harga bukaan dan lebih kecil dari harga terendah dari dua garis K sebelumnya, sementara harga tertinggi dari garis K saat ini lebih tinggi dari harga tertinggi dari garis K sebelumnya。Ketika menyalakan sinyal banteng, lakukan lebih banyak; ketika menyalakan sinyal beruang, kosongkan.

Stop loss dan stop loss dapat diatur.

Strategi ini memanfaatkan fitur dua arah untuk menilai perubahan tren dengan menerobos kisaran harga kunci, sehingga menghasilkan sinyal perdagangan.

Analisis Keunggulan

Ini adalah strategi penembakan yang relatif sederhana dan intuitif, dengan keuntungan sebagai berikut:

Logika yang jelas, mudah dipahami, implementasi yang sederhana.

Penembusan adalah sinyal perdagangan yang umum dan mudah untuk membentuk tren.

Pada saat yang sama, Anda dapat melakukan lebih banyak shorting, sehingga Anda dapat melakukan perdagangan dua arah dan meningkatkan peluang untuk mendapatkan keuntungan.

Fleksibel untuk mengatur Stop Loss Stop dan mengendalikan risiko.

Analisis risiko

Strategi ini juga memiliki beberapa risiko:

Transaksi dua arah sangat berisiko dan perlu dipantau secara ketat.

“Kemungkinan penembusan ini bisa menimbulkan sinyal palsu.

Pengaturan parameter yang tidak tepat dapat menyebabkan perdagangan berlebihan.

Pengaturan yang salah dari stop loss juga dapat mempengaruhi margin keuntungan.

Parameter dapat dioptimalkan, dengan pemilihan varietas yang tepat untuk mengurangi risiko.

Arah optimasi

Strategi ini dapat dioptimalkan dalam beberapa hal:

Parameter optimasi, seperti parameter siklus terobosan, stop loss stop loss, dan sebagainya.

Menambahkan kondisi penyaringan untuk menghindari sinyal-sinyal yang salah seperti arbitrage, getaran, dan lain-lain.

Dengan menggunakan indikator tren, menghindari penyesuaian jangkauan.

Optimalkan pengelolaan dana, memperbaiki algoritma posisi.

Parameter yang berbeda untuk varietas yang berbeda dapat diuji dan dioptimalkan secara terpisah.

Meringkaskan

Ini adalah strategi sederhana yang didasarkan pada pemikiran terobosan dua arah. Ini memiliki keunggulan dalam kejernihan logika dan kemudahan implementasi, tetapi ada juga risiko pengawasan tertentu. Dengan optimasi parameter dan kondisi, diharapkan untuk mendapatkan efek strategi yang lebih baik.

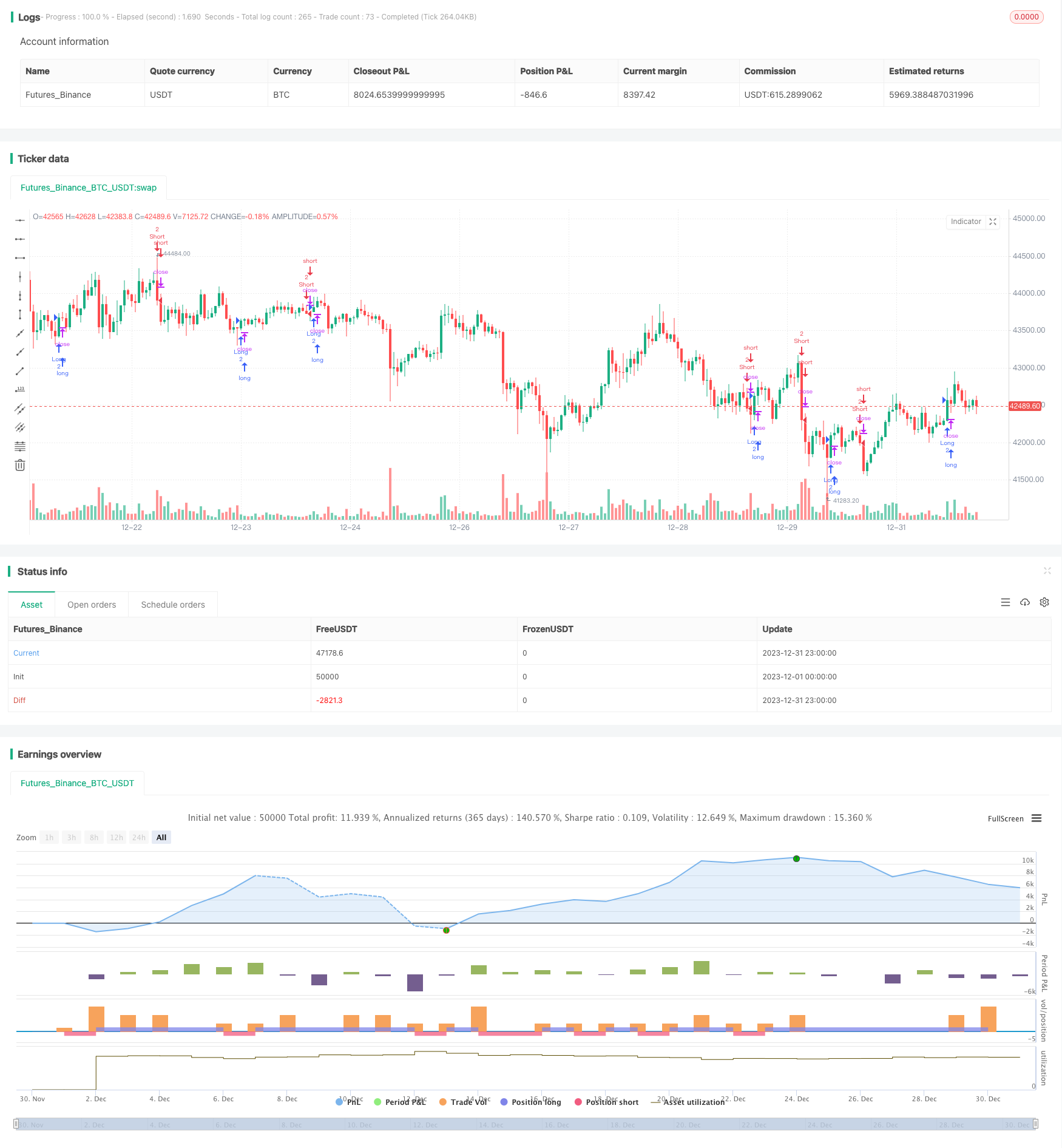

/*backtest

start: 2023-12-01 00:00:00

end: 2023-12-31 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

// # ========================================================================= #

// # | Strategy |

// # ========================================================================= #

SystemName = "Strategy Template Autoview"

TradeId = "S"

// These values are used both in the strategy() header and in the script's relevant inputs as default values so they match.

// Unless these values match in the script's Inputs and the TV backtesting Properties, results between them cannot be compared.

InitCapital = 1000000

InitPosition = 2

InitCommission = 0.075

InitPyramidMax = 1

CalcOnorderFills = false

ProcessOrdersOnClose = true // display the signals one candle earlier

CalcOnEveryTick = true // forward testing

//CloseEntriesRule = "ANY"

strategy(title=SystemName, shorttitle=SystemName,

overlay=true, pyramiding=InitPyramidMax, initial_capital=InitCapital, default_qty_type=strategy.fixed, process_orders_on_close=ProcessOrdersOnClose,

default_qty_value=InitPosition, commission_type=strategy.commission.percent, commission_value=InitCommission, calc_on_order_fills=CalcOnorderFills,

calc_on_every_tick=CalcOnEveryTick,

precision=6, max_lines_count=500, max_labels_count=500)

// # ========================================================================= #

// # ========================================================================= #

// # || Alerts ||

// # ========================================================================= #

// # ========================================================================= #

show_alerts_debug = input.bool(true, title = "Show Alerts Debug Label?", group = "Debug")

//i_alert_txt_entry_long = input.text_area(defval = "", title = "Long Entry Message", group = "Alerts")

//i_alert_txt_entry_short = input.text_area(defval = "", title = "Short Entry Message", group = "Alerts")

//i_alert_txt_exit_long = input.text_area(defval = "", title = "Long Exit Message", group = "Alerts")

//i_alert_txt_exit_short = input.text_area(defval = "", title = "Short Exit Message", group = "Alerts")

i_broker_mode = input.string("DEMO", title = "Use Demo or Live Broker", options=["DEMO", "LIVE"], group = "Automation")

i_broker_name = input.string("Tradovate", title = "Broker Name", options=["Tradovate", "AscendEX", "Binance", "Binance Futures", "Binance US", "Binance Delivery", "Kraken", "Deribit", "Poloniex", "Okcoin", "Bitfinex", "Oanda", "Kucoin", "Okex", "Bybit", "FTX", "Bitmex", "Alpaca", "Gemini"], group = "Automation")

i_enable_trades = input.bool(true, title = "Enable trades?", group = "Automation", tooltip = "If not enabled, disables live trades, but more importantly, it will output what Autoview is going to do when you go live.")

i_account_name = input.string("*", title = "Account Name", group = "Automation")

i_symbol_name = input.string("btcusd_perp", title = "Symbol Name", group = "Automation")

nb_contracts = input.int(2, title = "Nb Contracts", group = "Automation")

use_delay = input.bool(false, title = "Use Delay between orders", group = "Automation", inline = "delay")

i_delay_qty = input.int(1, title = "Delay in seconds", group = "Automation", inline = "delay")

i_use_borrow_repay = input.bool(false, title = "Use Borrow/Repay Mode?", group = "Binance Automation")

i_asset_borrow_repay = input.string("BTC", title = "Asset to Borrow/Repay", group = "Binance Automation")

i_qty_borrow_repay = input.float(1., title = "Quantity of assets to borrow?", group = "Binance Automation")

// # ========================================================================= #

// # ========================================================================= #

// # || Dates Range Filtering ||

// # ========================================================================= #

// # ========================================================================= #

DateFilter = input(false, "Date Range Filtering", group="Date")

// ————— Syntax coming from https://www.tradingview.com/blog/en/new-parameter-for-date-input-added-to-pine-21812/

i_startTime = input(defval = timestamp("01 Jan 2019 13:30 +0000"), title = "Start Time", group="Date")

i_endTime = input(defval = timestamp("30 Dec 2021 23:30 +0000"), title = "End Time", group="Date")

TradeDateIsAllowed() => true

// # ========================================================================= #

// # | Custom Exits |

// # ========================================================================= #

//use_custom_exit = input.bool(true, title = "Use Custom Exits?", group = "Custom Exits")

// # ========================================================================= #

// # | Stop Loss |

// # ========================================================================= #

use_sl = input.string("None", title = "Select Stop Loss Mode", options=["None", "Percent", "Price"], group = "Stop Loss")

sl_input_perc = input.float(3, minval = 0, title = "Stop Loss (%)", group = "Stop Loss (%)") * 0.01

sl_input_pips = input.float(30, minval = 0, title = "Stop Loss (USD)", group = "Stop Loss (USD)")

// # ========================================================================= #

// # | Take Profit |

// # ========================================================================= #

use_tp = input.string("None", title = "Select Take Profit Mode", options=["None", "Percent", "Price"], group = "Take Profit")

tp_input_perc = input.float(3, minval = 0, title = "Take Profit (%)", group = "Take Profit (%)") * 0.01

tp_input_pips = input.float(30, minval = 0, title = "Take Profit (USD)", group = "Take Profit (USD)")

// # ========================================================================= #

// # | Consolidated Entries |

// # ========================================================================= #

bull = close > open and close > math.max(close[2], open[2]) and low[1] < low[2] and high[1] < high[2] // low < low[1] and low[1] < low[2]

bear = close < open and close < math.min(close[2], open[2]) and low[1] > low[2] and high[1] > high[2] // low < low[1] and low[1] < low[2]

// # ========================================================================= #

// # | Entry Price |

// # ========================================================================= #

entry_long_price = ta.valuewhen(condition=bull and strategy.position_size[1] <= 0, source=close, occurrence=0)

entry_short_price = ta.valuewhen(condition=bear and strategy.position_size[1] >= 0, source=close, occurrence=0)

var float entry_price = 0.

if bull

entry_price := entry_long_price

if bear

entry_price := entry_short_price

// # ========================================================================= #

// # || Global Trend Variables ||

// # ========================================================================= #

T1_sinceUP = ta.barssince(bull)

T1_sinceDN = ta.barssince(bear)

T1_nUP = ta.crossunder(T1_sinceUP,T1_sinceDN)

T1_nDN = ta.crossover(T1_sinceUP,T1_sinceDN)

T1_sinceNUP = ta.barssince(T1_nUP)

T1_sinceNDN = ta.barssince(T1_nDN)

T1_BuyTrend = T1_sinceDN > T1_sinceUP

T1_SellTrend = T1_sinceDN < T1_sinceUP

T1_SellToBuy = T1_BuyTrend and T1_SellTrend[1]

T1_BuyToSell = T1_SellTrend and T1_BuyTrend[1]

T1_ChangeTrend = T1_BuyToSell or T1_SellToBuy

// # ========================================================================= #

// # | Stop Loss |

// # ========================================================================= #

var float final_SL_Long = 0.

var float final_SL_Short = 0.

if use_sl == "Percent"

final_SL_Long := entry_long_price * (1 - sl_input_perc)

final_SL_Short := entry_short_price * (1 + sl_input_perc)

else if use_sl == "Price"

final_SL_Long := entry_long_price - (sl_input_pips)

final_SL_Short := entry_short_price + (sl_input_pips)

plot(strategy.position_size > 0 and use_sl != "None" ? final_SL_Long : na, title = "SL Long", color = color.fuchsia, linewidth=2, style=plot.style_linebr)

plot(strategy.position_size < 0 and use_sl != "None" ? final_SL_Short : na, title = "SL Short", color = color.fuchsia, linewidth=2, style=plot.style_linebr)

// # ========================================================================= #

// # | Take Profit |

// # ========================================================================= #

var float final_TP_Long = 0.

var float final_TP_Short = 0.

if use_tp == "Percent"

final_TP_Long := entry_long_price * (1 + tp_input_perc)

final_TP_Short := entry_short_price * (1 - tp_input_perc)

else if use_tp == "Price"

final_TP_Long := entry_long_price + (tp_input_pips)

final_TP_Short := entry_short_price - (tp_input_pips)

plot(strategy.position_size > 0 and use_tp != "None" ? final_TP_Long : na, title = "TP Long", color = color.orange, linewidth=2, style=plot.style_linebr)

plot(strategy.position_size < 0 and use_tp != "None" ? final_TP_Short : na, title = "TP Short", color = color.orange, linewidth=2, style=plot.style_linebr)

// # ========================================================================= #

// # | AutoView Calls |

// # ========================================================================= #

float quantity = nb_contracts

string product_type_ticker = i_symbol_name

var string broker_mode = ""

if i_broker_mode == "DEMO"

broker_mode := switch i_broker_name

"Tradovate" => "tradovatesim"

"Ascendex" => "ascendex-sandbox"

"Binance Futures" => "binancefuturestestnet"

"Binance Delivery" => "binancedeliverytestnet"

"Oanda" => "oandapractice"

"Bitmex" => "bitmextestnet"

"Bybit" => "bybittestnet"

"Alpaca" => "alpacapaper"

"Kucoin" => "kucoinsandbox"

"Deribit" => "deribittestnet"

"Gemini" => "gemini-sandbox"

=> i_broker_name

else // "LIVE"

broker_mode := switch i_broker_name

"Tradovate" => "tradovate"

"Ascendex" => "ascendex"

"Binance Futures" => "binancefutures"

"Binance Delivery" => "binancedelivery"

"Binance" => "binance"

"Oanda" => "oanda"

"Kraken" => "kraken"

"Deribit" => "deribit"

"Bitfinex" => "bitfinex"

"Poloniex" => "poloniex"

"Bybit" => "bybit"

"Okcoin" => "okcoin"

"Kucoin" => "kucoin"

"FTX" => "ftx"

"Bitmex" => "bitmex"

"Alpaca" => "alpaca"

"Gemini" => "gemini"

=> i_broker_name

enable_trades = i_enable_trades ? "" : " d=1"

string delay_qty = use_delay ? " delay=" + str.tostring(i_delay_qty) : ""

i_alert_txt_entry_long = "a=" + i_account_name + " e=" + broker_mode + " s=" + product_type_ticker + enable_trades + " b=short c=position t=market" +

"\n a=" + i_account_name + " e=" + broker_mode + " s=" + product_type_ticker + " b=long q=" + str.tostring(quantity, "#") + " t=market" + enable_trades + delay_qty

i_alert_txt_entry_short = "a=" + i_account_name + " e=" + broker_mode + " s=" + product_type_ticker + enable_trades + " b=long c=position t=market" +

"\n a=" + i_account_name + " e=" + broker_mode + " s=" + product_type_ticker + " b=short q=" + str.tostring(quantity, "#") + " t=market" + enable_trades + delay_qty

var string temp_txt_SL_long = ""

var string temp_txt_SL_short = ""

var string temp_txt_TP_long = ""

var string temp_txt_TP_short = ""

if use_sl == "Percent"

temp_txt_SL_long := "sl=-" + str.tostring(sl_input_perc * 100) + "%"

temp_txt_SL_short := "sl=" + str.tostring(sl_input_perc * 100) + "%"

else if use_sl == "Price"

temp_txt_SL_long := "fsl=" + str.tostring(final_SL_Long)

temp_txt_SL_short := "fsl=" + str.tostring(final_SL_Short)

if use_tp == "Percent"

temp_txt_TP_long := "p=" + str.tostring(tp_input_perc * 100) + "%"

temp_txt_TP_short := "p=-" + str.tostring(tp_input_perc * 100) + "%"

else if use_tp == "Price"

temp_txt_TP_long := "fpx=" + str.tostring(final_TP_Long)

temp_txt_TP_short := "fpx=" + str.tostring(final_TP_Short)

i_alert_txt_exit_SL_long = "a=" + i_account_name + " e=" + broker_mode + " s=" + product_type_ticker + " b=long c=position t=market " + temp_txt_SL_long + enable_trades

i_alert_txt_exit_SL_short = "a=" + i_account_name + " e=" + broker_mode + " s=" + product_type_ticker + " b=short c=position t=market " + temp_txt_SL_short + enable_trades

i_alert_txt_exit_TP_long = "a=" + i_account_name + " e=" + broker_mode + " s=" + product_type_ticker + " b=long c=position t=market " + temp_txt_TP_long + enable_trades

i_alert_txt_exit_TP_short = "a=" + i_account_name + " e=" + broker_mode + " s=" + product_type_ticker + " b=short c=position t=market " + temp_txt_TP_short + enable_trades

string final_alert_txt_entry_long = i_alert_txt_entry_long

string final_alert_txt_entry_short = i_alert_txt_entry_short

if i_use_borrow_repay and i_broker_name == "Binance"

final_alert_txt_entry_long := "a=" + i_account_name + " e=" + broker_mode + "y=borrow w=" + i_asset_borrow_repay + " q=" + str.tostring(i_qty_borrow_repay, "#") + enable_trades +

"\n a=" + i_account_name + " e=" + broker_mode + " s=" + product_type_ticker + enable_trades + " b=short c=position t=market" + delay_qty +

"\n a=" + i_account_name + " e=" + broker_mode + " s=" + product_type_ticker + " b=long q=" + str.tostring(quantity, "#") + " t=market" + enable_trades + delay_qty +

"\n a=" + i_account_name + " e=" + broker_mode + "y=repay w=" + i_asset_borrow_repay + " q=" + str.tostring(i_qty_borrow_repay, "#") + enable_trades

final_alert_txt_entry_short := "a=" + i_account_name + " e=" + broker_mode + "y=borrow w=" + i_asset_borrow_repay + " q=" + str.tostring(i_qty_borrow_repay, "#") + enable_trades +

"\n a=" + i_account_name + " e=" + broker_mode + " s=" + product_type_ticker + enable_trades + " b=long c=position t=market" + delay_qty +

"\n a=" + i_account_name + " e=" + broker_mode + " s=" + product_type_ticker + " b=short q=" + str.tostring(quantity, "#") + " t=market" + enable_trades + delay_qty +

"\n a=" + i_account_name + " e=" + broker_mode + "y=repay w=" + i_asset_borrow_repay + " q=" + str.tostring(i_qty_borrow_repay, "#") + enable_trades

//i_alert_txt_entry_long := final_alert_txt_entry_long

//i_alert_txt_entry_short := final_alert_txt_entry_short

if show_alerts_debug and barstate.islastconfirmedhistory

var label lblTest = na

label.delete(lblTest)

string label_txt = i_alert_txt_entry_long

if use_sl != "None"

label_txt := label_txt + "\n" + i_alert_txt_exit_SL_long

if use_tp != "None"

label_txt := label_txt + "\n" + i_alert_txt_exit_TP_long

t = time + (time - time[1]) * 25

lblTest := label.new(

x = t,

y = ta.highest(50),

text = label_txt,

xloc = xloc.bar_time,

yloc = yloc.price,

color = color.new(color = color.gray, transp = 0),

style = label.style_label_left,

textcolor = color.new(color = color.white, transp = 0),

size = size.large

)

// # ========================================================================= #

// # | Strategy Calls and Alerts |

// # ========================================================================= #

if bull and TradeDateIsAllowed()

strategy.entry(id = "Long", direction = strategy.long, comment = "Long", alert_message = i_alert_txt_entry_long, qty = nb_contracts)

alert(i_alert_txt_entry_long, alert.freq_once_per_bar)

else if bear and TradeDateIsAllowed()

strategy.entry(id = "Short", direction = strategy.short, comment = "Short", alert_message = i_alert_txt_entry_short, qty = nb_contracts)

alert(i_alert_txt_entry_short, alert.freq_once_per_bar)

//quantity := quantity * 2

strategy.exit(id = "Exit Long", from_entry = "Long", stop = (use_sl != "None") ? final_SL_Long : na, comment_loss = "Long Exit SL", alert_loss = (use_sl != "None") ? i_alert_txt_exit_SL_long : na, limit = (use_tp != "None") ? final_TP_Long : na, comment_profit = "Long Exit TP", alert_profit = (use_tp != "None") ? i_alert_txt_exit_TP_long : na)

strategy.exit(id = "Exit Short", from_entry = "Short", stop = (use_sl != "None") ? final_SL_Short : na, comment_loss = "Short Exit SL", alert_loss = (use_sl != "None") ? i_alert_txt_exit_SL_short : na, limit = (use_tp != "None") ? final_TP_Short : na, comment_profit = "Short Exit TP", alert_profit = (use_tp != "None") ? i_alert_txt_exit_TP_short : na)

if strategy.position_size > 0 and low < final_SL_Long and use_sl != "None"

alert(i_alert_txt_exit_SL_long, alert.freq_once_per_bar)

else if strategy.position_size < 0 and high > final_SL_Short and use_sl != "None"

alert(i_alert_txt_exit_SL_short, alert.freq_once_per_bar)

if strategy.position_size > 0 and high > final_TP_Long and use_tp != "None"

alert(i_alert_txt_exit_TP_long, alert.freq_once_per_bar)

else if strategy.position_size < 0 and low < final_TP_Short and use_tp != "None"

alert(i_alert_txt_exit_TP_short, alert.freq_once_per_bar)

// # ========================================================================= #

// # | Reset Variables |

// # ========================================================================= #