Tren Mengikuti Strategi dengan Moving Average dan Pola Candlestick

Penulis:ChaoZhang, Tanggal: 2024-02-02 17:53:43Tag:

Gambaran umum

Strategi ini menggabungkan rata-rata bergerak untuk menentukan arah tren dan pola lilin untuk mengidentifikasi titik pembalikan potensial, untuk menerapkan tren setelah perdagangan. Strategi pertama menggunakan rata-rata bergerak untuk menilai arah tren keseluruhan, dan kemudian mencari pola lilin pembalikan potensial sebagai sinyal masuk di sepanjang arah tren untuk melacak tren.

Prinsip Strategi

Strategi ini mengadopsi rata-rata bergerak sederhana 10 hari untuk menentukan tren harga. Ketika harga berada di atas rata-rata bergerak, dianggap berada dalam tren naik; ketika harga berada di bawah rata-rata bergerak, dianggap berada dalam tren turun.

Setelah menentukan arah tren, strategi akan menilai potensi titik pembalikan tren berdasarkan serangkaian pola candlestick bullish dan bearish. Pola bullish umum termasuk Morning Star, Bullish Engulfing, Three White Soldiers, dll; pola bearish umum termasuk Evening Star, Three Black Crows, dll. Ketika sinyal bullish diidentifikasi dalam tren naik, strategi akan menempatkan pesanan beli; ketika sinyal bearish diidentifikasi dalam tren turun, strategi akan menempatkan pesanan jual.

Selain itu, strategi ini juga menggabungkan level support dan resistance utama untuk menentukan harga masuk tertentu.

Keuntungan

Keuntungan terbesar dari strategi ini adalah bahwa ia menggabungkan penilaian tren dan sinyal pembalikan sehingga dapat menangkap titik balik tren secara tepat waktu untuk mengikuti tren.

Selain itu, penggabungan penilaian pola lilin juga meningkatkan kemampuannya untuk menangani peristiwa mendadak.

Risiko

Risiko utama dari strategi ini terletak pada akurasi pengaturan parameter rata-rata bergerak dan penilaian pola lilin. Jika periode rata-rata bergerak ditetapkan dengan tidak benar, itu akan menyebabkan penentuan tren yang salah; jika penilaian pola lilin memiliki kesalahan, itu juga akan menyebabkan keputusan perdagangan yang salah.

Selain itu, pola lilin pembalikan tidak dapat menjamin pembalikan tren dengan kepastian 100%, sehingga masih ada beberapa risiko dalam strategi.

Arahan Optimasi

Ada ruang yang cukup besar untuk optimasi dalam strategi ini. Sebagai contoh, kita dapat mempertimbangkan menyesuaikan secara dinamis parameter rata-rata bergerak dan mengadopsi periode rata-rata bergerak yang berbeda di tahap pasar yang berbeda. Kita juga dapat memperkenalkan metode pembelajaran mesin untuk melatih model penilaian pola lilin menggunakan data historis untuk meningkatkan akurasi penilaian.

Selain itu, kita juga dapat mempertimbangkan untuk memasukkan lebih banyak faktor untuk menilai tren dan area panas, seperti perubahan volume perdagangan, indikator volatilitas, dll., Untuk membuat strategi lebih komprehensif dan kuat.

Kesimpulan

Secara umum, strategi ini sangat cocok untuk melacak tren jangka menengah di pasar saham dan dapat memperoleh pengembalian yang relatif tinggi dan stabil. Jika dioptimalkan lebih lanjut, strategi ini berpotensi menjadi strategi kuantitatif yang berfungsi dengan baik. Jika investor memahami penggunaan strategi ini, mereka juga dapat menggunakannya untuk membangun kepemilikan jangka panjang untuk mengendalikan risiko saham individu sambil mendapatkan pengembalian yang lebih baik.

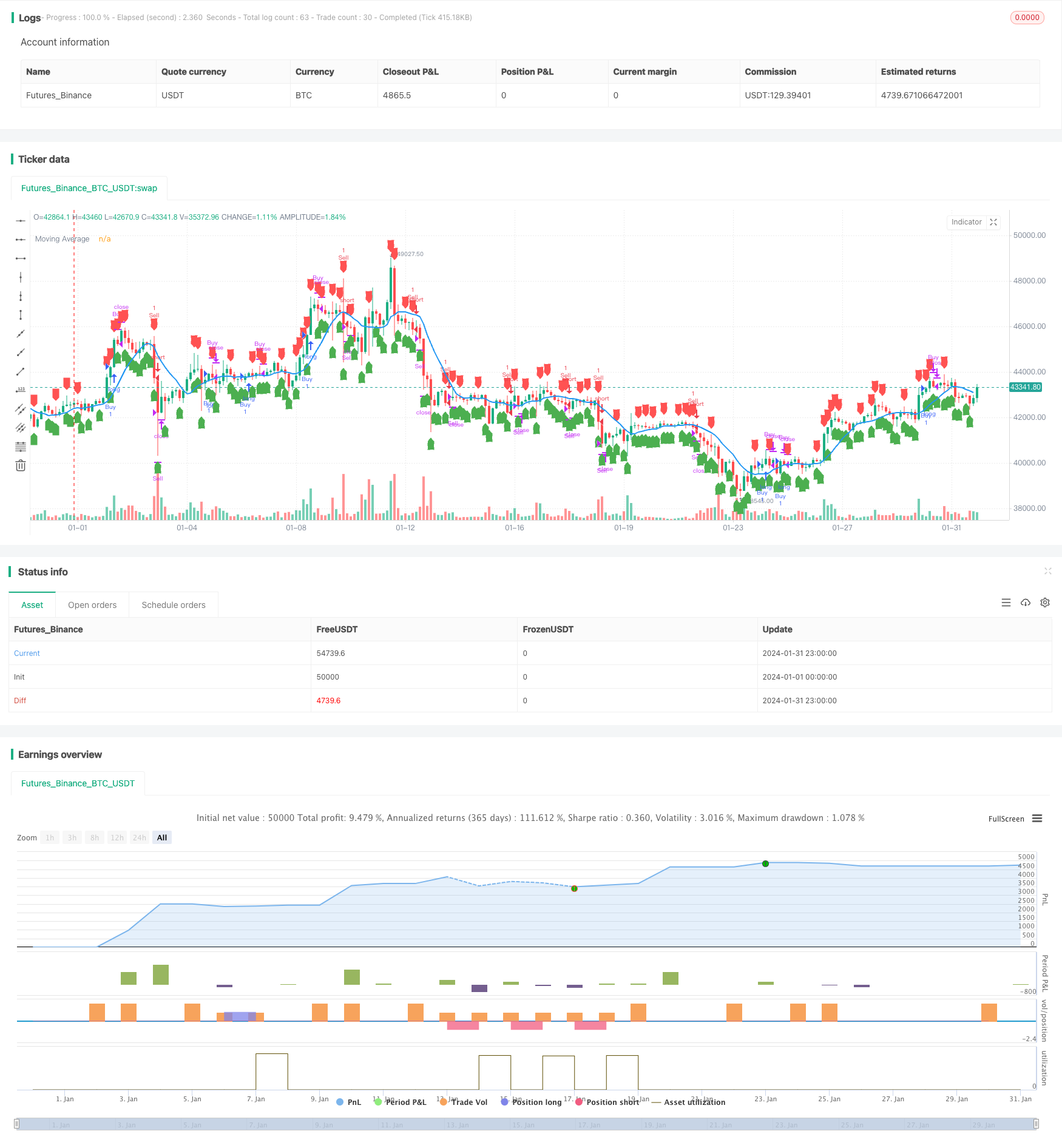

/*backtest

start: 2024-01-01 00:00:00

end: 2024-01-31 23:59:59

period: 3h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Trend Following Strategy with Candlestick Patterns", overlay=true)

// Moving Average

ma_period = input(10, title="Moving Average Period")

moving_average = ta.sma(close, ma_period)

// Candlestick Patterns

// Custom Function

abs(x) => x >= 0 ? x : -x

// Candlestick Patterns

isDoji() =>

(close - open) <= (high - low) * 0.1

isMarubozuWhite() =>

close == high and open == low and close > open

isHammer() =>

(high - low) >= 3 * abs(open - close) and (close - low) / (0.001 + high - low) > 0.6 and (open - low) / (0.001 + high - low) > 0.6

isInvertedHammer() =>

(high - low) >= 3 * abs(open - close) and (high - close) / (0.001 + high - low) > 0.6 and (high - open) / (0.001 + high - low) > 0.6

isLongLowerShadow() =>

(low - close) > 2 * abs(open - close) and (low - open) / (0.001 + high - low) > 0.6

isUpsideTasukiGap() =>

close[1] < open[1] and open > close and open > close[1] and close < open[1]

isRisingWindow() =>

high[1] < low and close > open

isPiercing() =>

close[1] < open[1] and close > open and close > ((open + low) / 2) and close < open[1] and open < close[1]

isBullishEngulfing() =>

close[1] < open[1] and close > open and high > high[1] and low < low[1]

isTweezerBottom() =>

low == ta.valuewhen(low == ta.lowest(low, 10), low, 0) and low == ta.valuewhen(low == ta.lowest(low, 20), low, 0)

isBullishAbandonedBaby() =>

close[2] < open[2] and close[1] > open[1] and low[1] > ta.valuewhen(high == ta.highest(high, 2), high, 0) and open > close and close > ta.valuewhen(high == ta.highest(high, 2), high, 0)

isMorningStar() =>

close[2] < open[2] and close[1] < open[1] and close > open[1] and open < close[2] and open > close[1]

isMorningDojiStar() =>

close[2] < open[2] and close[1] < open[1] and isDoji() and close > open[1] and open < close[2] and open > close[1]

isDragonflyDoji() =>

isDoji() and (high - close) / (0.001 + high - low) < 0.1 and (open - low) / (0.001 + high - low) > 0.6

isThreeWhiteSoldiers() =>

close[2] < open[2] and close[1] < open[1] and close > open and open < close[2] and open < close[1] and close > open[1]

isRisingThreeMethods() =>

close[4] < open[4] and close[1] < open[1] and close > open and open < close[4] and open < close[1] and close > open[1]

isMarubozuBlack() =>

close == low and open == high and open > close

isGravestoneDoji() =>

isDoji() and (close - low) / (0.001 + high - low) < 0.1 and (high - open) / (0.001 + high - low) > 0.6

isHangingMan() =>

(high - low) >= 4 * abs(open - close) and (open - close) / (0.001 + high - low) > 0.6 and (high - open) / (0.001 + high - low) > 0.6

isLongUpperShadow() =>

(high - open) > 2 * abs(open - close) and (high - close) / (0.001 + high - low) > 0.6

isDownsideTasukiGap() =>

close[1] > open[1] and open < close and open < close[1] and close > open[1]

isFallingWindow() =>

low[1] > high and close < open

isDarkCloudCover() =>

close[1] > open[1] and close < open and close < ((open + high) / 2) and close > open[1] and open > close[1]

isBearishEngulfing() =>

close[1] > open[1] and close < open and high > high[1] and low < low[1]

isTweezerTop() =>

high == ta.valuewhen(high == ta.highest(high, 10), high, 0) and high == ta.valuewhen(high == ta.highest(high, 20), high, 0)

isAbandonedBaby() =>

close[2] > open[2] and close[1] < open[1] and high[1] < ta.valuewhen(low == ta.lowest(low, 2), low, 0) and open < close and close < ta.valuewhen(low == ta.lowest(low, 2), low, 0)

isEveningDojiStar() =>

close[2] > open[2] and close[1] > open[1] and isDoji() and close < open[1] and open > close[2] and open < close[1]

isEveningStar() =>

close[2] > open[2] and close[1] > open[1] and close < open[1] and open > close[2] and open < close[1]

isThreeBlackCrows() =>

close[2] > open[2] and close[1] > open[1] and close < open and open > close[2] and open > close[1] and close < open[1]

isFallingThreeMethods() =>

close[4] > open[4] and close[1] > open

isShootingStar() =>

(high - low) >= 3 * abs(open - close) and (high - close) / (0.001 + high - low) > 0.6 and (high - open) / (0.001 + high - low) > 0.6

doji = isDoji()

marubozuWhite = isMarubozuWhite()

hammer = isHammer()

invertedHammer = isInvertedHammer()

longLowerShadow = isLongLowerShadow()

upsideTasukiGap = isUpsideTasukiGap()

risingWindow = isRisingWindow()

piercing = isPiercing()

bullishEngulfing = isBullishEngulfing()

tweezerBottom = isTweezerBottom()

bullishAbandonedBaby = isBullishAbandonedBaby()

morningStar = isMorningStar()

morningDojiStar = isMorningDojiStar()

dragonflyDoji = isDragonflyDoji()

threeWhiteSoldiers = isThreeWhiteSoldiers()

risingThreeMethods = isRisingThreeMethods()

marubozuBlack = isMarubozuBlack()

gravestoneDoji = isGravestoneDoji()

hangingMan = isHangingMan()

longUpperShadow = isLongUpperShadow()

downsideTasukiGap = isDownsideTasukiGap()

fallingWindow = isFallingWindow()

darkCloudCover = isDarkCloudCover()

bearishEngulfing = isBearishEngulfing()

tweezerTop = isTweezerTop()

abandonedBaby = isAbandonedBaby()

eveningDojiStar = isEveningDojiStar()

eveningStar = isEveningStar()

threeBlackCrows = isThreeBlackCrows()

fallingThreeMethods = isFallingThreeMethods()

shootingStar = isShootingStar()

isBullishPattern() =>

(isMarubozuWhite() or isHammer() or isInvertedHammer() or isDoji() or isMorningStar() or isBullishEngulfing() or isThreeWhiteSoldiers() or isMarubozuBlack() or isHangingMan() or isDownsideTasukiGap() or isDarkCloudCover())

isBearishPattern() =>

(isMarubozuBlack() or isInvertedHammer() or isLongUpperShadow() or isTweezerTop() or isGravestoneDoji() or isEveningStar() or isBearishEngulfing() or isThreeBlackCrows() or isShootingStar())

isBullishCandle = isBullishPattern()

isBearishCandle = isBearishPattern()

// Calculate Pivot Points

pivotPoint(high, low, close) =>

(high + low + close) / 3

r1 = pivotPoint(high[1], low[1], close[1]) * 2 - low[1]

s1 = pivotPoint(high[1], low[1], close[1]) * 2 - high[1]

r2 = pivotPoint(high[1], low[1], close[1]) + (high[1] - low[1])

s2 = pivotPoint(high[1], low[1], close[1]) - (high[1] - low[1])

r3 = high[1] + 2 * (pivotPoint(high[1], low[1], close[1]) - low[1])

s3 = low[1] - 2 * (high[1] - pivotPoint(high[1], low[1], close[1]))

// Trend Identification

is_uptrend = close > moving_average

is_downtrend = close < moving_average

// Entry and Exit Conditions with Trend Identification

enterLong = is_uptrend and isBullishCandle and close > r1

exitLong = is_uptrend and (bearishEngulfing or doji or close < s1)

enterShort = is_downtrend and isBearishCandle and close < s1

exitShort = is_downtrend and (bullishEngulfing or doji or close > r1)

// Strategy Execution

if enterLong and strategy.position_size == 0 and strategy.position_size[1] == 0 and close > r1

strategy.entry("Buy", strategy.long, qty=1)

if exitLong and strategy.position_size > 0

strategy.close("Buy")

if enterShort and strategy.position_size == 0 and close < s1

strategy.entry("Sell", strategy.short, qty=1)

if exitShort and strategy.position_size < 0

strategy.close("Sell")

// Stop-Loss and Trailing Stop-Loss

stop_loss_pct = input(2.0, title="Stop Loss Percentage")

trailing_stop_loss_pct = input(1.0, title="Trailing Stop Loss Percentage")

trailing_stop_loss_active = input(true, title="Trailing Stop Loss Active")

// Stop-Loss

stop_loss_level = strategy.position_avg_price * (1 - stop_loss_pct / 100)

strategy.exit("Stop Loss", "Buy", loss=stop_loss_level)

// Trailing Stop-Loss

// Plotting Moving Average

plot(moving_average, color=color.blue, title="Moving Average", linewidth=2)

// Plotting Candlestick Patterns

plotshape(isBullishCandle, title="Bullish Candle", location=location.belowbar, color=color.green, style=shape.labelup)

plotshape(isBearishCandle, title="Bearish Candle", location=location.abovebar, color=color.red, style=shape.labeldown)

// Plotting Support and Resistance Levels

//hline(r1, "Resistance Level 1", color=color.red, linestyle=hline.style_dotted)

//hline(s1, "Support Level 1", color=color.green, linestyle=hline.style_dotted)

- Triple Exponential Moving Average Profit Taking dan Stop Loss Strategy

- Strategi perdagangan lebar saluran Donchian

- Strategi Crossover Rata-rata Gerak yang Dioptimalkan

- Strategi Pelacakan Osilasi Pita Isolasi

- Strategi Double Donchian Channel Breakout

- Strategi rata-rata bergerak CRSI

- Strategi Perdagangan Jaringan Kuantum yang Beradaptasi Sendiri

- Strategi gabungan Ichimoku, MACD dan DMI Multi-Timeframe

- Strategi Trading Tren Berdasarkan Divergensi Harga

- Supertrend Bitcoin Long Line Strategi

- Strategi perdagangan kuantitatif berdasarkan Ichimoku Cloud Breakout dan Indeks ADX

- Strategi kombinasi Bollinger Bands dan Moving Averages

- Strategi Momentum Squeeze Beruang malas

- Prediksi Tren Strategi Rata-rata Bergerak Ganda

- Strategi pembalikan rata-rata bergerak ganda

- Strategi perdagangan rata-rata bergerak dengan terobosan ganda

- Tren Bolt yang Mencolok Mengikuti Strategi

- Strategi VRSI dan MARSI

- Strategi Stop Loss and Take Profit Berdasarkan Pola Doji

- Tren Rata-rata Bergerak Eksponensial Ganda Mengikuti Strategi