Tren Mengikuti Strategi Berdasarkan SMA Multi-Periode

Penulis:ChaoZhang, Tanggal: 2024-02-04 14:50:24Tag:

Gambaran umum

Strategi ini menggabungkan beberapa garis SMA dengan periode yang berbeda untuk mengidentifikasi dan mengikuti tren. Ide utamanya adalah: bandingkan arah naik/turun SMA dengan periode yang berbeda untuk menentukan tren; pergi panjang ketika SMA jangka pendek melintasi SMA jangka panjang, dan pergi pendek ketika SMA pendek melintasi di bawah SMA jangka panjang. ZeroLagEMA juga digunakan untuk mengkonfirmasi entri dan keluar.

Logika Strategi

- Gunakan 5 garis SMA dengan periode masing-masing 10, 20, 50, 100 dan 200.

- Bandingkan arah dari 5 SMA ini untuk menentukan tren. Misalnya, ketika SMA 10-, 20-, 100- dan 200 periode naik bersama-sama, itu menunjukkan tren naik; ketika mereka semua turun, itu menunjukkan tren turun.

- Bandingkan nilai SMA dengan periode yang berbeda untuk menghasilkan sinyal perdagangan. Misalnya, ketika SMA 10 periode melintasi SMA 20 periode, pergi panjang; ketika 10SMA melintasi di bawah 20SMA, pergi pendek.

- Gunakan ZeroLagEMA untuk konfirmasi masuk dan sinyal keluar. pergi panjang ketika ZeroLagEMA cepat melintasi ZeroLagEMA lambat, keluar panjang ketika melintasi di bawah. logika penilaian untuk celana pendek adalah sebaliknya.

Keuntungan

- Menggabungkan beberapa SMA dengan periode yang berbeda dapat secara efektif menentukan tren pasar.

- Membandingkan nilai SMA menghasilkan aturan masuk dan keluar kuantitatif.

- Filter ZeroLagEMA menghindari perdagangan yang tidak perlu dan meningkatkan stabilitas.

- Menggabungkan penilaian tren dan sinyal perdagangan mencapai tren setelah perdagangan.

Risiko dan Solusi

- Ketika pasar memasuki konsolidasi, penyeberangan SMA yang sering dapat menyebabkan kerugian berlebihan.

- Solusi: Tingkatkan filter ZeroLagEMA untuk menghindari entri sinyal yang tidak valid.

- Dilihat dari SMA multi-periode memiliki beberapa keterbelakangan, gagal untuk merespons dengan cepat terhadap perubahan harga jangka pendek yang tajam.

- Solusi: Tambahkan indikator yang lebih cepat seperti MACD untuk membantu penilaian.

Arahan Optimasi

- Mengoptimalkan parameter periode SMA untuk menemukan kombinasi terbaik.

- Tambahkan strategi stop loss seperti trailing stop untuk lebih membatasi kerugian.

- Tambahkan mekanisme ukuran posisi untuk meningkatkan taruhan dalam tren yang kuat dan mengurangi taruhan dalam konsolidasi.

- Menggabungkan lebih banyak indikator pendukung seperti MACD dan KDJ untuk meningkatkan stabilitas keseluruhan.

Kesimpulan

Strategi ini secara efektif menentukan tren pasar dengan menggabungkan SMA multi-periode, dan menghasilkan sinyal perdagangan kuantifikasi. ZeroLagEMA meningkatkan tingkat kemenangan. Singkatnya, strategi ini mencapai tren kuantitatif setelah perdagangan, dengan hasil yang luar biasa. Periode optimasi lebih lanjut, stop loss, ukuran posisi dll dapat memperkuat strategi untuk perdagangan langsung.

/*backtest

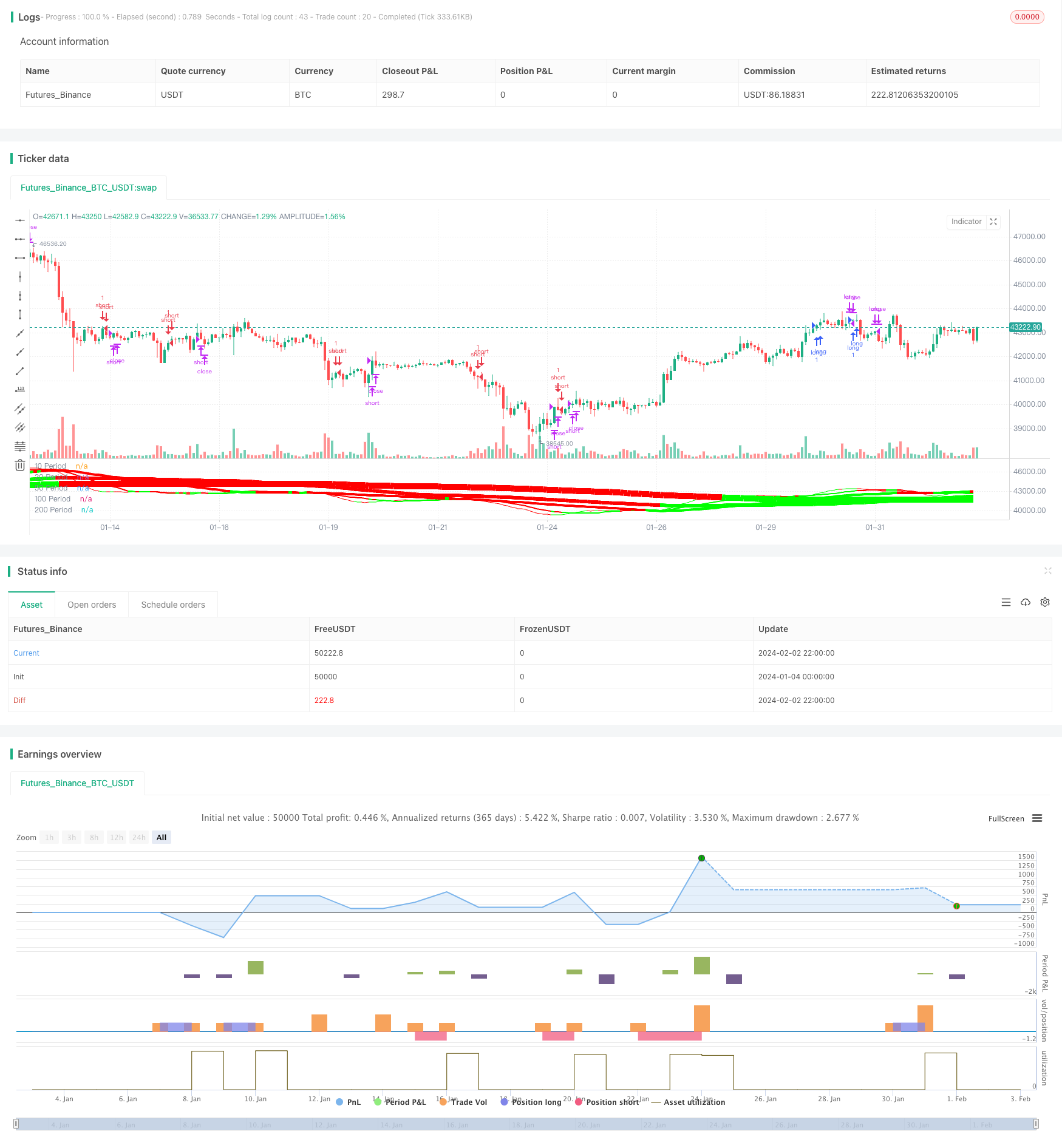

start: 2024-01-04 00:00:00

end: 2024-02-03 00:00:00

period: 2h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=2

strategy("Forex MA Racer - SMA Performance /w ZeroLag EMA Trigger", shorttitle = "FX MA Racer (5x SMA, 2x zlEMA)", overlay=false )

// === INPUTS ===

hr0 = input(defval = true, title = "=== SERIES INPUTS ===")

smaSource = input(defval = close, title = "SMA Source")

sma1Length = input(defval = 10, title = "SMA 1 Length")

sma2Length = input(defval = 20, title = "SMA 2 Length")

sma3Length = input(defval = 50, title = "SMA 3 Length")

sma4Length = input(defval = 100, title = "SMA 4 Length")

sma5Length = input(defval = 200, title = "SMA 5 Length")

smaDirSpan = input(defval = 4, title = "SMA Direction Span")

zlmaSource = input(defval = close, title = "ZeroLag EMA Source")

zlmaFastLength = input(defval = 9, title = "ZeroLag EMA Fast Length")

zlmaSlowLength = input(defval = 21, title = "ZeroLag EMA Slow Length")

hr1 = input(defval = true, title = "=== PLOT TIME LIMITER ===")

useTimeLimit = input(defval = true, title = "Use Start Time Limiter?")

// set up where we want to run from

startYear = input(defval = 2018, title = "Start From Year", minval = 0, step = 1)

startMonth = input(defval = 02, title = "Start From Month", minval = 0,step = 1)

startDay = input(defval = 01, title = "Start From Day", minval = 0,step = 1)

startHour = input(defval = 00, title = "Start From Hour", minval = 0,step = 1)

startMinute = input(defval = 00, title = "Start From Minute", minval = 0,step = 1)

hr2 = input(defval = true, title = "=== TRAILING STOP ===")

useStop = input(defval = false, title = "Use Trailing Stop?")

slPoints = input(defval = 200, title = "Stop Loss Trail Points", minval = 1)

slOffset = input(defval = 400, title = "Stop Loss Trail Offset", minval = 1)

// === /INPUTS ===

// === SERIES SETUP ===

// Fast ZeroLag EMA

zema1=ema(zlmaSource, zlmaFastLength)

zema2=ema(zema1, zlmaFastLength)

d1=zema1-zema2

zlemaFast=zema1+d1

// Slow ZeroLag EMA

zema3=ema(zlmaSource, zlmaSlowLength)

zema4=ema(zema3, zlmaSlowLength)

d2=zema3-zema4

zlemaSlow=zema3+d2

// Simple Moving Averages

period10 = sma(close, sma1Length)

period20 = sma(close, sma2Length)

period50 = sma(close, sma3Length)

period100 = sma(close, sma4Length)

period200 = sma(close, sma5Length)

// === /SERIES SETUP ===

// === PLOT ===

// colors of plotted MAs

p1 = (close < period10) ? #FF0000 : #00FF00

p2 = (close < period20) ? #FF0000 : #00FF00

p3 = (close < period50) ? #FF0000 : #00FF00

p4 = (close < period100) ? #FF0000 : #00FF00

p5 = (close < period200) ? #FF0000 : #00FF00

plot(period10, title='10 Period', color = p1, linewidth=1)

plot(period20, title='20 Period', color = p2, linewidth=2)

plot(period50, title='50 Period', color = p3, linewidth=4)

plot(period100, title='100 Period', color = p4, linewidth=6)

plot(period200, title='200 Period', color = p5, linewidth=10)

// === /PLOT ===

//BFR = BRFIB ? (maFast+maSlow)/2 : abs(maFast - maSlow)

// === STRATEGY ===

// calculate SMA directions

direction10 = rising(period10, smaDirSpan) ? +1 : falling(period10, smaDirSpan) ? -1 : 0

direction20 = rising(period20, smaDirSpan) ? +1 : falling(period20, smaDirSpan) ? -1 : 0

direction50 = rising(period50, smaDirSpan) ? +1 : falling(period50, smaDirSpan) ? -1 : 0

direction100 = rising(period100, smaDirSpan) ? +1 : falling(period100, smaDirSpan) ? -1 : 0

direction200 = rising(period200, smaDirSpan) ? +1 : falling(period200, smaDirSpan) ? -1 : 0

// conditions

// SMA Direction Trigger

dirUp = direction10 > 0 and direction20 > 0 and direction100 > 0 and direction200 > 0

dirDn = direction10 < 0 and direction20 < 0 and direction100 < 0 and direction200 < 0

longCond = (period10>period20) and (period20>period50) and (period50>period100) and dirUp//and (close > period10) and (period50>period100) //and (period100>period200)

shortCond = (period10<period20) and (period20<period50) and dirDn//and (period50<period100) and (period100>period200)

longExit = crossunder(zlemaFast, zlemaSlow) or crossunder(period10, period20)

shortExit = crossover(zlemaFast, zlemaSlow) or crossover(period10, period20)

// entries and exits

startTimeOk() =>

// get our input time together

inputTime = timestamp(syminfo.timezone, startYear, startMonth, startDay, startHour, startMinute)

// check the current time is greater than the input time and assign true or false

timeOk = time > inputTime ? true : false

// last line is the return value, we want the strategy to execute if..

// ..we are using the limiter, and the time is ok -OR- we are not using the limiter

r = (useTimeLimit and timeOk) or not useTimeLimit

if( true )

// entries

strategy.entry("long", strategy.long, when = longCond)

strategy.entry("short", strategy.short, when = shortCond)

// trailing stop

if (useStop)

strategy.exit("XL", from_entry = "long", trail_points = slPoints, trail_offset = slOffset)

strategy.exit("XS", from_entry = "short", trail_points = slPoints, trail_offset = slOffset)

// exits

strategy.close("long", when = longExit)

strategy.close("short", when = shortExit)

// === /STRATEGY ===

- Strategi perdagangan kuantitatif berdasarkan RSI dan Bollinger Bands

- Strategi Perdagangan Kuantitatif Berdasarkan SMA dan Rolling Trendline

- Strategi perdagangan opsi mingguan stokastis

- Strategi Perdagangan Kuantitatif EMA dan RSI yang Kuat

- Bollinger Bands dan RSI Kombinasi Strategi Trading

- Semigod Candlestick MACD Divergence Trend Mengikuti Strategi

- Strategi perdagangan jangka waktu lintas rata-rata bergerak ganda

- Strategi perdagangan RSI dan EMA dengan indikator ganda

- SMA Crossover Bullish Trend Mengikuti Strategi

- Bollinger Bands Breakout Strategi Perdagangan Kuantitatif

- Ichimoku Breakout Strategy Berdasarkan Sentimen Pasar

- Strategi Perdagangan Kuantitatif Multi-Indikator Dinamis

- Coral Trend Pullback Strategi

- Strategi Swing Trading Berdasarkan Momentum

- Momentum Breakout Trading Strategi

- Trend Riding RSI Swing Capture Strategi

- Strategi Bollinger Bands SAR Parabolik Dual-Rail

- Triple Exponential Moving Average Profit Taking dan Stop Loss Strategy

- Strategi perdagangan lebar saluran Donchian

- Strategi Crossover Rata-rata Gerak yang Dioptimalkan