概述

本策略运用LazyBear的Coral Trend指标判断价格趋势方向,通过识别Coral Trend指标方向的反转来判断潜在的入场点。为过滤假突破,本策略采用ADX指标或Absolute Strength Histogram和HawkEye Volume指标的组合作为确认指标,实现更可靠的入场。

Exit机制采用最近N根K线的最高价/最低价乘以可配置风险回报比例来设置止损位和止盈位。

策略原理

基于Coral Trend指标判断大趋势方向后,当指标颜色保持不变的同时,价格出现一个向相反方向的小回调(pullback)。这时如果回调结束,价格重新回到Coral Trend指示的主趋势方向上去,那么就可以认为这是一个比较好的入场时机。

入场条件包括:

Coral Trend指标方向与交易方向一致(多头=绿色,空头=红色)

自上一个价格完全突破Coral Trend指标以来(最后一个bar的高点都超过Coral Trend线),至少已有1根K线的低点全部在Coral Trend指标之上(多头)或高点全部在Coral Trend指标之下(空头)

发生向相反方向的小回调(拉回),这个小回调过程中关闭价一直保持在Coral Trend的反向一边

小回调结束后,收盘价重新回到Coral Trend指示的主趋势方向

以上为主条件。同时,策略采用ADX指标或Absolute Strength Histogram和HawkEye Volume指标作为入场的确认条件。

ADX指标要求其值 > 20并且最近1根K线上升。以及DI的绿线和红线的顺序与交易方向一致。

Absolute Strength Histogram要求其颜色与交易方向一致(多头=蓝色,空头=红色)。HawkEye Volume要求其颜色与交易方向一致(多头=绿色,空头=红色)。

Exit机制则是采用最近N根K线的最高价或最低价乘以风险回报比例来设置止损位和止盈位。N值和风险回报比例均是可以通过参数配置的。

优势分析

本策略最大的优势在于利用Coral Trend指标判断主趋势方向后,通过识别其反转来发现入场机会,避免在非趋势市场中随波逐流。同时,采用Confirm指标可过滤许多假突破,从而提高入场的成功率。

另外,本策略提供了完整的风控机制,包括止损幅度设置和风险敞口百分比控制,使得即便个别交易亏损也不会对总体资金造成较大的冲击。

风险分析

本策略最大的风险在于采用指标进行入场判断,容易产生错觉,认为完全依赖参数配置就可以自动获利。事实上,参数优化和规则配置都需要结合底层价格变化的规律,直观判断指标与价格联动的效果,才能设定出更加适合自己的交易风格和品种的配置。

另外,止损位和止盈位的设置也要适当,过大的止盈倍数可能导致无法止盈离场,而过小的止损位则风险过大。这需要根据不同品种的波动程度和个人风险承受能力来设置。

优化方向

本策略可优化的方向包括:

调整Coral Trend指标的参数,使其对不同品种价格变化的反应更加灵敏

尝试不同的Confirm指标或指标组合,如KDJ, MACD等,使入场信号更加准确

根据不同品种的波动程度,调整止损位和止盈位的计算方式,实现更好的风险控制

增加资金管理模块,可根据仓位数量调整单笔委托量,有效控制总体亏损

增加交易时间控制模块,使策略只在特定时段运行,避免剧烈波动期的亏损

总结

本策略首先利用Coral Trend判断价格中长线趋势,然后通过判断其反转,配合Confirm信号过滤假突破,构建了一个较为可靠的趋势追踪策略。同时,完善的风控设置也使得本策略可以长期运行而资金稳定。通过进一步的参数和模块优化,有望使本策略适应更多品种,具有更好的稳定性和盈利能力。

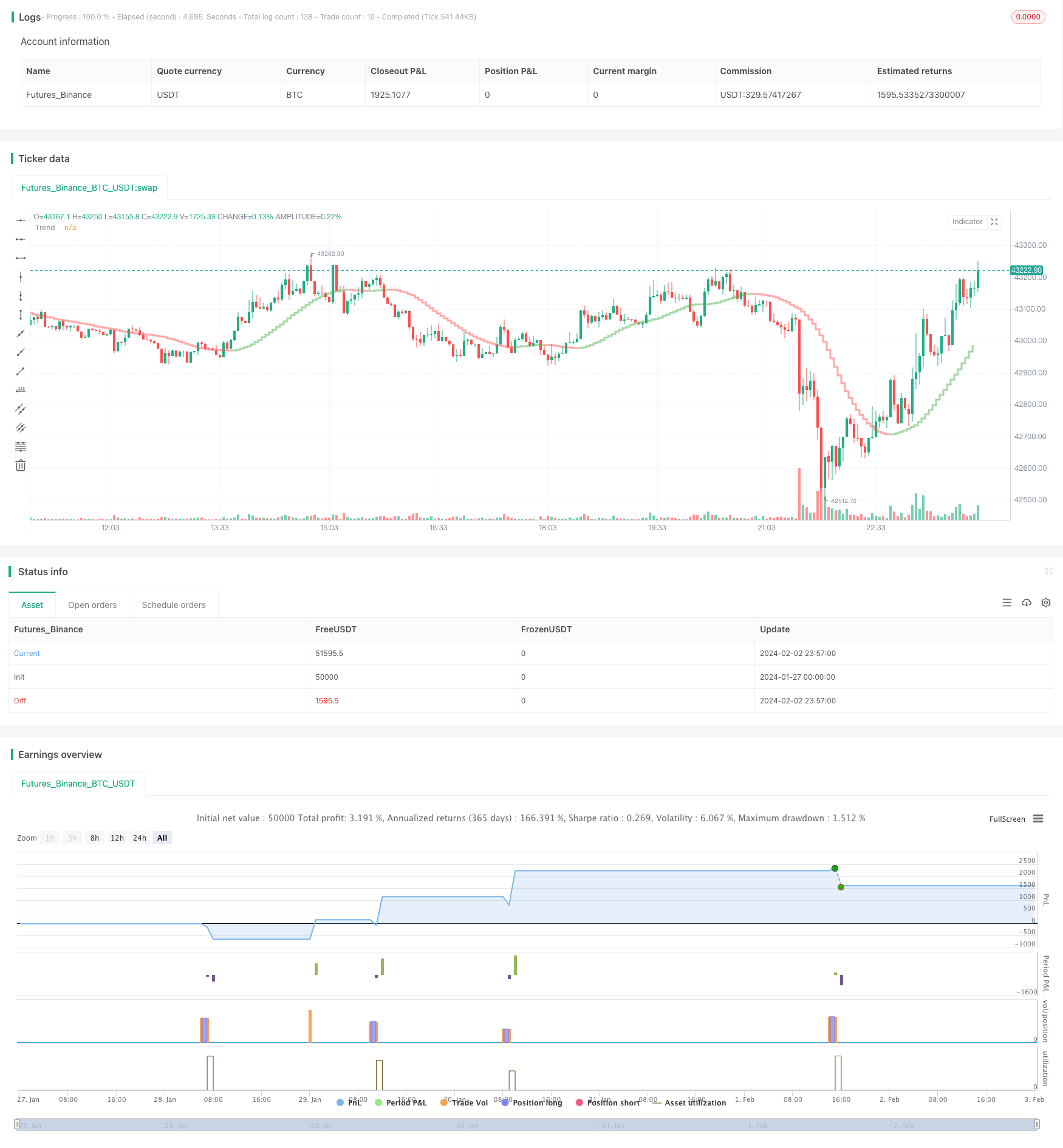

/*backtest

start: 2024-01-27 00:00:00

end: 2024-02-03 00:00:00

period: 3m

basePeriod: 1m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © kevinmck100

// @description

//

// Strategy is taken from the TradeIQ YouTube video called "I Finally Found 80% Win Rate Trading Strategy For Crypto"

// Check out the full video for further details/clarification on strategy entry/exit conditions.

//

// It incorporates the following features:

//

// - Risk management: Configurable X% loss per stop loss

// Configurable R:R ratio

//

// - Trade entry: Conditions outlines below

//

// - Trade exit: Conditions outlined below

//

// - Backtesting: Configurable backtesting range by date

//

// - Trade drawings: TP/SL boxes drawn for all trades (can be turned on and off)

// Trade exit information labels (can be turned on and off)

// NOTE: Trade drawings will only be applicable when using overlay strategies

//

// - Debugging: Includes section with useful debugging techniques

//

// Strategy conditions:

//

// - Trade entry: LONG: C1: Coral Trend is bullish

// C2: At least 1 candle where low is above Coral Trend since last cross above Coral Trend

// C3: Pullback happens and price closes below Coral Trend

// C4: Coral Trend colour remains bullish for duration of pullback

// C5: After valid pullback, price then closes above Coral Trend

// C6: Optional confirmation indicators (choose either C6.1 or C6.2 or NONE):

// C6.1: ADX and DI (Single indicator)

// C6.1.1: Green line is above red line

// C6.1.2: Blue line > 20

// C6.1.3: Blue trending up over last 1 candle

// C6.2: Absolute Strengeh Histogram + HawkEye Volume Indicator (Two indicators combined)

// C6.2.1: Absolute Strengeh Histogram colour is blue

// C6.2.2: HawkEye Volume Indicator colour is green

// SHORT: C1: Coral Trend is bearish

// C2: At least 1 candle where high is below Coral Trend since last cross below Coral Trend

// C3: Pullback happens and price closes above Coral Trend

// C4: Coral Trend colour remains bearish for duration of pullback

// C5: After valid pullback, price then closes below Coral Trend

// C6: Optional confirmation indicators (choose either C6.1 or C6.2 or NONE):

// C6.1: ADX and DI (Single indicator)

// C6.1.1: Red line is above green line

// C6.1.2: Blue line > 20

// C6.1.3: Blue trending up over last 1 candle

// C6.2: Absolute Strengeh Histogram + HawkEye Volume Indicator (Two indicators combined)

// C6.2.1: Absolute Strengeh Histogram colour is red

// C6.2.2: HawkEye Volume Indicator colour is red

// NOTE: All the optional confirmation indicators cannot be overlayed with Coral Trend so feel free to add each separately to the chart for visual purposes

//

//

// - Trade exit: Stop Loss: Calculated by recent swing low over previous X candles (configurable with "Local High/Low Lookback")

// Take Profit: Calculated from R:R multiplier * Stop Loss size

//

// @credits

//

// Coral Trend Indicator [LazyBear] by @LazyBear

// Absolute Strength Histogram | jh by @jiehonglim

// Indicator: HawkEye Volume Indicator by @LazyBear

// ADX and DI by @BeikabuOyaji

//@version=5

INITIAL_CAPITAL = 1000

DEFAULT_COMMISSION = 0.02

MAX_DRAWINGS = 500

IS_OVERLAY = true

strategy("Coral Trend Pullback Strategy (TradeIQ)", "Coral Trend Pullback", overlay = IS_OVERLAY, initial_capital = INITIAL_CAPITAL, currency = currency.NONE, max_labels_count = MAX_DRAWINGS, max_boxes_count = MAX_DRAWINGS, max_lines_count = MAX_DRAWINGS, default_qty_type = strategy.cash, commission_type = strategy.commission.percent, commission_value = DEFAULT_COMMISSION)

// =============================================================================

// INPUTS

// =============================================================================

// ---------------

// Risk Management

// ---------------

riskReward = input.float(1.5, "Risk : Reward 1 :", group = "Strategy: Risk Management", inline = "RM1", minval = 0, step = 0.1, tooltip = "Previous high or low (long/short dependant) is used to determine TP level. 'Risk : Reward' ratio is then used to calculate SL based of previous high/low level.\n\nIn short, the higher the R:R ratio, the smaller the SL since TP target is fixed by previous high/low price data.")

accountRiskPercent = input.float(1, "Portfolio Risk % ", group = "Strategy: Risk Management", inline = "RM2", minval = 0, step = 0.1, tooltip = "Percentage of portfolio you lose if trade hits SL.\n\nYou then stand to gain\n Portfolio Risk % * Risk : Reward\nif trade hits TP.")

localHlLookback = input.int (5, "Local High/Low Lookback ", group = "Strategy: Stop Loss Settings", inline = "SL1", minval = 1, tooltip = "This strategy calculates the Stop Loss value from the recent local high/low. This lookback period determines the number of candles to include for the local high/low.")

// ----------

// Date Range

// ----------

startYear = input.int (2010, "Start Date ", group = "Strategy: Date Range", inline = "DR1", minval = 1900, maxval = 2100)

startMonth = input.int (1, "", group = "Strategy: Date Range", inline = "DR1", options = [1, 2, 3, 4, 5, 6, 7, 8, 9, 10, 11, 12])

startDate = input.int (1, "", group = "Strategy: Date Range", inline = "DR1", options = [1, 2, 3, 4, 5, 6, 7, 8, 9, 10, 11, 12, 13, 14, 15, 16, 17, 18, 19, 20, 21, 22, 23, 24, 25, 26, 27, 28, 29, 30, 31])

endYear = input.int (2100, "End Date ", group = "Strategy: Date Range", inline = "DR2", minval = 1900, maxval = 2100)

endMonth = input.int (1, "", group = "Strategy: Date Range", inline = "DR2", options = [1, 2, 3, 4, 5, 6, 7, 8, 9, 10, 11, 12])

endDate = input.int (1, "", group = "Strategy: Date Range", inline = "DR2", options = [1, 2, 3, 4, 5, 6, 7, 8, 9, 10, 11, 12, 13, 14, 15, 16, 17, 18, 19, 20, 21, 22, 23, 24, 25, 26, 27, 28, 29, 30, 31])

// ----------------

// Drawing Settings

// ----------------

showTpSlBoxes = input.bool(true, "Show TP / SL Boxes", group = "Strategy: Drawings", inline = "D1", tooltip = "Show or hide TP and SL position boxes.\n\nNote: TradingView limits the maximum number of boxes that can be displayed to 500 so they may not appear for all price data under test.")

showLabels = input.bool(false, "Show Trade Exit Labels", group = "Strategy: Drawings", inline = "D2", tooltip = "Useful labels to identify Profit/Loss and cumulative portfolio capital after each trade closes.\n\nAlso note that TradingView limits the max number of 'boxes' that can be displayed on a chart (max 500). This means when you lookback far enough on the chart you will not see the TP/SL boxes. However you can check this option to identify where trades exited.")

// ------------------

// Indicator Settings

// ------------------

// Coral Trend

ctSm = input.int (25, "Smoothing Period ", group = "Leading Indicator: Coral Trand Settings", inline = "CT1")

ctCd = input.float(0.4, "Constant D ", group = "Leading Indicator: Coral Trand Settings", inline = "CT2", step = 0.1)

// Confirmation indicator inputs

confirmationInd = input.string("ADX and DI", "Entry Confirmation Method ", group = "Confirmation Indicator: Indicator Selection", inline = "IS1", options=["None", "ADX and DI", "Absolute Strength Histogram + HawkEye Volume"], tooltip = "Select one of the possible confirmation indicator(s) which can be used to confirm entry signals from the main Coral Trend indicator conditions. See strategy conditions to understand the logic behind each confirmation indicator")

// ADX and DI

adxLen = input.int(14, "ADX Length ", group = "Confirmation Indicator: ADX and DI Settings", inline = "AD1")

midLine = input.int(20, "Mid Line ", group = "Confirmation Indicator: ADX and DI Settings", inline = "AD2", tooltip = "Mid line on standard ADX and DI indicator. In this strategy the DI must be above this line for entry confirmation.")

// Absolute Strength Histogram

ashLength = input.int(9, "Period of Evaluation ", group = "Confirmation Indicator: Absolute Strength Histogram Settings", inline = "ASH1")

ashSmooth = input.int(6, "Period of Smoothing ", group = "Confirmation Indicator: Absolute Strength Histogram Settings", inline = "ASH2")

ashSrc = input.source(close, "Source ", group = "Confirmation Indicator: Absolute Strength Histogram Settings", inline = "ASH3")

ashMode = input.string("RSI", "Indicator Method ", group = "Confirmation Indicator: Absolute Strength Histogram Settings", inline = "ASH4", options=["RSI", "STOCHASTIC", "ADX"])

sahMaType = input.string("SMA", "MA ", group = "Confirmation Indicator: Absolute Strength Histogram Settings", inline = "ASH5", options=["ALMA", "EMA", "WMA", "SMA", "SMMA", "HMA"])

ashAlmaOffset = input.float(0.85, "* Arnaud Legoux (ALMA) Offset", group = "Confirmation Indicator: Absolute Strength Histogram Settings", inline = "ASH6", minval=0, step=0.01)

ashAlmaSigma = input.int(6, "* Arnaud Legoux (ALMA) Sigma", group = "Confirmation Indicator: Absolute Strength Histogram Settings", inline = "ASH7", minval=0)

// HawkEye Volume Indicator

hevLength = input.int(200, "Length ", group = "Confirmation Indicator: HawkEye Volume Settings", inline = "HV1")

hevDivisor = input.float(1.6, "Divisor ", group = "Confirmation Indicator: HawkEye Volume Settings", inline = "HV2", step=0.1)

// =============================================================================

// INDICATORS

// =============================================================================

// -----------

// Coral Trend

// -----------

src = close

di = (ctSm - 1.0) / 2.0 + 1.0

c1 = 2 / (di + 1.0)

c2 = 1 - c1

c3 = 3.0 * (ctCd * ctCd + ctCd * ctCd * ctCd)

c4 = -3.0 * (2.0 * ctCd * ctCd + ctCd + ctCd * ctCd * ctCd)

c5 = 3.0 * ctCd + 1.0 + ctCd * ctCd * ctCd + 3.0 * ctCd * ctCd

var float i1 = na

var float i2 = na

var float i3 = na

var float i4 = na

var float i5 = na

var float i6 = na

i1 := c1 * src + c2 * nz(i1[1])

i2 := c1 * i1 + c2 * nz(i2[1])

i3 := c1 * i2 + c2 * nz(i3[1])

i4 := c1 * i3 + c2 * nz(i4[1])

i5 := c1 * i4 + c2 * nz(i5[1])

i6 := c1 * i5 + c2 * nz(i6[1])

bfr = -ctCd * ctCd * ctCd * i6 + c3 * i5 + c4 * i4 + c5 * i3

bfrC = bfr > nz(bfr[1]) ? color.new(color.green, 50) : bfr < nz(bfr[1]) ? color.new(color.red, 50) : color.new(color.blue, 50)

plot(bfr, "Trend", linewidth = 3, style = plot.style_stepline, color = bfrC)

// ----------

// ADX and DI

// ----------

TrueRange = math.max(math.max(high - low, math.abs(high - nz(close[1]))), math.abs(low - nz(close[1])))

DirectionalMovementPlus = high - nz(high[1]) > nz(low[1]) - low ? math.max(high - nz(high[1]), 0) : 0

DirectionalMovementMinus = nz(low[1]) - low > high - nz(high[1]) ? math.max(nz(low[1]) - low, 0) : 0

SmoothedTrueRange = 0.0

SmoothedTrueRange := nz(SmoothedTrueRange[1]) - nz(SmoothedTrueRange[1]) / adxLen + TrueRange

SmoothedDirectionalMovementPlus = 0.0

SmoothedDirectionalMovementPlus := nz(SmoothedDirectionalMovementPlus[1]) - nz(SmoothedDirectionalMovementPlus[1]) / adxLen + DirectionalMovementPlus

SmoothedDirectionalMovementMinus = 0.0

SmoothedDirectionalMovementMinus := nz(SmoothedDirectionalMovementMinus[1]) - nz(SmoothedDirectionalMovementMinus[1]) / adxLen + DirectionalMovementMinus

DIPlus = SmoothedDirectionalMovementPlus / SmoothedTrueRange * 100

DIMinus = SmoothedDirectionalMovementMinus / SmoothedTrueRange * 100

DX = math.abs(DIPlus - DIMinus) / (DIPlus + DIMinus) * 100

ADX = ta.sma(DX, adxLen)

// ---------------------------

// Absolute Strength Histogram

// ---------------------------

ashMa(ashType, ashSrc, ashLen) =>

float result = 0

if ashType == 'SMA' // Simple

result := ta.sma(ashSrc, ashLen)

result

if ashType == 'EMA' // Exponential

result := ta.ema(ashSrc, ashLen)

result

if ashType == 'WMA' // Weighted

result := ta.wma(ashSrc, ashLen)

result

if ashType == 'SMMA' // Smoothed

ashWma = ta.wma(ashSrc, ashLen)

ashSma = ta.sma(ashSrc, ashLen)

result := na(ashWma[1]) ? ashSma : (ashWma[1] * (ashLen - 1) + ashSrc) / ashLen

result

if ashType == 'HMA' // Hull

result := ta.wma(2 * ta.wma(ashSrc, ashLen / 2) - ta.wma(ashSrc, ashLen), math.round(math.sqrt(ashLen)))

result

if ashType == 'ALMA' // Arnaud Legoux

result := ta.alma(ashSrc, ashLen, ashAlmaOffset, ashAlmaSigma)

result

result

Price = ashSrc

Price1 = ashMa('SMA', Price, 1)

Price2 = ashMa('SMA', Price[1], 1)

//RSI

Bulls0 = 0.5 * (math.abs(Price1 - Price2) + Price1 - Price2)

Bears0 = 0.5 * (math.abs(Price1 - Price2) - (Price1 - Price2))

//STOCHASTIC

Bulls1 = Price1 - ta.lowest(Price1, ashLength)

Bears1 = ta.highest(Price1, ashLength) - Price1

//ADX

Bulls2 = 0.5 * (math.abs(high - high[1]) + high - high[1])

Bears2 = 0.5 * (math.abs(low[1] - low) + low[1] - low)

Bulls = ashMode == 'RSI' ? Bulls0 : ashMode == 'STOCHASTIC' ? Bulls1 : Bulls2

Bears = ashMode == 'RSI' ? Bears0 : ashMode == 'STOCHASTIC' ? Bears1 : Bears2

AvgBulls = ashMa(sahMaType, Bulls, ashLength)

AvgBears = ashMa(sahMaType, Bears, ashLength)

SmthBulls = ashMa(sahMaType, AvgBulls, ashSmooth)

SmthBears = ashMa(sahMaType, AvgBears, ashSmooth)

isTrendBullish = SmthBulls > SmthBears ? true : false

// ------------------------

// HawkEye Volume Indicator

// ------------------------

hevRange1 = high - low

hevRangeAvg = ta.sma(hevRange1, hevLength)

hevVolumeA = ta.sma(volume, hevLength)

hevHigh1 = high[1]

hevLow1 = low[1]

hevMid1 = hl2[1]

hevU1 = hevMid1 + (hevHigh1 - hevLow1) / hevDivisor

hevD1 = hevMid1 - (hevHigh1 - hevLow1) / hevDivisor

rEnabled1 = hevRange1 > hevRangeAvg and close < hevD1 and volume > hevVolumeA

rEnabled2 = close < hevMid1

rEnabled = rEnabled1 or rEnabled2

gEnabled1 = close > hevMid1

gEnabled2 = hevRange1 > hevRangeAvg and close > hevU1 and volume > hevVolumeA

gEnabled3 = high > hevHigh1 and hevRange1 < hevRangeAvg / 1.5 and volume < hevVolumeA

gEnabled4 = low < hevLow1 and hevRange1 < hevRangeAvg / 1.5 and volume > hevVolumeA

gEnabled = gEnabled1 or gEnabled2 or gEnabled3 or gEnabled4

grEnabled1 = hevRange1 > hevRangeAvg and close > hevD1 and close < hevU1 and volume > hevVolumeA and volume < hevVolumeA * 1.5 and volume > volume[1]

grEnabled2 = hevRange1 < hevRangeAvg / 1.5 and volume < hevVolumeA / 1.5

grEnabled3 = close > hevD1 and close < hevU1

grEnabled = grEnabled1 or grEnabled2 or grEnabled3

// =============================================================================

// STRATEGY LOGIC

// =============================================================================

// ---------

// FUNCTIONS

// ---------

percentAsPoints(pcnt) =>

math.round(pcnt / 100 * close / syminfo.mintick)

calcStopLossPrice(pointsOffset, isLong) =>

priceOffset = pointsOffset * syminfo.mintick

if isLong

close - priceOffset

else

close + priceOffset

calcProfitTrgtPrice(pointsOffset, isLong) =>

calcStopLossPrice(-pointsOffset, isLong)

printLabel(barIndex, msg) => label.new(barIndex, close, msg)

printTpSlHitBox(left, right, slHit, tpHit, entryPrice, slPrice, tpPrice) =>

if showTpSlBoxes

box.new (left = left, top = entryPrice, right = right, bottom = slPrice, bgcolor = slHit ? color.new(color.red, 60) : color.new(color.gray, 90), border_width = 0)

box.new (left = left, top = entryPrice, right = right, bottom = tpPrice, bgcolor = tpHit ? color.new(color.green, 60) : color.new(color.gray, 90), border_width = 0)

line.new(x1 = left, y1 = entryPrice, x2 = right, y2 = entryPrice, color = color.new(color.yellow, 20))

line.new(x1 = left, y1 = slPrice, x2 = right, y2 = slPrice, color = color.new(color.red, 20))

line.new(x1 = left, y1 = tpPrice, x2 = right, y2 = tpPrice, color = color.new(color.green, 20))

printTpSlNotHitBox(left, right, entryPrice, slPrice, tpPrice) =>

if showTpSlBoxes

box.new (left = left, top = entryPrice, right = right, bottom = slPrice, bgcolor = color.new(color.gray, 90), border_width = 0)

box.new (left = left, top = entryPrice, right = right, bottom = tpPrice, bgcolor = color.new(color.gray, 90), border_width = 0)

line.new(x1 = left, y1 = entryPrice, x2 = right, y2 = entryPrice, color = color.new(color.yellow, 20))

line.new(x1 = left, y1 = slPrice, x2 = right, y2 = slPrice, color = color.new(color.red, 20))

line.new(x1 = left, y1 = tpPrice, x2 = right, y2 = tpPrice, color = color.new(color.green, 20))

printTradeExitLabel(x, y, posSize, entryPrice, pnl) =>

if showLabels

labelStr = "Position Size: " + str.tostring(math.abs(posSize), "#.##") + "\nPNL: " + str.tostring(pnl, "#.##") + "\nCapital: " + str.tostring(strategy.equity, "#.##") + "\nEntry Price: " + str.tostring(entryPrice, "#.##")

label.new(x = x, y = y, text = labelStr, color = pnl > 0 ? color.new(color.green, 60) : color.new(color.red, 60), textcolor = color.white, style = label.style_label_down)

printVerticalLine(col) => line.new(bar_index, close, bar_index, close * 1.01, extend = extend.both, color = col)

// ----------

// CONDITIONS

// ----------

inDateRange = true

// Condition 1: Coral Trend color matches trend direction (long=green, short=red)

isCoralBullish = bfr > nz(bfr[1])

isCoralBearish = bfr < nz(bfr[1])

// Condition 2: At least 1 candle completely above/below (long/short) Coral Trend since last cross above/below (long/short) Coral Trend (could potentially try also with only close above)

sincePrePullbackBullBreakout= ta.barssince(ta.crossover(close, bfr))

sincePrePullbackBearBreakout= ta.barssince(ta.crossunder(close, bfr))

prePullbackBullBreakout = ta.barssince(low > bfr and high > bfr) < sincePrePullbackBullBreakout[1]

prePullbackBearBreakout = ta.barssince(low < bfr and high < bfr) < sincePrePullbackBearBreakout[1]

// Condition 3: Pullback closes below/above (long/short) Coral Trend

barssinceBullPullbackStart = ta.barssince(ta.crossunder(close, bfr))

barssinceBearPullbackStart = ta.barssince(ta.crossover(close, bfr))

barssincePullbackStart = isCoralBullish ? barssinceBullPullbackStart : isCoralBearish ? barssinceBearPullbackStart : na

// Condition 4: Coral Trend colour matched trend direction for duration of pullback

sinceBullish = ta.barssince(ta.crossover(bfr, nz(bfr[1])))

sinceBearish = ta.barssince(ta.crossunder(bfr, nz(bfr[1])))

barssinceCoralflip = isCoralBullish ? sinceBullish : isCoralBearish ? sinceBearish : na

isPullbackValid = barssincePullbackStart < barssinceCoralflip

// Condition 5: After valid pullback, price then closes above/below (long/short) Coral Trend

entryBreakout = (isCoralBullish and ta.crossover(close, bfr)) or (isCoralBearish and ta.crossunder(close, bfr))

// Condition 6: Confirmation indicators (6.1 or 6.2, optional depending on settings) confirms trade entry

// 6.1: ADX and DI

// 6.1.1: Green and red match trend (long=(green > red), short=(red > green))

// 6.1.2: Blue > 20

// 6.1.3: Blue trending up over last 1 candle

// 6.2: Absolute Strengeh Histogram + HawkEye Volume Indicator

// 6.2.1: Absolute Strengeh Histogram colour matches trend (long=blue, short=red)

// 6.2.2: HawkEye Volume Indicator colour matches trend (long=green, short=red)

var longTradeConfirmed = false

var shortTradeConfirmed = false

if confirmationInd == "ADX and DI"

isAdxUp = ADX > ADX [1]

isAdxValid = ADX > midLine and isAdxUp

longTradeConfirmed := DIPlus > DIMinus and isAdxValid

shortTradeConfirmed:= DIMinus > DIPlus and isAdxValid

else if confirmationInd == "Absolute Strength Histogram + HawkEye Volume"

isAshBullish = SmthBulls > SmthBears ? true : false

isHevBullish = not grEnabled and gEnabled ? true : false

isHevBearish = not grEnabled and rEnabled ? true : false

longTradeConfirmed := isAshBullish and isHevBullish

shortTradeConfirmed:= not isAshBullish and isHevBearish

else if confirmationInd == "None"

longTradeConfirmed := true

shortTradeConfirmed:= true

// Combine all entry conditions

goLong = inDateRange and isCoralBullish and prePullbackBullBreakout and isPullbackValid and entryBreakout and longTradeConfirmed

goShort = inDateRange and isCoralBearish and prePullbackBearBreakout and isPullbackValid and entryBreakout and shortTradeConfirmed

// Trade entry and exit variables

var tradeEntryBar = bar_index

var profitPoints = 0.

var lossPoints = 0.

var slPrice = 0.

var tpPrice = 0.

var inLong = false

var inShort = false

var entryPrice = 0.

// Entry decisions

openLong = (goLong and not inLong)

openShort = (goShort and not inShort)

flippingSides = (goLong and inShort) or (goShort and inLong)

enteringTrade = openLong or openShort

inTrade = inLong or inShort

// Exit calculations

entryPrice := close

longSlPrice = ta.lowest(localHlLookback)

shortSlPrice = ta.highest(localHlLookback)

slAmount = isCoralBullish ? entryPrice - longSlPrice : shortSlPrice - entryPrice

slPercent = math.abs((1 - (entryPrice - slAmount) / entryPrice) * 100)

tpPercent = slPercent * riskReward

// Risk calculations

riskAmt = strategy.equity * accountRiskPercent / 100

entryQty = math.abs(riskAmt / slPercent * 100) / close

if openLong

if strategy.position_size < 0

printTpSlNotHitBox(tradeEntryBar + 1, bar_index + 1, strategy.position_avg_price, slPrice, tpPrice)

printTradeExitLabel(bar_index + 1, math.max(tpPrice, slPrice), strategy.position_size, strategy.position_avg_price, strategy.openprofit)

strategy.entry("Long", strategy.long, qty = entryQty, alert_message = "Long Entry")

enteringTrade := true

inLong := true

inShort := false

if openShort

if strategy.position_size > 0

printTpSlNotHitBox(tradeEntryBar + 1, bar_index + 1, strategy.position_avg_price, slPrice, tpPrice)

printTradeExitLabel(bar_index + 1, math.max(tpPrice, slPrice), strategy.position_size, strategy.position_avg_price, strategy.openprofit)

strategy.entry("Short", strategy.short, qty = entryQty, alert_message = "Short Entry")

enteringTrade := true

inShort := true

inLong := false

if enteringTrade

profitPoints := percentAsPoints(tpPercent)

lossPoints := percentAsPoints(slPercent)

slPrice := calcStopLossPrice(lossPoints, openLong)

tpPrice := calcProfitTrgtPrice(profitPoints, openLong)

tradeEntryBar := bar_index

strategy.exit("TP/SL", profit = profitPoints, loss = lossPoints, comment_profit = "TP Hit", comment_loss = "SL Hit", alert_profit = "TP Hit Alert", alert_loss = "SL Hit Alert")

// =============================================================================

// DRAWINGS

// =============================================================================

// -----------

// TP/SL Boxes

// -----------

slHit = (inShort and high >= slPrice) or (inLong and low <= slPrice)

tpHit = (inLong and high >= tpPrice) or (inShort and low <= tpPrice)

exitTriggered = slHit or tpHit

ctEntryPrice = strategy.closedtrades.entry_price (strategy.closedtrades - 1)

pnl = strategy.closedtrades.profit (strategy.closedtrades - 1)

posSize = strategy.closedtrades.size (strategy.closedtrades - 1)

// Print boxes for trades closed at profit or loss

if (inTrade and exitTriggered)

inShort := false

inLong := false

// printTpSlHitBox(tradeEntryBar, bar_index, slHit, tpHit, ctEntryPrice, slPrice, tpPrice)

// printTradeExitLabel(bar_index, math.max(tpPrice, slPrice), posSize, ctEntryPrice, pnl)

// Print TP/SL box for current open trade

// if barstate.islastconfirmedhistory and strategy.position_size != 0

// printTpSlNotHitBox(tradeEntryBar + 1, bar_index + 1, strategy.position_avg_price, slPrice, tpPrice)

// // =============================================================================

// // DEBUGGING

// // =============================================================================

// Data window plots

plotchar(prePullbackBullBreakout, "prePullbackBullBreakout", "")

plotchar(prePullbackBearBreakout, "prePullbackBearBreakout", "")

plotchar(barssincePullbackStart, "barssincePullbackStart", "")

plotchar(isCoralBullish, "isCoralBullish", "")

plotchar(isCoralBearish, "isCoralBearish", "")

plotchar(barssinceCoralflip, "barssinceCoralflip", "")

plotchar(isPullbackValid, "isPullbackValid", "")

plotchar(entryBreakout, "entryBreakout", "")

plotchar(slHit, "slHit", "")

plotchar(tpHit, "tpHit", "")

plotchar(slPrice, "slPrice", "")

// Label plots

// plotDebugLabels = false

// if plotDebugLabels

// if bar_index == tradeEntryBar

// printLabel(bar_index, "Position size: " + str.tostring(entryQty * close, "#.##"))