Strategi Perdagangan Terobosan Bollinger Band

Ringkasan

Strategi ini didasarkan pada desain indikator Bollinger Bands, melakukan lebih banyak ketika harga menembus Bollinger Bands ke arah yang lebih baik, dan mengambil posisi kosong ketika harga menembus Bollinger Bands ke arah yang lebih buruk, dan merupakan strategi pelacakan tren.

Prinsip Strategi

- Perhitungan rel tengah, rel atas, dan rel bawah di Brin Belt

- Jika Anda memiliki banyak uang, Anda akan memiliki lebih banyak uang.

- Ketika harga close out menembus tren bawah, bukalah.

- Kondisi posisi rata: meredam banyak kartu saat menerobos rel tengah, meredam kartu kosong saat menerobos rel tengah

Strategi ini menggunakan Bollinger Bands untuk menilai kisaran fluktuasi dan arah tren di pasar, dan ketika harga menembus Bollinger Bands untuk turun ke bawah, dianggap sebagai sinyal untuk membalikkan tren, dan berdasarkan sinyal ini, masuk dan melakukan lebih banyak shorting. Sebagai posisi stop loss di dekat mid-trail, keluar dari posisi saat menembus mid-trail.

Analisis Keunggulan

- Menggunakan indikator Brinks untuk menilai tren pasar dan resistance level support

- Kesempatan lebih tinggi untuk menembus Brin Belt dan naik ke bawah

- Ada aturan masuk dan keluar yang jelas

Analisis risiko

- Brin mempertaruhkan sinyal palsu yang mungkin akan terjadi pada harga saham dalam jangka pendek

- Stop loss mungkin lebih besar jika terjadi dalam jumlah besar.

Solusi untuk Mengatasi Risiko:

- Tren penilaian dalam kombinasi dengan indikator lain

- Menyesuaikan parameter untuk memperluas jangkauan Brin

Arah optimasi

- Menggunakan indikator tren untuk menghindari pembalikan yang tidak perlu

- Dimensi parameter yang disesuaikan secara dinamis

Meringkaskan

Strategi ini menggunakan indikator Brin untuk menentukan tren harga dan level resistensi pendukung, dengan titik masuk di Brin di atas jalur bawah, dan titik berhenti di Brin di tengah jalur. Logika strategi sederhana dan jelas, mudah untuk diterapkan.

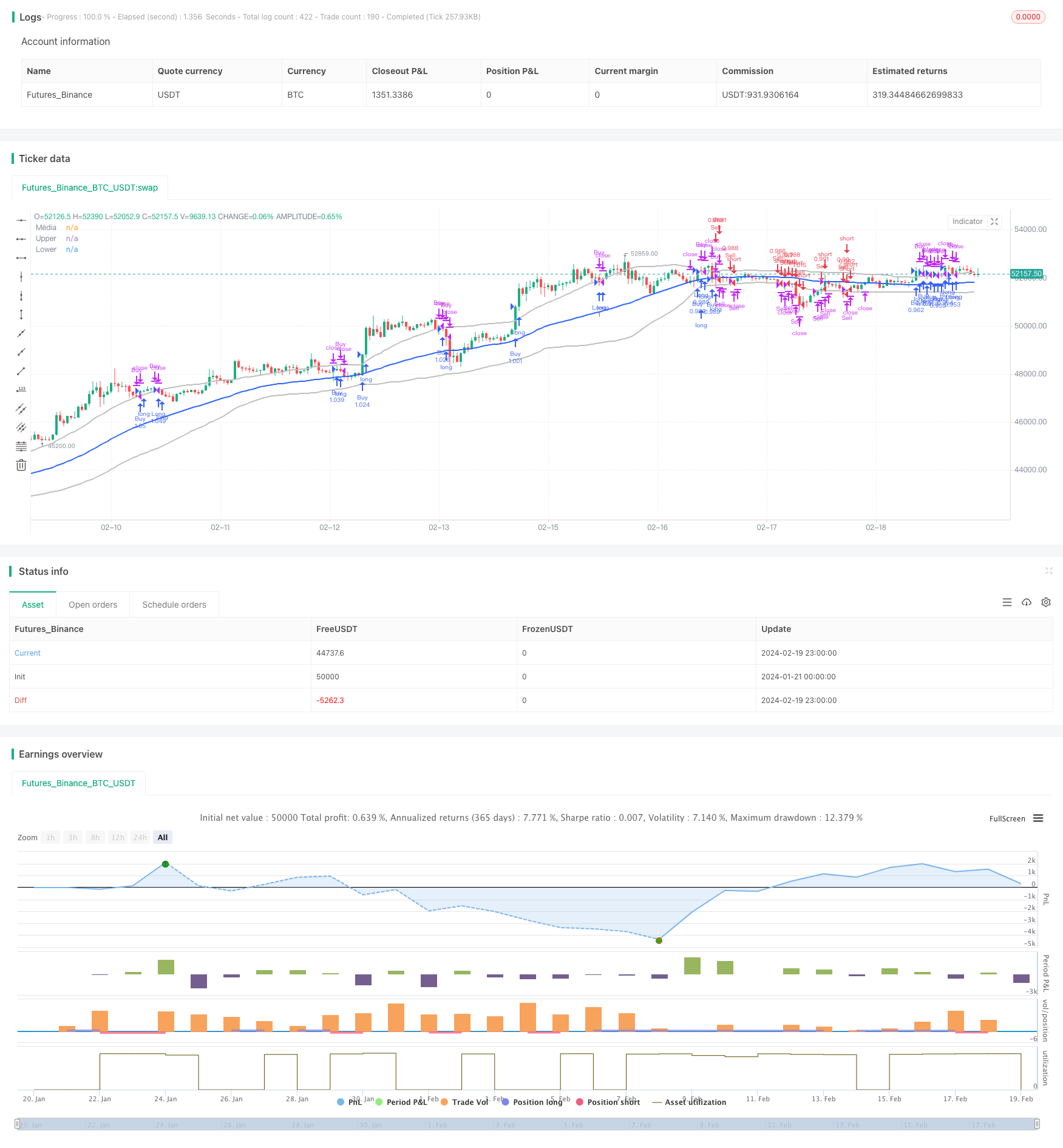

/*backtest

start: 2024-01-21 00:00:00

end: 2024-02-20 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("FFFDBTC", overlay=true,initial_capital = 100,commission_type =strategy.commission.percent,commission_value= 0.15,default_qty_value = 100,default_qty_type = strategy.percent_of_equity)

// === INPUT BACKTEST RANGE ===

FromMonth = input.int(defval=1, title="From Month", minval=1, maxval=12)

FromDay = input.int(defval=1, title="From Day", minval=1, maxval=31)

FromYear = input.int(defval=1972, title="From Year", minval=1972)

ToMonth = input.int(defval=1, title="To Month", minval=1, maxval=12)

ToDay = input.int(defval=1, title="To Day", minval=1, maxval=31)

ToYear = input.int(defval=9999, title="To Year", minval=2010)

// === FUNCTION EXAMPLE ===

start = timestamp(FromYear, FromMonth, FromDay, 00, 00) // backtest start window

finish = timestamp(ToYear, ToMonth, ToDay, 23, 59) // backtest finish window

window() => true

// Definindo tamanho da posição

position_size = strategy.equity

// Definir parâmetros das Bandas de Bollinger

length = input.int(51, "Comprimento")

mult = input.float(1.1, "Multiplicador")

// Calcular as Bandas de Bollinger

basis = ta.sma(close, length)

dev = mult * ta.stdev(close, length)

upper = basis + dev

lower = basis - dev

// Definir condições de entrada e saída

entrada_na_venda = low < lower

saida_da_venda = high > lower and strategy.position_size < 0

entrada_na_compra = high > upper

saida_da_compra = low < upper and strategy.position_size > 0

shortCondition = close[1] < lower[1] and close > lower and close < basis

longCondition = close[1] > upper[1] and close < upper and close > basis

// Entrar na posição longa se a condição longCondition for verdadeira

if ((entrada_na_compra) and window() )

strategy.entry("Buy", strategy.long)

//saida da compra

if (saida_da_compra)

strategy.close("Buy")

//entrada na venda

if ((entrada_na_venda) and window() )

strategy.entry("Sell", strategy.short)

//saida da venda

if (saida_da_venda)

strategy.close("Sell")

if ((longCondition) and window())

strategy.entry("Long", strategy.long)

// Entrar na posição curta se a condição shortCondition for verdadeira

if ((shortCondition) and window())

strategy.entry("Short", strategy.short)

// Definir a saída da posição

strategy.exit("Exit_Long", "Long", stop=ta.sma(close, length), when = close >= basis)

strategy.exit("Exit_Short", "Short", stop=ta.sma(close, length), when = close <= basis)

// Desenhar as Bandas de Bollinger no gráfico

plot(basis, "Média", color=#2962FF, linewidth=2)

plot(upper, "Upper", color=#BEBEBE, linewidth=2)

plot(lower, "Lower", color=#BEBEBE, linewidth=2)