Strategi Perdagangan Pembalikan RSI Cepat

Ringkasan

Strategi perdagangan reversal RSI cepat untuk menentukan titik reversal tren dengan menggunakan kombinasi indikator RSI cepat, filter entitas K-line, filter harga maksimum dan minimum, dan filter rata-rata SMA. Strategi ini dirancang untuk menangkap peluang reversal jangka pendek.

Prinsip Strategi

Strategi ini didasarkan pada beberapa indikator:

Indikator RSI cepat: Menghitung RSI dengan fungsi RMA, membuatnya lebih sensitif untuk menangkap sinyal overbought dan oversold yang lebih cepat.

K-line entitas filter: Memerlukan entitas K lebih besar dari 1⁄5, untuk filter entitas yang tidak banyak berubah.

Filter harga minimum dan maksimumHal ini dikarenakan banyaknya inovasi yang dilakukan oleh perusahaan-perusahaan teknologi di Indonesia.

Filter SMA rata-rata“Saya tidak tahu apa-apa tentang itu, tapi saya pikir itu adalah salah satu hal yang paling penting yang harus dilakukan.

Sinyal perdagangan dihasilkan ketika beberapa kondisi di atas dipicu secara bersamaan. Logika spesifiknya adalah:

Multi-head entry: RSI cepat di bawah zona oversold AND entitas garis K lebih besar dari entitas garis rata-rata EMA 1⁄5 AND memiliki nilai minimum untuk menembus AND harga melewati garis rata-rata SMA

Masuk kosong: indikator RSI cepat lebih tinggi dari zona oversold AND entitas garis K lebih besar dari entitas garis rata-rata EMA 1⁄5 AND memiliki nilai maksimum untuk menembus AND harga di bawah garis rata-rata SMA

Keluar dari posisi rata: RSI cepat kembali ke zona normal

Keunggulan Strategis

Strategi ini memiliki keuntungan sebagai berikut:

- Menangkap Volatilitas dari Reversal Jangka Pendek

- Indeks RSI cepat sangat sensitif

- Filter ganda mengurangi sinyal palsu

- Risiko dikontrol, penarikan kecil

Risiko dan optimasi

Strategi ini juga memiliki beberapa risiko:

- Bahaya dari Kegagalan Reversi

- Optimasi parameter terbatas

Optimalisasi lebih lanjut dapat dilakukan dengan:

- Filter volume transaksi

- Meningkatkan strategi stop loss

- Kombinasi parameter optimasi

Meringkaskan

Strategi ini secara keseluruhan merupakan strategi perdagangan berbalik jangka pendek yang berisiko rendah. Strategi ini menilai titik jual beli dengan indikator RSI yang cepat dan menggunakan beberapa filter untuk mengurangi sinyal palsu, sehingga memungkinkan perdagangan berbalik yang dapat dikontrol risiko dan cocok untuk operasi garis pendek. Strategi ini dapat dioptimalkan lebih lanjut dan memiliki potensi pengembangan yang besar.

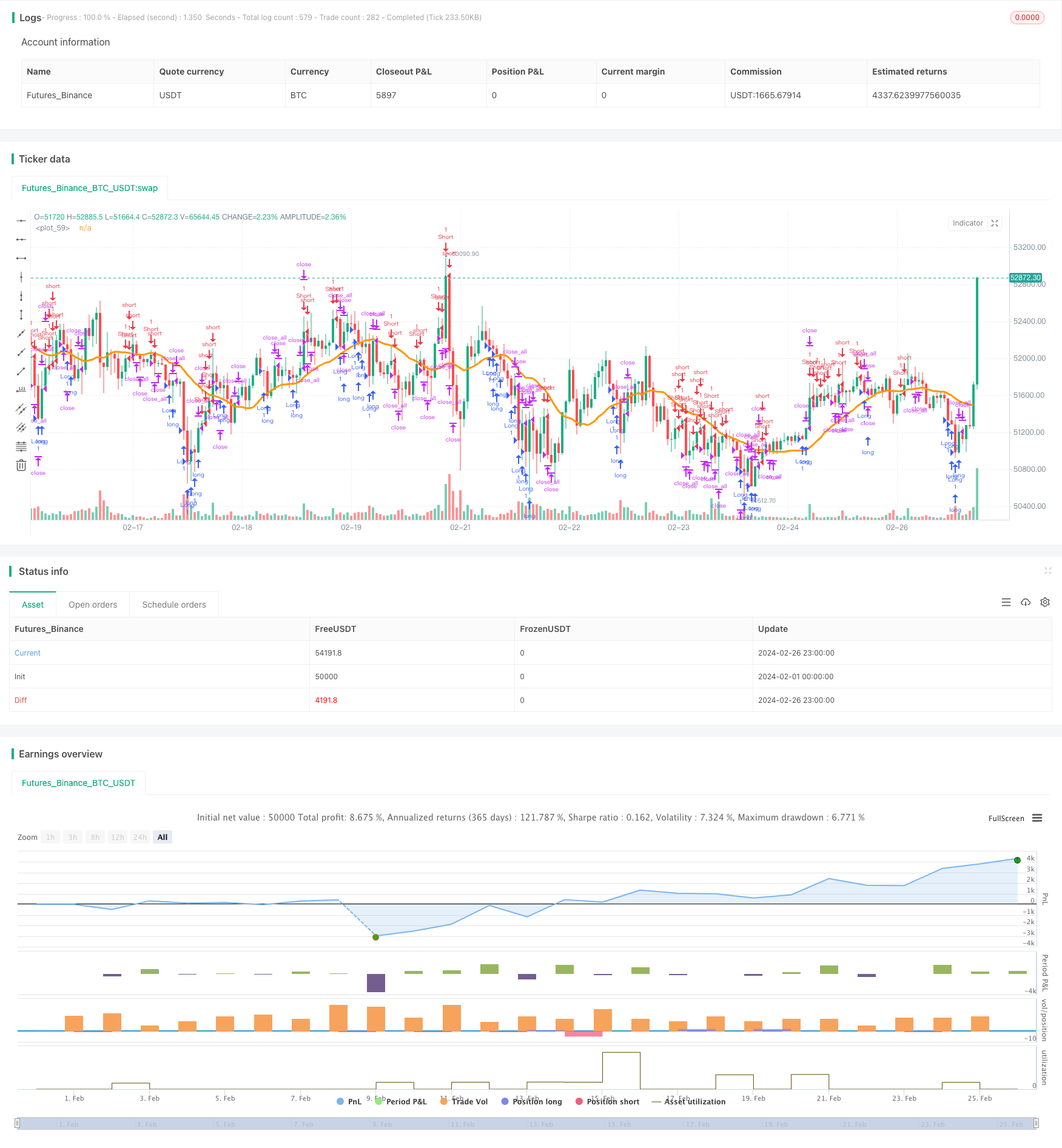

/*backtest

start: 2024-02-01 00:00:00

end: 2024-02-26 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//Noro

//2018

//@version=3

strategy(title = "Noro's Fast RSI Strategy v1.4", shorttitle = "Fast RSI str 1.4", overlay = true, default_qty_type = strategy.percent_of_equity, default_qty_value = 100, pyramiding = 5)

//Settings

needlong = input(true, defval = true, title = "Long")

needshort = input(true, defval = true, title = "Short")

usersi = input(true, defval = true, title = "Use Fast RSI Strategy")

usemm = input(true, defval = true, title = "Use Min/Max Strategy")

usesma = input(true, defval = true, title = "Use SMA Filter")

smaperiod = input(20, defval = 20, minval = 2, maxval = 1000, title = "SMA Filter Period")

rsiperiod = input(7, defval = 7, minval = 2, maxval = 50, title = "RSI Period")

limit = input(30, defval = 30, minval = 1, maxval = 100, title = "RSI limit")

rsisrc = input(close, defval = close, title = "RSI Price")

rsibars = input(1, defval = 1, minval = 1, maxval = 20, title = "RSI Bars")

mmbars = input(1, defval = 1, minval = 1, maxval = 5, title = "Min/Max Bars")

showsma = input(false, defval = false, title = "Show SMA Filter")

showarr = input(false, defval = false, title = "Show Arrows")

fromyear = input(2018, defval = 2018, minval = 1900, maxval = 2100, title = "From Year")

toyear = input(2100, defval = 2100, minval = 1900, maxval = 2100, title = "To Year")

frommonth = input(01, defval = 01, minval = 01, maxval = 12, title = "From Month")

tomonth = input(12, defval = 12, minval = 01, maxval = 12, title = "To Month")

fromday = input(01, defval = 01, minval = 01, maxval = 31, title = "From day")

today = input(31, defval = 31, minval = 01, maxval = 31, title = "To day")

//Fast RSI

fastup = rma(max(change(rsisrc), 0), rsiperiod)

fastdown = rma(-min(change(rsisrc), 0), rsiperiod)

fastrsi = fastdown == 0 ? 100 : fastup == 0 ? 0 : 100 - (100 / (1 + fastup / fastdown))

//Limits

bar = close > open ? 1 : close < open ? -1 : 0

uplimit = 100 - limit

dnlimit = limit

//RSI Bars

upsignal = fastrsi > uplimit ? 1 : 0

dnsignal = fastrsi < dnlimit ? 1 : 0

uprsi = sma(upsignal, rsibars) == 1

dnrsi = sma(dnsignal, rsibars) == 1

//Body

body = abs(close - open)

emabody = ema(body, 30)

//MinMax Bars

min = min(close, open)

max = max(close, open)

minsignal = min < min[1] and bar == -1 and bar[1] == -1 ? 1 : 0

maxsignal = max > max[1] and bar == 1 and bar[1] == 1 ? 1 : 0

mins = sma(minsignal, mmbars) == 1

maxs = sma(maxsignal, mmbars) == 1

//SMA Filter

sma = sma(close, smaperiod)

colorsma = showsma ? blue : na

plot(sma, color = colorsma, linewidth = 3)

//Signals

up1 = bar == -1 and (strategy.position_size == 0 or close < strategy.position_avg_price) and dnrsi and body > emabody / 5 and usersi

dn1 = bar == 1 and (strategy.position_size == 0 or close > strategy.position_avg_price) and uprsi and body > emabody / 5 and usersi

up2 = mins and (close > sma or usesma == false) and usemm

dn2 = maxs and (close < sma or usesma == false) and usemm

exit = ((strategy.position_size > 0 and fastrsi > dnlimit and bar == 1) or (strategy.position_size < 0 and fastrsi < uplimit and bar == -1)) and body > emabody / 2

//Arrows

col = exit ? black : up1 or dn1 ? blue : up2 or dn2 ? red : na

needup = up1 or up2

needdn = dn1 or dn2

needexitup = exit and strategy.position_size < 0

needexitdn = exit and strategy.position_size > 0

plotarrow(showarr and needup ? 1 : na, colorup = blue, colordown = blue, transp = 0)

plotarrow(showarr and needdn ? -1 : na, colorup = blue, colordown = blue, transp = 0)

plotarrow(showarr and needexitup ? 1 : na, colorup = black, colordown = black, transp = 0)

plotarrow(showarr and needexitdn ? -1 : na, colorup = black, colordown = black, transp = 0)

//Trading

if up1 or up2

strategy.entry("Long", strategy.long, needlong == false ? 0 : na)

if dn1 or dn2

strategy.entry("Short", strategy.short, needshort == false ? 0 : na)

if time > timestamp(toyear, tomonth, today, 00, 00) or exit

strategy.close_all()