期間制限付きの二重MA戦略

作者: リン・ハーンチャオチャン開催日:2023年11月14日 16時45分03秒タグ:

概要

この戦略は,戦略の開始時間を制御するために,元の二重移動平均戦略に基づいたタイムリームモジュールを実装しています.タイムリームモジュールは,戦略の実行時間を効果的に管理し,不利な市場条件下で取引リスクを軽減することができます.

原則

この戦略は,速いMAと遅いMAを使用して取引信号を生成する.速いMAは14日,遅いMAは21日間の期間を有する.速いMAが遅いMAを超えると購入信号が生成される.速いMAが遅いMAを下回ると販売信号が生成される.

この戦略には,元の貿易方向を逆転させる貿易逆転オプションも含まれています.

タイムリームモジュールは,タイムスタンプを使用して現在の時間を設定された開始時間と比較し,戦略が起動するかどうかを制御するために真または偽を返します. スタート年,月,日,時間,分を設定する必要があります. 戦略は,現在の時間が設定された開始時間を超えるとのみ開始されます.

利点

- 双重MAsは,中期から短期間の傾向を効果的に捉える

- タイムリームモジュールは,戦略の実行時間を正確に制御し,不利な市場条件下で不必要な取引を回避します.

- 取引の逆転オプションは柔軟性を追加します

リスク と 解決策

- 双重MAsは過剰な取引信号を生成し,取引頻度とコストを増加させる可能性があります.

- 誤った時間制限の設定は,機会を逃す可能性があります

- 誤った取引逆転が誤った取引信号につながる可能性があります.

MA期間を最適化することで,取引頻度が減少する可能性があります.また,機会を逃さないために開始時間を合理的に設定する必要があります.最後に,市場の状況に基づいて信号を逆転するかどうかを慎重に選択してください.

オプティマイゼーションの方向性

- ストップ・ロスのモジュールを追加することで,個々の取引のリスクをよりよく制御できます.

- ストップ・ロスのポイントを徐々に移動させるストップ・ロスの実行は,利益をロックするのに役立ちます

- 複数のシンボルの信号を組み合わせることで,信号の質が向上し,誤った信号が減少します

- パラメータ最適化モジュールを開発し,自動的に最適なパラメータ組み合わせを見つける

概要

この戦略は,デュアルMAを使用して取引信号を生成し,タイムリームモジュールで実行時間を制御し,不利な市場条件を回避しながら,効果的にトレンドを把握します.パラメータチューニング,ストップロスのモジュール,クロス資産信号生成などを通じて,さらなる改善が行われ,各取引の安定性と収益性を向上させながら取引頻度を減らすことができます.

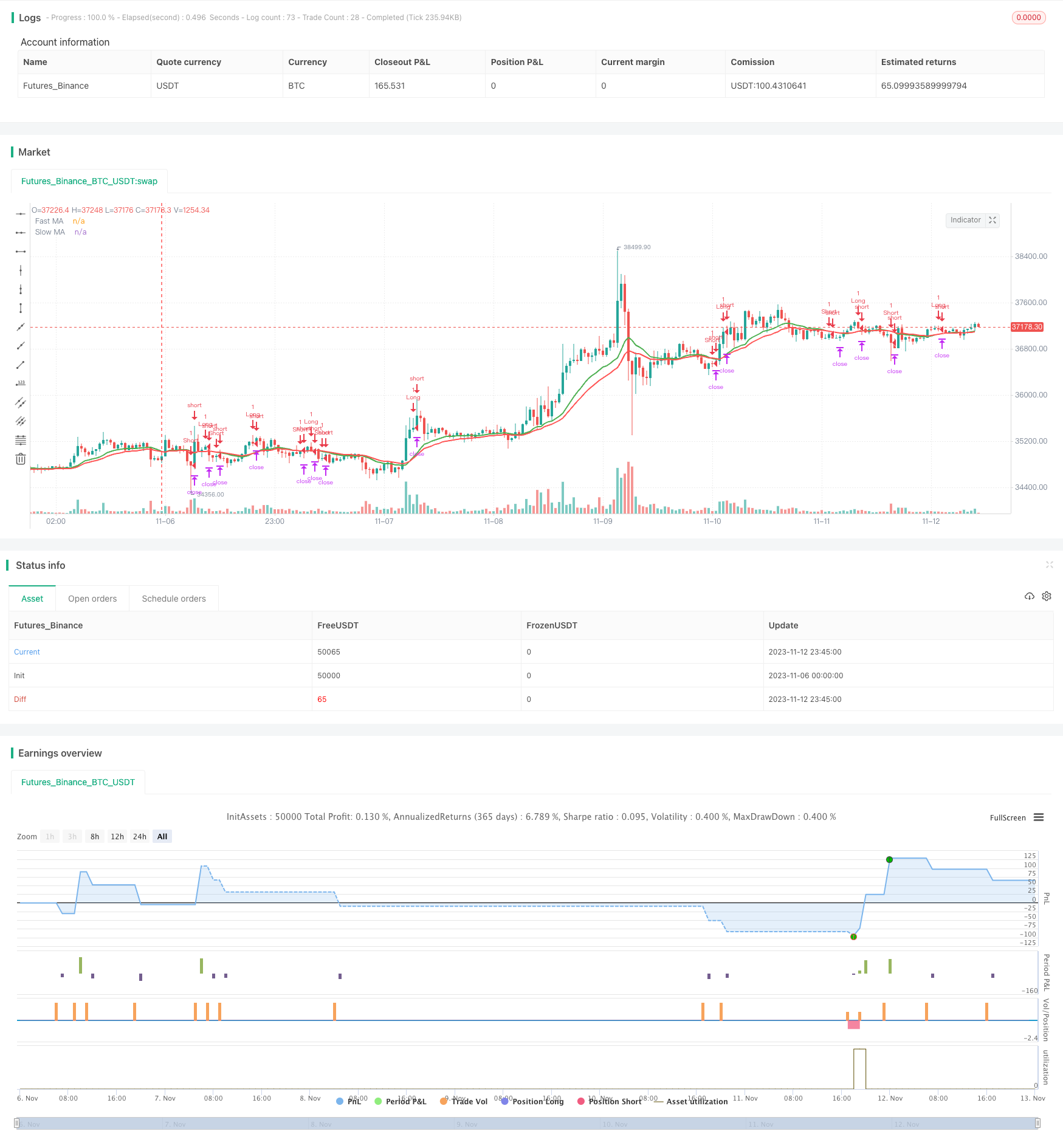

/*backtest

start: 2023-11-06 00:00:00

end: 2023-11-13 00:00:00

period: 45m

basePeriod: 5m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=2

strategy(title = "Strategy Code Example", shorttitle = "Strategy Code Example", overlay = true)

// Revision: 1

// Author: @JayRogers

//

// *** THIS IS JUST AN EXAMPLE OF STRATEGY TIME LIMITING ***

//

// This is a follow up to my previous strategy example for risk management, extended to include a time limiting factor.

// === GENERAL INPUTS ===

// short ma

maFastSource = input(defval = open, title = "Fast MA Source")

maFastLength = input(defval = 14, title = "Fast MA Period", minval = 1)

// long ma

maSlowSource = input(defval = open, title = "Slow MA Source")

maSlowLength = input(defval = 21, title = "Slow MA Period", minval = 1)

// === STRATEGY RELATED INPUTS ===

tradeInvert = input(defval = false, title = "Invert Trade Direction?")

// Risk management

inpTakeProfit = input(defval = 1000, title = "Take Profit", minval = 0)

inpStopLoss = input(defval = 200, title = "Stop Loss", minval = 0)

inpTrailStop = input(defval = 200, title = "Trailing Stop Loss", minval = 0)

inpTrailOffset = input(defval = 0, title = "Trailing Stop Loss Offset", minval = 0)

// *** FOCUS OF EXAMPLE ***

// Time limiting

// a toggle for enabling/disabling

useTimeLimit = input(defval = true, title = "Use Start Time Limiter?")

// set up where we want to run from

startYear = input(defval = 2016, title = "Start From Year", minval = 0, step = 1)

startMonth = input(defval = 05, title = "Start From Month", minval = 0,step = 1)

startDay = input(defval = 01, title = "Start From Day", minval = 0,step = 1)

startHour = input(defval = 00, title = "Start From Hour", minval = 0,step = 1)

startMinute = input(defval = 00, title = "Start From Minute", minval = 0,step = 1)

// === RISK MANAGEMENT VALUE PREP ===

// if an input is less than 1, assuming not wanted so we assign 'na' value to disable it.

useTakeProfit = inpTakeProfit >= 1 ? inpTakeProfit : na

useStopLoss = inpStopLoss >= 1 ? inpStopLoss : na

useTrailStop = inpTrailStop >= 1 ? inpTrailStop : na

useTrailOffset = inpTrailOffset >= 1 ? inpTrailOffset : na

// *** FOCUS OF EXAMPLE ***

// === TIME LIMITER CHECKING FUNCTION ===

// using a multi line function to return true or false depending on our input selection

// multi line function logic must be indented.

startTimeOk() =>

// get our input time together

inputTime = timestamp(syminfo.timezone, startYear, startMonth, startDay, startHour, startMinute)

// check the current time is greater than the input time and assign true or false

timeOk = time > inputTime ? true : false

// last line is the return value, we want the strategy to execute if..

// ..we are using the limiter, and the time is ok -OR- we are not using the limiter

r = (useTimeLimit and timeOk) or not useTimeLimit

// === SERIES SETUP ===

/// a couple of ma's..

maFast = ema(maFastSource, maFastLength)

maSlow = ema(maSlowSource, maSlowLength)

// === PLOTTING ===

fast = plot(maFast, title = "Fast MA", color = green, linewidth = 2, style = line, transp = 50)

slow = plot(maSlow, title = "Slow MA", color = red, linewidth = 2, style = line, transp = 50)

// === LOGIC ===

// is fast ma above slow ma?

aboveBelow = maFast >= maSlow ? true : false

// are we inverting our trade direction?

tradeDirection = tradeInvert ? aboveBelow ? false : true : aboveBelow ? true : false

// *** FOCUS OF EXAMPLE ***

// wrap our strategy execution in an if statement which calls the time checking function to validate entry

// like the function logic, content to be included in the if statement must be indented.

if( startTimeOk() )

// === STRATEGY - LONG POSITION EXECUTION ===

enterLong = not tradeDirection[1] and tradeDirection

exitLong = tradeDirection[1] and not tradeDirection

strategy.entry( id = "Long", long = true, when = enterLong )

strategy.close( id = "Long", when = exitLong )

// === STRATEGY - SHORT POSITION EXECUTION ===

enterShort = tradeDirection[1] and not tradeDirection

exitShort = not tradeDirection[1] and tradeDirection

strategy.entry( id = "Short", long = false, when = enterShort )

strategy.close( id = "Short", when = exitShort )

// === STRATEGY RISK MANAGEMENT EXECUTION ===

strategy.exit("Exit Long", from_entry = "Long", profit = useTakeProfit, loss = useStopLoss, trail_points = useTrailStop, trail_offset = useTrailOffset)

strategy.exit("Exit Short", from_entry = "Short", profit = useTakeProfit, loss = useStopLoss, trail_points = useTrailStop, trail_offset = useTrailOffset)

もっと

- 基本的Pinbar取引戦略

- トレンドフォロー戦略 MACD と ドンチアンチャネル

- トレンドフォロー戦略 ストップ損失を追う距離に基づいた戦略

- ICHIMOKU クラウドとSTOCH 指標に基づくトレンド追跡戦略

- モメントブレイク戦略

- 優位性 移動平均 ブレイクトレンド フォローシステム

- トリプル指数関数移動平均 ロングのみ戦略

- 3EMAとストカスティックRSI戦略

- 戦略をフォローする二重移動平均傾向

- RSI逆転取引戦略

- トレンドフォロー戦略 移動平均と超トレンドに基づいた

- 簡単な移動平均のクロスオーバー戦略

- 二重取利益移動平均クロスオーバー量的な戦略

- RSI オシレーター カメ トレーディング 短期戦略

- マッキンリー移動平均取引戦略

- 改善された渦輪指標に基づく定量的な取引戦略

- 多期トレンド追跡戦略

- 双方向オシレーターパターン戦略

- モメントスプレス戦略

- MCL-YG ボリンジャー・バンド・ブレークアウト・ペア・トレーディング・戦略