概述

这是一个结合多种指标的趋势跟踪策略。它同时使用三个不同周期的EMA,Stochastic RSI和ATR来识别趋势方向和建立仓位。当快周期EMA上穿慢周期EMA时开仓做多,止损位于最近ATR的值的3倍下方,止盈为2倍最近ATR的值。

原理

该策略使用三个EMA均线,分别是8周期、14周期和50周期的EMA。它们分别代表了不同时间段内的价格趋势。当8周期EMA上穿14周期EMA,14周期EMA上穿50周期EMA时,说明目前处于趋势开始阶段,可以选择建立做多仓位。

Stochastic RSI指标结合RSI和Stochastic计算方法,可以发现超买超卖现象。当Stochastic RSI的K线从下方上穿D线时,说明市场正在从超卖状态转为看涨,可以选做多。

ATR代表最近的波动范围。策略使用ATR的3倍作为止损距离,2倍作为止盈距离,以锁定盈利并控制风险。

优势

- 使用EMA均线可以滤除价格数据中的部分噪音,识别出趋势方向

- Stochastic RSI指标可以发现反转机会

- ATR动态跟踪止损止盈,可以根据市场波动幅度来设定合理的盈亏距离

风险

- 多重指标组合可能出现错误信号

- 固定的止损止盈倍数无法适应市场的变化

- 短周期做多容易受反转影响

可以通过调整EMA周期参数来优化指标的敏感度。也可以使ATR的止损止盈倍数可调,根据市场情况来设定合适参数。此外,可以考虑加入其它指标辅助判断,避免出现误信号。

优化方向

- 调整EMA周期参数,优化指标敏感度

- 使ATR止损止盈倍数可调

- 加入其它指标判断,避免误信号

总结

本策略综合考虑了趋势方向、超买超卖现象和波动范围来识别入场时机。EMA均线和Stochastic RSI指标配合使用可以有效识别趋势,ATR动态跟踪止损止盈有助于风险控制。通过参数调整和优化,该策略可以成为一个可靠的趋势跟踪系统。但需要注意防范指标误信号和固定止损止盈的弊端。

策略源码

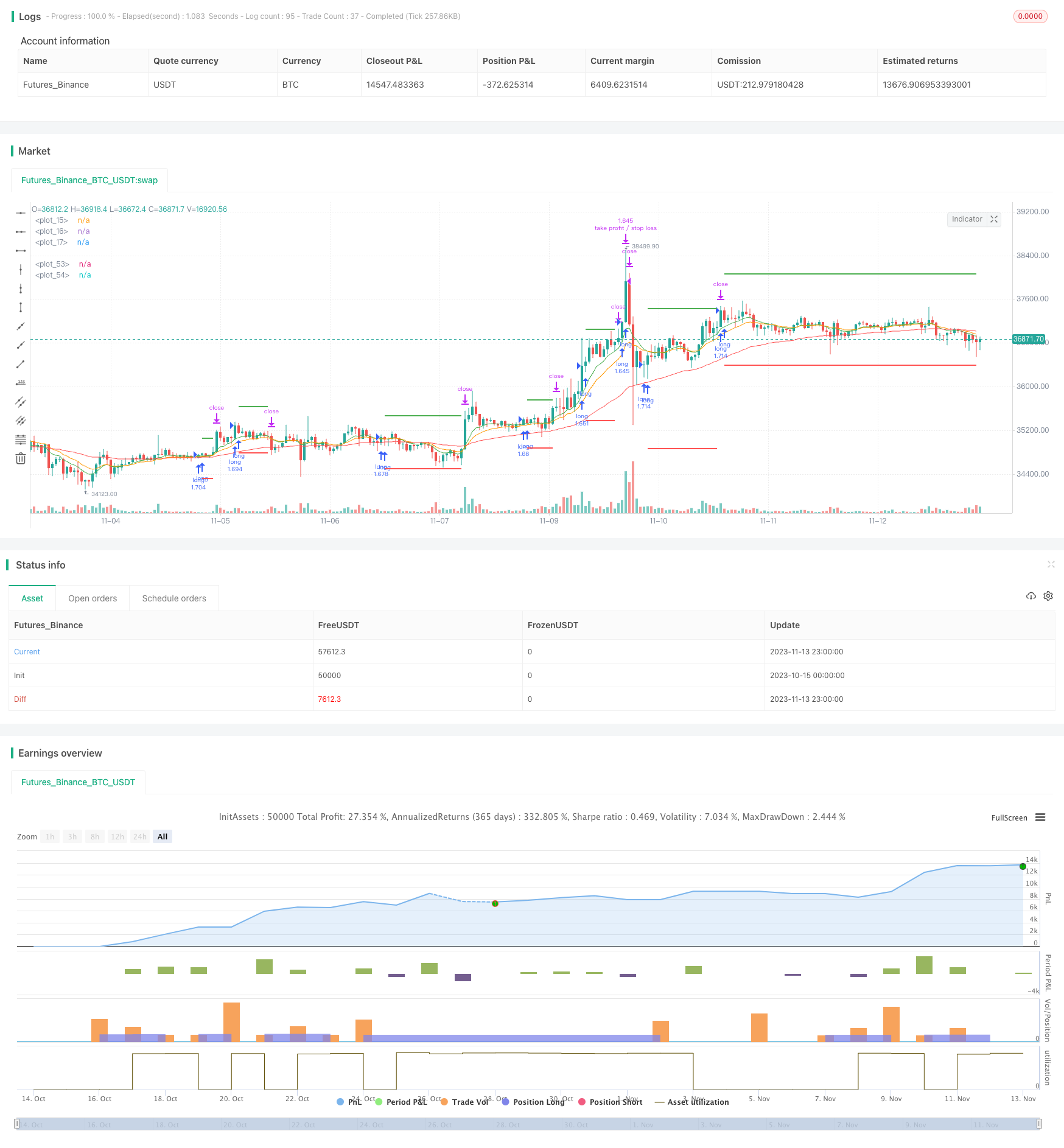

/*backtest

start: 2023-10-15 00:00:00

end: 2023-11-14 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © FreddieChopin

//@version=4

strategy("3 x EMA + Stochastic RSI + ATR", overlay = true, default_qty_type = strategy.percent_of_equity, default_qty_value = 100)

// 3x EMA

ema1Length = input(8, "EMA1 Length", minval = 1)

ema2Length = input(14, "EMA2 Length", minval = 1)

ema3Length = input(50, "EMA3 Length", minval = 1)

ema1 = ema(close, ema1Length)

ema2 = ema(close, ema2Length)

ema3 = ema(close, ema3Length)

plot(ema1, color = color.green)

plot(ema2, color = color.orange)

plot(ema3, color = color.red)

// Stochastic RSI

smoothK = input(3, "K", minval=1)

smoothD = input(3, "D", minval=1)

lengthRSI = input(14, "RSI Length", minval=1)

lengthStoch = input(14, "Stochastic Length", minval=1)

src = input(close, title="RSI Source")

rsi1 = rsi(src, lengthRSI)

k = sma(stoch(rsi1, rsi1, rsi1, lengthStoch), smoothK)

d = sma(k, smoothD)

// ATR

atrPeriod = input(14, "ATR Period")

takeProfitMultiplier= input(2.0, "Take-profit Multiplier")

stopLossMultiplier= input(3.0, "Stop-loss Multiplier")

atrSeries = atr(atrPeriod)[1]

longCondition = ema1 > ema2 and ema2 > ema3 and crossover(k, d)

strategy.entry("long", strategy.long, when = longCondition)

float stopLoss = na

float takeProfit = na

if (strategy.position_size > 0)

if (na(stopLoss[1]))

stopLoss := strategy.position_avg_price - atrSeries * stopLossMultiplier

else

stopLoss := stopLoss[1]

if (na(takeProfit[1]))

takeProfit := strategy.position_avg_price + atrSeries * takeProfitMultiplier

else

takeProfit := takeProfit[1]

strategy.exit("take profit / stop loss", limit = takeProfit, stop = stopLoss)

plot(stopLoss, color = color.red, linewidth = 2, style = plot.style_linebr)

plot(takeProfit, color = color.green, linewidth = 2, style = plot.style_linebr)

更多内容