RSIとT3指標に基づくPMax適応型ブレイクアウト戦略

作成日:

2023-11-22 15:03:08

最終変更日:

2023-11-22 15:03:08

コピー:

0

クリック数:

804

1

フォロー

1627

フォロワー

概要

この戦略は,RSIとT3の指数を使用してトレンド判断を行い,ATRの指数と組み合わせてストップラインを設定し,PMaxを突破に適応させるための量化取引戦略である.その主な考えは,トレンド判断とストップ損失設定を最適化して,リスクを制御しながら収益性を向上させることである.

戦略原則

RSIとT3を計算してトレンドを決定する

- RSIで 株価が過度に高騰しているかどうかを判断する

- RSI によるT3 指数の計算によるトレンド判断

ATR指数によるPMax自主ストップライン設定

- ATR指標を波動の代表として計算する

- T3指数の上下にストップラインを設定し,その幅はATR指数の一定倍数です.

- ストップラインの自己適応調整を実現する

突破買いと破損退出

- 価格がT3を突破すると,買入のシグナルになります.

- 価格がストップラインを下回ると,現在のポジションを終了します.

戦略的優位性

この戦略の利点は以下の通りです.

- RSIとT3の組み合わせは,傾向を判断し,より高い正確性を持っています.

- PMaxは自律的な停止メカニズムによるリスク管理

- ATR指標は波動度を表すため,ストップラインの幅を設定し,過度に過激なことを避ける

- 撤収と収益性のバランス

戦略リスク

この戦略には以下のリスクがあります.

- 逆転リスク

短期間の価格逆転が起こると,ストップがトリガーされ,損失が生じることがあります. ストップラインを適切に緩めることで,反転の影響を軽減することができます.

- トレンド判断の失敗リスク

RSIとT3指標のトレンド判断の効果は100%信頼できない.判断が間違っている場合も損失を伴う.パラメータを適切に調整したり,他の指標を加えて最適化することができる.

戦略最適化の方向性

この戦略は,以下の点でさらに最適化できます.

- 移動平均などの他の指標を添加して判断する傾向

- RSIとT3の長さのパラメータを最適化する

- 異なるATR倍数をストップラインの幅としてテストする

- 市場によって調整されるストップラインの緩和幅

要約する

この戦略は,RSI,T3およびATRの3つの指標の使用の優位性を統合し,トレンド判断とリスク管理の有機的な組み合わせを実現します.単一の指標と比較して,この組み合わせは判断精度が高く,引き下がり制御が良好な特性を有しており,信頼できるトレンド追跡戦略です.パラメータとリスク管理の面で最適化の余地があり,全体的に推奨される量化取引戦略です.

ストラテジーソースコード

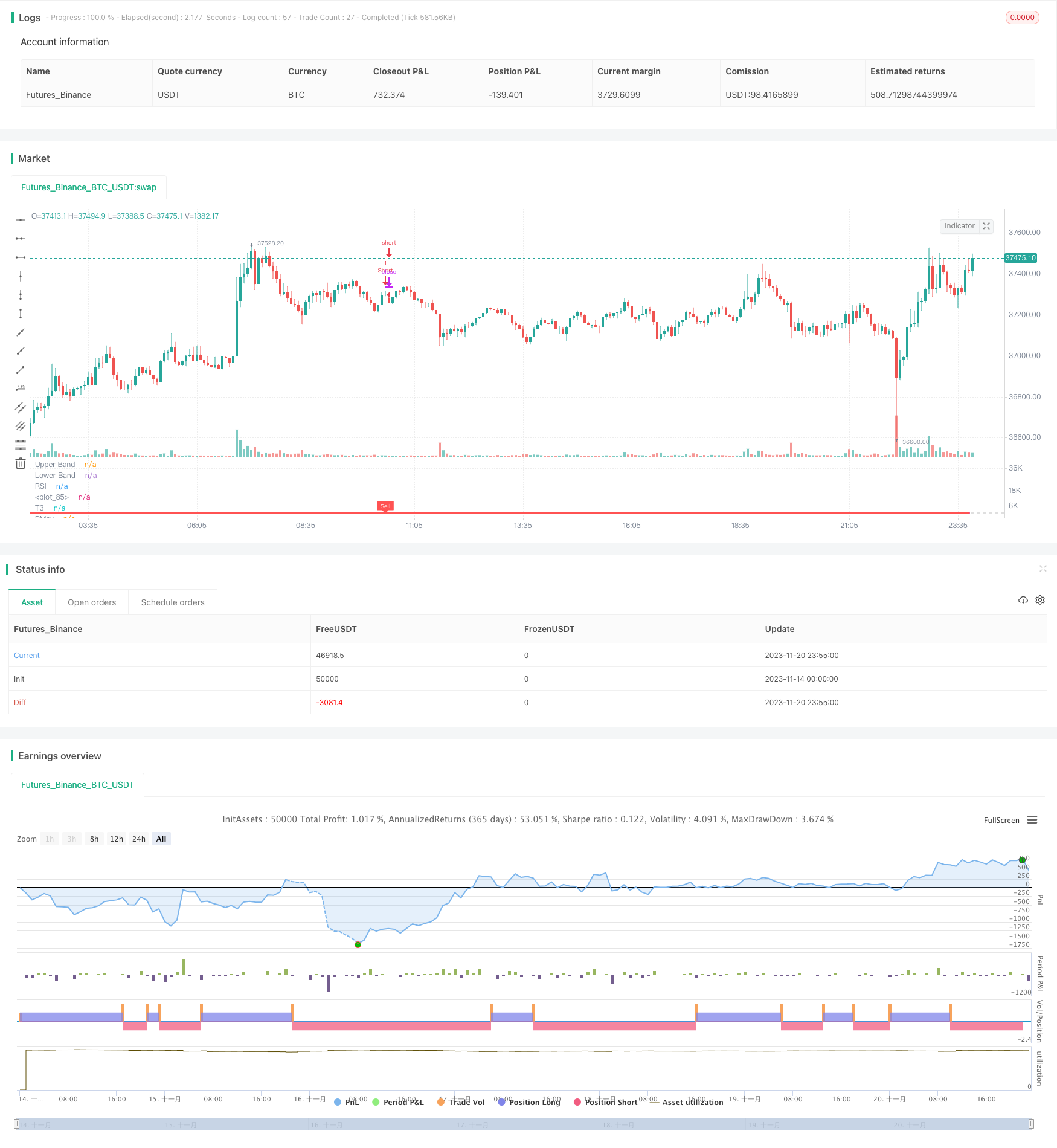

/*backtest

start: 2023-11-14 00:00:00

end: 2023-11-21 00:00:00

period: 5m

basePeriod: 1m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © KivancOzbilgic

//developer: @KivancOzbilgic

//author: @KivancOzbilgic

strategy("PMax on Rsi w T3 Strategy","PmR3St.", overlay=false, precision=2)

src = input(hl2, title="Source")

Multiplier = input(title="ATR Multiplier", type=input.float, step=0.1, defval=3)

length =input(8, "Tillson T3 Length", minval=1)

T3a1 = input(0.7, "TILLSON T3 Volume Factor", step=0.1)

Periods = input(10,title="ATR Length", type=input.integer)

rsilength = input(14, minval=1, title="RSI Length")

showrsi = input(title="Show RSI?", type=input.bool, defval=true)

showsupport = input(title="Show Moving Average?", type=input.bool, defval=true)

showsignalsk = input(title="Show Crossing Signals?", type=input.bool, defval=true)

highlighting = input(title="Highlighter On/Off ?", type=input.bool, defval=true)

i = close>=close[1] ? close-close[1] : 0

i2 = close<close[1] ? close[1]-close : 0

Wwma_Func(src,rsilength)=>

wwalpha = 1/ rsilength

WWMA = 0.0

WWMA := wwalpha*src + (1-wwalpha)*nz(WWMA[1])

WWMA=Wwma_Func(src,rsilength)

AvUp = Wwma_Func(i,rsilength)

AvDown = Wwma_Func(i2,rsilength)

AvgUp = sma(i,rsilength)

AvgDown =sma(i2,rsilength)

k1 = high>close[1] ? high-close[1] : 0

k2 = high<close[1] ? close[1]-high : 0

k3 = low>close[1] ? low-close[1] : 0

k4 = low<close[1] ? close[1]-low : 0

AvgUpH=(AvgUp*(rsilength-1)+ k1)/rsilength

AvgDownH=(AvgDown*(rsilength-1)+ k2)/rsilength

AvgUpL=(AvgUp*(rsilength-1)+ k3)/rsilength

AvgDownL=(AvgDown*(rsilength-1)+ k4)/rsilength

rs = AvUp/AvDown

rsi= rs==-1 ? 0 : (100-(100/(1+rs)))

rsh=AvgUpH/AvgDownH

rsih= rsh==-1 ? 0 : (100-(100/(1+rsh)))

rsl=AvgUpL/AvgDownL

rsil= rsl==-1 ? 0 : (100-(100/(1+rsl)))

TR=max(rsih-rsil,abs(rsih-rsi[1]),abs(rsil-rsi[1]))

atr=sma(TR,Periods)

plot(showrsi ? rsi : na, "RSI", color=#8E1599)

band1 = hline(70, "Upper Band", color=#C0C0C0)

band0 = hline(30, "Lower Band", color=#C0C0C0)

fill(band1, band0, color=#9915FF, transp=90, title="Background")

T3e1=ema(rsi, length)

T3e2=ema(T3e1,length)

T3e3=ema(T3e2,length)

T3e4=ema(T3e3,length)

T3e5=ema(T3e4,length)

T3e6=ema(T3e5,length)

T3c1=-T3a1*T3a1*T3a1

T3c2=3*T3a1*T3a1+3*T3a1*T3a1*T3a1

T3c3=-6*T3a1*T3a1-3*T3a1-3*T3a1*T3a1*T3a1

T3c4=1+3*T3a1+T3a1*T3a1*T3a1+3*T3a1*T3a1

T3=T3c1*T3e6+T3c2*T3e5+T3c3*T3e4+T3c4*T3e3

MAvg=T3

Pmax_Func(rsi,length)=>

longStop = MAvg - Multiplier*atr

longStopPrev = nz(longStop[1], longStop)

longStop := MAvg > longStopPrev ? max(longStop, longStopPrev) : longStop

shortStop = MAvg + Multiplier*atr

shortStopPrev = nz(shortStop[1], shortStop)

shortStop := MAvg < shortStopPrev ? min(shortStop, shortStopPrev) : shortStop

dir = 1

dir := nz(dir[1], dir)

dir := dir == -1 and MAvg > shortStopPrev ? 1 : dir == 1 and MAvg < longStopPrev ? -1 : dir

PMax = dir==1 ? longStop: shortStop

PMax=Pmax_Func(rsi,length)

plot(showsupport ? MAvg : na, color=color.black, linewidth=2, title="T3")

pALL=plot(PMax, color=color.red, linewidth=2, title="PMax", transp=0)

alertcondition(cross(MAvg, PMax), title="Cross Alert", message="PMax - Moving Avg Crossing!")

alertcondition(crossover(MAvg, PMax), title="Crossover Alarm", message="Moving Avg BUY SIGNAL!")

alertcondition(crossunder(MAvg, PMax), title="Crossunder Alarm", message="Moving Avg SELL SIGNAL!")

alertcondition(cross(src, PMax), title="Price Cross Alert", message="PMax - Price Crossing!")

alertcondition(crossover(src, PMax), title="Price Crossover Alarm", message="PRICE OVER PMax - BUY SIGNAL!")

alertcondition(crossunder(src, PMax), title="Price Crossunder Alarm", message="PRICE UNDER PMax - SELL SIGNAL!")

buySignalk = crossover(MAvg, PMax)

plotshape(buySignalk and showsignalsk ? PMax*0.995 : na, title="Buy", text="Buy", location=location.absolute, style=shape.labelup, size=size.tiny, color=color.green, textcolor=color.white, transp=0)

sellSignallk = crossunder(MAvg, PMax)

plotshape(sellSignallk and showsignalsk ? PMax*1.005 : na, title="Sell", text="Sell", location=location.absolute, style=shape.labeldown, size=size.tiny, color=color.red, textcolor=color.white, transp=0)

mPlot = plot(rsi, title="", style=plot.style_circles, linewidth=0,display=display.none)

longFillColor = highlighting ? (MAvg>PMax ? color.green : na) : na

shortFillColor = highlighting ? (MAvg<PMax ? color.red : na) : na

fill(mPlot, pALL, title="UpTrend Highligter", color=longFillColor)

fill(mPlot, pALL, title="DownTrend Highligter", color=shortFillColor)

dummy0 = input(true, title = "=Backtest Inputs=")

FromDay = input(defval = 1, title = "From Day", minval = 1, maxval = 31)

FromMonth = input(defval = 1, title = "From Month", minval = 1, maxval = 12)

FromYear = input(defval = 2005, title = "From Year", minval = 2005)

ToDay = input(defval = 1, title = "To Day", minval = 1, maxval = 31)

ToMonth = input(defval = 1, title = "To Month", minval = 1, maxval = 12)

ToYear = input(defval = 9999, title = "To Year", minval = 2006)

Start = timestamp(FromYear, FromMonth, FromDay, 00, 00)

Finish = timestamp(ToYear, ToMonth, ToDay, 23, 59)

Timerange() =>

time >= Start and time <= Finish ? true : false

if buySignalk

strategy.entry("Long", strategy.long,when=Timerange())

if sellSignallk

strategy.entry("Short", strategy.short,when=Timerange())