SARベースのトレンド追従型定量戦略

概要

投機溝戦略は,トレンドを追跡する量化取引戦略であり,SAR平滑曲線を主要取引信号として使用し,EMA,圧縮量,波動振動器などの複数のフィルターに付加し,SARパラメータを配置してトレンドの逆転点を識別し,低リスクのトレンドを追跡を実現します.これは中長期投資に適した戦略です.

戦略原則

この戦略は,パラパララインのSARを主要取引信号指標として使用する.SARは,価格トレンドの反転点を効果的に判断し,SAR記号が変化すると,トレンドが反転することを意味する.この戦略は,一般的にSARが反転したときに買ったり売ったりするシグナルを発する.

さらに,戦略はSARを突破するオプションも提供しています.つまり,SARが完全に逆転する前に,価格が最後のSAR値を突破した場合にシグナルを生成します.これは,戦略の感度をさらに追求することができます.

偽信号をフィルターするために,この戦略は,価格動向と取引シグナルの信頼性を確認するために,単独でも組み合わせて使用できる,EMA,圧縮量,波動性振動器の3つの補助フィルターも導入した.

最後に,戦略は,固定ストップ,固定ストップ,リスクリターン比率ストップなどの3つのストップ・ストップの方法を提供しています.これは,戦略を異なるタイプの取引品種に柔軟に適応させることができます.

優位分析

SARは,価格トレンドの逆転を正確に判断し,新しい価格トレンドをタイムリーに捉えることができ,中長線トレンドを追跡するのに適しています.

複数のフィルター設定により,偽破裂の確率を低くし,信号の信頼性を高めます.

配置はシンプルで柔軟で,異なる取引品種に対応するためにパラメータをカスタマイズできます.

リスクとリターンのバランスを追求する多種多様なストップ・ストップ・ロスを提供します.

自動化取引を実現するために,取引ロボットに直接接続できます.

リスク分析

傾向のない市場では,偽信号や無効取引が増加する可能性があります.

SARパラメータの不適切な設定は,信号判断の正確さにも影響する.

トレンド追跡策として,大波動の市場では,ストップ・ローンを容易に行う.

上記のリスクに対応して,SARパラメータまたはフィルターパラメータを適切に調整して,無効取引の確率を下げることができる.また,市場変動のより大きな波動に耐えるために,止損制限を適切に緩和することもできる.

最適化の方向

SARパラメータの最適化 SARのステップ長さとインクリメントパラメータの最適化により,より安定で効率的な取引戦略を得ることができる.

トレンド判断指標を導入する.戦略にMACD,DMIなどの補助判断指標を追加し,トレンド判断能力を向上させる.

リスク・リターン比率の最適化. 固定ストップ・ストップ・損失比率とリスク・リターン比率のパラメータを調整し,より高いリスクを適切に負うことで,より高いリターンを得ます.

外国為替品種を追加する. 現行の戦略はデジタル通貨取引のみをサポートしており,外国為替,商品,証券市場の品種をサポートする範囲を拡大することができます.

要約する

投機溝は,非常に実用的なトレンド型量化戦略である. それは,反応が敏感で,信号判断が信頼性があり,ストップ・ストップ・ストップ管理によって長期にわたる安定した利益を得ることができます.適切なパラメータとルール最適化は,戦略の効率をさらに向上させることができます. これは,長期にわたって使用する価値のある高効率の量化戦略です.

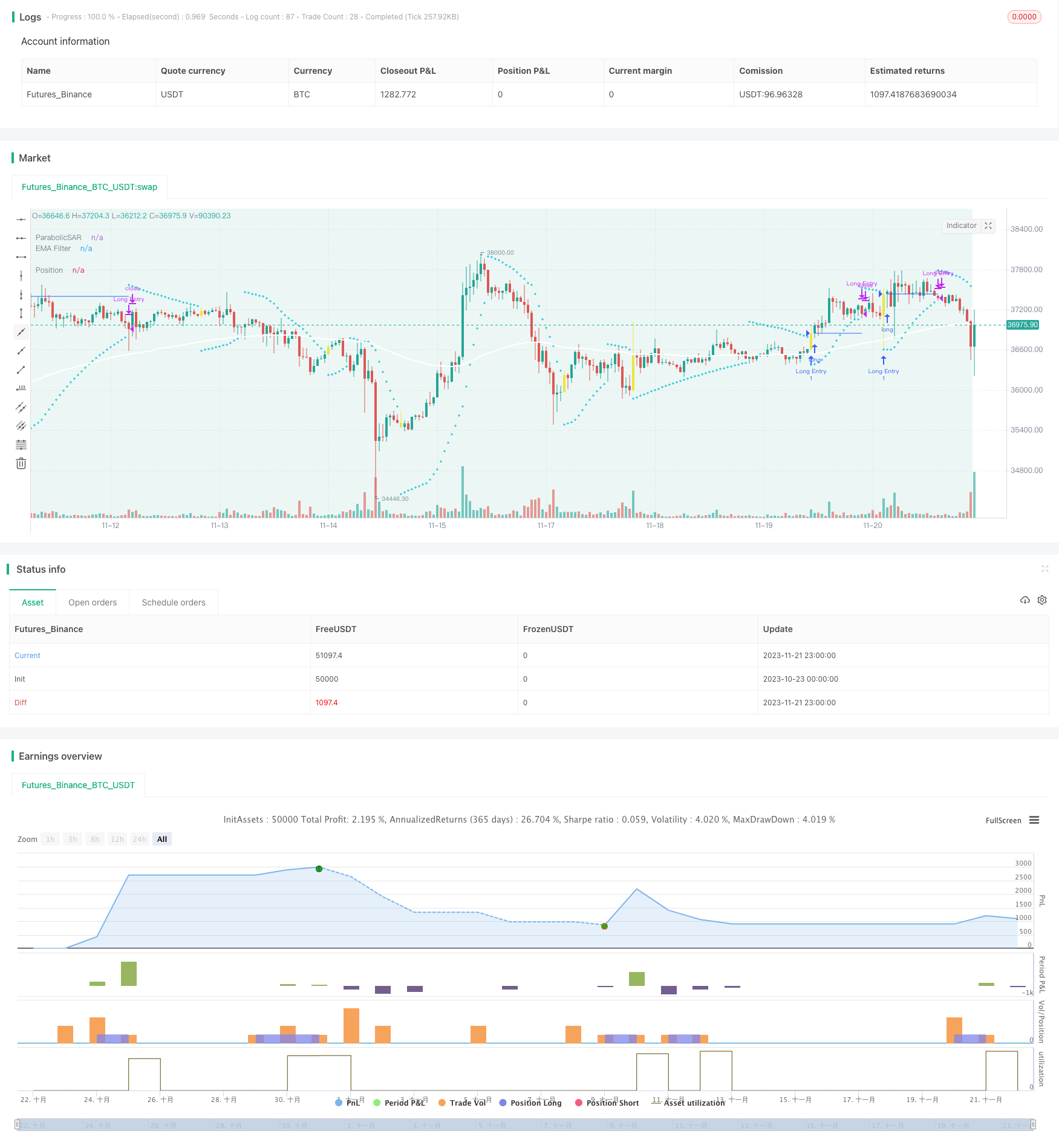

/*backtest

start: 2023-10-23 00:00:00

end: 2023-11-22 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//VERSION =================================================================================================================

//@version=5

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// This strategy is intended to study.

// It can also be used to signal a bot to open a deal by providing the Bot ID, email token and trading pair in the strategy settings screen.

// As currently written, this strategy uses a SAR PARABOLIC to send signal, and EMA, Squeeze Momentum, Volatility Oscilator as filter.

// There are two enter point, when SAR Flips, or Breakout Point - the last SAR Value before it Flips.

// There are tree options for exit: SAR Flips, Fixed Stop Loss ande Fixed Take Profit in % and Risk Reward tha can be set, 0.5/1, 1/1, 1/2 etc.

//Autor M4TR1X_BR

//▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒

//STRATEGY ================================================================================================================

strategy(title = 'BT-SAR Ema, Squeeze, Voltatility',

shorttitle = 'SAR ESV',

overlay = true)

//▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒

// INPUTS =================================================================================================================

// TIME INPUTS

usefromDate = input.bool(defval = true, title = 'Start date', inline = '0', group = "Time Filters")

initialDate = input(defval = timestamp('01 Jan 2022 00:00 UTC'), title = '', inline = "0",group = 'Time Filters',tooltip="This start date is in the time zone of the exchange ")

usetoDate = input.bool(defval = true, title = 'End date', inline = '1', group = "Time Filters")

finalDate = input(defval = timestamp('31 Dec 2029 23:59 UTC'), title = '', inline = "1",group = 'Time Filters',tooltip="This end date is in the time zone of the exchange")

// TIME LOGIC

inTradeWindow = true

// SAR PARABOLIC INPUTS ==================================================================================================

string sargroup= "SAR PARABOLIC ========================================="

start = input.float(defval=0.02,title='Start',inline='',group = sargroup)

increment = input.float(defval=0.02,title='Increment',inline='',group = sargroup)

maximum = input.float(defval=0.2,title='Maximo',inline='',group = sargroup)

// SAR PARABOLIC LOGIC

out = ta.sar(start, increment, maximum)

// SAR FLIP OR BREAKOUT OPTIONS

string bkgroup ='SAR TRADE SIGNAL ====================================== '

sarTradeSignal =input.string(defval='SAR Flip',title='SAR Trade Signal', options= ['SAR Flip','SAR Breakout'],group=bkgroup, tooltip='SAR Flip: Once the parabolic SAR flips it will send a signal, SAR Breakout: Will wait the price cross last Sar Value before it flips.')

nBars = input.int(defval=4,title='Bars',group=bkgroup, tooltip ='Define the number of bars for a entry when the price cross breakout point')

float sarBreakoutPoint= ta.valuewhen((close[1] < out[1]) and (close > out),out[1],0) //Get Sar Breakout Point

bool check = (close[1] < out[1]) and (close > out) //Verify when sar flips

bool BreakoutPrice = sarTradeSignal=='SAR Breakout'? (ta.barssince(check) < nBars) and ((open < sarBreakoutPoint) and (close > sarBreakoutPoint)): (ta.barssince(check) < nBars) and (close > out)

barcolor (check? color.yellow:na,title="Signal Bar color" )

// MOVING AVERAGES INPUTS ================================================================================================

string magroup = "Moving Average ========================================"

useEma = input.bool(defval = true, title = 'Moving Average Filter',inline='', group= magroup,tooltip='This will enable or disable Exponential Moving Average Filter on Strategy')

emaType=input.string (defval='Ema',title='Type',options=['Ema','Sma'],inline='', group= magroup)

emaSource = input.source(defval=close,title=" Source",inline="", group= magroup)

emaLength = input.int(defval=100,title="Length",minval=0,inline='', group= magroup)

// MOVING AVERAGE LOGIC

float ema = emaType=='Ema'? ta.ema(emaSource,emaLength): ta.sma(emaSource,emaLength)

// VOLATILITY OSCILLATOR =================================================================================================

string vogroup = "VOLATILITY OSCILLATOR ================================="

useVltFilter=input.bool(defval=true,title="Volatility Oscillator Filter",inline='',group= vogroup,tooltip='This will enable or disable Volatility Oscillator filter on Strategy')

vltFilterLength = input.int(defval=100,title="Volatility Oscillator",inline='',group=vogroup)

vltFilterSpike = close - open

vltFilterX = ta.stdev(vltFilterSpike,vltFilterLength)

vltFilterY = ta.stdev(vltFilterSpike,vltFilterLength) * -1

// SQUEEZE MOMENTUM INPUTS ==============================================================================================

string sqzgroup = "SQUEEZE MOMENTUM ====================================="

useSqzFilter=input.bool(defval=true,title="Squeeze Momentum Filter",inline='',group= sqzgroup, tooltip='This will enable or disable Squeeze Momentum filter on Strategy')

sqzFilterlength = input.int(defval=20, title='Bollinger Bands Length',inline='',group= sqzgroup)

sqzFiltermult = input.float(defval=2.0, title='Boliinger Bands Mult',inline='',group= sqzgroup)

keltnerLength = input.int(defval=20, title='Keltner Channel Length',inline='',group= sqzgroup)

keltnerMult = input.float(defval=1.5, title='Keltner Channel Mult',inline='',group= sqzgroup)

useTrueRange = input(true, title='Use TrueRange (KC)', inline='',group= sqzgroup)

// CALCULATE BOLLINGER BANDS

sqzFilterSrc = close

basis = ta.sma(sqzFilterSrc, sqzFilterlength)

dev = keltnerMult * ta.stdev(sqzFilterSrc, sqzFilterlength)

upperBB = basis + dev

lowerBB = basis - dev

// CALCULATE KELTNER CHANNEL

sma = ta.sma(sqzFilterSrc, keltnerLength)

range_1 = useTrueRange ? ta.tr : high - low

rangema = ta.sma(range_1, keltnerLength)

upperKC = sma + rangema * keltnerMult

lowerKC = sma - rangema * keltnerMult

// CHECK IF BOLLINGER BANDS IS IN OR OUT OF KELTNER CHANNEL

sqzOn = lowerBB > lowerKC and upperBB < upperKC

sqzOff = lowerBB < lowerKC and upperBB > upperKC

noSqz = sqzOn == false and sqzOff == false

// SQUEEZE MOMENTUM LOGIC

val = ta.linreg(sqzFilterSrc - math.avg(math.avg(ta.highest(high, keltnerLength), ta.lowest(low, keltnerLength)),ta.sma(close, keltnerLength)), keltnerLength, 0)

// ▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒

// TAKE PROFIT STOP LOSS INPUTS =========================================================================================

string tkpgroup='Take Profit =================================================='

tpType = input.string(defval = 'SAR Flip', title='Take Profit and Stop Loss', options=['SAR Flip','Fixed % TP/SL', 'Risk Reward TP/SL'], group=tkpgroup )

longTakeProfitPerc = input.float(defval = 1.5, title = 'Fixed TP %', minval = 0.05, step = 0.5, group=tkpgroup, tooltip = 'The percentage increase to set the take profit price target.')/100

longLossPerc = input.float(defval=1.0, title="Fixed Long SL %", minval=0.1, step=0.5, group = tkpgroup, tooltip = 'The percentage increase to set the Long Stop Loss price target.') * 0.01

//shortLossPerc = input.float(defval=1.5, title="Fixed Short SL (%)", minval=0.1, step=0.5, group = tkpgroup, tooltip = 'The percentage increase to set the Short Stop Loss price target.') * 0.01

longTakeProfitRR = input.float(defval = 1, title = 'Risk Reward TP', minval = 0.25, step = 0.25, group=tkpgroup, tooltip = 'The Risk Reward parameter.')

var plotStopLossRR = input.bool(defval=false, title='Show RR Stop Loss', group=tkpgroup)

//enableStopLossRR = input.bool(defval = false, title = 'Enable Risk Reward TP',group=tkpgroup, tooltip = 'Enable Variable Stop Loss.')

string trpgroup='Traling Profit ==============================================='

enableTrailing = input.bool(defval = false, title = 'Enable Trailing',group=trpgroup, tooltip = 'Enable or disable the trailing for take profit.')

trailingTakeProfitDeviationPerc = input.float(defval = 0.1, title = 'Trailing Take Profit Deviation %', minval = 0.01, maxval = 100, step = 0.01, group=trpgroup, tooltip = 'The step to follow the price when the take profit limit is reached.') / 100

// BOT MESSAGES

string msgroup='Alert Message For Bot ========================================='

messageEntry = input.string("", title="Strategy Entry Message",group=msgroup)

messageExit =input.string("",title="Strategy Exit Message",group=msgroup)

messageClose = input.string("", title="Strategy Close Message",group=msgroup)

// ▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒

// POSITIONS =============================================================================================================

//VERIFY IF THE BUY FILTERS ARE ON OR OFF

bool emaFilterBuy = useEma? (close > ema):(close >= ema) or (close <= ema)

bool volatilityFilterBuy = useVltFilter? (vltFilterSpike > vltFilterX) : (vltFilterSpike >= 0) or (vltFilterSpike <= 0)

bool sqzFilterBuy = useSqzFilter? (val > val[1]): (val >= val[1] or val <=val[1])

bool sarflip = (close > out)

//LONG / SHORT POSITIONS LOGIC

//Var 'check' will verify if the SAR flips and if the exit price occurs it will limit in bars number a new entry on the same signal.

bool limitEntryNumbers = (ta.barssince(check) < nBars)

bool openLongPosition = sarTradeSignal == 'SAR Flip'? (sarflip and emaFilterBuy and volatilityFilterBuy and sqzFilterBuy and limitEntryNumbers) :sarTradeSignal=='SAR Breakout'? (BreakoutPrice and emaFilterBuy and volatilityFilterBuy and sqzFilterBuy): na

bool openShortPosition = na

bool closeLongPosition= tpType=='SAR Flip'? (close < out):na

bool closeShortPosition=na

// CHEK OPEN POSITONS =====================================================================================================

// open signal when not already into a position

bool validOpenLongPosition = openLongPosition and strategy.opentrades.size(strategy.opentrades - 1) <= 0

bool longIsActive = validOpenLongPosition or strategy.opentrades.size(strategy.opentrades - 1) > 0

// ▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒

// TAKE PROFIT STOP LOSS CONFIG ==========================================================================================

// FIXED TAKE PROFIT IN %

float posSize = strategy.opentrades.entry_price(strategy.opentrades - 1) //Get the entry price

var float longTakeProfitPrice = na

longTakeProfitPrice := if (longIsActive)

if (openLongPosition and not (strategy.opentrades.size(strategy.opentrades - 1) > 0))

posSize * (1 + longTakeProfitPerc)

else

nz(longTakeProfitPrice[1], close * (1 + longTakeProfitPerc))

else

na

longTrailingTakeProfitStepTicks = longTakeProfitPrice * trailingTakeProfitDeviationPerc / syminfo.mintick

// FIXED STOP LOSS IN %

longStopPrice = strategy.position_avg_price * (1 - longLossPerc)

//shortStopPrice = strategy.position_avg_price * (1 + shortLossPerc)

// TAKE PROFIT BY RISK/REWARD

// Set stop loss

tta = not (strategy.opentrades.size(strategy.opentrades - 1) > 0)

float lastb = ta.valuewhen(check and tta,ta.lowest(low,5),0) - (10 * syminfo.mintick)

// TAKE PROFIT CALCULATION

float stopLossRisk = (posSize - lastb)

float takeProfitRR = posSize + (longTakeProfitRR * stopLossRisk)

// ▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒

// POSITION ORDERS =====================================================================================================

// LOGIC ===============================================================================================================

// getting into LONG position

if (openLongPosition) and (inTradeWindow)

strategy.entry(id = 'Long Entry', direction = strategy.long, alert_message=messageEntry)

//submit exit orders for trailing take profit price

if (longIsActive) and (inTradeWindow)

strategy.exit(id = 'Long Take Profit', from_entry = 'Long Entry', limit = enableTrailing ? na : tpType=='Fixed % TP/SL'? longTakeProfitPrice: tpType == 'Risk Reward TP/SL'? takeProfitRR:na, trail_price = enableTrailing ? longTakeProfitPrice : na, trail_offset = enableTrailing ? longTrailingTakeProfitStepTicks : na, stop = tpType =='Fixed % TP/SL' ? longStopPrice: tpType == 'Risk Reward TP/SL'? lastb:na) //, alert_message='{ "action": "close_at_market_price", "message_type": "bot", "bot_id": 9330698, "email_token": "392265bc-84eb-4a54-a99c-758383ff9449", "delay_seconds": 0,"pair":"USDT_{{ticker}}" }')

if (closeLongPosition)

strategy.close(id = 'Long Entry', alert_message='{ "action": "close_at_market_price", "message_type": "bot", "bot_id": 9330698, "email_token": "392265bc-84eb-4a54-a99c-758383ff9449", "delay_seconds": 0,"pair":"USDT_{{ticker}}" }')

// ▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒

// PLOTS ===============================================================================================================

// TRADE WINDOW ========================================================================================================

bgcolor(color = inTradeWindow ? color.new(#089981,90):na, title = 'Time Window')

// SAR PARABOLIC

var sarColor = color.new(#00bcd4,0)

plot(out, "ParabolicSAR", color=sarColor, linewidth=1,style=plot.style_cross)

//BREAKOUT LINE

var plotBkPoint = input.bool(defval=false, title='Show Breakout Point', group=bkgroup)

plot(series = (sarTradeSignal=='SAR Breakout' and plotBkPoint == true)? sarBreakoutPoint:na, title = 'Breakout line', color =color.new(#ffeb3b,50) , linewidth = 1, style = plot.style_linebr, offset = 0)

// EMA/SMA

var emafilterColor = color.new(color.white, 0)

plot(series=useEma? ema:na, title = 'EMA Filter', color = emafilterColor, linewidth = 2, style = plot.style_line)

// ENTRY PRICE

var posColor = color.new(#2962ff, 0)

plot(series = strategy.opentrades.entry_price(strategy.opentrades - 1), title = 'Position', color = posColor, linewidth = 1, style = plot.style_linebr,offset=0)

// FIXED TAKE PROFIT

var takeProfitColor = color.new(#ba68c8, 0)

plot(series = tpType=='Fixed % TP/SL'? longTakeProfitPrice:na, title = 'Fixed TP', color = takeProfitColor, linewidth = 1, style = plot.style_linebr, offset = 0)

// FIXED STOP LOSS

var stopLossColor = color.new(#ff0000, 0)

plot(series = tpType=='Fixed % TP/SL' ? longStopPrice:na, title = 'Fixed SL', color = stopLossColor, linewidth = 1, style = plot.style_linebr, offset = 0)

// RISK REWARD TAKE PROFIT

var takeProfitRRColor = color.new(#ba68c8, 0)

plot(series=tpType == 'Risk Reward TP/SL'? takeProfitRR:na,title='Risk Reward TP',color=takeProfitRRColor,linewidth=1,style=plot.style_linebr)

// STOP LOSS RISK REWARD

plot(series = (check and plotStopLossRR)? lastb:na, title = 'Last Bottom', color =color.new(#ff0000,0), linewidth = 2, style = plot.style_linebr, offset = 0)

// ======================================================================================================================