コンボトレンド逆転移動平均クロスオーバー戦略

作者: リン・ハーンチャオチャン開催日:2023年11月28日 13:47:05タグ:

概要

これは,より正確な取引信号を生成するために,トレンド逆転と移動平均クロスオーバー戦略を組み合わせるコンボ戦略です.

戦略の論理

戦略は2つの部分からなる.

-

123 逆転戦略: 閉じる価格が2日連続で上昇し,9日間のスローストカスティックは50を下回るとロング; 閉じる価格が2日連続で低下し,9日間の急速ストカスティックは50を超えるとショート.

-

ビル・ウィリアムズ平均戦略: 13,8 日,および 5 日間の中位価格移動平均を計算し,速いMAsが遅いMAsを横切るときに長引く.速いMAsが遅いMAsを下回るときに短引く.

最後に,実際の取引信号は,両方の戦略が方向に合意した場合にのみ生成されます.そうでなければ取引はありません.

利点分析

コンボ戦略は二重トレンド検証を使用してノイズをフィルターし,信号の精度を向上させる.さらに,移動平均値はノイズの一部をフィルターする.

リスク分析

リスクは次のとおりです

- ダブルフィルターは良い取引を見逃すかもしれない

- 誤ったMA設定は,トレンドを誤って判断する可能性があります.

- 逆転戦略自体には損失リスクがあります

リスクは,MAパラメータやエントリー/アウトリースロジックを最適化することで軽減できる.

オプティマイゼーションの方向性

戦略を最適化するには

- 最適なパラメータを見つけるために異なるMA組み合わせをテストする

- ストップ・ロスの追加

- 信号の質を識別するための音量を組み込む

- 自動最適化のための機械学習を使用

結論

この戦略は,ダブルトレンドフィルターとMAを組み合わせて,ノイズを効果的にフィルタリングし,意思決定の正確性を向上させる.しかし,リスクは存在し,安定した収益性を得る前に論理の継続的な最適化が必要です.

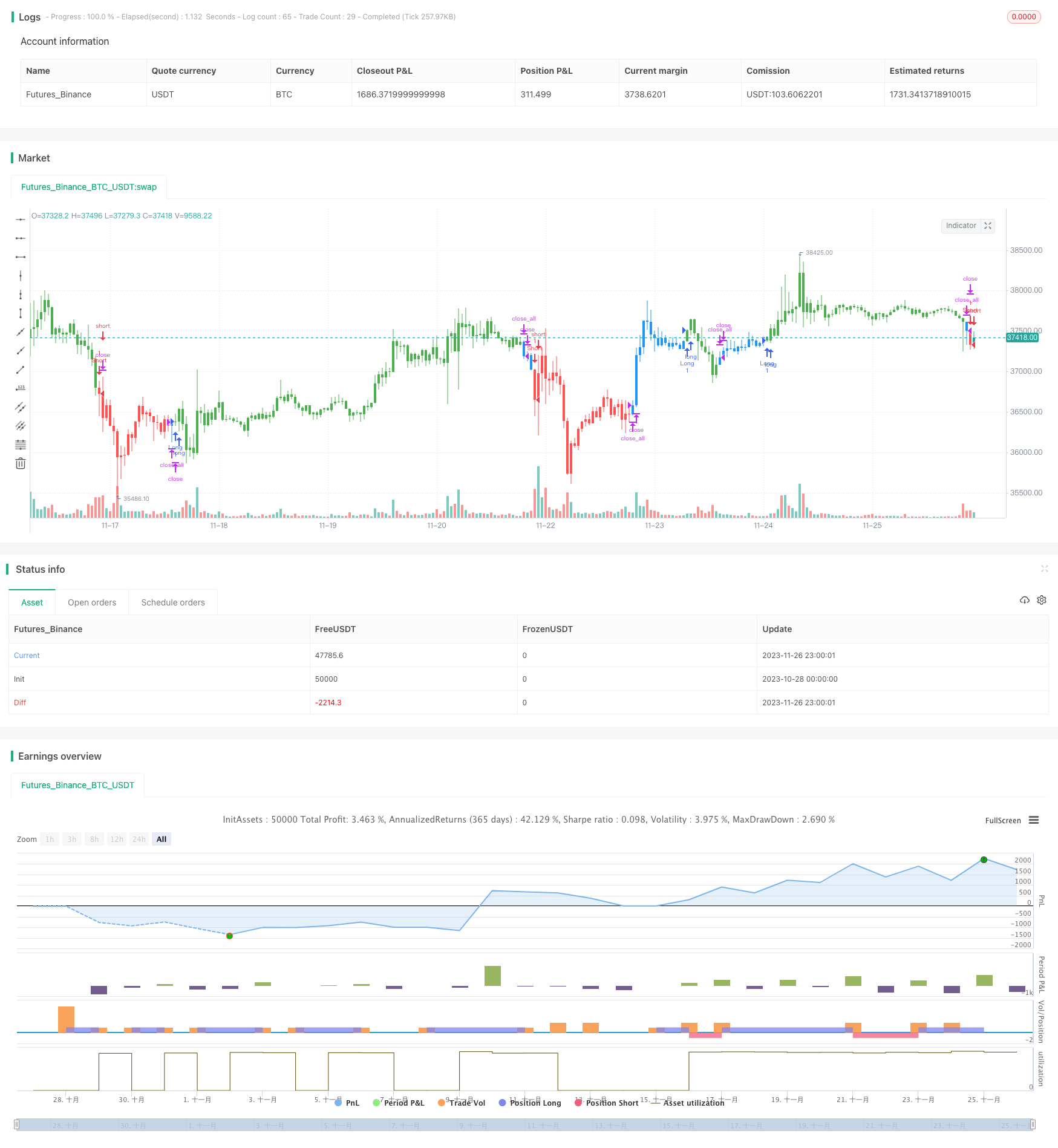

/*backtest

start: 2023-10-28 00:00:00

end: 2023-11-27 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=3

////////////////////////////////////////////////////////////

// Copyright by HPotter v1.0 18/06/2019

// This is combo strategies for get

// a cumulative signal. Result signal will return 1 if two strategies

// is long, -1 if all strategies is short and 0 if signals of strategies is not equal.

//

// First strategy

// This System was created from the Book "How I Tripled My Money In The

// Futures Market" by Ulf Jensen, Page 183. This is reverse type of strategies.

// The strategy buys at market, if close price is higher than the previous close

// during 2 days and the meaning of 9-days Stochastic Slow Oscillator is lower than 50.

// The strategy sells at market, if close price is lower than the previous close price

// during 2 days and the meaning of 9-days Stochastic Fast Oscillator is higher than 50.

//

// Second strategy

// This indicator calculates 3 Moving Averages for default values of

// 13, 8 and 5 days, with displacement 8, 5 and 3 days: Median Price (High+Low/2).

// The most popular method of interpreting a moving average is to compare

// the relationship between a moving average of the security's price with

// the security's price itself (or between several moving averages).

//

// WARNING:

// - For purpose educate only

// - This script to change bars colors.

////////////////////////////////////////////////////////////

Reversal123(Length, KSmoothing, DLength, Level) =>

vFast = sma(stoch(close, high, low, Length), KSmoothing)

vSlow = sma(vFast, DLength)

pos = 0.0

pos := iff(close[2] < close[1] and close > close[1] and vFast < vSlow and vFast > Level, 1,

iff(close[2] > close[1] and close < close[1] and vFast > vSlow and vFast < Level, -1, nz(pos[1], 0)))

pos

BillWilliamsAverages(LLength, MLength,SLength, LOffset,MOffset, SOffset ) =>

xLSma = sma(hl2, LLength)[LOffset]

xMSma = sma(hl2, MLength)[MOffset]

xSSma = sma(hl2, SLength)[SOffset]

pos = 0

pos := iff(close < xSSma and xSSma < xMSma and xMSma < xLSma, -1,

iff(close > xSSma and xSSma > xMSma and xMSma > xLSma, 1, nz(pos[1], 0)))

pos

strategy(title="Combo Backtest 123 Reversal & Bill Williams Averages. 3Lines", shorttitle="Combo", overlay = true)

Length = input(14, minval=1)

KSmoothing = input(1, minval=1)

DLength = input(3, minval=1)

Level = input(50, minval=1)

//-------------------------

LLength = input(13, minval=1)

MLength = input(8,minval=1)

SLength = input(5,minval=1)

LOffset = input(8,minval=1)

MOffset = input(5,minval=1)

SOffset = input(3,minval=1)

reverse = input(false, title="Trade reverse")

posReversal123 = Reversal123(Length, KSmoothing, DLength, Level)

posBillWilliamsAverages = BillWilliamsAverages(LLength, MLength,SLength, LOffset, MOffset, SOffset)

pos = iff(posReversal123 == 1 and posBillWilliamsAverages == 1 , 1,

iff(posReversal123 == -1 and posBillWilliamsAverages == -1, -1, 0))

possig = iff(reverse and pos == 1, -1,

iff(reverse and pos == -1, 1, pos))

if (possig == 1)

strategy.entry("Long", strategy.long)

if (possig == -1)

strategy.entry("Short", strategy.short)

if (possig == 0)

strategy.close_all()

barcolor(possig == -1 ? red: possig == 1 ? green : blue )

もっと

- ドンチアン・トレンド戦略

- マルチSMA移動平均のクロスオーバー戦略

- マルチRSIインジケーター取引戦略

- 超トレンド戦略 ストップ損失を後押しする

- 重度の移動平均のブレイクアウト逆転戦略

- 移動平均相対強度指数戦略

- ADX インテリジェントトレンド追跡戦略

- RSIのモメントマグネレーション戦略

- 価格格差に基づくストップ損失戦略

- 移動平均のブレイクアウト戦略

- ポイントベースのRSIディバージェンツ戦略

- 黄金比率 長期戦略

- RSIフィルター付きのボリンガーバンド戦略

- ケルトナー チャンネル に 基づく 戦略 を フォロー する 傾向

- RSI移動平均のクロスオーバー戦略

- モメントブレイクトレード戦略

- ダイナミックなRSIとCCIを組み合わせた多要素量的な取引戦略

- スーパーZ量的な傾向戦略

- キャンドルスタイク・パターンの戦略

- CKモメンタム逆転ストップ損失戦略