二重のCCI量的な戦略

作者: リン・ハーンチャオチャン, 日付: 2023-11-28 15:47:04タグ:

概要

この戦略は,クラシックな技術指標CCIと自社開発したVCIとMCIの二重指数を組み合わせて,典型的な定量的な取引戦略である取引信号を形成する. 量と価格の変化の傾向と勢いを特定することによって,現在の市場の主要な方向性を決定し,取引信号を形成する. デジタル通貨,外国為替,株式などの金融機器に広く使用することができます.

戦略原則

- ohlc4移動平均を計算し, cci指標と組み合わせて価格レベルを判断します.

- 資本流動を測定するためのオーブ指標を計算する.

- VCI インデックスを計算する.このインデックスは,オーブ指標の変数による資本流の分布を測定する.

- MCI インデックスを計算し,価格の変動による価格の分布を測定する.

- 市場情勢を判断するために,VCIとMCIを比較する.

- VCI > MCI 高い購入意欲

- VCI < MCI 強い販売関心

- VCIとMCIの比較に基づいて長信号と短信号を形成する.

利点分析

- 戦略は,価格,取引量,資本流量などの多面性を考慮し,比較的正確な信号で市場情勢を判断する.

- VCIとMCIは,動的標準偏差によって計算され,リアルタイム市場変化に適応することができる.

- 戦略パラメータは,広範なバックテストによって最適化され,強い安定性があります.

リスク分析

- 価格と取引量の指標の計算は遅れており,突然の出来事を事前に把握することはできません.

- 単一の戦略は 複雑で不安定な市場状況を完全にカバーすることはできません

- 他の補助指標と併用し,市場を単独で判断することはできません.

オプティマイゼーションの方向性

- 深層学習などの予測モデルを組み込み,信号判断の精度を向上させる.

- 戦略の安定性を高めるため,ストップロスのようなリスク管理モジュールを追加する.

- 特定の市場での適用性をテストするために,異なるパラメータの組み合わせを試す.

結論

この戦略は,市場情勢を評価するために,価格や取引量などの要因を考慮して,二重CCIインデックスを比較することによって取引信号を形成する.これは典型的な実践的な定量的な取引戦略である.しかし,戦略の有効性を最大化するために,他の補助ツールと一緒に使用する必要がある.リスクを軽減しながら適用可能なシナリオをさらに最適化し,拡大することは価値がある.

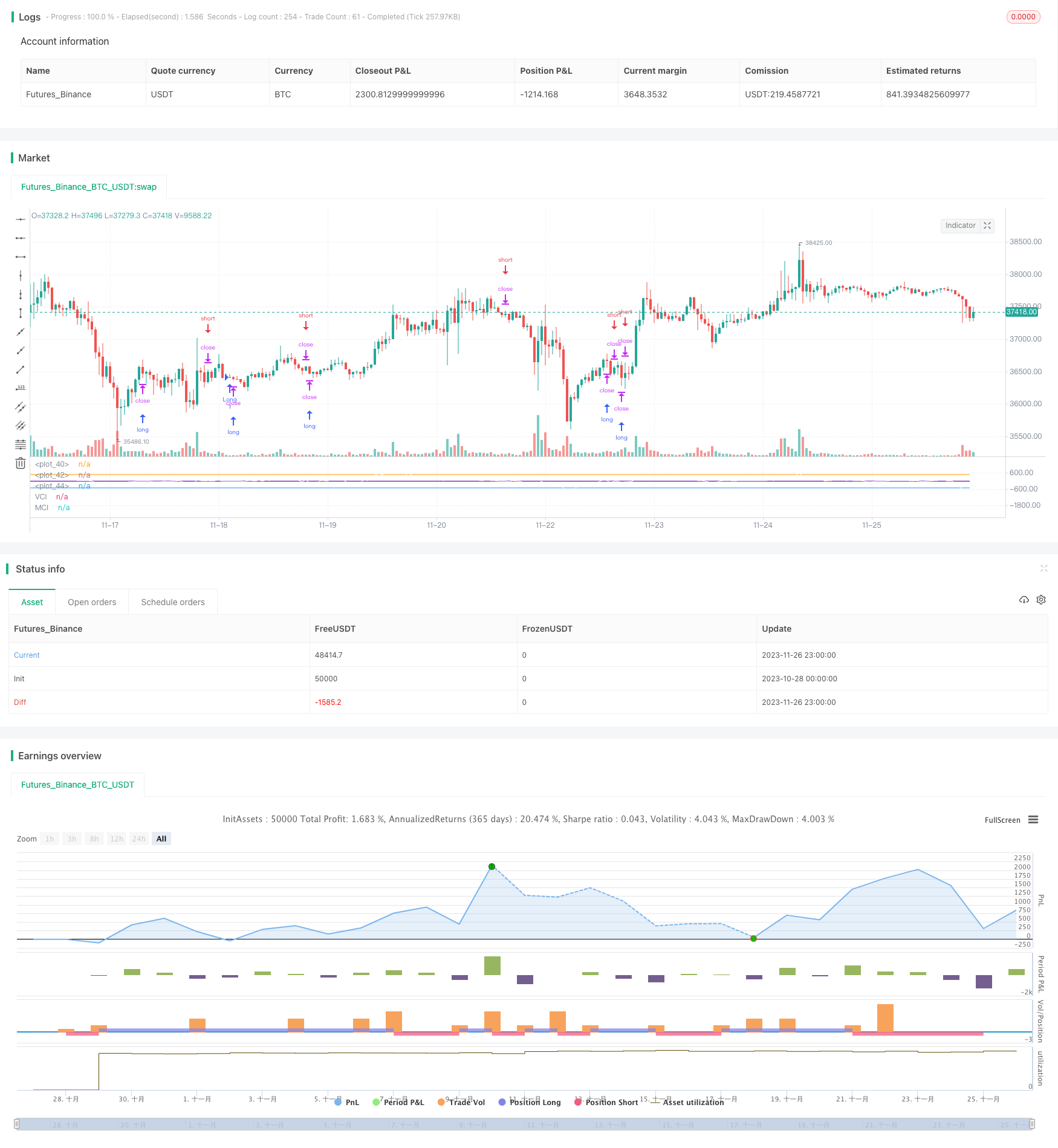

/*backtest

start: 2023-10-28 00:00:00

end: 2023-11-27 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=3

strategy("MCI and VCI - Modified CCI Formulas")

test = cci(ohlc4, 13)

test1 = cci(ohlc4, 20)

obv(src) => cum(change(src) > 0 ? volume : change(src) < 0 ? -volume : 0*volume)

mDisc = input(0, title="Mode Discrepency")

mDiv = input(0.015, title="Interval")

mean(_src, _length)=>

_return = sum(_src, _length) / _length

median(_src, _length)=>

_return = _src

for _i = 0 to _length

_return := _return == 0 ? _src : (_return + _src[_i]) / 2

_return

len = input(20, title="Standard (Average) Length")

mmm = input(20, title="Lookback length")

srcV = obv(input(ohlc4))

srcP = input(close)

x = sma(srcV, len)

MDV2 = abs(stdev(median(x, len), mmm))

MDV3 = abs(stdev(mean(x, len), mmm))

AMDV = (MDV2+MDV3)/2

pt1v = (srcV-ema(srcV, len))/ AMDV

pt2v = 1/mDiv

VCI=pt1v*pt2v

y = ema(srcP, len)

MDP2 = abs(stdev(median(y, len), mmm))

MDP3 = abs(stdev(mean(y, len), mmm))

AMDA = (MDP2 + MDP3)/2

pt1p = 1/mDiv

pt2p = (srcP-ema(srcP, len))/ AMDA

MCI = pt1p * pt2p

plot(VCI, color=yellow, title="VCI", style="Histogram")

plot(MCI, color=white, title="MCI")

plot(500, style=line)

plot(0, style=line, linewidth=2)

plot(-500, style=line)

long = crossover(MCI, 0) and VCI > MCI[2]

short = crossunder(MCI, 0) and VCI < MCI[2]

//Time Control

//Set date and time

FromMonth = input(defval = 9, title = "From Month", minval = 1, maxval = 12)

FromDay = input(defval = 13, title = "From Day", minval = 1, maxval = 31)

FromYear = input(defval = 2018, title = "From Year", minval = 2017)

ToMonth = input(defval = 1, title = "To Month", minval = 1, maxval = 12)

ToDay = input(defval = 1, title = "To Day", minval = 1, maxval = 31)

ToYear = input(defval = 9999, title = "To Year", minval = 2017)

// === FUNCTION EXAMPLE ===

start = timestamp(FromYear, FromMonth, FromDay, 00, 00) // backtest start window

finish = timestamp(ToYear, ToMonth, ToDay, 23, 59) // backtest finish window

window() => time >= start and time <= finish ? true : false // create function "within window of time"

direction = input(0, title = "Strategy Direction", minval=-1, maxval=1)

strategy.risk.allow_entry_in(direction == 0 ? strategy.direction.all : (direction < 0 ? strategy.direction.short : strategy.direction.long))

if (long)

strategy.entry("Long", strategy.long, when=window(), limit=ohlc4, oca_name="BollingerBands", comment="BBandLE")

else

strategy.cancel(id="Long")

if (short)

strategy.entry("Short", strategy.short, when=window(), limit=ohlc4, oca_name="BollingerBands", comment="BBandSE")

else

strategy.cancel(id="Short")

もっと

- ハラミ 閉店価格戦略

- CMOとWMAをベースにしたモメンタム・トレード戦略

- P-Signal マルチタイムフレーム取引戦略

- コモディティ・モメントムインデックス戦略

- ダブル・タートル・ブレークスルー戦略

- 波動傾向に基づく定量的な取引戦略

- イチモク・クモ・トウィスト ゴールド吸収戦略

- 部分的な利益を取る戦略でステップアップトラッキングストップ

- Hull TSI と CCI の移動平均傾向追跡戦略

- リバースエンジニアリング RSI 戦略

- 双 EMA クロスオーバー ブレイクアウト 戦略

- マルチタイムフレームMACD戦略

- RSIとATR経路に基づく超スカルピング戦略

- ドンチアン・トレンド戦略

- マルチSMA移動平均のクロスオーバー戦略

- マルチRSIインジケーター取引戦略

- 超トレンド戦略 ストップ損失を後押しする

- 重度の移動平均のブレイクアウト逆転戦略

- 移動平均相対強度指数戦略

- ADX インテリジェントトレンド追跡戦略