TFOとATRに基づくトレンド追跡ストップ損失戦略

作者: リン・ハーンチャオチャン, 日付: 2023-12-04 13:32:41タグ:

概要

この戦略は,ジョン・エーラーズ博士のトレンドフレックスオシレーター (TFO) と平均真の範囲 (ATR) 指標に基づいて設計されています. これは牛市場に適しており,過売り価格の動きが逆転するように見えたときにロングポジションを開きます. 熊市場に捕まらない限り,通常数日以内にポジションを閉じる. この場合,保持します. この戦略はパラメータを構成可能にしてバックテストを簡素化しますが,バックテスト結果は完全に信頼されるべきではありません.

戦略の論理

この戦略は,TFOとATRの指標を組み合わせて入口と出口を決定します.

入場条件:TFOが限界値を下回り (過売値を示し),TFOが前のバーから上昇し (TFOの逆転を上向きに示す),ATRが設定された波動性限界値を超えると (市場の波動性が増加することを示す) ロングポジションが開かれる.

エクジット条件: TFO が値を下げると (過剰購入値を示し),ATR が値を下げると,すべてのロングポジションは閉鎖される.また,値が値を下げるとすべてのポジションはストップ・ロスが終了する.ユーザーはインジケーター信号に基づいて戦略の退出を許可するか,ストップ・ロスのみに基づいて選択することができます.

この戦略では,最大15つの同時ロングポジションが可能です.パラメータは異なるタイムフレームに調整できます.

利点

-

トレンドと波動性分析を組み合わせると安定した信号が伝わります.TFOは早期のトレンド逆転信号を捉え,ATRは波動性の急増を特定します.

-

調節可能なエントリー,出口,ストップ損失パラメータは柔軟性を提供します.ユーザーは市場の状況に基づいて最適化することができます.

-

ストップ・ロスは極端な動きから守ります.ストップ・ロスは量子取引において不可欠です.

-

ピラミッド型と部分的な退出への支援は,牛市場での利益複合を可能にします.

リスク

-

短縮するメカニズムは無い 市場が落ちるから利益を得られない 厳しい熊市は大きな損失を引き起こす

-

パラメータの調節が不十分である場合,過剰な取引または入口と出口を逃す可能性があります.最適なパラメータを見つけるには広範なテストが必要です.

-

極端な動きでは,ストップ・ロスは失敗し,大きな損失を防ぐことができません.

-

バックテストは実演を完全に反映していない.いくつかの偏差を期待してください.

増進 の 機会

-

移動ストップ損失線が追加されれば 適切なタイミングで退場し 下向きの保護ができます

-

TFOが下がり,ATRが十分高いとき,市場の落ち込み時に利益を得られるようにショートメカニズムを追加することができる.

-

価格変動の影響を減らすことができます 価格変動の影響を減らすことができます

-

最適な組み合わせを見つけるために 異なる時間枠とパラメータをテストできます

結論

この戦略は,市場方向を決定するためにTFOとATRを使用してトレンドと変動分析の強みを組み合わせます.ピラミディング,部分的な閉鎖,トライリングストップ損失などのメカニズムにより,牛市中にリスクを制御しながら利益複合が可能になります.より多くの指標フィルターとパラメータ最適化を通じて改善の余地があります.これは量子戦略の基本的な目標を達成し,さらなる研究と適用に値します.

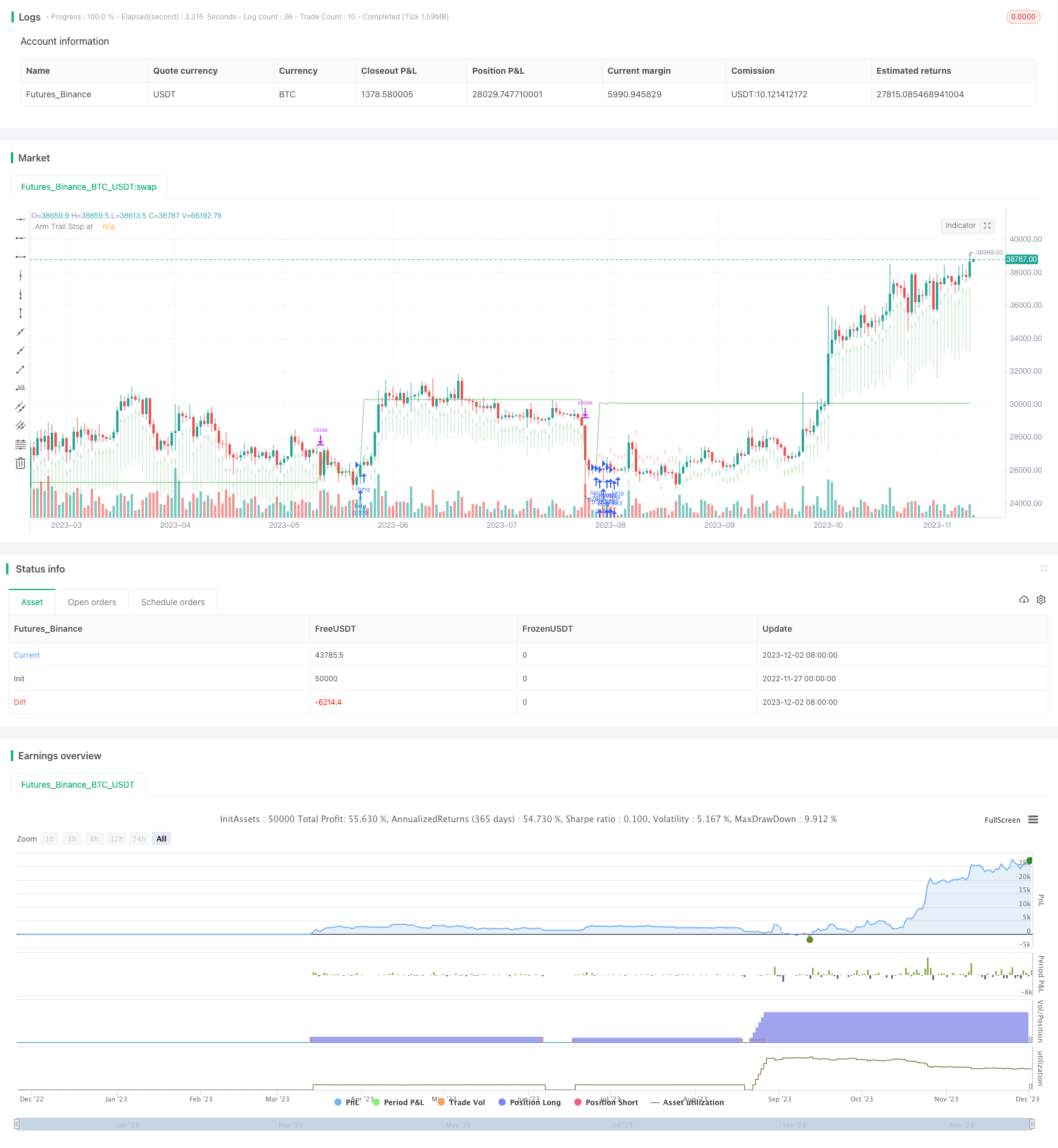

/*backtest

start: 2022-11-27 00:00:00

end: 2023-12-03 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © Chart0bserver

//

// Open Source attributions:

// portions © allanster (date window code)

// portions © Dr. John Ehlers (Trend Flex Oscillator)

//

// READ THIS CAREFULLY!!! ----------------//

// This code is provided for educational purposes only. The results of this strategy should not be considered investment advice.

// The user of this script acknolwedges that it can cause serious financial loss when used as a trading tool

// This strategy has a bias for HODL (Holds on to Losses) meaning that it provides NO STOP LOSS protection!

// Also note that the default behavior is designed for up to 15 open long orders, and executes one order to close them all at once.

// Opening a long position is predicated on The Trend Flex Oscillator (TFO) rising after being oversold, and ATR above a certain volatility threshold.

// Closing a long is handled either by TFO showing overbought while above a certain ATR level, or the Trailing Stop Loss. Pick one or both.

// If the strategy is allowed to sell before a Trailing Stop Loss is triggered, you can set a "must exceed %". Do not mistake this for a stop loss.

// Short positions are not supported in this version. Back-testing should NEVER be considered an accurate representation of actual trading results.

//@version=5

strategy('TFO + ATR Strategy with Trailing Stop Loss', 'TFO ATR Trailing Stop Loss', overlay=true, pyramiding=15, default_qty_type=strategy.cash, default_qty_value=10000, initial_capital=150000, currency='USD', commission_type=strategy.commission.percent, commission_value=0.5)

strategy.risk.allow_entry_in(strategy.direction.long) // There will be no short entries, only exits from long.

// -----------------------------------------------------------------------------------------------------------//

// Back-testing Date Range code ----------------------------------------------------------------------------//

// ---------------------------------------------------------------------------------------------------------//

fromMonth = input.int(defval=9, title='From Month', minval=1, maxval=12, group='Back-Testing Start Date')

fromDay = input.int(defval=1, title='From Day', minval=1, maxval=31, group='Back-Testing Start Date')

fromYear = input.int(defval=2021, title='From Year', minval=1970, group='Back-Testing Start Date')

thruMonth = 1 //input(defval = 1, title = "Thru Month", type = input.integer, minval = 1, maxval = 12, group="Back-Testing Date Range")

thruDay = 1 //input(defval = 1, title = "Thru Day", type = input.integer, minval = 1, maxval = 31, group="Back-Testing Date Range")

thruYear = 2112 //input(defval = 2112, title = "Thru Year", type = input.integer, minval = 1970, group="Back-Testing Date Range")

// === FUNCTION EXAMPLE ===

start = timestamp(fromYear, fromMonth, fromDay, 00, 00) // backtest start window

finish = timestamp(thruYear, thruMonth, thruDay, 23, 59) // backtest finish window

window() => // create function "within window of time

time >= start and time <= finish ? true : false

// Date range code -----//

// -----------------------------------------------------------------------------------------------------------//

// ATR Indicator Code --------------------------------------------------------------------------------------//

// ---------------------------------------------------------------------------------------------------------//

length = 18 //input(title="ATR Length", defval=18, minval=1)

Period = 18 //input(18,title="ATR EMA Period")

basicEMA = ta.ema(close, length)

ATR_Function = ta.ema(ta.tr(true), length)

EMA_ATR = ta.ema(ATR_Function, Period)

ATR = ta.ema(ta.tr(true), length)

ATR_diff = ATR - EMA_ATR

volatility = 100 * ATR_diff / EMA_ATR // measure of spread between ATR and EMA

volatilityAVG = math.round((volatility + volatility[1] + volatility[2]) / 3)

buyVolatility = input.int(3, 'Min Volatility for Buy', minval=-20, maxval=20, step=1, group='Average True Range')

sellVolatility = input.int(13, 'Min Volatility for Sell', minval=-10, maxval=20, step=1, group='Average True Range')

useAvgVolatility = input.bool(defval=false, title='Average the Volatility over 3 bars', group='Average True Range')

// End of ATR ------------/

// -----------------------------------------------------------------------------------------------------------//

// TFO Indicator code --------------------------------------------------------------------------------------//

// ---------------------------------------------------------------------------------------------------------//

trendflex(Series, PeriodSS, PeriodTrendFlex, PeriodEMA) =>

var SQRT2xPI = math.sqrt(8.0) * math.asin(1.0) // 4.44288293815 Constant

alpha = SQRT2xPI / PeriodSS

beta = math.exp(-alpha)

gamma = -beta * beta

delta = 2.0 * beta * math.cos(alpha)

float superSmooth = na

superSmooth := (1.0 - delta - gamma) * (Series + nz(Series[1])) * 0.5 + delta * nz(superSmooth[1]) + gamma * nz(superSmooth[2])

E = 0.0

for i = 1 to PeriodTrendFlex by 1

E += superSmooth - nz(superSmooth[i])

E

epsilon = E / PeriodTrendFlex

zeta = 2.0 / (PeriodEMA + 1.0)

float EMA = na

EMA := zeta * epsilon * epsilon + (1.0 - zeta) * nz(EMA[1])

return_1 = EMA == 0.0 ? 0.0 : epsilon / math.sqrt(EMA)

return_1

upperLevel = input.float(1.2, 'TFO Upper Level', minval=0.1, maxval=2.0, step=0.1, group='Trend Flex Ocillator')

lowerLevel = input.float(-0.9, 'TFO Lower Level', minval=-2.0, maxval=-0.1, step=0.1, group='Trend Flex Ocillator')

periodTrendFlex = input.int(14, 'TrendFlex Period', minval=2, group='Trend Flex Ocillator')

useSuperSmootherOveride = true //input( true, "Apply SuperSmoother Override Below*", input.bool, group="Trend Flex Ocillator")

periodSuperSmoother = 8.0 //input(8.0, "SuperSmoother Period*", input.float , minval=4.0, step=0.5, group="Trend Flex Ocillator")

postSmooth = 33 //input(33.0, "Post Smooth Period**", input.float , minval=1.0, step=0.5, group="Trend Flex Ocillator")

trendFlexOscillator = trendflex(close, periodSuperSmoother, periodTrendFlex, postSmooth)

// End of TFO -------------//

// -----------------------------------------------------------------------------------------------------------//

// HODL Don't sell if losing n% ---------------------------------------------------------------------------- //

// ---------------------------------------------------------------------------------------------------------//

sellOnStrategy = input.bool(defval=true, title='Allow Stategy to close positions', group='Selling Conditions')

doHoldLoss = true // input(defval = true, title = "Strategy can sell for a loss", type = input.bool, group="Selling Conditions")

holdLoss = input.int(defval=0, title='Value (%) must exceed ', minval=-25, maxval=10, step=1, group='Selling Conditions')

totalInvest = strategy.position_avg_price * strategy.position_size

openProfitPerc = strategy.openprofit / totalInvest

bool acceptableROI = openProfitPerc * 100 > holdLoss

// -----------------------//

// -----------------------------------------------------------------------------------------------------------//

// Buying and Selling conditions -------------------------------------------------------------------------- //

// ---------------------------------------------------------------------------------------------------------//

if useAvgVolatility

volatility := volatilityAVG

volatility

tfoBuy = trendFlexOscillator < lowerLevel and trendFlexOscillator[1] < trendFlexOscillator // Always make a purchase if TFO is in this lowest range

atrBuy = volatility > buyVolatility

tfoSell = ta.crossunder(trendFlexOscillator, upperLevel)

consensusBuy = tfoBuy and atrBuy

consensusSell = tfoSell and volatility > sellVolatility

if doHoldLoss

consensusSell := consensusSell and acceptableROI

consensusSell

// --------------------//

// -----------------------------------------------------------------------------------------------------------//

// Tracing & Debugging --------------------------------------------------------------------------------------//

// ---------------------------------------------------------------------------------------------------------//

plotchar(strategy.opentrades, 'Number of open trades', ' ', location.top)

plotarrow(100 * openProfitPerc, 'Profit on open longs', color.new(color.green, 75), color.new(color.red, 75))

// plotchar(strategy.position_size, "Shares on hand", " ", location.top)

// plotchar(totalInvest, "Total Invested", " ", location.top)

// plotarrow(strategy.openprofit, "Open profit dollar amount", color.new(color.green,100), color.new(color.red, 100))

// plotarrow(strategy.netprofit, "Net profit for session", color.new(color.green,100), color.new(color.red, 100))

// plotchar(acceptableROI, "Acceptable ROI", " ", location.top)

// plotarrow(volatility, "ATR volatility value", color.new(color.green,75), color.new(color.red, 75))

// plotchar(strategy.position_avg_price, "Avgerage price of holdings", " ", location.top)

// plotchar(volatilityAVG, "AVG volatility", " ", location.top)

// plotchar(fiveBarsVal, "change in 5bars", " ", location.top)

// plotchar(crossingUp, "crossingUp", "x", location.belowbar, textcolor=color.white)

// plotchar(crossingDown, "crossingDn", "x", location.abovebar, textcolor=color.white)

// plotchar(strategy.closedtrades, "closedtrades", " ", location.top)

// plotchar(strategy.wintrades, "wintrades", " ", location.top)

// plotchar(strategy.losstrades, "losstrades", " ", location.top)

// plotchar(close, "close", " ", location.top)

//--------------------//

// -----------------------------------------------------------------------------------------------------------//

// Trade Alert Execution ------------------------------------------------------------------------------------//

// ---------------------------------------------------------------------------------------------------------//

strategy.entry('long', strategy.long, when=window() and consensusBuy, comment='long')

if sellOnStrategy

strategy.close('long', when=window() and consensusSell, qty_percent=100, comment='Strat')

// -----------------------------------------------------------------------------------------------------------//

// Trailing Stop Loss logic -------------------------------------------------------------------------------- //

// ---------------------------------------------------------------------------------------------------------//

useTrailStop = input.bool(defval=true, title='Set Trailing Stop Loss on avg positon value', group='Selling Conditions')

arm = input.float(defval=15, title='Trailing Stop Arms At (%)', minval=1, maxval=30, step=1, group='Selling Conditions') * 0.01

trail = input.float(defval=2, title='Trailing Stop Loss (%)', minval=0.25, maxval=9, step=0.25, group='Selling Conditions') * 0.1

longStopPrice = 0.0

stopLossPrice = 0.0

if strategy.position_size > 0

longStopPrice := strategy.position_avg_price * (1 + arm)

stopLossPrice := strategy.position_avg_price * ((100 - math.abs(holdLoss)) / 100) // for use with 'stop' in strategy.exit

stopLossPrice

else

longStopPrice := close

longStopPrice

// If you want to hide the Trailing Stop Loss threshold (green line), comment this out

plot(longStopPrice, 'Arm Trail Stop at', color.new(color.green, 60), linewidth=2)

if strategy.position_size > 0 and useTrailStop

strategy.exit('exit', 'long', when=window(), qty_percent=100, trail_price=longStopPrice, trail_offset=trail * close / syminfo.mintick, comment='Trail')

//-----------------------------------------------------------------------------------------------------------//

- 動的移動平均を追跡する戦略

- 2倍移動平均振動取引戦略

- EMA バンド + Leledc + Bollinger バンド

- 急速なRSI戦略分析

- 適応性波動性ブレイクアウト取引戦略

- 高マイナス指数関数移動平均株戦略

- ドンチアン運河からの脱出戦略

- ビットコイン - MAクロスオーバー戦略

- フィッシャー・トランスフォーマー バックテスト戦略

- 123 逆転とSTARC帯のコンボ戦略

- 大喜び 多要素量策

- フォローライン戦略

- 4倍指数関数移動平均取引戦略

- モメント 指数関数移動平均クロスオーバー取引戦略

- 2つの移動平均のクロスオーバー戦略

- モメンタム ダブル移動平均取引戦略

- マルチテイク・プロフィートとストップ・ロスの波 トレンド 戦略をフォローする

- RSI と STOCH RSI に基づく双方向取引戦略

- スピード・アンド・ロング EMA ゴールデンクロス・ブレークスルー戦略

- RSIと移動平均の組み合わせ MT5 マルティンゲール スカルピング戦略