定量取引の正確なロングとショート戦略

概要

本記事では,ブルリンチャネル,ADX指標とK線を組み合わせて多空判断を行う量化取引戦略を主に紹介する.この戦略は,ブルリンチャネルを用いて市場の傾向と波動性を判断し,ADX指標と組み合わせて市場の傾向が強いことを判断し,強いトレンドの方向に市場が多空を行うことを選択し,振動的な行情では整合的な見通しを見据え,最大限リスクを回避する.

戦略原則

-

- ブリン通路上下軌を基準に市場のトレンド方向を判断する.価格は上軌の上の多頭行情,下軌の下の空頭行情である.

-

- ブリン通路の帯域幅は市場の波動性とリスクを反映する. ブリン通路の帯域幅が広いということは,市場の揺れが大きいほどリスクが大きいので,ポジションは避けるべきである.

-

- ADX指数は,市場の傾向が強いことを判断する。ADX値が25より大きいときは,トレンドの動きを示し,このとき,ブリン通路の方向がポジションの方向を選択することを判断する。ADXが25より小さい時は,震動の動きを示し,このとき,取引は避けるべきである。

-

- 多空方向を決定した後,ATR指標に基づいてストップロスを設定する.ATRは市場の変動幅を測定するために使用される.ATR倍数に基づいてストップロスの距離を設定する.

-

- ストップはブリン上下線に応じて設定する。多頭ストップは下線,空頭ストップは上線。またはATR指数のATR倍数に応じて固定ストップ距離を設定する。

-

- ストップとストップオフの間の利益と損失を管理し,利益をロックするために移動ストップを設定します.

戦略的優位性

ブリン・チャネルとADX指数の判断方向を組み合わせて,空白を明確に判断し,選択的にポジションを立て,震動の状況で無駄な取引を避ける.

ブリン帯域幅を用い波動率のリスクを判断する.ブリン帯域が狭くなるとチャンスは高く,リスクも小さい.ブリン帯域が広くなる時に取引を避ける.

ATRの止損設定により,リスクがコントロールされ,最大限止損が追いつかれないようにします.

ブリン通路の設定により,止まるところは止まらず,止まるところは止まらず,止まるところは止まってしまう.

モバイルストップは,収益の後のタイムストップで利益を確保し,トレンドを継続する.

戦略リスク

ブリン経路とADX指標の両方に圧力がかかっている可能性がある. 偏差が起これば誤判が起こりうる.

ATR指標は,過去の変動のみを反映し,将来の変動を予測することはできません.

ブリン通路の区分は主観的で,機会が逃れている場合もある.

移動ストップはディスク内でのみ行われ,間隔期間に移動できないリスクがある.

テストデータ適合のリスク.実際の市場ではテストレポートを複製することが困難である.

戦略の最適化

ブルリン・チャネルとADXの偽信号を防ぐために,より多くの指標を統合して相互信頼を保つ.

ATRストップは,跳躍ストップに加えることができる.または,ディープラーニングアルゴリズムを使用して,市場の波動を予測するストップを設定することができる.

ブリン通路の通路のパラメータを最適化して,より大きな市場機会を受け入れることができるようにする.

より効率的なプログラム化された取引システムを利用して,無人監視による移動停止を行う.

より長い時間周期で,より多くの品種組合せで再テストを行い,戦略の安定性を確保する.

要約する

この戦略は,ブリン・チャネル,ADX指数など複数の指標信号を統合し,明確なトレンド方向を判断した後に選択的にポジションを構築し,ATR指数を使用してストップ・ストップの設定を最適化し,リスクと収益率を最大限に制御する,推奨される定量取引戦略です.この戦略には,多くの最適化可能な余地があり,将来のエピデーション版の出力を期待しています.

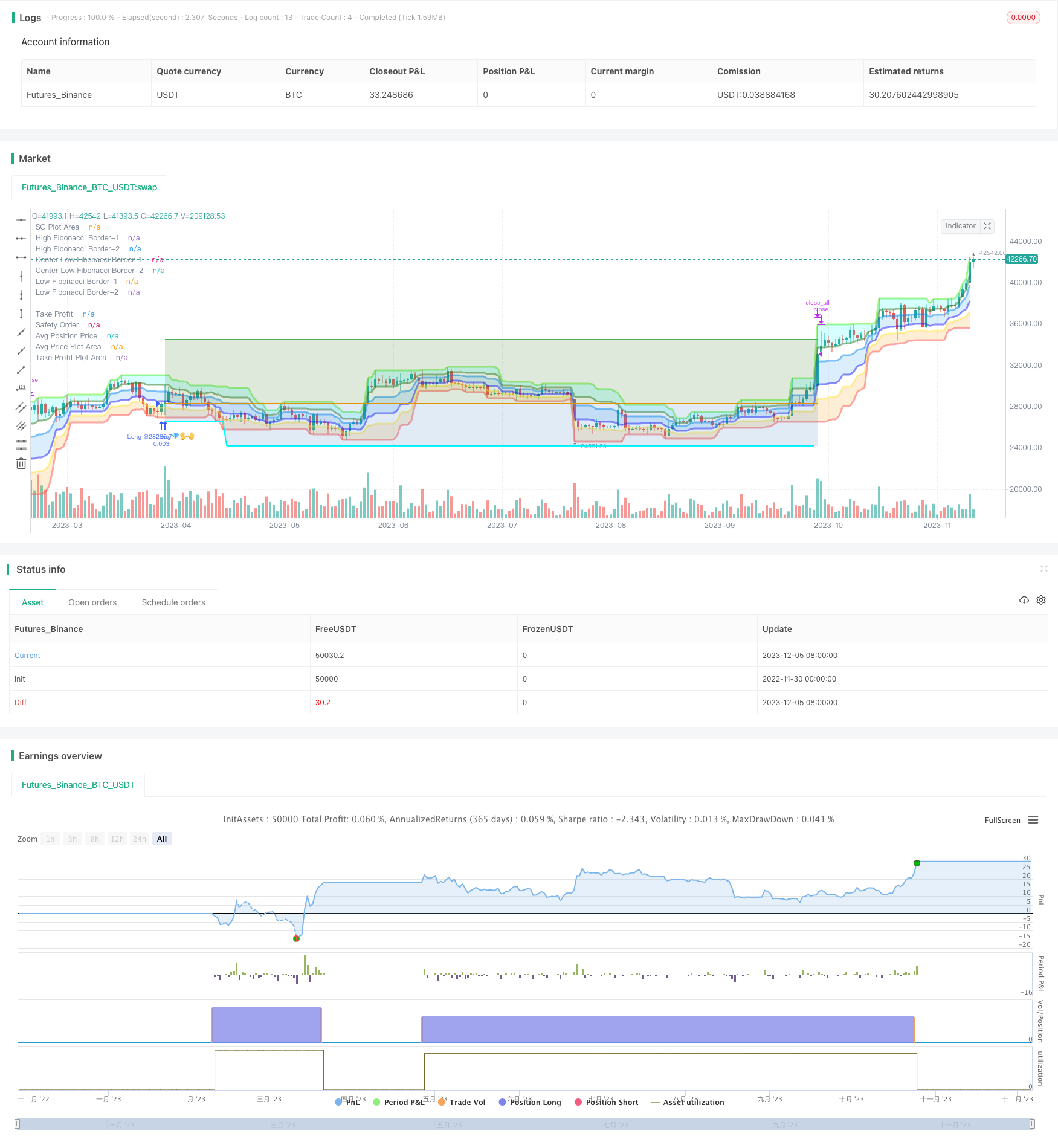

/*backtest

start: 2022-11-30 00:00:00

end: 2023-12-06 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// © Fibonacci Zone DCA Strategy - R3c0nTrader ver 2022-06-12

// For backtesting with 3Commas DCA Bot settings

// Thank you "eykpunter" for granting me permission to use "Fibonacci Zones" to create this strategy

// Thank you "junyou0424" for granting me permission to use "DCA Bot with SuperTrend Emulator" which I used for adding bot inputs, calculations, and strategy

//@version=5

strategy('Fibonacci Zone DCA Strategy - R3c0nTrader', shorttitle='Fibonacci Zone DCA Strategy', overlay=true )

// Strategy Inputs

// Start and End Dates

i_startTime = input(defval=timestamp('01 Jan 2015 00:00 +0000'), title='Start Time', group="Date Range")

i_endTime = input(defval=timestamp('31 Dec 2050 23:59 +0000'), title='End Time', group="Date Range")

inDateRange = true

// Fibonacci Settings

sourceInput = input.source(close, "Source", group="Trade Entry Settings")

per = input(14, title='Fibonacci length', tooltip='Number of bars to look back. Recommended for beginners to set ADX Smoothing and DI Length to the same value as this.', group="Trade Entry Settings")

hl = ta.highest(high, per) //High Line (Border)

ll = ta.lowest(low, per) //Low Line (Border)

dist = hl - ll //range of the channel

hf = hl - dist * 0.236 //Highest Fibonacci line

cfh = hl - dist * 0.382 //Center High Fibonacci line

cfl = hl - dist * 0.618 //Center Low Fibonacci line

lf = hl - dist * 0.764 //Lowest Fibonacci line

// ADX Settings

lensig = input.int(14, title="ADX Smoothing", tooltip='Fibonacci signals work best when market is trending. ADX is used to measure trend strength. Default value is 14. Recommend for beginners to match this with Fibonacci length and DI Length',minval=1, maxval=50, group="Trade Entry Settings")

len = input.int(14, minval=1, title="DI Length", tooltip='Fibonacci signals work best when market is trending. DI Length is used to calculate ADX to measure trend strength. Default value is 14. Recommend for beginners to match this with Fibonacci length and ADX Smoothing.', group="Trade Entry Settings")

adx_min = input.int(25, title='Min ADX value to open trade', tooltip='Use this to set the minium ADX value (trend strength) to open trade. 25 or higher is recommended for beginners. 0 to 20 is a weak trend. 25 to 35 is a strong trend. 35 to 45 is a very strong trend. 45 to 100 is an extremely strong trend.', group="Trade Entry Settings")

up = ta.change(high)

down = -ta.change(low)

plusDM = na(up) ? na : (up > down and up > 0 ? up : 0)

minusDM = na(down) ? na : (down > up and down > 0 ? down : 0)

trur = ta.rma(ta.tr, len)

di_plus = fixnan(100 * ta.rma(plusDM, len) / trur)

di_minus = fixnan(100 * ta.rma(minusDM, len) / trur)

sum = di_plus + di_minus

adx = 100 * ta.rma(math.abs(di_plus - di_minus) / (sum == 0 ? 1 : sum), lensig)

fib_choice = input.string("2-Higher than the top of the Downtrend Fib zone", title="Open a trade when the price moves:", options=["1-To the bottom of Downtrend Fib zone", "2-Higher than the top of the Downtrend Fib zone", "3-Higher than the bottom of Ranging Fib Zone", "4-Higher than the top of Ranging Fib Zone", "5-Higher than the bottom of Uptrend Fib Zone", "6-To the top of Uptrend Fib Zone"],

tooltip='There are three fib zones. The options are listed from the bottom zone to the top zone. The bottom zone is the Downtrend zone; the middle zone is the Ranging zone; The top fib zone is the Uptrend zone;',

group="Trade Entry Settings")

di_choice = input.bool(false, title="Only open trades on bullish +DI (Positive Directional Index)? (off for contrarian traders)", tooltip=

'Default is disabled. If you want to be more selective (you want a bullish confirmation), enable this and it will only open trades when the +DI (Positive Directional Index) is higher than the -DI (Negative Directional Index). Contrarian traders (buy the dip) should leave this disabled',

group="Trade Entry Settings")

di_min = input.int(0, title='Min +DI value to open trade',

tooltip='Default is zero. Use this to set the minium +DI value to open the trade. Try incrementing this value if you want to be more selective and filter for more bullish moves (e.g. 20-25). For Contrarian traders, uncheck "Only open trades on bullish DI" option and set Min +DI to zero',

group="Trade Entry Settings")

di_max = input.int(100, title='Max +DI value to open trade', tooltip='Default is 100. Use this to set the maxium +DI value to open trade. For Contrarian traders, uncheck "Only open trades on bullish DI" option and try a Max +DI value no higher than 20 or 25', group="Trade Entry Settings")

di_inrange = di_plus >= di_min and di_plus <= di_max

// Truncate function

truncate(number, decimals) =>

factor = math.pow(10, decimals)

int(number * factor) / factor

//Declare take_profit

take_profit = float(0.22)

// Take Profit Drop-down menu option

tp_choice = input.string("Target Take Profit (%)", title="Take profit using:", options=["Target Take Profit (%)", "High Fibonacci Border-1", "High Fibonacci Border-2"], tooltip=

'Select how to exit your trade and take profit. Then specify below this option the condition to exit. "High Fibonacci Border-1" is the top-most Fibonacci line in the green uptrend zone. "High Fibonacci Border-2" is the bottom Fibonacci line in the green uptrend zone. You can find these lines on the "Style" tab and toggle them off/on to locate these lines for more clarity',

group="Trade Exit Settings")

if tp_choice == "Target Take Profit (%)"

take_profit := input.float(22.0, title='Target Take Profit (%)', step=0.5, minval=0.0, tooltip='Only used if "Target Take Profit (%)" is selected above.', group="Trade Exit Settings") / 100

take_profit

else if tp_choice == "High Fibonacci Border-1"

take_profit := float(hl)

take_profit

else if tp_choice == "High Fibonacci Border-2"

take_profit := float(hf)

take_profit

trailing = input.float(0.0, title='Trailing deviation. Default= 0.0 (%)', step=0.5, minval=0.0, group="Trade Exit Settings") / 100

base_order = input(100.0, title='Base order', group="Trade Entry Settings")

safe_order = input(200.0, title='Safety order', group="Trade Entry Settings")

price_deviation = input.float(6.0, title='Price deviation to open safety orders (%)', step=0.25, minval=0.0, group="Trade Entry Settings") / 100

safe_order_volume_scale = input.float(2.0, step=0.5, title='Safety order volume scale', group="Trade Entry Settings")

safe_order_step_scale = input.float(1.4, step=0.1, title='Safety order step scale', group="Trade Entry Settings")

max_safe_order = input(5, title='Max safety orders', group="Trade Entry Settings")

var current_so = 0

var initial_order = 0.0

var previous_high_value = 0.0

var original_ttp_value = 0.0

// Calculate our key levels

take_profit_level = strategy.position_avg_price * (1 + take_profit)

if tp_choice == "Target Take Profit (%)"

take_profit_level := strategy.position_avg_price * (1 + take_profit)

else

take_profit_level := take_profit

fib_trigger = bool(false)

if fib_choice == "2-Higher than the top of the Downtrend Fib zone"

fib_trigger := ta.crossover(sourceInput, lf)

else if fib_choice == "1-To the bottom of Downtrend Fib zone"

fib_trigger := sourceInput <= ll

else if fib_choice == "3-Higher than the bottom of Ranging Fib Zone"

fib_trigger := ta.crossover(sourceInput, cfl)

else if fib_choice == "4-Higher than the top of Ranging Fib Zone"

fib_trigger := ta.crossover(sourceInput, cfh)

else if fib_choice == "5-Higher than the bottom of Uptrend Fib Zone"

fib_trigger := ta.crossover(sourceInput, hf)

else if fib_choice == "6-To the top of Uptrend Fib Zone"

fib_trigger := sourceInput >= hl

// If option enabled for enter trades only when DI is positive, then open trade based on user settings

if di_choice == true and strategy.position_size == 0 and sourceInput > 0 and inDateRange and fib_trigger and adx >= adx_min and di_plus > di_minus and di_inrange

strategy.entry('Long @' + str.tostring(sourceInput)+'💎✋🤚', strategy.long, qty=base_order / sourceInput)

initial_order := sourceInput

current_so := 1

previous_high_value := 0.0

fib_trigger := false

original_ttp_value := 0

original_ttp_value

// Open First Position when candle source value crosses above the 'Low Fibonacci Border-1'

else if di_choice == false and strategy.position_size == 0 and sourceInput > 0 and inDateRange and fib_trigger and adx >= adx_min and di_inrange

strategy.entry('Long @' + str.tostring(sourceInput)+'💎✋🤚', strategy.long, qty=base_order / sourceInput)

initial_order := sourceInput

current_so := 1

previous_high_value := 0.0

fib_trigger := false

original_ttp_value := 0

original_ttp_value

threshold = 0.0

if safe_order_step_scale == 1.0

threshold := initial_order - initial_order * price_deviation * safe_order_step_scale * current_so

threshold

else if current_so <= max_safe_order

threshold := initial_order - initial_order * ((price_deviation * math.pow(safe_order_step_scale, current_so) - price_deviation) / (safe_order_step_scale - 1))

threshold

else if current_so > max_safe_order

threshold := initial_order - initial_order * ((price_deviation * math.pow(safe_order_step_scale, max_safe_order) - price_deviation) / (safe_order_step_scale - 1))

threshold

// Average down when lowest candle value crosses below threshold

if current_so > 0 and low <= threshold and current_so <= max_safe_order and previous_high_value == 0.0

// Trigger a safety order at the Safety Order "threshold" price

strategy.entry('😨🙏 SO ' + str.tostring(current_so) + '@' + str.tostring(threshold), direction=strategy.long, qty=safe_order * math.pow(safe_order_volume_scale, current_so - 1) / threshold)

current_so += 1

current_so

// Take Profit!

// Take profit when take profit level is equal to or higher than the high of the candle

if take_profit_level <= high and strategy.position_size > 0 or previous_high_value > 0.0

if trailing > 0.0

if previous_high_value > 0.0

if high >= previous_high_value

previous_high_value := sourceInput

previous_high_value

else

previous_high_percent = (previous_high_value - original_ttp_value) * 1.0 / original_ttp_value

current_high_percent = (high - original_ttp_value) * 1.0 / original_ttp_value

if previous_high_percent - current_high_percent >= trailing

strategy.close_all(comment='Close (trailing) @' + str.tostring(truncate(current_high_percent * 100, 3)) + '%')

current_so := 0

previous_high_value := 0

original_ttp_value := 0

original_ttp_value

else

previous_high_value := high

original_ttp_value := high

original_ttp_value

else

strategy.close_all(comment='💰 Close @' + str.tostring(high))

current_so := 0

previous_high_value := 0

original_ttp_value := 0

original_ttp_value

// Plot Fibonacci Areas

fill(plot(hl, title='High Fibonacci Border-1', color=color.new(#53ed0f, 50), linewidth=3), plot(hf, title='High Fibonacci Border-2', color=color.new(#38761d, 50), linewidth=3), color=color.new(#00FFFF, 80), title='Uptrend Fibonacci Zone @ 23.6%') //uptrend zone

fill(plot(cfh, title='Center Low Fibonacci Border-1', color=color.new(#0589f4, 50), linewidth=3), plot(cfl, title='Center Low Fibonacci Border-2', color=color.new(#2018ff, 50), linewidth=3), color=color.new(color.blue, 80), title='Ranging Fibonacci Zone @ 61.8%') // ranging zone

fill(plot(lf, title='Low Fibonacci Border-1', color=color.new(color.yellow, 50), linewidth=3), plot(ll, title='Low Fibonacci Border-2', color=color.new(color.red, 50), linewidth=3), color=color.new(color.orange, 80), title='Downtrend Fibonacci Zone @ 76.4%') //down trend zone

// Plot TP

plot(strategy.position_size > 0 ? take_profit_level : na, style=plot.style_linebr, color=color.green, linewidth=2, title="Take Profit")

// Plot All Safety Order lines except for last one as bright blue

plot(strategy.position_size > 0 and current_so <= max_safe_order and current_so > 0 ? threshold : na, style=plot.style_linebr, color=color.new(#00ffff,0), linewidth=2, title="Safety Order")

// Plot Last Safety Order Line as Red

plot(strategy.position_size > 0 and current_so > max_safe_order ? threshold : na, style=plot.style_linebr, color=color.red, linewidth=2, title="No Safety Orders Left")

// Plot Average Position Price Line as Orange

plot(strategy.position_size > 0 ? strategy.position_avg_price : na, style=plot.style_linebr, color=color.orange, linewidth=2, title="Avg Position Price")

// Fill TP Area and SO Area

h1 = plot(strategy.position_avg_price, color=color.new(#000000,100), title="Avg Price Plot Area", display=display.none, editable=false)

h2 = plot(take_profit_level, color=color.new(#000000,100), title="Take Profit Plot Area", display=display.none, editable=false)

h3 = plot(threshold, color=color.new(#000000,100), title="SO Plot Area", display=display.none, editable=false)

// Fill TP Area and SO Area

fill(h1,h2,color=color.new(#38761d,80), title="Take Profit Plot Area")

// Current SO Area

fill(h1,h3,color=color.new(#3d85c6,80), title="SO Plot Area")