モメンタム追従型適応統計的裁定戦略

作成日:

2023-12-11 16:41:27

最終変更日:

2023-12-11 16:41:27

コピー:

0

クリック数:

803

1

フォロー

1627

フォロワー

概要

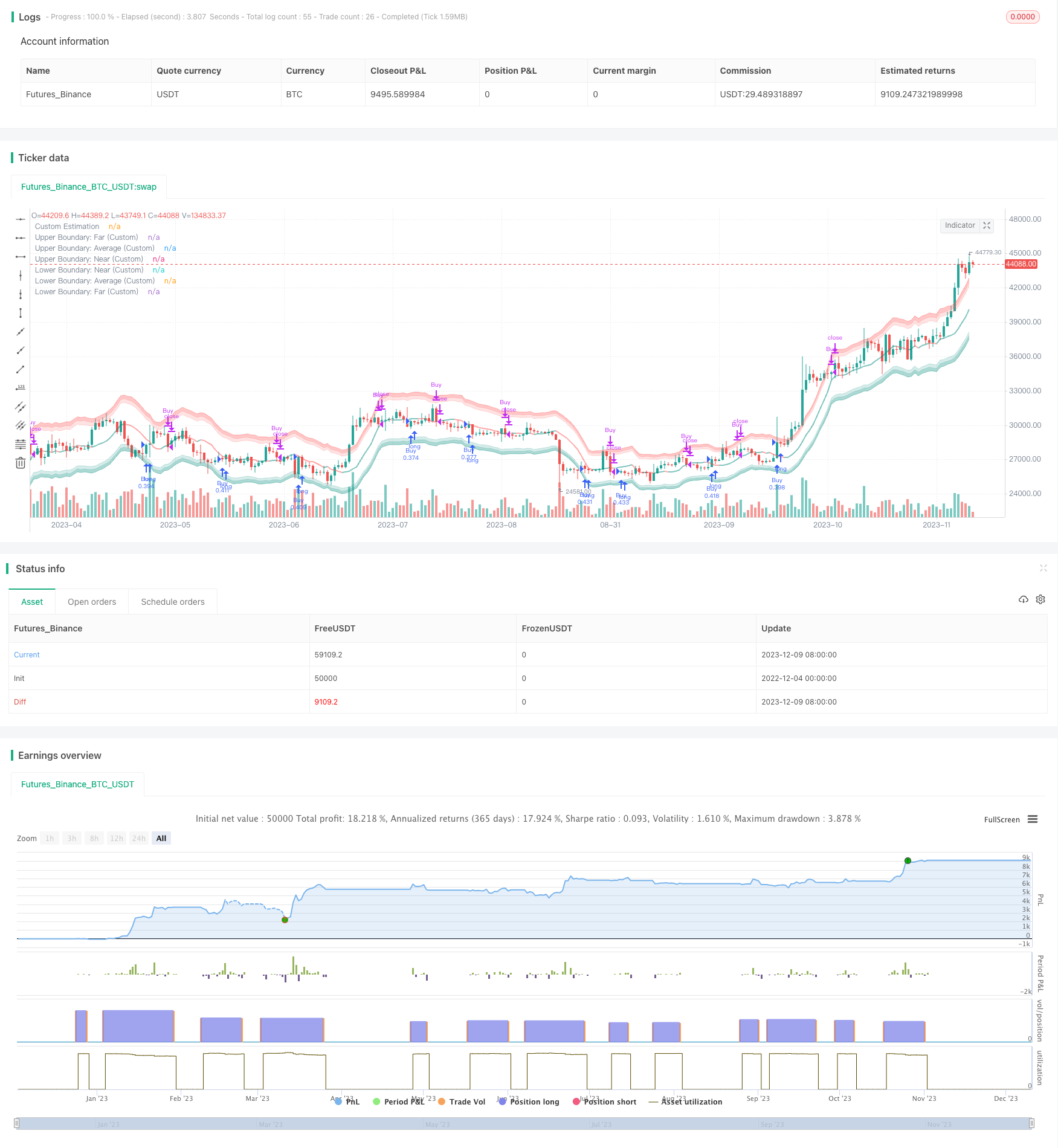

この戦略は,Nadaraya-Watson核帰帰法に基づいて,動的波動率の包囲帯を構成し,価格と包囲帯の交差状況を追跡することによって,低価格で高価格で売る取引信号を実現する.この戦略は,数学分析の基礎を持ち,市場変化に自律的に適応する.

戦略原則

戦略の核心は,価格の動的包囲帯を計算することです. まず,カスタマイズされた回顧期に基づいて価格 ((閉店価格,最高価格,最低価格) のナダラヤ-ワトソン核回帰曲線を構成し,平らな価格見積もりを得ます. その後,カスタマイズされたATR長さのベースでATR指標を計算し,近端因子と遠端因子を組み合わせて,上下包囲帯の範囲を得ます.

戦略的優位性

- 数学モデルに基づく,パラメータは制御可能で,過剰最適化には容易ではない.

- 市場の変化に適応し,価格と変動のダイナミックな関係を利用して取引の機会を捉える

- 対数座標を使用し,異なる時間周期と波動幅の品種をうまく処理できます

- カスタマイズ可能なパラメータの調整策の感度

戦略リスク

- 数学モデル理論化,リッドディスクのパフォーマンスが予想より低い

- 重要なパラメータの選択は経験が必要で,不適切な設定は収益に影響を及ぼす可能性があります.

- 取引の機会を逃したかもしれない.

- 市場が大きく揺れ動いた時,誤ったシグナルが出る可能性が高い.

これらのリスクは,主にパラメータの最適化,反省,影響要因の理解,慎重な実盤によって回避および軽減されます.

戦略最適化の方向性

- パラメータをさらに最適化して,最適なパラメータの組み合わせを見つけます.

- 機械学習による自動選択パラメータ

- フィルタリング条件を追加し,特定の市場環境で戦略を活性化します.

- 他の指標と組み合わせたフィルタリング

- 異なる数学モデルのアルゴリズムを試す

要約する

この戦略は,統計分析と技術指標分析を統合し,価格と変動率を動的に追跡することによって,低価格と高価格の取引シグナルを実現する.市場と自身の状況に応じてパラメータを調整することができる.全体的に,戦略の理論的基盤は堅牢であり,実際のパフォーマンスはさらに検証される必要がある.慎重に観察し,慎重に実態を観察する必要があります.

ストラテジーソースコード

/*backtest

start: 2022-12-04 00:00:00

end: 2023-12-10 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// © Julien_Eche

//@version=5

strategy("Nadaraya-Watson Envelope Strategy", overlay=true, pyramiding=1, default_qty_type=strategy.percent_of_equity, default_qty_value=20)

// Helper Functions

getEnvelopeBounds(_atr, _nearFactor, _farFactor, _envelope) =>

_upperFar = _envelope + _farFactor*_atr

_upperNear = _envelope + _nearFactor*_atr

_lowerNear = _envelope - _nearFactor*_atr

_lowerFar = _envelope - _farFactor*_atr

_upperAvg = (_upperFar + _upperNear) / 2

_lowerAvg = (_lowerFar + _lowerNear) / 2

[_upperNear, _upperFar, _upperAvg, _lowerNear, _lowerFar, _lowerAvg]

customATR(length, _high, _low, _close) =>

trueRange = na(_high[1])? math.log(_high)-math.log(_low) : math.max(math.max(math.log(_high) - math.log(_low), math.abs(math.log(_high) - math.log(_close[1]))), math.abs(math.log(_low) - math.log(_close[1])))

ta.rma(trueRange, length)

customKernel(x, h, alpha, x_0) =>

sumWeights = 0.0

sumXWeights = 0.0

for i = 0 to h

weight = math.pow(1 + (math.pow((x_0 - i), 2) / (2 * alpha * h * h)), -alpha)

sumWeights := sumWeights + weight

sumXWeights := sumXWeights + weight * x[i]

sumXWeights / sumWeights

// Custom Settings

customLookbackWindow = input.int(8, 'Lookback Window (Custom)', group='Custom Settings')

customRelativeWeighting = input.float(8., 'Relative Weighting (Custom)', step=0.25, group='Custom Settings')

customStartRegressionBar = input.int(25, "Start Regression at Bar (Custom)", group='Custom Settings')

// Envelope Calculations

customEnvelopeClose = math.exp(customKernel(math.log(close), customLookbackWindow, customRelativeWeighting, customStartRegressionBar))

customEnvelopeHigh = math.exp(customKernel(math.log(high), customLookbackWindow, customRelativeWeighting, customStartRegressionBar))

customEnvelopeLow = math.exp(customKernel(math.log(low), customLookbackWindow, customRelativeWeighting, customStartRegressionBar))

customEnvelope = customEnvelopeClose

customATRLength = input.int(60, 'ATR Length (Custom)', minval=1, group='Custom Settings')

customATR = customATR(customATRLength, customEnvelopeHigh, customEnvelopeLow, customEnvelopeClose)

customNearATRFactor = input.float(1.5, 'Near ATR Factor (Custom)', minval=0.5, step=0.25, group='Custom Settings')

customFarATRFactor = input.float(2.0, 'Far ATR Factor (Custom)', minval=1.0, step=0.25, group='Custom Settings')

[customUpperNear, customUpperFar, customUpperAvg, customLowerNear, customLowerFar, customLowerAvg] = getEnvelopeBounds(customATR, customNearATRFactor, customFarATRFactor, math.log(customEnvelopeClose))

// Colors

customUpperBoundaryColorFar = color.new(color.red, 60)

customUpperBoundaryColorNear = color.new(color.red, 80)

customBullishEstimatorColor = color.new(color.teal, 50)

customBearishEstimatorColor = color.new(color.red, 50)

customLowerBoundaryColorNear = color.new(color.teal, 80)

customLowerBoundaryColorFar = color.new(color.teal, 60)

// Plots

customUpperBoundaryFar = plot(math.exp(customUpperFar), color=customUpperBoundaryColorFar, title='Upper Boundary: Far (Custom)')

customUpperBoundaryAvg = plot(math.exp(customUpperAvg), color=customUpperBoundaryColorNear, title='Upper Boundary: Average (Custom)')

customUpperBoundaryNear = plot(math.exp(customUpperNear), color=customUpperBoundaryColorNear, title='Upper Boundary: Near (Custom)')

customEstimationPlot = plot(customEnvelopeClose, color=customEnvelope > customEnvelope[1] ? customBullishEstimatorColor : customBearishEstimatorColor, linewidth=2, title='Custom Estimation')

customLowerBoundaryNear = plot(math.exp(customLowerNear), color=customLowerBoundaryColorNear, title='Lower Boundary: Near (Custom)')

customLowerBoundaryAvg = plot(math.exp(customLowerAvg), color=customLowerBoundaryColorNear, title='Lower Boundary: Average (Custom)')

customLowerBoundaryFar = plot(math.exp(customLowerFar), color=customLowerBoundaryColorFar, title='Lower Boundary: Far (Custom)')

// Fills

fill(customUpperBoundaryFar, customUpperBoundaryAvg, color=customUpperBoundaryColorFar, title='Upper Boundary: Farmost Region (Custom)')

fill(customUpperBoundaryNear, customUpperBoundaryAvg, color=customUpperBoundaryColorNear, title='Upper Boundary: Nearmost Region (Custom)')

fill(customLowerBoundaryNear, customLowerBoundaryAvg, color=customLowerBoundaryColorNear, title='Lower Boundary: Nearmost Region (Custom)')

fill(customLowerBoundaryFar, customLowerBoundaryAvg, color=customLowerBoundaryColorFar, title='Lower Boundary: Farmost Region (Custom)')

longCondition = ta.crossover(close, customEnvelopeLow)

if (longCondition)

strategy.entry("Buy", strategy.long)

exitLongCondition = ta.crossover(customEnvelopeHigh, close)

if (exitLongCondition)

strategy.close("Buy")