ダイナミックトレーダーズインデックスインジケーター戦略

概要

この戦略は,ダイナミックトレーダー指数 (TDI) 指数と価格行動チャネル (PAC) 指数に基づいて,ブリン帯通路,相対的に強い指数 (RSI) 指数とMACD指数と組み合わせて,トレンド追跡システムを実現します.

この戦略は,主にトレンドを発見し,トレンドの方向に重大な変化があるときに取引信号を生成するために使用されます.これは,信号の再生率と信号の質を向上させるために複数の指標を融合します.

戦略原則

この戦略の核心はTDI指標である.TDIは複数の子指標を重ねて構成され,主に以下を含む.

- 比較的強い指数 (RSI):反応価格の強さや弱さ

- ブリン帯通路:反応価格変動範囲

- RSI価格線:RSIのシンプル移動平均で,RSIの価格傾向に反応する

- RSI取引シグナルライン:RSIの別の単純な移動平均で,取引シグナルを生成する

RSI価格線とRSI取引シグナル線が金交差を現したときは買入シグナル;両線が死交差を現したときは売り出シグナル.取引シグナル線が中線を横切ると弱いシグナルも発生する.

さらに,戦略は,価格行動チャネル指標を組み合わせている.この指標は,時間周期内の最高価格,最低価格を計算して,価格チャネルを計算している.価格がチャネルの上沿線または下沿線に近づくと,反転の機会があることを示している.

誤報をフィルターするために,戦略はMACD指数も導入した. MACD柱の色が取引信号の方向と一致する場合にのみ,入場シグナルを誘発する.

戦略的優位性

この戦略は,単一の指標よりも複数の指標の優位性を統合しています.

- TDI指標はトレンドの変化に敏感である

- 価格の動きは,サポートとプレッシャーを明確に表しています.

- MACDは誤報を効果的にフィルターします.

さらに,移動平均などのトレンド追跡指標と比較して,TDIはトレンドの逆転に敏感であり,不必要な損失を減らすことができます.

この戦略は,パラメータによって異なる市場環境に適応することもできます.

戦略リスク

- 複数の指標が重なり,パラメータの調整が複雑

- 取引頻度が高くなり,取引コストと滑り込みリスクが増加する

- 逆転認識は100%正確ではないので,価格が1方向に進む傾向を逃している可能性があります.

- リアルタイムの取引における価格変動は,反測よりも複雑で,シグナル効果は複製することが困難である.

ストップを拡大することで単一損失を減らすことができます. パーメータの最適化組み合わせは,信号品質を改善します. 適切な入場条件の緩和は,取引頻度を減らすことができます.

最適化の方向

- TDIのパラメータを調整して,最適な組み合わせを探します.

- 価格行動チャネルの長さを調整し,サポートレジスタンス識別を最適化

- MACDパラメータを調整し,入場フィルタリングを最適化

- ポジション管理と移動停止策を追加

要約する

この戦略は,多種多様な指標を用いてトレンドと逆転の機会を判断する.パラメータによって異なる品種に自律的に適応できる.ある程度の実戦価値があるが,信号効果が完璧に近づくのは依然としてある程度の困難である.複雑な多変数の実盤で慎重に使用することを推奨する.

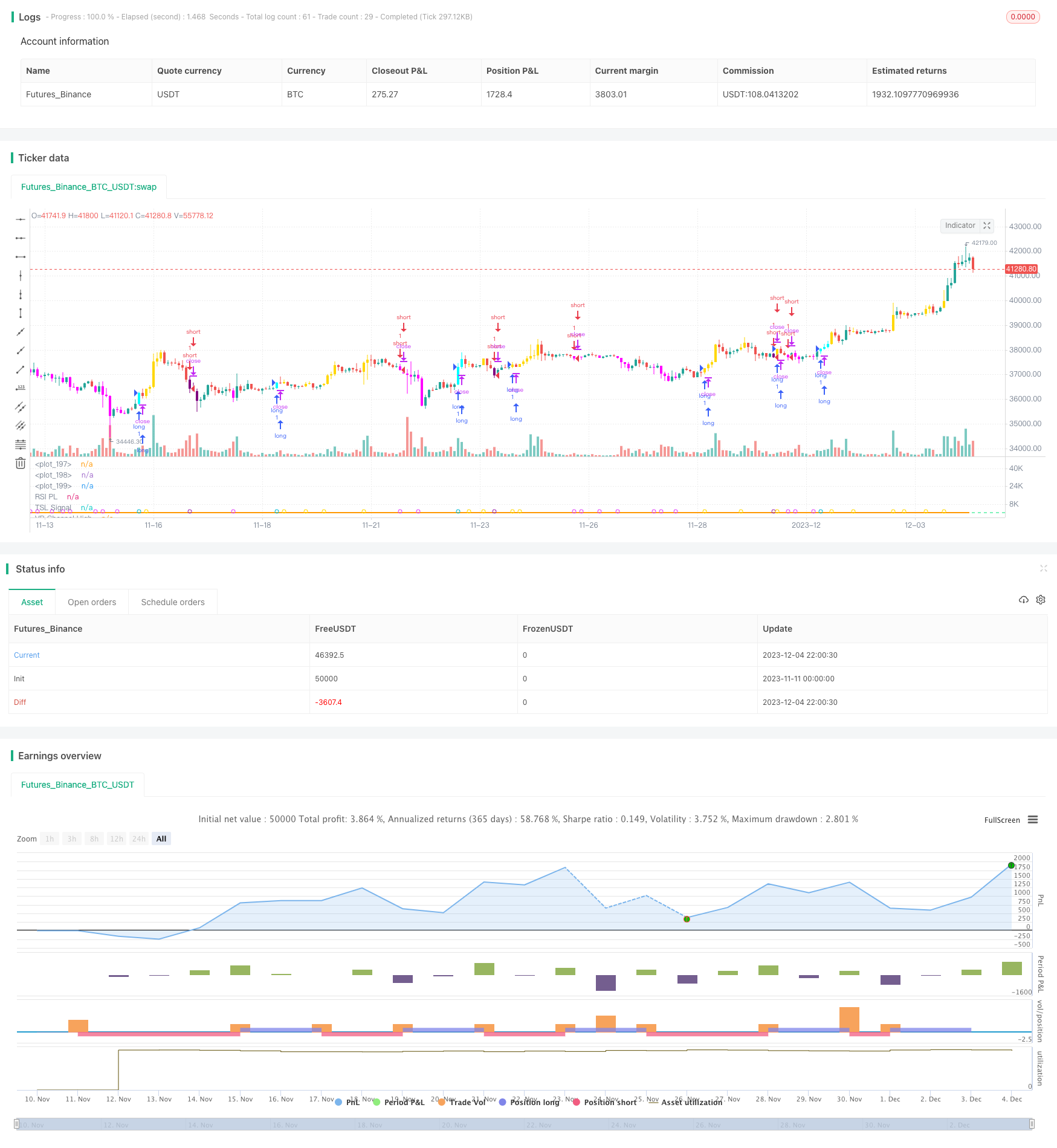

/*backtest

start: 2023-11-11 00:00:00

end: 2023-12-05 00:00:00

period: 2h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

//

strategy("[BACKTEST]Traders Dynamic Index Indicator Alert by JustUncleL", shorttitle="[BACKTEST]TDIALT")

//

// author: JustUncleL

// date: 10-Oct-2019

//

// Description:

// This script is a "strategy" version of the "Traders Dynamic Index Indicator Alert v0.1 by JustUncleL"

// made available for backtesting to help optimize settings.

//

// This is a Trend following system utilising the Traders Dynamic Index (TDI),

// Price Action Channel (PAC) and Heikin Ashi candles.

// About while ago I came across the use of TDI in "E.A.S.Y. Method" that I found in

// forexfactory forums: http://www.forexfactory.com/attachment.php?attachmentid=686629&d=1303831008

// and I was able to set up a chart based on the specifications by using Kurbelklaus scripts.

// However, I found that the alerts were being generated one or two bars too late,

// so I was not successful using it with Binary Options. Later I found a variation of the

// method in the forums which generates alerts a bit earlier, so this indicator is a

// variation of that early detection version.

// The indicator can optionally use Heikin Ashi candles only for all it's calculations,

// I would recommend viewing the chart with normal Heikin Ashi candles, these

// smooth out the trends and makes them more visible.

//

// I found that this metod it works OK with currency pairs or commodities.

// It also seems to work well with 5min+ timeframe charts,

// and for Binary Options I would suggest expiry of 2 to 6 candles.

//

// ALERT GENERATION:

// =================

//

// The TDI (Traders Dynamic Index)

// -------------------------------

// Volatility Band VB(34), color: Blue, buffer: UpZone, DnZone

// Relative Strength Index RSI(13)

// RSI PRICE LINE (2), color: Green, buffer: mab

// RSI TRADE SIGNAL LINE (7), color: Red, buffer: mbb

// MARKET BASE LINE MID VB(34), color: Orange, buffer: mid

//

// Indicator SignalLevels:

// -----------------------

// RSI_OversoldLevel : 22 (normally: 32)

// RSI_OverboughtLevel : 78 (normally: 68)

//

// Alert Conditions:

// -----------------

// Strong Buy (yellow): HIGH>PAC upper && BULL Candle && Candle High>PAC High && RSI>TRADE SIGNAL LINE && RSI>RSI_OversoldLevel &&

// && RSI<RSI_OverboughtLevel && TRADE SIGNAL LINE> MARKET BASE LINE

// Medium Buy (aqua): HIGH>PAC upper && BULL Candle && Candle High>PAC High && RSI>TRADE SIGNAL LINE && RSI>RSI_OversoldLevel

// && RSI<RSI_OverboughtLevel && RSI> MARKET BASE LINE && TRADE SIGNAL LINE< MARKET BASE LINE

// Weak Buy (blue): HIGH>PAC upper && BULL Candle && Candle High>PAC High && RSI>TRADE SIGNAL LINE && RSI>RSI_OversoldLevel

// && RSI<RSI_OverboughtLevel && TRADE SIGNAL LINE<MARKET BASE LINE && RSI< MARKET BASE LINE

//

// Strong Sell (fuchsia): LOW<PAC lower && BEAR Candle && Candle Low>PAC Low && RSI<TRADE SIGNAL LINE && RSI>RSI_OversoldLevel

// && RSI<RSI_OverboughtLevel && TRADE SIGNAL LINE< MARKET BASE LINE

// Medium Sell (purple): LOW<PAC lower && BEAR Candle && Candle Low>PAC Low && RSI<TRADE SIGNAL LINE && RSI>RSI_OversoldLevel

// && RSI<RSI_OverboughtLevel && RSI< MARKET BASE LINE && TRADE SIGNAL LINE> MARKET BASE LINE

// Weak Sell (black): LOW<PAC lower && BEAR Candle && Candle Low>PAC Low && RSI<TRADE SIGNAL LINE && RSI>RSI_OversoldLevel

// && RSI<RSI_OverboughtLevel && TRADE SIGNAL LINE> MARKET BASE LINE && RSI> MARKET BASE LINE

//

// HIGH LEVEL FILTER (Overbought): RSI>=RSI_OverboughtLevel or MACD Histogram not green

// LOW LEVEL FILTER (Oversold): RSI<=RSI_OversoldLevel or MACD Histogram not red

//

// Hints on How to use:

// --------------------

// - When a Medium or Strong alert is generated and MACD histogram colour matches the direction

// of the alert, then place trade in direction of alert candle and MACD.

// - Use the multi-Hull MA's for trend direction confirmation.

// - Best positions occur near the MACD(8,16,1) Histogram crossing the zero line.

// - The optional coloured Dots along the bottom of the indicator represent the first alert

// of this type that was generated in this sequence.

// - It is advisable to trade in the direction of the main trend as indicated the HULL MA red cloud:

// if red cloud underneath PAC then BULLISH trend, if red cloud above PAC then BEARISH trend.

// - Selecting the HeiKin Ashi candles does affect the MACD and MA caculations, so if you select

// normal candles the result chart will change. Although the TDI calculations and alerts will stay the

// same.

// - When using the Heikin Ashi candles, a good buy entry is indicated by long top wick and no bottom wick

// for bull (green) candles and good sell entry is indicated by long bottom wick and no top wick for

// bear (red) candles.

// - When the MACD histogram is flat and close to zero line,

// this indicates a ranging market, do NOT trade when this occurs.

// - When the PAC channel on the main chart is spread apart widely, this is an indication

// of extreme volitity and choppy chart, do NOT try to trade during these periods.

// A choppy chart is also indicated by Heikin Ashi candles with long wicks on both sides

// of the candles.

// - You can specify what strength level Alerts are generated (default 2):

// Level (1) means only generate Strong Alerts only.

// Level (2) means generate Strong and Medium Alerts.

// Level (3) means generate Strong, Medium and Weak Alerts.

//

// Modifications:

// --------------

// 11-Oct-2019

// - Strategy Version for backtesting created.

// - Converted to Pinescript V4

//

// 1.3 7-Aug-2017

// - Modified Alertcondition code so that it only signals on the last completed alerted

// candle. This should prevent some false alerts and multiple alerts being generated.

// When setting alarms I suggest using Frequency "Once per bar (on condition)" to get

// the earliest signal possible.

// - Added optional alert long/short spikes that only occur on the first Long or Short// Original code @author LazyBear for basic TDI indicator.

// signals.

// 1.2 5-Aug-2017:

// - Added new alerts for Buy and Sell (Long and Short) signals seperately.

// - Upgraded to version 3 Pinescript.

// - Added work around patch for opaque bar colouring issue.

//

// 1.1 - Modified code so when viewing Top chart with Heikin Ashi candles, calculations

// are still based on standard candles, unless Heikin Ashi calculation option selected.

//

// 0.2 - Simplified MACD direction calculation to use just rising/falling.

// 0.1 - Oroginal Version

// References:

// -----------

// Traders Dynamic Index [LazyBear]

// KK_Traders Dynamic Index_Bar Highlighting by Kurbelklaus

// KK_Price Action Channel (TDI BH) by Kurbelklaus

// http://www.forexfactory.com/attachment.php?attachmentid=686629&d=1303831008

// http://www.forexstrategiesresources.com/trading-system-metatrader-4-iv/504-traders-dynamic-index-how-to-use/

// http://www.forexfactory.com/showthread.php?t=460148

// http://www.forexstrategiesresources.com/scalping-forex-strategies-ii/205-scalping-with-tdi-real-macd-stochrainbow/

//

// -----------------------------------------------------------------------------

// Copyright 2016, 2017, 2019 JustUncleL

//

// This program is free software: you can redistribute it and/or modify

// it under the terms of the GNU General Public License as published by

// the Free Software Foundation, either version 3 of the License, or

// any later version.

//

// This program is distributed in the hope that it will be useful,

// but WITHOUT ANY WARRANTY; without even the implied warranty of

// MERCHANTABILITY or FITNESS FOR A PARTICULAR PURPOSE. See the

// GNU General Public License for more details.

//

// The GNU General Public License can be found here

// <http://www.gnu.org/licenses/>.

//

// -----------------------------------------------------------------------------

//

//

lengthrsi = input(13)

lengthband = input(34)

lengthrsipl = input(2)

lengthtradesl = input(7)

lenH = input(5, minval=1, title="Price Action Channel Length")

lenL = lenH

rsiOSL = input(22, minval=0, maxval=49, title="RSI Oversold Level")

rsiOBL = input(78, minval=51, maxval=100, title="RSI Overbought Level")

strength = input(2, minval=1, maxval=3, step=1, title="Strength Level: (1)Strong (2)Medium (3)All")

sgb = input(false, title="Check Box To Turn Bars Gray")

sbr = input(true, title="Highlight TDI Alert Bars")

sal = input(true, title="Show Alert Condition Status")

uha = input(false, title="Use Heikin Ashi Candles for Calculations")

//

// Constants colours that include fully non-transparent option.

blue100 = #0000FFFF

aqua100 = #00FFFFFF

fuchsia100 = #FF00FFFF

purple100 = #800080FF

gray100 = #808080FF

gold100 = #FFD700FF

white100 = #FFFFFFFF

black100 = #000000FF

gold = #FFD700

// Use only Heikinashi Candles for all calculations or use Standard Candles for calculations.

security_1 = security(heikinashi(syminfo.tickerid), timeframe.period, close)

security_2 = security(syminfo.ticker, timeframe.period, close)

srcClose = uha ? security_1 : security_2

security_3 = security(heikinashi(syminfo.tickerid), timeframe.period, open)

security_4 = security(syminfo.ticker, timeframe.period, open)

srcOpen = uha ? security_3 : security_4

security_5 = security(heikinashi(syminfo.tickerid), timeframe.period, high)

security_6 = security(syminfo.ticker, timeframe.period, high)

srcHigh = uha ? security_5 : security_6

security_7 = security(heikinashi(syminfo.tickerid), timeframe.period, low)

security_8 = security(syminfo.ticker, timeframe.period, low)

srcLow = uha ? security_7 : security_8

//

r = rsi(srcClose, lengthrsi)

ma = sma(r, lengthband)

offs = 1.6185 * stdev(r, lengthband)

upZone = ma + offs

dnZone = ma - offs

mid = (upZone + dnZone) / 2

mab = sma(r, lengthrsipl)

mbb = sma(r, lengthtradesl)

//

hline(rsiOSL, color=color.red, linewidth=1)

hline(50, color=color.black, linewidth=1)

hline(rsiOBL, color=color.lime, linewidth=1)

// Plot the TDI

upl = plot(upZone, color=color.blue, title="VB Channel High", linewidth=2)

dnl = plot(dnZone, color=color.blue, title="VB Channel Low", linewidth=2)

midl = plot(mid, color=color.orange, linewidth=2, title="MBL")

mabl = plot(mab, color=color.green, linewidth=2, title="RSI PL")

mbbl = plot(mbb, color=color.red, linewidth=2, title="TSL Signal")

//

//create RSI TSL cloud to indicate trend direction.

fill(mabl, mbbl, color=mab > mbb ? color.green : color.red, transp=90)

// Calculate Price Action Channel (PAC)

smmaH = 0.0

smmaL = 0.0

sma_1 = sma(srcHigh, lenH)

smmaH := na(smmaH[1]) ? sma_1 : (smmaH[1] * (lenH - 1) + srcHigh) / lenH

sma_2 = sma(srcLow, lenL)

smmaL := na(smmaL[1]) ? sma_2 : (smmaL[1] * (lenL - 1) + srcLow) / lenL

//

umacd = input(false, title="Use MACD Filtering")

fastMA = input(title="MACD Fast MA Length", type=input.integer, defval=8, minval=2)

slowMA = input(title="MACD Slow MA Length", type=input.integer, defval=16, minval=7)

signal = input(title="MACD Signal Length", type=input.integer, defval=1, minval=1)

//

//

[currMacd, _, _] = macd(srcClose[0], fastMA, slowMA, signal)

rising_1 = rising(currMacd, 2)

falling_1 = falling(currMacd, 2)

macdH = currMacd > 0 ? rising_1 ? color.green : color.red :

falling_1 ? color.red : color.green

//

// Bar - Highlighting based on indication strength

long = (not umacd or macdH == color.green) and mab > mbb and mab < rsiOBL and

mab > rsiOSL and srcHigh > smmaH and srcClose > srcOpen ?

mbb > mid ? 1 : mab > mid and mbb < mid ? 2 : mab < mid and mbb < mid ? 3 : 0 : 0

short = (not umacd or macdH == color.red) and mab < mbb and mab < rsiOBL and

mab > rsiOSL and srcLow < smmaL and srcClose < srcOpen ?

mbb < mid ? 1 : mab < mid and mbb > mid ? 2 : mab > mid and mbb > mid ? 3 : 0 : 0

//

// Find the right Bar colour if enabled.

bcolor = not sbr ? na : long == 1 ? gold100 :

long == 2 and strength > 1 ? aqua100 : long == 3 and strength > 2 ? blue100 :

short == 1 ? fuchsia100 : short == 2 and strength > 1 ? purple100 :

short == 3 and strength > 2 ? black100 : sgb ? gray100 : na

//

barcolor(color=bcolor, title="Bars Colours")

//

//

// === ALERT conditions

//

// create alerts only once per sequence type.

//

longCond = long > 0 and long != long[1] and long <= strength

shortCond = short > 0 and short != short[1] and short <= strength

// show dot only when alert condition is met and bar closed.

plotshape(sal and (longCond[1] or shortCond[1]), title="Alert Indicator", location=location.bottom,

color=long[1] == 1 ? gold : long[1] == 2 ? color.aqua : long[1] == 3 ? color.blue : short[1] == 1 ? color.fuchsia : short[1] == 2 ? color.purple : short[1] == 3 ? color.black : na,

transp=0, style=shape.circle, offset=-1)

//

// === /ALERT conditions.

// === STRATEGY ===

tradeType = input("BOTH", title="What trades should be taken : ", options=["LONG", "SHORT", "BOTH", "NONE"])

// stop loss

slPoints = input(defval=0, title="Initial Stop Loss Points (zero to disable)", minval=0)

tpPoints = input(defval=0, title="Initial Target Profit Points (zero for disable)", minval=0)

//>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>//

testStartYear = input(2018, "Backtest Start Year", minval=1980)

testStartMonth = input(1, "Backtest Start Month", minval=1, maxval=12)

testStartDay = input(1, "Backtest Start Day", minval=1, maxval=31)

testPeriodStart = timestamp(testStartYear, testStartMonth, testStartDay, 0, 0)

testStopYear = input(9999, "Backtest Stop Year", minval=1980)

testStopMonth = input(12, "Backtest Stop Month", minval=1, maxval=12)

testStopDay = input(31, "Backtest Stop Day", minval=1, maxval=31)

testPeriodStop = timestamp(testStopYear, testStopMonth, testStopDay, 0, 0)

testPeriod() =>

time >= testPeriodStart and time <= testPeriodStop ? true : false

//<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<//

//

//set up exit parameters

TP = tpPoints > 0 ? tpPoints : na

SL = slPoints > 0 ? slPoints : na

// Make sure we are within the bar range, Set up entries and exit conditions

if testPeriod() and tradeType != "NONE"

strategy.entry("long", strategy.long, when=longCond == true and tradeType != "SHORT")

strategy.entry("short", strategy.short, when=shortCond == true and tradeType != "LONG")

strategy.close("long", when=shortCond == true and tradeType == "LONG")

strategy.close("short", when=longCond == true and tradeType == "SHORT")

strategy.exit("XL", from_entry="long", profit=TP, loss=SL)

strategy.exit("XS", from_entry="short", profit=TP, loss=SL)

// === /STRATEGY ===

//EOF