波のトレンドに基づいた取引戦略

作成日:

2023-12-19 12:07:14

最終変更日:

2023-12-19 12:07:14

コピー:

0

クリック数:

1140

1

フォロー

1628

フォロワー

概要

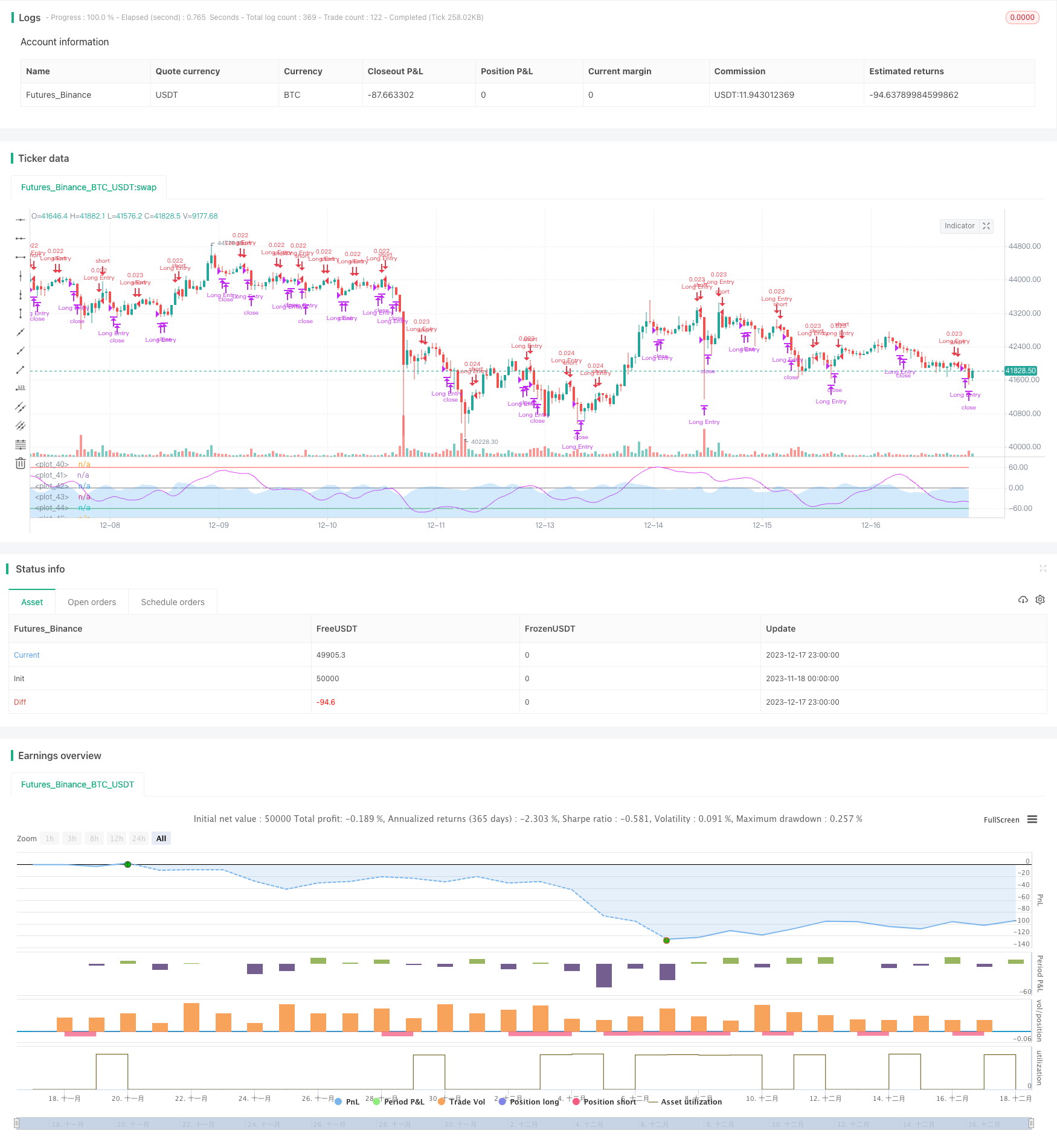

これは,LazyBearの波動トレンド指数に基づく取引戦略である.この戦略は,価格変動の波動トレンドを計算して,市場の過剰買いや過剰売り状況を判断し,ロングとショートリングを行う.

戦略原則

この戦略は主にLazyBearの波動トレンド指数に基づいています. まず価格の平均価格 (AP) を計算し,次にAPの指数移動平均 (ESA) と絶対価格変化の指数移動平均 (D) を計算します. その基礎で波動指数 (CI) を計算し,次にCIの指数移動平均を計算し,波動トレンドライン (WT) を得ます. WTは,次に,単純な移動平均でWT1とWT2を生成します.

優位分析

これは非常にシンプルで実用的なトレンド追跡戦略で,以下の利点があります.

- 価格の動向と市場の情勢を,波動のトレンド指標に基づいて明確に識別できます.

- WTの黄金交差点と死交差点から判断して,操作は簡単です.

- 異なる周期に対応するために,カスタマイズ可能なパラメータでWT線の感度を調整

- 取引時間ウィンドウを制限するなど,さらに条件のフィルタリング信号を追加できます.

リスク分析

この戦略にはいくつかのリスクがあります.

- トレンド追跡策として,市場を整理する際に多くの誤信号を生じやすい.

- WT線自体は遅滞性があり,価格の急激な転換点を逃している可能性がある.

- デフォルトのパラメータは,すべての品種と周期に適していない可能性があり,最適化が必要です

- 投資家は,投資先の利益に悪影響を及ぼす可能性が高い.

解決策は以下の通りです.

- WT線の感性を調整する最適化パラメータ

- 誤信号を避けるために,他の指標を追加します.

- 停止と停止を設定する

- 取引数やポジションを1日に制限する

最適化の方向

この戦略はさらに改善できる余地があります.

- WTのパラメータを最適化して,より敏感またはより安定化

- 周期によって異なるパラメータの組み合わせ

- 量値指標,波動率指標などを追加し,確認信号として

- ストップ・ロズとストップ・ロジックを追加

- ピラミッド加仓,格子取引など,富裕な保有方法

- 機械学習などの手法と組み合わせて,より良い特性と取引規則を掘り出す.

要約する

この戦略は,非常にシンプルで実用的な波動トレンド追跡戦略である。価格の変動トレンドを計算し,市場の超買超売状態を識別し,WT線の金交差と死交差を利用して取引信号を発信する。戦略の操作はシンプルで,実行しやすい。しかし,トレンド戦略として,株価の感度と安定性をさらに最適化する必要があり,同時に,誤信号を避けるために他の指標と論理と連携する必要があります。全体的に言えば,これは非常に実用的な戦略のテンプレートであり,大きな最適化余地があります。

ストラテジーソースコード

/*backtest

start: 2023-11-18 00:00:00

end: 2023-12-18 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//

// @author LazyBear

//

// If you use this code in its original/modified form, do drop me a note.

//

//@version=4

// === INPUT BACKTEST RANGE ===

fromMonth = input(defval = 1, title = "From Month", type = input.integer, minval = 1, maxval = 12)

fromDay = input(defval = 1, title = "From Day", type = input.integer, minval = 1, maxval = 31)

fromYear = input(defval = 2021, title = "From Year", type = input.integer, minval = 1970)

thruMonth = input(defval = 1, title = "Thru Month", type = input.integer, minval = 1, maxval = 12)

thruDay = input(defval = 1, title = "Thru Day", type = input.integer, minval = 1, maxval = 31)

thruYear = input(defval = 2112, title = "Thru Year", type = input.integer, minval = 1970)

// === INPUT SHOW PLOT ===

showDate = input(defval = true, title = "Show Date Range", type = input.bool)

// === FUNCTION EXAMPLE ===

start = timestamp(fromYear, fromMonth, fromDay, 00, 00) // backtest start window

finish = timestamp(thruYear, thruMonth, thruDay, 23, 59) // backtest finish window

window() => true // create function "within window of time"

n1 = input(10, "Channel Length")

n2 = input(21, "Average Length")

obLevel1 = input(60, "Over Bought Level 1")

obLevel2 = input(53, "Over Bought Level 2")

osLevel1 = input(-60, "Over Sold Level 1")

osLevel2 = input(-53, "Over Sold Level 2")

ap = hlc3

esa = ema(ap, n1)

d = ema(abs(ap - esa), n1)

ci = (ap - esa) / (0.015 * d)

tci = ema(ci, n2)

wt1 = tci

wt2 = sma(wt1,4)

plot(0, color=color.gray)

plot(obLevel1, color=color.red)

plot(osLevel1, color=color.green)

plot(obLevel2, color=color.red, style=3)

plot(osLevel2, color=color.green, style=3)

plot(wt1, color=color.white)

plot(wt2, color=color.fuchsia)

plot(wt1-wt2, color=color.new(color.blue, 80), style=plot.style_area)

//Strategy

strategy(title="T!M - Wave Trend Strategy", overlay = false, precision = 8, max_bars_back = 200, pyramiding = 0, initial_capital = 1000, currency = currency.NONE, default_qty_type = strategy.cash, default_qty_value = 1000, commission_type = "percent", commission_value = 0.1, calc_on_every_tick=false, process_orders_on_close=true)

longCondition = crossover(wt1, wt2)

shortCondition = crossunder(wt1, wt2)

strategy.entry(id="Long Entry", comment="buy", long=true, when=longCondition and window())

strategy.close("Long Entry", comment="sell", when=shortCondition and window())

//strategy.entry(id="Short Entry", long=false, when=shortCondition)