モメンタムフォロー移動平均反転戦略

概要

この戦略は,移動平均,ブリン帯,RSI,ランダムな指標などの複数の指標を組み合わせて,複数の時間枠分析を組み合わせて,市場逆転を判断するダイナミクス指標を利用した総合的な戦略を設計する.

戦略原則

この戦略の核心的な論理は,短期および長期の移動平均の交差を追跡して底と頂点を判断し,RSIやランダムな指標などの参照動力の指標の極限値を補助して,超買超売現象を判断することです.

具体的には,2つの異なるパラメータの移動平均をそれぞれ描きます.より短期間の移動平均は,現在のトレンドを判断し,より長期間の移動平均は,主要なトレンドを判断します.短期間の移動平均が,下から長期移動平均を横切るとき,市場が逆転すると考えられ,買入シグナルを生じます.上から下を通るとき,売り信号を生じます.

さらに,戦略は,RSI指標を組み合わせてそれが超売り領域に入っているかどうかを確認し,K線が超売り領域に入っているかどうかを確認するランダムな指標を組み合わせて,下位特性を判断する.上位特性を対象に,この2つの指標の反転論理も使用する.

出場に関しては,ストップ・ストップ・ストップ・ストップ・ストップを同時に使ってポジションを管理する戦略である.

優位分析

これは,トレンド追跡と逆転認識を組み合わせた戦略であり,動態指標の実用的な戦略を兼ね備えています.

移動平均の交差系は,反転を判断する簡単な効果的な方法である.双均線戦略は操作が容易で,歴史は良好である.

RSIなどの指標と組み合わせて,反転信号の信頼性を判断し,非底部非頂部位置で誤導信号を生じさせないようにする.

ストップ・ストップ・ストップ・ストップ・ストップ・ストップ・ストップ・ストップ・ストップ・ストップ・ストップ・ストップ

リスク分析

この戦略には多くの利点がありますが,注意すべきリスクもあります.

双均線戦略は,波動的な状況に容易く巻き込まれます. 長期にわたって市場が整合すれば,頻繁にポジションを開き,平らになるでしょう.

RSIなどの指標は,誤ったシグナルの出現を完全に回避することはできません.例えば,急激に上波の高点を突破すると,RSIが超買い領域に入れないようにします.

ストップ・ポイントの幅が大きすぎると,損失のリスクが増加する.ストップ・ポイントの幅は,特定の品種に応じて調整する必要がある.

最適化の方向

この戦略には多くの改善点があります.

異なる種類の移動平均をテストして,最もマッチする平均線指数を見つけることができます.

MACD,KD,Brinなどの補助指標を追加することで,戦略の論理を豊かにすることができる.

自動でポジション管理パラメータを最適化し,ストップ・ロスト・ストップをスマートにすることができる.

異なる品種のパラメータは,それぞれの品種の特性に合わせて個別に最適化できます.

要約する

総括すると,動量追跡均線逆転戦略は,シンプルで実用的な量化戦略である.それは均線システムを活用して市場の逆転点を判断し,動量指標で信号の信頼性を確認し,インテリジェントなポジション管理を使用して利益をロックし,リスクを制御する.この戦略は,理解し実行しやすい,練習し,最適化し,トレーダーが量化取引を学ぶための良い出発点である.

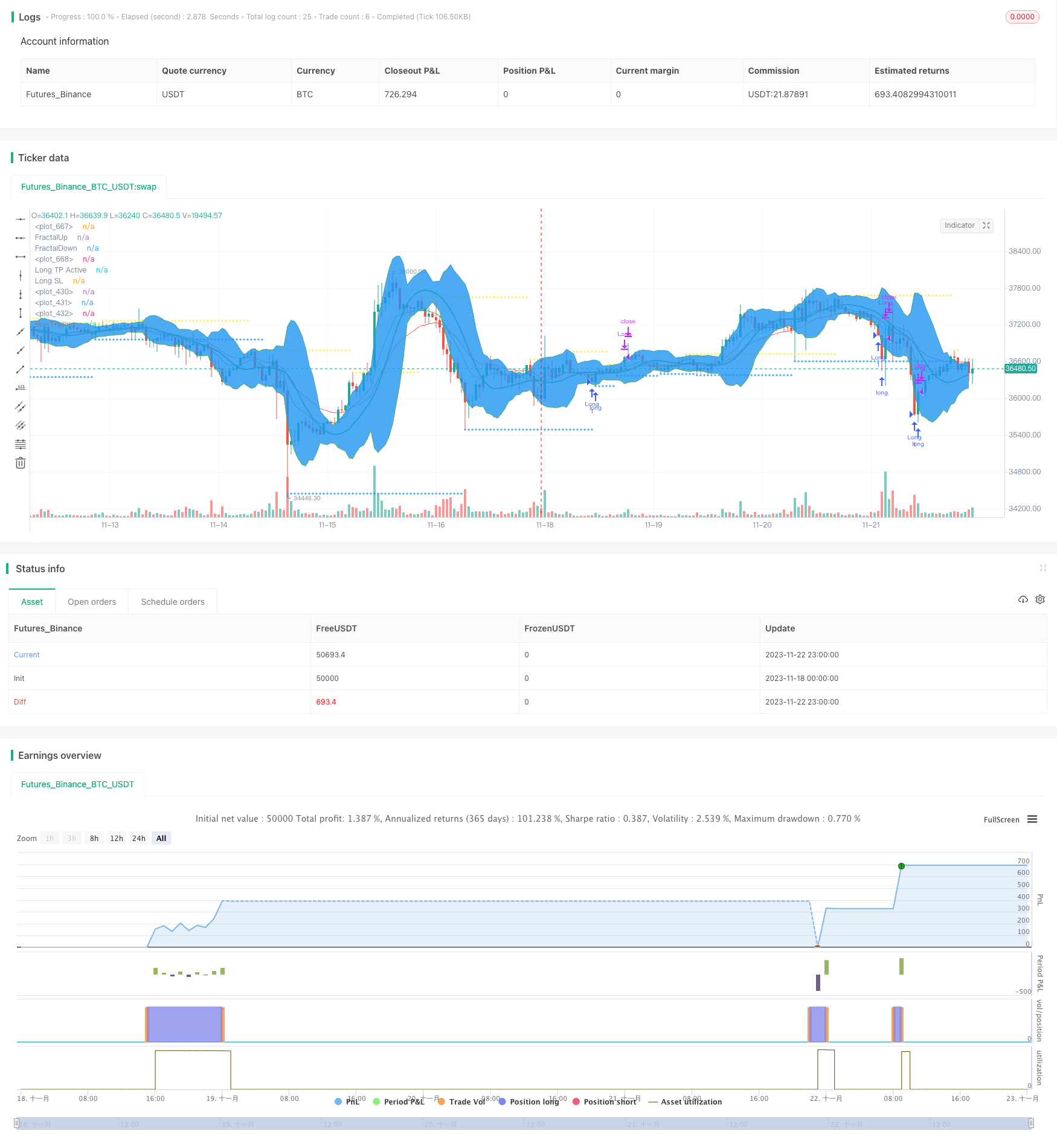

/*backtest

start: 2023-11-18 00:00:00

end: 2023-11-23 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=3

strategy("APEX - Tester - Buy/Sell Strategies - Basic - BACKTESTER", overlay = true)

//study("APEX - Tester - Buy/Sell Strategies - Basic ", overlay = true)

source_main = close

/////////////////////////////////////////////////

// BUY STRATEGIES - SELECTION

/////////////////////////////////////////////////

puppy_sep = input(false, title=" APEX Tester Buy/Sell Basic v01 ")

buy1_sep = input(false, title="▔▔▔▔▔▔▔▔▔▔▔▔▔▔▔▔▔▔▔▔" )

buy2_sep = input(false, title="******** BUY STRATEGIES ********")

ma_sep = input(false, title="⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻ MA ⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻")

ma_length_short = input(8, minval=1, title="MA length - short")

ma_length_long = input(9, minval=1, title="MA length - long")

ma_useRes = input(false, title="Check to turn ON Different Time Frame")

ma_candle_period = input("5", title="MA - Different Time Frame")

ma_type = input("T3", title="MA Type", options=["SMA", "EMA", "WMA", "DEMA", "TEMA", "TRIMA", "KAMA", "MAMA", "T3"])

ma_detector = input("Short Crosses Above Long", title="Detector", options=["Short Crosses Above Long",

"Short Above Long","Price Cross Above Short","Price Above Short","Price Cross Above Long","Price Above Long","Price Above Both","Price Below Both"])

ma_use = input(false, title="Use Moving Average ? (On / Off)")

bb_sep = input(false, title="⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻ BB ⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻")

bb_length = input(10, minval=1, title="BB length")

bb_std = input(2.1, minval=0, type = float, title="BB std")

bb_useDifferentRes = input(false, title="Check to turn ON Different Time Frame")

bb_candle_period = input("3", title="BB - Time Frame")

bb_type = input("T3", title="MA", options=["SMA", "EMA", "WMA", "DEMA", "TEMA", "TRIMA", "KAMA", "MAMA", "T3"])

bb_detector = input("Price Cross Below", title="Detector", options=["Price Cross Below", "Price Below", "Price Cross Above", "Price Above"])

bb_use = input(true, title="Use BB ? (On / Off)")

rsi_sep = input(false, title="⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻ RSI ⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻")

rsi_length = input(2, minval=1, title="RSI length")

rsi_useDifferentRes = input(false, title="Check to turn ON Different Time Frame")

rsi_candle_period = input("3", title="STOCH - Time Frame")

rsi_oversold = input(defval = 12 , title = "RSI Oversold", minval=0)

rsi_detector = input("Signal Below Oversold", title="Detector", options=["Signal Below Oversold", "Cross Below Oversold", "Signal Above Oversold", "Cross Above Oversold"])

rsi_use = input(true, title="Use RSI ? (On / Off)")

stoch_sep = input(false, title="⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻ STOCH ⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻")

stoch_useDifferentRes = input(false, title="Check to turn ON Different Time Frame")

stoch_candle_period = input("3", title="STOCH - Time Frame")

stoch_length_fk = input(12, minval=1, title="STOCH fast K")

stoch_length_sk = input(1, minval=1, title="STOCH slow K")

stoch_type_sk = input("EMA", title="STOCH slow K", options=["SMA", "EMA", "WMA", "DEMA", "TEMA", "TRIMA", "KAMA", "MAMA", "T3"])

stoch_length_sd = input(1, minval=1, title="STOCH slow D")

stoch_type_sd = input("EMA", title="STOCH slow D", options=["SMA", "EMA", "WMA", "DEMA", "TEMA", "TRIMA", "KAMA", "MAMA", "T3"])

stoch_oversold = input(defval = 10 , title = "STOCH Oversold Treashold", minval=0)

stoch_detector = input("Signal Below Oversold", title="Detector", options=["Signal Below Oversold", "Cross Below Oversold", "Cross Above Oversold"])

stoch_use = input(true, title="Use STOCH ? (On / Off)")

srsi_sep = input(false, title="⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻ SRSI ⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻")

stochrsi_useDifferentRes= input(false, title="Check to turn ON Different Time Frame")

stochrsi_candle_period = input("3", title="SRSI - Time Frame")

stochrsi_len = input(14, minval=1, title="RSI length")

stochrsi_stoch = input(14, minval=1, title="Time Period")

stochrsi_length_fk = input(3, minval=1, title="Fast K")

stochrsi_length_sd = input(3, minval=1, title="Slow D(or Fast)")

stochrsi_oversold = input(defval = 30 , title = "STOCHRSI Oversold Treashold", minval=0)

stochrsi_detector = input("K Below Oversold", title="Detector", options=["K Cross Above D and Oversold", "K Cross Above D", "K Cross Above Oversold",

"K Cross Below Oversold","K Below Oversold","K Above Oversold"])

stochrsi_use = input(false, title="Use STOCHRSI (On / Off)?")

macd_sep = input(false, title="⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻ MACD ⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻")

macd_fast = input(12, title="MACD fast")

macd_slow = input(26, title="MACD slow")

macd_signal = input(9, title="MACD signal")

macd_useDifferentRes = input(false, title="Check to turn ON Different Time Frame")

macd_candle_period = input("3", title="MACD - Time Frame")

macd_detector = input("MACD Cross Above Signal", title="Detector", options=["MACD Cross Above Signal", "MACD Above Signal", "MACD Below Signal",

"MACD Above Treshold", "MACD Below Treshold", "Centerline Cross Upward", "Centerline Cross Downward"])

macd_treshold = input(defval = 0 , title = "Treshold", type = float)

macd_use = input(false, title="Use MACD (On / Off)?")

cci_sep = input(false, title="⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻ CCI ⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻")

cci_len = input(14, title="CCI Length")

cci_treshold = input(100, title="CCI Treshold")

cci_useDifferentRes = input(false, title="Check to turn ON Different Time Frame")

cci_candle_period = input("3", title="CCI - Time Frame")

cci_detector = input("Signal Below Treshold", title="Detector", options=["Signal Cross Above Treshold", "Signal Above Treshold", "Signal Cross Below Treshold", "Signal Below Treshold"])

cci_use = input(false, title="Use CCI (On / Off)?")

vwap_sep = input(false, title="⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻ VWAP ⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻")

vwap_useRes = input(false, title="Check to turn ON Different Time Frame")

vwap_candle_period = input("5", title="VWAP - Time Frame")

vwap_detector = input("Price Above", title="Detector", options=["Price Cross Above","Price Above","Price Cross Below","Price Below"])

vwap_use = input(false, title="Use VWAP (On / Off)?")

pc_sep = input(false, title="⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻Perc.Chan.⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻")

pc_change = input(-2, type=float, title="Drop Percent")

pc_useDifferentRes = input(false, title="Check to turn ON Different Time Frame")

pc_candle_period = input("3", title="Percent Change - Time Frame")

pc_use = input(false, title="Use Percent Change (On / Off)?")

///////////////////////////////////////////////

// SELL STRATEGIES - SELECTION

///////////////////////////////////////////////

sell0_sep = input(false, title="▔▔▔▔▔▔▔▔▔▔▔▔▔▔▔▔▔▔▔▔" )

sell1_sep = input(false, title="******** SELL STRATEGIES ********")

sell_ma_sep = input(false, title="⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻ MA ⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻")

sell_ma_length_short = input(10, minval=1, title="MA length - short")

sell_ma_length_long = input(20, minval=1, title="MA length - long")

sell_ma_useRes = input(false, title="Check to turn ON Different Time Frame")

sell_ma_candle_period = input("5", title="MA - Different Time Frame")

sell_ma_type = input("EMA", title="MA Type", options=["SMA", "EMA", "WMA", "DEMA", "TEMA", "TRIMA", "KAMA", "MAMA", "T3"])

sell_ma_detector = input("Short Crosses Below Long", title="Detector", options=["Short Crosses Below Long",

"Short Below Long","Short Above Long","Price Cross Below Short","Price Below Short","Price Cross Below Long","Price Below Long","Price Above Both MA","Price Below Both MA"])

sell_ma_use = input(true, title="Use Moving Average ? (On / Off)")

sell_bb_sep = input(false, title="⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻ BB ⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻")

sell_bb_length = input(10, minval=1, title="BB length")

sell_bb_std = input(2.1, minval=0, type = float, title="BB std")

sell_bb_useDifferentRes = input(false, title="Check to turn ON Different Time Frame")

sell_bb_candle_period = input("3", title="BB - Time Frame")

sell_bb_type = input("T3", title="MA", options=["SMA", "EMA", "WMA", "DEMA", "TEMA", "TRIMA", "KAMA", "MAMA", "T3"])

sell_bb_detector = input("Price Cross Below", title="Detector", options=["Price Cross Above", "Price Above","Price Cross Below", "Price Below"])

sell_bb_use = input(false, title="Use BB ? (On / Off)")

sell_rsi_sep = input(false, title="⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻ RSI ⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻")

sell_rsi_length = input(2, minval=1, title="RSI length")

sell_rsi_useDifferentRes = input(false, title="Check to turn ON Different Time Frame")

sell_rsi_candle_period = input("3", title="STOCH - Time Frame")

sell_rsi_overbought = input(defval = 12 , title = "RSI Overbought", minval=0)

sell_rsi_detector = input("Signal Above Overbought", title="Detector", options=["Signal Below Overbought", "Cross Below Overbought", "Signal Above Overbought", "Cross Above Overbought"])

sell_rsi_use = input(false, title="Use RSI ? (On / Off)")

sell_stoch_sep = input(false, title="⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻ STOCH ⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻")

sell_stoch_useDifferentRes = input(false, title="Check to turn ON Different Time Frame")

sell_stoch_candle_period = input("3", title="STOCH - Time Frame")

sell_stoch_length_fk = input(12, minval=1, title="STOCH fast K")

sell_stoch_length_sk = input(1, minval=1, title="STOCH slow K")

sell_stoch_type_sk = input("EMA", title="STOCH slow K", options=["SMA", "EMA", "WMA", "DEMA", "TEMA", "TRIMA", "KAMA", "MAMA", "T3"])

sell_stoch_length_sd = input(1, minval=1, title="STOCH slow D")

sell_stoch_type_sd = input("EMA", title="STOCH slow D", options=["SMA", "EMA", "WMA", "DEMA", "TEMA", "TRIMA", "KAMA", "MAMA", "T3"])

sell_stoch_overbought = input(defval = 10 , title = "STOCH Overbought Treashold", minval=0)

sell_stoch_detector = input("Signal Above Overbought", title="Detector", options=["Signal Above Overbought", "Cross Below Overbought", "Cross Above Overbought"])

sell_stoch_use = input(false, title="Use STOCH ? (On / Off)")

sell_stochrsi_sep = input(false, title="⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻ SRSI ⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻")

sell_stochrsi_useDifferentRes = input(false, title="Check to turn ON Different Time Frame")

sell_stochrsi_candle_period = input("3", title="SRSI - Time Frame")

sell_stochrsi_len = input(14, minval=1, title="RSI length")

sell_stochrsi_stoch = input(14, minval=1, title="Time Period")

sell_stochrsi_length_fk = input(3, minval=1, title="Fast K")

sell_stochrsi_length_sd = input(3, minval=1, title="Slow D(or Fast)")

sell_stochrsi_overbought = input(defval = 30 , title = "STOCHRSI Overbought Treashold", minval=0)

sell_stochrsi_detector = input("K Above Overbought", title="Detector", options=["K Cross Above D and Overbought", "K Cross Above D", "K Cross Above Overbought",

"K Cross Below Overbought","K Below Overbought","K Above Overbought"])

sell_stochrsi_use = input(false, title="Use STOCHRSI (On / Off)?")

sell_macd_sep = input(false, title="⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻ MACD ⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻")

sell_macd_fast = input(12, title="MACD fast")

sell_macd_slow = input(26, title="MACD slow")

sell_macd_signal = input(9, title="MACD signal")

sell_macd_useDifferentRes = input(false, title="Check to turn ON Different Time Frame")

sell_macd_candle_period = input("3", title="MACD - Time Frame")

sell_macd_detector = input("MACD Cross Below Signal", title="Detector", options=["MACD Cross Below Signal", "MACD Above Signal", "MACD Below Signal",

"MACD Above Treshold", "MACD Below Treshold", "Centerline Cross Upward", "Centerline Cross Downward"])

sell_macd_treshold = input(defval = 0 , title = "Treshold", type = float)

sell_macd_use = input(false, title="Use MACD (On / Off)?")

sell_cci_sep = input(false, title="⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻ CCI ⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻")

sell_cci_len = input(14, title="CCI Length")

sell_cci_treshold = input(100, title="CCI Treshold")

sell_cci_useDifferentRes = input(false, title="Check to turn ON Different Time Frame")

sell_cci_candle_period = input("3", title="CCI - Time Frame")

sell_cci_detector = input("Signal Below Treshold", title="Detector", options=["Signal Cross Above Treshold", "Signal Above Treshold", "Signal Cross Below Treshold", "Signal Below Treshold"])

sell_cci_use = input(false, title="Use CCI (On / Off)?")

sell_vwap_sep = input(false, title="⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻ VWAP ⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻")

sell_vwap_useRes = input(false, title="Check to turn ON Different Time Frame")

sell_vwap_candle_period = input("5", title="VWAP - Time Frame")

sell_vwap_detector = input("Price Above", title="Detector", options=["Price Cross Above","Price Above","Price Cross Below","Price Below"])

sell_vwap_use = input(false, title="Use VWAP (On / Off)?")

sell_pc_sep = input(false, title="⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻Perc.Chan.⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻")

sell_pc_change = input(2, type=float, title="Rise Percent")

sell_pc_useDifferentRes = input(false, title="Check to turn ON Different Time Frame")

sell_pc_candle_period = input("3", title="Percent Change - Time Frame")

sell_pc_use = input(false, title="Use Percent Change (On / Off)?")

strat1_sep = input(false, title="▔▔▔▔▔▔▔▔▔▔▔▔▔▔▔▔▔▔▔▔" )

strat2_sep = input(false, title="******** STRATEGY SETTINGS ********")

///////////////////////////////////////////////

// GLOBAL FUNCTIONS

///////////////////////////////////////////////

kama(src, len)=>

xvnoise = abs(src - src[1])

nfastend = 0.666

nslowend = 0.0645

nsignal = abs(src - src[len])

nnoise = sum(xvnoise, len)

nefratio = iff(nnoise != 0, nsignal / nnoise, 0)

nsmooth = pow(nefratio * (nfastend - nslowend) + nslowend, 2)

nAMA = 0.0

nAMA := nz(nAMA[1]) + nsmooth * (src - nz(nAMA[1]))

mama(src, len)=>

fl=0.5

sl=0.05

pi = 3.1415926

sp = (4*src + 3*src[1] + 2*src[2] + src[3]) / 10.0

p = 0.0

i2 = 0.0

q2 = 0.0

dt = (.0962*sp + .5769*nz(sp[2]) - .5769*nz(sp[4])- .0962*nz(sp[6]))*(.075*nz(p[1]) + .54)

q1 = (.0962*dt + .5769*nz(dt[2]) - .5769*nz(dt[4])- .0962*nz(dt[6]))*(.075*nz(p[1]) + .54)

i1 = nz(dt[3])

jI = (.0962*i1 + .5769*nz(i1[2]) - .5769*nz(i1[4])- .0962*nz(i1[6]))*(.075*nz(p[1]) + .54)

jq = (.0962*q1 + .5769*nz(q1[2]) - .5769*nz(q1[4])- .0962*nz(q1[6]))*(.075*nz(p[1]) + .54)

i2_ = i1 - jq

q2_ = q1 + jI

i2 := .2*i2_ + .8*nz(i2[1])

q2 := .2*q2_ + .8*nz(q2[1])

re_ = i2*nz(i2[1]) + q2*nz(q2[1])

im_ = i2*nz(q2[1]) - q2*nz(i2[1])

re = 0.0

im = 0.0

re := .2*re_ + .8*nz(re[1])

im := .2*im_ + .8*nz(im[1])

p1 = iff(im!=0 and re!=0, 2*pi/atan(im/re), nz(p[1]))

p2 = iff(p1 > 1.5*nz(p1[1]), 1.5*nz(p1[1]), iff(p1 < 0.67*nz(p1[1]), 0.67*nz(p1[1]), p1))

p3 = iff(p2<6, 6, iff (p2 > 50, 50, p2))

p := .2*p3 + .8*nz(p3[1])

spp = 0.0

spp := .33*p + .67*nz(spp[1])

phase = 180/pi * atan(q1 / i1)

dphase_ = nz(phase[1]) - phase

dphase = iff(dphase_< 1, 1, dphase_)

alpha_ = fl / dphase

alpha = iff(alpha_ < sl, sl, iff(alpha_ > fl, fl, alpha_))

mama = 0.0

mama := alpha*src + (1 - alpha)*nz(mama[1])

t3(src, len)=>

xe1_1 = ema(src, len)

xe2_1 = ema(xe1_1, len)

xe3_1 = ema(xe2_1, len)

xe4_1 = ema(xe3_1, len)

xe5_1 = ema(xe4_1, len)

xe6_1 = ema(xe5_1, len)

b_1 = 0.7

c1_1 = -b_1*b_1*b_1

c2_1 = 3*b_1*b_1+3*b_1*b_1*b_1

c3_1 = -6*b_1*b_1-3*b_1-3*b_1*b_1*b_1

c4_1 = 1+3*b_1+b_1*b_1*b_1+3*b_1*b_1

nT3Average_1 = c1_1 * xe6_1 + c2_1 * xe5_1 + c3_1 * xe4_1 + c4_1 * xe3_1

variant(type, src, len) =>

v1 = sma(src, len) // Simple

v2 = ema(src, len) // Exponential

v3 = 2 * v2 - ema(v2, len) // Double Exponential

v4 = 3 * (v2 - ema(v2, len)) + ema(ema(v2, len), len) // Triple Exponential

v5 = wma(src, len) // Weighted

v6 = sma(sma(src, ceil(len / 2)), floor(len / 2) + 1) // TRIMA

v7 = kama(src, len) // KAMA

v8 = mama(src, len) // MAMA

v9 = t3(src, len) // T3

type=="EMA"?v2 : type=="DEMA"?v3 : type=="TEMA"?v4 : type=="WMA"?v5 : type=="TRIMA"?v6 : type=="KAMA"?v7 : type=="MAMA"?v8 : type=="T3"?v9 : v1

calc_cci(src, len, res) =>

cci_ma = sma(src, len)

cci = (src - cci_ma) / (0.015 * dev(src, len))

cci_res = request.security(syminfo.tickerid, res, cci)

calc_macd(macd_fast, macd_slow, src, res) =>

macd = ema(src, macd_fast) - ema(src, macd_slow)

res_macd = request.security(syminfo.tickerid, res, macd)

///////////////////////////////////////////////

// BUY STRATEGIES LOGIC

///////////////////////////////////////////////

//RSI

rsi = rsi(source_main, rsi_length)

per_rsi = rsi_useDifferentRes?request.security(syminfo.tickerid, rsi_candle_period, rsi):rsi

rsiBelow = false

rsiCrossBelow = false

rsiCrossAbove = false

rsiAbove = false

rsiBelow := per_rsi<rsi_oversold

rsiCrossBelow := crossunder(per_rsi, rsi_oversold)

rsiCrossAbove := crossover(per_rsi, rsi_oversold)

rsiAbove := per_rsi>rsi_oversold

rsiBuy = rsi_use ? (

rsi_detector=="Signal Below Oversold"?rsiBelow:

rsi_detector=="Cross Below Oversold"?rsiCrossBelow:

rsi_detector=="Cross Above Oversold"?rsiCrossAbove:

rsi_detector=="Signal Above Oversold"?rsiAbove:

false ) : true

//STOCH

stoch_k = variant(stoch_type_sk, stoch(source_main, high, low, stoch_length_fk), stoch_length_sk)

stoch_d = variant(stoch_type_sd, stoch_k, stoch_length_sd)

per_stoch_k = stoch_useDifferentRes?request.security(syminfo.tickerid, stoch_candle_period, stoch_k):stoch_k

per_stoch_d = stoch_useDifferentRes?request.security(syminfo.tickerid, stoch_candle_period, stoch_d):stoch_d

stochBelow = false

stochCrossBelow = false

stochCrossAbove = false

stochBelow := per_stoch_k<stoch_oversold

stochCrossBelow := crossunder(per_stoch_k, stoch_oversold)

stochCrossAbove := crossover(per_stoch_k, stoch_oversold)

stochBuy = stoch_use ? (

stoch_detector=="Signal Below Oversold"?stochBelow:

stoch_detector=="Cross Below Oversold"?stochCrossBelow:

stoch_detector=="Cross Above Oversold"?stochCrossAbove:

false ) : true

//STOCHRSI

stochrsi_rsi = rsi(source_main, stochrsi_len)

stochrsi_stoch_k = sma(stoch(stochrsi_rsi, stochrsi_rsi, stochrsi_rsi, stochrsi_stoch), stochrsi_length_fk)

stochrsi_stoch_d = sma(stochrsi_stoch_k, stochrsi_length_sd)

per_stochrsi_k = stochrsi_useDifferentRes?request.security(syminfo.tickerid, stochrsi_candle_period, stochrsi_stoch_k):stochrsi_stoch_k

per_stochrsi_d = stochrsi_useDifferentRes?request.security(syminfo.tickerid, stochrsi_candle_period, stochrsi_stoch_d):stochrsi_stoch_d

stochrsiKDCrossOversold = false

stochrsiKDCross = false

stochrsiKCrossAboveOversold = false

stochrsiKCrossBelowOversold = false

stochrsiKBelowOversold = false

stochrsiKAboveOversold = false

stochrsiKDCrossOversold := crossover(per_stochrsi_k, per_stochrsi_d) and per_stochrsi_k<stochrsi_oversold

stochrsiKDCross := crossover(per_stochrsi_k, per_stochrsi_d)

stochrsiKCrossAboveOversold := crossover(per_stochrsi_k, stochrsi_oversold)

stochrsiKCrossBelowOversold := crossunder(per_stochrsi_k, stochrsi_oversold)

stochrsiKBelowOversold := per_stochrsi_k<stochrsi_oversold

stochrsiKAboveOversold := per_stochrsi_k>stochrsi_oversold

stochrsiBuy = stochrsi_use ? (

stochrsi_detector=="K Cross Above D and Oversold"?stochrsiKDCrossOversold:

stochrsi_detector=="K Cross Above D"?stochrsiKDCross:

stochrsi_detector=="K Cross Above Oversold"?stochrsiKCrossAboveOversold:

stochrsi_detector=="K Cross Below Oversold"?stochrsiKCrossBelowOversold:

stochrsi_detector=="K Below Oversold"?stochrsiKBelowOversold:

stochrsi_detector=="K Above Oversold"?stochrsiKAboveOversold:

false ) : true

//CCI

per_cci = calc_cci(hlc3, cci_len, cci_candle_period)

cciBelow = false

cciCrossBelow = false

cciCrossAbove = false

cciAbove = false

cciBelow := per_cci<cci_treshold

cciCrossBelow := crossover(per_cci, cci_treshold)

cciCrossAbove := crossunder(cci_treshold, per_cci)

cciAbove := per_cci>cci_treshold

cciBuy = cci_use ? (

cci_detector=="Signal Below Treshold"?cciBelow:

cci_detector=="Signal Cross Belove Treshold"?cciCrossBelow:

cci_detector=="Signal Cross Above Treshold"?cciCrossAbove:

cci_detector=="Signal Above Treshold"?cciAbove:

false ) : true

//MACD

fastMA = ema(source_main, macd_fast)

slowMA = ema(source_main, macd_slow)

macd = fastMA - slowMA

signal = sma(macd, macd_signal)

delta = macd - signal

outmacd = request.security(syminfo.tickerid, macd_candle_period, macd)

outsignal = request.security(syminfo.tickerid, macd_candle_period, signal)

outdelta = request.security(syminfo.tickerid, macd_candle_period, delta)

plot_macd = macd_useDifferentRes?outmacd:macd

plot_signal = macd_useDifferentRes?outsignal:signal

plot_delta = macd_useDifferentRes?outdelta:delta

MACDCrossAboveSignal = false

CenterlineCrossUpwards = false

CenterlineCrossDownwards = false

MACDAboveSignal = false

MACDBelowSignal = false

MACDAboveTreshold = false

MACDBelowTreshold = false

MACDCrossAboveSignal := crossunder(plot_signal, plot_macd)

CenterlineCrossUpwards := crossover(plot_delta, 0)

CenterlineCrossDownwards := crossunder(plot_delta, 0)

MACDAboveSignal := plot_macd > plot_signal

MACDBelowSignal := plot_macd < plot_signal

MACDAboveTreshold := plot_macd > macd_treshold

MACDBelowTreshold := plot_macd < macd_treshold

macdBuy=macd_use ? (

macd_detector=="MACD Cross Above Signal"?MACDCrossAboveSignal:

macd_detector=="Centerline Cross Upwards"?CenterlineCrossUpwards:

macd_detector=="Centerline Cross Downwards"?CenterlineCrossDownwards:

macd_detector=="MACD above Signal"?MACDAboveSignal:

macd_detector=="MACD below Signal"?MACDBelowSignal:

macd_detector=="MACD above Treshold"?MACDAboveTreshold:

macd_detector=="MACD below Treshold"?MACDBelowTreshold:

false ) : true

//BB

bb_basis = variant(bb_type, source_main, bb_length)

bb_dev = bb_std * stdev(source_main, bb_length)

bb_upper = bb_basis + bb_dev

bb_lower = bb_basis - bb_dev

per_lower_bb = bb_useDifferentRes?request.security(syminfo.tickerid, bb_candle_period, bb_lower):bb_lower

per_upper_bb = bb_useDifferentRes?request.security(syminfo.tickerid, bb_candle_period, bb_upper):bb_upper

per_bb_basis = bb_useDifferentRes?request.security(syminfo.tickerid, bb_candle_period, bb_basis):bb_basis

bbBelow = false

bbCrossBelow = false

bbCrossAbove = false

bbAbove = false

bbBelow := per_lower_bb>close or per_lower_bb>low

bbAbove := per_lower_bb<high or per_lower_bb<close

bbCrossAbove := crossover(source_main, per_lower_bb)

bbCrossBelow := crossunder(source_main, per_lower_bb)

bbBuy = stochrsi_use ? (

bb_detector=="Price Cross Below"?bbCrossBelow:

bb_detector=="Price Below"?bbBelow:

bb_detector=="Price Cross Above"?bbCrossAbove:

bb_detector=="Price Above"?bbAbove:false ) : true

plot(per_bb_basis, color=green, linewidth=2)

p1 = plot(per_upper_bb, color=green)

p2 = plot(per_lower_bb, color=green)

fill(p1, p2)

//MA Calculation

ma_short = variant(ma_type, source_main, ma_length_short)

ma_long = variant(ma_type, source_main, ma_length_long)

per_ma_short = ma_useRes?request.security(syminfo.tickerid, ma_candle_period, ma_short):ma_short

per_ma_long = ma_useRes?request.security(syminfo.tickerid, ma_candle_period, ma_long ):ma_long

p1ma = plot(ma_use?per_ma_short:na, color=green)

p2ma = plot(ma_use?per_ma_long:na , color=red)

ShortCrossesAboveLong = false

ShortAboveLong = false

PriceCrossesAboveShort = false

PriceAboveShort = false

PriceCrossesAboveLong = false

PriceAboveLong = false

PriceAboveBoth = false

PriceBelowBoth = false

ShortCrossesAboveLong := crossover(per_ma_short, per_ma_long)

ShortAboveLong := per_ma_short > per_ma_long

PriceCrossesAboveShort := ( close > per_ma_short or high > per_ma_short ) and low < per_ma_short

PriceAboveShort := close > per_ma_short or high > per_ma_short

PriceCrossesAboveLong := ( close > per_ma_long or high > per_ma_long ) and low < per_ma_long

PriceAboveLong := close > per_ma_long or high > per_ma_long

PriceAboveBoth := ( close > per_ma_long or high > per_ma_long ) and (close > per_ma_short or high > per_ma_short )

PriceBelowBoth := ( close < per_ma_long or low < per_ma_long ) and (close < per_ma_short or low < per_ma_short )

maBuy = ma_use ? ( ma_detector=="Short Crosses Above Long"?ShortCrossesAboveLong:

ma_detector=="Short Above Long"?ShortAboveLong:

ma_detector=="Price Cross Above Short"?PriceCrossesAboveShort:

ma_detector=="Price Above Short"?PriceAboveShort:

ma_detector=="Price Crosses Above Long"?PriceCrossesAboveLong:

ma_detector=="Price Above Long"?PriceAboveLong:

ma_detector=="Price Above Both"?PriceAboveBoth:

ma_detector=="Price Below Both"?PriceBelowBoth:

false ) : true

//VWAP

var_vwap = vwap(hlc3)

per_vwap = vwap_useRes?request.security(syminfo.tickerid,vwap_candle_period,var_vwap):var_vwap

PriceCrossAbove = false

PriceAbove = false

PriceCrossBelow = false

PriceBelow = false

PriceCrossAbove := ( close > per_vwap or high > per_vwap ) and low < per_vwap

PriceAbove := close > per_vwap or high > per_vwap

PriceCrossBelow := ( close < per_vwap or low < per_vwap ) and high > per_vwap

PriceBelow := close < per_vwap or low < per_vwap

vwapBuy = false

vwapBuy := vwap_use ?(

vwap_detector=="Price Cross Above"?PriceCrossAbove:

vwap_detector=="Price Above"?PriceAbove:

vwap_detector=="Price Cross Below"?PriceCrossBelow:

vwap_detector=="Price Below"?PriceBelow:false ) : true

//PC

price_change = (close - close[1])/close[1]*100

per_price_change = pc_useDifferentRes?request.security(syminfo.tickerid, pc_candle_period, price_change):price_change

pcBuy = false

pcBuy := pc_use ? ( per_price_change < pc_change ) : true

///////////////////////////////////////////////

// SELL STRATEGIES LOGIC

///////////////////////////////////////////////

//SELL RSI

sell_rsi = rsi(source_main, sell_rsi_length)

sell_per_rsi = sell_rsi_useDifferentRes?request.security(syminfo.tickerid, sell_rsi_candle_period, sell_rsi):sell_rsi

sell_rsiBelow = false

sell_rsiCrossBelow = false

sell_rsiCrossAbove = false

sell_rsiAbove = false

sell_rsiBelow := sell_per_rsi<sell_rsi_overbought

sell_rsiCrossBelow := crossunder(sell_per_rsi, sell_rsi_overbought)

sell_rsiCrossAbove := crossover(sell_per_rsi, sell_rsi_overbought)

sell_rsiAbove := sell_per_rsi>sell_rsi_overbought

sell_rsiBuy = sell_rsi_use ? (

sell_rsi_detector=="Signal Below Overbought"?sell_rsiBelow:

sell_rsi_detector=="Cross Below Overbought"?sell_rsiCrossBelow:

sell_rsi_detector=="Cross Above Overbought"?sell_rsiCrossAbove:

sell_rsi_detector=="Signal Above Overbought"?sell_rsiAbove:

false ) : true

//SELL STOCH

sell_stoch_k = variant(sell_stoch_type_sk, stoch(source_main, high, low, sell_stoch_length_fk), sell_stoch_length_sk)

sell_stoch_d = variant(sell_stoch_type_sd, sell_stoch_k, sell_stoch_length_sd)

sell_per_stoch_k = sell_stoch_useDifferentRes?request.security(syminfo.tickerid, sell_stoch_candle_period, sell_stoch_k):sell_stoch_k

sell_per_stoch_d = sell_stoch_useDifferentRes?request.security(syminfo.tickerid, sell_stoch_candle_period, sell_stoch_d):sell_stoch_d

sell_stochAbove = false

sell_stochBelow = false

sell_stochCrossAbove = false

sell_stochAbove := sell_per_stoch_k>sell_stoch_overbought

sell_stochBelow := sell_per_stoch_k<sell_stoch_overbought

sell_stochCrossAbove := crossover(sell_per_stoch_k, sell_stoch_overbought)

sell_stochBuy = sell_stoch_use ? (

sell_stoch_detector=="Signal Above Overbought"?sell_stochAbove:

sell_stoch_detector=="Signal Below Overbought"?sell_stochBelow:

sell_stoch_detector=="Cross Above Overbought"?sell_stochCrossAbove:

false ) : true

//SELL STOCHRSI

sell_stochrsi_rsi = rsi(source_main, sell_stochrsi_len)

sell_stochrsi_stoch_k = sma(stoch(sell_stochrsi_rsi, sell_stochrsi_rsi, sell_stochrsi_rsi, sell_stochrsi_stoch), sell_stochrsi_length_fk)

sell_stochrsi_stoch_d = sma(sell_stochrsi_stoch_k, sell_stochrsi_length_sd)

sell_per_stochrsi_k = sell_stochrsi_useDifferentRes?request.security(syminfo.tickerid, sell_stochrsi_candle_period, sell_stochrsi_stoch_k):sell_stochrsi_stoch_k

sell_per_stochrsi_d = sell_stochrsi_useDifferentRes?request.security(syminfo.tickerid, sell_stochrsi_candle_period, sell_stochrsi_stoch_d):sell_stochrsi_stoch_d

sell_stochrsiKDCrossOverbought = false

sell_stochrsiKDCross = false

sell_stochrsiKCrossAboveOverbought = false

sell_stochrsiKCrossBelowOverbought = false

sell_stochrsiKBelowOverbought = false

sell_stochrsiKAboveOverbought = false

sell_stochrsiKDCrossOverbought := crossover(sell_per_stochrsi_k, sell_per_stochrsi_d) and sell_per_stochrsi_k>sell_stochrsi_overbought

sell_stochrsiKDCross := crossover(sell_per_stochrsi_k, sell_per_stochrsi_d)

sell_stochrsiKCrossAboveOverbought := crossover(sell_per_stochrsi_k, sell_stochrsi_overbought)

sell_stochrsiKCrossBelowOverbought := crossunder(sell_per_stochrsi_k, sell_stochrsi_overbought)

sell_stochrsiKBelowOverbought := sell_per_stochrsi_k<sell_stochrsi_overbought

sell_stochrsiKAboveOverbought := sell_per_stochrsi_k>sell_stochrsi_overbought

sell_stochrsiBuy = sell_stochrsi_use ? (

sell_stochrsi_detector=="K Cross Below D and Overbought"?sell_stochrsiKDCrossOverbought:

sell_stochrsi_detector=="K Cross Below D"?sell_stochrsiKDCross:

sell_stochrsi_detector=="K Cross Above Overbought"?sell_stochrsiKCrossAboveOverbought:

sell_stochrsi_detector=="K Cross Below Overbought"?sell_stochrsiKCrossBelowOverbought:

sell_stochrsi_detector=="K Below Overbought"?sell_stochrsiKBelowOverbought:

sell_stochrsi_detector=="K Above Overbought"?sell_stochrsiKAboveOverbought:

false ) : true

//SELL CCI

sell_per_cci = calc_cci(hlc3, sell_cci_len, sell_cci_candle_period)

sell_cciBelow = false

sell_cciCrossBelow = false

sell_cciCrossAbove = false

sell_cciAbove = false

sell_cciBelow := sell_per_cci<sell_cci_treshold

sell_cciCrossBelow := crossunder(sell_per_cci, sell_cci_treshold)

sell_cciCrossAbove := crossover(sell_cci_treshold, sell_per_cci)

sell_cciAbove := sell_per_cci>sell_cci_treshold

sell_cciBuy = sell_cci_use ? (

sell_cci_detector=="Signal Below Treshold"?sell_cciBelow:

sell_cci_detector=="Signal Cross Belove Treshold"?sell_cciCrossBelow:

sell_cci_detector=="Signal Cross Above Treshold"?sell_cciCrossAbove:

sell_cci_detector=="Signal Above Treshold"?sell_cciAbove:

false ) : true

//SELL MACD

sell_fastMA = ema(close, sell_macd_fast)

sell_slowMA = ema(close, sell_macd_slow)

sell_macd = sell_fastMA - sell_slowMA

sell_signal = sma(sell_macd, sell_macd_signal)

sell_delta = sell_macd - sell_signal

sell_outmacd = request.security(syminfo.tickerid, sell_macd_candle_period, sell_macd)

sell_outsignal = request.security(syminfo.tickerid, sell_macd_candle_period, sell_signal)

sell_outdelta = request.security(syminfo.tickerid, sell_macd_candle_period, sell_delta)

sell_plot_macd = sell_macd_useDifferentRes?sell_outmacd:sell_macd

sell_plot_signal = sell_macd_useDifferentRes?sell_outsignal:sell_signal

sell_plot_delta = sell_macd_useDifferentRes?sell_outdelta:sell_delta

sell_MACDCrossBelowSignal = false

sell_CenterlineCrossUpwards = false

sell_CenterlineCrossDownwards = false

sell_MACDAboveSignal = false

sell_MACDBelowSignal = false

sell_MACDAboveTreshold = false

sell_MACDBelowTreshold = false

sell_MACDCrossBelowSignal := crossover(sell_plot_signal, sell_plot_macd)

sell_CenterlineCrossUpwards := crossover(sell_plot_delta, 0.0)

sell_CenterlineCrossDownwards := crossunder(sell_plot_delta, 0.0)

sell_MACDAboveSignal := sell_plot_macd > sell_plot_signal

sell_MACDBelowSignal := sell_plot_macd < sell_plot_signal

sell_MACDAboveTreshold := sell_plot_macd > sell_macd_treshold

sell_MACDBelowTreshold := sell_plot_macd < sell_macd_treshold

sell_macdBuy=sell_macd_use ? (

sell_macd_detector=="MACD Cross Below Signal"?sell_MACDCrossBelowSignal:

sell_macd_detector=="Centerline Cross Upwards"?sell_CenterlineCrossUpwards:

sell_macd_detector=="Centerline Cross Downwards"?sell_CenterlineCrossDownwards:

sell_macd_detector=="MACD above Signal"?sell_MACDAboveSignal:

sell_macd_detector=="MACD below Signal"?sell_MACDBelowSignal:

sell_macd_detector=="MACD above Treshold"?sell_MACDAboveTreshold:

sell_macd_detector=="MACD below Treshold"?sell_MACDBelowTreshold:

false ) : true

//SELL BB

sell_bb_basis = variant(bb_type, source_main, sell_bb_length)

sell_bb_dev = sell_bb_std * stdev(source_main, sell_bb_length)

sell_bb_upper = sell_bb_basis + sell_bb_dev

sell_bb_lower = sell_bb_basis - sell_bb_dev

sell_per_lower_bb = sell_bb_useDifferentRes?request.security(syminfo.tickerid, sell_bb_candle_period, sell_bb_lower):sell_bb_lower

sell_per_upper_bb = sell_bb_useDifferentRes?request.security(syminfo.tickerid, sell_bb_candle_period, sell_bb_upper):sell_bb_upper

sell_per_bb_basis = sell_bb_useDifferentRes?request.security(syminfo.tickerid, sell_bb_candle_period, sell_bb_basis):sell_bb_basis

sell_bbBelow = false

sell_bbCrossBelow = false

sell_bbCrossAbove = false

sell_bbAbove = false

sell_bbBelow := sell_per_upper_bb>close or sell_per_upper_bb>low

sell_bbAbove := sell_per_upper_bb<high or sell_per_upper_bb<close

sell_bbCrossAbove := crossover(source_main, sell_per_upper_bb)

sell_bbCrossBelow := crossunder(source_main, sell_per_upper_bb)

sell_bbBuy = sell_bb_use ? (

sell_bb_detector=="Price Cross Below"?sell_bbCrossBelow:

sell_bb_detector=="Price Below"?sell_bbBelow:

sell_bb_detector=="Price Cross Above"?sell_bbCrossAbove:

sell_bb_detector=="Price Above"?sell_bbAbove:false ) : true

//SELL MA Calculation

sell_ma_short = variant(sell_ma_type, source_main, sell_ma_length_short)

sell_ma_long = variant(sell_ma_type, source_main, sell_ma_length_long)

sell_per_ma_short = sell_ma_useRes?request.security(syminfo.tickerid, sell_ma_candle_period, sell_ma_short):sell_ma_short

sell_per_ma_long = sell_ma_useRes?request.security(syminfo.tickerid, sell_ma_candle_period, sell_ma_long ):sell_ma_long

sell_p1ma = plot(sell_ma_use?sell_per_ma_short:na, color=green)

sell_p2ma = plot(sell_ma_use?sell_per_ma_long:na , color=red)

sell_ShortCrossesBelowLong = false

sell_ShortBelowLong = false

sell_ShortAboveLong = false

sell_PriceCrossesBelowShort = false

sell_PriceBelowShort = false

sell_PriceCrossesBelowLong = false

sell_PriceBelowLong = false

sell_PriceAboveBoth = false

sell_PriceBelowBoth = false

sell_ShortCrossesBelowLong := crossunder(sell_per_ma_short, sell_per_ma_long)

sell_ShortBelowLong := sell_per_ma_short < sell_per_ma_long

sell_ShortAboveLong := sell_per_ma_short > sell_per_ma_long

sell_PriceCrossesBelowShort := ( close > sell_per_ma_short or high > sell_per_ma_short ) and low < sell_per_ma_short

sell_PriceBelowShort := close > sell_per_ma_short or high > sell_per_ma_short

sell_PriceCrossesBelowLong := ( close > sell_per_ma_long or high > sell_per_ma_long ) and low < sell_per_ma_long

sell_PriceBelowLong := close > sell_per_ma_long or high > sell_per_ma_long

sell_PriceAboveBoth := ( close > sell_per_ma_long or high > sell_per_ma_long ) and (close > sell_per_ma_short or high > sell_per_ma_short )

sell_PriceBelowBoth := ( close < sell_per_ma_long or low < sell_per_ma_long ) and (close < sell_per_ma_short or low < sell_per_ma_short )

sell_maBuy = sell_ma_use ? (

sell_ma_detector=="Short Crosses Below Long"?sell_ShortCrossesBelowLong:

sell_ma_detector=="Short Below Long"?sell_ShortBelowLong :

sell_ma_detector=="Price Cross Below Short"?sell_PriceCrossesBelowShort:

sell_ma_detector=="Price Below Short"?sell_PriceBelowShort:

sell_ma_detector=="Price Cross Below Long"?sell_PriceBelowShort:

sell_ma_detector=="Price Below Long"?sell_PriceCrossesBelowLong:

sell_ma_detector=="Price Above Both"?sell_PriceAboveBoth:

sell_ma_detector=="Price Below Both"?sell_PriceBelowBoth:

false ) : true

//SELL VWAP

sell_var_vwap = vwap(hlc3)

sell_per_vwap = sell_vwap_useRes?request.security(syminfo.tickerid,sell_vwap_candle_period,sell_var_vwap):sell_var_vwap

sell_PriceCrossAbove = false

sell_PriceAbove = false

sell_PriceCrossBelow = false

sell_PriceBelow = false

sell_PriceCrossAbove := ( close > sell_per_vwap or high > sell_per_vwap ) and low < sell_per_vwap

sell_PriceAbove := close > sell_per_vwap or high > sell_per_vwap

sell_PriceCrossBelow := ( close < sell_per_vwap or low < sell_per_vwap ) and high > sell_per_vwap

sell_PriceBelow := close < sell_per_vwap or low < sell_per_vwap

sell_vwapBuy = false

sell_vwapBuy := sell_vwap_use ?(

sell_vwap_detector=="Price Cross Above"?sell_PriceCrossAbove:

sell_vwap_detector=="Price Above"?sell_PriceAbove:

sell_vwap_detector=="Price Cross Below"?sell_PriceCrossBelow:

sell_vwap_detector=="Price Below"?sell_PriceBelow:false ) : true

//PC

sell_price_change = (close - close[1])/close[1]*100

sell_per_price_change = sell_pc_useDifferentRes?request.security(syminfo.tickerid, sell_pc_candle_period, sell_price_change):sell_price_change

sell_pcBuy = false

sell_pcBuy := sell_pc_use ? ( sell_per_price_change > sell_pc_change ) : true

///////////////////////////////////////////////

// MAIN LOGIC

///////////////////////////////////////////////

allBuy = false

allBuy := rsiBuy and bbBuy and stochBuy and stochrsiBuy and cciBuy and macdBuy and maBuy and vwapBuy and pcBuy

allSell = false

allSell := sell_rsiBuy and sell_bbBuy and sell_stochBuy and sell_stochrsiBuy and sell_cciBuy and sell_macdBuy and sell_maBuy and sell_vwapBuy and sell_pcBuy

buy = allBuy

sell = (

sell_pc_use?sell_pcBuy:false or

sell_vwap_use?sell_vwapBuy:false or

sell_rsi_use?sell_rsiBuy:false or

sell_ma_use?sell_maBuy:false or

sell_bb_use?sell_bbBuy:false or

sell_cci_use?sell_cciBuy:false or

sell_macd_use?sell_macdBuy:false or

sell_stoch_use?sell_stochBuy:false or

sell_stochrsi_use?sell_stochrsiBuy:false ) ? true : false

//////////////////////////////////////////////////////////////////////////////////////////

//*** This Trade Management Section of code is a modified version of that found in ***//

//*** "How to automate this strategy for free using a chrome extension" by CryptoRox ***//

//*** Modifications and tradeState engine by JustUncleL. ***//

//////////////////////////////////////////////////////////////////////////////////////////

//

///////////////////////////////////////////////

//* Backtesting Period Selector | Component *//

///////////////////////////////////////////////

// * https://www.tradingview.com/script/eCC1cvxQ-Backtesting-Period-Selector-Component *//

// * https://www.tradingview.com/u/pbergden/ *//

// * Modifications made by JustUncleL*//

testStartYear = input(2018, "Backtest Start Year",minval=1980)

testStartMonth = input(9, "Backtest Start Month",minval=1,maxval=12)

testStartDay = input(20, "Backtest Start Day",minval=1,maxval=31)

testPeriodStart = timestamp(testStartYear,testStartMonth,testStartDay,0,0)

testStopYear = 9999 //input(9999, "Backtest Stop Year",minval=1980)

testStopMonth = 12 // input(12, "Backtest Stop Month",minval=1,maxval=12)

testStopDay = 31 //input(31, "Backtest Stop Day",minval=1,maxval=31)

testPeriodStop = timestamp(testStopYear,testStopMonth,testStopDay,0,0)

testPeriod() => time >= testPeriodStart and time <= testPeriodStop ? true : false

//////////////////////////

//* Strategy Component *//

//////////////////////////

high_ = high

low_ = low

AQUA = #00FFFFFF

BLUE = #0000FFFF

RED = #FF0000FF

LIME = #00FF00FF

GRAY = #808080FF

DARKRED = #8B0000FF

DARKGREEN = #006400FF

//

//fastExit = input(false,title="Use Opposite Trade as a Close Signal")

//clrBars = input(true,title="Colour Candles to Trade Order state")

fastExit = true

clrBars = false

//orderType = input("LongsOnly",title="What type of Orders", options=["Longs+Shorts","LongsOnly","ShortsOnly","Flip"])

orderType = "LongsOnly"

//

isLong = (orderType != "ShortsOnly")

isShort = (orderType != "LongsOnly")

//////////////////////////////////////////////////

//* Put Entry and special Exit conditions here *//

//////////////////////////////////////////////////

//////////////////////////

//* tradeState Engine *//

INACTIVE = 0 // No trades open

ACTIVELONG = 1 // Long Trade Started

ACTIVESHORT = -1 // Short Trade Started

//

//////////////////////////

// Keep track of current trade state

longClose = false, longClose := nz(longClose[1],false)

shortClose = false, shortClose := nz(shortClose[1],false)

tradeState = INACTIVE, tradeState := nz(tradeState[1])

tradeState := tradeState==INACTIVE ? buy==1 and (barstate.isconfirmed or barstate.ishistory) and isLong and not longClose and not shortClose? ACTIVELONG :

sell==1 and (barstate.isconfirmed or barstate.ishistory) and isShort and not longClose and not shortClose? ACTIVESHORT :

tradeState : tradeState

//Entry Triggers, this happens when tradeState changes from neutral to active

longCondition = false

shortCondition = false

longCondition := change(tradeState) and tradeState==ACTIVELONG

shortCondition := change(tradeState) and tradeState==ACTIVESHORT

if orderType=="Flip"

temp = longCondition

longCondition := shortCondition

shortCondition := temp

//end if

//SPECIAL Exit Condition.

// Exit on Average Fast/Slow MA cross over, force no repaint

longExitC = sell ? 1 : 0

shortExitC = 0

// Exit Trigger without SL set and trade Actine

longExit = change(longExitC) and longExitC==1 and tradeState==1

shortExit = change(shortExitC) and shortExitC==1 and tradeState==-1

// -- debugs

//plotchar(tradeState,"tradeState at Event",location=location.bottom, color=na)

//plotchar(longCondition, title="longCondition",color=na)

//plotchar(shortCondition, title="shortCondition",color=na)

//plotchar(tradeState, title="tradeState",color=na)

// -- /debugs

/////////////////////////////////////

//======[ Deal Entry Prices ]======//

/////////////////////////////////////

last_open_longCondition = na

last_open_shortCondition = na

last_open_longCondition := longCondition ? close : nz(last_open_longCondition[1])

last_open_shortCondition := shortCondition ? close : nz(last_open_shortCondition[1])

//////////////////////////////////

//======[ Position State ]======//

//////////////////////////////////

in_longCondition = tradeState == ACTIVELONG

in_shortCondition = tradeState == ACTIVESHORT

/////////////////////////////////

//======[ Trailing Stop ]======//

/////////////////////////////////

// This Trailing Stop Starts as soon as trade is Started

isTS = input(false, "Trailing Stop")

ts = input(3.0, "Trailing Stop (%)", minval=0,step=0.1, type=float) /100

// Initialise and track highs and lows

short_ts = false, long_ts = false

last_high = 0.0, last_high := nz(last_high[1],na)

last_low = 0.0, last_low := nz(last_low[1],na)

last_high_short = 0.0, last_high_short := nz(last_high_short[1],na)

last_low_long = 0.0, last_low_long := nz(last_low_long[1],na)

// LONGS TSL

if in_longCondition == true

last_high := (na(last_high) or high_ > last_high) ? high_ : last_high

last_low_long := (na(last_low_long) or low_ < last_low_long) ? low_ : last_low_long

long_ts := isTS and (low_ <= last_high - last_high * ts)

//else

if in_longCondition == false

long_ts := false

last_high := na

last_low_long := na

//end if

//SHORTS TSL

if in_shortCondition == true

last_low := (na(last_low) or low_ < last_low) ? low_ : last_low

last_high_short := (na(last_high_short) or high_ > last_high_short) ? high_ : last_high_short

short_ts := isTS and (high_ >= last_low + last_low * ts)

if in_shortCondition == false

short_ts := false

last_low := na

last_high_short := na

//end if

///////////////////////////////

//======[ Take Profit ]======//

///////////////////////////////

isTP = input(true, "Take Profit")

tp = input(1.0, "Take Profit (%)",minval=0,step=0.1,type=float) / 100

ttp = input(0.0, "Trailing Profit (%)",minval=0,step=0.1,type=float) / 100

ttp := ttp>tp ? tp : ttp

long_tp = isTP and in_longCondition and (last_high >= last_open_longCondition + last_open_longCondition * tp) and (low_ <= last_high - last_high * ttp)

short_tp = isTP and in_shortCondition and (last_low <= last_open_shortCondition - last_open_shortCondition * tp) and (high_ >= last_low + last_low * ttp)

/////////////////////////////

//======[ Stop Loss ]======//

/////////////////////////////

isSL = input(true, "Stop Loss")

sl = input(2.0, "Stop Loss (%)", minval=0,step=0.1, type=float) / 100

long_sl = isSL and in_longCondition and (low_ <= last_open_longCondition - last_open_longCondition * sl)

short_sl = isSL and in_shortCondition and (high_ >= last_open_shortCondition + last_open_shortCondition * sl)

////////////////////////////////////

//======[ Stop on Opposite ]======//

////////////////////////////////////

//NOTE Short exit signal is non-repainting, no need to force it, if Pyramiding keep going

long_sos = (fastExit or (not isTS and not isSL)) and longExit and in_longCondition

short_sos = (fastExit or (not isTS and not isSL)) and shortExit and in_shortCondition

/////////////////////////////////

//======[ Close Signals ]======//

/////////////////////////////////

// Create a single close for all the different closing conditions, all conditions here are non-repainting

longClose := isLong and (long_tp or long_sl or long_ts or long_sos) and not longCondition

shortClose := isShort and (short_tp or short_sl or short_ts or short_sos) and not shortCondition

///////////////////////////////

//======[ Plot Colors ]======//

///////////////////////////////

longCloseCol = na

shortCloseCol = na

longCloseCol := long_tp ? green : long_sl ? maroon : long_ts ? purple : long_sos ? orange :longCloseCol[1]

shortCloseCol := short_tp ? green : short_sl ? maroon : short_ts ? purple : short_sos ? orange : shortCloseCol[1]

//

tpColor = isTP and in_longCondition ? lime : isTP and in_shortCondition ? lime : na

slColor = isSL and in_longCondition ? red : isSL and in_shortCondition ? red : na

//////////////////////////////////

//======[ Strategy Plots ]======//

//////////////////////////////////

//LONGS

plot(isTS and in_longCondition?

last_high - last_high * ts : na, "Buy Trailing", fuchsia, style=2, linewidth=1,offset=1)

plot(isTP and in_longCondition and last_high < last_open_longCondition + last_open_longCondition * tp ?

last_open_longCondition + last_open_longCondition * tp : na, "Long TP Active", tpColor, style=3,join=false, linewidth=1,offset=1)

plot(isTP and in_longCondition and last_high >= last_open_longCondition + last_open_longCondition * tp ?

last_high - last_high * ttp : na, "Buy Trailing", black, style=2, linewidth=1,offset=1)

plot(isSL and in_longCondition and last_low_long > last_open_longCondition - last_open_longCondition * sl ?

last_open_longCondition - last_open_longCondition * sl : na, "Long SL", slColor, style=3,join=false, linewidth=1,offset=1)

//SHORTS

plot(isTS and in_shortCondition?

last_low + last_low * ts : na, "Short Trailing", fuchsia, style=2, linewidth=1,offset=1)

plot(isTP and in_shortCondition and last_low > last_open_shortCondition - last_open_shortCondition * tp ?

last_open_shortCondition - last_open_shortCondition * tp : na, "Short TP Active", tpColor, style=3,join=false, linewidth=1,offset=1)

plot(isTP and in_shortCondition and last_low <= last_open_shortCondition - last_open_shortCondition * tp ?

last_low + last_low * ttp : na, "Short Trailing", black, style=2, linewidth=1,offset=1)

plot(isSL and in_shortCondition and last_high_short < last_open_shortCondition + last_open_shortCondition * sl ?

last_open_shortCondition + last_open_shortCondition * sl : na, "Short SL", slColor, style=3,join=false, linewidth=1,offset=1)

// Colour code the candles for Profit/Loss: Profit=LIGHT colour, Loss=DARK colour

bclr = not clrBars ? na : tradeState==INACTIVE ? GRAY :

in_longCondition ? close<last_open_longCondition? DARKGREEN : LIME :

in_shortCondition ? close>last_open_shortCondition? DARKRED : RED : GRAY

barcolor(bclr,title="Trade State Bar Colouring")

///////////////////////////////

//======[ Alert Plots ]======//

///////////////////////////////

// //LONGS

// plotshape(longCondition?close:na, title="Buy", color=green, textcolor=green, transp=0,

// style=shape.triangleup, location=location.belowbar, size=size.small,text="Buy",offset=0)

// plotshape(longClose?close:na, title="Sell", color=longCloseCol, textcolor=white, transp=0,

// style=shape.labeldown, location=location.abovebar, size=size.small,text="Sell",offset=0)

// //SHORTS

// plotshape(shortCondition?close:na, title="Short", color=red, textcolor=red, transp=0,

// style=shape.triangledown, location=location.abovebar, size=size.small,text="SHORT",offset=0)

// plotshape(shortClose?close:na, title="Short Close", color=shortCloseCol, textcolor=white, transp=0,

// style=shape.labelup, location=location.belowbar, size=size.small,text="Short",offset=0)

// Autoview alert syntax - This assumes you are trading coins BUY and SELL on Binance Exchange

// WARNING*** Only use Autoview to automate a strategy after you've sufficiently backtested and forward tested the strategy.

// You can learn more about the syntax here:

// http://autoview.with.pink/#syntax and you can watch this video here: https://www.youtube.com/watch?v=epN5Tjinuxw

// For the opens you will want to trigger BUY orders on LONGS (eg ETHBTC) with alert option "Once Per Bar Close"

// and SELL orders on SHORTS (eg BTCUSDT)

// b=buy q=0.001 e=binance s=ethbtc u=currency t=market ( LONG )

// or b=sell q=0.001 e=binance s=btcusdt t=market ( SHORT )

//alertcondition(longCondition, "Open Long", "LONG")

//alertcondition(shortCondition, "Open Short", "SHORT")

// For the closes you will want to trigger these alerts on condition with alert option "Once Per Bar"

// (NOTE: with Renko you can only use "Once Per Bar Close" option)

// b=sell q=99% e=binance s=ethbtc t=market ( CLOSE LONGS )

// or b=buy q=99% e=binance s=btcusdt u=currency t=market ( CLOSE SHORTS )

// This gets it as it happens and typically results in a better exit live than in the backtest.

// It works really well for counteracting some market slippage

//alertcondition(longClose, "Close Longs", "CLOSE LONGS")

//alertcondition(shortClose, "Close Shorts", "CLOSE SHORTS")

////////////////////////////////////////////

//======[ Strategy Entry and Exits ]======//

////////////////////////////////////////////

if testPeriod() and isLong

strategy.entry("Long", 1, when=longCondition)

strategy.close("Long", when=longClose )

//if testPeriod() and isShort

// strategy.entry("Short", 0, when=shortCondition)

// strategy.close("Short", when=shortClose )

// --- Debugs

//plotchar(longExit,title="longExit",location=location.bottom,color=na)

//plotchar(longCondition,title="longCondition",location=location.bottom,color=na)

//plotchar(in_longCondition,title="in_longCondition",location=location.bottom,color=na)

//plotchar(longClose,title="longClose",location=location.bottom,color=na,color=na)

//plotchar(buy,title="buy",location=location.bottom,color=na)

// --- /Debugs

///////////////////////////////////

//======[ Reset Variables ]======//

///////////////////////////////////

if longClose or shortClose

tradeState := INACTIVE

in_longCondition := false

in_shortCondition := false

last_low := na

last_low_long := na

last_high := na

last_high_short := na

// EOF

//-- SUPPORT/RESISTANCE LINES by:ByDipsOnly -----------------------------------------------------------------------------

sr_sep = input(false, title="⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻ S/R Lines ⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻⎻")

show_SPlines_input = input(true, "Show S/R Lines")

tf = timeframe.period

vamp = input(title="VolumeMA", defval=6)

vam = sma(volume, vamp)

upside = high[3]>high[4] and high[4]>high[5] and high[2]<high[3] and high[1]<high[2] and volume[3]>vam[3]

downside = low[3]<low[4] and low[4]<low[5] and low[2]>low[3] and low[1]>low[2] and volume[3]>vam[3]

calcup() =>

fractalup = na

fractalup := upside ? high[3] : fractalup[1]

calcdown() =>

fractaldown = na

fractaldown := downside ? low[3] : fractaldown[1]

fuptf = request.security(syminfo.tickerid,tf == "current" ? timeframe.period : tf, calcup())

fdowntf = request.security(syminfo.tickerid,tf == "current" ? timeframe.period : tf, calcdown())

plotup = show_SPlines_input==true?fuptf:na

plotdown = show_SPlines_input==true?fdowntf:na

plot(plotup, "FractalUp", color=yellow, linewidth=1, style=cross, transp=0, offset =-3, join=false)

plot(plotdown, "FractalDown", color=blue, linewidth=1, style=cross, transp=0, offset=-3, join=false)

fractalupalert = na

fractalup = na

fractalup := upside ? high[3] : fractalup[1]

fractalupalert := high[3] > open or fractalup[1] > open

alertcondition(show_SPlines_input?fractalupalert:na, title="R Line", message='R Line')

//-- END SUPPORT/RESISTANCE LINES -------------------------------------------------------------------------------------------